Acceptance of Trade Finance Digitalization among SMEs in

Malaysia: A Conceptual Model

Yeoh Ee Pheng

1

, Teoh Ai Ping

1

and T. Ramayah

2

1

Graduate School of Business, Universiti Sains Malaysia, Penang, Malaysia

2

School of Management, Universiti Sains Malaysia, Penang, Malaysia

Keywords: Acceptance, Trade Finance Internet Banking Services, Small and Medium-sized Enterprises, Malaysia.

Abstract: The Internet is a very powerful tool and become a major challenge to service providers with the amount and

scale of products and services offered online. The rapid growth of Internet and IT/IS applications used in

businesses has resulted to digitalization of trade finance. However, the trade finance Internet banking

services is under-utilized despite availability. Service providers that had heavily invested in trade finance

Internet banking services will be very much interested to know what are the determinants that can increase

the system’s acceptance and utilization. The purpose of the study is to investigate the determinants that

affect acceptance of trade finance Internet banking services. Small and Medium-Sized Enterprises (SME)

are they key focus for this study as they are the catalyst and key contributors to national economies. This

study will make contribution to banking literature by providing insights on the IT/IS acceptance. It will also

help service providers to better justify their investments.

1 BACKGROUND

The Bank of International Settlements (BIS) has

noted that there is no single, comprehensive source

of statistics allowing for evaluation of the exact

composition and size of trade finance markets.

However, it is gauged that almost 67 per cent (USD

12 trillion annually out of USD 18 trillion of exports

and / or imports) were transacted through trade

finance (WTO, 2016). DBS Bank Ltd. (2017) also

testified that trade finance powers international trade

and is vital for turning the wheels of trade globally.

These roles make trade finance an important pillar

for banking business as it is one of the most

profitable and ever-growing division. However,

challenges remain in mitigating risks and improving

operational efficiencies.

The Internet is a very powerful tool and it brings

closer people to people, people to businesses or

businesses to businesses. It can change the way we

do things and also transform our life style via

information technology / information system (IT/IS)

innovation. Not only has the Internet demanded that

individuals and businesses change their habits and

even learn new skills, it has also become a major

challenge to service providers with the amount and

scale of products and services offered online. e-

Commerce is the latest in the evolution of business

transactions using the Internet platform. In the field

of financial services, Internet or online banking is

defined as the use of Internet as a remote delivery

channel of banking system via the World Wide Web.

Services provided include bank transfers, payments,

credit cards, trade settlement and others (Nasri and

Charfeddine, 2012). In tandem with the rapid growth

of Internet usage and IT/IS applications used in

businesses has resulted the need for trade finance

Internet banking services.

Simultaneously, Megatrends have been described

as large, transformative global forces that impact

individuals and businesses. Four Megatrends have

been identified for Small and Medium Enterprises

(SME) businesses, which are: (1) Digital Future and

4

th

Industrial Revolution (IR 4.0), (2) Rise of

Entrepreneurship, (3) Globalization and (4)

Community Living. Referring to Megatrend 1:

Digital Future and 4

th

Industrial Revolution (IR4.0),

we noted that technology changes business process

and transforms the way people work i.e. increasingly

enabling machines and software to substitute

humans (SME Annual Report 2016-17). Those who

can seize the opportunities offered by digital

advances stand to gain significantly while those who

cannot may become obsolete. Under Industrial

Pheng, Y., Ping, T. and Ramayah, T.

Acceptance of Trade Finance Digitalization among SMEs in Malaysia: A Conceptual Model.

DOI: 10.5220/0008489101190123

In Proceedings of the 7th International Conference on Entrepreneurship and Business Management (ICEBM Untar 2018), pages 119-123

ISBN: 978-989-758-363-6

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

119

Internet of Things (IoT), communication is improved

with connecting the embedded devices, plants,

offices and companies, which enables real-time data

sharing between all parts of the system and all

connected parties. The trade finance Internet banking

service is one of the systems or services that enables

to achieve the above-mentioned in the area of

handling trade transactions.

The Trade Finance Review (2016) also

recognized that technology is driving change within

the field. The trade arena is increasingly warming to

digitization but a number of barriers to adoption

persist. The acceptance or uptake of trade finance

Internet banking services seems to be slow and the

system is underutilized despite availability.

1.1 Trade Finance Internet Banking

Services

International trade finance transactions involve

numerous parties in different countries, using

various documents as payment instrument or

international guarantees to secure payment as

agreed. Trade finance department handle or assist in

simple to complex domestic and international trade

transactions and hence involve voluminous data and

documentations. The conventional way of trade

financing is full of voluminous physical documents.

Moving towards digitalization, trade finance Internet

banking service is a full-featured console for the

online management for trade finance businesses and

transactions. It provides straight through processing

via direct data entry and online transaction enquiries.

This will improve efficiency and accuracy; reduce

processing time, as well as cost and paperwork. The

online service also enables customers to utilize and

monitor their trade financing activities and status

online anywhere, anytime

(http://maybank2e.com.my).

Currently, seven banks have introduced trade

finance Internet banking i.e. Alliance Bank, CIMB,

Citibank, Hong Leong Bank, Maybank, OCBC and

Standard Chartered. These banks provide fairly

similar and standard services via Internet banking

such as real-time online trade status checking

facilities, online application for trade transactions

and etc. The claimed benefits for businesses to use

trade finance Internet banking services includes: cost

savings, increase productivity and efficiency etc.

1.2 Small and Medium-Sized

Enterprises in Malaysia

Effective 1

st

Jan, 2014, the SMEs definition in

Malaysia have been revised. For manufacturing

sector, SMEs have been reclassified as companies

whose annual turnover is less than RM50 million

with workers not exceeding 200, from the previous

definition of less than RM25 million in revenue and

less than 150 workers. As for services sector, the

value threshold has also been raised, with SMEs

defined as firms with annual sales not exceeding

RM20 million (less than RM5 million at previously)

or not more than 75 workers (less than 50

previously) while micro enterprises are firms with

annual sales of less than RM300,000 or fewer than 5

workers. The former Malaysia Prime Minister YAB

Dato’ Sri Haji Mohammad Najib announced that the

number of SMEs is expected to increase from 97.3

per cent to 98.5 per cent under the new definition for

SMEs. The review is right noting the changing

economy and these will facilitate the country’s

transformation into a high income nation (The Sun,

July 12, 2013).

Focusing on the utilization of ICT among SMEs,

a survey conducted by SME Corporation, Malaysia

found that majority of the SMEs utilizes computers,

smartphones and Internet in their daily business

operation. As at Q1 2017, it is found that 87.9% of

SMEs participated in the survey are using computer,

laptop, notebook in their business operation, 77.6%

using smartphones, tablets and 69.0% adopted

Internet service. Comparing Q1 2017 to Q3 2016,

there is also an increase in SMEs maintaining

official company website and SMEs’ participation in

e-commerce marketplace (SME Annual Report

2016-17). It is apparent that SMEs have

acknowledged the importance of ICT and adopted

various IT/IS to realign their businesses to the new

technology. However, it is also found that most

SMEs adopt the Internet if it fits their particular

communication needs. For example, the “wait-and-

see” attitude (until profitability is demonstrated)

towards Internet adoption is currently prevalent

among SMEs (Sadowski et al., 2002).

Specifically, on the acceptance of trade finance

Internet banking services, an interview with two

distinguished Heads (from one local and one foreign

bank) heading the trade business in Northern

Malaysia also confirmed that the acceptance and

actual usage of trade finance Internet banking

services is below 20 percent out of their trade

finance clients’ base. It is of high concern that the

bank’s trade finance Internet banking services is

under-utilized despite availability. To address this

issue and to ensure achievement of return on

investment (ROI), both banks had embarked in

various and continuous initiatives to increase their

ICEBM Untar 2018 - International Conference on Entrepreneurship and Business Management (ICEBM) Untar

120

system’s acceptance and utilization rate. On-going

campaign is also being launched to attract new

customers to come on-board and to encourage the

existing customers to sustain the usage of the

system.

2 REVIEW OF PREVIOUS

LITERATURE

Tornatzky and Fleischer (1990) defined innovation

as “the situational new development and

introduction of knowledge-derived tools, artifacts,

and devices by which people extend and interact

with their environment. The authors had identified

three aspects of an enterprise’s context (technology,

organization and environment) that influence the

process by which it adopts and implements a

technological innovation. The original Technology,

Organization and Environment (TOE) framework

was adapted in numerous IT/IS adoption studies and

provides a useful analytical framework that can be

used for studying the adoption and assimilation of

various types of innovation.

By applying the TOE framework, Ifinedo (2011)

found that perceived benefits (representing the

technology context) are a significant predictor of

Internet and e-business technology acceptance

among the Canadian SMEs. Scholtz et al., (2016)

examined the interface usability of Enterprise

Resource Planning (ERP) software system and found

that interface usability has a significant impact on

users’ perceptions of usefulness and ease of use

which ultimately affects attitudes and intention to

use the ERP software. Yoon and Steege (2013) also

found that website usability significantly influence

customers’ Internet banking use.

In lieu of organization context, Ramdani,

Chevers and Williams (2013) found that top

management support and organizational readiness

are significant determinants of enterprise application

(EA) adoption by SMEs. Gutierrez et al. (2015)

found that technology readiness pressure influence

organization’s adoption decision of cloud

computing. As such, it is apparent that technology

and organization contexts have a significant impact

for organization’s IT/IS acceptance.

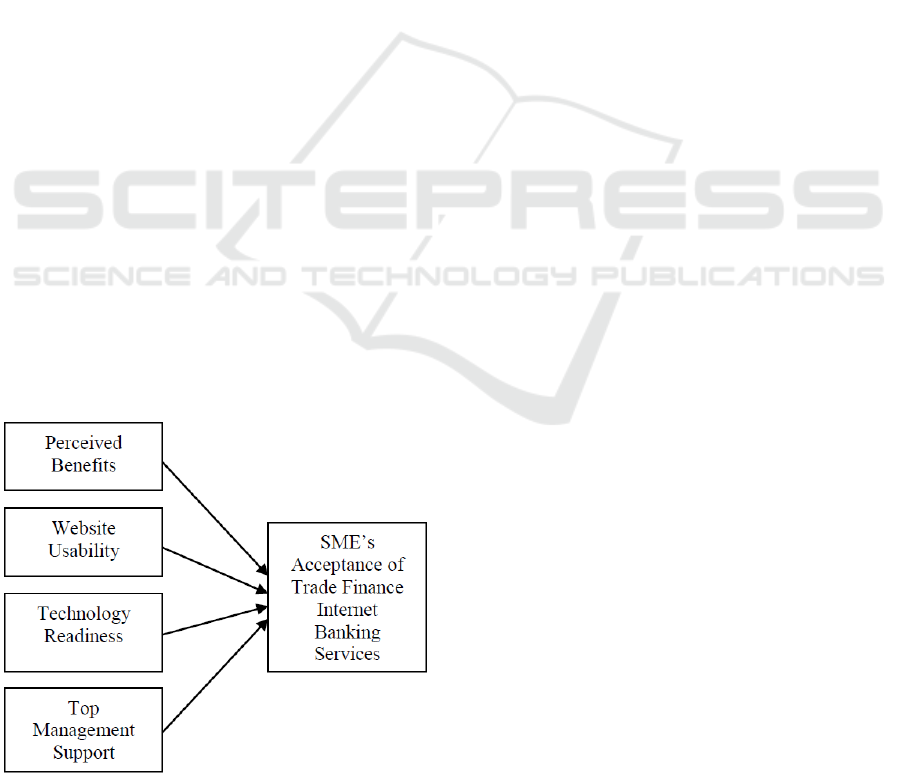

This conceptual framework focuses on the

internal aspects of the organization i.e. technology

and organization contexts. This is because the

decision for acceptance of trade finance Internet

banking services is highly based on the specific

internal consideration and evaluation on the IT/IS by

the organization. Presently, acceptance of trade

finance Internet banking services is based on

voluntary choice and not a mandatory system to be

adopted by the trade clientele.

3 PROPOSED CONCEPTUAL

FRAMEWORK

In this study, the proposed conceptual framework as

per depicted in Figure 1 is adapted from TOE.

Tornatzky and Fleischer (1990) defined acceptance

as making the technology available to the users.

Featherman and Pavlou (2003) had highlighted that

it is important to distinguish the difference between

conducting basic e-commerce purchases and

adopting e-services. In comparison to one-time e-

commerce-based purchases, the e-service adoption /

acceptance decision is more complex as they initiate

a long-term relationship between the consumer and

service provider. When an organization accepts the

trade finance Internet banking services, they are

entering into a business relationship with a distant

and faceless e-service provider. Moreover, unlike

product purchases where consumers receive tangible

goods, acceptance of e-service only entitle access to

the functionality provided by web-portal.

The proposed determinants to study technology

context are perceived benefits and website usability.

Kuan and Chau (2001) defined perceived benefits as

perceived technological benefits (direct and

indirect), which refer to the degree to which the

IT/IS is perceived as providing the benefits to the

organization. The trade finance Internet banking

services provides numerous benefits such as

convenience, improve efficiency and accuracy;

reduce processing time, as well as cost and

paperwork.

According to Scholtz et al., (2016) website

usability is measured by three criteria of usability i.e.

navigation (design issue), presentation

(appropriateness of the layout of menus, dialog

boxes, controls and information elements on the data

entry screen as well as included in output) and

learnability (ease with which new or novice users

can start effective interaction with the system and

achieve maximum performance. Trade finance

transactions (domestic and international) normally

involve various parties coupled with voluminous

documents. Hence, it is very important for service

providers to design and offer a system that is able to

assist to the nature of trade finance transactions. This

is because website usability can influence end user’s

Acceptance of Trade Finance Digitalization among SMEs in Malaysia: A Conceptual Model

121

attitude and behavior to use the trade finance

Internet banking services.

The organization context will be studied using

technology readiness and top management support.

Parasuraman (2000) defined technology readiness as

people’s propensity to embrace and use new

technologies for accomplishing goals in home life

and at work. As highlighted by Trade Finance

Review (2016), one of the barriers to the growth of

electronic trade finance is the significant level of

investment needed. Comparatively to big

corporations, SMEs may not maintain a separate

budget or tend to have smaller budget to commit to

substantial costly infrastructures such as setup of

IT/IS and also providing comprehensive training to

their staffs.

Top management support is defined as

involvement, enthusiasm, motivation and

encouragement provided by management towards

the acceptance of IT/IS innovations (Ifinedo, 2011).

Decision to accept trade finance Internet banking

services fall on the top management. Top

management like Finance Director or Finance

Manager plays an important role and is the decision

maker to accept or reject the acceptance of trade

finance Internet banking services.

Financial institutions or service providers that

had heavily invested in trade finance Internet

banking services will be very much interested to

know what determinants that can increase the

system’s acceptance and utilization. The study also

focuses on SMEs as they are the catalyst and key

contributors to national economies. Besides that,

SMEs also hold the biggest percentage in market

share under the financial institutions commercial

customers’ portfolio.

Figure 1: Proposed Conceptual Framework.

4 SIGNIFICANCE OF STUDY

Digital trade finance is the trend for the future.

Theoretically, this study will make contribution to

trade finance Internet banking services literature by

providing insights on the IT/IS acceptance. To date,

there has been little scholarly research pertaining to

barriers and commercial banking customers’

readiness to accept such system. This research also

focuses on IT/IS acceptance among SMEs which are

business organizations.

Practically, this study will be significant for

service providers to understand the underlying

factors that could increase the acceptance of trade

finance Internet banking services by their

commercial clientele. With the understanding of the

degree of influence towards trade finance Internet

banking services, financial institutions could

concentrate and pay careful attention to the area to

be focused or improved. It will also help service

providers; namely financial institutions to better

justify their investments and ensure continuous

revenue to maintain system’s sustainability. As for

business entity level, this study will enable

companies to understand and appreciate the

managerial implications of utilizing trade finance

Internet banking services.

5 CONCLUSION

The trade finance Internet banking services will

benefit the SMEs in term of cost savings, increase

productivity and efficiency. On the other hand, a

well-accepted trade finance Internet banking services

enables the service provider to reduce operating

costs, increase revenue, ensure customer retention

and attraction. Understanding customers’ needs and

providing up-to-date services in accordance to IT/IS

innovation is crucial in any service industry. This

study will help to increase and achieve widespread

acceptance of trade finance Internet banking services

among the SMEs. It will also help service providers;

namely financial institutions to better justify their

investments.

REFERENCES

DBS Bank Ltd. (2017), “The digital journey in trade

finance”, Digital Trade Infographic, February 2017.

Featherman, M.S. and Pavlou, P.A. (2003), “Predicting e-

service adoption: a perceived risk facets perspective”,

Int. J. Human-Computer Studies, 59, pp. 451-474.

ICEBM Untar 2018 - International Conference on Entrepreneurship and Business Management (ICEBM) Untar

122

Gutierrez, A., Boukrami, E. and Lumsden, R. (2015),

“Technological, organizational and environmental

factors influencing managers’ decision to adopt cloud

computing in the UK”, Journal of Enterprise

Information Management, 28(6), pp.788-807.

Ifinedo, P. (2011), “Internet / e-business technologies

acceptance in Canada’s SMEs: an exploratory

investigation”, Internet Research, 21(3), pp. 255-281.

Kuan, K.K.Y. and Chau, P.Y.K. (2001), “A perception-

based model for EDI adoption in small businesses

using a technology-organization-environment

framework”, Information & Management, 381(2001),

pp. 507-521.

Parasuraman, A. (2000), “Technology Readiness Index

(TRI). A multiple-item scale to measure readiness to

embrace new technologies”, Journal of Service

Research, 2(4), pp. 307-320.

Nasri, W. and Charfeddine, L. (2012), “Factors affecting

the adoption of Internet banking in Tunisia: An

integration theory of acceptance model and theory of

planned behavior”, Journal of High Technology

Management Research, 23(2012), pp. 1-14.

Ramdani, B., Chevers, D. and Williams, D.A. (2013),

“SMEs’ adoption of enterprise applications. A

technology-organization-environment model”, Journal

of Small Business and Enterprise Development, 20(4),

pp. 735-753.

Sadowski, B.M., Maitland, C. and Dongen, J.V. (2002),

“Strategic use of the Internet by small-and medium-

sized companies: an exploratory study”, Information

Economics and Policy, 14(2002), pp. 75-93.

Scholtz, B., Mahmud, I., and Ramayah, T. (2016). “Does

usability matter? An analysis of the impact of usability

on technology acceptance in ERP settings”,

Interdisciplinary Journal of Information, Knowledge,

and Management, 11, pp. 309-330. Retrieved from

http://www.informingscience.org/Publications/3591

SME Annual Report 2016/17, “SME Developments and

Outlook”

http://www.smecorp.gov.my/index.php/en/slides/2151-

sme-annual-report-2016-17. Accessed 5

th

June 2018.

The Sun (2013). “Najib announces new definition of

‘SME’”, The Sun, dated July 12, 2013.

Tornatzky, L. and Fleischer, M. (1990), “The processes of

technological innovation”. New York: Lexington

Books.

Trade Finance Review (2016), “Digitizing trade finance –

a work in progress” http://www.tfreview.com.

Accessed 5

th

June 2018.

World Trade Organization (2016), “Trade Finance and

SMEs. Bridging the gaps in provision”, A publication

of World Trade Organization, publications@wto.org

Yoon, H.S. and Stege, L.M.B., (2013), “Development of a

quantitative model of the impact of customers’

personality and perceptions on Internet banking use”,

Computers in Human Behavior, 29(2013), pp. 1133-

1141.

Acceptance of Trade Finance Digitalization among SMEs in Malaysia: A Conceptual Model

123