Panel Data Regression Analysis of Partnership Contract in

Indonesian Sharia Banks

Titin Vegirawati

1

, Didik Susetyo

2

, Inten Meutia

2

, Lukluk Fuadah

2

1

Accounting Department, IBA University, Jalan Mayor Ruslan, Palembang, Indonesia

2

Faculty of Economics, Universitas Sriwijaya, Palembang, Indonesia

Keyword

:

financing, panel data

Abstract

:

Sharia banks in Indonesia are experiencing very rapid growth. Currently, there are 13 Sharia Banks and

21 Sharia Business Units.However, market share of Islamic banks is still very small, as is the role of

Islamic banking in partnership financing contracts. The contract value is still far below the value of the

sales-based financing contract. The purpose of this research is to find out the factors that influence the

distribution of financing with a partnership contract. This research was conducted on all sharia banks and

sharia business units that have run their businesses in the period of 2011 and 2016. The analytical tool

used is panel data regression. Because this analysis tool is the most appropriate analysis tool for panel

data. The results of the study indicate that wadiah third party funds, mudharabah third party funds and

bank monitoring affect financing with a partnership contract.

1 INTRODUCTION

Sharia bank is a bank that is operated based on

the principles of Islam, so that the objectives of

sharia bank is also part of the goal of Islam is as..

This purpose is applied in various sharia bank

Rahmatan Lil Alaminproducts.

Sharia banks distribute three types of financing

contracts namely sales based financing contract,

leasing based financing contract and partnership

financing contract(Tahir, 2013). There are several

types of sales or trade based contract, namely

murabahah, salam and istisna. Leasing based

contract consists of ijarah financing, while financing

based on a partnership contracts consists of

mudharabah and musyarakah.Salas based contract

and leasing based contract are often used for

consumer financing, while partnership contract is

often used for productive activities and encourage

the growth of the real sectors. (Abduh & Omar,

2012).

The amount of funds distributed through

partnership contract is still very low, and lower than

sales based contract and leasing based contract.The

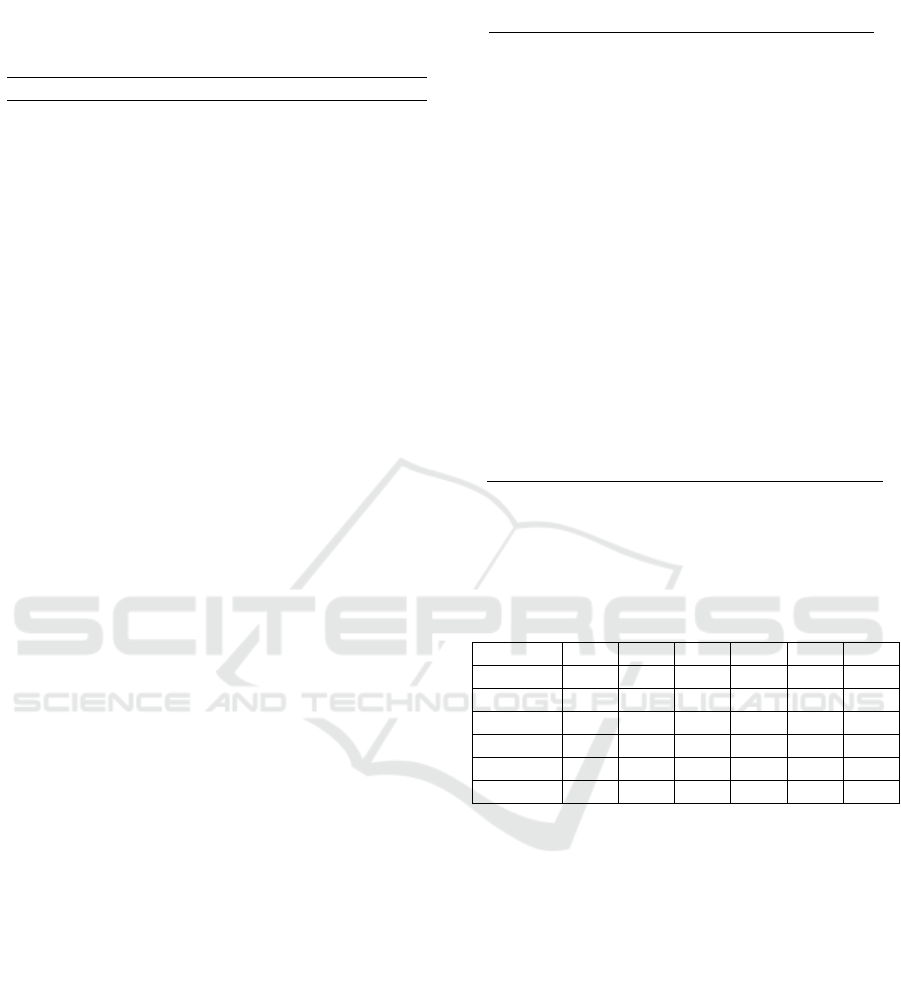

following table describes the financing data:

Table 1: Financing Composition at Sharia Banks in

Indonesia

Contracts

2014

(%)

2015

(%)

2016

(%)

Partnership

financing contracts

31.98

35.46

37.78

Sales based

financing contracts

59.20

57.69

56.61

Leasing based

financing contracts

5.83

4.99

3.67

Others

2.99

1.86

1.94

Total

Source: SPS 2016

The composition of partnership contracts is

smaller than sales based contracts. This fact shows

the banks have not yet become the ideal bank. Some

researchers argued that the ideal financing product of

sharia bank based on partnership contract(Saad &

Razak, 2013).

Some facts are the background of this

phenomenon. Financial intermediation theory stated

that a bank is an institution delegated the authority to

channel funds by creditors or investors, as well as

being given responsibility for monitoring (Diamond,

1996). Investors want a lot of profits, regardless of

people's welfare. The bank becomes an intermediary

institution between creditor, investor and debtor.

Vegirawati, T., Susetyo, D., Meutia, I. and Fuadah, L.

Panel Data Regression Analysis of Partnership Contract in Indonesian Sharia Banks.

DOI: 10.5220/0008444206990707

In Proceedings of the 4th Sriwijaya Economics, Accounting, and Business Conference (SEABC 2018), pages 699-707

ISBN: 978-989-758-387-2

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

699

Third party funds, investor capital and bank

monitoring are the main factors in bank lending.

The research results of some researchers stated

that third party funds and capital influence the

provision of credit (John, 2014). Research conducted

at the sharia bank also showed the same results, that

third party funds affected the distribution of

funding(Ghoniyah & Wakhidah, 2012).

However, there are some differences in this

study. This study focus on partnership contract,

whichis considered risky financing (Abdul-rahman

& Nor, 2016). The banks will get a share of profits,

when the funding users get a profit, on the contrary

the banks must also bear part or all of the loss, if

they bear losses. Banks get uncertainty about profits

and share of losses. These two reasons have caused

banks to be reluctant to finance this financing

Partnership contract is an ideal financing

contract. This financing contract is most in

accordance with the principles of Islamic finance,

namely no exploitation and risk sharing. Therefore

this financing should be the main financing of sharia

banks. Sharia banks must involve all stakeholders to

increase this financing contract. Freeman

(1984)explained that an organization must involve

capital owners, creditors, suppliers, employees,

management, and consumers to achieve common

goals.

Al-Shamali (2013) explained that stakeholders in

sharia banks are tied to Islamic identity, namely

piety to Allah SWT. This identity is binding on all

stakeholders who are more concerned with piety

compared to profit. Stakeholders prioritize

community welfare rather than personal benefits.If

the piety of Allah SWT is more favored, sharia

banks should choose to provide partnership contracts

rather than sales based contracts.

Sharia banks need the support of all stakeholders

to provide their resources. They have to support

banks to become ideal Islamic banks.Sharia banks

cannot rely solely on investors and creditors. Sharia

banks as management play a role in monitoring and

increasing management commitment in fighting for

this financing contract.

Management must have a strong commitment to

become the ideal Islamic bank. Commitment is

always the main factor that can drive management

success to achieve its goals (Tzempelikos, 2015).

commitment can affect management to improve

company performance(Babakus, Yavas, Karatepe, &

Avci, 2003).

Sharia banks are different from conventional

banks. They have an independent board that always

ensures the bank to carry out sharia principles,

namely sharia supervisory board. This board

controls sharia bank to establish products and

services that are in accordance with sharia. Several

studies have been conducted on the Sharia

Supervisory Board. Alman (2013) examined the

effect of the composition of the shariah supervisory

board on the behavior of Islamic banks in loan risk

taking. The study was conducted on Islamic banks in

the Middle East, North Africa and Southeast Asia in

the study period from 2000 to 2010. The results

showed that there was an influence on the

composition of the sharia supervisory board on the

behavior of Islamic banks in taking credit risk.

2 LITERATURE REVIEW

2.1 Financial Intermediation Theory

Initially the traditional allocation of company

and household resources was carried out through

markets and financial intermediation. Along growth

of the money market, traditional interactions do not

promise efficiency. Allocation of investments or

loans directly to fund users or borrowers requires

high monitoring costs and faces the risk of

asymmetry information. Banking is needed as an

intermediary for channeling resources to agents who

need fund. An understanding of the role of

intermediation in the financial sector has been

discussed in models known as the Financial

Intermediation Theory. This theory is built on a

model of allocation of resources to a perfect and

complete market by proposing transaction costs and

asymmetry information. Transaction costs that

should be incurred by the owner of the capital can be

shared by the bank by means of diversification, so

that the distribution of funds by banks is more

efficient.

Banks that run the financial intermediation

function are agents, or groups of agents delegated

power to invest in financial assets (Diamond, 1996).

In carrying out the financial intermediation function,

the bank designed two debt contracts. The first debt

contract was made by the bank as an intermediary

and borrowers who used the bank's funds. The

second debt contract is a contract made jointly with a

bank investor.

2.2 Stakeholder Theory

Stakeholder theory was introduced by Freeman

(1984). This theory stated the company as an organ

that has a relationship with other interested parties,

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

700

both internal and external parties of the company.

Stakeholders of a company consist of individuals or

groups who earn profits or suffer losses, where their

rights can be valued or disturbed by company

actions.

This Stakeholder Theory differs from the opinion

of neo-institutional economists which stated that

companies are required and pay attention to

shareholders and creditors, and involve them in

explicit and implicit contracts. According to this

neo-institutional economist, the core elements of the

company which consist of employees, customers,

suppliers and investors provide their assets for

profit. All the core elements of this company are

bound by clear contracts, and with rights determined

through bargaining.

Donalson and Preston (1995) explain three

approaches in explaining stakeholder theory. The

approach is descriptive approach, instrumental

approach and normative truth approach. Descriptive

approach described the company as a combination of

interests to work together, compete and have

intrinsic value. The instrumental approach explained

a framework to test the relationship between

management and the achievement of company goals.

The normative approach explained that all

individuals or groups of stakeholders have interests.

They identify their interests, to find out whether the

company has interests related to their interests.

Donalson and Preston (1995) also explained that

management must provide simultaneous attention to

the legitimate interests of all stakeholders

appropriately, both in the formation of

organizational structures, general policies and in

each case of decision making.

2.3 Capital

Capital is residual ownership of company assets.

Bank capital buffer above the cost of bank

difficulties (Diamond and Rajan, 1999) and can

withstand adverse shocks (Karmakar and Mok,

2013). Large amounts of bank capital can cover

capital losses without having to reduce their assets.

But large number bank capital can reduce efficiency

due to the high cost of capital (Diamond and Rajan,

1999).Bank capital is one of the bank's main

incentives for monitoring (Jayaraman and Thakor,

2014). Monitoring is performed to maintain capital

security and investor confidence. This is an

application of Financial Intermediation Theory,

Banks are delegated by investors to monitor.

2.4 Third Party Funds

Sharia banks classify third party funds in two

groups, namely wadiah and mudharabah.

Wadiahthird party funds is a deposit in the form of

authority granted to someone to maintain ownership

of respectable personal property in a certain way that

is safeguarded and gives back when requested

(Qaed, 2014).

Mudharabahthird party fund is applied to savings

and deposits, where banks are given full power to

manage these funds without being limited by any

conditions (Prabowo, 2015). In this contract the

customer as Rabbul Maal deposits the money to the

bank as mudarib who will then use the money for

investment purposes. Profit distribution will be given

in accordance with the agreement agreed at the

beginning of the contract (Qaed, 2014).

Third party funds obtained using the wadiah

contract and mudarabah contract are two sources of

third party funds entrusted by customers to Islamic

banks. Customers' expectations of third party funds

invested through these two contracts are different,

both related to the responsibility of their use and the

expected returns of the customer. As a result of these

differences in characteristics, the effect of these two

types of third party funds on mudarabah and

musyarakah financing is also likely to be different.

2.5 Management Commitment

Commitment is defined as agreement or

attachment to doing something best in a particular

organization or group. Management commitment

includes active support activities for a company

goal, making oneself a figure, strengthening and

communicating the value of the company.

Management commitment is a very important factor

in all achievement activities (Nurhayati and

Mulyani, 2015).

Management commitment can be identified and

evaluated by seeing and observing its actions.

Caroline, Kidombo and Ndiritu (2016) observed

management commitment through promotion of

quality, quality policy as an integral part of the

group, the level of communication between leaders

and members, the frequency of leadership

communication regarding quality, goals and

processes, allocation of resources with the help of

evaluating leadership quality improvement quality

performance, and formation of the committee

hierarchy to provide confidence in improving quality

services. Babakus et al., (2003) used training,

authority and awards as indicators of management

Panel Data Regression Analysis of Partnership Contract in Indonesian Sharia Banks

701

commitment. Javed (2015) looked at and observed

management commitment through managerial

actions in demonstrating, communicating and

strengthening quality.

2.6 Sharia Supervisory Board

Sharia Supervisory Board is an independent

board that is placed in Islamic banks to ensure the

implementation of sharia principles in every bank

activity. Its members consist of several experts who

understand general knowledge about banking and

other capabilities that are relevant to their daily tasks

(Faozan, 2013). AAOIFI explains the main function

of the Sharia Supervisory Board is to direct, review

and supervise institutional activities to ensure sharia

compliance, provide sharia guidelines and advice,

provide sharia approval of products and services and

provide final reviews (Injas et al., 2016).

Alman (2013), Rahman and Bukair (2013) have

conducted research on the role of the Sharia

Supervisory Board on the behavior of banks in

risking loans and monitoring banks. The proxy used

in this study is the number of members of the Sharia

Supervisory Board, membership in other Islamic

banks, educational qualifications, academic

reputation and expertise of the Sharia Supervisory

Board.

2.7 Monitoring

Various definitions about monitoring have been

expressed by practitioners and academics. In

general, monitoring is defined as continuous or

periodic observation activities that aim to provide

information about the status of the development of a

program or activity, and identify problems that arise

and formulate the necessary follow-up (Hanik and

Subiantoro, 2010). In particular, for banks,

monitoring is a tracking action held by banks and is

a long-term relationship model in which banks can

monitor collateral balances, financial transactions

and business users' funds (Besanko and Kanatas,

1993).

Rigorous bank monitoring can increase the

number of good loans and obtain loan payments in

accordance with predetermined provisions

(Jayaraman and Thakor, 2014). By monitoring the

bank has the ability to reduce the selection of

adverse investments (adverse selection) and prevent

moral hazard (Vashishtha, 2014); (Carletti, 2003).

Bank monitoring can also influence the debtor's

reporting behavior (Ahn and Choi, 2009).

2.8 Partnership Financing Contracts

Partnership financing contract isan agreement

between investors and fundusers, where investors

can obtain the return of their investments with the

risk of losses (Ahmed and Barikzai, 2016). This

financing is in line with the spirit of the Islamic

banking system, upholds the justice system and

eradicates oppression and prevents capitalism

(Abdul-rahman and Nor, 2016). This financing is the

main financing of Islamic banking (Badaj and Radi,

2016), and is dominantly discussed in the theoretical

literature (Dar and Presley, 2000).

3 METHODOLOGY

3.1 The Scope of Research

This research was conducted on all Sharia

Commercial Banks and Sharia Business Units in

Indonesia. This research was conducted by

observing capital variables,wadiah third party funds,

mudarabah third party funds, management

commitment, the role of the Sharia Supervisory

Board, monitoring and profit-based financing. Data

collected from annual reports of Sharia Banks and

Conventional Banks that have Sharia Business Units

which are published in each company website from

2011 to 2016.

3.2 Types and Data Sources

The data needed for this study are secondary data

from the Indonesian Banking Statistics issued by the

Financial Services Authority, annual reports of all

Sharia Commercial Banks and annual reports of

conventional banks that have Sharia Business Units.

data obtained by the documentation method

3.3 Population and Sample

In this study all members of the population

became members of the sample. However, to get

balanced panel data, the sample is selected using

certain criteria. only sharia banks have been

operating since 2011 to 2016 which are members of

the research sample. Sharia banks must finance

partnership financing.

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

702

3.4 Analytical Techniques

Data analysis used is panel data regression. Panel

data refers to data that contains time series

observations from a number of individuals.

Observations in panel data consist of cross section

data and time series data. there are three advantages

of researching using a data panel namely (i) data

availability, (ii) greater capacity than cross section

data and time series, (iii) challenging methodology

(Hsiao, 2007).

3.5 Data Panel Regression Equation

Based on the background and literature review,

the following panel data regression equations are

formed:

Y

it

=

0it

+ Mo

it

+ DpkW

it

+ DpkM

it

+

KM

it

+ DPS

it +

M

it

+ µ

it

Description of variable :

i

1,2,.....N show unit data cross section

t

1,2 .......T show unit data time series

Y

it

The value of partnership financing

contract of unit cross sectionat- i for

t periode

0it

interceptof individual effect of unit

cross section i for time period t

1-6 it

1, 2, 3, 4, 5, 6

Mo

capital

DpkW

Third party fund wadiah

DpkM

Third party fund Mudarabah

KM

Management commitment

DPS

The Roles of Sharia Supervisory

Board

M

Monitoring

µ

it

regression error for unit cross

section i for time period t

4 RESULTS AND DISCUSSION

4.1 Result

This panel data usage is very appropriate for

researching sharia banks in Indonesia, because the

number of banks is still very limited. The number of

observations can be increased by examining sharia

bank data for several years. The increase in the

amount of data will result in a greater degree of

freedom.

The initial step of analysis using panel data

regression is to determine the appropriate model,

common effect, fixed effect or random effects.

Based on data collected from annual reports of each

sharia bank and sharia business unit on conventional

banks for 6 years, which began in 2011 to 2016,

panel data regression was conducted using the

common effect and fixed effects models.

The common effect and fixed effects models are

estimated by Chow test. The chow test results can

be seen in the following table:

Table 2: Chow Test

Redundant Fixed Effects Tests

Equation: Untitled

Test cross-section fixed effects

Effects Test

Statistic

d.f.

Prob.

Cross-section F

11.024720

(24,119)

0.0000

Cross-section

Chi-square

175.568900

24

0.0000

Source : analysis result

The chi-square value shown in the table above

shows a value of 0.0000 which is smaller than 0.05.

If the probability value of the chi-square cross

section is smaller than 0.05, then the model that will

be chosen is the fixed effect model.

After the chow test is applied, and the fixed

effect model is obtained as the best model, then

panel data regression will be continued using the

random effect model. The test will be continued with

Hausman estimation test. The Hausman test is

implemented to choose the best research model,

whether using a fixed effect model or using random

effects. The Hausman estimation test results can be

seen in the following table:

Source : Analysis Results

The table above shows that the Hausman test p-

value is 0.0002, this value is less than 0.05. The

conclusion taken from the results of this estimation

test is to re-select the fixed effect model as the best

research model.

The results of panel data regression analysis

using the fixed effect model are as follows:

Table 3: Hausman Test

Correlated Random Effects - Hausman Test

Equation: Untitled

Test cross-section random effects

Test Summary

Chi-Sq.

Statistic

Chi-Sq.

d.f.

Prob.

Cross-section

random

25.906728

6

0.0002

Panel Data Regression Analysis of Partnership Contract in Indonesian Sharia Banks

703

Table 4: Results of Panel Data Regression Analysis

Using the Fixed Effect model

Variable

Coefficient

Std. Error

t-Statistic

Prob.

C

365.7690

447.5926

0.817192

0.4155

MO

0.011004

0.209505

0.052524

0.9582

DPKW

0.382929

0.184247

2.078349

0.0398

DPKM

0.210328

0.033065

6.361089

0.0000

KM

9.189205

5.727909

1.604286

0.1113

DPS

-

14.26194

12.95005

-1.101303

0.2730

M

3.184754

0.788456

4.039231

0.0001

R-squared

0.970142

Mean dependent var

2170.640

Adjusted R-

squared

0.962614

S.D. dependent var

4357.952

F-statistic

128.8827

Durbin-Watson stat

0.987809

Prob(F-

statistic)

0.000000

Source : Result Analysis

4.2 Classical Test

The right model after chow test and Hausman

test is the fixed effect model, so it is relevant to do

the classic assumption test. This is because the fixed

effect model uses least square estimation method.

So the estimation procedure is identical to the

Ordinary Least Square estimation method (Astuti,

2010). By using a dummy estimate, it must be

ensured that the error variance between periods is

the same. if the error variance is different it can lead

to wrong conclusions. Therefore a heteroscedasticity

test and multicollinearity are needed,

Heterescedasticity test is applied to check if there

are residual of a regression have changing variance.

White test is used to detect heteroscedasticity. If the

significance value is greater than 0.05, there is no

heteroscedasticity.

Multicollinearity test is applied to check if there

is a situation that indicates a strong correlation

between two independent variables or more in a

ordinary least square model. The signal of

multicollinearity problem can be detected from

correlation coeffisient of two or more independent

variables. If the coeffisient is greater than 0.9, there

is multicollinearity problem (Gujarati, 2013)

The results of heteroscedasticity test can be seen

in the following table:

Table 5: Heteroscedasticity Test

Dependent Variable: RESABS

Method: Panel Least Squares

Date: 11/05/18 Time: 20:42

Sample: 2011 2016

Periods included: 6

Cross-sections included: 25

Total panel (balanced) observations: 150

White diagonal standard errors & covariance (d.f.

corrected)

Variable

Coefficient

Std.

Error

t-Statistic

Prob.

MO

-0.053277

0.073573

-

0.724137

0.4704

M

0.562115

0.661477

0.849788

0.3971

KM

2.025799

2.112591

0.958917

0.3395

DPS

-0.990541

4.995815

0.198274

0.8432

DPKW

0.007995

0.113098

0.070690

0.9438

DPKM

-0.009214

0.019314

-

0.477072

0.6342

C

360.0837

211.6219

1.701543

0.0915

Source : Result Analysis

From the table, it can be concluded that the

significance value is greater than 0.05, there is no

heteroscedasticity problem.

Table 6: Multicollinearity Test

MO

DPKW

DPKM

KM

DPS

M

MO

1.000000

0.803160

0.828540

0.465071

0.089915

0.555701

DPKW

0.803160

1.000000

0.898802

0.614443

0.051106

0.708221

DPKM

0.828540

0.898802

1.000000

0.594375

0.006410

0.764631

KM

0.465071

0.614443

0.594375

1.000000

0.175900

0.515828

DPS

0.089915

0.051106

0.006410

0.175900

1.000000

0.060423

M

0.555701

0.708221

0.764631

0.515828

0.060423

1.000000

Source : Result Analysis

From the table, it can be concluded that, the

correlation coeffisient is greater than 0.9, there is

multicollinearity problem

Equation of partnership financing is:

Y = 365.77 + 0.01MO + 0.38DPKW +

0.210DPKM + 9.189KM - 14.26DPS + 3.18M + ε

Based on the results of estimating the partnership

financing model and through simultaneous testing.

The F-statistic value of 128.88 is obtained. This F-

statistic value is greater than the F-table at the 95%

confidence level of 2.28. The results of this study

show that capital variables, wadiah third party funds,

mudarabah third party funds, management

commitment, the role of the shariah supervisory

board and monitoring have significant effect on

partnership financing. This influence is indicated by

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

704

the value of the coefficient of determination

(Adjusted R-Square = 0, 96). This result means that

the independent variables are able to explain the

change in partnership financing by 96 percent, while

the remainder is explained by other factors not

included in this research model.

Partial testing of parameter estimation is done by

t-test. Six independent variables that influence

partnership financing individually. In the research

model have t-values (t-statistics) of 0.05 for capital,

2.07 for Dpk wadiah, 6.36 for Dpk_Mudarabah,

1.60 for management commitment, -1.10 for the role

of the shariah supervisory board and 4.04 for

monitoring. The test is done by comparing the t-

theoretical value (t-table) with the value of t-value

(t-statistics) obtained from the calculation results.

The critical value obtained in a one-way test with df

= n-k-1. df = 150-5-1 = 144. So that t table is worth

1.9765. Value of t-variable variable of wadiah third

party funds, mudarabah third party funds and

monitoring is greater than t-table. This shows that

the three variables partially have a significant effect

on partnership financing. While the t-statistics of the

other three variables are capital variables,

management commitment and supervisory board

roles are smaller than t-table. This shows that the

three variables partially do not significantly

influence the partnership financing.

Both the variables of wadiah third party funds,

mudarabah third party funds, and monitoring have a

positive influence on partnership financing. This

positive influence can be seen from the value of t

statistics that are positive. Estimates of the level and

signs for wadiah third party funds, mudarabah third

party funds, and monitoring are in accordance with

statistical criteria and theories that support this

research.

4.3 Discussion

The test results on the estimation of the

partnership financing model with panel data

regression show simultaneously the variables of

capital, wadiah third party funds, mudarabah third

party funds, management commitment, the role of

shariah supervisory board and monitoring

significantly influence partnership financing. The

results of this study support the theories used in this

study. The theory is the theory of financial

intermediation, the banksappliedtheir intermediation

function, by collecting customer funds, preparing

monitoring and distributing these funds to fund

users

The results of this study also support the

Stakeholder theory, where sharia bank stakeholders

consisting of third party deposit holders and deposits

of mudarabah third party funds, capital investors,

management who have management commitment

and hold monitoring, and the role pf sharia

supervisory board simultaneously influence

partnership financing. The analysis of the influence

of independent variables on partnership financing

also supports Sharia Enterprise Theory. This theory

explained that Allah SWT as the real owner, third

party depositors, investors and management still try

to provide the ideal financing for this Islamic bank,

even though this mudarabah and musyarakah

financing is a risky financing.

All variables in this study affect banks in

distributingpartnership financing Simultaneously.

These results show that banks need strong support

from all stakeholders in an effort to finance more

partnership financing. This support is not only

needed from within the bank but all internal and

external stakeholders of Islamic banks.

There are only three variables that have t-

statistics greater than t-tables partially. These results

show that these three variables have a real effect on

partnership financing. These variables are wadiah

third party funds, mudarabah third party funds and

monitoring. The results of the t-statistical test, these

three variables have a positive effect on profit-based

financing.

The results of this study support several previous

studies. The amount of third party funds affects the

amount of lending (John, 2014). The results of this

study also support several studies that specifically

examine Islamic banks. Conclusion of Amelia and

Fauziah (2017) study stated that third party funds

affect mudarabah financing are also in line with the

results of this study which states that third party

funds, both third party wadiah funds and mudarabah

third party funds, affect two partnership financing

consisting of mudarabah financing and musyarakah.

Othman and Masih (2015) who are investigating

the relationship of third-party mudarabah funds and

partnership financing, result in the same

conclusions. They also concluded that mudarabah

third party funds affected the value of mudarabah

financing and musyarakah financing.

One variable that also gives significant partial

effect on partnership financing is the monitoring

variable. The monitoring variables measured

allowance for bad debt (Johnson, 1997) affect the

amount of partnership financing that are intended to

be given to users of funds. The results of this study

are in line with several research results. One of them

Panel Data Regression Analysis of Partnership Contract in Indonesian Sharia Banks

705

is a study conducted by Ascarya (2010, which states

that the lack of partnership financing is due to

internal factors for monitoring.

One of the variables in this study are not

statistically proven to affect partnership financing.

These variables are capital, management

commitment and the role of shariah supervisory

board. The results of this study are not in line with

some of the results of previous studies, namely

research conducted by Berrospide and Edge (2010),

Karmakar and Mok (2013) and Siringoringo (2012)

research, which stated that capital affects lending.

The results of the research that show the value of

capital do not give significant effect on the

partnership financing in accordance with the results

of research conducted by Rahman and Nor (2016).

The results of Rahman and Nor's study using

questionnaires as a way of collecting data stated that

banks were still thinking about their capital security

in providing financing. They said that the bank had

not received adequate capital security guarantees for

this type of financing.

The management commitment variable used in

this study to predict partnership financing is not

statistically proven to affect this financing. The

results of this study are not in line with the results of

Keramati and Azadeh (2007), Tzempelikos (2015),

Caroline, Harriet and Anne (2016), Javed (2015) and

Cooper (2006). The results of previous studies state

that managementcommitment will influence the

success of these actions. Management's commitment

to distribute these partnership financing listed in the

annual report is still in the form of communication

regarding this financing. While the real form of

management commitment in the form of training for

staff or prospective customers is indeed not done.

The variable role of the shariah supervisory

board on partnership financing is also not proven

statistically. The results of this study are not in line

with the results of Alman's (2013) study, where

Alman (2013) concluded that the composition of the

sharia supervisory board had an effect on the risk

taking of lending. The analysis in research is

precisely in line with the results of Dusuki (2008)

research which explained that the sharia supervisory

board prioritizes the business continuity of Islamic

banks rather than maintaining the ideal product of

Islamic banks. In implementing its duties, sharia

supervisory board places more emphasis on sharia

compliance, so that sharia supervisory board pay

low attention on partnershipcontract. Other

financing contracts such as murabahah, ijarah,

istisna and salam financing contracts are also halal

financing contract, Sharia supervisory board does

not impose sharia commercial banks and sharia

business units to implement partnership contract

5 CONCLUSION

1. Capital, Wadiah third party funds, mudarabah

third party funds, management commitment,

the role of sharia supervisory board

simultaneously have a positive and significant

effect on partnership financing.

2. Wadiah third party funds, mudarabah third

party funds and partial monitoring have a

significant positive effect on partnership

financing.

REFERENCES

Abduh, M., & Omar, M. A. (2012). Islamic banking and

economic growth : the Indonesian experience.

International Journal of Islamic and Middle Eastern

Finance and Management, 5(1), 35–47.

https://doi.org/10.1108/17538391211216811

Abdul-rahman, A., & Nor, S. M. (2016). Challenges of

Profit-and-Loss Sharing Financing in Malaysian

Islamic Banking. Malaysian Journal of Society and

Space, 12(2), 39–46.

Alman, M. (2012). Shari’ah Supervisory Board

Composition Effects On Islamic Banks ’ Risk-Taking

Behavior Shari ’ ah Supervisory Board Composition

Effects On Islamic Banks ’ Risk-Taking Behavior.

Journal of Banking and Regulation, 82, no.1, 1–43.

Al-shamali, F. A., Sharif, A., & Irani, Z. (2013). Islamic

Banking Reinterpretation of The Stakeholder

Theory. Arabian Journal of Business and

Management Review, 3(2), 63–72.

Ascarya. (2010). The Lack of Profit and Loss Sharing

Financing in Indonesia’s Islamic Banks: Revisited.

Review of Indonesia of Economic and Business Sudy,

1(1), 1–15.

Babakus, E., Yavas, U., Karatepe, O. M., & Avci, T.

(2003). The Effect of Management Commitment to

Service Quality on Employees ’ Affective and

Performance Outcomes. Journal of the Academy of

Marketing Science, 31(3), 272–286.

https://doi.org/10.1177/0092070303253525

Dar, H. a, & Presley, J. R. (2000). Lack of Profit Loss

Sharing in Islamic Banking : Management and Control

Imbalances. International Journal of Islamic Financial

Services, 2, 9–12. Retrieved from

http://www.iefpedia.com/english/wp-

content/uploads/2009/09/Lack-of-Profit-Loss-Sharing-

in-Islamic-Banking-Management-and-Control-

Imbalances.pdf

Diamond, D. W. (1996). as Delegated Monitoring : A

Simple Example. Federal Reserve Bank of Richmond

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

706

Economic Quarterly, 82(3), 51–66.

Donaldson, T., Preston, L. E., Donaldson, T., & Preston,

L. E. E. E. (1995). Theory The Stakeholder Of The

Concepts , Evidence , Corporation : And

Implication. Academy of Management Review, 20(1),

65–91.

Faozan, A. (2013). Implementasi Good Corporate

Governance Dan. LA RIBA - Jurnal Ekonomi Islam,

VII(1), 1–14.

Freeman, R. E. (1984). Strategic Management: A

stakeholder approach. Boston: Pitman.

Ghoniyah, N., & Wakhidah, N. (2012). Pembiayaan

Musyarakah Dari Sisi Penawaran Pada Perbankan

Syariah di Indonesia. Dharma Ekonomi, 36, 1–20.

Gujarati, D dan Porter, D (2013). Dasar-dasar

Ekonometrika (Edisi5). Terjemahan oleh Eugenia

Mardanugraha dkk. Jakarta: Salemba Empat

Hanif, M., & Iqbal, Ab. M. (2010). Islamic Financing and

Business Framework : A Survey. European Journal of

Social Sciences, 15(4), 1–18.

Hanik, M. and Subiyantoro, Heru (2010). Monitoring &

Evaluasi Sebagai Konsensus Untuk Mencapai

Efektivitas Pemanfaatan Pinjaman/Hibah Luar Negeri.

Jurnal BPKP, 1 pp.131-160

Hsiao, C. (2007). Panel data analysis-advantages and

challenges. Test, 16(1), 1–22.

https://doi.org/10.3233/IES-150586

Javed, S. (2015). Impact of Top Management

Commitment on Quality Management. International

Journal of Scientific and Research Publication, 5(8),

1–5.

Jayaraman, S., & Thakor, A. V. (2014). Who Monitors the

Monitor ? Bank Capital Structure and Borrower

Monitoring.

Karmakar, S., & Mok, J. (2013). Bank Capital And

Lending : An Analysis Of Commercial Banks In The

United States. Portugal.

Keramati, A., & Azadeh, M. (2007). Exploring the Effects

of Top Management’s Commitment on Knowledge

Management Success in Academia: A Case Study.

International Journal of Industrial and Manufacturing

Engineering, 1(3), 292–297. Retrieved from

http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.

1.1.193.2355&rep=rep1&type=pdf

Nurhayati, N., & Mulyani, S. (2015). User Participation on

System Development, User Competence and Top

Management Commitment and Their Effect on The

Success of The Implementation of Accounting

Information System ( Empirical Study in Islamic Bank

in Bandung). European Journal of Business and

Innovation Research, 3(2), 56–68.

Othman, A. N., & Masih, M. (2015). Do profit and loss

sharing (PLS) deposits also affect PLS financing?

Evidence from Malaysia based on DOLS, FMOLS and

system GMM techniques. Kuala Lumpur.

Prabowo, A. B. (2015). Permodelan Pengaruh NPF

Pembiayaan dan Dana Pihak Ketiga Terhadap Kinerja

BPR Syariah di Jawa Tengah. In Seminar Nasional

danThe 2nd Call for Syariah Paper (pp. 3–16).

Qaed, Issa Qaed, M. (2014). The Concept of Wadiah and

its application in Islamic Banking. Journal of Research

in Humanities and Social Science, 2(11), 70–74.

Saad, N. M., & Razak, D. A. (2013). Towards An

Application of Musharakah Mutanaqisah Principle In

Islamic Microfinance, 14(2), 221–234.

Siringoringo, R. (2012). Karakteristik dan Fungsi

Intermediasi Perbankan di Indonesia. Buletin Ekonomi

Moneter Dan Perbankan, 61–84.

Tahir, S. (2013). Alternative Structures for Financing by

Islamic Banks.

Tzempelikos, N. (2015). Top Management Commitment

and Involvement and Their Link to Key Account.

Journal of Business & Industrial Marketing, 30(1),

32–44. https://doi.org/10.1108/JBIM-12-2012-0238

Vashishtha, R. (2014). The Role of Bank Monitoring in

Borrowers ’ Discretionary Disclosure : Evidence from

Covenant Violations. Journal of Accounting and

Economic, March, 1

Panel Data Regression Analysis of Partnership Contract in Indonesian Sharia Banks

707