Analysis of Investment Efficiency by using ICOR Approach to

Economic Growth in All Provinces of Sumatera Island

Anna Yulianita, Feny Marissa, Fera Widyanata, Annisa Fitriyah, Monica Marcheline

Faculty of Economics, Universitas Sriwijaya, Palembang, Indonesia

fenymarissa, annayulianita

@yahoo.co.id

Keywords: Investment Efficiency, ICOR, Economic Growth, Sumatra Island

Abstract: This study aims to describe the effect of investment efficiency through ICOR approach to the economic

growth of provinces on Sumatra Island between 2007 and 2016. Using the data panel and Fixed Effect

Model, this study confirms that ICOR has a negative correlation with the level of economic growth like has

been expected in the theoretical model and it also found that the ICOR coefficient is -0.21. The coefficient

shows the meaning that the increasing in investment efficiency through the decreasing one percent of ICOR

will boost the economic growth of ten provinces in Sumatra by 0.21 percent. Based on the ICOR project of

Sumatra Island 12,762 - 0,2144 * ICOR shows that investment use is more efficient in increasing economic

growth in 2007-2016. This research also shows that for the Province of North Sumatra, Riau Province,

Jambi Province, Bengkulu Province and Lampung Province have grown better than other provinces in

Sumatra Island in the same development stage without an increase in the proportion of investment to Gross

Domestic Regional Product.

1 INTRODUCTION

Ccommunity welfare in a region can be seen from

the high and low economic growth in the region. By

increasing the economic growth of a region, it is

expected that the income of the people in the region

will increase so each region will always make an

effort to reach the optimal economic growth to bring

its people to a better life.

The factors that determine a country's economic

growth are determined by four factors namely: (i)

capital accumulation, including all new investments,

such as land (land), physical equipment (machinery),

and human resources (human resources); (ii)

population growth; (iii) technological progress; and

(iv) institutional resources (institutional system)

(Arsyad, 2010).

The several factors that influence economic

growth above, Indonesia is one of the broadest

developing countries who have that all factors and

Indonesia is rich in natural resources, both marine,

forest and mining. and others. The abundance of

natural resources is widespread in all provinces in

Indonesia.

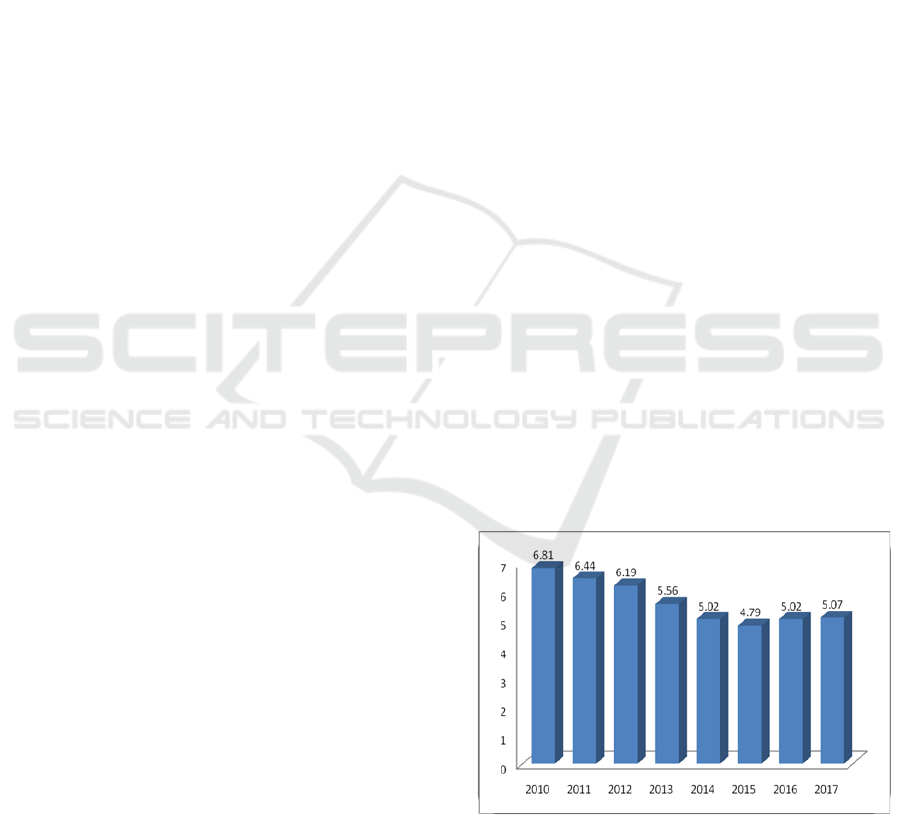

The Indonesian economy has experienced a

fluctuating growth in one windu. Since 2010,

Indonesia's economic growth has decreased from

6.81 percent and continues to decline each year to

reach 4.17 percent in 2015. However, in the

following years, the economy in Indonesia: a began

to make improvements. This was marked by an

increase in economic growth in 2015 and 2016

which was 5.02 percent and increased again to 5.07

percent. This condition can be seen in Figure 1

Source: BPS, 2017

Figure 1: Indonesian Economic Growth 2010-2017

(percent)

In terms of production, economic improvement

was driven by growth in almost all sectors of the

708

Yulianita, A., Marissa, F., Marcheline, M., Fitriyah, A. and Widyanata, F.

Analysis of Efficiency Investment by using ICOR Approach to the Economic Growth in All Provinces of Sumatera Island.

DOI: 10.5220/0008444307080714

In Proceedings of the 4th Sriwijaya Economics, Accounting, and Business Conference (SEABC 2018), pages 708-714

ISBN: 978-989-758-387-2

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

business sector in the economy. Sector that provides

a large portion of Gross Domestic Product, namely

the information and communication sector, other

services and the transportation and warehousing

sector.

In terms of expenditure, economic improvement

can be seen from the start of increased investment

and exports and imports. If seen from the spatial

economic structure, it is still dominated by

provincial groups in Java and Sumatra. In 2017, the

provincial group in Java made the largest

contribution to Gross Domestic Product, which

amounted to 58.49 percent, followed by Sumatra

Island at 21.66 percent.

Sumatra Island which has quite unique

characteristics and has a significant contribution to

the Indonesian economy because it is supported by

the availability of raw materials, energy sources,

labor, national markets and exports and the superior

location close to the shipping lanes in the Malacca

Strait.

According to the Indonesian Investment

Coordinating Board (BKPM) (2015), there are at

least some potential investments in Sumatra.

prepared by the government as a buffer for national

economic growth. Therefore, in line with the above

conditions, to optimize the use of natural resources

on the island of Sumatra, of course, sufficient

additional capital (investment) is needed to achieve

the targeted economic growth. This investment is

based efficiency in the use of investment in the

resources that are owned will only produce

economic growth that is not optimal. For this reason,

in order to achieve certain economic growth targets,

it is very necessary to estimate the investment needs

properly.

Harrod Domar's model relates the influence of

additional capital stock on output known as ICOR

Incremental Capital-Output Ratio. ICOR aprroach is

really needed in determining how much investment

needs at the level of economic growth that is

expected to grow and with ICOR approach, it can

see the efficiency of investments which has invested

in a certain period. The lower of the ratio means the

higher level of investment efficiency. The amount of

ICOR generally ranges from 2.0 to 5.0 with a

median value for more than 70 developing countries

between 3.0 to 3.5 (Arsyad, 2010).

Based on the above introduction, this study aims

to determine the effect of efficiency investment by

using ICOR indicator to economic growth in

provinces on the island of Sumatra. This research is

important in the economic development planning

process in Sumatera Island, so the author is

interested to discusses and analyzes "Investment

Efficiency in Provinces on Sumatra Island".

2 THEORETICAL FRAMEWORK

2.1 Adam Smith's Growth Theory

According to Smith (Arsyad, 2010), the main

elements of a country's production system are three,

namely:

1. The availability natural resources, which are

presented by the availability of land. According

to Smith, the available natural resources are the

most basic container of a society's production

activities. The amount of available natural

resources is the "maximum limit" for the growth

of an economy.

2. Human resources, represented by the

population. Human resources play a passive role

in the process of increasing output.

3. Accumulated capital owned. According to

Smith, the stock of capital plays the most

important role in economic development. Stock

capital can be identified as a development fund,

the rapid pace of economic development

depends on the availability of development

funds. In addition, capital stock is an element of

production that actively determines the level of

output. Its role is very central in the process of

output growth. The amount and growth rate of

output depends on the growth rate of the capital

stock in accordance with the "maximum limit"

of natural resources. In other words, output

growth will slow down if the "carrying

capacity" of natural resources is no longer able

to keep pace with the pace of economic

activities of the community.

Smith said, capital must be done first than the

division of labor. Smith considers capital

fertilization as an absolute condition for economic

development, thus the problem of broad economic

development is the ability of humans to save more

and invest more. "The capital of a nation increases in

the same way as increasing individual capital by

cultivating and continually increasing the savings

they set aside from income. Therefore, the fastest

way is to invest capital in such a way that it can

provide the greatest income to the entire population

and also influence savings. Thus the level of

investment will be determined by the level of

savings and savings fully invested (Jhingan, 2012).

Analysis of Efficiency Investment by using ICOR Approach to the Economic Growth in All Provinces of Sumatera Island

709

2.2 Harrod-Domar Model

Harrod and Domar provide a key role for investment

in the process of economic growth, especially

regarding the dual character of investment. First,

investment creates income and both investments

increase the production capacity of the economy by

increasing the capital stock. Therefore, as long as net

investment continues, real income and output will

always increase. However, to maintain the

equilibrium level of income in full employment from

year to year, both real income and output must both

increase at the same rate when the productive

capacity of capital increases. If not, any difference

between the two will cause excess capacity or idle

capacity. This forces employers to limit their

investment expenditures so that it will ultimately

adversely affect the economy, namely lowering

income and employment in the next period and

shifting the economy out of the path of steady

growth in balance. So if work is to be maintained in

the long run, investment must always be enlarged

(Jhingan, 2012).

The center of attention of Harrod revolves

around economic growth which can take place

continuously in a pattern of stable equilibrium.

Harrod's theory has general growth criteria and

economic assumptions, namely:

1. The rate of economic growth is defined as g =

∆Y / Y;

2. The desire to save is a proportional part of

national income, s = S / Y;

3. Additional capital for a given period is the same

as the existing investment, ∆K = I

4. All savings are channeled in net investment, S =

I = ∆K so that s = S / Y = I / Y

5. ∆K / ∆Y is defined as ICOR (Incremental

Capital Output Ratio), denoted by k;

6. Then growth can be formulated as

𝑔 =

∆𝑌

𝑌

=

∆𝑌/𝐼

𝑌/𝐼

=

𝐼/𝑌

𝐼/∆𝑌

=

𝑆/𝑌

∆𝐾/∆𝑌

=

𝑠

𝑦

Which means that economic growth depends on

the tendency to save society (s) as well as measures

of economic efficiency (k) (Hakim, 2014).

2.3 Neoclassical Growth Theories

According to the Solow-Swan theory, economic

growth depends on the availability of factors of

production (population, labor, and capital

accumulation) and the level of technological

progress.

The Neoclassical model states that the mobility

of production factors, both capital and labor, at the

outset was not smooth. As a result, at that time

capital and skilled labor tended to be concentrated in

more developed areas so that development

inequality tended to widen (divergence). But if the

development process continues, with better

infrastructure and communication facilities, the

mobility of capital and labor will be smoother. Thus,

later after the country concerned has advanced, then

development inequality will decrease (convergence).

This estimate is known as the Neoclassical

Hypothesis (Tambunan, 2009).

2.4 Endogenous Growth (New Growth

Model)

Endogenous growth theory is the beginning of a

revival of new understanding of the factors that

determine long-term economic growth. In this case,

endogenous growth theory explains why capital

accumulation does not experience diminishing

returns, but instead experiences increasing returns

with specialization and investment in the field of

human resources. The difference with the Solow

model is that in Solow growth, savings will

encourage growth temporarily, but decreasing return

to capital will ultimately drive the economy in

steady state where growth depends only on

exogenous technological advances. Conversely in

endogenous growth models, savings and investment

can encourage sustainable growth (Nanga, 2005).

2.5 Investment Theory

Investment is the first step in production activities.

With such a position, investment in essence is also

the first step in economic development activities.

The dynamics of investment affect the high and low

level of economic growth, reflecting the widespread

lack of development. In an effort to grow the

economy, every country is always trying to create a

climate that can stimulate investment. The target is

not only the public or domestic private sector, but

also foreign investors (Dumairy, 1996).

The issue of investment in the era of regional

autonomy needs to be assessed in terms of the issue

of investment carried out in the regions, how the

regulation and control is carried out as well as the

issue of budget (budget) issued.

Since the enactment of Law No. 1/1967 jo. No.

11/1970 concerning Foreign Investment (PMA) and

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

710

Law No. 6/1968 jo. No. 12/1970 concerning

Domestic Investment (PMDN), investment tends to

increase from time to time. However, in certain

years there was also a decline. The increasing trend

not only takes place in investments by the public or

the private sector, both PMDN and PMA, but also

investment by the government. This means the

formation of gross domestic capital increases from

year to year (Dumairy, 1996).

To get an overview of the development of

investment from time to time, there are three types

of methods (based on three clusters of data) that are

commonly done. First, by highlighting the

contribution of gross domestic capital formation in

the context of aggregate demand, namely seeing the

contribution and development of variable Investment

(I) in the national income identity Y = C + I + G +

(X-M). Data Investment (I) is the overall data on

gross domestic investment, including both

investment by the private sector (PMDN and PMA)

and by the government. The second way is to

observe PMDN and PMA data. In this way, we only

observe investment by the private sector. The third

way is to examine the development of investment

funds channeled by the banking world (Dumairy,

1996).

2.6 Investment Efficiency

Efficiency is an activity to use resources

appropriately, there is no waste of existing

resources. Companies usually make efficiency in

order to reduce costs and facilitate the process of

managing the company to easily achieve company

goals. Investment activities carried out by the

company must be efficient in order to give benefits

to the company. Investment efficiency is the optimal

level of investment from the company, where the

investment is a type of investment that is profitable

for the company (Suryana, 2014).

The indicator commonly used to measure

investment efficiency is Incremental Capital Output

Ratio or ICOR. According to the Central Bureau of

Statistics, (ICOR) is a quantity that shows the

amount of additional new capital (investment)

needed to increase / increase one unit of output. The

ICOR magnitude is obtained by comparing the

amount of additional capital with additional output.

Because unit capital forms are different and diverse

while output units are relatively not different, then to

facilitate calculation both are valued in terms of

money (nominal).

The ICOR concept was originally developed by

Harrod and Domar which later became known as the

Harrod-Domar model. This model basically shows

the relationship between output (regional income) of

an economy with the amount of capital stock

needed. Capital stock is the condition of the stock of

capital (capital goods) available at a certain time.

If you want to increase regional income by 1

unit, you need an additional capital stock of ICOR.

The capital stock in year t is basically the

accumulation of investment (capital goods) from a

given year (year (t-s)) where s = 1,2,3, …… up to

the t-year. Suppose an investment starts in the t-year

and continues until the year (t + 1), that is, the

condition is assumed to consist of only two years,

then the capital stock in the t-year and year (t + 1).

In calculating ICOR, the investment concept

used refers to the concept of the national economy.

Definition of investment referred to here is fixed

capital formation / formation of fixed capital goods

consisting of land, buildings / construction,

machinery and equipment, vehicles and other capital

goods. Meanwhile the calculated value includes: the

purchase of raw / used goods, large manufacturing /

repairs carried out by other parties, major

manufacturing / repairs carried out on its own, sales

of used capital goods. Fixed Capital Formation or

the formation of fixed capital goods in this case is

the formation of gross fixed capital goods (PMTB)

(BPS Calatog, 2008).

3 METHODOLOGY

The scope of this study is to analyze the investment

efficiency with ICOR approach in all provinces of

Sumatera Island and the impact on economic

growth. The study will be analyzed by using panel

data regression method. The data used is a

combination time series and cross section in the

form of annual data.

Observation period is adjusted to the availability

data from 2007 to 2016. The data will be analyzed in

this study include Gross Domestic Regional Product

(GDRP) data, Gross Fixed Investment and the rate

of economic growth of ten provinces in Sumatera

Island; Aceh Province, North Sumatera Province,

West Sumatera Province, Riau Island Province, Riau

Province, Jambi Province, South Sumatera Province,

Bangka Belitung Province, Bengkulu Province, and

Lampung Province.

This study analyzed the correlation of investment

efficiency by using ICOR approach to the economic

growth in all provinces of Sumatera Island. In this

case, investment efficiency which measured by

using ICOR approach can affect the economic

Analysis of Efficiency Investment by using ICOR Approach to the Economic Growth in All Provinces of Sumatera Island

711

growth. The lower value of ICOR means that

investment used more efficient. The impact of

efficiency investment used is the higher economic

growth.

This research plan will analyze the problem

based on the framework as in the following scheme:

Figure 2: Correlation of Investment Efficiency and

Economic Growth

In this study, the equation form is:

G

it

= β

0

+ β

1

COR

it

+ e

it

Where :

a : Constanta

G

it

: Economic growth in all provinces of Sumatera

Island

ICOR

it

: Incremental Capital Output Ratio in all

provinces of Sumatera Island

e : Error term

3.1 The Stages of Analysis

The steps of data panel analysis in this study are:

1. Estimating panel data regression using the fixed

effect model.

2. Perform the Chow test

a) If accepted, then the common effect model

(continue step 5).

b) If rejected, then the fixed effect model

(continue step 4).

3. Perform the Hausman test

a) If accepted, then the random effect model

(continue step 5).

b) If rejected, then the fixed effect model

(continue step 4).

4. Test assumptions on the selected model.

5. Conduct test of the significance of parameters

which include simultaneous test and partial test

with improved regression equation.

6. Dispose of several research variables that are not

in accordance with the theory.

7. Interpret the final panel data regression model

with the selected model.

3.2 Variable Operational

The limits of the variables contained in this study

are:

1. Economic growth

Economic growth is an increase in GRDP minus

the previous year's GRDP. Economic growth

used in this study is economic growth from 10

provinces in Sumatra, namely Nangroe Aceh

Darussalam, North Sumatra, West Sumatra,

Riau Islands, Riau, Jambi, South Sumatra,

Bangka Belitung, Bengkulu and Lampung in the

2007-2016 research period.

2. Investment Efficiency

Efficiency in this study is measured by the

calculation of the Incremental Capital Output

Ratio (ICOR) in 10 Provinces of Sumatra ICOR

approach shows the amount of additional

investment needed to increase one unit of output

(Central Statistics Agency, 2009). The lower

ICOR indicates an increase in efficiency.

3. Investment

The amount of investment is reflected by the

amount of Gross Fixed Capital Formation

(PMTB) and Stock Change (Central Statistics

Agency, 2009). Investment in this study is

PMTB in provinces (10 provinces) on the island

of Sumatra in 2007-2016. PMTB is the

procurement, manufacture, purchase of new

capital goods from within and outside the

country, minus the net sales of used capital

goods while stock changes are the difference

between the ending inventory with the initial

inventory at a certain period and which is

included in the stock calculation intermediate

goods in various economic sectors that have not

been used in the production or consumption

process.

4 RESULTS AND DISCUSSION

Equation obtained from the data analysis are:

G

it

= β

0

+ β

1

ICOR

it

+ e

it

Based on the results of all tests that have been

carried out, as in the Chow Test and Hausman Test

ICOR

Economic Growth of Provinces (10

Provinces) on Sumatra Island

Efficiency

Investment

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

712

the results obtained are Fixed Effect Model. From

the regression results, obtained by the following

equation:

G

it

= 12.76245 – 0.21446ICOR

it

+ e

it

Based on the regression that has been done, the

constant C = 12,76245 showed that if the

independent variable is 0, then the economic growth

in all provinces of Sumatera Island still increase

12,76245 percent. ICOR coefficient indicates the

number -0,21446 which means when the other

variables equal to zero, an increase of one percent in

ICOR figures will have an impact on decreasing

economic growth of 0,21446 percent.

The estimation results for the variable economic

growth show the value of t-test probability is of

0,0922 < alpha 10% or 0,10, meaning ICOR

partially have significant impact on economic

growth.

Determination coefficient R

2

is used to calculate

how much variance of the dependent variable can be

explained by the independent variables. The R

2

value obtained by 0,270305. That is, the economic

growth amounted to 27,03 percent variable

community in the province of Sumatera Island (the

dependent variable) can be explained by the

independent variable in the model. While the

remaining 72,97 percent is explained by other

variables outside the model are held constant (ceteris

paribus).

The results of this study indicate that there is a

relationship quite significantly between investment

efficiency that measured by using ICOR approach to

economic growth in all provinces of Sumatera

Island. The mutually beneficial relationship between

investment efficiency which measured by using

ICOR approach and economic growth is caused by

the utilization of government budget for investment

produce optimal output so productivity is high and

hence a high economic growth in the provinces of

Sumatera Islands.

Based on Table 1, the individual effect each

provinces reflected from last intercept (C + Ci) by

using Fixed Effect Models. It shows that the value of

intercept each province in Sumatera is different.

This situation explains that the investment efficiency

variable which measured by ICOR approach has a

different level of influences to the economic growth

of each provinces in Sumatera Island. It shows that

for the Province of North Sumatera, Riau Province,

Jambi Province, Bengkulu Province and Lampung

province have grown better than other provinces in

Sumatera Islands in the same development stage

without an increase in the proportion of investment

to Gross Domestic Regional Product.

Table 1: Individual Effect of Province in Sumatera Island

Fixed Effects Cross

Coefficient

Individual Effect

(C+Ci)

_ACEH--C

-6.497783

6.264667

_SUMUT--C

0.317095

13.079545

_SUMBAR--C

-0.312264

12.450186

_RIAU—C

1.798647

14.561097

_JAMBI--C

2.427833

15.190283

_SUMSEL--C

-0.209247

12.553203

_BENGKULU--C

0.100765

12.863215

_LAMPUNG--C

3.015841

15.778291

_BABEL--C

-0.389937

12.372513

_KEPRI--C

-0.25095

12.5115

Source: Processed Data

5 CONCLUSION AND

IMPLICATION

The conclusions from the results of the study

include: (1) The relationship between ICOR and the

economic growth of Sumatra Island is negative; (2)

This research shows that for the Province of North

Sumatra, Riau Province, Jambi Province, Bengkulu

Province, and Lampung Province have grown better

than other provinces in Sumatra Island in the same

development stage without an increase in the

proportion of investment to gross Domestic

Regional Product.

It is expected that the government more concern

to the use of appropriate technology in order to give

the positive impact to employment and economic

growth.

REFERENCES

Abdul, H. (2004).Ekonomi Pembangunan.( Ekonisia).

Yogyakarta.

Ajija. (2011). Makro Ekonomi: An Introduction. Harlow:

Addison-wisley.

Arsyad, L. (2010). Ekonomi Pembangunan (STIM

TKPN). Yogyakarta.

Badan Promosi dan Perizinan Penanaman Modal Daerah

Provinsi Sumatera Selatan. (2014). Potensi Investasi

Provinsi Sumatera Selatan.

(http://www.bp3md.sumselprov.go.id). diakses tanggal

30 april 2018

Badan Pusat Statistik (2008). Incremental Capital Output

Rasio. Kabupaten Bandung. Katalog BPS. Bandung.

Badan Pusat Statistik (2017). Produk Domestik Bruto

Indonesia. (Badan Pusat Statistik). Jakarta

Analysis of Efficiency Investment by using ICOR Approach to the Economic Growth in All Provinces of Sumatera Island

713

Damodar, Gujarati. (2006). Dasar-dasar Ekonometrika

Edisi ketiga jilid 1 & 11. ( Erlangga). Jakarta.

Dumairy. (1996). Perekonomian Indonesia. Jakarta.

Hiroyuki, Taguchi (2014). A Revisit to the Incremental

Capital Output Ratio: The Case of Asian Economies

and Thailand. (Jurnal of Economic Policy in

Emerging Economic). Thailand.

Imam, G. (2005). Analisis Multivariate Dengan Program

SPSS. (Universitas Diponegoro). Semarang.

Irham, F. (2006). Analisis Investasi dalam Perspektif

Ekonomi dan Politik.( PT Refika Aditama). Bandung.

Jhingan, M.L. (2012). Ekonomi Pembangunan dan

Perencanaan. (PT Rajagrafindo Persada). Jakarta.

Lipsey, R.G. (1997). Pengantar Makroekonomi. (Bina

Rupa Aksara). Jakarta

Mankiw, N.G. (2007). Makroekonomi. Edisi Keenam.

(Erlangga). Jakarta

Muana,Nanga (2005). Makroekonomi. Teori, Masalah dan

Kebijakan. (Raja Grafindo Persada). Jakarta

Novita, Luh (2014). Pengaruh Kualitas Laporan

Keuangan Pada Efisiensi

Investasi.Perusahaan.Pertambangan. (E-Jurnal

Akuntansi Universitas Udayana).

Ridha,Sastri (2013). Analisis Serta

Perencanaan.PertumbuhanEkonomi dan Investasi

(Jurnal Kajian Ekonomi.). Sumatera Barat.

Situmorang (2018). Pengaruh Efisiensi

Perekonomian,.Terhadap.Pertumbuhan Ekonomi 32

Provinsi di Indonesia. Semarang.

Sunariyah (2003). Pengantar Pengetahuan Pasar Modal,

Edisi ke Tiga. (UPP-AMP YKPN). Yogyakarta.

Tambunan, Tulus (2009). Perekonomian

Indonesia:beberapa masalh penting (Ghalia

Indonesia). Jakarta.

Yana,Rohmana (2010). Ekonometrika Teori dan Aplikasi

Eviews. (Laboratorium Ekonomi dan Koperasi).

Bandung

Yeni, Irawan. (2010). Analisis Incremental Capital Output

Rasio di Provinsi Sumatera Utara. (Politeknik Negeri

Lhokseumawe). Medan.

Zhang, Jun. (2003). Invesment, Invesment Efficiency and

Economic Growth. (Journal of Asian Economics).

China.

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

714