Detection of Financial Crisis in Indonesia based on Import and Yen

Exchange Rate to Rupiah Indicators using Combined of Volatility

and Markov Switching Models

Etik Zukhronah

1

, Sugiyanto

1

and Isna Ruwaidatul Azizah

2

1

Study Program of Statistics, Universitas Sebelas Maret Surakarta, Indonesia

2

Department of Mathematics, Universitas Sebelas Maret Surakarta, Indonesia

Keywords: Crisis, Detection, Import, Yen Exchange Rate to Rupiah, SWARCH.

Abstract: In 1997 and 1998 Indonesia experienced the most severe financial crisis, so early detection is needed to

anticipate the impact of the crisis. The financial crisis can be detected by import and yen exchange rate to

rupiah indicators. In this paper, it used import and yen exchange rate to rupiah data from January 1990 to

December 2016 to form the model, while the data from January until December 2017 were used to validate

the model. To overcome the problem of structural change in the data, it is used Markov switching model,

while to detect the volatility shift it is used ARCH model and the combination of both models is Markov

switching ARCH (SWARCH) model. The aim of this study is to determine the appropriate model and to

detect financial crisis based on import and yen exchange rate to rupiah indicators. The results show that the

appropriate model for import and yen exchange rate to rupiah data is SWARCH(2,1). Based on the model, it

can be predicted that Indonesia will not experience a financial crisis in 2018.

1 INTRODUCTION

The financial crisis in Asia came from the fall in

currency values bath in Thailand in 1997. In 1997 and

1998, Indonesia experienced a financial crisis.

Currently, global trade is already unavoidable, and

the exchange rate affects the economy of a country.

For example, when the rupiah becomes more valuable

to foreign currencies, the price of imported goods will

be cheaper for the Indonesian population and

Indonesian export goods are more expensive for

foreign countries (Mishkin, 2008). There are 15

indicators that could be used to detect financial crisis

for example import, export, price stock, and rupiah

exchange rate (Kaminsky et al., 1998).

Engle (1982) uses the Autoregressive Conditional

Heteroscedasticity ( ARCH ) model for resolving the

problem of heteroscedasticity. Model ARCH could

not be used to cover the data that have structural

changes . Therefore, Hamilton (1989) used the

Markov switching model for resolving the problem of

structural changes on data. However, Markov

switching model cannot solve the problem of

volatility so Hamilton and Susmel 1994) used the

Markov switching ARCH (SWARCH) model to

overcome structural changes and volatility of the

data. The aim of this paper is to determine the

appropriate model of import and yen exchange rate to

rupiah data. The model is used to detect the financial

crisis in 2018.

2 THEORY

2.1 Autoregressive (AR) and

Autoregressive Conditional

Heteroscedasticity (ARCH) Model

An AR model is as follows

(1)

where r

t

is log return in the t

th

period which is

formulated as

,

is a parameter of AR

model at p

th

time, and

is residue at t

th

time (Tsay,

2005). The next model that we are used is ARCH (p)

model. The model could be written as

Zukhronah, E., Sugiyanto, . and Azizah, I.

Detection of Financial Crisis in Indonesia based on Import and Yen Exchange Rate to Rupiah Indicators using Combined of Volatility and Markov Switching Models.

DOI: 10.5220/0008519402050209

In Proceedings of the International Conference on Mathematics and Islam (ICMIs 2018), pages 205-209

ISBN: 978-989-758-407-7

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

205

where

is a constant of ARCH model,

is a

parameter of ARCH model , and

is a variance of

residual at t

th

period.

2.2 Cluster Analysis

Cluster analysis is used to group a set of objects into

two or more clusters based on the similarity of objects

based on various characteristics. One method in

cluster analysis is Ward method that based on the sum

of square error (SSE), which is defined as

′

where

is the i

th

object,

is the average value of

the object in the cluster , and

is the number of

objects on the cluster , where

(Rencher, 2003).

2.3 Markov Switching ARCH

(SWARCH) Model

Hamilton and Susmel (1994) formulates SWARCH

model as below

where

is a variance of residue at i

th

period,

is

a residue of AR model and conditional variance of

is modeled as an ARCH(p) process.

2.4 Smoothed Probability

Smoothed probability is the probability of a state in

the t

th

period that based on all observational data

which formulated as

where

is a set of data from the past until time

(Hamilton and Susmel, 1994).

2.5 Crisis Detection

Crisis forecasting is determined by the forecasting

value of smoothed probability at time (t+1) which is

based on smoothed probability at time t, and

formulated as follows

where

is the probability of transition from state i

to state j and

is smoothed

probability at state i and time (t-1).

3 RESEARCH METHODS

Data that used in this paper is import and yen

exchange rate to rupiah data from January 1990 to

December 2016, there are 324 data. The steps of the

analysis are as follows.

1. Plot data for knowing the pattern of data.

Augmented Dickey-Fuller (ADF) test is used to

test the stationary of data. If the data are not

stationary, then do transform log return.

2. Analyze the AR model by looking at the plot of

PACF then perform a heteroscedasticity effect

test using the Lagrange Multiplier test .

3. Identify the volatility model and conduct

diagnostic tests.

4. Form the combined of Markov switching and

volatility models with the number of states

obtained from cluster analysis.

5. Calculate the value of smoothed probability to

detect a crisis.

4 RESULTS AND DISCUSSIONS

Figure 1 and 2 are a plot of import and yen exchange

rate to rupiah respectively. Figure 1 shows that the

import and yen exchange rate to rupiah data have

fluctuations and indicate that the data is not

stationary. To prove the allegation, the ADF test was

carried out and the probability value was 0.4446 for

import data and 0.2549 for yen exchange rate to

rupiah. Both the probability value is greater than 0.05,

it can be concluded that the import and yen exchange

rate to rupiah is not stationary. Furthermore, it was

done the transformation of log return and based on the

ADF test, it is obtained the both probabilities are 0.01

that these are smaller than 0:05, so it can be concluded

that the import and yen exchange rate to rupiah were

stationary. Furthermore, we estimated the parameter

of AR model based on plot of PACF as shown in

Table 1.

ICMIs 2018 - International Conference on Mathematics and Islam

206

Figure 1: Plot of import data.

Figure 2: Plot of yen exchange rate to rupiah.

Table 1: Results of estimation of AR model for import and

yen exchange rate to rupiah.

AR(2) model

for import

AR(1) model

for yen

exchange

rate to

rupiah

Based on Lagrange Multiplier test, it was

obtained the probability value for import data of

0.004175 and for yen exchange rate to rupiah of

0.000016. Because the both probabilities are smaller

than 0.05, this shows that the residue of AR model

contains the effect of heteroscedasticity. The next

step is to estimate the parameter of ARCH model as

shown in Table 2.

Table 2: Estimation of the ARCH model for import and yen

exchange rate to rupiah.

ARCH(1) model for

import

ARCH(1) model yen

exchange rate to

rupiah

The results of the Ljung-Box test, it was obtained

the probability value for import data is 0.5344 and for

yen exchange rate to rupiah is 0.0912. Both of

probabilities are greater than 0.05, it means that the

residue of the ARCH model does not contain

autocorrelation. Based on the Lagrange Multiplier

test , the probability value for import data is 0.333 and

0.1213 for the yen exchange rate to rupiah which is

greater than 0.05, it means that the residual of ARCH

model does not contain heteroscedasticity effects.

Whereas the Kolmogorov Smirnov test, it was

obtained the probability value for import data of 0.8

and for the yen exchange rate to rupiah of 0.6 which

is greater than 0.05. It can be concluded that the

residual of ARCH model is normally distributed.

Then cluster analysis is performed to determine

the number of states that can be formed. Based on the

cluster analysis, the results show that there are 2

clusters that can be formed, so that there are 2 states

in the formation of the SWARCH model. The

ARCH(1) model is combined with the Markov

switching model 2 state to overcome differences in

conditions not crisis and crisis on import data.

Transition probability matrix for import data are as

follows

In the transition probability matrix

, the first

column shows that the value of the probability of

holding on the low volatility state is 0.6669482 and

the probability of change in low to high volatility is

0.3330518 . In the second column, it indicated that the

probability of change in high to low volatility is

0.1511154 and the probability of holding on the high

volatility state is 0.8488846.

Based on the results of the analysis, the model that

full filled the assumption is the ARCH(1) model and

there are 2 states so that the SWARCH model that is

formed is SWARCH(2,1). Estimation results of the

parameter SWARCH(2,1) model for import data is

where is the average value of the log return data

import and the conditional volatility model is

Furthermore, the probability transition matrix for

the yen exchange rate to rupiah data is as follows

Parameter estimation result of SWARCH(2,1)

model for yen exchange rate to rupiah data is

Detection of Financial Crisis in Indonesia based on Import and Yen Exchange Rate to Rupiah Indicators using Combined of Volatility and

Markov Switching Models

207

where the conditional variance model is

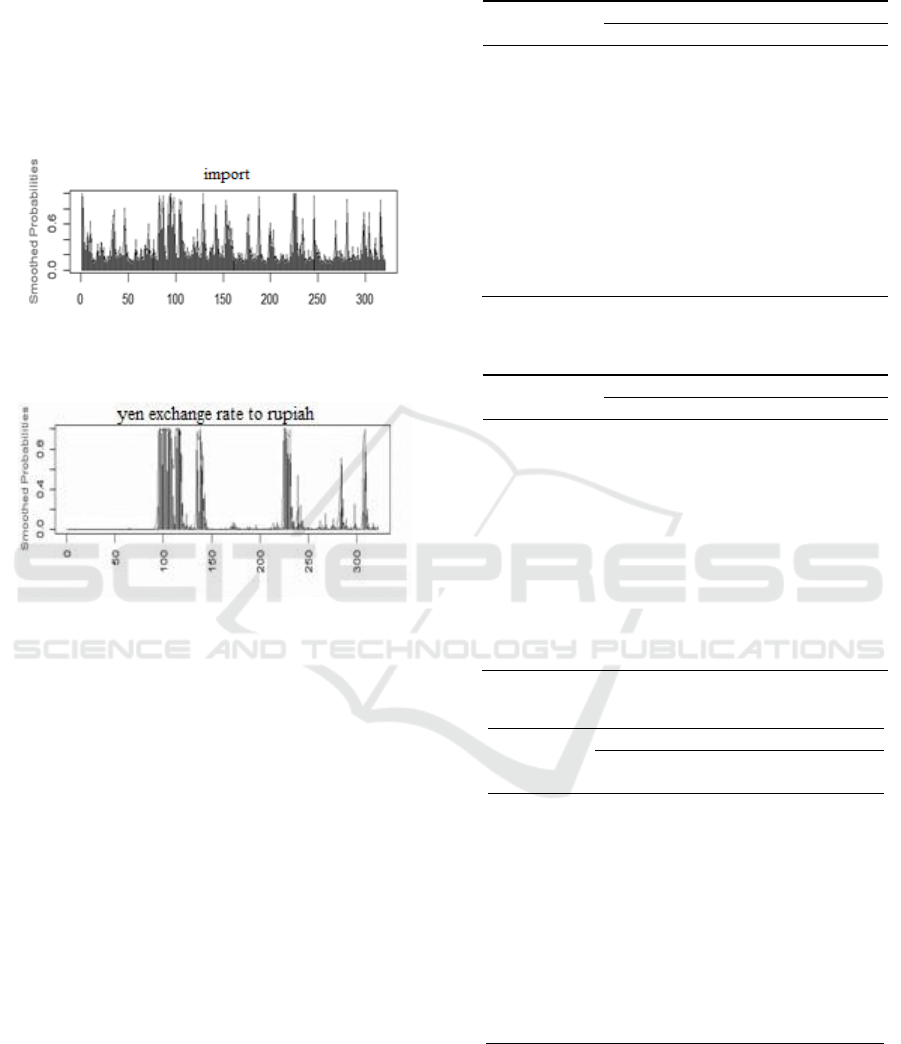

Furthermore, it is calculated the smoothed probability

to check the crisis condition. Figure 3 and Figure 4

are the value of smoothed probability for import and

yen exchange rate respectively.

Figure.3: Plot of smoothed probability of import.

Figure 4: Plot of smoothed probability of yen exchange rate

to rupiah.

The results of calculating the crisis limit on the

value of smoothed probability, it can be concluded

that the value of smoothed probability of import data

which more than 0.790915 is in a crisis and of yen

exchange rate to rupiah data which more than

0.448561 is in a crisis. Table 3 and Table 4 show the

comparison of forecasting and actual smoothed

probability value for import and yen exchange rate to

rupiah indicators in 2017 respectively.

Based on Table 3, the forecasting smoothed

probability value and the actual value do not

experience a significant difference, except in June

2017 on import data. This is happened because the

value of imports in June declined significantly but the

value of yen remained high so that financial

conditions in Indonesia were prone to crisis. In the

next month the import value rose again and stabilized

for the following months so that the SWARCH(2,1)

model for import data and yen exchange rate to rupiah

could be used to detect financial crises in Indonesia.

Table 3: Forecasting and Actual Smoothed Probability

Value for import in 2017.

Period

Import

Forecasting

Actual

Jan 2017

0.09058303

0.3051957

Feb 2017

0.08181023

0.4093009

Mar 2017

0.07728494

0.2398876

Apr 2017

0.07495064

0.2612489

May 2017

0.07374653

0.4023360

Jun 2017

0.07312542

0.9373966

Jul 2017

0.07280503

0.4731825

Aug 2017

0.07263976

0.2058910

Sept 2017

0.07255451

0.1341276

Oct 2017

0.07251053

0.1067105

Nov 2017

0.07248785

0.1126172

Dec 2017

0.07247615

0.1352822

Table 4: Forecasting and Actual Smoothed Probability

Value for yen exchange rate to rupiah in 2017.

Period

Yen Exchange Rate to Rupiah

Forecasting

Actual

Jan 2017

0.0151432

0.04266027

Feb 2017

0.0136995

0.01158024

Mar 2017

0.0124787

0.00366135

Apr 2017

0.0114462

0.00278140

May 2017

0.0105731

0.00735416

Jun 2017

0.0092109

0.00554720

Jul 2017

0.0080589

0.01410902

Aug 2017

0.0070847

0.00645248

Sept 2017

0.0062609

0.00510444

Oct 2017

0.0055642

0.00534139

Nov 2017

0.0049750

0.01698142

Dec 2017

0.0044768

0.02611092

Table 5: Forecasting smoothed probability value in 2018.

Period

Forecasting Smoothed Probability

Import

Yen Exchange

Rate to Rupiah

Jan 2018

0.07247012

0.00405546

Feb 2018

0.07246699

0.00369915

Mar 2018

0.07246539

0.00339783

Apr 2018

0.07246456

0.00314302

May2018

0.07246413

0.00292754

Jun 2018

0.07246391

0.00274532

Jul 2018

0.07246380

0.00259121

Aug 2018

0.07246374

0.00246090

Sept 2018

0.07246371

0.00235069

Oct 2018

0.07246369

0.00225749

Nov 2018

0.07246369

0.00217868

Dec 2018

0.07246368

0.00211203

Based on Table 4, the forecasting smoothed

probability value and the actual value for yen

exchange rate to rupiah do not experience a

significant difference. The results of forecasting

smoothed probability in 2018 are shown in Table 5.

ICMIs 2018 - International Conference on Mathematics and Islam

208

Table 5 shows that the forecasting smoothed

probability value on the import data and yen

exchange rate to rupiah was below the crisis limit, so

that Indonesia was detected not experiencing a

financial crisis in 2018.

5 CONCLUSIONS

Based on the results, it was obtained to the conclusion

as follows.

1. The appropriate model for import and yen

exchange rate to rupiah indicators is SWARCH

(2,1).

2. Based on import and yen exchange rate to rupiah

indicators, Indonesia was predicted that there is no

financial crisis in 2018.

REFERENCES

Engle, R. F., 1982. Autoregressive Conditional

Heteroscedasticity with Estimates of the Variance of

United Kingdom Inflation. Econometrica, vol. 50, pp.

987-1008.

Hamilton, J. D., 1989. A New Approach to the Economic

Analysis of Nonstationary Time Series and the

Business Cycle. Econometrics, vol. 57, pp. 357-384.

Hamilton, J. D. and Susmel, R., 1994. Autoregressive

Conditional Heteroscedasticity and Changes in

Regime. Journal of Econometrics, vol. 64, pp. 307-

333.

Kaminsky, G. L., Lizondo, S. and Reinhart. C. M., 1998.

Leading Indicators of Currency Crises. IMF Staff

Papers, Vol. 45 (1), pp. 1-48.

Mishkin, F. S., 2008. Globalization, Macroeconomic

Performance, and Monetary Policy. NBER Working

Paper Series, Cambridge.

Rencher, A. C., 2003. Methods of Multivariate Analysis.

John Wiley and Sons, Inc. New York, 2

nd

edition.

Tsay, R. S., 2005. Analysis of Financial Time Series. John

Wiley and Sons.

Detection of Financial Crisis in Indonesia based on Import and Yen Exchange Rate to Rupiah Indicators using Combined of Volatility and

Markov Switching Models

209