The Effect of Business Development Assistance Program and

Religiosity on the Economic Performance of Zakat Recipients

through Their Participations using Structural Equation Model

Estiningsih, Adi Kuswanto and Budi Hermana

Economics Department, Gunadarma University, Depok, West Java, Indonesia

Keywords: Business Development Assistance Program, Religiosity, Economic Rerformance, Participations.

Abstract: The benefit of zakat for productive business that is still not being explored optimally is the main motivation

of this research. The structural equation model is applied to test the impact of business development

assistance program and religiosity on the economic performance of zakat recipients through their

participation in the Special Region of Yogyakarta and we we conducted a survey of 365 respondents. The

research instrument uses 5 likert scale that have high reliability and validity based on the value of Alpha and

Kaiser-Meyer-Olkin. The empirical model with SEM analysis shows that a high goodness of fit. Busienss

developmentassistance program and religiosity have a significant effect on the participation of recipients of

zakat in the development of business with a positive direction, and the participation will then have a

significant and positive effect on the economic performance of zakat recipients. The direct effect of business

developmentassistance program and religiosity is lower than their indirect effect on economic performance

through participation.

1 INTRODUCTION

Indonesia is a country with a Muslim majority

population of 216.66 million people or 85 % of the

total population (BPS, 2015). The Muslim

population can increase the potential for the

collection and distribution of very large zakat.

Referring to the National Zakat Statistics issued by

the National Zakat Authority (BAZNAS), the total

zakat collection in 2017 was recorded at 6224.4

billion rupiah or an increase of 24.06 % compared to

2016. Zakat distribution was recorded at 4860.2

billion rupiah or increased compared to the previous

year of 65.81 %, with absorption of 78.08 %. The

allocation of zakat distribution based on their

respective fields is 8825 billion rupiah, for the

economic sector (20.33 %), 941.9 billion rupiah for

education (21.69 %), 979.5 billion rupiah for the

field of da'wah ( 22.56 %), 413.5 billion rupiah for

the health sector (9.52 %), and 1124.2 billion rupiah

for the field of Social Humanity (25.89 %).

According to the Law of the Republic of

Indonesia number 23 of 2011 concerning Zakat

Management, zakat management aims to: (a)

improve the effectiveness and efficiency of services

in the management of zakat; and (b) increasing the

benefits of zakat to realize community welfare and

poverty reduction. The benefits of zakat to realize

community welfare and poverty alleviation are still

a problem, because various studies reveal that zakat

distribution tends to be consumptive, or

unproductive. The Law on Zakat states that zakat

can be utilized for productive business in the context

of handling the poor and improving the quality of

the people if the basic needs of mustahik have been

fulfilled. The distribution of zakat is currently

dominated by consumptive activities. There are

various forms of zakat distribution carried out by

zakat institutions, one of which is the distribution of

zakat in the form of business capital allocated to

productive recipients of zakat known as

microfinance mechanisms (Ibrahim and Ghazali,

2014). Zakat and Waqf (Endowments) are basically

tools to create stability of economy through the

distribution of the right funds for the right people so

that they can decrease the gap between the poor and

the rich (Hassanain, 2015).

The Financial Services Authority (2016), which

is stated in the 2015-2019 Indonesia Financial

Services Sector Master Plan document states that

Indonesia holds enormous potential for the growth

Estiningsih, ., Kuswanto, A. and Hermana, B.

The Effect of Business Development Assistance Program and Religiosity on the Economic Performance of Zakat Recipients through Their Participations using Structural Equation Model.

DOI: 10.5220/0008896500050010

In Proceedings of the 1st International Conference on Teaching and Learning (ICTL 2018), pages 5-10

ISBN: 978-989-758-439-8

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

5

of the Islamic financial services sector, supported

by a large Muslim population of around 88.1%.

Indonesia is also the largest Muslim country in the

world with 12.7 % of Muslims in the world.

Referring to the report: "State of the Global

Islamic Economy" 2017-2018 edition, Indonesia

only occupies 11th position out of 73 countries in

the world based on Global Islamic Economy

Indicator which covers 6 sectors, including the

Islamic financial sector where Indonesia ranks 10th

(Thomson Reuters, 2018). Various data and

indicators show that Islamic finance in Indonesia

has not shown a performance optimally.

Considering that zakat has proven to be a very

effective way to help the poor, the collection and

distribution of zakat must be increased (Abdullah,

Derus and Al-Malkawi, 2015). According to Jaelani

(2015), optimizing the high potential of zakat in

Indonesian society, cooperation between

stakeholders, and government regulations can be a

solution in reducing poverty. The role of the

government which is the main stakeholder in the

management of zakat is represented by BAZNAS.

The challenge is how to allocate zakat to those

productive businesses. According to Hamzah

(2017), zakat has not been used intensively for

empowerment of mustahiq (recipients of zakat) in

the form of productive economic endeavors.

BAZNAS as a collection authority and fund

manager has compiled various utilization strategies

so that the utilization of zakat is more productive

which leads to business continuity in the three target

groups namely; the beginner mustahik businessman,

businessman mustahik and Z-mart. The problems

faced by entrepreneurs mustahik are access to:

capital, raw materials, production, and markets.

This research will examine the use of zakat for

the development of productive businesses by

recipients of zakat in the Special Region

Yogyakarta whose zakat management is carried

out by the BAZNAS Yogyakarta. The research

questions are whether the success of the

development of its business is influenced by

individual factors, external factors, and the

participation of zakat recipients in the development

of its business. The individual factor is religiosity

while the external factor is the role of business

development assistance program.

2 RESEARCH METHOD

The research was conducted in Bantul, Gunung

Kidul, Kulon Progo, Sleman, and Yogyakarta with

305 respondents. The measurement of variables

using 5likert scale with statement items are

presented in Table 1 below.

Table 1: Research Variables and Measurement.

Variable

Item

Reference

Religiosity

Attend attend recitation

groups

Abdullah and

Sapiei (2018),

Farouk et al.

(2018), Somu and

Sujatha (2015)

Pray at the mosque

Attend religious events

Assistance

Motivation

Hamzah (2015)

Learning

Entrepreneurship

Participation

Attend business meeting

Langerodi and

Dinpanah (2017);

Hamzah (2015);

and Radzi, Nor,

and Ali (2017)

Regularly save money

Loan payment

Capital empowerment

Economic cooperation

empowerment

Economic

Equity increasing

Berguiga (2017)

and Hamzah

(2015)

Income increasing

Business development

Business collaboration

Reliability test of the research instruments

using Cronbach Alpha while test of the validity

using Kaisser-Meyer-Olkin (KMO). Testing the

hypothesis using an analysis of structural equation

models with two exogenous variables, namely

business development assistance program and

religiosity, one mediator namely participation in

business development, and economic performance

variables as an endogenous variable.

3 RESULTS AND DISCUSSION

3.1 Reliability and Validity

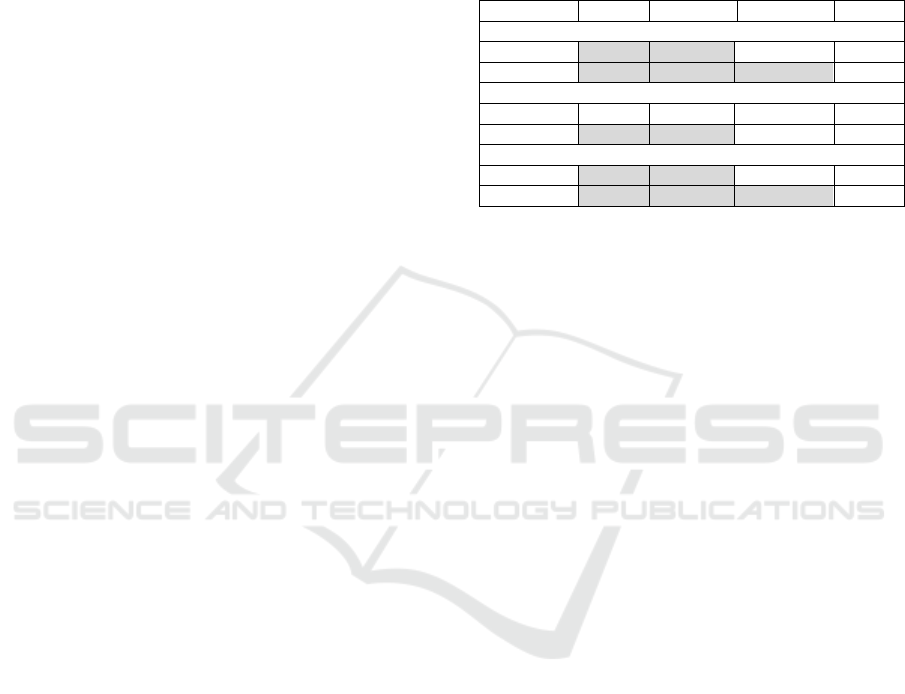

Table 2: Reliability and Validity of Research Instruments.

Variable

Code

Cronbach Alpha

KMO

Religiosity

R1

0.814

0.680

R2

R3

Assistance

A1

0.836

0.700

A2

A3

Participation

P1

0.764

0.785

P2

P3

P4

P5

Economic

E1

0.842

0.773

E2

E3

E4

ICTL 2018 - The 1st International Conference on Teaching and Learning

6

Research instruments have high reliability and

validity as indicated by the cronbach alpha value

above 0.75 and the KMO value above 0.65. The

results of the reliability and validity testing are

presented in the table below.

3.2 Respondent Profile

The number of respondents who filled out

complete questionnaire was 305 which consists of

56 % of men, 40 % of high school education, 34 %

of the age group 31-40 years, 51 % living in

Gunung Kidul, and 49.51 % engaged in the trade

sector. Most respondents (56 %) have business

experience under 5 years, 59 % have income

ranging from 1-2 million Rupiah per month, and

62 % receive zakat in the amount of 3-5 million.

Female respondents generally showed

religiosity and the role of Business Development

Assistance Program was higher than male

respondents. The group of respondents with high

education showed higher economic performance

and participation compared to those with

elementary, middle and high school education, but

the group of college graduates showed the lowest

role of Business Development Assistance Program.

Respondents in agricultural business sector

relatively found the importance of role of Business

Development Assistance Program and showed

higher participation compared to other business

sectors. Respondents in manufacturing showed

higher religiosity and participation than

agricultural sector, trade sector and service sector.

Respondents with age of 41-50 years showed

higher religiosity, the role of Business

Development Assistance Program, participation,

and economic performance compared to other age

groups.

3.3 Structural Equation Model

Participation which mediates the relationship

between religiosity and the role of Business

Development Assistance Program on the economic

performance of the productive business conducted

by zakat recipients are tested by using structural

equation model analysis. The results of the

structural equation model analysis are presented in

Figure 2 below.

Figure 1: Standardized Model.

The empirical model has a very good goodness

of fit as measured by several statistical parameters

as presented in table 3 below.

Table 3: Model Fit Analysis Summary.

Statistics

Independence

Model

Default

Model

Saturated

Model

CMIN

2252.830

330.992

0.000

GFI

0.342

0.876

1.000

CFI

0.000

0.885

1.000

FMIN

7.411

1.089

0.000

RMSEA

0.259

0.098

-

AIC

2282.830

402.992

240.000

This research has five hypotheses with the

complete test results presented in table 4 below.

Table 4: Hypotheses Test.

Relationship

Estimate

S.E.

C.R.

P

Religiosityto

Participation

0.450

0.085

5.269

***

AssistancetoParti

cipation

0.282

0.050

5.587

***

Participation to

Economic

0.346

0.050

6.958

***

AssistancetoEcon

omic

0.043

0.027

1.555

0.120

Religiosityto

Economic

0.112

0.045

2.461

0.014

Religiosity and the role of business development

assistance program to participation has a very

significant influence with a positive direction which

means that the higher the level of religiosity and the

role of business development assistance program,

the higher the level of participation of recipients of

zakat in developing and improving their businesses.

Both variables show relatively similar roles as

The Effect of Business Development Assistance Program and Religiosity on the Economic Performance of Zakat Recipients through Their

Participations using Structural Equation Model

7

indicated by the path coefficients of 0.37 and 0.38. It

means that the success in encouraging the level of

participation is strongly influenced by religiosity

and business development assistance program

(external factor) to zakat recipients in conducting

their productive business.

Research on the effect of religiosity of tax

recipients is relatively rare because most of the

previous research has linked religiosity to

compliance with zakat payments, as done by

Abdullah and Sapiei (2018) and Farouk, Idris, and

Jaffri (2018), or relates religiosity to business

performance or economic empowerment program,

as done by Somu and Sujatha (2015) which shows

that spiritual empowerment has a significant

impact on economic empowerment. According to

Abdullah and Sapiei (2018), three dimensions of

religious and virtue (akhlaq) dimensions are the

driving factors for zakat compliance. This research

is different from the research conducted by

Farouket al. (2018) which places religiosity as a

moderator that is significant to the relationship

between attitude and subjective norms with the

intention to pay zakat.

Significant influence of business development

assistance program on participation shows the

central role of education or training programs for

zakat authority in developing business. Business

development assistance program are needed to

reduce various problems that are still being faced,

especially in the management of businesses

financed by zakat. Although this research has not

yet studied about the application of sharia

principles in the management of businesses of

zakat recipients, several studies in the field of

Islamic finance are used as a comparison.

Lack of economic independence becomes a

problem in implementing sharia-based

microfinance such as lack of funding and lack of

skills in managing business (Rahim, 2015).

According to Abbas and Shirazi, 2015) Islamic

microfinance faces obstacles namely lack of

knowledge, experience and professionalism of

supporting staff. Various technical constraints in

business management can be overcome by

business development assistance program or other

forms of empowerment, with reference to several

research results, including Hamzah (2018) for

productive management. The last researcher

included technical support and managerial support

factors as support variables, in addition to five

other variables, namely external factors, individual

factors of business owners, business aspects,

management, and resources.

The indirect effect of religiosity and business

development assistance program to economic

performance through participation is greater than

the direct influence of the population, as presented

in table 5.

Tabel 5: Total Effect, Direct Effect, and Indirect Effect

(Standarized Model).

Assistance

Religiosity

Participation

Economic

Direct effect

Participation

0.377

0.373

0.000

0.000

Religiosity

0.100

0.162

0.604

0.000

Indirect Effect

Participation

0.000

0.000

0.000

0.000

Economic

0.228

0.225

0.000

0.000

Total Effect

Participation

0.377

0.373

0.000

0.000

EconoMic

0.327

0.387

0.604

0.000

Economic performance is directly influenced

by participation with a path coefficient of 0.604

and is influenced by religiosity and direct and

indirect assistance with a total effect of 0.387 from

Religiosity and 0.327 from business development

assistance program. Greater indirect influence on

economic performance through participation is one

of the empirical evidences for zakat managers,

especially BAZNAS Yogyakarta, to increase the

participation of zakat recipients in productive

business development programs funded by zakat.

Efforts to increase participation need to take into

account the characteristics of respondents whose

participation rates vary from respondent

demographics, type of business, age group, and

level of education. As a comparison, the Langerodi

and Dinpanah (2017) study on the participation of

farmers in environmental protection programs, the

level of participation of participants in the

empowerment program was significantly

influenced by social features, information sources,

and attitudes of program participants. Participation

as mediator was examined by Langford, Parkes,

and Metcalf (2006) which states that participation

is a mediator that is significant to the relationship

between business objectives and property with

business development which includes

organizational goals, change and innovation, and

customer satisfaction.

Radzi, Nor, and Ali (2017) use the concept of

knowledge sharing as one of the success factors of

small businesses. Sharing knowledge can occur

when respondents gather with each other in

training activities. Two indicators that measure the

participation variable in this study are the

activeness of zakat recipients in meetings and

ICTL 2018 - The 1st International Conference on Teaching and Learning

8

collaboration empowerment. Increased

participation will encourage the exchange of

experience, knowledge, and skills in business

development and finally it can ultimately support

increased economic performance. Referring to the

significant relationship between the role of

facilitator and the level of participation, the level

of participation of zakat recipients is expected to

increase more by increasing the role of facilitator

as one of the sources of knowledge in business

management by recipients of zakat.

Distribution of zakat for productive businesses

still needs to be strengthened in Indonesia,

especially in its financial management. During this

time, financial assistance to zakat providers for

productive businesses is still considered to be

funding assistance that is not demanded for

refunds. Strengthening the zakat management

program for the development of productive

businesses is a challenge from BAZNAS, which

does not rule out the possibility of its own financial

management system as in the form of microfinance

institutions that continue to apply sharia principles.

Balancing social performance and financial

performance is a major challenge for microfinance

institutions. The aspects of Islamic microfinance,

especially those whose funds are from zakat and

waqf, are still lagging behind. For example, there

is a need to establish financial management

guidelines related to governance to increase the

credibility of microfinance institutions, and to

support the sustainability and improvement of

operations. According to Berguiga, Said, and Adair

(2017), microfinance institutions face a two

challenges, namely that they must ensure increased

financial inclusion from the poor, while financially

sustainable without relying on subsidies.

4 CONCLUSIONS

The central role of the participation of zakat

recipients in the development of productive

business is the main finding of this study. This

participation increased with the increasing level of

religiosity and the role of business development

assistance program, which in turn had a significant

impact on improving the economic performance of

its productive businesses. The challenge is how

zakat recipients can increase their participation in

business development which is still relatively

diverse and the direct influence on economic

performance has not been significant. The business

development assistance program can provide

knowledge and skills in business management that

have been an obstacle, including the role of

BAZNAS in conducting more effective business

empowerment programs so that their productive

business show an increasing economic

performance.

This research will be continued by expanding

individual factors and external or institutional

factors to assess their effects on the economic

performance of businesses managed by zakat

recipients, including entrepreneurial ability,

financial literacy, and courage to take risks as other

individual factors; and social and religious

environmental influences and institutional support,

especially from BAZNAS. The aspect of financial

literacy is important because the zakat

management program is also linked to financial

inclusion programs that are prioritized programs in

the financial sector in Indonesia. According to

Ahmed and Salleh (2016), integrating zakat and

waqf into financial inclusive planning such as

money management through savings and

microfinance programs ensures that poor people

have access to financial products and services.

REFERENCES

Abbas, K., and Shirazi, N. 2015. The Key Players’

Perception on the Role of Islamic Microfinance in

Poverty Alleviation: The case of Pakistan. Journal of

Islamic Accounting and Business Research, Vol. 6

Issue: 2, 244-267.

Abdullah, M., and Sapiei, N. S. 2018. Do Religiosity,

Gender and Educational Background Influence

Zakat Compliance? The Case of Malaysia.

International Journal of Social Economics, Vol. 45

Issue: 8, 1250-1264.

Abdullah, N., Derus, A. M., and Al-Malkawi, H. N.

2015. The Effectiveness of Zakat in Alleviating

Poverty and Inequalities: A Measurement using a

newly developed technique. Humanomics, Vol. 31

Issue: 3, 314-329.

Ahmed, H., and Salleh, H. A. 2016. Inclusive Islamic

Financial Planning: a Conceptual framework.

International Journal of Islamic and Middle Eastern

Finance and Management, Vol. 9.

Alam, M. M, Hassan, S., and Said, J. 2015. Performance

of Islamic Microcredit in Perspective of Maqasid Al-

Shariah: A case study on Amanah Ikhtiar Malaysia.

Humanomics, Vol. 31 Issue: 4, 374-384.

Badan Amil Zakat Nasional. (2018). Statistik Zakat

Nasional 2017. BAZNAS, Juni 2018.

Berguiga, I., Said, Y., and Adair, P. (2017). The Social

and Financial Performance of Microfinance

Institutions in the MENA Region: Do Islamic

institutions perform better?. 34th Spring

The Effect of Business Development Assistance Program and Religiosity on the Economic Performance of Zakat Recipients through Their

Participations using Structural Equation Model

9

International Conference, French Finance

Association (AFFI), May 2017, Grenoble, France.

Farouk, A. U., Idris, K. M., and Jaffri, R. A. 2018.

Moderating Role of Religiosity on Zakat

Compliance Behavior in Nigeria. International

Journal of Islamic and Middle Eastern Finance and

Management, Vol. 11 Issue: 3, 357-373.

Hamzah. 2017. Empowerment of Mustahiq Zakat Model

Towards Business Independency. International

Journal of Nusantara Islam, Vol.5(1), 85-96.

Hassanain, K. M. 2015. Integrating Zakah, Awqaf and

IMF for Poverty Alleviation: Three Models of

Islamıc Micro Finance. Journal of Economic and

Social Thought, Vol.2 (3), 193-211.

Ibrahim, P., and Ghazali, R. 2014. Zakah as an Islamic

Micro- Financing Mechanism to Productive Zakah

Recipients. Asian Economic and Financial Review,

4(1), 117-125.

Langerodi, M. C., and Dinpanah, R. 2017. Structural

Equation Modeling of Rice Farmers’ Participation in

Environmental Protection. Applied Ecology and

Environmental Research, Vol.15(3), 1765-1780.

Langford, P. H., Parkes, L. P., and Metcalf, L. 2006.

Developing a Structural Equation Model of

Organisational Performance and Employee

Engagement. Psychology Bridging the Tasman:

Science, Culture and Practice, Mary Katsikitis (Ed.),

The Australian Psychological Society Ltd,

Melbourne, Australia.

Radzi, K. M., Nor, M. N. M., and Ali, S. M. 2017. The

Impact of Internal Factors on Small Business

Success: A Case of Small Enterprises Under The

Felda Scheme. Asian Academy of Management

Journal, Vol. 22, No. 1, 27–55.

Rahim, N. A. 2015. Cash Waqf: An Alternative Source

of Funding for Shariah Compliant Microfinance

Business In Malaysia. WIEF-UiTM Occasional

Papers, 2nd Edition.WIEF-UiTM International

Centre, Universiti Teknologi Mara.

Somu, A., and Sujatha, V. S. 2015. Spirituality and Its

Impact onEconomic Empowerment of Self Help

Group Members. IOSR Journal of Business and

Management, Vol. 17 (4), 11-18.

Undang-Undang Republik Indonesia Nomor 23 Tahun

2011 tentang Pengelolaan Zakat.

Thompson Reuters. 2018. State of the Global Islamic

Economy Report 2017/2018: Outpacing The

Mainstream.

ICTL 2018 - The 1st International Conference on Teaching and Learning

10