Improvement of Accounting Value Relevance Post Convergence IFRS

Elly Astuti

1

Universitas PGRI Madiun, Madiun -Indonesia

Keywords: Value Relevance, IFRS Convergence, Banking Company

Abstract: The purpose of this study is to evaluate the increasing relevance of accounting values after IFRS convergence

in Indonesia. The research focused on banking companies in two stages of full adaptation, namely in 2012 for

the first and 2015 stages for the second phase. The research method uses multiple linear regression and chow

test follow-up tests to evaluate structural changes in the relevance of accounting values during the adaptation

period. The results of the study using price models found that after IFRS convergence in Indonesia there was

an increase in the relevance of the value of accounting information in banking sector companies. But when

testing is done with the return model, IFRS convergence has no effect. This condition indicates that investors

in the banking sector companies pay more attention to the company's fundamental valuation for long-term

investments rather than short-term capital gains. Increasing the relevance of values after IFRS convergence

with price models, indicates that the market responds positively to IFRS adaptation policies in Indonesia so

as to strengthen the country's economic stability. Future research is expected to carry out testing using the

proxy of earnings management and timeliness to represent the relevance of accounting information values.

1 INTRODUCTION

IFRS is a set of global accounting standards that have

been required to be applied in the process of preparing

financial statements of business entities throughout

the world. IFRS convergence in various parts of the

world, has increased the value relevance of

accounting information (Agostino, Drago, & Silipo,

2011; Rodr, Aimer, Alejandro, & M, 2017; Trabelsi

& Trabelsi, 2014) However, increasing the relevance

of these values will differ between IFRS adaptation

processes carried out voluntarily with mandatory

IFRS adaptation (Kouki, 2018). A country's

economic growth rate also influences the increase in

the relevance of accounting values after IFRS

convergence. Less consistent results occur in

developing countries. IFRS convergence is able to

increase the relevance of accounting values in Latin

American countries (Rodr et al., 2017). But when

tested in Nigeria showed different results, IFRS

convergence did not have a significant impact on

increasing the relevance of accounting values

(Olowolaju, Ogunsan, & Plc, 2016).

Indonesia has carried out continuous

harmonization of standards to further improve the

quality of reporting produced. Full IFRS convergence

is a decision to further improve the quality of

information, where the information presented is

increasingly relevant and is used as the basis for the

company's economic decision making. However, the

convergence process is slightly different from other

countries. Indonesia adapted IFRS gradually and

carried out continuously. This might result in an

increase in the relevance of different accounting

values.

The banking industry is one of the most affected

sectors due to the full IFRS convergence process.

IFRS which provides a different perspective with its

fair valuation concept requires a lot of assessments

that involve complex aspects of the economy. One of

them is a financial instrument component that is very

sensitive to the entity's business environment. The

main components forming the sacrificial industrial

assets derived from financial instruments, may also

have a different effect on the value relevance of

accounting information after IFRS convergence in the

banking industry.

In stage 1 IFRS convergence in Indonesia it was

stated that IFRS did not have a significant impact on

value relevance due to institutional environmental

Astuti, E.

Improvement of Accounting Value Relevance Post Convergence IFRS.

DOI: 10.5220/0009500409951000

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 995-1000

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

995

conditions based on code law (Cahyonowati &

Ratmono, 2013). Juniarti et al., (2018) extended the

observation period with 4 years before and 4 years

after convergence, IFRS had an impact on increasing

the relevance of accounting values in Indonesia.

However, the study was limited only to

manufacturing companies. Different institutional

environmental conditions have an impact on the

relevance of values after different IFRS convergences

(Karampinis & Hevas, 2011). For this reason, the

research will focus on banking companies because

research on IFRS is usually only focused on

manufacturing companies.

2 THEORICAL FRAMEWORK

Value relevance is the ability of accounting

information in financial statements to influence the

economic decision making of investors. This is

reflected in stock price movements after the financial

statements are published (Barth et al., 1996). The

relevance of values can be fulfilled by the existence

of a good set of accounting standards, so that the

information delivered is more transparent and able to

reduce information asymmetry that can reduce

management opportunistic behavior.

IFRS is an accounting standard designed by the

IASB to be applied internationally to improve

transparency and comparability of company financial

statements. The main objective of establishing the

standard is to expand investment opportunities for

investors globally. Investors can obtain adequate

information so they can carry out investment

portfolios. On the other hand, this also benefits the

company in gaining access to funding its operational

activities.

Clarkson et al., (2011) suggested that after IFRS

convergence there was no change in the relevance of

values in European and Australian countries.

However, there are similar impacts between common

law and code law countries. This indicates that IFRS

can improve comparability. In line with this, Callao,

Jarne, & Laínez (2007) state that perhaps local

standard convergence to IFRS does not show an

increase in value relevance because the gap between

book value and market value is wider than the impact

of IFRS convergence. However, in the long run, the

benefits of IFRS will definitely be felt.

Daske, Leuz, & Verdi (2008) and Alali & Foote

(2012) document that the government environment

influences the relevance of accounting information.

When in a volatile period, the role of the government

must be greater by increasing compliance with

regulations to convince investors that the information

presented in the company's financial statements is

relevant. Thus, the institutional environment also

influences value relevance (Ball, Robin, & Shuang,

2003; Daske et al., 2008) which is one of the

qualitative characteristics of accounting information.

The Indonesian government's commitment to

converging local standards to IFRS has been seen

since 2008. IAI as an accounting standard-making

body in Indonesia has converged local standards to

IFRS gradually since 2008 with full adoption stage I

in 2012. In the banking sector, BI also issued PAPI

(Indonesian Banking Accounting Guidelines) in 2008

which was harmonized with the IFRS convergence

stage at that time. In 2015 there was a matching and

full adoption stage II. Adjustments in stage II were

carried out to reduce the gap between local

accounting standards and IFRS from 3 years to 1 year.

All companies listed on the IDX are required to use

accounting standards that have converged IFRS

H1: There is an increase in the relevance of

accounting values in banking companies after IFRS

convergence in Indonesia.

3 RESEARCH METHOD

This research method uses a positive approach with a

quantitative form using multiple linear regression in

analyzing changes in the value relevance of

information. The research population is all banking

companies listed on the Indonesia Stock Exchange

from 2007 to 2015. The sample collection technique

uses purposive sampling with criteria; 1) registered

on the IDX since 2007, 2) functional currency using

rupiah, 3) data related to research variables available.

Measurement of the relevance of accounting

values using price regression models (PRM) and

return regression models (RRM) (Onali, Ginesti, &

Vasilakis, 2017). Price model refers to the equation

proposed by Barth (2008) as follows:

(1)

While the return model refers to Barth and Clinch

(2009) as follows:

(2)

Where and

P is the stock price after the end of the company's

fiscal year (Barth, Landsman, and Lang, 2008;

Lang, Raedy, and Wilson, 2006). This study use the

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

996

stock prices 90

th

after the end of the fiscal year

because the relevance of information is a test of

whether the information submitted by the company

gives a difference in economic decision making

reflected in the stock price. In capital market

regulations and auditing standards that apply in

Indonesia, companies are allowed to submit

financial reports no later than 90 days after closing

the book (fiscal year). Prahesti, Utomo, & Astuti

(2016) documented that banking company audit

delay is between 7 - 90 days. Thus, the company's

financial statements are published a maximum of 90

days after the accounting period.

To test the effect of IFRS convergence on the

relevance of values, we examine whether structural

changes occur before after convergence. The test

uses the chow test. Besides that, there are also some

control variables that might influence company

adjustments with accounting standards that have

converged IFRS. Some of the control variables used

in this study are the size and level of corporate debt.

4 ANALYSIS

This research is a follow-up study from the previous

study to reexamine the impact of IFRS convergence

on value relevance (Astuti & Sulistyowati, 2017;

Cahyonowati & Ratmono, 2013; Juniarti et al., 2018).

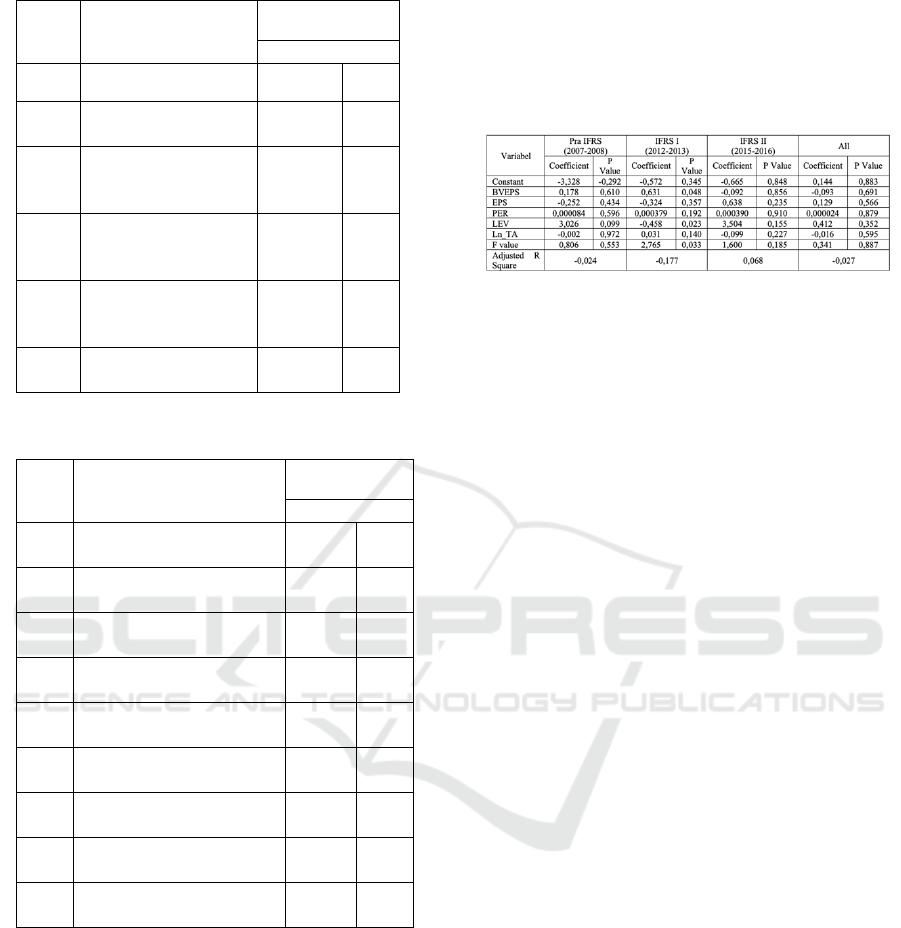

The test results in Table 1 show that there was an

increase in value relevance in the first phase of

convergence, namely in 2012, whereas in the second

period there was no increase. This can be seen from

the adjusted R square value from 2007 to 2012 which

has increased and from 2012 to 2015 has decreased.

Table 1: Results of Hypothesis testing (Price Model)

In the period before IFRS convergence investors

paid more attention to the fundamental value and

stock market value in a balanced manner. Investors

consider profitability (EPS), company market

performance (PER), company risk (LEV) and assets

that are capable to support the company's operations

(Ln_TA). However, in the period after stage I

convergence (2012-2013), the company considered

more fundamental values than market performance.

Investors do not consider stock prices in their

investment decisions (PER doesn’t effect stock

prices). This indicates that investors trust the intrinsic

value of the company rather than market performance

which is much influenced by the

external environment beyond the control of the

company.

In stage II the value of Adjusted R2 has

decreased. this indicates that there is no increase in

the relevance of values from stage I to stage II. In

stage II, investors also do not consider the company's

profitability (EPS) in making economic decisions. It

is possible to avoid mistakes, because of the existence

of earnings management practices that usually occur

in companies. overall it can be concluded that

investors use accounting information in financial

reports that reflect the intrinsic value of the company

for the decision making process.

Table 2: Results of Combined Regression (Price

Model)

Variabel

Pra IFRS + IFRS I

IFRS I + IFRS II

Coefficien

t

P Value

Coeffici

ent

P Value

Constant

-5,825

0,012

-2,991

0,261

BVEPS

0,000028

0,671

0,00042

1

0,001

EPS

0,003

0,000

0,001

0,173

PER

0,001

0,030

0,00027

4

0,825

LEV

-1,097

0,220

-1,328

0,127

Ln_TA

0,412

0,000

0,323

0,001

F value

26,046

0,000

31,857

0,000

Adjusted R

Square

0,601

0,650

The follow-up test was carried out by combining

pre IFRS data with stage I. Combined data was

regressed and compared with the combined results of

data after stage I and II IFRS convergence. The

adjusted R2 value shows an increase (see table 2).

This shows that there is an increase in value relevance

in stage II even though it is not as big as stage I.

Further analyses using the chow test found that there

were structural changes in both stages I and II of IFRS

convergence (see Table 3 and Table 4).

Table 3: Results of Chow Test Stage I (Price Model)

Notati

on

Description

Pre IFRS + Post

IFRS I

Value

RSS

r

Sum of square residual

(2007-2008 s.d 2012-

2013)

71,567

RSS

1

Sum of square residual

(2007-2008)

32,233

RSS

2

Sum of square residual

(2012-2013)

19,250

Improvement of Accounting Value Relevance Post Convergence IFRS

997

Notati

on

Description

Pre IFRS + Post

IFRS I

Value

RSS

ur

RSS

1

+ RSS

2

51,4

83

k

Number of parameters

estimated

5

n

1

Number of observations

before IFRS

convergence

42

n

2

Number of observations

after IFRS convergence

(stage I)

42

F

value

((RSS

r

-

RSS

ur

/k)/(RSS

ur

)/(n

1

+n

2

-2k)

5,77

13

F

table

2,34

Table 4: Results of Chow Test Stage II (Price

Model)

Nota

tion

Description

Post IFRS I +

Post IFRS II

Value

RSS

r

Sum of square residual (2012-

2013 s.d 2015-2016)

68,532

RSS

1

Sum of square residual (2012-

2013)

19,250

RSS

2

Sum of square residual (2015-

2016)

31,993

RSS

u

r

RSS

1

+ RSS

2

51,2

43

k

Number of parameters

estimated

5

n

1

Number of observations after

IFRS convergence (stage I)

42

n

2

Number of observations after

IFRS convergence (stage II)

42

F

value

((RSS

r

-

RSS

ur

/k)/(RSS

ur

)/(n

1

+n

2

-2k)

4,99

32

F

table

2,34

Table 3 and Table 4 show that the value of F is

greater than F table. These results support the

previous test, there were structural changes during the

period of IFRS convergence. Thus it can be

concluded that there is an increase in the relevance of

values after IFRS convergence, both in stage I and

stage II. However, the increase in stage II is not as big

as stage I.

Further analysis uses the return model. Table 5

shows that when using the return model analysis

cannot be done, because it is unable to meet the

classical assumption test. Influence between variables

is not consistent. Thus it can be concluded that the use

of return models is not relevant to test the increase in

value relevance in the banking sector in Indonesia.

Table 5: Results of Hypothesis testing (Return

Model)

5 RESULTS

The results of the study show that there is an increase

in value relevance after IFRS convergence using the

price model, but not with the return model. This

indicates that investors in the banking sector prefer

long-term investments rather than obtaining capital

gains in the short term. The results of this study

confirm the previous literature (Agostino et al., 2011;

Ebaid, 2014; Kouki, 2018; Palea & Scagnelli, 2017)

that IFRS is able to improve the quality of financial

reports with increasing the relevance of value.

These results also confirm (Daske et al., 2008;

Nurunnabi, 2015) which states that increasing the

relevance of values after IFRS convergence occurs if

there is support from the national and international

institutional environment. IFRS convergence in

Indonesia can increase value relevance because it is

strongly supported by the government. The

conversion of SAK (Indonesian Accounting

Standards) to IFRS in stage I was able to have a

positive impact because it was followed by Bank

Indonesia policy by issuing PAPI (Banking

Accounting Guidelines) at 2008 with strict

regulations and legal. Whereas in stage II the increase

in value relevance is not as big as in stage I because

there has only been a change in financial accounting

standards without being accompanied by the issuance

of relevant new regulations related to banking by

Bank Indonesia.

However, further analysis of the return model,

the results of the study failed to document the impact

of IFRS convergence on the relevance of accounting

values. Testing using the return model does not meet

the classic assumption test. Clarkson et al., (2011)

explained that, the impact of IFRS on value relevance

in the banking sector cannot fulfill classical

assumptions because two things, there are influence

the conservatism in the previous period and earnings

fluctuations before testing.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

998

6 CONCLUSIONS

IFRS has a positive impact on increasing the

relevance of accounting values in the Indonesian

banking sector. Structural changes occur in the period

before convergence, stage I convergence and stage II

convergence. These changes differ depending on how

big the role of the government is. The government

acts as a mediation to convince investors that

accounting numbers in financial statements can be

relied upon by enforcing regulations on compliance

with applicable standards (Daske et al., 2008; Ebaid,

2014).

This condition also occurs in some countries that

evaluate the impact of IFRS on increasing value

relevance (Alali & Foote, 2012; Karampinis & Hevas,

2011). When IFRS convergence is done voluntarily,

management will be more open if there is an increase

in incentives obtained. Also the convergence decision

depends on bad news or good news that happens to

the company. Thus IFRS convergence that is applied

voluntarily will not have any impact on increasing the

relevance of IFRS values (Christensen, Lee, Walker,

& Zeng, 2015). But when the standard regulatory

body mandatory IFRS convergence, it is found that

value relevance increases significantly.

The limitations of this study are not able to reveal

the impact of IFRS on value relevance by using the

return model. Future research is expected to be able

to eliminate conservatism and earnings fluctuations

so as to reveal an increase in value relevance

holistically. At the beginning of 2018, SAK 71 was

introduced for the regulation of financial instruments,

which were mandatory implemented at the beginning

of 2020. The adoption of the new standard may will

have a significant impact on the relevance of

accounting values in banking companies because

financial instruments are the main components

forming a company's balance sheet.

REFERENCES

Agostino, M., Drago, D., & Silipo, D. B. (2011). The

value relevance of IFRS in the European

banking industry. Review of Quantitative

Finance and Accounting, 36(3), 437–457.

https://doi.org/10.1007/s11156-010-0184-1

Alali, F. A., & Foote, P. S. (2012). The Value

Relevance of International Financial Reporting

Standards: Empirical Evidence in an Emerging

Market. International Journal of Accounting,

47(1), 85–108.

https://doi.org/10.1016/j.intacc.2011.12.005

Astuti, E., & Sulistyowati, N. W. (2017). Analysis Of

Implementation Sak Converged Ifrs For

Financial Instruments (Psak 50, 55 And 60) In

Banking Company. In Proceedings of the 2nd

International Conference on Accounting,

Management, and Economics 2017 (ICAME

2017). https://doi.org/10.2991/icame-

17.2017.8

Ball, R., Robin, A., & Shuang, J. (2003). Incentives

versus standards : properties of accounting

income in four East Asian countries $. Journal

of Accounting and Economics, 36, 235–270.

https://doi.org/10.1016/j.jacceco.2003.10.003

Barth, M. E., Beaver, W. H., Landsman, W. R., Barth,

M. E., Beaver, W. H., & Landsman, W. R.

(1996). Value-Relevance of Banks ’ Value

Disclosures under No . The Accounting Review,

71(4), 513–537.

Cahyonowati, N., & Ratmono, D. (2013). Adopsi

IFRS dan Relevansi Nilai Informasi Akuntansi.

Jurnal Akuntansi Dan Keuangan, 14(2), 105–

115. https://doi.org/10.9744/jak.14.2.105-115

Callao, S., Jarne, J. I., & Laínez, J. A. (2007).

Adoption of IFRS in Spain: Effect on the

comparability and relevance of financial

reporting. Journal of International Accounting,

Auditing and Taxation.

https://doi.org/10.1016/j.intaccaudtax.2007.06.

002

Christensen, H. B., Lee, E., Walker, M., & Zeng, C.

(n.d.). Incentives or Standards : What

Determines Accounting Quality Changes

around IFRS Adoption ?, (April 2015), 37–41.

https://doi.org/10.1080/09638180.2015.10091

44

Clarkson, P., Hanna, J. D., Richardson, G. D., &

Thompson, R. (2011). The impact of IFRS

adoption on the value relevance of book value

and earnings. Journal of Contemporary

Accounting and Economics, 7(1), 1–17.

https://doi.org/10.1016/j.jcae.2011.03.001

Daske, H., Leuz, C., & Verdi, R. S. (2008).

Mandatory IFRS Reporting Around the World :

Early Evidence on the Economic Consequences

Mandatory IFRS Reporting Around the World :

Early Evidence on the. Journal of Accounting

Research, 46, 1085–1142.

Ebaid, I. E.-S. (2014). International Accounting

Standards and Accounting Quality in Code

laws Countries the Case of Egypt. Journal of

Financial Regulation and Compliance, 24(1),

Improvement of Accounting Value Relevance Post Convergence IFRS

999

41–59.

https://doi.org/http://dx.doi.org/10.1108/MRR-

09-2015-0216

Juniarti, J., Helena, F., Novitasari, K., & Tjamdinata,

W. (2018). The Value Relevance of IFRS

Adoption in Indonesia. Jurnal Akuntansi Dan

Keuangan, 20(1), 13.

https://doi.org/10.9744/jak.20.1.13-19

Karampinis, N. I., & Hevas, D. (2011). Mandating

IFRS in an Unfavorable Environment: The

Greek Experience. The International Journal of

Accounting, 46(3), 304–332. Retrieved from

https://econpapers.repec.org/article/eeeaccoun/

v_3a46_3ay_3a2011_3ai_3a3_3ap_3a304-

332.htm

Kouki, A. (2018). IFRS and value relevance: A

comparison approach before and after IFRS

conversion in the European countries. Journal

of Applied Accounting Research, 19(1), 60–80.

https://doi.org/10.1108/JAAR-05-2015-0041

Nurunnabi, M. (2015). The impact of cultural factors

on the implementation of global accounting

standards (IFRS) in a developing country.

Advances in Accounting, 31(1), 136–149.

https://doi.org/10.1016/j.adiac.2015.03.015

Olowolaju, P. S., Ogunsan, J. O., & Plc, Z. B. (2016).

VALUE RELEVANCE OF ACCOUNTING

INFORMATION IN THE DETERMINATION

OF SHARES PRICES OF QUOTED

NIGERIAN DEPOSIT MONEY BANKS.

International Journal of Economics,

Commerce and Management, IV(10), 128–147.

Onali, E., Ginesti, G., & Vasilakis, C. (2017). How

should we estimate value-relevance models?

Insights from European data. The British

Accounting Review.

https://doi.org/10.1016/j.bar.2017.05.006

Palea, V., & Scagnelli, S. D. (2017). Earnings

Reported under IFRS Improve the Prediction of

Future Cash Flows? Evidence from European

Banks. Australian Accounting Review, 27(2),

129–145. https://doi.org/10.1111/auar.12115

Prahesti, E., Utomo, S. W., & Astuti, E. (2016).

Pengaruh Profitabilitas Dan Solvabilitas

terhadap Audit Delay pada Perusahaan

Perbankan Yang Terdaftar di Bursa Efek

Indonesia (BEI). FIPA: Forum Ilmiah

Pendidikan Akuntansi, 11, 1–8.

Rodr, P., Aimer, K., Alejandro, C., & M, A. B.

(2017). Does an IFRS adoption increase value

relevance and earnings timeliness in Latin

America? Emerging Markets Review, 30 (C),

155–168.

https://doi.org/10.1016/j.ememar.2016.11.001

Trabelsi, N. S., & Trabelsi, M. (2014). The Value

Relevance of IFRS in the UAE Banking

Industry : Empirical Evidence from Dubai

Financial Market , 2008-2013. International

Journal of Academic Research in Accounting,

Finance and Management Sciences, 4(4), 60–

71. https://doi.org/10.6007/IJARAFMS/v4-

i4/1241

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1000