Is Financial Distress Cost Important for Determining Firm

Performance ?

Estu Widarwati

1

, Dewi Sartika

2

1

ISTIE Sutaatmadja Subang, Jl. Otista 76, Subang, Indonesia

2

Akademi Sekretari dan Manajemen (ASMI)Persada Bunda, Jl. Diponegoro No. 42, Riau, Indonesia

Keywords: Financial Distress Cost, Firm Performance, Sales Growth, Stock Return.

Abstract: The global financial crisis provides the importance in developing model to monitor, identify and asses

potential risks that can threat business sustainability. Financial Distress Cost (FDC) seems to be one of early

signal about early risk of decreasing of firm performance such as sales growth and stock return. Futhermore

it give early signal to firm reducing the loss possibility before it lead to firm’s bankruptcy. This research aims

to explain the evidence of FDC in Indonesia’s industry and its impact to firm performance. The data use

financial reports of 107 firms of manufacture industry listed in Indonesia Stock Exchange (IDX) for 2011 –

2017 and all analyzed using panel regression for presenting FDC’s impact. The descriptive analysis show that

Indonesia’s manufacture industry have higher FDC and lower sales growth after based year of crisis. There

is a negative impact of FDC to firm’s sales growth. The result proposes that FDC can be used as an early

determinant for reducing loss possibility of firm’s market share.

1 INTRODUCTION

Environmental changes become an important part

of firm’s business strategies for managing the

performance. Economic expansion will create better

operational activity for better growth opportunity, but

recession may bring a probability of failing and

liquidation of firm that may caused by raising of cost

from distressed condition (John, 1993). The global

crisis in 2013 have still impacted to business stability

in some countries of Asia. Nikkei Releases on

December 2016 reported a decline in new foreign

business both volume and export since November

2015 where client demand weakened. Then leading

the ASEAN’s manufacturing industries to buy fewer

inputs in a third week of December and causing pre-

production stocks to fall in 16 last month. Other fact

in Indonesia for period 2014-2016, Indonesia Stock

Exchange (IDX) suspended 28 firms in their trading

stock caused by several things such as disruption of

company's sustainability, no income, and other

business management issues.

The uncertainty of this economic improvement

makes firm have greater pressure opportunity in

industrial competition. Investment activities make a

high probability of economic uncertainty risk which

will affect firm’s financial performance. A firm have

potential decreasing of it when management have

been unable to anticipate the impacts. This

phenomenon referred as financial distress that occurs

before liquidation (John, 1993).

The financial distress can occur in all industries

and have been an early signal of firm bankruptcy such

as in service (Smith and Graves, 2005) and

manufacture (Smith and Liou,2007). In distressed

firm, there is a cost incurred called by Financial

Distress Cost (FDC) and it is suffered by the firm as

impact of weakening of financial position or business

disruption (Bulot et al, 2017).

The firms tend to increase following cash flow

realization which may be lower in economic crisis

(Hann et al, 2013). Then that will damage firm

performance such as loss of market share and also

cause inefficiency. Opler and Titman (1994) found a

loss of firm’s market share was caused by distress

period of highly leveraged firm.

The importance of FDC still receive less attention

in its consequency to firm performance. In previous

studies, some researchers have been interesting to

analysis the factors of it and there is many different

estimation for measuring such growth of invested

capital (Chen and Marvile, 1999), and firm’s debt

(Korteweg, 2007). Opler and Titman (1994) captured

540

Widarwati, E. and Sartika, D.

Is Financial Distress Cost Important For Determining Firm Performance.

DOI: 10.5220/0008442305400545

In Proceedings of the 4th Sriwijaya Economics, Accounting, and Business Conference (SEABC 2018), pages 540-545

ISBN: 978-989-758-387-2

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

financial distress debt which based the indicators

assuming that the higher firms leverage will make

higher it. Other studies such Pindado and Rodrigues

(2005) and Bulot et al (2017) also captured

opportunity cost that refer to the cost lowered as a

result of decreasing financial conditions. This loss is

calculated as the difference between firm sales

growth and the sectors of sales growth. A positive

result will demonstrate that firm bear opportunity loss

and underperform as industry performance

comparison in term of sales growth.

The paper gives an insight when financial distress

occurs, mostly a pressure is directed toward firm

performance. In distressed firm, there is an indication

that management has an option to reduce budgets for

remaining of competitive because it may affect their

cost and this decision can damage its performance. It

captured that industry’s FDC in Indonesia

descriptively based distress period in Opler and

Titman’s study. The argumentation that the level of

firm’s financial distress is different between before

and after occure global crises in 2013, so it resulted

FDC and performance difference. Furthermore, for

completing our descriptive analysis, the FDC’s data

test of all sample firms to performance. Using

Pindado and Rodrigues’s model measurement

through opportunity loss, mean opportunity cost

which refer FDC and then tested the impact to firm

performance. It also estimated that firm leverage,

size, and firm age have influenced to firm

performance. This study shows that opportunity loss

as Financial Distress Cost’s proxy impact to firm

performance .

This paper provides more attention on the matters

that have not fully described but it is critical in

financial distress research that is FDC and its

implication to firm performance. Refering to previous

researchs, loosing opportunity as FDC’s

measurement, and firm performance proxied by sales

growth and stock return. The argumentation using

both of them as firm performance indicators can

reflect financial distress consequency in resource

management, and also in the effort to describe its link

to FDC. Furthermore, this study describes

descriptively about the difference of firm

performance in two years before based year of

occured global crisis in 2013 and four years after it.

The hyphotesis tested FDC have negative affect to

firm performance by using some control variables

such as firm size, leverage, and firm age in the

regression model of all samples are expected more

clarify the FDC’s impact to performance.

For easier explanation, we manage the systematic

of this paper as below: part 2 describes literature

review, then part 3 explains the data, including

variables, also empirical model. Part 4 talks about

descriptive analysis and regression result, and finally

part 5 discussion that includes the limitation and

suggestion.

2 LITERATURE REVIEW

2.1 Financial Distress Cost

In finance, a firm that use more debt in its

operation will get more risk of financial distress.

When firm have difficulty making payments to

creditors, it categorized as distressed firm. The firm

should pay some costs that associated with financial

distress such indirect cost, cost of capital, and

bankruptcy cost.

Financial Distress Cost (FDC) is a special

argument in main financial problems of a firm that

related with capital structure, firm valuation, and risk

management. If firm takes more debt, it give more

risk for firm being unable to meet the creditor’s

obligation. Previous research argue that FDC only

occurs in small percentage and temporary but on the

other side, there are some results find FDC is

significant impact to firm (Altman and Hotchkiss,

2006).

FDC appears as result of costs that occur when

firm unable to fulfil its responsibility because

financial decreasing (Altman and Hotchkiss, 2006).

The firm have difficulty in payment to its creditors

may cause by several reasons, such as decreasing of

profitability which Earning Before Interest and Tax

Depreciation of Assets (EBITDA) is lower than

financial costs incurred (Opler and Titman, 1994) and

poor management (Venkataramana et al., 2012).

Some of previous studies employ different

estimations in assessing FDC, such using firm

liabilities (Korteweg, 2007), and loose opportunity

(Pindado and Rodrigues, 2005). This study uses sales

as part to evaluates FDC according Pindado and

Rodrigues (2005) and Bulot et al. (2017), because it

less affected by firm characteristic According In

context of Indonesian firms, management tends more

attention to internal factors such as human labor and

sales growth. Therefore, sales used in measuring FDC

which opportunity loss or profit can be detected as

activities output. It calculated by comparison sales

growth and sales sector.

However, the FDC discussion is important to

understand the impact of control function for their

strategic decisions in improvement firm performance.

It may lead to bankruptcy (Altman and Hotckiness,

Is Financial Distress Cost Important For Determining Firm Performance

541

2006), so this paper assumes that FDC costs that

occurs as result of financial decresing which will

impact to market share loss, growth opportunity, and

firm return, therefore causes firm inability to fulfill its

responsibilities.

2.2 Firm Performance

The firm achievement in certain period reflects

the level of its performance. Using financial

statements, management and investors can analyze

firm performance and evaluate it. The information of

firm’s financial performance needed for getting better

investment decision making, and risk management.

Financial distress risk is one of things that firm should

needs to pay attention to. As Opler and Titman (1994)

states that financial distress is costly. The market

share decline impacts to firm income, therefore sales

growth be an important ratio to measure firm ability

for maintaining its position in economic and

industrial growth. In addition, firm performance in

distress conditions also impact to rate of return in the

market. Some results show evidence that firm earns

lower return when there is decreasing financial such

finding of Lamont et al. (2001) and Campbell et al

(2008). On the other side, some research also find that

firm ability of environment adapting make financial

distress for firm but it unrelated impact to rate of

return. The gap among these findings show there is an

optimum implementation of strategy that FDC is

managable well by effectively ways and not the

contrary, increasing high cost which may decline firm

performance.

3 METHODOLOGY

3.1 The Data

This research analyzes financial report of firms

listed in IDX of 2011-2017. The samples are 107

manufacture firms with total of 749 observations in

Indonsia’s industry covering the subsectors of basic

processing and chemical; pharmacy; textile and

garment; miscellaneous industries; automotive; cable

and electricity; cosmetics; and consumers goods. The

data consist of FDC, sales growth, and stock return

processed using panel data regression. In order to

attain required sample, firms observation having zero

sales and also merger firms are excluded.

FDC used as independent variable which

measured by opportunity loss following Pindado and

Rodrigues (2005) and Bulot et al (2017). Then

dependent variables are firm performance which

proxied by sales growth and stock return (Opler and

Titman,1994). Furthermore, we take firm size,

leverage, and firm age as variable control in this

research.

First, firms analyzed descriptively about their

FDC, sales growth, and stock return over five-year

periods between 2011 and 2017. It described

previously that distressed firm have market shares

loss possibility that impacted by uncertainty

economic such global krisis. Then dividing period in

two group are before and after crisis in 2013. As

known, there is Yunani’s crisis also impacted to many

countries including Indonesia.

Second, the link between FDC and firm

performance tested without crisis period because the

insight of this paper that financial distress make a

pressure to firm performance only. Then capturing

the differences during crisis in Indonesia

descriptively and focusing in FDC’s impact to firm

performance. Therefore it is not exploring the other

determinants. After that proposing regression model

in which is influenced by FDC formula as below:

SG

it

= β

0

+β

1

FDC

it

+ LEV

it

+ SIZE

it

+AGE

it

+

it

(1)

SR

it

= β

0

+β

1

FDC

it

+ LEV

it

+ SIZE

it

+AGE

it

+

it

(2)

SG

it

represents firm performance which can be

measured by sales growth and SR

it

is stock return as

another proxy of firm return, and FDC

it

measured

using opportunity loss as comparison sales growth of

firm and sales sector, LEV

it

is leverage of firm

measured by total debt to total assets, SIZE

it

is firm

size measured using ln assets, and AGE

it

is firm age.

4 RESULT AND ANALYSIS

4.1 Descriptive Statistics

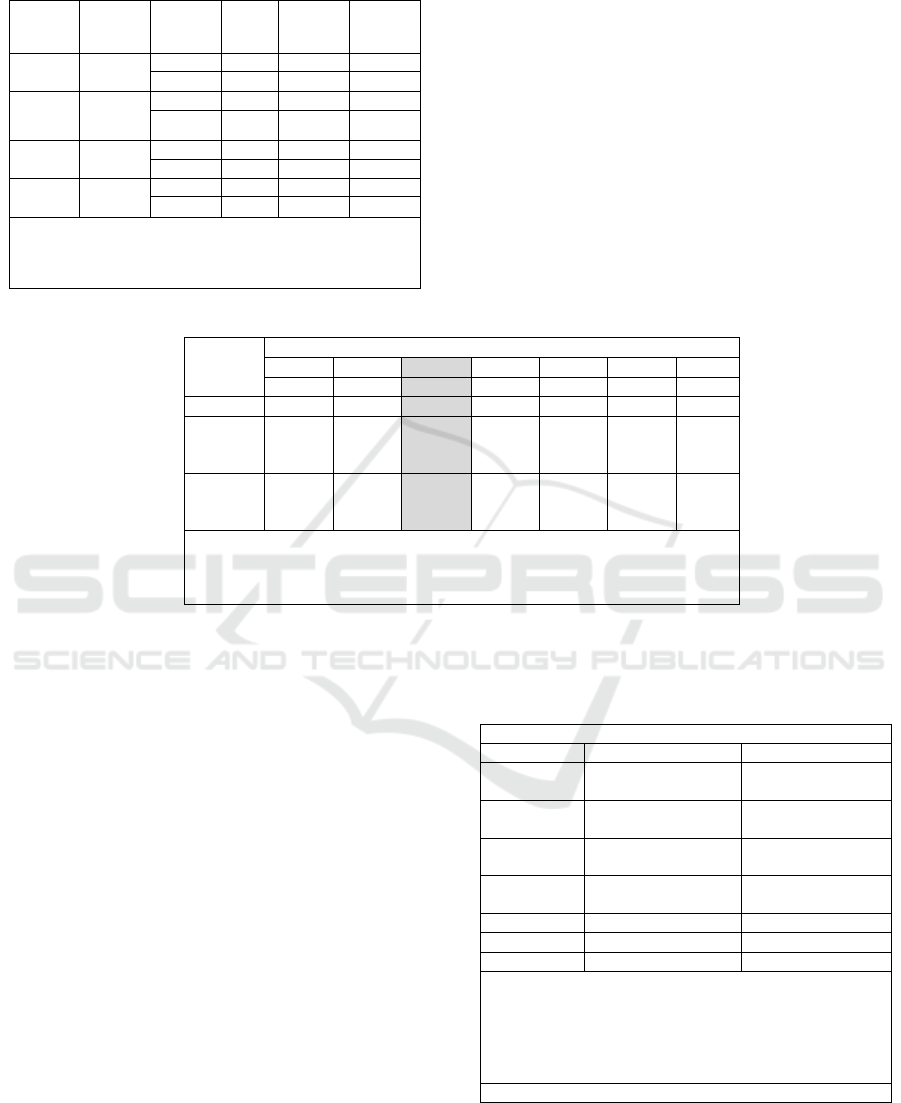

Table 1 shows descriptive statistic results for each

variable in all samples of manufacture sector. The

lowest sales growth is 3,34% and the highest FDC is

21,23%. The statistics for each observation year for

all sample of firms in which the lowest average of

sales growth and stock return for overall samples are

-26,6% in 2017 and -3,45% in 2013 and FDC as

independent variable is the highest average of overall

samples in 2017 with 26,6%.

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

542

Table 1: Descriptive Statistics Manufacture Sector

Sample

Firms

Statistic

FDC

Sales

Growth

Stock

Return

Full

Sample

107

Mean

0.0478

-0.0312

0.1967

Stdev

1.0944

1.0957

1.1641

Basic

&Chemi

cal

44

Mean

0.1184

-0.1017

0.1972

Stdev

1.4895

1.4910

1.505

Aneka

Industry

34

Mean

-0.0168

0.0334

0.1788

Stdev

0.2249

0.2263

0.7688

Consum

ption

29

Mean

-0.0311

0.0478

0.2123

Stdev

0.4974

0.4986

0.5419

This table presents the descriptive statistic of variables in which FDC

is Financial Distress Cost that measure by opportunity loss as

comparison sales growth of firm and sales growth in its sector. (%),

Sales growth and stock return are proxy of firm performance (%)

To provide background for the remainder of the

analysis, tabel 2 presents the result of all samples

before, during, and after the base year of global crisis

in 2013 for FDC, sales growth, and stock return.

Apart from showing how firms perform and the table

also shows how their performance changes over time.

This study finds that manufacture industry in

Indonesia have highest of FDC in 2017 then firms

take down in sales growth level since global crisis’s

year until four year after. It is an early indication that

firms may reduce budgets for remaining of

competitive when economic crisis and it may affect

their cost then it damage firms performance.

Tabel 2: Comparation the average of FDC and Firm Performance of all samples in 2011-2017

4.2 Regression

Against this background, the remainder of this

study investigates the impact of FDC to firm

performance. We employ panel least square

regression to explain these, controlling for a number

factors such firm size, leverage, and firm age that

might help to explain it.

The two dependent variables used to capture FDC

are sales growth, and stock return. Cash flow

problems of distressed firm may also retard firm

competitiveness in product market for various

reasons. Creditors may be unwilling to extend credit

to them fearing that they may go bankrupt before

clearing their debts. Distressed firm may be unable to

take advantage of cash discounts, and customers may

be reluctant to buy durable goods from weak firms,

which might not be in business to provide after sales

service. Decreasing of obligation fulfilment ability

due to increase FDC that lead to return decline for

investors.

Table 3: Regression Result of Financial Distress Cost and

Firm Performance

Dependent Variabel ; Firm Performance

Model 1 - SG

Model 2 - ST

FDC

-0,202*

[0,000]

-0,225

[0,5730]

LEV

-0,020

[0,1741]

0,1493**

[0,1001]

SIZE

0,0061

[0,3132]

-0.0634

[0,3095]

AGE

0,0004

[0,1475]

0,000018

[0,9945]

Method

Panel (LS)

Panel (RE)

Observations

749

747

R-squared

0,052

0,005

This table presents the result of LS on SG and SR. SG is sales

growth and SR is stock return in percent, which FDC is Financial

Distress Cost that measure by opportunity loss as comparison

sales growth of firm and sales growth in its sector (%), LEV is

measured by total debt to total asset, SIZE is firm size computed

from total asset ln TA, and AGE is firm age.

*significant at 1% **significant at 10%

As expected, this study finds negative and

significant on the impact of FDC to sales growth.

Firms with higher FDC decrease sales growth

meaning firm lose more market share. This result

Variables

Research Periode

2011

2012

2013

2014

2015

2016

2017

t-2

t-1

T

t+1

t+2

t+3

t+4

FDC

-0.0050

-0.0300

-0.1292

-0.0198

0.1232

0.1296

0.266

Sales

Growth

SG

0.1216

0.0795

0.0796

0.0198

-0.123

-0.1296

-0.266

Stock

Return

SR

0.2420

0.2969

-0.0345

0.1324

-0.158

0.6547

0.2425

This table presents the descriptive statistic of variables in which FDC is Financial

Distress Cost that measure opportunity loss as comparison sales growth of firm and

sales growth in its sector (%), Sales growth and stock return are firm performance

proxies (%)

Is Financial Distress Cost Important For Determining Firm Performance

543

support the hypothesis. As presented in Table 3, on

contrast, stock return not impacted by FDC although

it is significant by using size and firm age as control

variables. This finding shows an important role of

FDC as early signal for better managing of firm

performance.

This study also finds that firm size and firm age

has no role in controlling relation between FDC and

firm performance, but leverage level does. It

supported the finding of Opler and Titman (1994) that

leverage caused loss of firm’s market share.

5 CONCLUSION

The conceptualization of FDC shows that

Financial Distress Cost may appear as decreasing of

firm’s financial condition caused by economic crisis.

This paper focuses on explain the evidence of FDC in

Indonesia industries and its impact to firm

performance. This analysis proposes that sales growth

and stock return as firm performance proxies may be

better capture the impact of FDCs.

Firstly, this paper describes that there is difference

of firm performance before, during, and after the base

year of global crisis in 2013. From the descriptive

analysis, it is known that average FDC before the

crisis occurs lower with average sales growth is

greater than after the crisis occurred. This is in line

with the statement of Opler and Titman (1994) that

when a crisis occurs, there will be a loss of market

share in terms of lower sales growth.

Secondly, we examine the effect of FDC to firm

performance in all research periods with all samples.

The result show negative effect of FDC to sales

growth, but not find the FDC’s impact to stock return.

This is assumed due to the different Indonesian

industry characteristics that tend to be based on the

cost of human labor as the dominant determinant of

corporate costs. In addition, Indonesian industrial

investors may also have greater external

considerations than the internal factors of the

company, so it is necessary to explore further the link

between FDC and stock return.

Other result of test also finds evidence that firm

age has been as better controller on FDC’s impact to

firm performance, but none in firm size dan firm age.

Pindado and Rodrigues (2005) and Bulot et al (2017)

find the significant role of firm size in FDC. This

inconsistency finding needed to be explore more in

next research.

These all results have a theory implication that

enriching evidence of the FDC’s as one of firm

performance determinants. Furthermore, we also

reveals the relationship between leverage level on

management risk decision in improvement of

business performance. This study also offers an

practical implication for firms that the FDC’s role is

important as determinant of firm performance

especially in crisis period. Therefore, a firm can

choose preventive strategy for managing its growth

opportunity through FDC’s controling so the

decreasing probability of firm performance can be

minimized.

As limitation of this study, we only analyse

descriptively the differences of FDC and firm

performance before during, and after crisis base year

without examine it in regression. Then we use only

one proxy of FDC’s which measured based of

Pindado’s research. Those make this study’s result

can not generalized and we suggest future research

will explore the relation of FDC and firm

performance using a regression model which include

dummy function of FDCs difference in period

categories of crisis, so that firm performance can

reflected at different level of industry and research

period. Furthermore, next research also can combine

many proxies of FDC and use other proxies of firm

performance such Tobin’s Q, so its will explain better

about the impact FDC on firm performance.

Acknowledgements

We give appreciate thank to the anonymous

referees and all collegas in our affiliations for their

helpful and support in finishing this research. This

paper will be presented at 4th Sriwijaya Economics,

Accountings, and Business Conference (SEABC

2018) held in Palembang (Indonesia), November 8-9,

2018.

REFERENCES

Altman, E.I., Hotchkiss. 2006. Corporate Financial

Distress and Bankruptcy: Predict and Avoid

Bankruptcy, Analyze and Invest In Distressed Debt. 3rd

Edition. Wiley Finance: North America.

Bulot, N., Salamudin, N., Aziz, R.A. 2017. The Size

of Indirect Financial Distress Costs : Which Variable is

Reliable Important ? Jurnal Intelek, 12, 1, 12-29

Campbell, J.Y., Hilscher, J., Szilagyi, J. 2008. In Search of

Distress Risk. The Journal of Finance, 68, 6, 2899-

2939.

Chen, G.M., Marville, L.J. 1999. An Analysis The

Underreported Magnitue of the Indirect Financial

Distress Cost, Review of Quantitative Finance and

Accounting, 12, 277-293

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

544

Hann, R.N., Ognea, M., Ozbas, O. 2013. Corporate

Diversification and the Cost of Capital. The Journal of

Finance, 68, 5,1961-1999

John, T.A. 1993. Accounting Measures of Corporate

Liquidity, Leverage, adn Costs of Financial Distress,

22, 3, 91-100.

Korteweg, A.G. 2007. Financial Distress Cost across

Industries. www.ssrn.com.

Lamont, O., Polk, C., Saa-Requejo J. 2001. Financial

Constraints and Stock Returns. Review of Financial

Studies, 14, 2, 529-554.

Opler, T.C., Titman, S. 1994. Financial Distress and

Corporate Performance. The Journal of Finance, 49, 3,

1015–1040.

Pindado, J., Rodrigues, L. 2005. Determinants of Financial

Distress Costs. Swiss Society for Financial Market

Research, 19, 4, 343–359.

Smith, M., Graves, C. 2005. Corporate Turnaround and

Financial Distress. Managerial Auditing Journal, 20, 3,

304 – 320.

Smith, M., Liou, D.K. 2007. Industrial Sector and Financial

Distress. Managerial Auditing Journal, 22, 4, 376 –

391.

Venkataramana, N., Azash, S.Md., Ramakrisnaiah K.

2012. Financial Performance and Predicting the Risk of

Bankrupcty: A Case of Selected Cement Companies in

India. International Journal Of Public Administration

and Management Research (IJPAMR), 1, 1, 40-56

Is Financial Distress Cost Important For Determining Firm Performance

545