Fama-French Five-Factor Model Analysis

on Valuation of Bank Stock Returns

Syarief Fauzie

*

, Ranika Elizabeth Siagian

*

Faculty of Economic and Business, University of Sumatera Utara

Keywords: Excess return, fama-french five-factor model

Abstract: The purpose of this study was to examine the ability of the Fama-French Five-Factor Model in providing

explanatory power to banking stock excess returns on the Indonesia Stock Exchange. In examining the

validity of the model, this study was conducted to determine how the influence of five factors consists of

market risk, book-to-market ratio, market capitalization, profitability and investment in excess return of

banking stock portfolio. The test in this study uses time series data by analyzing multiple linear regression

for each portfolio that is formed based on the Fama-French five-factor model. The data used in this analysis

are the daily average return of the bank's stock portfolio every month, the average daily market return every

month, and the interest rate of Bank Indonesia Certificate as the rate for risk-free investments every month

in the period from January 2012 to December 2017. The results show that the use of variable operating

profit and investment gives anomalous results to banks that have a small market capitalization. But the use

of variable operating profit and investment can provide a strong explanation of the optimism and pessimism

of investors, especially in banks with a large market capitalization

1 INTRODUCTION

The valuation model that is well-known and widely

applied in the world of capital markets is the Capital

Asset Pricing Model (CAPM). This model is very

popular since 1964 and researched separately by

William Sharpe (1964), John Lintner (1965),

and Mossin (1966). The CAPM model is portfolio

theory development proposed by Markowitz (1952)

by introducing a new term, namely systematic risk,

and non-systematic risk. The risk measure used

in CAPM is beta. Beta is used as a measure of the

volatility of a security or portfolio return to market

returns. In other words, beta estimation is done by

collecting historical values of returns from securities

and returns from the market within a certain period

(Hartono, 2010). The concept of the relationship

of β (systematic risk) with the return is explained by

the security market line (SML). The relationship of

expected return and risk lies in the SML line, with

the main components of the CAPM including the

risk-free rate of return, and the risk premium for

securities. The simple calculation process and the

ease of obtaining the required data is a special added

value for the CAPM. However, over time

the CAPM began to show its weaknesses. According

to Tandelilin (2003) the possibility of errors in the

application of CAPM originating from beta

changes according to the length of the observation

period in the study, the market index used does not

represent the entire marketable assets in the

economy and the company's fundamental

fluctuations such as earnings, cash flows, and

leverage affect the beta value . Similarly, by looking

at the real conditions of the market, the validity

of CAPM is often questioned. In addition to the

above, some other researchers also doubt

the CAPM model which only uses beta as the only

indicator of return assessment. They assume that

there are other variables besides beta that can affect

stock returns.

Fama and French (1992) have developed a stock

pricing model by combining the Capital Asset

Pricing Model (CAPM) and Arbitrage Pricing

Theory (APT). This model is known as the Fama-

French three-factor model where the variables

consist of market risk used in CAPM, size and book-

to-market ratio. Size is seen through the stock

market capitalization value. The use of market

capitalization as a factor is due to the difference

between the risks in the stock and the small market

capitalization which tends to have a higher risk

276

Fauzie, S. and Siagian, R.

Fama-French Five-Factor Model Analysis on Valuation of Bank Stock Returns.

DOI: 10.5220/0008786802760284

In Proceedings of the 2nd International Research Conference on Economics and Business (IRCEB 2018), pages 276-284

ISBN: 978-989-758-428-2

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

compared to stocks that have big capitalization so

that stocks with small market capitalization have

higher expected profit levels compared to stocks

with big capitalization stocks. The use of book-to-

market ratios as a factor due to the high book-to-

market reflects investors who are pessimistic about

the company's future. Conversely, if investors are

optimistic about the future of the company, then the

value of book-to-market will be low. According to

Fama and French (1992) that these variables can

explain the average stock returns in a cross section

well. Likewise with other studies that have been

carried out such as Liew and Vassalou (2000),

Griffin and Lemmon (2002), Lettau and Ludvigson

(2001, 2006), Tandelilin (2003), and Bello (2008).

They have the same conclusions as for the results of

the Fama and French research. Therefore, the Fama-

French three-factor model has been used as a

reference in the literature on asset pricing.

Fama and French (2015) added two factors in the

asset pricing model to become five factors. Two

factors added in the model are profitability and

investment factors. The use of these two factors is

based on the model used in Novy-Marx (2013)

which gives the conclusion that higher returns tend

to occur in companies that have high profitability

compared to companies that have low profitability

and the results of Aharoni et al. (2013) who found

that there was a statistically significant relationship

between proxy investment and the average rate of

return. Fama and French (2015) use operating profit

as a proxy for profitability and change in total assets

as a proxy investment. In their research, Fama and

French (2015) found that the five-factor model was

better than the three-factor model in explaining stock

excess returns in the United States. Likewise with

other studies such as Chiah, et al. (2015) which

compares the performance of Fama-French three-

factor model and Fama-French five-factor model in

the Australian stock market in the period January

1982 to December 2013 where the research found

that the addition of profitability and investment

provides explanatory power on market risk,

profitability and investment factor and able to

explain anomaly better than other asset pricing

models

However, despite its success in some cases, there

are also other cases that deviate from the discovery

of Fama-French. Cakici (2015) using company-level

data from July 1992 to December 2014, which forms

size-to-market, size-gross profitability (GP) and

size-investment. Cakici (2015) found that the HML

factor (High Minus Low) or the difference in book-

market stock portfolio returns is high with the low

book to market share portfolio strongly influential in

all regions of the world, except North America.

Profitability factor is only significant in Europe and

the global market, but not for North America, Japan,

and the Asia Pacific. Significant investment factors

on Global, European and North American (slightly

significant), but not significant in Japan and the Asia

Pacific. These studies assume that the five-factor

model of Fama-French is less able to adapt to every

market situation in different regions and countries in

the world.

Martins and Jr (2015) re-examined the

performance of Fama-French three-factor and Fama-

French five-factor by using data obtained from the

Brazilian stock market in the period 2000-2012. The

results of this study indicate that market risk, size,

and Market-to-book ratios have the effect of most

variations in average returns. While for the new

variables which include profitability and investment

have explanatory power that is still relatively weak,

but still able to provide a better explanation than the

Fama-French three-factor model.

Sutrisno and Ekaputra (2016) from Indonesia

conducted research on Fama French Five Factors

using secondary data obtained from Thomson

Reuters Datastream during the period July 2000 to

June 2015. The results concluded that the Fama-

French five-factor model has the better capability in

explaining the excess return of the stock portfolio in

Indonesia compared to the Fama-French three-factor

model, although profitability and investment factors

have a weak effect on excess return. A significant

intercept of empirical tests of Fama-French asset

pricing models in Indonesia in every set of portfolios

25 indicates that the Fama-French model is invalid

in Indonesia. With the addition of profitability and

investment factors, the book-to-market factor is

redundant in explaining the excess return of stock

portfolios in Indonesia. This can be seen when the

book-to-market factor is re-enacted with four other

factors, the value of the intercept is near zero and

insignificant. In conclusion, the findings in

Indonesia support the findings of Fama and French

(2015) in the US.

Elliot et al., (2016) presents a comprehensive ex-

post analysis of Australian stock returns over the

period 1975 to 2013. Using concentrated datasets

with stocks showing high investment but low profits,

the researcher suggests that additional factors such

as profitability and investment are inconsistent and

insignificant in explaining stock returns. While the

market-to-book factor has a redundant power to the

stock return. Huynh (2017) compared the ability of

Fama-French three-factor to Fama-French five-

Fama-French Five-Factor Model Analysis on Valuation of Bank Stock Returns

277

factor in explaining the profit opportunities obtained

from the selection of several anomalies in the rate of

return of Australian equity. The results obtained are

the Fama-French five-factor model capable of

explaining 16 anomalies from the 19 selected

anomalies. So that the Fama-French five-factor

model is considered better than the Fama-French

three-factor. Where the market-to-book factor is

very significant in explaining stock returns, the

results of factor profitability and investment are very

large and very significant, while the size factor is

insignificant.

Estimating risk and stock returns are important

for investors, so estimating with the Fama-French

model is one way to predict and identify the

movement of stock returns in the company. The

effect of market risk, size, market-to-book,

profitability, and investment on excess return has

been widely studied in various countries' capital

markets. However, in the Indonesian capital market

itself, especially in the Indonesia Stock Exchange

(IDX), research with the Fama-French model is still

very limited. This research uses a sample of the

banking stock population listed on the Indonesia

Stock Exchange. The bank is a company that has

more complex risks than other companies. The

Fama-French five-factor model in which investment

factors are included in the model is very suitable in

this study because the Bank has a risk in investing in

productive assets that are heavily influenced by

market risk so that the decision in determining the

number of assets is influenced by market risk. On

the other hand, profitability is also influenced by the

quality of assets that have asset quality due to

market risk conditions at that time, because asset

quality is influenced by market risk, indirectly

profitability is also influenced by market risk. The

regulation of the Bank's minimum capital limitation

in financing assets is one of the factors that influence

the expectation of higher excess returns so that the

market capitalization has a link between profitability

and bank investment, this variable also has an

impact on the volume of stock sale transactions that

occur where the large volume of stock sales will

have an impact on the high or low book-to-market

ratio so that the use of the Fama-French five-factor

model is in accordance with the research using a

sample of banks whose shares are traded on the

Indonesia Stock Exchange.

2 METHODS

Fama and French (1992) suggested that the CAPM

model that uses only single factor models cannot be

market beta as a whole so that other factors are

needed to complement market risk factors. The

factors used to complete market risk are market

capitalization (size) and market-to-book. Based on

research conducted by Fama-French (1992) in

looking at the effect of size on stock excess returns,

each company is first divided into two groups:

companies that have big market capitalization and

small market capitalization where grouping is based

on the median that has calculated the total market

capitalization of the company. Grouping is divided

into companies with a total market capitalization that

are above the median into companies that have a big

size (B), while companies with market capitalization

that are below the median become companies that

have small size (S). The same thing is done in

grouping based on the market-to-book ratio.

Furthermore, it is calculated the difference between

stock returns with a big market capitalization (B)

and small capitalization (S), the same thing is also

done between stock returns with high (H) and low

(L) book-to-market. In the formation of portfolios in

independent variables, a grouping consists of 4

portfolios, namely companies with big market

capitalization (B) and high book-to-market (H),

companies with small market capitalization (S) and

low book-to-market ( L) and so on to become a

portfolio of B / H, B / L, S / H, S / L. Each portfolio

is calculated as excess return and regressed with the

following equation:

t

–

t

= + 1 (

t

–

t

) + 2 (

t

) + 3

(

t

) + µ .........................................................(1)

Where R

t

is stock portfolio return, Rf

t

is the return of

historical risk-free assets, Rm

t

is historical market

return, SMB

t

is the difference between the return of

stock portfolio with small market capitalization and

return of stock portfolio with big market

capitalization, HML

t

is the difference between the

return of stock portfolio with high B/M and return of

stock portfolio with low B/M.

This study uses the Fama-French five-factor

model by entering the profitability and investment

variables in which the grouping of banks that have

robust (R) and weak (W) profitability and banks that

have conservative (C) and aggressive (A)

investments are the same as the groupings used in

size and book-to-market. Furthermore, the excess

return difference between banks that have robust

operating profitability and weak is sought (robust

minus weak), the same thing is also done to find

IRCEB 2018 - 2nd INTERNATIONAL RESEARCH CONFERENCE ON ECONOMICS AND BUSINESS 2018

278

excess returns between banks that have conservative

and aggressive investments (conservative minus

aggressive). The five-factor model is formulated in

the following equation:

t

–

t

= + 1 (

t

–

t

) + 2 (

t

) + 3

(

t

) + 4 (RMW

t

) + 5 (CMA

t

) + µ

...........(2)

Where R

t

is the daily average return of the bank's

stock portfolio every month, Rf

t

is a risk-free

investment return, SMBt is the difference between

the return of a stock portfolio with a small market

capitalization and the return of a stock portfolio with

a big market capitalization, HML

t

is the difference

between the return of a bank's stock portfolio with

high book-to-market and low return on stock

portfolios with book-to-market, RMW

t

is the

difference between the bank's stock return portfolio

and high operating profitability (robust) and return

stock with low (weak) operating profitability, CMA

t

is the difference between returns return the bank's

stock portfolio with conservative investment and

return on stock portfolios with aggressive

investments.

The population in this study were all banks listed on

the Indonesia Stock Exchange (IDX) in the period

2012 to 2017. The samples in this study were

selected from the entire population using purposive

sampling method with criteria for banks listed on the

Indonesia Stock Exchange from January 2012 to

December 2017 and publish financial statements.

Based on these criteria, the samples taken were 28

banks with a period of 6 years. Banks that are

sampled in this study are presented in Table 1:

Table 1: Research Sample

No

Stock

Code Bank Name

1. AGRO

Bank Rakyat Indonesia

Agroniaga Tbk

2. BABP Bank MNC Internasional Tbk.

3. BACA Bank Capital Indonesia Tbk

4. BBCA Bank Central Asia Tbk

5. BBKP Bank Bukopin Tbk

6. BBNI Bank Negara Indonesia Tbk

7. BBRI

Bank Rakyat Indonesia (Persero)

Tbk

8. BBTN

Bank Tabungan Negara (Persero)

Tbk

9. BDMN Bank Danamon Indonesia Tbk

10. BEKS

Bank Pembangunan Daerah

Banten Tbk.

11. BJBR

Bank Pembangunan Daerah Jawa

Barat dan Banten Tbk

12. BKSW Bank QNB Indonesia Tbk

13. BMRI Bank Mandiri (Persero) Tbk

14. BNBA

Bank Bumi Arta Tbk

15. BNGA Bank CIMB Niaga Tbk

16. BNII Bank Maybank Indonesia Tbk

17. BNLI Bank Permata Tbk

18. BSIM Bank Sinarmas Tbk

19. BSWD Bank of India Indonesia Tbk

20. BTPN

Bank Tabungan Pensiunan

Nasional Tbk

21. BVIC Bank Victoria International Tbk

22. INPC

Bank Artha Graha Internasional

Tbk

23. MAYA

Bank Mayapada Internasional

Tbk

24. MCOR

Bank China Construction Bank

Indonesia Tbk

25. MEGA Bank Mega Tbk

26. NISP Bank OCBC NISP Tbk

27. PNBN Bank Pan Indonesia Tbk

28. SDRA

Bank Woori Saudara Indonesia

1906 Tbk

Before testing the hypothesis in this study,

we formed a stock portfolio of 28 Bank samples

using models such as Fama and French (2015) with

sorts of 2 x 2 x 2 x 2 on size, book-to-market,

operating profit and investment consisting of

portfolios : 1) S/H//R/C; 2) S/H/R/A; 3) S/H/W/C;

4) S/H/W/A; 5) S/L/R/C; 6) S/L/R/A; 7) S/L/W/C;

8) S/L/W/A; 9) B/H/R/C; 10) B/H/R/A; 11) B/H

/W/C; 12) B/H/W/A; 13) B/L/R/C; 14) B/L/R/A; 15)

B/L/W/C; 16) B/L/W/A. Where S is a bank that has

small market capitalization, B is a bank that has big

market capitalization, H is a bank that has high book

to market, L is a bank that has low book to market,

R is a bank that has robust operating profitability

and a bank that has weak operating profitability, C is

a bank that has conservative investment and A is a

bank that has aggressive investment. By using the

Fama and Fench (2015) model, the determination of

the dependent and independent variables in this

research are:

1) Dependent variables: The dependent

variable used in this study is the excess

return of each bank's stock portfolio that

has been formed as the pattern specified

above. After forming a portfolio, the excess

return for each portfolio is calculated

monthly with the formula: Rit - Rft. Where

Rit is the average daily portfolio return

every month and Rft is the Bank Indonesia

rate (BI Rate) every month.

2) independent variable: the independent

variable used in this study consists of:

a) SMB (Small Minus Big) is the

difference in average returns on eight

Fama-French Five-Factor Model Analysis on Valuation of Bank Stock Returns

279

stock portfolios with small market

capitalization and average return on

eight stock portfolios with big market

capitalization. Grouping portfolios in

banks by categorizing shares with 50

percent market capitalization below,

and 50 percent market capitalization.

The market capitalization used to

classify shares in forming a portfolio

each year is market capitalization at the

end of December t-1 adjusted for

changes in the number of shares

outstanding at the end of December.

The SMB equation above is as follows:

SMB = (S/H/R/C + S/H/R/A +

S/H/W/C + S/H/W/A + S/L/R/C +

S/L/R/A + S/L/W/C + S/L/W/A)/8 –

(B/H/R/C + B/H/R/A + B/H/W/C +

B/H/W/A + B/L/R/C + B/L/R/A +

B/L/W/C + B/L/W/A)]/ 8.

b) HML (High Minus Low) is the

difference between the average return

of eight stock portfolios with a high

book to market ratio and the average

return of eight stock portfolios with a

low book to market ratio based on the

proportion of 50 percent stock portfolio

formation for the lowest group (Low),

and 50 percent for the highest group

(High). The book equity used to

classify shares in forming a portfolio

each year is book equity at the end of

December t-1 while the market

capitalization class is the same as the

above classification of SMB. HML

equation as follows: HML =(S/H/R/C

+ S/H/R/A + S/H/W/C + S/H/W/A +

B/H/R/C + B/H/R/A + B/H/W/C +

B/H/W/A)/8 – (S/L/R/C + S/L/R/A +

S/L/W/C + S/L/W/A + B/L/R/C +

B/L/R/A + B/L/W/C +B/L/W/A)/ 8

c) RMW (Robust Minus Weak) is the

difference in the average return on

eight stock portfolios that have a high

operating profitability value with an

average return on eight portfolios that

have a low operating profitability value

by classifying operating profitability

based on the proportion of 50 percent

for the highest group ( robust) and 50

percent for the lowest group (weak).

Profitability used to classify shares in

forming a portfolio each year is

profitability at the end of December t-

1. RMW equation as follows: RMW =

(S/H/R/C + S/H/R/A + S/L/R/C +

S/L/R/A + B/H/R/C + B/H/R/A +

B/L/R/C + B/L/R/A)/8 – (S/H/W/C +

S/H/W/A + S/L/W/C + S/L/W/A +

B/H/W/C + B/H/W/A + B/L/W/C +

B/L/W/A) / 8

d) CMA (Conservative Minus

Aggressive) is the difference between

the average return of eight stock

portfolios that have high investment

value with the average stock portfolio

return which has low investment value

by classifying investments based on the

proportion of 50 percent for the lowest

group (Aggressive), and 50 percent for

the highest group (Conservative). The

investment used to classify shares in

forming a portfolio every year is an

investment at the end of December t-1.

CMA equation as follows: CMA =

[(S/H/R/C + S/H/W/C + S/L/R/C +

S/L/W/C + B/H/R/C + B/H/W/C +

B/L/R/C + B/L/W/C) – (S/H/R/A +

S/H/W/A + S/L/R/A + S/L/W/A +

B/H/R/A + B/H/W/A + B/L/R/A +

B/L/W/A)] / 8

The data analysis technique used is multiple

linear regression with time series data with a total of

72 months by regressing each independent variable

with the excess return of each portfolio with the

following equation (2) above.

3 RESULTS AND DISCUSSION

In providing a better explanation of the four factors

that affect the excess return of the banking stock

portfolio, this study first calculates the daily average

portfolio return every month in the period January

2012 to December 2017 based on 4 factors

consisting of size, book-to-market, profitability, and

investment so that it can be seen that there is an

interaction between one independent variable and

another in generating the average return. The results

of this calculation form the pattern presented in

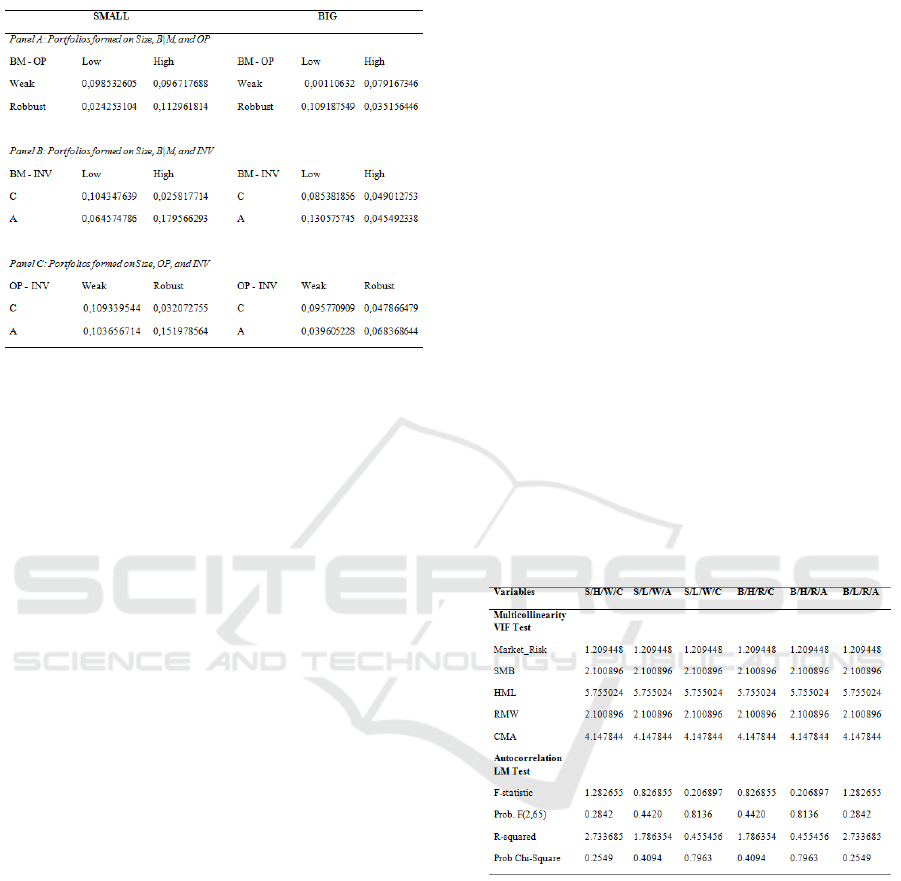

Table 2:

IRCEB 2018 - 2nd INTERNATIONAL RESEARCH CONFERENCE ON ECONOMICS AND BUSINESS 2018

280

Table 2: Average Monthly Return

The average bank stock return with small market

capitalization shows that the average stock return

that has robust profitability give higher return if

book-to-market gets higher. But if the Bank has low

profitability it does not show the difference in the

average significant return between low or high book-

to-market conditions. These results indicate that

there are pessimistic investors in banks with a small

market capitalization that provides weak

profitability. If we look at the relationship between

book-to-market and investment, it shows the

negative relationship in generating high average

returns, where high book-to-market with aggressive

investment gives a high average return and if low

book-to-market with conservative investment also

gives a high average return. The results show that

investors are optimistic that banks have low market

prices to make aggressive investments and high

market prices to make conservative investments. If

we look at the relationship between profitability and

investment in generating average returns, it indicates

that banks that have robust operating profitability

and aggressive investments provide average higher

return while robust operating profitability with

conservative investment provides a lower average

return. When the Bank is in a condition of having

weak operating profitability, there is no difference in

the average significant return in the conservative and

aggressive investment conditions. These results

indicate investors are optimistic about banks that

have robust profitability to invest aggressively.

The average stock return of banks that have big

market capitalization shows high average return if

the Bank has low book-to-market with robust

profitability but provides an average low return if

weak profitability. In the low book-to-market

condition there is no significant difference in the

average return between banks which provide robust

and weak profitability. These results indicate that

investors are optimistic about banks with big market

capitalization to have high book-to-market and

robust operating profitability. Likewise, with

investments where banks that have low book-to-

market will have an average high return if the

investment is aggressive but will provide an average

low return if the investment is conservative. These

results indicate that investors are optimistic that

banks have low book-to-market to invest

aggressively. In looking at the average return

generated in terms of the relationship between

operating profitability and investment shows a

significant difference, so this result shows that

relation between operating profitability and

investment provide more explanatory power to the

average return on companies that have big market

capitalization. The results from Table 2 show that

operating profitability and investment provide a

strong explanation for the average bank stock return

which has big and small market capitalization.

Before conducting multiple linear regression

analysis on time series data, a classic assumption test

consisting of multicollinearity test and

autocorrelation test is needed as presented in Table 3

Table 3: Classic Assumption Test

Multicollinearity testing results in a perfect

correlation between SMB and RMW variables so

that the multicollinearity test between SMB and

RMW variables is done separately by doing two

tests, namely multicollinearity testing between

variables using the SMB variable and take out the

RMW variable, then doing multicollinearity testing

again with enter the RMW variable and take out

SMB variable so that there is no multicollinearity.

The autocorrelation test results using the Langrage

Multiplier test (LM-Test) where the results show no

Prob. Chi-Square (2) is below 5 percent so it can be

said that autocorrelation does not occur for each

portfolio.

Fama-French Five-Factor Model Analysis on Valuation of Bank Stock Returns

281

In this study, each portfolio was regressed twice

by using the SMB and RMW factors alternately.

This is done because of the problem of

multicollinearity between SMB and RMW. The

influence of five independent variables (market risk,

size, a book to market ratio, operating profitability,

and investment) on the dependent variable namely

excess return for each portfolio from January 2012

to December 2017 was tested using time series data

are presented in Table 4:

Table 4: Fama-French Five-Factor Model for Each

Portfolio

Variabl

es

S/H/W/

C

S/L/W/A S/L/W/C

B/H/R/

C

B/H/R/

A

B/L/R/

A

Market_

Risk

41.0618

***

22.118***

43.549**

*

22.118

***

43.549*

**

41.061*

**

SMB

16.1489

***

1.8923* -0.439

-

8.770*

**

-0.439

-

4.434**

*

HML 8.1896*

**

-1.215

-

9.872***

-1.215 2.371**

-

2.781**

RMW -

16.148*

**

-1.8923* 0.439

8.770*

**

0.439

4.434**

*

CMA

0.7260 2.000**

12.640**

*

9.391*

**

-

3.281**

0.726

Adj. R

2

0.968 0.886 0.971 0.960 0.970 0.967

F value 549.31*

**

139.51***

600.14**

*

428.85

***

583.794

***

527.926

***

***,**, and * indicate statistical significance at

1, 5 and 10 percent, respectively.

Market risk has a positive effect on the excess return

of all portfolios where this result shows that the

market risk variable is a systematic risk that has a

very strong impact on the banking industry in

Indonesia. Market capitalization (SMB) has positive

and significant effect on the S/H/W/C portfolio

excess return but has negative and insignificant

effect on the S/L/W/C portfolio excess return, then

market capitalization (SMB) has a negative and

significant effect on B/H/R/C and B/L/R/A portfolio

excess returns. These results indicate that market

capitalization cannot show an explanation of the

Bank's excess return in Indonesia by using a 2 x 2 x

2 x 2 pattern where the research was previously

Fama and French (2015), Martins and Jr (2015), and

Huynh (2017) Using portfolio formation with a

pattern of 2 x 2 and 2 x 3 can show a significant

explanation of the effect of market capitalization

(SMB) on excess return. The use of patterns in this

study shows anomalies where the effect of market

capitalization is positive on S/H/W/C portfolio

excess return and negative on the B/H/R/C and

B/L/R/A portfolio excess return which are not

suitable as presented in Table 2.

The anomaly results also occur in the analysis

of book-to-market influence on excess returns which

shows a positive and significant effect of book-to-

market (HML) on S/H/W/C portfolio excess return

and negative and significant effect on portfolio

excess return S/L/W/C where Table 2 shows that

S/L/W/C portfolio should provide a higher average

return compared to the S/H/W/C portfolio. The

results of this anomaly are in accordance with the

conclusions of Fama and French (2015) that the

addition of variable operating profit and investment

provides anomalies caused by the existence of small

companies that invest aggressively with low

operating profit so that high investments made in the

company become a problem in research.

But the pattern of 2 x 2 x 2 x 2 in this study can

explain that the effect of operating profit and

investment on the excess return of the Bank's

portfolio in Indonesia. These results are shown in

Table 4 where operating profit has a positive and

significant effect on excess return portfolio B/H/R/C

and B/L/R/A. These results indicate that the pattern

of 2 x 2 x 2 x 2 can show that operating profit

explains the relationship between book-to-market

and investment where banks that have high book-to-

market and conservative investments give the same

results as banks that have a low book-to-market and

aggressive investment in large banks if the operating

profit condition is robust. But the results that occur

in small banks cannot provide an explanation for the

book-to-market relationship with investment. These

results reinforce the same conclusion from Fama and

French (2015) which has been stated that small

companies with small profits carry out high

investment actions so as not to influence investors'

optimism.

The influence of investment presented in Table

4 can also explain the reciprocal relationship

between market capitalization, book-to-market and

operating profit where investment has a positive and

significant effect on the excess return on the

S/L/W/C and B/H/R/C portfolios. These results

indicate that investors prefer small banks that have

low book-to-market but produce weak operating

profit and large banks that have high book-to-market

but generate robust operating profit to invest

conservatively. These results can provide an

explanation that the pattern of 2 x 2 x 2 x 2 used in

this study can better explain that investment can

provide a pessimistic and optimistic relationship

between investors through conservative investments

by banks compared to previous studies that applied 2

x 2 and 2 x 3 patterns.

4 CONCLUSION

This study is to test the five-factor model developed

by Fama-French (2015) on banks listed on the

Indonesia Stock Exchange. This research was

conducted because there are still not many studies

that use the Fama-French five-factor model to test its

IRCEB 2018 - 2nd INTERNATIONAL RESEARCH CONFERENCE ON ECONOMICS AND BUSINESS 2018

282

validity in Indonesia. The use of banks as samples in

this study is because banks have assets that are

riskier than other companies and the management of

banks in generating profits is a factor that is very

much considered by investors so that it is more

suitable in testing operating profit and investment

factors used in Fama-French five-factor model.

The pattern used for the formation of portfolios

using 2 x 2 x 2 x 2 is rarely done by previous

research with the intention of operating profit factors

and investment can provide explanatory power that

can influence other factors on excess return. The

application of this pattern provides anomalies in

testing market capitalization and book-to-market

factors. But this pattern can explain that investors

are pessimistic and optimistic about large banks in

investing in terms of the operating profit they have.

The results show investors like a high investment if

they generate high profits and low investment if

profits are low. But this relationship does not occur

in banks that have small assets due to the high

investment made by small banks even though the

resulting profits are low so there is an anomaly in

the results of this study

The results obtained from testing the portfolio

of small banks provide anomalies in testing the

factors of market capitalization, book-to-market, and

operating profit, giving a finding that investors

prefer small banks to invest low in their assets. This

result is reinforced by the results of the test of the

effect of the investment on excess returns where

investors are optimistic about small banks that make

conservative investments if their book-to-market has

a low.

ACKNOWLEDGMENT

The conclusions expressed in this paper are entirely

from the authors. We are grateful to the University

of Sumatera Utara for its assistance in this research

and the State University of Malang for its

opportunity in publishing this paper.

REFERENCES

Aharoni, G., Grundy, B., and Zeng, Q. (2013). Stock

returns and the Miller Modigliani valuation formula:

Revisiting the fama-french analysis. Journal of

Financial Economics, 110(2), 347-357.

Cakici, N. (2015). The five-factor Fama-French model:

international evidence. SSRN Electronic Journal.

Retrieved from

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2

601662

Chiah, M., Chai, D., Zhong, A., and Li, S. (2016). A better

Model? An empirical investigation of the Fama–

French five-factor model in Australia. International

Review of Finance, 16(4), 595-638.

Elliot, B., Docherty, P., Easton, S., and Lee, D. (2018).

Profitability and investment-based factor pricing

models. Accounting and Finance, 58(2), 397-421.

Fama, E. F., and French K. R. (1992). The cross-section of

expected stock returns. The Journal of Finance, 47(2),

427-465.

Fama, E. F., and French, K. R. (1993). Common Risk

Factors in the Returns on Stocks and Bonds. Journal

of Financial Economics, 33(1), 3-56.

Fama, E. F., and French, K. R. (1995). Size and book-to-

market factors in earnings and returns. The Journal of

Finance, 50(1), 131-155.

Fama, E. F., and French K. R. (2003). The CAPM: Theory

and Evidence. Journal of Economic Perspective,

18(3), 25.46.

Fama, E.F., and French, K.R. (2015). A five-factor asset

pricing model. Journal of Financial Economics,

116(1), 1-22.

Griffin, J. M., and Lemmon, M. L. (2002).

Book‐to‐market equity, distress risk, and stock returns.

The Journal of Finance, 57(5), 2317-2336.

Fawziah, S. A, (2016). Pengaruh Fama-French Three

factor model terhadap return saham. Skripsi

Universitas Negeri Yogyakarta.

Hartono, J. (2013). Teori Portofolio dan Analisis

Investasi. Yogyakarta: BPFE-Yogyakarta.

Huynh, T. D. (2017). Explaining anomalies in Australia

with a Five-factor asset pricing model. International

Review of Finance, Volume 18(1), 123-135.

https://doi.org/10.1111/irfi.12125.

Lettau, M., Sidney C. L., and Wachter J. A. (2004). The

Declining equity premium: What role does

macroeconomic risk play? NBER Working Paper No

10270. Retrieved from:

http://www.nber.org/papers/w10270.

Liew, J., and Vassalou, M. (2000).

Can book-to-market,

size, and momentum be risk factors that predict

economic growth? Journal of Financial Economics,

57(2), 221-245.

Martins, C. C., and Jr, W. E. (2015). Pricing assets with

Fama and French 5-factor model: a Brazilian

Marketnovelty.Retrievedfrom:https://www.researchgat

e.net/publication/277020668_Pricing_Assets_with_Fa

ma_and_French_5-

Factor_Model_a_Brazilian_market_novelty

Novry-Marx, R. (2013). The other side of value: The gross

profitability premium. Journal of Financial

Economics, 108(1) 1-28.

Racicot, F., and Rentz, W. F. (2016). Testing Fama

French’s new five-factor assets pricing model:

Evidence from robust instruments. Aplied Economic

Letter, 23(6), 444-448.

Sudiyatno, B., and Irsad, M. (2012). Study of three factors

model fama and french in the Indonesia Stock

Fama-French Five-Factor Model Analysis on Valuation of Bank Stock Returns

283

Exchange (Study on the stock LQ 45). Journal and

Proceeding FEB Universitas Jendral Soedirman 2(1).

Sutrino, B., and Ekaputra, I. A. (2016). Uji empiris model

asset pricing lima faktor Fama-French di Indonesia.

Jurnal Keuangan dan Perbankan 20(3), 343–357.

Trimech, A., Hedi K., Salwa B., and Samir B. (2009).

Multiscale Fama-French model: application to the

French market. The Journal of Risk Finance, 10(2),

179-192.

Jiao, W., and Lilti, J. (2017). Whether profitability and

investment factors have additional explanatory power

comparing with the Fama-French three-factor model:

Empirical evidence on Chinese a-share stock market.

China Finance and Economic Review, 5(7). Retrieved

from https://link.springer.com/article/10.1186/s40589-

017-0051-5.

Yolita and Fauzie, S. (2014). Analisis Stock Returns

Perusahaan Perbankan Pada Jakarta Composite Index

Menggunakan Fama-French Three-Factor Model.

Jurnal Universitas Sumatera Utara, 2 (11)

IRCEB 2018 - 2nd INTERNATIONAL RESEARCH CONFERENCE ON ECONOMICS AND BUSINESS 2018

284