Analysis of Labor Absorption

Province of South Sumatera

Leo Budiriansyah, Nurlina Tarmizi and Bambang Bemby Soebyakto

Universitas Sriwijaya, Palembang, Indonesia

Keyword: Labor Force, domestic investment, foreign investment

Abstract: This study aims to find out how is the level of employment and the influence of economic growth,

investment (domestic investment and foreign investment), and provincial minimum wage affect it in the

province of South Sumatra. The analytical tool used is Multiple Linear Regression with data obtained is

secondary data that is economic growth, domestic invesment, foreign investment, provincial minimum

wage, and number of labor in South Sumatera Province during period 2006-2015. The results showed that

the absorption of labor force in South Sumatra during the period 2006-2015 has a fluctuated value. More

than 50 percent of the workforce is absorbed in the agricultural sector. The rest is mostly absorbed by the

trade and services sectors. Based on the regression result, it is found that economic growth, domestic

invesment, foreign investment have a significant and positive effect on employment, while provincial

minimum wage also has significant influence but has negative relation to employment in South Sumatera

Province.

1 INTRODUCTION

Theoretically there is a link between economic

development, economic growth and the level of

employment. If economic growth increases, it

means that there is an increase in the production

capacity of goods and services in a region, so that

theoretically this increase indicates an expansion in

production activities which then increases

employment in various economic sectors. Thus the

wheels of the economy will continue to roll so as to

achieve the goals of economic development itself.

(Dornbusch, Fischer and Startz, 2001) states that

national output (as a representation of economic

growth) is a function of physical capital, labor and

technological progress achieved. An important

factor that influences the procurement of physical

capital is investment, in the sense that high

economic growth is expected to have a positive

impact on employment rates. The relationship

between economic growth and theoretical

employment is also demonstrated through Okun's

Law. (Mankiw, 2007) Okun's law is a negative

relationship between unemployment and GDP,

which refers to a decline in unemployment of one

percent associated with additional growth in GDP

which is close to two percent. In other words,

Okun's Law illustrates that if GDP increases by two

percent, there will be an increase in employment

which then decreases the unemployment rate by one

percent.

South Sumatra Province is one of the provinces

in Indonesia that has fluctuated in its economic

growth rate. Table 1.1 below illustrates the

development of the South Sumatra Province GRDP

from 2012-2015.

300

Budiriansyah, L., Tarmizi, N. and Bemby Soebyakto, B.

Analysis of Labor Absorption Province of South Sumatera.

DOI: 10.5220/0008439603000308

In Proceedings of the 4th Sriwijaya Economics, Accounting, and Business Conference (SEABC 2018), pages 300-308

ISBN: 978-989-758-387-2

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Table 1: Development of GDP in South Sumatra Province 2010-2015 period (in million Rupiah)

South Sumatra

PDRB Period

Period

2010

2011

2012

2013

2014

2015

GRDP based

on constant

2010 prices

232.175.048

206.360.699

220.459.198

232.175.048

243.093.768

254.022.862

% Growth

5,31

6,36

6,83

5,31

4,70

4,50

Source: Processed from "Province of South Sumatra in Figures 2016" (BPS)

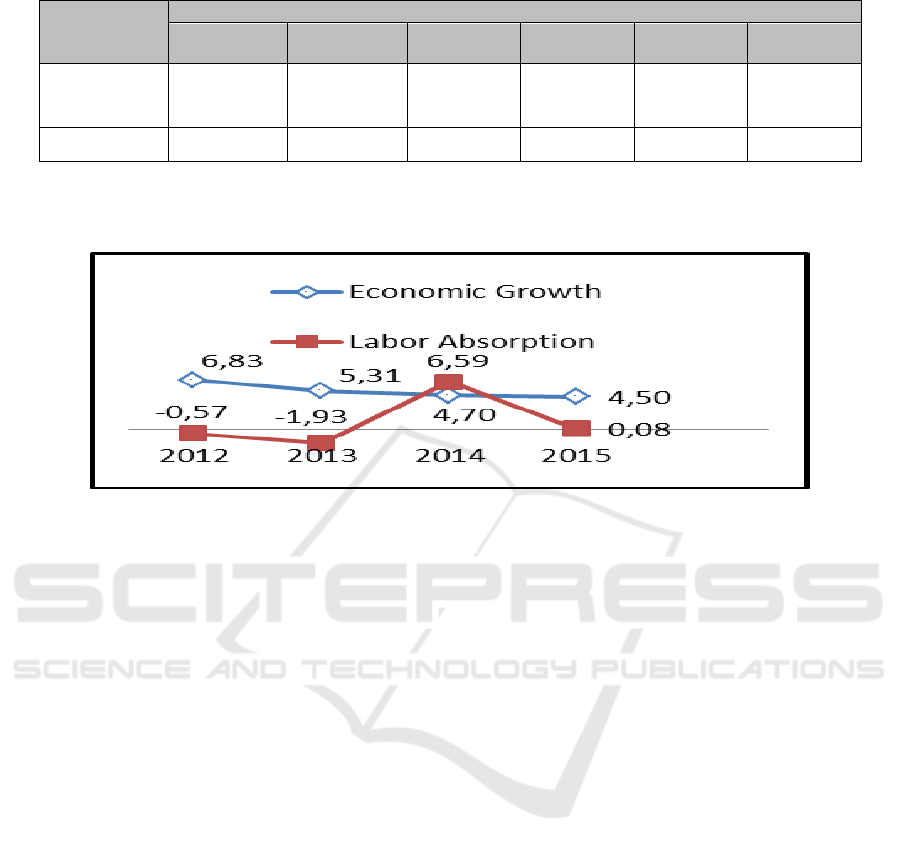

Following Figure 1 shows a graph of economic growth and employment in South Sumatra.

Source: Central Bureau of Statistics, 2016

Figure1: Chart of Economic Growth and Absorption of South Sumatra Labor Year 2012–2015

From the picture above, it can be seen that

economic growth and employment of the Province

of South Sumatra have not run the same trend.

During 2012-2015 economic growth tended to

decline while the absorption of labor experienced a

fluctuating growth.

Employment problems in South Sumatra

Province are not much different from labor issues in

Indonesia in general. Whether it concerns the

unemployment rate which is still relatively high, and

the level of labor productivity that is still not

optimal. One of the biggest challenges is creating

jobs or businesses that are feasible for the workforce

that must be anticipated from an early age before

there is an increase due to changes in the age

structure of the population. The challenge includes

two aspects at once, namely the creation of new

employment opportunities for the workforce who

have not yet worked, and the increase in work

productivity for those who have worked so that they

can obtain adequate employee benefits to live decent

lives (Central Bureau of Statistics, 2016).

The problem of employment and unemployment

is a serious problem that must be observed by the

government. The main factor in the size of the

unemployment rate is limited employment. This

problem will undoubtedly put heavy pressure on the

economy as well as adverse social impacts such as

crime and so on. One of the government's strategic

steps to create new jobs to reduce unemployment in

South Sumatra Province is that the government must

raise investment funds from local governments, the

central government, the public and foreign

investment by improving the business climate and

cutting down licensing bureaucracies. It is expected

that the increase in investment through PMA and

PMDN will stimulate the growth of the production

sector which will then increase economic growth

which of course also impacts on the increase in

employment due to the creation of new jobs.

The following table reveals the percentage of the

number of workers employed based on the business

field in South Sumatra 2012-2015.

Analysis of Labor Absorption Province of South Sumatera

301

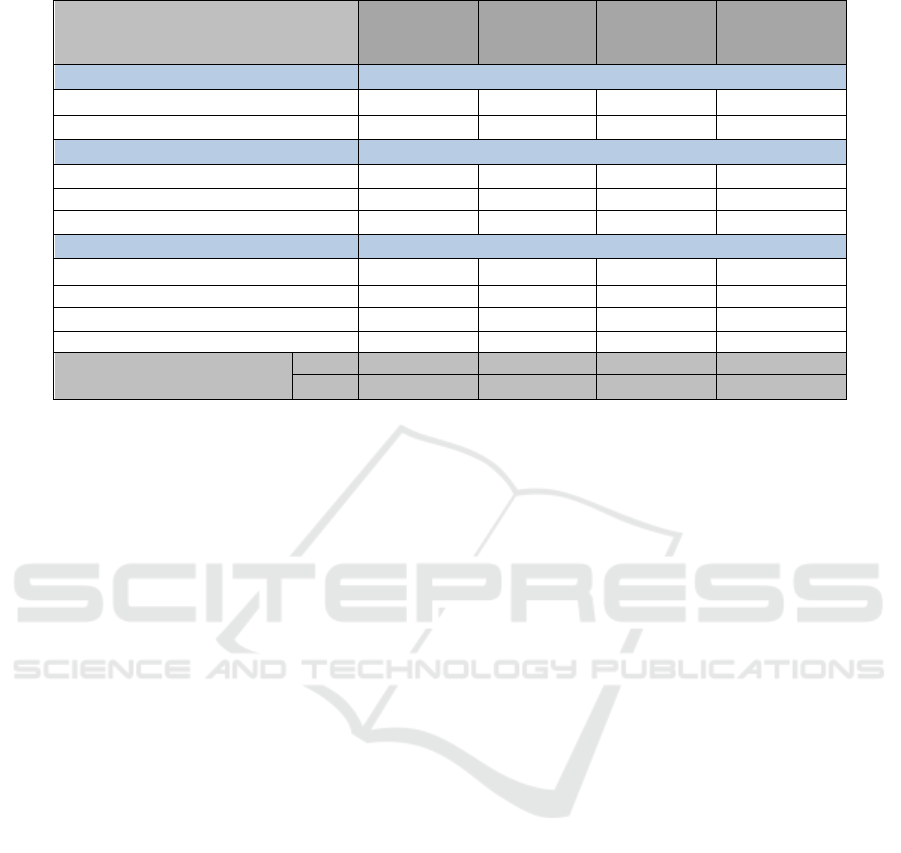

Table 2: Percentage of Number of Workers by Business Field South Sumatra Province 2012-1015

Business field

2012

2013

2014

2015

Primary Sector

- Agriculture

56,37

54,86

53,37

54,74

- Mining

1,38

1,49

1,02

1,56

Secondary Sector

- Industry

5,58

4,48

5,05

4,7

- Electricity, Water and Gas

0,19

0,19

0,17

0,17

- Building

4,01

3,82

4,32

4,54

Tertiary Sector

- trade

14,59

15,46

11,96

16,82

- Transportation / Communication

3,43

3,63

5,65

3,64

- finance

2,03

2,24

1,72

1,61

- Services

12,63

13,44

9,76

12,22

Total

%

100

100

100

100

N

3.532.932

3.524.883

3.692.806

3.695.866

Source: Central Bureau of Statistics, 2016

Table 1.8 above reveals that the absorption of

labor in South Sumatra during 2012-2015 was most

prevalent in the agricultural business field. More

than half of the total workforce in South Sumatra

works in the agricultural sector. The next biggest

contribution to labor absorption is in the trade

business sector and services (including hotel and

restaurant businesses). The smallest business sector

absorbing labor is the electricity, water and gas

sector.

Based on the theory of labor demand and supply,

one of the factors that determines the absorption rate

of work is the prevailing wage level. Wage rates in

Indonesia are regulated in the minimum wage

policy. Minimum wage policy is a wage system that

has been widely applied in several countries, which

basically can be seen from two sides. First, the

minimum wage is a protection tool for workers to

maintain that the value of wages received does not

decrease in meeting their daily needs. Second, as a

protection tool for companies to maintain worker

productivity (Simanjuntak, 2001).

The Provincial Minimum Wage tends to continue

to increase every year due to changes in components

which are the Minimum Wage setting factor. In

theory, this certainly affects the demand and supply

of labor so that it will have an impact on the amount

of employment in the Province of South Sumatra.

2 LITERATURE REVIEW

2.1 Theoretical basis

2.1.1 Theory of Labor

(Ehrenberg and Smith, 2012) labor is a person

who is over 16 years old and is being employed by a

company.

Manpower is a population in working age (aged

15-64 years) or the total number of residents in a

country who can produce goods and services if the

demand for their workforce, and if they want to

participate in these activities (Subri, 2003).

2.1.2 Labor Supply and Demand

The demand for labor is related to the amount of

labor needed by the company or the instant of a

certain staff. Usually the demand for labor will be

influenced by the level of wages and changes in

other factors that affect demand for production

(Afrida, 2003).

The supply of labor is a function of wages, so the

amount of labor offered will be affected by the level

of wages. The supply of labor is influenced by

someone's decision whether he wants to work or not.

This decision depends also on a person's behavior to

use his time, whether used for work, or used for

other activities that are relaxed (unproductive but

consumptive), or a combination of both. If it is

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

302

associated with the level of wages, then the decision

to work someone will also be influenced by the high

and low income of someone. That is, if the labor

income is relatively high enough, then the workforce

tends to reduce the time allocated for work

(Sumarsono, 2009).

2.1.3 Employment Opportunities and

Absorption of Labor

Job opportunities contain the notion that the

amount of willingness of the production business to

employ labor is needed in the production process,

which can mean jobs or opportunities available to

work that exist from one moment of economic

activity. Job opportunities can be created if there is a

demand for labor in the labor market, so that in other

words employment opportunities also show demand

for labor.

The growth of employment opportunities will

certainly be accompanied by an increase in the level

of employment. (Simanjuntak, 2001), employment is

a population that works absorbed and spread across

various sectors

2.1.4 Theory of Economic Growth

Economic growth (economic growth) is closely

linked to the increase in the production of goods and

services, which among others is measured by the

amount called gross domestic product (GDP) at the

national level and gross regional domestic product

(GRDP) for regions, both provinces and districts /

cities. (Central Bureau of Statistics, 2016) calls

economic growth a growth in real production, both

in sector and in totality. Called real production

growth because prices are used in assessing a

production from year to year using prices in a given

year so that price changes (inflation) do not affect

the value of production

2.1.5 Wage

The provision of wages for labor in a production

activity is basically a reward or remuneration from

producers to workers for their achievements that

have been donated in production activities. The

wages given depend (Sulistiawati, 2012): (a) The

cost of minimum living necessities for workers and

their families; (b) Binding Laws concerning

minimum wages for workers; (c) Marginal

productivity of labor; (d) Pressure that can be given

by trade unions and employers' unions; (e) Different

types of work.

2.1.6 Minimum wage

The minimum wage policy in Indonesia is

determined by the government to ensure the welfare

of workers. Many events have occurred in Indonesia

about workers' conflicts with employers. Workers

who force employers to raise wages while employers

who object to rising wages, the government applies

the drinking wage policy. Determination of

minimum wages in accordance with Minister of

Manpower Regulation No. 1 of 1999 article 1

paragraph 1.

(Sumarsono, 2009), there are three components

of minimum wages: (a) Minimum Physical Needs

(KFM); (b) Consumer Price Index; and (c) Regional

economic growth. In the 2012 Minister of

Manpower Regulation No. 13, the factors considered

in determining minimum wages are: (a) Value of

Decent Life Needs (KHL); (b) Macro productivity

(comparison of the number of Gross Regional

Domestic Products (GRDP) with the number of

workers in the same period); (c) Economic Growth

(GRDP Value); (d) Labor market conditions

(comparison of the number of employment

opportunities with the number of job seekers in a

particular area in the same period); (e) Conditions

for businesses that are not (marginal), indicated by

the development of the existence of a number of

marginal businesses in a particular area in the same

period. 23 Determination of minimum wages is

calculated based on Minimum Physical Needs

(KFM), Then changes in calculations occur based on

Minimum Life Needs (KHM).

2.1.7 Investation

Investment can be interpreted as spending or

spending on investments and production equipment

to increase the ability to produce goods and services

available in the economy (Sukirno, 2010). Machines

are driven by labor or resources and materials

managed by humans. (Samuelson, 2005), investment

involves adding capital stocks or inventory items

within one year.

Investment is essentially the beginning of

economic development activities. Investments can

be made by private sector, government or

cooperation between the government and the private

sector. Investment is a way that can be done by the

government to increase economic growth and for the

long term can increase the living standards of its

people (Mankiw, 2007).

Based on its origin, investment can be divided

into two types, namely:

Analysis of Labor Absorption Province of South Sumatera

303

1. Domestic Investment or Domestic Investment

(PMDN).

According to Regulation Number 27 of 2007

concerning Investment, what is meant by domestic

capital is part of the wealth of the people of

Indonesia, including rights and objects, both state-

owned and national or private, which are domiciled

in Indonesia, which set aside / provided to run a

business.

2. Foreign Investment or Foreign Investment

(PMA)

Foreign investment is capital owned by a

foreign country, an individual from a foreign

country, a foreign business entity, a foreign legal

entity, and / or an Indonesian legal entity which is

partly or wholly owned by a foreign party. Foreign

investment is an investment activity to do business

in the territory of the Republic of Indonesia carried

out by foreign investors, both those who use foreign

capital fully and share with domestic investors.

2.2 Previous Research

(Chusna, 2013) reviewing the influence of the

growth rate of the industrial sector, investment, and

wages on the absorption of industrial sector labor in

the Central Java province in 1980-2011. This study

was analyzed using multiple linear regression

analysis. The conclusion of this study shows that

industrial sector growth shows a declining trend

while investment, wages and labor absorption in the

industrial sector shows an increasing trend, the

growth rate of the industrial sector does not affect

the absorption of industrial sector employment,

while investment and wages affect absorption

industrial sector workforce in Central Java.

(Darman, 2013) examines the effect of economic

growth on the unemployment rate: Okun's Legal

analysis. This study uses time series data from 1990-

2013. The method used is the difference version of

Okun's law Okun gain coefficient and analysis of

ordinary least squares (OLS) to obtain regression

coefficients. The results of the study indicate that

Okun's law applies in Indonesia, where the Okun

coefficient is negative. The unemployment rate tends

to increase along with the achievement of GDP

growth.

(Dimas and Woyanti, 2009), conducted research

on employment absorption in DKI Jakarta in 1990-

2004. The analysis technique used is multiple linear

regression. The results indicate that GDP growth had

a positive effect on employment in Jakarta, while the

variable wage and investment negatively affect

employment. These negative effects caused by a

more focused investment coming to the capital-

intensive business than labor-intensive, so that

investment does not increase employment.

(Sobita and Suparta, 2014) conducted research

on economic growth and employment in Lampung.

the period 2008-2012. The data analysis method

used is quantitative data analysis (statistics) using

panel data analysis. These results indicate that the

independent variable and the real GRDP Capital

prices in agriculture significantly positive effect on

employment. The increase in real GDP and capital in

agriculture will increase employment. Meanwhile

the real wage variable significantly has a negative

effect on employment. Increase in real wages will

reduce employment.

(Sulistiawati, 2012) conducted a study on the

effect of minimum wages on employment and social

welfare in the province in Indonesia 2006-2010. The

analytical method used is the path analysis model.

These results indicate that the minimum wage

increase will reduce the use of labor with low

productivity that is generally absorbed in the

primary sector, the sector that absorbs most of the

manpower. Second, the absorption of labor has a

positive but not significant effect on social welfare.

The influence of employment on social welfare has

path coefficient of 0.08 with a significance

probability value (Sig) of 0.332. The results of this

study showed that the increase in employment did

not cause an increase in social welfare in the

provinces in Indonesia because: (1). The minimum

wages received by workers is lower than the

minimum basic needs, (2) the minimum wage

earned by a lower level of tax revenue.

(Mahalli, 2008) examining employment

opportunities and economic growth in the city of

Medan. The analysis tool used is the elasticity

calculation formula. Using the concept of elasticity

found the results of that labor elasticity coefficient

of 0.207% (Inelastic), means that for every 1% of

economic growth led to employment opportunities

open to 0.207%. While the most sensitive sectors for

employment in financial services with employment

elasticity coefficient of 1,023% (elastic). On the

demand side, the average education level of workers

is occupied by Diploma III (40.67%). Followed by

postgraduate level of 30.67% and secondary school

(25.33%) until 2010

(Arida, Zakiah and Julaini, 2015) conducted

research on the analysis of labor demand and supply

in the agricultural sector in Aceh Province. Analysis

of the data used in this study using an econometric

model with multiple single equation is the method of

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

304

ordinary least squares (OLS) or the method of least

squares. The results of the analysis of labor supply

shows that the variable of labor in the agricultural

sector and rural employment has a positive effect

and significant effect on labor supply, while the

variable quality of the population have a positive

effect but not significant to labor supply.

3 RESEARCH METHODS

3.1 Types and Data Sources

The type of data used in this study is

secondary data released by the Central Sumatra

Provincial Statistics Agency (BPS). Data collected is

data on Gross Regional Domestic Product (GRDP)

at constant prices, PMA and PMDN investment data

in South Sumatra, data on South Sumatra provincial

minimum wage development, and data on the

number of people working in the economic sectors

of South Sumatra Province. The data studied are

data for the period 2006-2015. Data collection

methods used through the library approach (Library

Research), which is done by getting secondary data

derived from the data of the relevant agencies.

3.2. Data analysis technique

3.2.1 Multiple Regression

The analytical tool used in this study is multiple

regression analysis using the Ordinary Least Square

(OLS) method or the least squares method through

SPSS 23 software.

For an analysis of the employment of South

Sumatra, the models formed are as follows:

Information:

PTkP = Manpower Absorption

PE = Economic Growth

PMDNP = Domestic Investment

PMAP = Foreign Investment

UMP = Provincial Minimum Wage

β0 = Constants

β1 - β4 = Regression coefficient

e = error term (confounding variable)

4 RESULTS AND DISCUSSION

4.1 Determination Coefficient

4.1.1 Regression Estimation Results

The following are the estimation results obtained

through regression calculations.

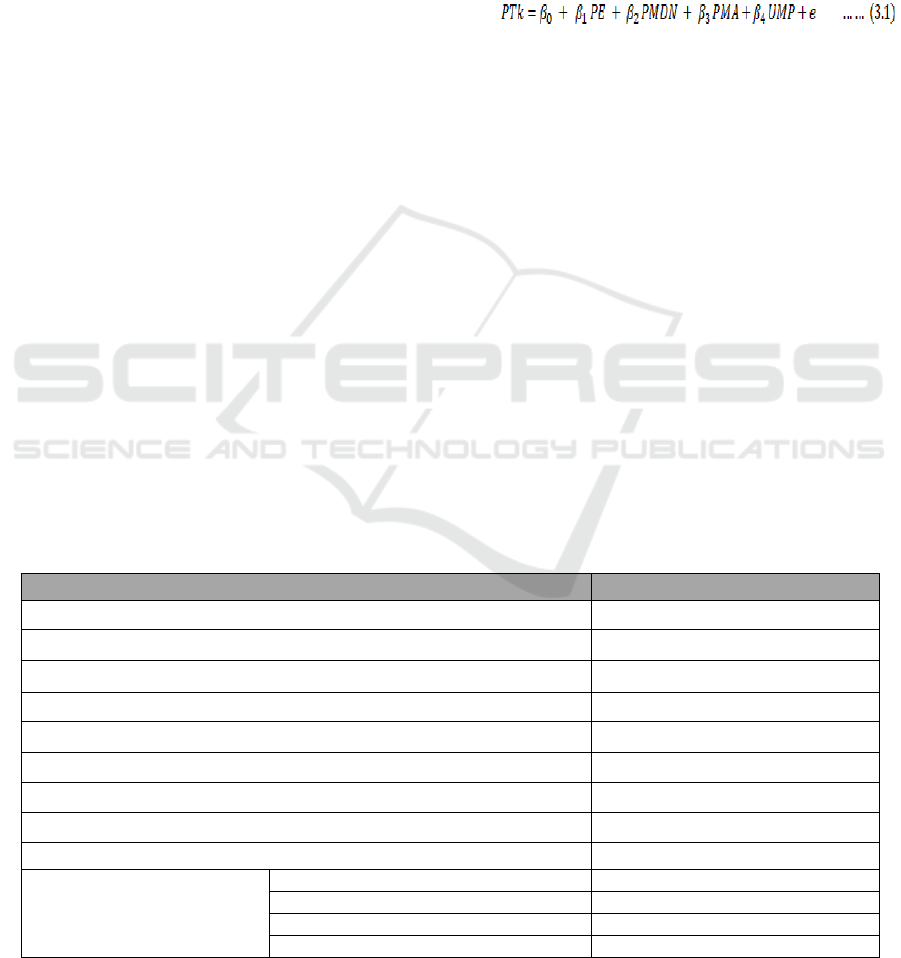

Table 3: Summary of Regression Output

REGRESSION RESULTS

VALUE

R square

0,936

Konstanta (α)

2.999.917,543

Koefisien Regression 1 (β1)

0,732

Koefisien Regression 2 (β2)

0,717

Koefisien Regression 3 (β3)

0,723

Koefisien Regression 4 (β4)

-0,628

Standard error

129.706,101

Durbin Watson (DW)

2,459

F – count

18,201

T –count variabel:

- Economic growth

3,077

- Domestic investment

3,325

- Foreign Investment

2,876

- Provincial minimum wage

-3,129

Analysis of Labor Absorption Province of South Sumatera

305

From the table above, it is found that the

coefficient of determination (R2 / R square) is 0.936.

This means that the independent variable is

influenced by the dependent variable of 93.6 percent

while the other 6.4 percent is determined by other

variables which are outside the regression model.

Based on the regression coefficient value (β1

value) it can be concluded that the increase in labor

absorption by 1% is driven by an increase in

economic growth of 0.732%. While based on the

regression coefficient value (β2 value) states that the

increase in employment by 1% is driven by an

increase in domestic investment by 0.717%. Then

based on the regression coefficient value (β3 value)

it can be concluded that the increase in employment

is 1% driven by an increase in FDI of 0.723%.

Furthermore, based on the regression coefficient

value (β4 value) it can be concluded that the increase

in employment is 1% driven by a decrease in

provincial minimum wages of 0.628%.

Based on the constant value, standard error, and

regression coefficient obtained in the table above,

the regression equation formed is as follows.

The regression coefficient value is positive for

the variable economic growth, PMDN, and PMA

shows a unidirectional relationship, which means

that the increase in these variables will cause an

increase in employment or vice versa. The

regression coefficient is negative for the minimum

wage variable, indicating the opposite relationship,

that is, if the minimum wage increases, it will tend

to reduce the amount of employment or vice versa.

This regression model has also gone through a

series of classic assumption tests, namely the test for

normality, multicollinearity, heterocedasticity, and

autocorrelation. The classic assumption test results

show the regression model does not show any

classical assumption deviations.

4.2 Test Statistics

4.2.1 Test F (Simultaneous)

The calculated F value as described in the

regression estimation results above is 18.201. With a

probability of 0.05, the degree of freedom 1 (df1 = k

- 1) is 4 and the degree of freedom 2 (df 2 = n - k) is

7, then the F table value is obtained at 5.19. By

comparing F count with F table, it can be found that

the calculated F value is greater than F table. It can

be concluded that the variables of economic growth,

PMDN, PMA and provincial minimum wages

simultaneously have a significant effect on

employment absorption variables.

4.2.2 Tes t (Partial)

The value of t calculated on each variable has

been presented in table 4.10 above. For t table values

obtained with a probability of 0.05 testing in two

directions, the degree of freedom (df = n - k) value is

5, so that the t value of the table is equal to 2.57058.

By comparing t count with t table, the conclusions

are as shown in the following table.

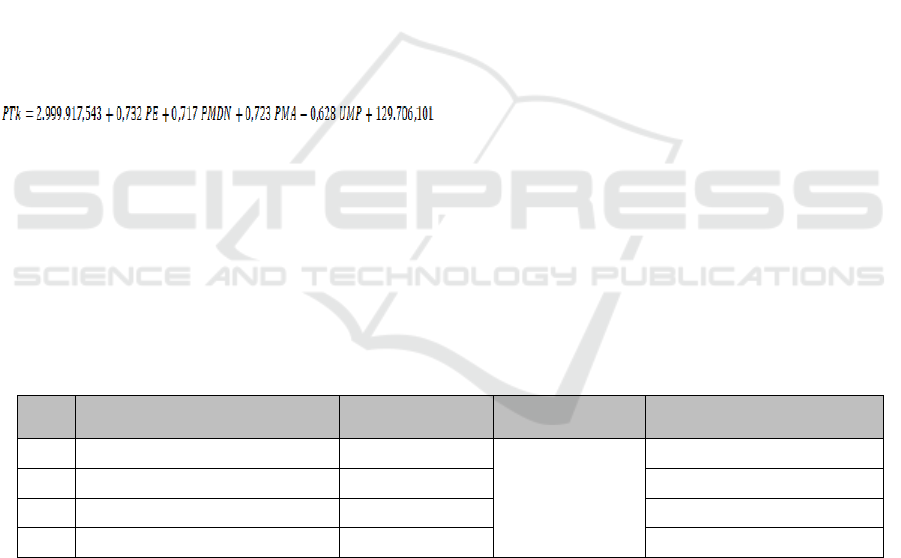

Table 4: Partial Statistics Test Results (t Test)

No.

Free variable

T-count value

T-table value

Conclusion

1

Economic growth

3,077

2,57058

Significant

2

Domestic Investment

3,325

Significant

3

Foreign Investment

2,876

Significant

4

Provincial Minimum Wage

-3,129

Significant

Source: Processed data, 2017

From the table above, it can be seen that the t

value of all independent variables is greater than t-

table so that the conclusions taken are that each

independent variable has a significant influence on

employment. The negative sign at the t value of the

variable minimum wage shows the opposite

relationship between the provincial minimum wage

and employment.

4.3 Discussion

4.3.1 Effect of Economic Growth on Labor

Absorption

Economic growth is the most dominant variable

influencing labor absorption. This research has

shown that if there is an increase in the value of

production of goods and services in the economy of

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

306

South Sumatra in a certain period, it can be

predicted that there has been an increase in the use

of labor in that period. Some theoretical studies

suggest that economic growth has a reciprocal

relationship with employment. This means that

economic growth can encourage the business sector

to increase the use of labor or economic growth can

grow due to an increase in the use of labor resulting

in increased production.

4.3.2 Effect of PMDN and PMA on

Manpower Absorption

Investment through PMDN and PMA plays an

important role in supporting the development of the

South Sumatra business sector. Investment fund

injections are able to move the government and the

private sector to increase production capacity

through increasing technology or increasing

employment and opening new jobs. If more

investment funds are directed towards improving

technology in this case, for example, the addition of

machinery and production equipment, investment is

not able to encourage an increase in employment

significantly. This is because if investment is more

inclined to increase capital, namely machinery and

production equipment, then certainly there is no

increase in the use of labor. However, if more

investment funds are allocated to increase

production capacity through increasing the number

of workers or opening new production branches,

then the role of investment is clearly able to

encourage the growth of the use of new workers. In

the Province of South Sumatra more investment is

allocated to projects that are not only capital

intensive but are more directed to labor intensive

especially in the small and medium business sector.

4.3.3 Effect of Minimum Wages on Labor

Absorption

Provincial Minimum Wages have a significant

influence on employment. Provincial minimum

wages also have a negative relationship to labor

absorption. This is consistent with the theory that

wage rates will always be the opposite of the amount

of labor use. The minimum wage level will always

be a consideration for the business sector in making

additional use of labor.

(Tarmizi, 2012) argues that the minimum wage

will reduce the number of workers, and then it will

cause unemployment if based on the model of

demand and supply in the labor market.

Basically, the application of minimum wages

serves to prevent the exploitation of companies

against labor through low wages. Related to the

above, in practice companies that are not willing to

pay at the minimum wage level that is determined

assuming the minimum wage is greater than the

market wage, then the company will do efficiency

by reducing the use of labor. While companies that

are willing to pay at the minimum wage level will

usually exploit labor in the form of adding

workloads to workers. On the other hand, setting

minimum wages can also make companies increase

the price of their products to cover the increase in

their wage costs so that it can trigger inflation.

Secara keseluruhan, model regresi yang dibangun

telah menjelaskan bahwa pertumbuhan ekonomi,

penanaman modal dalam negeri, penanaman modal

asing, serta upah minimum memiliki peran yang

signifikan terhadap tingkat penyerapan tenaga kerja

di Provinsi Sumatera Selatan. Peningkatan

pertumbuhan ekonomi, PMDN dan PMA akan

mampu meningkatkan penyerapan tenaga kerja,

namun sebaliknya peningkatan Upah minimum akan

cenderung menghambat penyerapan tenaga kerja di

Sumatera Selatan.

5 CONCLUSIONS AND

RECOMMENDATIONS

5.1 Conclusion

Based on the description above, the following

conclusions can be drawn:

1. Conditions for employment in South Sumatra

during the period 2006-2015 have fluctuated in

number. More than 50 percent of the workforce is

absorbed in the agricultural sector. The rest is mostly

absorbed by the trade sector and services.

2. Based on the results of data processing through

regression it was found that economic growth,

PMDN, and PMA had a significant and positive

effect on labor absorption. That is, the higher the

level of economic growth, PMDN, and PMA will

tend to increase employment rates. While the

provincial minimum wage has a significant but

negative influence. This means that the increase in

minimum wages will tend to reduce the amount of

employment.

5.2 Recommendation

The suggestions that the author can give are as

follows:

1. Given the large role of investment in employment

in South Sumatra, the effort to create a healthy

business climate, infrastructure development, and

Analysis of Labor Absorption Province of South Sumatera

307

ease of bureaucracy is very important to be realized

in South Sumatra in order to be able to attract

investors to invest. The South Sumatra Provincial

Government must develop an appropriate and

effective policy strategy related to this problem.

2. The author realizes that there needs to be further

in-depth research with alternatives to adding other

variables, adding years of data series, or using other

analytical tools to obtain a better picture of the

factors that affect employment in South Sumatra.

REFERENCES

Afrida, B. (2003) Economics of Human Resources.

Jakarta: Ghallia Indonesia.

Arida, A., Zakiah and Julaini (2015) ‘Analisis Permintaan

Dan Penawaran Tenaga Kerja Pada Sektor Pertanian

Di Provinsi Aceh’, Agrisep, 16(1), pp. 66–78.

Central Bureau of Statistics (2016) South Sumatra

Province in Numbers 2016. Palembang: BPS Sumsel.

Chusna, A. (2013) ‘Pengaruh Laju Pertumbuhan Sektor

Industri, Investasi, Dan Upah Terhadap Penyerapan

Tenaga Kerja Sektor Industri Di Provinsi Jawa Tengah

Tahun 1980-2011’, Economics Development Analysis

Journal (EDAJ), 2(3), pp. 14–23. doi: 10.1016/S0301-

7036(14)70862-4.

Darman (2013) ‘Pengaruh Pertumbuhan Ekonomi

Terhadap Tingkat Pengangguran : Analisis Hukum

Okun’, Journal The WINNERS, 14(9), pp. 1–12.

Dimas and Woyanti, N. (2009) ‘Penyerapan Tenaga Kerja

Di Dki Jakarta’, Jurnal Bisnis dan Ekonomi (JBE),

16(1), pp. 32–41.

Dornbusch, R., Fischer, S. and Startz, R. (2001)

Macroeconomics. Jakarta: Global Media Edukasi.

Ehrenberg, R. G. and Smith, R. S. (2012) Modern Labor

Economics: Theory and Public Policy. New York:

Prentice Hall.

Mahalli, K. (2008) ‘KESEMPATAN KERJA DAN

PERTUMBUHAN EKONOMI KOTA MEDAN’,

WAHANA HIJAU Jurnal Perencanaan &

Pengembangan Wilayah, 3(3), pp. 127–135.

Mankiw, N. G. (2007) Macroeconomics: Sixth Edition.

6th edn. Jakarta: Erlangga.

Samuelson, N. (2005) Economics 18th Edition. 18th edn.

New York: Mc Graw Hill-Irwin.

Simanjuntak, P. J. (2001) Introduction to Human Resource

Economics. Jakarta: LP FEUI.

Sobita, N. E. and Suparta, I. W. (2014) ‘Pertumbuhan

Ekonomi Dan Penyerapan Tenaga Kerja Di Provinsi

Lampung’, Jurnal Ekonomi Pembangunan (JEP),

3(2), pp. 141–166.

Subri, M. (2003) Economics of Human Resources. Jakarta:

PT. Raja Grafindo Persada.

Sukirno, S. (2010) Introduction to Macroeconomics, Third

Edition. 3rd edn. Jakarta: Raja Grafindo.

Sulistiawati, R. (2012) ‘Pengaruh Upah Minimum

Terhadap Penyerapan Tenaga Kerja dan Kesejahteraan

Masyarakat di Provinsi di Indonesia’, Jurnal

Keperawatan, 8(3), pp. 195–211. doi:

10.1155/2008/756565.

Sumarsono, S. (2009) Theory and Public Policy of Human

Resources Economics. Jakarta: Graha Ilmu.

Tarmizi, N. (2012) Labor Economics. Palembang: UNSRI

Press.

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

308