Board of Directors Effectiveness, Integrated Reporting Quality, and

Firm Risk

Rita Sugiarti, Ancella Anitawati Hermawan

Faculty of Economics, Universitas Indonesia, Kampus FEB UI Depok, 16424, Indonesia

Keywords: Board of Directors Effectiveness, Integrated Reporting Quality, Firm Risk

Abstract: IR is propose to "reform" corporate's financial statements, address the shortcomings in existing reporting

practices and provides a better understanding of financial and non-financial information in an integrated

manner. This study aims to provide empirical evidence on the role of IR quality in mediating the effect of

board of director effectiveness on firm risk directly and indirectly. This study is a quantitative research and

used panel data. The sampleswere used are 143 listed companies on the Johannesburg Stock Exchange

(South Africa) with 4 years observation that is from 2014 to 2017. Structural Equation Model was used to

analize data and test hypotheses. The results found that BOD effectiveness has a significant negative effect

on firm risk but has not affect IR quality,andIR quality has not affects firm risk directly. This study also

found that IR quality cannot mediate the effect of BOD effectiveness on firm risk. It is because the

implementation of IR was only use to comply with regulatory requirements.

1 INTRODUCTION

Current corporate reporting model deemed to be

less relevant to shareholders (Financial Reporting

Council, 2011), failed to provide tools that can be

used to communicate future opportunities, strategy

and value creation (Simnett& Huggins, 2015) and

cannot meet stakeholders' information needs to

assess past and future corporate performance

(Flower, 2015). To respond this issue, Integrated

Reporting (IR) has proposed to "reform" the

company's reporting model. IR provides a better

understanding to stakeholders about financial and

non-financial information in an integrated manner

(IIRC, 2013).

In practice, in most countries of the world, IR is

voluntary and the first country to require IR is South

Africa. Although in South Africa IR is mandatory,

but compliance level of each firms may differ

because basically IR guidance regulates minimum

level of firms to disclose IR components so that the

firms may publish IR more than minimum level. On

contrary, the regulation also provides management

flexibility in publishing IRs for being "applied" or

"explain". The companies may present IRs below

minimum level and only provide explanations for

reasons of non-compliance. Therefore, this may

cause IR quality level to be different for each

company. For this reason, this study used listed

companies on the Johannesburg Stock Exchange as

samples.

Corporate governance is one factor that can

affect IR quality (Velte&Stawinoga, 2016;

DeVilliers et al., 2017). To improve IR quality,

boards play a role in monitoring performance of

management and ensuring accountability of

management in manage the company (including

financial reporting process).

DeVilliers et al. (2017) suggested totests IR

consequences such as firm risk. IRs issued by the

company should contain information that integrates

Environment, Social, and Governance (ESG) factors

into strategy, output measurement and risk and

opportunities assessment faced by company to

maximize long-term value creation (Steyn, 2014).

Corporate social performance is often defined as the

ESG factor (Sassen, Hinze, &Hardeck, 2016).

Higher social performance can increase company

value through improved financial performance i.e.

cash flow and / or capital cost reduction (Plumlee,

Brown, Hayes, & Marshall, 2015). The low social

performance allows high lawsuits to be faced by

company. Conversely, high corporate social

performance can reduce firm risk because it can

meet information needs of various stakeholders, and

also can create a moral capital that can make

112

Sugiarti, R. and Anitawati Hermawan, A.

Board of Directors Effectiveness, Integrated Reporting Quality, and Firm Risk.

DOI: 10.5220/0008437401120121

In Proceedings of the 4th Sriwijaya Economics, Accounting, and Business Conference (SEABC 2018), pages 112-121

ISBN: 978-989-758-387-2

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

stakeholders become more loyal to company, so that

stakeholders tend to react less to negative news

about company and can reduce firm risk and

resulting in increasing volatility and market risk

(Sassen et al., 2016). Some researchers have

examined the association of ESG factors to firm risk

(Oikonomou, Brooks, &Pavelin, 2012; Sassen et al.,

2016). However, until now researchers have not

found a study that examines the effect of IR quality

on firm risk.

The existence of corporate governance structures

(such as Board of Directors effectiveness) is

expected to reduce firm risk as it may impede

managerial opportunistic behavior and excessive risk

taking (Balachandran& Faff, 2015). Mathew et al.

(2018) documented that corporate governance index

(compiled based on board attributes such as

composition, leadership structure, member

characteristics, and board processes) are negatively

related to firm risk because they can influence

control role, so board attributes may affect firm risk

through its impact on strategic direction for

management and control functions.

Research that examines relationship of

governance and firm risk is still limited (such as

Alam& Shah, 2013; Sila et al., 2016; Mathew et al.,

2018). The researchers measured corporate

governance based on each board's characteristics.

Alam& Shah (2013) examines ownership,

independence, size, and CEO-Duality against firm

risk, while Sila et al. (2016) examines the effect of

proportion of women on board against firm risk.

This study examines the effects of corporate

governance (as measured by overall BOD

characteristics or BOD effectiveness) on firm risk.

This study aims to provide empirical evidence on the

effect of BOD effectiveness on firm risk, and the

role of IR quality in mediating those influences.

Based on signaling and legitimacy theory, this

study developed hypotheses. This study used panel

data from 143 listed companies in JSE from 2014 to

2017. Using Structural Equation Modeling (SEM)

analysis, this study found that BOD effectiveness

has a negative effect on firm risk. However, BOD

effectiveness does not affect IR quality in which IR

quality does not affect firm risk. This study also

found that IR quality cannot mediate the effect of

BOD effectiveness against firm risk.

2 LITERATURE REVIEW AND

HYPOTHESIS DEVELOPMENT

2.1 Integrated Reporting Quality

IR is a brief communication of how corporate

strategy, governance, performance and prospects can

lead to create short, medium and long term value

(IIRC, 2013). IRs including eight interrelated

content elements: organizational overview and

external environment, governance, business models,

risks and opportunities, strategy and resource

allocation, performance, outlook, and base of

presentation.

2.2 Firm Risk

Ross et al. (2015) classifies firm risk into two

components: systematic and specific or unsystematic

risk. Systematic risk is all risks that can affect a

large number of assets become larger or smaller.

This risk is often referred to as market risk as there

is uncertainty about economic conditions such as

GNP, interest rates, or inflation. While specific or

unsystematic risk is defined as a risk that

specifically affects an asset or a small asset such as

announcement of an oil strike by a company will

only affect the company itself or some other

company, it will not affect the world oil market.

Such information is unsystematic and affects only

certain companies. This risk is also often referred to

as an idiosyncratic risk (Ross et al., 2015).

2.3 Board of Directors Effectiveness

BOD effectiveness is influenced by the

characteristics it possesses. Hermawan (2011) uses

several board characteristics (i.e. independence,

activity, size, and board competencies) to measure

board of commissioner effectiveness, but his

research uses a sample of Indonesian companies

which follow a two-tier system. This study uses a

sample of listed companies on Johannesburg Stock

Exchange (South Africa) which adopt a one-tier

system where there is no board of commissioners, so

board characteristics are used to measure BOD

effectiveness. First characteristic is independence.

King III (2009) requires that majority of non-

executive directors be independent to reduce

conflicts of interest and encourage objectivity.

Second characteristic is board activity.

Frequent meetings will have a more effective

role as they can better control the company (Lipton

Board of Directors Effectiveness, Integrated Reporting Quality, and Firm Risk

113

&Lorsch, 1992). Third characteristic is board size.

King III (2009) requires that board must have at

least two executive directors who must become

CEOs and other directors responsible for finance.

Last characteristic is competence. The effectiveness

of boards monitoring role depends on their

experience, knowledge, and educational background

so they can have ability to understand business

operations of the company and also they must have

competence in understanding company's financial

statements, since reported financial performance is

one of the information used in evaluating action

management (Hermawan, 2011).

2.4 Board of Directors Effectiveness

and Firm Risk

Board plays a role in lead company with a

prudent and effective controlling framework for

assessing and managing risks (Mallin, 2016). Board

attributes (measured by composition, leadership

structure, characteristics, and board processes)

determine how board performs control roles,

services, and strategies that can affect results and

performance of the company and it is expected that

these board attributes relate to firm risk through its

impact on strategic direction over function and

management control (Mathew et al., 2018). Bennett

(2013) confirmed that enhanced monitoring roles,

through increased board attendance and other factors

related to less risk taking. Platt & Platt (2012) tested

several board attributes linked to bankruptcy and

found that bankrupt companies have fewer

independent directors, smaller board sizes, higher

shareholdings by directors, less compensation and

nominations. This indicates that the board factors are

related to firm risk.

Baulkaran (2014) found that board size can

reduce firm risk, this is because more board

members the company's monitoring role is

increasing which will reduce firm risk. Mathew et al.

(2018) is also documented that governance as

measured by board attributes is negatively related to

firm risk. Based on the description above, the first

hypothesis in this study is as follows:

Ha1: Board of Directors effectiveness has a

negativeeffect on firm risk

2.5 Board of Directors Effectiveness

and IR Quality

King III (2009) requires boards to ensure and verify

IR integrity. This can be done in a way such as

delegating authority to audit committee to evaluate

disclosure of sustainability, ensuring that published

IR has included issues of going concern, and

illustrated positive and negative impacts of the

company's operations and plans to improve positive

things and reduce impact of negative things. Alfiero

et al. (2017) documented a positive relationship

between board characteristics to IR adoption. Thus,

it is expected that an effective BOD will be able to

better monitor financial and non financial reporting

and improve IR quality. Frias-Aceituno et al. (2012)

found that larger board sizes, boards with more

experience, and more board diversity can result in an

increasingly IR quality. It is expect that board

characteristics can create an increasingly effective

monitoring role which can lead to better IR quality.

Based on the description above, the next hypothesis

is:

Ha2: Board of Directors effectiveness has positive

effect onIntegrated Reporting Quality

2.6 Integrated Reporting Qualityand

Firm Risk

IR essentially integrates ESG factors into

strategies, output measurements and assessments of

risks and opportunities faced by firms (Steyn, 2014).

ESG factor disclosed may reduce firm risk (Sassen

et al., 2016). Lower level of corporate social

performance tends to increase the likelihood of

lawsuits faced by companies, whereas companies

with high levels of social performance can reduce

financial risk and market participants are more

willing to allocate capital so as to lower capital limit

for firms (Cheng, Green, Conradie, &Romi, 2014).

Better corporate social performance can also meet

stakeholder information needs, enhance corporate

reputation, enhance brand value, improve corporate

image, and create moral capital (Sassen et al., 2016).

Sassen et al. (2016) documented a negative

relationship between social performance and firm

risk, meaning that there was a decrease in risk (ie

systematic and total risk) in companies with high

social performance. Furthermore, idiosyncratic risk

also declines when firms have high environmental

performance, but negative effects of environmental

performance with systematic risk and total risk apply

only to industries that are environmentally sensitive.

Based on the description, high IR quality is expected

to decrease firm risk. This is because better IR

quality indicates ESG factor has been well integrated

in IR. Thus, the next hypothesis in this study is:

Ha3: IR quality has a negative effect on firm risk

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

114

2.7 Board of Directors Effectiveness,

IR Quality, and Firm Risk

The effect of BOD effectiveness on firm risk has

been proven by previous research. Mathew et al.

(2018) documented that board attributes of

composition, leadership structure, characteristics,

and board processes are negatively related to firm

risk. This is because board attribute can determine

how the board performs role of controls, services,

and strategies that can affect results and performance

of company and it is expected that these board

attributes can reduce firm risk through its impact on

strategic direction of management functions and

controls (Mathew et al., 2018). Although the

relationship of BOD effectiveness and firm risk has

been demonstrated, board actually has many roles

which role does not only focus on managing firm

risk. For example monitoring role of corporate

reporting, this role has been set in King III (2009)

i.e. board must ensure and verify IR integrity. On the

other hand, company reports (in this case IRs) are

among the sources of information considered by

investors in assessing company, moreover this study

measures firm risk by using market risk. So through

IR, it is expected to reduce firm risk because board

plays a role in monitoring IR process and then can

affect IR quality generated and qualified IR is

expected to reduce firm risk because in assessing

company, information in IR become one of

considerations by investors to take decision.

Ha4: Board of Directors effectiveness has a negative

effect on firm risk through enhanced

integrated reporting quality

3 METHOD

Population of this study are all public companies

listed on Johannesburg Stock Exchange (JSE), South

Africa. The sample was chosen by using purposive

sampling technique. The reason of selecting this

sample is because South Africa was first country to

require listed companies on JSE to issue an IR or

explain reasons for not complying. BOD

effectiveness and IR quality data are obtained from

the company's annual report accessed from the

official JSE website or official website of each

company. Listed companies on JSE numbered 488

companies. Then, this study excluded companies

that include in financial industry as much as 119;

companies that do not issued IR 2014 to 2017 of 56

companies; companies with unavailable and

incomplete data of 157 companies; and companies

with data outliers of 11 companies. The final sample

numbered 143 companies with 4 years of

observations. So the number of observations is 572

Firms-Years.While financial data to measures other

variables obtained from datastream accessed through

Pusat Data EkonomidanBisnis (PDEB), Universitas

Indonesia. Structural Equation Modeling (SEM) is

used to data analysis with Stata Version 13 software.

The use of SEM aims to prove hypotheses of this

study that examines the direct and indirect effects.To

test hypotheses, this study uses two research models,

as follows:

Hypotheses 1 and 3 were tested using Model 1 as

follows:

RISKit = α

0

+ α

1

BODit + α

2

IRQit + α

3

SIZEit +

α

4

ROAit + α

5

LEVit + α

6

MTBit +

α

7

DPRit-1 + α

8

IND + α

9

YEAR +

ε

it

..............................................(1)

With an expectation: H

1

: α

1

< 0, H

3

: α

2

< 0

Hypothesis 2was tested using Model 2 as follows:

IRQit = β

0

+ β

1

BODit + β

2

SIZEit + β

3

ROAit +

β

4

LEVit + β

5

MTBit + β

6

IND +

β

7

YEAR+ ε

it

..............................(2)

With an expectation: H

2

: β

1

< 0

Hypothesis4was tested using the following model:

RISKit = λ

0

+ λ

1

IRQit + λ

2

BODit + λ

3

SIZEit +

λ

4

ROAit + λ

5

LEVit + λ

6

MTBit +

λ

7

DPRit-1 + λ

8

IND + λ

9

YEAR +

ε

it

...............................................(3)

With an expectation: H

4

: λ

2

< 0

The above four models of research refer to

Violita et al. (2014). Description of each variable is

presented in Table 1.

Board of Directors Effectiveness, Integrated Reporting Quality, and Firm Risk

115

Table 1: Description of Research Variables

Variables

Description

IRQ

IR quality is measured using keyword searches referring to IIRC (2013) and Zhou et al. (2017) with

NVIVO software. Keywords are presented in Appendix 1

BOD

Board of directors effectiveness is measured by content analysis based on Hermawan (2011)

(Appendix 2)

RISK

Firm risk is measured by standard deviation of daily stock returns over 12 months from April to

March (Sassen et al., 2016; Mathew et al., 2018)

SIZE

Firm size is measured using the natural logarithm of total assets (Baboukardos&Rimmel, 2016;

García-Sánchez &Noguera-Gámez, 2017; Lee & Yeo, 2016)

ROA

Profitability is measured by using ROA is net profit divided by total assets (Haji &Anifowose,

2016).

LEV

Leverage is measured by using total liabilities divided by total assets (Hajj &Anifowose, 2016; Lee

& Yeo, 2016).

MTB

Growth is measured using market-to-book ratio is market value of equity divided by book value of

equity (García-Sánchez &Noguera-Gámez, 2017).

DPR

Dividends are measured using Dividend Payout Ratio (DPR) of previous year (Sassen et al., 2016)

IND

Industry types is measured by dummy variables (Baboukardos&Rimmel, 2016)

YEAR

Year of this study as a control with dummy

3.1 Measurement of Integrated

Reporting Quality

This study uses keywords to measure IR quality

with NVIVO10 software. Keywords that have been

inputted in NVIVO will show percentage coverage

value. Fernando (2018) states that percentage of

keywords coverage are percentage of keywords

number against all words disclosed in corporate

report. Keywords used in this study are presented in

Appendix 1.

3.2 Measurement of Firm Risk

This study measures firm risk using standard

deviations from daily stock returns over the previous

12 months (Sassen et al., 2016; Mathew et al.,

2018). The period used is from April to March.

3.3 Measurement of Board of Directors

Effectiveness

BOD effectiveness is assessed by using question

checklist based on their characteristics ie

independence, activity, size, and competence. The

checklist was developed from Hermawan (2011)

which consisted of 20 questions for BOD

effectiveness. There are 3 possible assessments for

each question: Good, Fair, and Poor, but there are a

few questions that have only 2 possible assessments:

Good and Poor. Each assessment is rated 3 for

Good, 2 for Fair, and 1 for Poor or for inadequate

information. Maximum score is 60 and minimum 20.

Scores obtained from each company then divided by

total maximum score, so value of BOD effectiveness

ranged from 0 to 1. The questionnaire used in

checklist is presented in Appendix 2. This study then

conducts Cronbach Alpha testing to test the

reliability of these questions.

4 RESULT AND DISCUSSION

4.1 Description Statistics

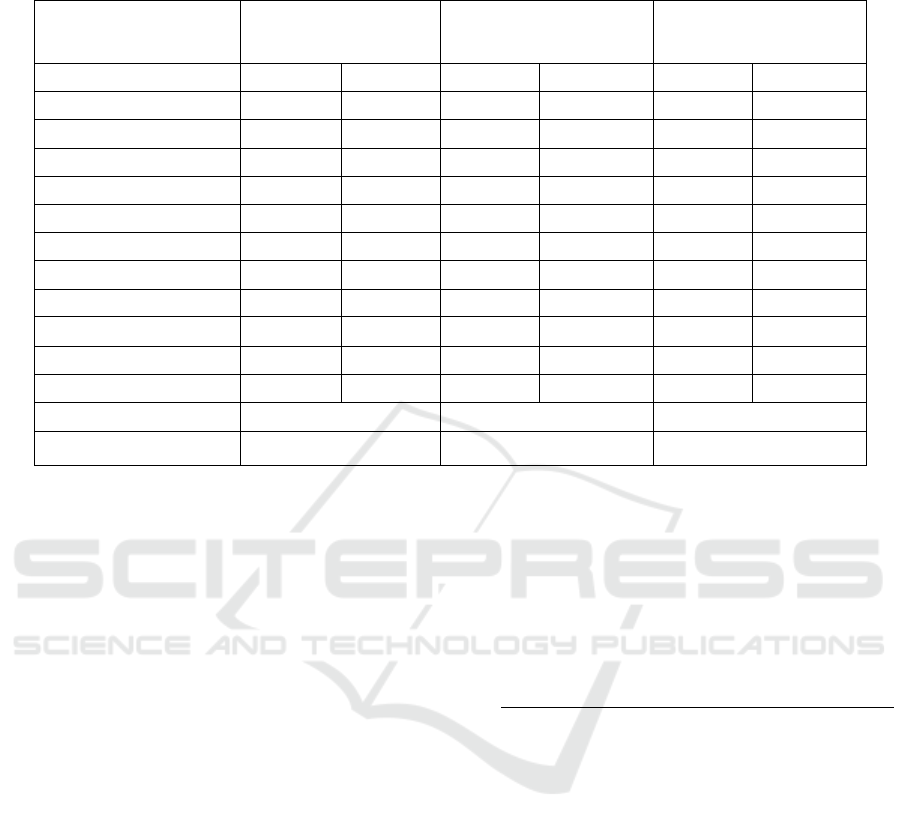

Table 2 shows descriptive statistics. Based on

Table 2, it shows that companies listed on JSE have

an average risk of 2.68%, firm risk variable shows a

standard deviation value of 0.0215 which means that

the data variation is quite low and data is normally

distributed. IR quality variable shows an average

value of 0.1855 which means that on average firms

listed on JSE reveal 18.55% IR elements of total

information disclosed in company report. The IRs

issued by Sasol Limited 2015 has highest quality of

21.5% in which earned an award from EY in 2015 as

one of the best IRs. However, Table 3 shows that the

average value of IR quality variables each year is not

very different i.e. only between 18.3% to 18.8%,

indicating that IR quality in South Africa is not

growing significantly. BOD effectiveness variable is

good because it shows average value of 84,17%.

Sasol Limited is also one of the companies that has

an BOD effectiveness value of 83.

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

116

Table 2: Descriptive Statistics

Variabel

Mean

St. Dev

Min

Max

RISK

0,0268

0,0215

0,0000

0,2067

IRQ

0,1855

0,0092

0,1445

0,2150

BOD

0,7872

0,0479

0,6167

0,9000

SIZE (Thousands of

Rand)

19.685.240

44.740.709

42.515

398.939.000

SIZE (Ln)

22,1908

1,9188

17,5654

26,7121

ROA

0,0733

0,1107

-0,3498

0,6300

MTB

2,4304

2,7003

-2,6053

23,5078

LEV

0,4978

0,1924

0,0020

2,1997

DPR

0,1715

0,2818

0,2038

1,8851

IND

0

1

YEAR

2014

2017

Description: Mean is average value of variable. Std. Dev is standard deviation of variable. Min is minimum value.

Max is maximum value. RISK is a dependent variable, ie firm risk as measured by standard deviation of daily stock

return for 12 months from April to March. IRQ is a mediation variable that is IR quality measured by keyword

search in IR using NVIVO software. BOD is an independent variable, ie BOD effectiveness as measured by a

manual check on the company's annual report. SIZE is a control variable that is firm size measured by using Ln value

of total assets. MTB is a control variable that is growth measured by using market-to-book ratio. ROA is a control

variable that is profitability measured by return on assets is net profit divided by total assets. LEV is a control

variable that is the level of debt measured by total debt divided by total assets. DPR is a control variable that is

dividend measured by using dividend payout ratio. YEAR is a control variable that is the year of study measured by

dummy varibel 1 and 0. IND is control variable that is industrial type measured with dummy variable 1 and 0.

Table 3: Average of IR Quality Scores Each Year

Year

Average

2014

0,1846

2015

0,1839

2016

0,1857

2017

0,1879

4.2 Reliability of Board of Directors

Checlist

Table 4 shows BOD cronbach alpha value of

0.6407. According to Hermawan (2011) there is no

statistical test of standard significance for alpha

values. However, alpha coefficient of BOD score in

this study is not much different from alpha

coefficient value for checklist board of

commissioner in Hermawan (2011) that is 0,607 and

not much different from coefficient alpha value of

disclosure index in Botosan (1997) that is equal to

0,64. Thus, BOD scores used in this study are

considered valid enough.

Table 4: Cronbach Alpha Testing

Variabel

Cronbach Alpha

BOD

0,6407

Descriptions:

BOD = board of directors effectiveness

4.3 Hypotheses Testing

4.3.1 Direct Effect Testing of Model 1

Table 5 shows a significant negative effect

between BOD effectiveness against firm risk seen

from 0.000 with negative coefficient (H1 accepted).

More effective BOD, the BOD can provide strategic

direction for better management and control

functions (including risk management). Mathew et

al. (2018) found that board attributes consisting of

composition, leadership structure, characteristics and

board processes negatively affect firm risk. Bernile

et al. (2016) documented that BOD diversity can

reduce the volatility of stock returns because board

diversity tends to adopt a more stable and less daring

policy in financial risk taking.

Board of Directors Effectiveness, Integrated Reporting Quality, and Firm Risk

117

However, this study can not prove the effect of

IR quality on firm risk (H3 is unacceptable). This

can be seen from significance value of 0.313 which

is greater than alpha. IR implementation in South

Africa has been mandatory, so all companies listed

on JSE have published IR. Many companies have

not complied with the rules and only provided

explanations for the reasons behind their

disobedience to the regulation. Therefore, IR can not

be used as a signal to reduce firm risk because IR

quality is not much different between companies in a

state that is already mandatory. Descriptive statistics

also indicate that the IR quality level is very low and

has not experienced significant progress from year to

year. It is also supported by the analysis done by the

researcher that many companies provide an

explanation ("explain") in their IR, which indicates

that many companies do not fully comply with the

IIRC framework or do not reveal IR content

elements.

Table 5: Direct Effect (Model 1)

Research Model:

RISKit = α

0

+ α

1

BODit + α

2

IRQit + α

3

SIZEit + α

4

ROAit + α

5

LEVit + α

6

MTBit + α

7

DPRit-1

+ α

8

IND + α

9

YEAR + ε

it

.......................(1)

Prediction

Coef.

Sig.

Constant

0,2303

0,000***

BOD

-

-0,1011

0,000***

IRQ

-

0,0425

0,313

SIZE

-

-0,0032

0,000***

ROA

-

-0,0202

0,007***

LEV

+

0,0082

0,0295**

MTB

-

-0,0004

0,1505

DPR

-

0,0055

0,0535*

IND

Yes

YEAR

Yes

Adjusted R-squared

0,3489

Prob(F-Statistics)

0,003

*** significant at α=1%, ** significant at α=5%, *significant at α=10%

Description:

BOD = board of directors effectiveness, IRQ = integrated reporting quality, SIZE = firm

size, MTB = firm growth, ROA = profitability, LEV = debt ratio, DPR = dividend payout

ratio, IND = dummy industry, YEAR = dummy year

4.3.2 Direct Effect Testing of Model 2

Table 6 shows that BOD effectiveness has no effect

on IR quality. This is seen from the significant value

of BOD of 0.436 (greater than alpha) which means

that BOD effectiveness does not affect IR quality

(H2 is unacceptable). The results of this study

support Hurghis (2017). Hurghis (2017)

documented that BOD characteristics (which are the

determinants of BOD effectiveness) such as

percentage of independent non-executive directors,

gender CEOs, duality CEOs, CEO and women board

changes do not affect the company's issued IR

expansion because the IR framework principles and

guidelines are still flexible and IR is still a new so

training is still needed for companies to publish IRs.

This indicates that the board's ability to publish IRs

is lacking, so companies generally only issue IRs at

a minimal level or just to meet the applicable of

regulatory requirements of King III (2009).

Additional testing result shows that each board

characteristic has no effect on board quality except

independence. This indicates that only the

independence of the board has a significant positive

effect on IR quality which means that board

independence can improve IR quality. An

independent board is considered as an important

mechanism for controlling manager activities and

ensuring that the objectives of shareholders are

achieved. An independent board is expected to be

able to apply greater objectivity and independence in

managing the company, so as to encourage

improvement of the quality and quantity of

information disclosed (Frias-Aceituno et al., 2012).

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

118

Table 6: Direct Effect (Model 2)

Research Model:

IRQit = β

0

+ β

1

BODit + β

2

SIZEit + β

3

ROAit + β

4

LEVit + β

5

MTBit + β

6

IND + β

7

YEAR+

ε

it

…...................................................(2)

Prediction

Coef.

Sig.

Constant

0,1562

0,000***

BOD

+

0,0022

0,436

SIZE

+

0,0015

0,000***

ROA

+

0,0096

0,006***

LEV

+

0,0038

0,034**

MTB

+

0,0001

0,267

IND

Yes

YEAR

Yes

Adjusted R-squared

0,1817

Prob(F-Statistics)

0,003

*** significant at α=1%, ** significant at α=5%, *significant at α=10%

Description:

BOD = board of directors effectiveness, SIZE = firm size, ROA = profitability, LEV = debt

ratio, MTB = firm growth, IND = dummy industry, YEAR = dummy year

4.3.3 Indirect Effect Testing of Model 3

Table 7 shows that IR quality can not mediate

the effect of BOD effectiveness on firm risk (H4).

Flower (2015) states that IIRC does not require

companies to include information on losses caused

by company activity (e.g. Environment) to IR. In

addition, IR is considered to have little impact on

corporate reporting practices. This is due to lack of

strength from IR regulatory body IIRC where IIRC

council is dominated by accounting profession and

multinational corporations determined to control the

rules that threaten their positions. As a result, IIRC

is considered a "regulatory capture".

Flower (2015) further explains that the IIRC

framework (which was used as the basis for IR

quality measurement in this study) failed for two

reasons, (1) this Framework does not require

company to report fully impact of its activities on

stakeholders,society, and environment; and (2) In IR

process, this framework involves too much corporate

management discretion. Therefore, even if company

applies this framework correctly, this report will still

have many shortcomings. In addition, IIRC can not

guarantee that the company has implemented IR

elements well. Thus, IR users can confidently

predict that the company does not disclose complete,

correct and comparable information about its

sustainability performance and its impact on

stakeholders, society and environment. In addition,

IRs can not provide the information society needs to

assess company performance (Flower, 2015).

4.3.4 Additional Testing Analysis

Additional analysis aims to obtain additional

results and analysis by making changes in the

research model. Hermawan (2011) and Haji &

Anifowose (2016) performed additional analyzes by

examining the effect of each characteristic used to

measure BOD effectiveness. This research tries to

see the influence of these characteristics on firm risk

directly or indirectly through IR quality. Additional

analysis test results are presented in Table 8. Based

on table 8, for model 1 it is seen that each

characteristic of BOD has negative effect to firm

risk, while IR quality does not affect IR quality.

These results are consistent with the main tests in

this study that BOD effectiveness may reduce firm

risk and there is no effect of IR quality on firm risk.

For model 2, overall test results show same thing as

the main test, but BOD independence can improve

IR quality. While other have no effect on IR quality.

The indirect effect test indicates that the results are

consistent with main test that IR quality can not

mediate influence of each BOD characteristics on

firm risk.

Table 7: Indirect Effect

Variable

Risiko

Perusahaan

Coef.

Sig.

BOD

0,0000

0,439

Prob F

0,003

*significant at α=10%, **significant at α=5%,***

significant at α=1%

Board of Directors Effectiveness, Integrated Reporting Quality, and Firm Risk

119

Table 8: Additional Testing Results

Variabel

Model 1

Dependen Variable:

RISK

Model 2

Dependent Variable:

IRQ

Indirect Effect

Coef.

Sig.

Coef.

Sig.

Coef.

Sig.

Constan

0,2333

0,000***

0,1562

0,000***

0,2333

0,000***

IRQ

0,1524

0,4315

BOD_INDEPENDENCE

-0,0012

0,0245**

0,0005

0,0365**

0,0000

0.4315

BOD_ACTIVITIES

-0,0014

0,009***

0,0002

0,2695

0,0000

0.4340

BOD_SIZE

-0,0019

0,057*

-0,0006

0,1225

-0,0000

0.4320

BOD_COMPETENCE

-0,0023

0,000***

-0.0004

0,1990

-0,0000

0.4320

SIZE

-0,0034

0,000***

0,0012

0,0000***

ROA

-0,0190

0,011**

0,0099

0,0055***

MTB

-0,0003

0,135

0,0001

0,2660

LEV

0,0084

0,0275**

0,0034

0,0490**

DPR

0,0055

0,054*

IND

Yes

Yes

Yes

YEAR

Yes

Yes

Yes

5 CONCLUSION

This study aims to provide empirical evidence

the effect of BOD effectiveness on firm risks

directly and indirectly through IR quality. Research

samples are 143 companies with 4 years observation

that is 2014 until 2017, data analysis using Structural

Equation Model. The results showed that BOD

effectiveness has a significant negative effect on

firm risk, BOD effectiveness has no effect on IR

quality, and IR quality has not affect firm risk. The

results of this study have implications for regulators,

especially in Indonesia that need to do a good

consideration if want to require IR practices in

Indonesia. This study has some limitations:

searching keywords for IR quality only captures how

much information disclosure but cannot assess how

information quality is disclosed, sample of this study

uses only one country i.e. South Africa, using only

one proxy for risk measurement i.e. total risk, and

this study combine 8 elements of IR content, so the

results of each content element cannot be analysed.

Further research may consider the limitations in this

study.

REFERENCES

Alam, A & Shah, S.Z. (2013). Corporate Governance and

Its Impact on Firm Risk. International Journal of

Management, Economics, and Social Sciences, 2 (2),

76-98

Alfiero, S., Cane, M., Doronzo, R., & Esposito, A. (2017).

Integrated reporting: the links between its adoption

and board characteristics. Proceeding. Available on

http://disa.uniroma3.it/ricerca/osservatori-e-laboratori/

Baboukardos, D., & Rimmel, G. (2016). Value relevance

of accounting information under an integrated

reporting approach: A research note. Journal of

Accounting and Public Policy, 35(4)

Balachandran, B. & Faff, R. (2015). Corporate

governance, firm value and risk: past, present, and

future. Pacific-Basin Finance Journal, 32, 1-12

Baulkaran, V. (2014). A Quiet Revolution in Corporate

Governance: An Examination of Voluntary Best

Practice Governance Policies. International Review of

Finance, 14(3), 459-483

Bennett, B. (2013). Evidence on the value of director

monitoring: a natural experiment. Working Paper,

Arizona State University, available at SSRN:

http://ssrn.com/abstract=2218773

Bernile, G., Bhagwat, V., & Yonker, S. (2016). Board

diversity, firm risk, and corporate policies. Working

Paper

Brick, I.E. & Chidambaran, N.K. (2008). Board

monitoring, firm risk, and external regulation. Journal

of Regulation Economic, 33, 87-116

Cheng, M., Green, W., Conradie, P., & Romi, A. (2014).

The international integrated reporting framework: Key

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

120

issues and future research opportunities. Journal of

International Financial Management & Accounting,

25(1), 90–119.

DeVilliers, C., Hsiao, P.-C. K., & Maroun, W. (2017).

Developing a conceptual model of influences around

integrated reporting, new insights and directions for

future research. Meditari Accountancy Research,

25(4), 450–460.

Fernando, K. (2018). Relevansi nilai informasi

sustainability reporting dan integrated reporting: Bukti

dari Afrika Selatan. Tesis. Universitas Indonesia

Financial Reporting Council (FRC). (2011). Cutting

clutter. Combating clutter in annual reports.

Flower, J. (2015). The international integrated reporting

council: A story of failure. Critical Perspectives on

Accounting, 27, 1–17.

Frias-Aceituno, J. V., Rodriguez-Ariza, L., & Garcia-

Sanchez, I. M. (2012). The role of the board in the

dissemination of integrated corporate social reporting.

Corporate Social Responsibility and Environmental

Management, 20(4), 219–.

Frías-Aceituno, J. V, Rodríguez-ariza, L., & García-

sánchez, I. M. (2013). Is integrated reporting

determined by a country ’ s legal system ? An

exploratory study. Journal of Cleaner Production,

44(1), 45–55.

García-Sánchez, I.-M., & Noguera-Gámez, L. (2017).

Integrated Reporting and Stakeholder Engagement:

The Effect on Information Asymmetry. Corporate

Social Responsibility and Environmental

Management.

Haji, A.A. (2015). The role of audit committee attributes

in intellectual capital disclosures. Managerial Auditing

Journal, 30(8/9), 756–784.

https://doi.org/10.1108/MAJ-07-2015-1221

Haji, A.A., & Anifowose, M. (2016). Audit committee and

integrated reporting practice: does internal assurance

matter? Managerial Auditing Journal, 31(8/9), 915–

948.

Hermawan, A.A. (2011). The Influence of Effective Board

of Commissioners and Audit Committee on the

Informativeness of Earnings: Evidence from

Indonesian Listed Firms. Asia Pacific Journal of

Accounting and Finance, 2 (1).

Hurghis, R. (2017). Integrated reporting and board

features. Audit Financiar, XV (1), 83-92

IIRC. (2013). The International IR Framework.

http://integratedreporting.org/resource/international-ir-

framework/

Ika, S.R. & Ghazali, M.N.A. (2012). Audit committee

effectiveness and timeliness of reporting: Indonesian

evidence. Managerial Auditing Journal, Vol. 27 (4),

pp. 403-424.

King III.(2009). King Code of Governance for South

Africa. Institute of Directors in Southern Africa.

Lee, K. W., & Yeo, G. H. H. (2016). The association

between integrated reporting and firm valuation.

Review of Quantitative Finance and Accounting,

47(4), 1221–1250.

Mallin, C.A. (2016). Corporate Governance. Oxford:

University Press, Fifth Edition

Mathew, S., Ibrahim, S., & Archbold, S. (2018) Corporate

governance and firm risk. Corporate Governance: The

International Journal of Business in Society, 18 (1),

52-67.

Oikonomou, I., Brooks, C., & Pavelin, S. (2012). The

Impact of Corporate Social Performance on Financial

Risk and Utility: A Longitudinal Analysis. Financial

Management, 41(2), 483–515.

Platt, H., & Platt, M. (2012). Corporate board attributes

and bankruptcy. Journal of Business Research, Vol.

65 No. 8, pp. 1139-1143

Plumlee, M., Brown, D., Hayes, R. M., & Marshall, R. S.

(2015). Voluntary environmental disclosure quality

and firm value: Further evidence. Journal of

Accounting and Public Policy, 34(4), 336–361.

Sassen, R., Hinze, A. K., & Hardeck, I. (2016). Impact of

ESG factors on firm risk in Europe. Journal of

Business Economics, 86(8), 867–904.

Sila, V., Gonzalez, A., & Hagendorff, J. (2016). Women

on board: does boardroom gender diversity affect firm

risk?. Journal of Corporate Finance, 36, 26-53

Simnett, R., & Huggins, A. L. (2015). Integrated reporting

and assurance: where can research add value?

Sustainability Accounting, Management and Policy

Journal, 6(1), 29–53.

Steyn, M. (2014). Organisational benefits and

implementation challenges of mandatory integrated

reporting. Sustainability Accounting, Management and

Policy Journal, 5(4), 476–503.

Velte, P., & Stawinoga, M. (2016). Integrated reporting:

The current state of empirical research, limitations and

future research implications. Journal of Management

Control, 1–46.

Zhou, S., Simnett, R., & Green, W. (2017). Does

integrated reporting matter to the capital

market?.ABACUS: A Journal of Accounting, Finance,

and Business Studies, 53 (1)

Board of Directors Effectiveness, Integrated Reporting Quality, and Firm Risk

121