The Influence of Fiscal Autonomy and Local Expenditure Towards

Economic Growth in Southern Sumatera, Indonesia

Hendri, Didik Susetyo, Syamsurijal AK, Saadah Yuliana

Faculty of Economics, Universitas Sriwijaya, Inderalaya, Indonesia

Keywords: Fiscal autonomy, local expenditure, economic growth, Southern Sumatera.

Abstract: Provinces in Southern Sumatra have different rate of economic growth. In 2016, Southern Sumatera

provinces of which economic growth is higher than the national economic growth were Lampung and

Bengkulu. Meanwhile the economic growth of South Sumatera, Jambi, and Bangka Belitung in the same

year was lower than the national economic growth. The phenomena are the underlying reason for

conducting this study in Southern Sumatera. Objective of this study was to analyze influence of fiscal

autonomy and local expenditure towards economic growth in Southern Sumatera. The population was 5

provinces in Southern Sumatera. The data were panel data observed between 2012 and 2016. The finding

showed that Local Retribution, Staff Expenditure, and Capital Expenditure had positive influence towards

economic growth, while Local Tax had negative influence towards the economic growth in Southern

Sumatera.

1 INTRODUCTION

Economic growth is a process to increase output

from time to time and becomes an important

indicator to measure how successful development is

(Todaro & Smith, 2011; Septiatin, Mawardi &

Rizki, 2016; Ma’ruf & Wihastuti 2012). Economic

growths a pivotal phenomenon a country or region

has to pay close attention to. In general, local

economic growth is an indicator to measure local

economic growth. It is related to an increase in

public economic activities. It is expected that the

increase results in trickle-down effect. Therefore,

economic growth should become one of the targets

of both local and national development.

Todaro & Smith (2011) categorically states there

are three factors that be the main components that

influence economic growth, namely capital

accumulation, population growth and the number of

workforces that are considered to be driving

economic growth. Government expenditure also has

an important role in the process of economic growth.

This can be seen from the goods and services

produced by an area that can affect the increase in

people's living standards.

The implementation of the government's role in

the process of economic growth is one of them in the

form of expenditure. Government expenditure is

often referred to as local expenditure, which is a

fiscal policy that is useful for stimulating the

economy and creating jobs. Private investment and

government expenditure should increase economic

growth; this is the development of an endogenous

growth model developed by Romer (2015); and

Lucas (1988). The endogenous growth model of

Barro (1990) explains that productive government

spending will affect growth rates. One of the

government expenditures that can increase economic

growth is capital expenditure in the form of

infrastructures such as electricity, transportation,

education, and health.

Economic growth in Indonesia between 2012 and

2016 was fluctuating. Between 2012 and 2015, the

national economy showed negative trend but it was

growing in 2016. An area in Indonesia that has

various rate of economic growth is Southern

Sumatera. Provinces in Southern Sumatera have a

unique economic growth. Based on the data from the

National Bureau of Statistics, in 2016, the Southern

Hendri, ., Susetyo, D., AK, S. and Yuliana, S.

The Influence of Fiscal Autonomy and Local Expenditure Towards Economic Growth in Southern Sumatera, Indonesia.

DOI: 10.5220/0008443106110618

In Proceedings of the 4th Sriwijaya Economics, Accounting, and Business Conference (SEABC 2018), pages 611-618

ISBN: 978-989-758-387-2

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

611

Sumatera provinces of which economic growth is

higher than the national economic growth were

Lampung and Bengkulu. On the other hand, the

economic growth of South Sumatera, Jambi, and

Bangka Belitung in the same year was lower than

the national economic growth (National Bureau of

Statistics, 2017).

Several factors that influence economic growth

are Fiscal autonomy (Barimbing & Karmini, 2015;

Priambodo, 2014; Tahar & Zakhiya, 2011) and local

expenditure (Hamsinah, Mursinto &Soekarnoto,

2014; Wu, Tang, Lin, 2010; Zahari, 2017),

The objective of this study was to analyze

influence of Fiscal autonomy and local expenditure

towards economic growth in Southern Sumatera,

which consisted of Jambi, South Sumatera, Bangka

Belitung, Bengkulu, and Lampung. There are only

few studies investigating the influence of fiscal

autonomy and local expenditure towards economic

growth in all provinces in Southern Sumatera. It is

expected that this study can fill the gap and it also

becomes originality of this study. Both the national

and local (Southern Sumatra) government can use

finding of this study as recommendation to increase

economic growth in the area. In addition, the finding

can also be used as reference for future researchers.

2 LITERATURE REVIEW

2.1 Economic Growth

Economic growth is process of increasing

production capacity of an economic system;

economic growth is represented in the form of an

increase in national income. A country’s economy is

growing when its Gross Domestic Product (GDP) is

increasing. Economic growth is one indicator of

successful economic development (Jhingan, 2000).

Economic growth means the development of

activities in the economy which causes the goods

and services produced in society to increase and the

prosperity of the community to increase. The

problem of economic growth can be seen as a

macroeconomic problem in the long run. The ability

of a country to produce goods and services will

increase from one period to the next.

According to Kuznets as cited in Dumairy

(1997), economic growth is defined as a long-term

increase in ability of a country to provide more

economic goods to its citizens. This ability grows

according to technological advances, and both

institutional and ideological adjustments a country

needs.

The definition of Kuznets's economic growth has

three components, namely: first, a nation's economic

growth can be seen from the continual increase in

inventory; both advanced technologies are factors in

economic growth that determine the degree of

growth in the ability to supply various kinds of

goods to the population; and thirdly the widespread

and efficient use of technology requires adjustments

in the institutional and ideological fields so that the

innovations produced by human sciences can be

utilized appropriately.

Gross Domestic Product (GDP) is the amount of

added value produced by all business units in a

particular country or is the sum of the value of final

goods and services produced by all economic units.

GDP at current prices illustrates the added value of

goods and services calculated using the prevailing

prices every year, while GDP at constant prices

shows the added value of goods and services

calculated using prices that apply to a given year as

a basis for calculation.

Calculation of GDP figures uses three

approaches, namely:

1. Production Approach defines GDP is the amount

of added value for goods and services produced

by various production units in the territory of a

country within a certain period (usually one

year). The production units are grouped into nine

business fields (sectors), namely: agriculture,

mining, processing industry, electricity, gas and

clean water, building, transportation, finance,

and services.

2. Income Approach defines GDP is the amount of

remuneration received by the factors of

production that participate in the production

process in a country within a certain period.

Repayment services for production factors are

wages and salaries, land rent, capital interest, and

profits; all before deducting income tax and other

direct taxes. In the definition of GDP also

includes depreciation and net indirect tax

(indirect tax minus subsidies).

3. Expenditure Approach defines GDP is all

components of final demand consisting of

household consumption expenditure and non-

profit private institutions, government

consumption, gross domestic fixed capital

formation, changes in stock and net exports

(exports minus imports).

GDP is the most suitable indicator of economic

growth (Mankiw, 2010), but Gross Regional

Domestic Bruto (GRDB) is an indicator to measure

local economic growth. Economic growth in general

is closely related to increasing production of goods

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

612

and service. It is measured using GRDP, an indicator

to identify economic growth in an area.

Keynes argues that the level of activity in the

economy is determined by aggregate expenditure. In

general, aggregate expenditure in a given period is

less than the aggregate expenditure needed to reach

the full employment level. This situation is caused

by investments made by entrepreneurs usually lower

than the savings that will be made in the full

employment economy. Keynes argues that a free

market system will not be able to make adjustments

that will create full employment (Jhingan, 2000).

Maynard Keynes presented a model to overcome

the crisis that hit Europe around 1930 after the First

World War. The Keynesian model shows that during

a recession, budget expansion policies must be

carried out to increase aggregate demand in the

economy to increase the Gross Domestic Product

(GDP). Keynes considers public spending as an

exogenous factor that can be used as a policy

instrument to encourage economic growth. From

Keynesian thought, government spending can

contribute positively to economic growth. Therefore,

an increase in government spending tends to lead to

increased employment, profitability and investment

through a multiplier effect on aggregate demand. As

a result, government spending adds to aggregate

demand, which provokes an increase in output

depending on expenditure multipliers. In economic

theory, the role of government expenditure emerged

as a growth theory of the Keynesian Harrod-Domar

or the Harrod-Domar growth model (Todaro &

Smith, 2011).

According to Keynesian theory in his book The

General Theory of Employment, Interest, and

Money which discusses the relationship between

government expenditure and economic growth from

the increase in total economic income output in the

short term, largely determined by the desire of

households, companies, and governments to spend

their income. To model the Keynesian view of the

effect of government spending on economic growth,

this is illustrated by modeling called Keynesian

intersection (Mankiw, 2010).

2.2 Fiscal Autonomy

Local financial independence or often referred to

as fiscal autonomy shows ability of a region to

finance their own government activities,

development, and services to people who have paid

taxes and levies as sources of income local

government needs (Halim and Kusufi, 2014).

Independence is ratio of regional finance indicated

by comparison between Local Own-Source Revenue

(PAD) and total local revenue. This ratio also

illustrates local government dependence towards

external funding sources. The higher the

independence ratio is, the lower the level of regional

dependence towards external funding source is

lower; this results in local economic growth

(Barimbing & Karmini, 2015; Priambodo, 2014;

Tahar & Zakhiya, 2011).

Conceptually there are four relationship patterns

that show the level of regional independence,

namely (Paul Hersey and Kenneth Blanchard in

Halim, 2007):

1. The pattern of instructive relations, the role of

the central government is more dominant than

the independence of local governments with a

ratio of 0% -10%.

2. The pattern of consultative relations, the

intervention of the central government has begun

to diminish because the regions are considered to

be better able to carry out autonomy with a ratio

of 10% - 20%.

3. The pattern of participatory relations, the role of

the central government has diminished, given the

area concerned is close to being able to carry out

autonomous affairs with a ratio of 20% - 30%.

4. The pattern of delegative relations, the

intervention of the central government is not

there because the regions have been truly capable

and independent in carrying out the affairs of

regional autonomy with a ratio of 30% - 40%.

Regional independence is measured by regional

financial independence, in the form of a ratio of the

size of Regional Original Income (PAD) compared

to total regional income. Regional Original Income

(PAD) is one of the sources of revenue that must

always be spurred on by growth. In this regional

autonomy, the independence of the regional

government is highly demanded in financing

regional development and service to the community.

Therefore, investment growth in the regency and

city government needs to be prioritized because it is

expected to have a positive impact on improving the

regional economy.

Halim and Kusufi (2014) explained that Local

Own-source Revenue refers to all local revenue

derived from local economic sources. Mardiasmo

(2002) stated that Local Own-source Revenue

includes local tax, local retribution, revenue from

separated local wealth management, profit of local

government-owned companies and other legitimate

revenue.

Based on the 2009 Decree number 28 on local

tax, local tax is compulsory premium derived from

The Influence of Fiscal Autonomy and Local Expenditure Towards Economic Growth in Southern Sumatera, Indonesia

613

an individual or institution without equal direct

return that can be enforced out based on applicable

regulations for local government programs/activities

and local development. Furthermore, local

retribution is local levies as payment for particular

service/ license granted by local government to an

individual/institution.

Other legitimate Regional Revenues are local

revenues originating from others belonging to the

regional government. This account is provided to

ensure receipt of areas other than those mentioned

above. This type of income includes the following

income objects: (1) proceeds from the sale of non-

segregated regional assets; (2) Current account

services; (3) Interest income; (4) acceptance of

claims for compensation for the area; (5) receipt of

commissions, deductions, or other forms as a result

of sales, procurement of goods and services by the

region; (6) Financial receipts from the difference in

the rupiah exchange rate against foreign currencies;

(7) Fine income for late execution of work; (8)

Income tax penalties; (9) Income from fine levies;

(10) Execution revenue on collateral; (11) Income

from returns; (12) Social and public facilities; (13)

Income from the provision of education and training;

(14) Income from budget / sales installments.

2.3 Local Expenditure

Local expenditure is a decline in economic

benefits during one accounting period in the form of

outflow, asset deflation, or debt that results in a

decrease in equity; it is not related to distribution to

equity participants (Halim, 2007). Based on the 2005

Decree number 58 on Regional Financial

Management, local expenditure is a regional

government liability recognized as a deduction of

net worth. Local expenditure is all local government

expenditure in a budget period.

Based on the 2005 Decree number 58 which is

then elaborated to 2006 Decree of the Ministry of

Domestic Affairs number 13, local expenditure is

classified as indirect and direct expenditure. Indirect

expenditure does not have any direct relationship to

program or activities while direct expenditure is

closely related to program and activities.

Furthermore, expenditure can be classified into staff

expenditure, capital expenditure, interest

expenditure, subsidy expenditure, grant expenditure,

social assistance expenditure, revenue-sharing and

financial assistance and incidental expenditure.

In general, regional expenditures in the APBD

are grouped into five groups, namely:

1. General administration expenditure. It is the

local expenditure that is not related to public

activities or services including employee

expenditure, goods expenditure, official travel,

and maintenance expenditure.

2. Expenditures for operations, maintenance of

facilities, and public infrastructure. It is local

expenditure for the supply of goods and services

that are directly related to public services

including employee expenditure, goods

expenditure, official travel, and maintenance

expenditures.

3. Capital expenditure. It is regional expenditure

whose benefits exceed one fiscal year and will

add local assets or wealth to further increase

routine expenditures such as operating and

maintenance costs. Capital expenditure consists

of public expenditure and apparatus expenditure.

4. Transfers expenditure. It is the transfer of money

from the regional government to a third party

without any hope of obtaining a refund of the

benefits or profits from the transfer of the

money. This expenditure group consists of

repayment of loan installments, aid funds, and

reserve funds.

5. Unexpected expenditure. Is an expenditure made

by the local government to finance unexpected

activities and extraordinary events.

Based on the 2010 Decree number 71, one

sort/posting accounting standard is capital

expenditure. Capital expenditure is type of

expenditure from public sector budget spent to

obtain fixed asset or other assets that can provide

benefit for government program/activities more than

twelve months. Most local government spends their

budget on capital expenditure for things related to

public development. Capital expenditure, according

to Government Accounting Standard, includes

Capital Expenditure for Land, Equipment and

Machinery, Building, Road, Irrigation and Network

and other physical objects. These are infrastructure

local government needs. Capital expenditure is

basically spent for building local infrastructure and

public facilities, helping local government carrying

out their tasks or for development. The higher

Capital Expenditure Ratio to total local expenditure,

the more impactful it is towards economic growth in

an area.

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

614

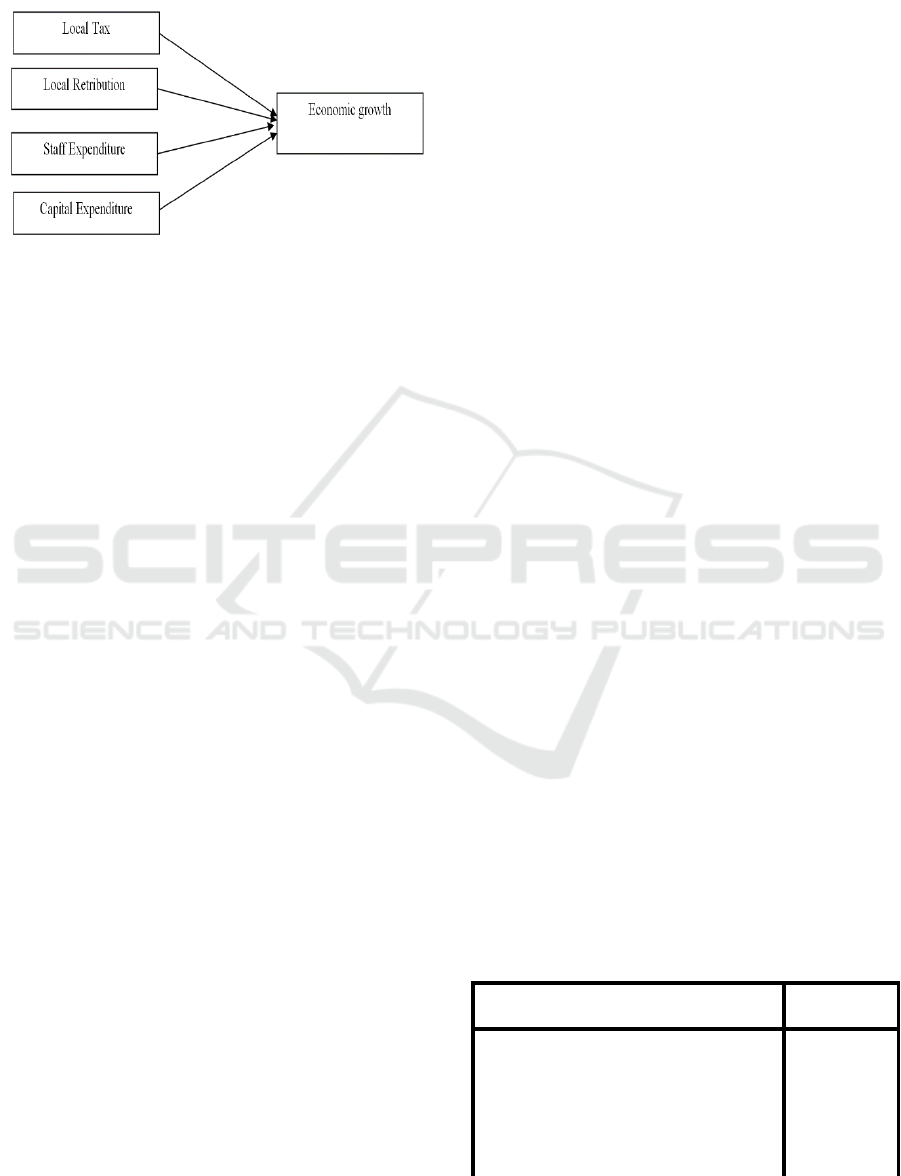

2.4 Theoretical Framework and

Hypothesis

Figure 1: Theoretical Framework

Based on the literature review, the research

hypotheses are:

1. Local tax has positive influence towards

economic growth of Southern Sumatera;

2. Local retribution has positive influence towards

economic growth of Southern Sumatera.

3. Staff expenditure has positive influence towards

economic growth of Southern Sumatera;

4. Capital expenditure has positive influence

towards economic growth of Southern Sumatera;

3 METHOD

3.1 Populations and Samples

The population was 5 provinces in Southern

Sumatera, namely Jambi, South Sumatera, Bangka

Belitung, Bengkulu, and Lampung. The sampling

technique was non-probability sampling, in which

all members of the population became the sample.

So, the sample of this research were 5 provinces in

Southern Sumatera consisting Jambi, South

Sumatera, Bangka Belitung, Bengkulu, and

Lampung.

3.2 Measurement of Variable

The data were secondary data in the form of

panel data. The data were obtained from the

National Bureau of Statistics and Directorate

General of Fiscal Balance and Ministry of Finance

between 2012 and 2016. The instruments were as

follows:

1. Economic growth: economic growth is increase

of output continuously in a long time. It is an

indicator of development in a region. Economic

growth is represented in percentage. Economic

growth was projected with increasing percentage

of GRDP of constant price in an on-going year

compared to GRDP in the previous year in

Southern Sumatera between 2012 and 2016.

2. Fiscal autonomy: fiscal autonomy was measured

with local tax and local retribution in Southern

Sumatera between 2012 and 2016. Local tax is

compulsory premium derived from an individual

or institution without equal direct return that can

be enforced out based on applicable regulations

for local government programs/activities and

local development. Local retribution is local

levies as payment for particular service/ license

granted by local government to an

individual/institution.

3. Local expenditure: local expenditure was

measured using staff expenditure and capital

expenditure in Southern Sumatera between 2012

and 2016. Staff expenditure referred to local

expenditure, of which source was the Local

Budgets, for staffs. Capital expenditure was

some money spent for assets or infrastructure; it

was categorized as local capital in the Local

Budgets.

4 RESULT AND FINDINGS

The first stage was to conduct classic assumption

testing towards the model. Objective of the test was

to identify whether or not the research model had

met requirements of BLUE (Best Linear Unbiased

Estimator). Classic assumption testing consisted of

normality testing, multicollinearity testing and

heteroscedasticity testing.

Kolmogorov–Smirnov test was the method of

analysis used to evaluate normality of the data.Data

was normally distributed when Asymp. Sig (2-

tailed) score was higher than 0.05. Table 1 showed

result of the Kolmogorov-Smirnov test towards the

research model.

Table 1: Result of Kolmogorov-Smirnov Test towards the

Model

Unstandardiz

ed Residual

N

25

Normal Parameters

a,b

Mean

0E-7

Std.

Deviation

.8115207

5

Most Extreme

Differences

Absolute

.079

Positive

.079

Negative

-.064

The Influence of Fiscal Autonomy and Local Expenditure Towards Economic Growth in Southern Sumatera, Indonesia

615

Kolmogorov-Smirnov Z

.397

Asymp. Sig. (2-tailed)

.997

a. Test distribution is Normal.

b. Calculated from data.

Source: Data Analysis, 2018

Based on the normality testing towards how

much influence the independent variable had

towards the dependent variable. The Asymp. Sig (2-

tailed) score was higher than 0.05 which indicated

that the data were normally distributed.

The following procedure was multicollinearity

test. The objective was to identify correlation

between the independent variables. Ideally,

regression model did not have multicollinearity.

Multicollinearity test was conducted by

identification of Tolerance and VIF scores. When

tolerance score was higher than 0.1 and VIF score

was lower than 10, multicollinearity occured. Table

2 showed result of the multicollinearity test.

Table 2: Collinearity Regression Model

No

Variable

Collinearity Statistics

Tolerance

VIF

1

LT

0.122

3.225

2

LR

0.525

1.905

3

SE

0.269

3.722

4

CE

0.238

4.202

a. Dependent Variable: EG

Source: Data Analysis, 2018

Table 2 showed that Tolerance scores of the

independent variables were higher than 0.10 and

their VIF scores were lower than 10. It meant that

the research model did not have multicollinearity

issue.

The next procedure was heteroscedasticity

testing using Glejser test. Ideally, a regression model

did not have heteroscedasticity. When significance

of the independent variables towards their residue

was higher than 0.05, heteroscedasticity did not

occur. Table 3 showed result of the

heteroscedasticity testing.

Table 3. Heteroscedasticity Testing

No

Variable

Significance

1

LT

0.718

2

LR

0.100

3

SE

0.576

4

CE

0.364

a. Dependent Variable: RES_2

Source: Data Analysis, 2018

Table 3 showed that the significance of the

independent variables towards their residue was

higher than 0.05. These are evidence that the

research model did not have heteroscedasticity issue.

Having finished the classic assumption testing,

the following step was multiple regression testing to

identify relationship between the independent

variables towards the dependent variable. Table 4

showed result of the regression testing towards the

independent variables, namely local tax (PD), local

retribution (RD), staff expenditure (BP), and capital

expenditure (BM) towards economic growth (PE),

the dependent variable.

Table 4: Result of Multiple Regression Test

Model

B

Sig.

(Constant)

4.592

.000

LT

-0.328

0.671

LR

1.983

0.013

SE

1.653

0.482

CE

1.208

0.012

a. Dependent Variable: EG

Source: Data Analysis, 2018

Based on Table 4, structural equation of the

research model was as follows:

EG = 4.592 – 0.328 LT – 1.983 LR + 1.653SE

+ 1.208 CE + ε

In which:

EG : Economic growth

LT : Local Tax

LR : Local Retribution

SE

:

Staff Expenditure

CE : Capital Expenditure

ε : Error term

5 CONCLUSION

Finding of this study showed that:

1. Hypothesis was 1 rejected. Local tax has

negative and non-significant influence towards

the economic growth in Southern Sumatera. The

beta score is -0.328 (negative) and the

significance is 0.671 or higher than 0.05. The

local government inability to meet the targeted

LT is the reason why the influence of LT is not

significant.

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

616

2. Hypothesis 2 is accepted. Local retribution has

positive and significant influence towards the

economic growth in Southern Sumatera. The

beta score is 1.983 (positive) and the significance

is 0.013 or lower than 0.05. The significant

influence means that the local retribution has met

the target and is able to support the economic

growth in Southern Sumatera. It is in line with

previous studies conducted by Barimbing &

Karmini (2015); Priambodo (2014) and Tahar &

Zakhiya (2011).

3. Hypothesis 3 is partially accepted. Staff

expenditure has positive but non-significant

influence towards the economic growth in

Southern Sumatera. The beta score is 1.653

(positive) and the significance is 0.482 or higher

than 0.05. Staff expenditure has not been able to

encourage the economic growth in Southern

Sumatera and that is the reason why the

influence of SE is not significant.

4. Hypothesis is accepted. Capital expenditure has

positive and significant influence towards the

economic growth in Southern Sumatera. The

beta score is 1.208 (positive) and he significance

is 0.012 or lower than 0.05. The significant

influence is the result of effective allocation of

capital expenditure so that it supports the

economic growth in Southern Sumatera. The

finding supports previous studies conducted by

Hamsinah, Mursinto, Soekarnoto (2014); Wu,

Tang, Lin (2010) and Zahari (2017).

Future researchers interested in investigating

factors that influence economic growth can use the

finding of this study as reference. Limitation of this

study is the number of variables and provinces that

become analysis units. It is expected that future

researchers involve more independent variables and

more regions as the analysis unit.

REFERENCES

Badan Pusat Statistik. (2017). Laporan Produk Domestik

Regional Bruto Kabupaten/Kota di Indonesia tahun

2012-2016. Retrieved from

http://www.bps.go.id/publikasi, on March 20

th

, 2018.

Badan Pusat Statistik. (2017). Laporan PMA and PMDN

Kabupaten/Kota di Indonesia tahun 2012-2016.

Retrieved from http://www.bps.go.id/publikasi, on

March 20

th

, 2018.

Barimbing, Y.R., & Karmini, N.L. (2015). Pengaruh

PAD, Tenaga Kerja, danInvestasi terhadap

Pertumbuhan Ekonomi di Provinsi Bali. E-Jurnal EP

Unud, 4(5), 434-450.

Barro, R. J. (1990). Government Spending in a Simple

Model of Endogeneous Growth. Journal of Political

Economy, 98(5, Part 2), 103–125.

Direktorat Jenderal Perimbangan Keuangan Kementerian

Keuangan Republik Indonesia. (2017). Laporan APBD

Provinsi-Provinsi di Indonesia tahun 2012-2016.

Retrieved from http://www.djpk.kemenkeu.go.id/, on

March 20

th

, 2018.

Dumairy. (1997). Perekonomian Indonesia. Jakarta:

Penerbit Erlangga.

Halim, A., & Kusufi, M. S. (2014). Akuntansi Keuangan

Daerah (4th ed.). Jakarta: Salemba Empat.

Halim, A. (2007). Akuntansi Sektor Publik Akuntansi

keuangan daerah (Revisi). Jakarta:Salemba Empat.

Hamsinah, Mursinto, D., & Soekarnoto. (2014). Influence

of Capital Expenditure to the Economic Growth and

Manpower Absorption and People Welfare in

Regencies/Cities in South Sulawesi. Europan Journal

of Business and Management, 6 (16), 1-5.

Jhingan, M.L. (2000). Ekonomi Pembangunan and

Perencanaan. Jakarta: Rajawali Pers.

Jogiyanto, H.M. (2003). Teori Portofolio and Analisis

Investasi. Third Edition. Yogyakarta: BPFE.

Lucas, R. E. (1988). On the mechanics of economic

development. Journal of Monetary Economics, 22(1),

3–42.

Ma’ruf, A., & Wihastuti, L. (2012). Pertumbuhan

Ekonomi Indonesia: Determinan and Prospeknya.

Jurnal Ekonomi & Studi Pembangunan, 9(4), 44–55.

Mankiw, N. G. (2010). Principles of Macro Economics.

Mason: Cengage Learning.

Mardiasmo. (2002). Otonomi and Manajemen Keuangan

Daerah. Yogyakarta: Penerbit Andi

Priambodo, A. (2014). Analisis Pengaruh Pendapatan Asli

Daerah, Belanja Modal, dan Tenaga Kerja Terhadap

Pertumbuhan Ekonomi Kabupaten/Kota Di Provinsi

Jawa Tengah Tahun 2008-2012. Economics

Development Analysis Journal, 3(3), 427-435.

Romer, P. (2015). Mathiness in the Theory of Economic

Growth. American Economic Review: Papers &

Proceedings, 105(5), 89–93.

Salvatore, D. (1997). Ekonomi Internasional:Edisi Kelima.

Jakarta: Erlangga

Samuelson, P.(2004). Macro Economic. Jakarta:

Airlangga.

Septiatin, A., Mawardi, Rizki, M. (2016). Pengaruh Inflasi

And Tingkat Pengangguran Terhadap Pertumbuhan

Ekonomi Di Indonesia. Ekonomi, 2(2), 54-67.

Setyowati, E., & Fatimah, S. (2007).Analisis Faktor-

Faktor yang Mempengaruhi Investasi Dalam Negeri di

Jawa Tengah 1980-2002. Jurnal Ekonomi

Pembangunan, 8(1), 62-84.

Sunariyah. (2003).Pengantar Pengetahuan Pasar Modal,

edisi ke tiga. Yogyakarta: UPP-AMP YKPN.

Tahar, A., & Zakhiya, M. (2011). Pengaruh Pendapatan

Asli Daerah AndDana Alokasi Umum Terhadap

Kemandirian Keuangandan Pertumbuhan Ekonomi

Daerah. Jurnal Akuntansi dan Investasi, 12(1), 88–99.

Tandelilin, E. (2001). Analisis Investasiand Manajemen

Portofolio. Edisi Pertama. Yogyakarta: BPFE.

Todaro, M. P., & Smith, S. C. (2011). Economic

The Influence of Fiscal Autonomy and Local Expenditure Towards Economic Growth in Southern Sumatera, Indonesia

617

Development. Eleventh Edition. United States:

Addison Wesley.

Wu, S. Y., Tang, J. H., & Lin, E. S. (2010). The impact of

government expenditure on economic growth: How

sensitive to the level of development? Journal of

Policy Modeling, 32(6), 804–817.

Zahari. (2017). Pengeluaran Pemerintah Terhadap

Pertumbuhan Ekonomi Di Provinsi Jambi. Jurnal of

Economics and Business, 1(1), 15-28.

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

618