Digitizing Zakat Management in Improving

LAZ Accountability

Amin Wahyudi

1*

, Puji Handayati

2

1

Faculty of Islamic Economics and Business of IAIN Ponorogo

2

Universitas Negeri Malang

Keywords: zakat, accountability, LAZ, digital-internet

Abstract: In response to the increasing potential growth of zakat, the increasing growth of the provincial level

of zakat management institutions also occurred. However, the community's response to the

presence of the institution still relatively low. The community prefers to channel zakat directly to

those who are entitled to receive it. This study aims to examine the financial accountability of zakat

management institutions at the provincial level by looking at the utilization of digital-internet

technology as a tool for financial disclosure to donors and other stakeholders. This research is

qualitative research with interpretive descriptive methods. Data collection was carried out by

observing the official websites of the provincial-level Amil Zakat institution. The content analysis is

used to analyze the research objectives. The results of this study indicate that none of the 9

institutions of provincial level amil zakat uses digital-internet technology or online media as a tool

for financial information disclosure. This finding indicates that the accountability of periodic

reporting of the provincial amil zakat institutions still low. Therefore, this study recommends that

the provincial amil zakat institution, using digital-internet technology as a tool to perform their

accountability, since it is more effective and efficient. There is also a need to encourage the

government to urge the provincial-level Amil Zakat institutions to disclose their financial reporting

on their official websites as part of their financial accountability, because it is in line with the

needs of the community.

1 INTRODUCTION

Indonesia with a large Muslim population has a

large potential zakat fund. The UN Study of UIN

Syarif Hidayatullah (2005) estimates the potential of

Indonesian Islamic philanthropy in the amount of

Rp. 19.3 trillion (0.8% of GDP 2004). Study of

BAZNAS - IRTI IDB / Firdaus et., Al. (2012)

founds that Indonesia's zakat potential to have

reached Rp 217 trillion (3.4% of 2010 GDP).

Wibisono (2015) founds Indonesia's zakat potential

in 2010 reached IDR 106.6 trillion (1.7% of 2010

GDP) (Wibisono, 2016).

Canggih et.al (2017), stated that the potential and

realization of zakat in Indonesia for five years (2011

to 2015) was experiencing positive growth even

though the realization amount was still very small.

The figures for potential zakat funds and their

realization are as follows:

Table 1: Potential and Realization of Zakat Funds in

Indonesia

Year

Potency [Rp]

Realization [Rp]

%

2011

58.961.143.222.174

32.986.949.797

0,06

2012

64.086.440.764.997

40.387.972.149

0,06

2013

69.794.542.095.826

50.741.735.215

0,07

2014

78.374.957.309.348

69.865.506.671

0,09

2015

82.609.152.671.724

74.225.748.204

0,09

Source: Research by Canggih et al, entitled Potential and

Realization of Zakat Funds in Indonesia

The gap between realization and potential,

encourages people to optimizing the utilization of

zakat by establishing the amil zakat institutions. The

number of zakat management an institution which

registered and authorized by the National Zakat

Agency (BAZNAS), in 2018, was 53 institutions,

Wahyudi, A. and Handayati, P.

Digitizing Zakat Management in Improving LAZ Accountability.

DOI: 10.5220/0008783500050013

In Proceedings of the 2nd International Research Conference on Economics and Business (IRCEB 2018), pages 5-13

ISBN: 978-989-758-428-2

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

5

consisted of 19 national level institutions, 9

provincial level institutions and 25 district and city

level institutions (HTTP: //pid.baznas.go.id/daftar-

baznas-daerah-laz). In addition to this amount, there

were also few BAZNAS representatives in each

province and city.

However, the public trust in the zakat

management institution is relatively low. Most

people prefer to give zakat individually [to a poor

relative, for instance] instead of channeling it

through zakat management institutions. This is

because the impact of giving can be more

immediately felt compared with payment through

zakat institutions. The Eighteen (18) survey of

Public Interest Research and Advocacy Center

(PIRAC) show that the level of public trust in zakat

institutions in 2004 was only 15% (Nikmatuniayah

and Marliyati, 2015). This poor of trust was caused

by the lack of proper financial reporting of the zakat

management institution, which causes the zakat

payer to be unsatisfied. Insufficient financial

reporting also raises doubts about the accountability

of zakat institutions (Sudjali, 2017)

A Research conducted by Rini in 2015 under

concerning the Internet Financial Reporting

Application to Improve the Accountability of Zakat

Management Organizations, shows that out of the 19

national level zakat management institutions in

Indonesia, only one institution provide their

financial reporting via the internet. This shows that

the accountability of zakat institutions can be said in

a low condition (Rini, 2016).

Accountability at least defined as submission of

information to muzakki who have given the mandate

to the amil zakat institution (LAZ) to channel their

zakat to those who have the right to receive

(mustahik). One of the information that must be

submitted by LAZ is financial information or

financial statements. With financial information,

sharia accountability can be revealed. In addition to

accountability, the purpose of providing financial

information or financial statements is to provide

useful information for users in the context of

decision making. Therefore the provision of

information must meet the relevant qualifications.

Providing irrelevant information will cause the

information to be in vain because it cannot be used

for decision making. Among the relevance of

information is the use of media in accordance with

the information user.

In this digital era, where the internet has become

the lifestyle of most people, which includes muzakki,

the delivery of financial information by utilizing

digital-internet technology is certainly effective,

because in addition to meeting the needs of users, it

also has a wide range. This is because zakat

institutions, in general, especially provincial-scale

zakat institutions have donors with a wide area.

Based on the background of the above

discussion, this study intends to examine the

accountability of zakat management institutions in

provincial-level in related to the utilization of

digital-internet-based technology [online] as a

medium for delivering accountability of zakat

management institutions.

2 LITERATURE REVIEW

2.1 Zakat in Islamic Teachings

Literally, the word zakat means growing,

developing, blessing, holy, healthy or good, and

praiseworthy (Ibn Manthur, tt). According to the

fiqh, term zakat is a certain amount of property that

is obliged by Allah to be handed over to those who

are entitled to receive it (Qardlawi, 1973). Al-Jaziri

(1994) defined zakat as a grant of belonging to

certain people with certain conditions. In an

economic perspective, zakat is a movement to

transform the economic life of an economy that is

individualistic, materialistic, capitalistic, liberalistic

which is driven by greed in the pursuit into

togetherness and prosperity of social welfare

(Sariati, 1994).

According to Ali (1998), the purpose of zakat is

follows; (1) Improving the status of the poor (2)

Fostering kinship among Muslims and humankind in

general (3) Eliminating the stinging and striving

nature of property owners (4) Developing a sense of

social responsibility in a person, especially those

who have no assets (5) As means of income

equalization to achieve social justice. To achieve

those goals, the implementation of zakat must be

based on: (1) Principles of religious beliefs; (2)

Principles of equity and justice; (3) Principles of

productivity; (4) The principle of reasoning; (5) The

principle of freedom; (6) Principles of ethics and

fairness (Mannan, 1970).

In the study of zakat, zakat is often juxtaposed

with infq and shadaqah. Infaq is a common

terminology whic includes all of sthe ocial

fundraising to help the needs of the weak. The word

infaq is more specific, namely- giving which

unbinnd with formal obligations and based on

willingness. On the Other side, zakat is a formal

obligation which bind with certain conditions and

amount, such as the the amount of wealth that must

IRCEB 2018 - 2nd INTERNATIONAL RESEARCH CONFERENCE ON ECONOMICS AND BUSINESS 2018

6

be paid zakat or the precentage of zakat that must be

paid. However he infatq is related to the necessity

and condition of the person in need (Munir, 2011).

Shadaqah literally means strength. In the

terminology of fiqh, shadaqah is defined as a giving

in order to achieve purely the pleasure of Allah.

Taimiyah in his opinion defines shadaqah as

something that is given to expect the pleasure of

Allah which is done purely on the basis of religion

and worship without expecting anything or any

exchange from anybody. The giving is meant to

serve those who need. (Munir, 2011).

In Sharia Accounting, zakat is defined as

property that must be withdrawn by muzakki in

accordance with sharia regulation to be given to

those who are entitled to receive it (mustahiq). Zakat

is a sharia obligation that must be transferred by

muzakki to mustahiq, either directly or through the

amil institutions. On the other hand, the infaq/assests

donation is given voluntarily by the owner, either

with limited/determined and unrestricted

distribution. Infaq and shadaqah are voluntary

donations, whether determined or undetermined

distribution by the donors (Board of SAS, 2016).

In order to achieve its objectives and functions

optimally, it is necessary for the officer in charge on

zakat handling to withdraw the zakat from muzakki

and distributing it to mustahik. This is evident from

the command of zakat in QS Taubah 103 which

states; "Take zakat from some of their property, with

that charity you cleanse and purify them and pray for

them. Surely your prayer (becomes) the tranquility

of the soul for them. Allah is all-hearer and all-

knowing ". Regarding the command in the verse, it

is clear that the verse is not addressed to muzakki but

to the other parties [amil zakat administrators].

Moreover, in QS at-Taubah verse 60, it is also

mentioned the existence of amil as the party entitled

to receive a share of zakat.

Hafidhuddin (2002) explained that amil zakat is

those who carried out all activities related to zakat

management, starts from the collection, maintenance

until the distribution process, as well as

administrative activities related to the cashflow of

the zakat funds. Sabiq (2008) explained that amil

zakat is a person who appointed by the government

or government representative to work on the zakat

collection from the rich people. Thus, amil does not

only manage zakat, but also has to obtain the

legitimacy from the government, without the

legitimacy then it cannot be called as amil.

In the Indonesian context, the zakat management

institution that represents amil is the National Zakat

Agency [BAZNAS] with its organizational

hierarchy; BAZNAS in Provincial Level and

BAZNAS in Regency / city level. This is because

only BAZNAS has the mandate to manage zakat

from the government. The Amil Zakat Institute

[LAZ] which established by the community is an

institution that assists BAZNAS in performing its

functions, utilizing zakat, infaq and shodaqah to be

more optimal (Indonesian Law No. 23 of 2011).

2.2 Zakat Management Accountability

Accountability is translated into Indonesian

language as a state of accountability, circumstances

can be asked for answers (Enchols and Sadili, 1997).

In the perspective of Agency Theory, accountability

is a logical consequence of the relationship between

the owner [principal] and management [agent]. The

owner has given a full mandate to the management

to manage the organization, so as a consequence, the

management conveys accountability to the owner for

the mandate received (Nikmatuniayah et.al, 2017).

Accountability is a social relationship between

organizational actors that involves take and give

reasons to perform or an obligation to explain and

justify behavior.

In a manager's perspective, accountability is a

process of providing information to explain and

justify the fairness of any action or inaction and

results. This principle ensures the owners that they

have the opportunity to acknowledge by whom and

how decisions are made and the reasons that

triggered the decision making and what the results

are. Thus, the fulfillness of accountability requires

the existence of information transparency which

refers to the openness of the [agent] manager to the

owner to get the valid information and the

confidentiality of the company as the working

element (Sudjali, 2017).

In Islam, despite having accountability as secular

social relations, it also has a sacred relationship. The

s only false,

possession

are essentially entrusted [trustworthy]. Humans have

wealth because God entrusts the property to humans

to be managed so that useful to life. Without any

mandate, humans do not possess any property. Thus,

the position of human being is only an agent while

the principal is Allah. As the consequence as a

manager, then humans must follow Islamic sharia

which is Allah's provision. Furthermore, in the

framework of managing assets, humans mandate

assets to the others or cooperate with each other.

The existence and success of the organization as

an agent in carrying out the mandate given by the

Digitizing Zakat Management in Improving LAZ Accountability

7

owner cannot be separated from the support of

individuals or organizations outside the owner which

called stakeholders (Nikmauniayah et.al., 2017).

Ebrahim (2003) in Sudjali (2017) explained that

stakeholders of non-profit organizations including

zakat institutions, can be classified into three major

groups: (1) resource providers (2) regulators (3)

beneficiaries and communities as the service users in

the broader definition, which include religious

organizations, supervisory institutions, advisors,

media, and academics.

The implementation and management of zakat by

the Amil Zakat Institute [LAZ], is a religious order

that has a clear foundation in the holy book [al-

Qur'an] (Sudjali, 2017). Zakat and its management

are Allah's commands. Therefore stakeholders from

the zakat institution consist of sacred stakeholders

and secular stakeholders. Sacred stakeholders are

God, while secular stakeholders are resource

providers, regulators, beneficiaries, and those who

carried out supervisory functions. Accountability to

Allah means that the management of zakat by LAZ

must be performed in accordance with Islamic law.

Secular accountability means that zakat management

has the truth according to criteria and human needs

as secular stakeholders. Zakat institutions must also

be responsible to those who affected by the activities

of zakat agents, such as beneficiaries and other

parties.

One of the information that must be conveyed in

the management of zakat is about financial

management based on sharia principles. The

purposes of delivering information in the financial

reporting by zakat institutions are (1) Providing

information to help the evaluation of the fulfillment

of amil zakat responsibilities. (2) Providing

information on the compliance of amil zakat on the

sharia principles. (3) Improving compliance on

sharia principles of all transactions and business

activities. (4) Improving management efficiency and

effectiveness. (5)

(Board of SAS, 2016). According to Zaid (2014), in

order to the financial information used to help its

users for decision making, financial information

needs to be conveyed in a way that is possible to be

utilized. The basic principles of financial

information in order to be beneficial are: (1)

Relevant, (2) Reliable, (3) Understandable, (4)

Comparable.

In large organizations, the stakeholders are

varied and there is a gap between individuals that

involved in accountability relationships. This means

that stakeholders cannot observe organizational

activities directly. Therefore, reporting must be

submitted using such media which appropriate with

stakeholders conditions, such as: the internet,

internal printed media, mass media, dialogue, oral

reporting, and / or social interaction (Zaid, 2014).

Accountability can be delivered trough digital-

internet-based technology. With digital-internet

technology all entities in the environment will

always be connected and enable to share information

with each other at high speed so they can

disseminate information in real-time and can be

accessed anytime and anywhere. Digital-internet

technology has the following advantages: (1) Social

Machines, (2) Global Facility and Virtual

Production, (3) Smart Products, (4) Smart Services

(Prasetyo and Sutopo, 2017).

Moreover, the internet can be reached by a large

number of stakeholders with minimum marginal

costs and provides the opportunity to engage

dialogue interactively with stakeholders. With this

technology, organizations can disclose large amount

of information in compare with the other media.

Although this technology offers significant

opportunities in disseminating accountability

information, most non-profit organizations only use

the internet to disclose promotional information

rather than to disseminate the accountability

information (Sudjali, 2017).

2.3 Conceptual Framework of Zakat

Management Accountability

Conceptually, the relationship of accountability in

the management of zakat can be described as

follows:

Figure 1: Chart of Accountability relationship in the

management of zakat

Explanation:

(1.a) Allah gave wealth to muzakky (1.b) Allah

mandated the government to manage zakat (2.a)

Muzakky mandated zakat distribution to amil (2.b)

The government mandates the implementation of

zakat management to amil (3) Amil distributes the

assets of zakat to mustahiq (4) As a form of

accountability, amil submits reports to muzakky and

the government

IRCEB 2018 - 2nd INTERNATIONAL RESEARCH CONFERENCE ON ECONOMICS AND BUSINESS 2018

8

3 RESEARCH METHODS

This research is using the qualitative method with

interpretive. This study took the case of nine

provincial zakat institutions, as follows: (1) LAZ

Baitul Maal FKAM (2) LAZ Yayasan Nurul Fikri

Palangkaraya (3) LAZ Dompet Amal Ibn Abbas

(DASI) West Nusa Tenggara (4) LAZ Dompet

Social Madani (DSM) Bali (5) LAZ Harapan Dhuafa

Banten (6) LAZ Solo Peduli Ummat (7) LAZ Dana

Peduli Ummat East Kalimantan (8) LAZ Yayasan

Al-Ihsan Central Java (9) LAZ Semai Sinergi Umat.

The data collection in this study was carried out by

observation and documentation of the institution's

web address as the object observed starting from

April 25 to July 01, 2018.

As explained by Creswell, the analysis and

interpretation carried out in this study follow the

procedure as follows; (1) Processing and preparing

data for analysis; (2) Read the entire data. This step

is intended to build a general sense of the

information obtained and reflect its overall meaning;

(3) Data Coding. The coding is the process of

organizing the data by collecting parts according to

the topics. (4) Describe the settings, categories and

themes to be analyzed. This description involves the

effort to deliver detail information concerning the

events of the financial reporting of zakat institutions.

(5) Describe in a narrative manner the results of the

analysis (6) Make interpretation or interpret the data.

Interpretation in this case is in the form of meaning

that comes from the comparison between research

results and information derived from the theory

(Creswell, 2016).

4 RESULTS AND DISCUSSION

LAZ is a public institution, since the LAZ collects

and manages zakat, infaq, alms and endowments

(ziswaf) funds, which are public funds. As a public

institution, LAZ is bound by Law No. 14 of 2008

concerning Public Information Openness (UU KIP).

LAZ is considered as a public institution that are

required to disclose information of its organizational

activities (Mubarok and Fanani, 2014) including

financial information to the public.

Based on the BAZNAS report published on its

website, there are 9 zakat institutions in provincial

level all of which are equipped with internet

addresses.

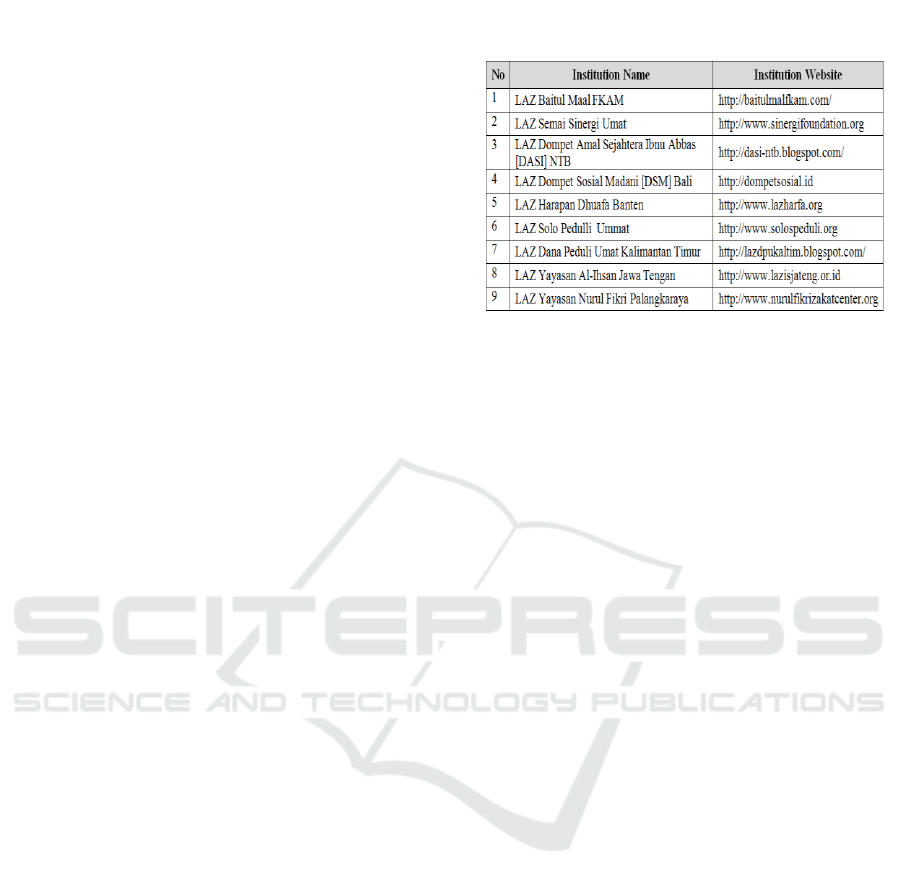

Table 2: List of names of Amil Zakat Institutions and their

Internet Websites

Source: https://pid.baznas.go.id/rekapitulasi-laz-

skala-provinsi/

The nine institutions already have their owned

websites and can be accessed easily. Unfortunately,

the information available and easy to access

provided by the zakat institutions is only for non-

financial information. Except for LAZ Yayasan

Nurul Fikri Palangkaraya, all these institutions do

not provide a menu of financial reports on its

website. Although providing a menu of financial

reports on its website, the Nurul Fikri Foundation

Palangkaraya LAS financial report cannot be

accessed. In addition, the financial information also

unavailable by searching it via the google search

engine. During observations, researcher has been

googling with keywords: laporan keuangan+[nama

lembaga], but it is not available.

Availability of website addresses and facilities to

access information related to LAZ shows that they

ease the stakeholders to access information needed.

In its position as zakat manager, the zakat institution

is the recipient of the mandate or as an agent. While

donors with various parties who provide financial

and non-financial supports can be seen as principals

or owners. The existence and success of zakat

management institutions are attached with the role of

stakeholders, so that in this case, the ease of access

of information performed by zakat institutions is a

logical matter.

The availability of these facilities also shows that

the zakat institution is adaptive to the development

of digital technology where the internet has become

a current lifestyle (https; // Ekonomi.kompas.

com/read/2018). The results of research conducted

by the Indonesian Internet Network Organizing

Association (APJII) from the Indonesian Penetration

and Internet User Behavior survey in 2017, showed

that 143.26 million of the 262 mill

population are connected to the internet. It means, as

Digitizing Zakat Management in Improving LAZ Accountability

9

many as 54.68 percents of Indonesia's population is

connected to the internet. Of the 143 million people

or 29.63 percent spend four to seven hours per day

using the internet. While the other 26.48 percent

spend more than seven hours a day inaccessing the

internet. Within a week, 65.98 percent of

Indonesians access the internet in seven days, half of

them access the internet from a smartphone or tablet

(Pratiwi, 2018).

Unfortunately, the available information in the

-financial information.

LAZ do not provide financial reports on their

websites or online-basis. This is probably based on

the assumption that donors give donations with full

sincerity so they do not need any report for their

donations. A sincere person can be described as a

religious-spiritual person. As expressed by Emmons,

Barrett, & Schnitker (2008) in Chizanah, a religious-

spiritual person is a pro-social person because of the

person easy to empathize, honest, fair, and show

respect to the pro-social norms. The behaviors

shown in the social context are helpful behavior,

altruism, and having an anti-violence attitude and

conflict avoidance (Pratiwi, 2018).

LAZ's position on the donations they received

was as the recipient of the mandate [agent] or the

recipient of the mandate from the owner of the

donation (principal), namely muzakki. In essence,

Muzakki also as the recipient of the mandate of the

assets they controlled. The real owner of the

property is Allah SWT. Both muzakki and zakat

institutions are jointly positioned as recipients of the

mandate from Allah.

Mandate (amanah) in etymology (lughawi

approach) from Arabic in the form of mashdar from

(amina-amanatan) which means honest or

trustworthy (Munawir, 1994). According to Al-

Maraghi (1964), the mandate is something that must

be nurtured and maintained in regard to being

achieved to whom with the right to possess it. The

mandate consists of 3 types, namely: (1) Human

trust in God (2) Human trust in others (3) Human

trust to themselves.

The consequence of the acceptance of the

mandate, the muzakki must obey Allah as the

ultimate owner by carrying out orders in the form of

paying zakat. The zakat submitted by muzakki to

LAZ is intended for those who are entitled to receive

it. In this context, the position of LAZ is the

representative of muzakki to distribute their zakat to

those who are entitled to receive in proper, in

addition to gain the pleasure of Allah, in reality to

help those who are entitled to receive. Muzakki

needs information concerning the achievement of

the goals of paying zakat. Therefore, as the recipient

of the mandate, LAZ must perform according to the

interests. LAZ must convey information

to muzakki that the donations they received were

distributed according to the interests of muzakki.

Thus, the absence of a financial report clearly

violates the principle of this mandate.

The absence of financial reports that are easily

accessed by donors certainly makes it difficult for

donors to know the allocation of donations that have

been given (Endahwati, 2014) and makes it difficult

for other stakeholders to get information about the

management of financial resources carried out by

LAZ. This is contrary to the demands of public

accountability that the community wants (Indriani

and Nanda, 2017).

By not publishing financial reports online,

community also have difficulty or evenmore unable

to carry out supervision on LAZ management as

required by the law. Supervision is needed to control

the LAZ, so there are no deviations on the goals that

have been set to be achieved and from the rules that

have been enacted. Supervision also becomes a

correction and improvement of goals and rules

deviation. The weak supervision system will lead to

fraud action and moral hazard which can cause some

drawbacks to the parties concerned or society in

general (Nurhasanah, 2013). RI Law No. 23 of 2011

concerning Zakat Management states that the public

can participate in the supervision of zakat

management carried out by BASNAS and LAZ in

the form of (1) access to information on zakat

management carried out by BAZNAS and LAZ; and

(2) information delivery on the event of irregularities

in the management of zakat carried out by BAZNAS

and LAZ.

Another consequence, accountability in the

aspects of sharia is weak and not even guaranteed.

Zakat is a kind of worship that involves assets with

detailed shariaconditions. Zakat is taken from people

who have fulfilled the minimum required to pay

zakat [muzakki] and only be distributed to those

who fulfill the conditionsto receive it [mustahik]. As

mentioned in the Al-Qur'an Surat al-Taubah verse

60, recipients of zakat consist of (1) Fakir, (2) Poor,

(3) Riqab, (4) Gharm (5) Muallaf (6 ) F Sablillah

(7) Ibn sabil; and (8) Amil. Distributor of zakat

funds to other than the 8 groups is not justified or

illegal in sharia.

The unavailability of financial reports in digital-

internet-based media also shows that LAZ does not

meet the criteria of good governance which become

a demand andeven the needs of the present time.

Good governance can be defined as the

IRCEB 2018 - 2nd INTERNATIONAL RESEARCH CONFERENCE ON ECONOMICS AND BUSINESS 2018

10

implementation of solid and responsible

development management in accordance with

democratic principles and efficient markets,

avoiding faulty allocation of investment funds, and

preventing corruption both politically and

administratively, implementing budget discipline,

and also to create a legal and political framework for

the growth of business activities (Mindarti 2016).

In the perspective of good governance, an

organization must be able to provide financial

reports in a transparent and relevant manner. Among

the meanings of transparency and relevant for the

current era is digital-internet-based delivery. This is

because people have a very large dependency on the

use of information technology. A survey in 2014

conducted by Nokia explained that one of four

people admitted that their duration on the online

surfing was muchmore than their duration to sleep

for each day. They have higher levels of addiction to

social media like Twitter and Facebook compare

with smoking (Nessy, 2014).

The difference in treatment in the delivery of

information between financial and non-financial can

also raise suspicion by the public about the integrity

of the management and accountability of LAZ which

leads to the weak interest of muslims to pay tithe

through LAZ. This is certainly not beneficial in

functioning zakat as an instrument to build the

welfare of the people in a conducive socio-economic

condition. Weak trust in LAZ causes muslims to pay

zakat individually. If this happens, the distribution of

zakat is uneven. A group of mustahik, because they

have a dean relationship with a relatively large

number of muzakki, they will get abundant zakat.

Whereas other mustahik groups, because they only

have a relationship with a small number of muzakki,

then getting a small amount of zakat can even have a

group of mustahik who do not get the zakat rights at

all. This is certainly far from the goal of tasyri

'zakat.

Zakat management by LAZ has several

advantages, including: (1) Ensuring certainty and

discipline of zakat payments; (2) Maintaining the

inferiority complex of the zakat mustahik when

dealing directly to receive zakat from the muzakki.

(3) Achieving efficiency and effectiveness and the

right target in the use of zakat assets according to the

priority scale that exists in a place. (4) Shows

Islamic Shi'ism in the spirit of Islamic governance

(5) Facilitates coordination and consolidation of

muzakki and mustahik data. (6) Facilitate reporting

and accountability to the public. (7) Professional

management. (Qadir, 2016)

However, juridically, the absence of submission

of financial reports through internet media does not

completely violate the law. The law does explain

that zakat management is based on [a] Islamic law;

[b] trust; [c] benefits; [d] justice; [e] legal certainty;

[f] integrated; and [g] accountability. However, the

law does not require zakat institutions to publish

financial statements online. The law on zakat

number 38 the year 1999 only oblige zakat

institutions to provide financial reports regularly

without explaining the reporting media. Law no. 23

the year 2011 concerning the Management of Zakat

only requires zakat institutions to report on the

implementation of the collection, distribution and

utilization of zakat which audited to BAZNAS

periodically.

The results of this study strengthen the research

results of Nikmatuniayah and Marliyati, which

stated that the financial accountability of zakat

institutions in national-level are relatively weak. The

number of Muslim population in Indonesia occupies

the highest position compared to other religions. In

2015 the percentage of the Muslim population

reached 81 percent of the Indonesian population

(Pangestu and Jayanto, 2017), with a high level of

economic and religious prosperity. This is evident

from the growing number of pilgrims which has

increased for the last few years

(https://haji.kemenag.go.id). On the other hand, the

amount of zakat payment is still relatively small.

Chairman of the National Zakat Agency (BAZNAS)

Bambang Sudibyo in the Focus Group Discussion of

Contextual Zakat Fiqh in Jakarta, stated that based

on research data from BAZNAS, the potential of

zakat in Indonesia in 2016 reached Rp. 286 trillion.

At the national level, zakat which can be collected

by the new official amil institutionsreached Rp 5.1

trillion or 1.78%. It means that there is still a large

space of zakat collection potential

(http://khazanah.republika.co.id). Pangestu and

Jayanto (2017) explained that the accountability of

the management agency has positive influence to

improve the interest of people to pay zakat.

In the management of zakat, LAZ is the recipient

of a mandate with complex accountability relations.

The management of zakat carried out by zakat

institutions is a manifestation of the implementation

of Allah's order regarding the obligation of zakat.

Therefore, he must submit to Islamic Sharia. In his

function as amil, he is a representative of BAZNAS

in order to optimize the use of zakat. Therefore, he

must submit to the regulations and provisions

stipulated by BAZNAS. Regarding the distribution

of zakat, he received the mandate from muazakki as

Digitizing Zakat Management in Improving LAZ Accountability

11

a donor. He also has a relationship with mustahik as

a recipient of zakat. The existence of zakat

institutions cannot be separated from the role and

support of the general public. Therefore zakat

institutions have both vertical and horizontal

acquisitions.

Accountability means that individuals or

organizations provide reports to the authorities and

responsible for their actions in response to

information needed by interested parties. Otherthan

being justified to the needs of the stakeholders, the

way they perform the responsibility of the zakat

institution must be in accordance with Islamic

sharia. In regard to financial reporting, zakat

institutions should also meet the needs of muzakki

and must also comply with the provisions of the

regulator, such as the government, BAZNAS and the

Accounting Standards Board.

LAZ financial statements should be prepared in

accordance with the regulations stipulated by

Islamic financial accounting standards set by the

Indonesian Association of Accountants. The

financial statements of zakat management

institutions include; [a] statement of financial

position [b] report on changes in funds [c] report on

changes in assets managed [d] cash flow statement

and [e] notes to financial statements. (SAS Board,

2016).

Regarding the lifestyle of the people of the

present era who much rely on online media, the

financial statements should be published in the

official website of the institution with facilities for

stakeholders in real time and real place. The

government as the regulator, both through the

BAZNAS and the Ministry of Religion should

oblige zakat institutions to report their financial

statements on time by online basis.

5 CONCLUSION

Based on the above discussion, it appears that the

use of digital-internet-based technology by zakat

institutions in the provincial level on the delivery of

financial reports is still low. All agencies have used

online media to provide non-financial information

and have not used it for financial reporting. This

shows that the financial accountability of zakat

management institutions on a provincial level is still

weak. This also does not fulfill the good governance

which becomes the demand of the community from

public institutions. Thus, the accountability of zakat

management institutions, whether it is national or

provinciallevel, can be concluded to be weak.

This study recommends that: Zakat institutions to

use online-internet-based media as the tool to

disclose financial statements. By improving the

accountability of zakat institution, it is expected that

the level of public trust in the zakat institution would

be increased along withthe increasing amount the

zakat from the community distributed through zakat

institutions, The BAZNAS, and the Government

should formulate regulations that required zakat

institutions to submit their financial statements

online in a timely manner and The government

through the inspectorate general of the ministry of

religion should conduct monitoring and supervision

on zakat institutions, especially regarding financial

issues.

REFERENCES

Al-Bal

. 1368 H. Mukhtashar al-Fata

̂

wa

̂

al-Mishriyyah li

Ibn Taimiyah. Mesir : Al-Sunnah al-Muhammadiyah.

Ali, Mohamad Daud. 1998. Sistem Ekonomi Islam Zakat

dan Wakaf. Jakarta : UI Press.

Al- -Rahman. 1994. Kita

̂

b al-Fiqh ‘ala

̂

Madza

̂

hib al-Arba‘ah. Beirut : Dâr al-Fikr.

Canggih, Clarashinta. Khusnul Fikriyah and Achmad.

Yasin. 2017.

. Al-Uqud: Journal of Islamic Economics 1

(1).

Creswell, John W. 2016. Research Design; Pendekatan

Metode Kualitatif, Kuantitatif dan Campuran. terj.

Jakarta : Pustaka Pelajar

Dewan Standard Akuntansi Syariah. 2016. Standar

Akuntansi Keuangan Syariah. Jakarta : Ikatan Akuntan

Indonesia.

Echols, J.M. dan Hassan S. 1997. Kamus Inggris-

Indonesia. Jakarta : PT Gramedia.

beritasatu.com. http://www.beritasatu

.com/gaya-hidup/232713-8-fakta-ketergantungan-

pada-teknologi.html. diakses 17 Mei 2018

Hafidhuddin, Didin. 2002. Zakat dalam Perekonomian

Modern. Jakarta : Gema Insani Press.

Mannan, M.A. 1989. Islamic Economics : Theory and

Practice. Jilid 3. Lahore : Kazi Pubns Inc.

Manzhûr, Jamaludin Muhammad Ibn Mukarram Ibn.

Lisa

̂

n al ‘Arab. Beirut : D

r al Ma

rif.

Mindarti, Lely Indah. 2016.

Participation Principles in Good GJurnal

Ilmiah Administrasi Publik (JIAP) 2(2).

Mubarok, Abdulloh and Baihaqi Fanani. 2014.

Penghimpuunan Dana Zakat Nasional (Potensi,

Realisasi dan Peran Penting Organisasi Pengelola

Zakat) Permana 5(2).

Munawir, Ahmad Warson. 1984. Kamus Al-Munawir.

Arab-Indonesia. Yogyakarta : Pustaka Pesantren.

IRCEB 2018 - 2nd INTERNATIONAL RESEARCH CONFERENCE ON ECONOMICS AND BUSINESS 2018

12

Nikmatuniayah and Marliyati. 2015.

Laporan Keuangan Lembaga Amil Zakat Di Kota

Mimbar 31(2)

Nikmatuniayah, Marliyati, and Lilis Mardiana. 2017.

Accounting Information Quality

Accountability and Transparency on Zakat

Mimbar 33(1)

Nurhasanah, Neneng. 2013. slam dalam

. Mimbar

29(1)

Pangestu, Itaq. And Prabowo Yudo Jayanto. 2017.

. AAJ : Accounting

Analysis Journal 6(1).

Prasetyo and Sutopo. 20 Perkembangan Keilmuan

Teknik Industri Menuju Era Digital minar dan

Konferensi Nasional IDEC 2017. Surakarta.

https://tekno.kompas.com/read/2018/02/22/12010087/

mayoritas-orang-indonesia-bisa-internetan-seharian.

diakses 20 Mei 2018

Qadir, Abdurrahman. 1988, Zakat dalam Dimensi Mahdah

dan Sosial, Jakarta : Raja Grafindo Persada.

Qardlaw

, Yusuf. 1973. Fiqh al-Zaka

̂

t . Beirut : Muassasah

al-Ris

lah.

Rini. 2016. t Finansial Reporting untuk

Meningkatkan Akuntabilitas Organisasi Pengelola

Zakat, Jurnal Akuntansi Multi Paradigma, 7(2).

Sabiq, Sayyid. 2008. Fiqh Sunnah, Jilid 2. terj. Khairul

Amru Harahap. Jakarta : Cakrawala Publishing.

Zakat

Interntional Journal of Economic

Research 14(16 ).

Queensland University of Technology.

Membangun Masa Depan Islamm:

Pesan Untuk Para Intelektual Muslim. Bandung :

Mizan.

Tim DEKS Bank Indonesia-P3EI-FE-UII. 2016.

Pengelolaan Zakat yang Efektif: Konsep dan Praktik

di Beberapa Negara. Jakarta : Bank Indonesia

Undang-Undang Republik Indonesia. No. 23 tahun 2011

tentang Pengelolaan Zakat

https://puskasbaznas.com/images/ppt/Panel-1_Yusuf-

WIbisono.pdf. diakses, 20 Mei 2018

Zaid, Omar Abdullah. 2004. Akuntansi Syariah :

Kerangka Dasar dan Sejarah Keuangan dalam

Masyarakat Islam

LPFE Universitas Trisakti.

__

https://www.republika.co.id/berita/dunia-

islam/wakaf/17/11/29/p05ukg335-baznas-potensi-

zakat-di-indonesia-sangat-besar. diakses 18 Mei

2018.

____

https://pid.baznas.go.id/rekapitulasi-laz-skala-

provinsi. diakses 19 Mei 2018.

Digitizing Zakat Management in Improving LAZ Accountability

13