Corporate Social Responsibility, Auditor Opinion, Financial Distress

Impact to Auditor Switching for Banking Companies in Indonesia

Stock Exchange for Period of 2014 to 2017

Duma Megaria Elisabeth

1

, Arthur Simanjuntak

1

, Iskandar Muda

1

and Syafruddin Ginting

1

1

Student of Doctorate Program, Faculty Economic and Business,Universitas Sumatera Utara, Medan Indonesia

Keywords: Auditor Switching, Corporate Social Responsibility, Auditor Opinion, Financial Distress

Abstract: The purposes of this research are to analyze the impact of corporate socialresponsibility, auditor opinion,

financial distress Auditor independence is an issue that causes the change of auditors (auditor switching) or

Public Accounting Firm. One suggestion that auditors remain objective in carrying out auditing tasks is the

mandatory rotation of auditors. Rotation of auditors is associated with the company’s actions to make the

turn auditor (auditor switching) or Public Accounting Firm. The purpose of this study was to determine the

effect of corporate social responsibility, the auditor’s opinion financial distress on auditor switching. This

study uses data on banking companies listed in Indonesia Stock Exchange 2014 – 2017 period. The samples

in this study using purposive sampling method, the number of observations of sample of 132 samples. The

technique of data analysis is logistic regression analysis, because the dependent variable using dummy

variable. Based on the result of analysis show that the variables of corporate social responsibility, the

auditor’s opinion and financial distress does not significantly influence the auditor switching.

1 INTRODUCTION

Every company that has been listed on the Indonesia

Stock Exchange (IDX) is required to submit

financial statements coming from outside the

company. Reliability is one of the main qualitative

attributes of a financial statement and therefore an

independent third party is required to assess the

fairness of a company's financial statements. (Ngala

Solo Wea, 2015) A third party who can guarantee

the quality of the financial statements is known as a

public accountant or auditor who has been registered

in Capital Market Supervisory Board and Financial

Institution (Bapepam LK). The “auditor change”

phenomenon has been found to have implications for

the credibility of financial reporting and the cost of

monitoring management activities . The relationship

between the auditor and the client makes asymmetric

financial information or false financial information

has the potential to create a conflict of interest

between the management of the company and the

users of the financial statements coming from

outside the company.(Mulyono and Majidah, 2015).

There are many of KAPs or audit firm size currently

operating give the option to companies to continue

to use the same KAP (audit firm size) or make

changes to KAP (audit firm size) as known as

auditor switching (Susan and Trisnawati, 2011). The

independence of auditor could be impaired with the

long auditor-client relationship as the firm’s capacity

of critical appraisal may decline with time. The

extended auditor-client relationship might deter the

ability of the auditor to provide high quality of audit.

However, audit failures are generally higher during

the first year of auditor–client relationship as the

new auditor needs more effort to become familiar

with the client operation.

A change of auditor means that they are going to

lose clients and income, and for the client it means

that they have to incur more cost on the

rotation/changes of audit firm found that there are

benefits and problems perceived by partners of audit

firms and CFOs of client firms. (Nazri, Smith and

Ismail, 2012)The Government of Indonesia, through

Ministerial decree of Finance No.17 / PMK.01 /

Elisabeth, D., Simanjuntak, A., Muda, I. and Ginting, S.

Corporate Social Responsibility, Auditor Opinion, Financial Distress Impact to Auditor Switching for Banking Companies in Indonesia Stock Exchange for Period of 2014 to 2017.

DOI: 10.5220/0009499909910994

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 991-994

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

991

2008, requires companies to replace KAP that have

received six consecutive years of audit assignments

and auditor switching for three consecutive years.

The implementation of mandatory rotation

requirement is also based on the theoretical reason

that the implementation of auditor and KAP rotation

in the company is expected to improve auditor

independence. (Dalgleish et al., 2007) when the

principal appoints agents as managers and decision

makers for the company, at which point an agency

relationship exists between shareholders and

managers. In agency theory, independent auditors

act as mediators between agents and principles that

have different interest. Independent auditors also

have function to reduce agency costs arising from

selfish behaviour by agents (managers). Thus, to

prevent the loss of the auditor independence, the

government regulates auditor's rotation obligations.

Test on the effect of management changes variable

has been done by (Winata and Anisykurlillah,

2017)who found that management changes is one of

significant variables affecting KAP switching, while

proves that management changes does not have

effect on KAP switching.

Corporate social responsibility (CSR) is a form

of corporate social responsibility in improving social

inequalities and environmental damage caused by

the company's operational activities. The more forms

of social responsibility carried out by companies, the

better the company will be. Investors are more

interested in companies that have a good image in

the community because the better the company's

image, the more consumers to participate in

increasing sales and profitability of the company

(Retno and Prihatinah, 2012) This means that

companies that implement CSR tend not to do

auditor switching to maintain a good corporate

image.

According to financial distress is a company

experiencing financial distress if the company

cannot meet its financial obligations. This

contradicts the findings who found that companies

that experiencing financial difficulties is not the

cause of replacing KAP. The variable of auditor

opinion found evidence that auditors are more likely

to be replaced when issuing auditor opinion. While

in research (Susan and Trisnawati, 2011)auditor

opinion does not affect Auditor switching.

This research provides insights into the

association between factors related to audit and

client firm characteristics and auditor change by

companies listed on IDX or BEI. The findings of the

research will strengthen and further streamline

auditors’ responsibilities in the audit of financial

statements, and facilitate effective regulation of the

auditing profession. Based on the description, the

auditor switching along with the factors that

influence it become a significant object to study, so

the title of this research is entitled "Impact of

Corporate Social Responsibility, Auditor Opinion

and Financial Distress on Auditor Switching in

Banking companies listed on the Indonesia Stock

Exchange in 2014 - 2017 ".

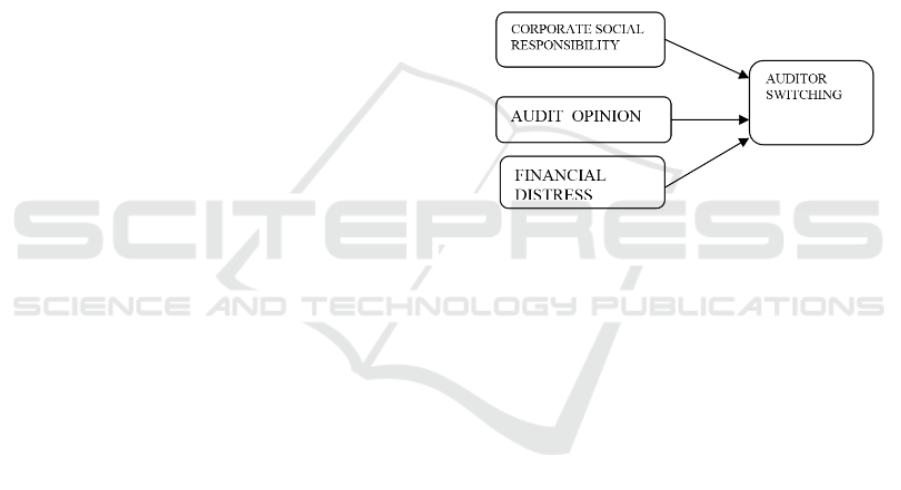

2 THEORICAL FRAMEWORK

Hypothesis of the research:

H1: Corporate Social Responsibility negatively

effect on Auditor switching

H2: Audit Opinion negatively affects on Auditor

switching

H3: Financial distress positively affects on Auditor

switching

Figure 1: Theoretical Framework

This study used secondary data obtained with

documentation. The population in this reseaerch was

banking companies listed on the Indonesia Stock

Exchange during 2014-2017 amounted to 45

companies. The methods used were descriptive

analysis and inferential analysis with logistic

regression from SPSS. The population in this

research are all banking companies listed on the

Indonesia Stock Exchange in the period 2014-2017

with a total of 45 companies. The year period used

in this study is 4 (four) years, namely from 2014-

2017. Taking years of research is intended to explain

the actual data variability. The number of banking

companies as the sample of criteria are 32

companies.

The method of determining the sample used in

this research using logistic regression because the

dependent variable is qualitative data that uses

dummy variables . The analysis technique with

logistic regression does not require more normality

tests on the independent variables (Ghozali, 2016).

Logistic regression analysis is use SPSS program.

The researchers considered the entry into the

sample in this research were those that the following

criteria:

1. The Banking companies are listed on the

Indonesia Stock Exchange during the period of

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

992

2014 - 2017. These criteria are listed to avoid

over differences in the types of existing

industries and the deadline for the company's

financial statements.

2. Financial statements of banking companies

listed on the Stock Exchange in 2014 - 2017 and

audited by KAP and include an independent

auditor's report.

3. The company presents the 2014-2017 financial

statements stated in rupiah (Rp.)

4. The company did not make auditor switching

during the 2014-2017 period.

5. The company presents complete information in

the form of information on the name of the KAP

auditing, the composition of the Board of

Directors, total assets, total debt, audit opinion

and CSR given in the 2014-2017 period.

3 RESULST AND DISCUSSION

From table 1 the results of the analysis presented in

the table :

Table 1:Distribution of sample

No

Total

1

Banking companies listed on the

Indonesia Stock Exchange(BEI)

during the 2014-2017 period.

45

2

Banking Companies thats make

audit firm exchange manadatory -

3

Banking companies that do not

have complete dat

a

needed in this study (overall data

is available in publications

during the period 31 Decembe

r

2014-2017).

-12

Total of Companies sample

33

Amount of research samples during the

observation period (4 years)

132

Table 2: Hosmer and Lemeshow’s Goodness of Fit

Test

Step Chi-square

Df

Sig

1 6,983 8 0,518

Based on Table 2, it can be seen that the

statistical value of the Hosmer and Lemeshow Test

is measured by the Chi-square value of 6.983 with a

significance of 0.518. The significance value is

greater than 0.05 (5%) so it can be concluded that

the regression model is able to predict the value of

its observations or it can be said that the model is

acceptable because it matches the observational data.

The logistic regression model formed produces

regression coefficients and significance. The logistic

regression model formed can be seen in the

parameter estimation value in Variables in The

Equation. The following are the results of testing the

regression model formed, presented in Table 3.

Table 3: Variables In Equation

B

S.E

Wald Df Sig.

Exp

(B)

Step

1

a

CSR -1,32

5,84

0,07

1

0,83 0,243

AO -0,03

1,11

0 1

0,95 0,965

Z

0,14

0,23

0,34

1

0,55 1,125

Constant

-1,05

0,64

3,08

1

0,06 0,342

The results of the research in Table 3 show that

CSR does not show a significant impact on auditor

switching. This shows that there is no impact

between CSR on the probability of companies to

conduct auditor switching. This research cannot

prove the effect of CSR on auditor switching. The

company is increasingly aware that the survival of

the company also depends on the company's

relationship with the community and the

environment in which the company operates. This is

in accordance with the legitimacy theory which

states that the company has an agreement with the

community to carry out its activities based on social

values, and the attitude of the company in response

to the interests of the group to legitimize the

company's actions. If there is a balance between the

company's value system and the community value

system, then the company can lose its legitimacy,

which in turn will threaten the survival of the

company. If this happens it can affect the auditor in

giving an audit opinion and if the auditor's opinion is

not as expected by the company, then the company

will conduct an auditor switching.

The results of the research in Table 3 show that

the auditor's opinion did not show a significant

impact on the auditor switching. This shows that

there is no impact between auditor opinion on the

probability of the company to conduct auditor

switching. These findings support the results of

research conducted (Ekonomi and Diponegoro,

2011)); and (Estate, Terdaftar and Bei, 2012)which

states that audit opinion does not have a significant

effect on auditor switching. This research failed to

Corporate Social Responsibility, Auditor Opinion, Financial Distress Impact to Auditor Switching for Banking Companies in Indonesia

Stock Exchange for Period of 2014 to 2017

993

prove the influence of auditor opinion on auditor

switching. This condition is probably due to the fact

that the sample companies have received an

unqualified opinion from the independent auditor

who audited the company's financial statements.

The results of the research in Table 3 show that

financial distress does not show a significant impact

on auditor switching. This shows that there is no

influence between financial distress on the

probability of companies to conduct auditor

switching. These findings support the results of

research which states that financial distress has no

significant effect on auditor switching. This study

failed to prove the influence of financial distress on

auditor switching. This condition is probably due to

the fact that most sample companies use non-Big 4

KAP services, thus auditors switching to the use of

Big 4 KAP services will actually complicate the

company's financial condition due to the increase in

audit fees.

4 CONCLUSION

Based on the results of research and discussion, it

can be concluded that CSR, opinion auditor,

financial distress did not significantly influence the

auditor switching on banking companies listed on

the Indonesia Stock Exchange for the period 2014-

2017. Future research should consider several

theoretical variables that can affect auditor switching

such as profitability ratio variables, liquidity ratios

or other variables found in financial ratios. In

addition, the researcher also suggested to be able to

add non-financial variables such as company size or

audit fees (audit fees) and use observations of more

than 4 (four) years.

REFERENCES

Arends, R. I. (2008) LEARNING TO TEACH (Belajar

Dalgleish, T., Williams, J. M. G. ., Golden, A.-M. J.,

Perkins, N., Barrett, L. F., Barnard, P. J., Au Yeung,

C., Murphy, V., Elward, R., Tchanturia, K. and

Watkins, E. (2007) ‘[ No Title ]’, Journal of

Experimental Psychology: General, 136(1), pp. 23–

42.

Ekonomi, F. and Diponegoro, U. (2011) ‘Manufaktur Di

Indonesia’.

Estate, R., Terdaftar, Y. and Bei, D. I. (2012) ‘Analisis

hubungan auditor – klien : faktor – faktor yang

mempengaruhi’, Jurusan Akuntansi Fakultas

Ekonomi Universitas Gunadarma ABSTRACT, pp.

1–12.

Ghozali, I. (2016) Aplikasi Analisis Multivariete SPSS 23.

Mulyono, A. and Majidah (2015) ‘Auditor Switching :

Perbedaan Aktivitas Dan Pangsa Pasar Auditor

Setelah Corporate Takeovers Auditor Switching :

Differences of Activities and Auditor ’ S’, Jurnal

Akuntansi, (August 2015).

Nazri, S. N. F. S. M., Smith, M. and Ismail, Z. (2012)

‘Factors influencing auditor change: Evidence from

Malaysia’, Asian Review of Accounting, 20(3), pp.

222–240. doi: 10.1108/13217341211263274.

Ngala Solo Wea, A. D. M. (2015) ‘Faktor-Faktor Yang

Mempengaruhi Auditor Switching Secara Voluntary

Pada Perusahaan Manufaktur’, 22(2), pp. 154–170.

Retno, D. R. and Prihatinah, D. (2012) ‘Jurnal Nominal /

Volume I Nomor I / Tahun 2012’, Jurnal Nominal,

I(5), pp. 12–14. doi: 998-3068-1-pb.pdf.

Susan and Trisnawati, E. (2011) ‘Faktor-Faktor yang

Mempengaruhi Perusahaan Melakukan Auditor

Switching’, Jurnal Bisnis dan Akuntansi, 13(2), pp.

131–144. doi: ISSN 2252-6765.

Winata, A. S. and Anisykurlillah, I. (2017) ‘Analysis of

Factors Affecting Manufacturing Companies in

Indonesia Performing a Switching Auditor’, Jurnal

Dinamika Akuntansi, 9(1), pp. 82–91.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

994