The Making of Software as a Service (SaaS) Pricing Policy: A Case

Study in PT XYZ

Hidayatulloh

1

and Thomas H. Secokusumo

1

1

Faculty of Economics, Universitas Indonesia, Jakarta -Indonesia

Keywords: Software as a Service, SaaS, Pricing Policy, Life-Cycle Costing, Target Pricing

Abstract: Too high pricing will cause companies to lose customers, while too low one will cause companies to lose

profits and threaten the company's long-term service commitment. The Target price method and the Life-

Cycle Costing method are solutions in pricing that are in accordance with the ability of the customer as well

as providing the expected benefits and covering costs during the life span of the product. This thesis is

presented a case study research using the Life-Cycle Costing (LCC) method and target Pricing on the

problems faced by PT XYZ in making SaaS product pricing policies. The current pricing policy has not

used a cost method and a precise and measurable pricing technique. This will potentially disrupt the

continuity of services and that of the company itself. This research uses qualitative methods with data

collection techniques using in-depth interviews, understanding of documents and observation. The data are

analysed to answer research questions and giving solution for the problems that is faced by PT XYZ. The

research results are the price policy solutions for PT XYZ using the target pricing method by taking into

account all costs during the life span of the product. Research related to the use of the Life-Cycle Costing

and Target Pricing methods for SaaS products has not been done much, so it is expected that this research

can contribute to the business world and the world of education when facing the same problems.

1 INTRODUCTION

One of the most difficult things in a company's

activities is in determining the value of a product or

service. Too low pricing will result in companies not

making a profit, even suffering losses and too high

pricing will reduce the number of buyers.

(Lipovetsky, et al., 2011) (Horngren, et al., 2012)

(Hansen & Mowen, 2015).

Target pricing is one of the methods of setting

the product prices with a basic approach (Horngren,

et al., 2012). The company provides prices based on

the customer's ability to pay for the product or

service (Hansen & Mowen, 2015) (Horngren, et al.,

2012). Target pricing is used to increase market

share, which eventually will increase company

profits (Hongmin, et al., 2012). The determined

target pricing must be able to meet profit

expectations and target costs during the life cycle of

the product, so that the pricing target is very closely

related to the use of the Life-Cycle Costing method

(Kadarova, et al., 2015).

PT XYZ, as a SaaS service provider, has never

analysed and used the right techniques in

determining the pricing policy of software products

sold under the Software as a Service (SaaS) method.

This causes management to not be able to determine

whether the product provides benefits and can cover

costs during the life-cycle period for the company to

provide long-term commitment services (XYZ,

2017).

Life-Cycle Costing from the SaaS service

provider side is divided into two, which are at the

development stage and the operating support stage

(Whitten & Bentley, 2007). Costs incurred during

the development stage are the acquisition cost of

information technology infrastructure and software

development, while costs incurred during the

operating support stage are maintenance, marketing

and sales costs (Fichman & Kemerer, 2002).

The price of software products sold using the

Software as a Service (SaaS) method is different

from the software offered conventionally or on

premise. Conventional software provides a one-time

price that is quite expensive and users are required to

1028

Hidayatulloh, . and Secokusumo, T.

The Making of Software as a Service (SaaS) Pr icing Policy: A Case Study in PT XYZ.

DOI: 10.5220/0009501410281034

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 1028-1034

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

have an information technology infrastructure to

store data and software itself. On the other hand, the

software sold under the SaaS method offers very

affordable software leases. Customers do not need to

provide information technology infrastructure,

because access to the system uses the internet

network and has use flexibility (commitment is

limited to the contract period) (Armbrust, et al.,

2010) (Jalao, et al., 2012).

To ensure continuity of service, the SaaS price

scheme must be done with the right technique,

Zheng, et al., (2015), because the costs inherent are

not only in the past costs, but also for cost

commitments in the future (Fichman & Kemerer,

2002) (Whitten & Bentley, 2007).

The research will answer these questions: is the

current pricing policy can achieve its target profit

using Life-Cycle Costing Method? How to

achieving target profit.

This research is useful for the management of PT

XYZ and similar industries in the formulation of

pricing policies for Software as a Service (SaaS)

products, and can be used as literacy materials for

written works in the future. The scope of this

research is limited only to the making of price

policies on SaaS products consisting of: SaaS -

Human Resources System, SaaS - Asset

Management, and SaaS-Helpdesk at PT XYZ. Thus,

the costs covered in the cost calculation using the

LCC method are only those related to the product

mentioned above.

2 THEORICAL FRAMEWORK

2.1 Prospect Theory

The philosophy of pricing policy in this research is

based on the prospect theory used in studying

decision-making behaviour in the context of risks

developed by Kahneman and Tversky in 1979 (Wei,

2008). Example of the use of prospect theory is that

pricing will determine customer behaviour in

making purchasing decisions by assessing whether

the purchase they make will add value to the value

of their life or the wealth they have. (Shoemaker,

2005) .

2.2 Life-Cycle Costing Method

Life-Cycle Costing (LCC) was first published in

1977 by the UK Department of Industry which was

used for construction companies (Boussabaine &

Kirkham, 2004). Definition of Life-cycle costing

(LCC) was first issued by the British Ministry of

Industry in 1977 which is the first definition of LCC,

a concept that uses several techniques to calculate

significant costs that arise during ownership of

assets (Boussabaine & Kirkham, 2004). British

Standard BS 3843 in 1992 defined the LCC as the

costs associated with acquisition, use, maintenance

and final disposal, including feasibility studies,

research and development, design, production,

replacement, support and training (Boussabaine &

Kirkham, 2004). Furthermore, ISO 2000 revised the

definition into a technique that can compare the

valuation of costs in a certain time period,

considering all economic factors, including capital

costs and operational costs in the future.

(Boussabaine & Kirkham, 2004). Life-Cycle Costing

(LCC) is the calculation of the cost of goods or

services that cover all costs starting from research

and development, to the support provided by the

company for the product to end (Horngren, et al.,

2012) (Khrisnan, 1996). LCC is an approach in the

field of cost management that focuses on the total

costs that occur throughout the life span of the

product (Lindholm & Suomala, 2007). Based on

these definitions, it can be concluded that LCC is an

approach to calculating the cost of goods or services,

taking into account all costs that have occurred or

will occur, during the life span of the product.

Traditional cost calculations emphasize the costs

that have occurred and are attached to the product,

without taking into account the costs after the

product is made. As we know, there are still other

costs after the product is released to the market, such

as customer service costs, product repair costs, costs

occurring after the product is not on the market

(Kadarova, et al., 2015). LCC is oriented to the long-

term performance of a product, starting before the

product is produced until the end of the support

provided by the manufacturer (Horngren, et al.,

2012) (Lindholm & Suomala, 2007) (Krishnan, et

al., 2000). LCC is useful as a cost analysis tool

during the life span of a product or service

(Boussabaine & Kirkham, 2004) (Fabrycky &

Blanchard, 1991), because the LCC does not only

consider the costs that have occurred, but also all

costs during the life span of the product or service

(Boussabaine & Kirkham, 2004) (Fabrycky &

Blanchard, 1991) (Horngren, et al., 2012) (Jalao, et

al., 2012). LC-Cost on software products consists of

Dev-Cost (development costs) and LC-Cost (costs

after the software is sent to customers). These costs

include costs of initial software requirement

analysis, costs of business process analysis,

programming costs, testing costs, costs of delivering

product information and product delivery to

customers, training, up to product maintenance costs

(Khrisnan, 1996), (Fichman & Kemerer, 2002) and

(ISO/IEC/IEEE, 2015).

The life-cycle period of a product varies

depending on technology and customer preferences.

Then the time span used in the LCC varies following

The Making of Software as a Service (SaaS) Pricing Policy: A Case Study in PT XYZ

1029

the Life-Cycle of the product (Horngren, et al.,

2012). Software life cycle will go through several

life cycle stages, starting from the development

stage (Prototype Phase, Development Phase),

supporting stage (Evolution Phase, Maintenance

Phase), final stage (Retirement Phase) (Sneed,

2004). Understanding the stages or processes is very

important because it will be the basis of the category

of costs during the life span of the product, starting

from the development stage, to the final stage

(Fabrycky & Blanchard, 1991).

The steps to determine the cost profile with the

Life-Cycle Costing method are as follows (Fabrycky

& Blanchard, 1991) (Kadarova, et al., 2015) :

1. Determine how long the product Life-Cycle

estimates;

2. Identify all product activities until support for

the product ends;

3. Connect activities that have been identified with

a predetermined cost structure;

4. Determine the costs for each of the activities.

Costs are calculated using purchasing power

when a decision is made;

5. Enter these costs into activities at a

predetermined cost structure. This results in

costs over the life of the product, using current

purchasing power;

6. Enter the factors of inflation, economic effects

on learning curves, changes in price levels, and

others. These costs reflect on more realistic

costs to anticipate economic changes in the life

span of a product

7. Combine each cost based on the life cycle

stages of a product, then combine all of those

costs.

2.3 Target Pricing

Target Pricing is the determination of the price of a

product or service based on the amount of rupiah

that the customer is willing to pay (Hansen &

Mowen, 2015) (Horngren, et al., 2012). So, the

company will determine in advance how much the

value of goods or services is willing to be paid by

the customer, after that, the company will design a

product or service that can cover costs and provide

the desired profit (Hansen & Mowen, 2015)

(Horngren, et al., 2012). If the costs associated with

the software have not reached the desired cost target,

the company must review the product development

techniques and all costs during the cycle period until

it is based on the predetermined cost target. (Hansen

& Mowen, 2015) (Horngren, et al., 2012)

(Lipovetsky, et al., 2011). The price of Cloud

Computing services can be seen from three

perspectives, which are: Cloud Computing market

perspective; producer/vendor perspective; and user

perspective (Jianhui, 2013). Market perspective is

related to competition maps, where companies

determine prices based on comparative surveys of

similar products. The producer perspective is related

to the costs attached to the product. The user

perspective is related to what value the customer is

willing to pay (Lipovetsky, et al., 2011).

In marketing research, the research method used

to find out how much the customer wants to pay for

the product or service produced is divided into three,

which are first, the direct method (the customer is

immediately asked about how much the replacement

value is); second, Gabor-Granger Indirect Price

Models (companies set the highest and lowest values

range, then the customer is given the choice to bring

up a product image that has the highest price, if the

customer does not agree then the product image is

returned with the lowest value, and it continues until

the highest value that the customer is willing to pay

is known; third, Van Westedorp Price Sensitivity

Models (the company believes that there are

differences in prices in each category of buyers

depending on the quality provided) (Lipovetsky, et

al., 2011). There are two price mechanisms in the

cloud, namely Spot Pricing and Reserved Pricing.

Spot pricing can be interpreted simply as the current

price, where the customer pays one price for one

time usage, while Reserved Pricing is the price for a

certain period of time (Jianhui, 2013).

The steps in using Target Pricing and Target Cost,

are (Horngren, et al., 2012):

1. Develop products that satisfy potential

customers;

2. Determine the target price;

3. Get the target cost per unit through the target

price minus the target profit per unit. The

operating income target per unit is the operating

income per unit of goods or services sold. The

target cost per unit is the estimated long-term

cost per unit when the company can achieve its

operating income target per unit;

4. Perform a cost analysis;

5. Perform technical assessment of product

manufacture until the cost target is reached.

3 RESEARCH METHOD AND A

GENERAL DESCRIPTION OF

THE COMPANY

3.1 Research Method

This research uses a case study method, because

researchers answer in depth the research questions

that arise and describe in depth the phenomena that

occur at PT XYZ. The case study method is also

very relevant in answering questions that require an

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1030

explanation of in-depth answers to the research

questions.(Yin, 2009).

Data are collected through interviews conducted

with PT XYZ employees related to pricing and

system development. The interview aims to get a

clear picture of software development activities and

significant costs incurred. Interviews will use semi-

structured techniques with several questionnaires

and are developed according to the research

objectives. Documentation techniques are used to

obtain information on prices, costs, and other

information related to activities during the lifetime

of the software. Observation techniques are useful

for comparing the results of documentation and

interviews, so that the information received can be

relied upon.

3.2 A General Description of the Company

PT XYZ is an information technology solutions

company that was established and approved by the

ministry of law and human rights in 2007 in South

Jakarta. At the beginning of its establishment, PT

XYZ was a reseller and distributor of software

products that simulated the durability of the material

used to make a product. In 2008, PT XYZ developed

a network monitoring center (NMS) software

product and obtained brand rights in 2010. In

addition to selling software products, PT XYZ also

provides software manufacturing services according

to customer orders. Overall, the products sold are

divided into several types, such as :

1. Product principals and PT XYZ acting as

resellers and distributors in Indonesia. Products

included in this category are software products

that simulate the durability of the material used

to make a product. PT XYZ acts as a

reseller/distributor and earns a commission of a

percentage of the price list issued by the

principal and also gets income from the

installation services of the product.

2. Software products on premise (installed on

consumer information technology devices).

Products included in this section are: Internet

Network Monitoring System software; Electronic

Mail Monitoring Software; Document

Management System software; Consumer

Service Center software.

3. Software products sold using the Software as a

Service (SaaS) method. Software is not installed

on consumer information technology devices

(Server, Storage, PC and Portable PC).

Consumers use software through internet

network services (Web-Service).

4. Software development services are services

provided to build software according to customer

desires in which PT XYZ gets income from the

experts used.

Consumers of PT XYZ were initially only large

companies engaged in the manufacture of frame and

car parts for software of material molds simulation

techniques, as well as government offices for

software manufacturing services and sales of

Network Monitoring System software products.

Eventually in 2016, the company began developing

business software products for small and medium-

sized companies using cloud computing technology.

Based on the organizational structure of the

company, parties involved in operational

development, operational support and sales of

software products sold using the Software as a

Service method consist of two departments, which

are the marketing and sales departments headed by

the General Manager of Marketing and Sales and the

technical department, headed by the technical

general manager.

3.3 The Product of SaaS at PT XYZ

SaaS is one of the cloud computing technologies,

which is a website-based software rental service,

where companies access services using internet

networks and data can be stored in the cloud or

service user devices. (Jianhui, 2013).

Software sold using the SaaS method at PT XYZ

is developed using the Opensource ERP Platform

which is obtained for free. Open source ERP is used

because it uses the Python programming language,

Maria DB database, adopts Big Data technology and

has been used in several prestigious projects abroad.

The SaaS service products offered by the

company are: SaaS - Human Resource Information

System (HRIS); SaaS - Asset Management; and

SaaS – Helpdesk.

3.4 Product Prices for Software as a Service

(SaaS) Services

As mentioned in the introduction, price is a very

important thing for the company (Lipovetsky, et al.,

2011) (Horngren, et al., 2012) (Hansen & Mowen,

2015). PT XYZ currently does not have a systematic

and informative pricing policy (there are no

company rules governing written pricing policies).

The existing policy scheme is the price given at the

time of request from customers who will use the

service. The price submitted must be approved by

the Technical GM, Marketing and Sales GM, and

the Main Director. In a competitive market, late

delivery of prices can cause sales failures, because

The Making of Software as a Service (SaaS) Pricing Policy: A Case Study in PT XYZ

1031

customers will request services from other

manufacturers offering similar services.

3.5 The Product Life Cycle, Activities during

the SaaS Life Cycle, and Significant Costs

As it is known that the purpose of life-cycle costing

is to know the cost, lock costs, and is a cost control

tool during the life cycle of a product (Boussabaine

& Kirkham, 2004) (Fabrycky & Blanchard, 1991)

(Horngren, et al., 2012) (Jalao, et al., 2012). PT

XYZ has determined to provide support for SaaS

products for up to 4 years because it considers

changes in technological progress in the future. Life-

Cycle Product starts from the development stage, the

technical support and sales stages to the end of the

support for the product.

The activities carried out by PT XYZ during the

SaaS life cycle are as follows: analysis of customer

needs, analysis of system requirements, procurement

of software and installation development

infrastructure, software development, initial testing,

software installation on operational infrastructure,

final testing, final documentation, marketing and

sales activities, contracts, service preparation, After

sales service/Operational support, End of Service,

and Disposal.

Significant costs associated with providing

software services with the SaaS method are

employee costs in 2016 of Rp. 2,555,028,000, - and

2017 of Rp. 2,766,000,000, -. The acquisition cost of

information technology was Rp. 1,773,971,540. The

subscription cost for Infrastructure as a service

(IaaS) in 2017 was Rp. 547,092,000, -. Marketing

operational cost in 2016 was Rp. 245,350,000, - and

in 2017 Rp. 273,250,000.

3.6 SaaS Customer Profile

PT XYZ SaaS customer profiles are small and

medium-sized companies that have limited

budgetary costs to build the infrastructure needed by

the system and the availability of experts to develop

and maintain the software and infrastructure built.

4 ANALYSIS

The steps in analysing the price policy that will be

conducted are below:

1. Determine target price

2. Determine target cost per unit

3. Determine target sales

4. Doing cost analysis using Life-Cycle Costing

Method.

For first analysis, we will using existing price

exclude VAT. SaaS-HRIS is Rp. 4.545.455,-

monthly rent per unit, SaaS-Asset Management is

Rp. 13.636.364.,- monthly rent per unit, and SaaS-

Helpdesk is Rp 16.590.909,- monthly rent per unit.

PT XYZ plans to gain profit Rp. 150.000.000,- per

month for all SaaS Products and sells 2.400 unit

monthly rent for SaaS-HRIS, 600 unit monthly rent

for SaaS-Asset Management, 600 unit monthly rent

for SaaS-Helpdesk. Life-Cycle Sales for all products

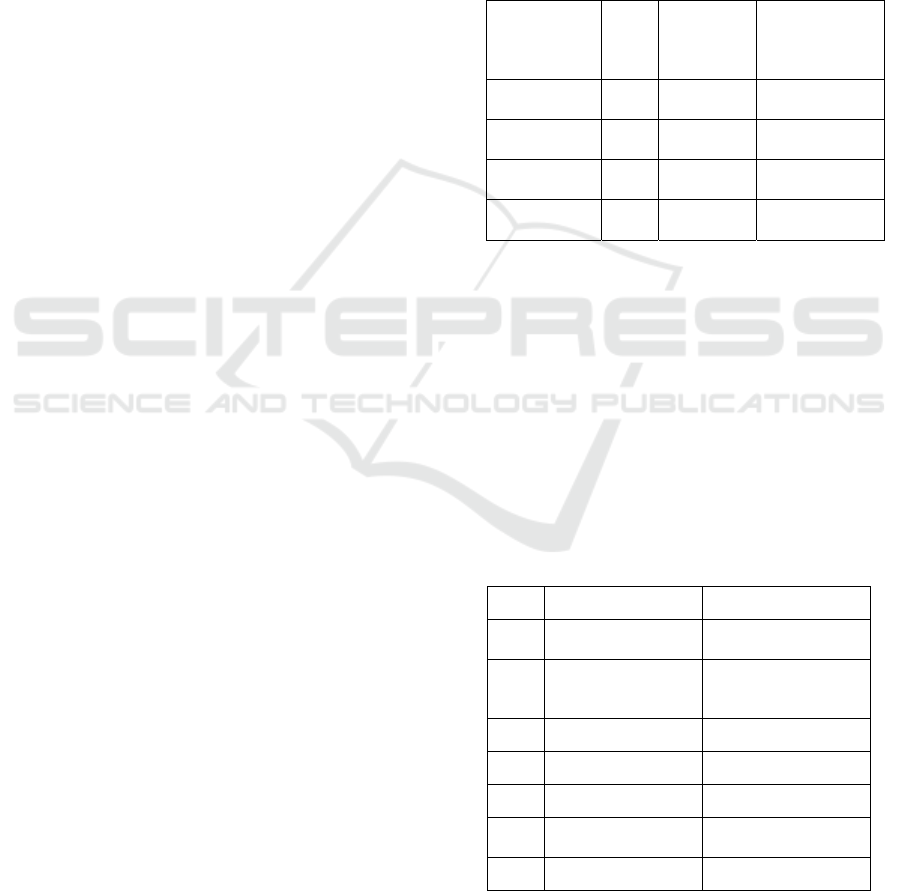

is Rp. 29.045.454.545,- as shows in Table 1.

Table 1: Life-Cycle Sales for all products

Description

Unit

Sold

Price Per

Monthly

Rent Per

uni

t

Total

HRIS 2400

4.545.455

10.909.090.909

asset

Managemen

t

t

600

13.636.364

8.181.818.182

Helpdes

k

600

16.590.909

9.954.545.455

29.045.454.545

The Life-Cycle Sales has to be compared with the

cost through product life-cycle. After doing data

gathering and observation, we found that the

activities during product life-cycle are development

activities, sales and support activities, and product

end of life activities. The cost that related to

activities then divided into two part, Fixed Cost and

Variable Cost. The result shows that total cost

during products life-cycle is Rp. 24.092.952.040,-,

consist of Fixed Cost Rp. 9.392.112.040,- as shows

at Table 2 and Variable Cost Rp. 14.115.840.000,-.

As shows at Table 3.

Table 2. Fixed Cost during products life-cycle

No Description Total (Rp.)

1

Software

Development Cos

t

773.306.500

2

IT Infrastructure for

developing the

software’s 1.792.445.540

3 Interne

t

88.000.000

4 Customer Service 847.740.000

5 Software Update 2.409.732.000

6

Marketing

Operation (Salary) 3.480.888.000

Total 9.392.112.040

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1032

Table 3: Variable Cost during Products Life-Cycle

No Description Total (Rp.)

1 IaaS Ren

t

10.941.840.000

2 Sales Prospects 792.000.000

3 Service Se

t

-Up 1.782.000.000

4 Customers visi

t

600.000.000

Total 14.115.840.000

Variable cost for IaaS Rent Service is Rp.

3.039.400,- per month per customer. Variable Cost

for Sales Prospect activities is Rp. 6.000.000,- per

new customer. Variable cost for Service Set-Up is

Rp. 13.500.000,- per new customer. Customers visit

is Rp. 2.000.000 per customer per year.

At first analysis, PT XYZ has not achieve its

target profit for SaaS Products. PT XYZ only gain

profit Rp. 115.364.636, per month instead of its

target Rp. 150.000.000,-. The result is PT XYZ has

to increase its unit target sales per product by 16% to

achieve its target profit.

After increasing the unit sales target by 16%, the

total sales become Rp. 33.692.727.273,- and total

cost is Rp. 26.445.086.440. Total cost is consist of

Rp. 9.392.112.040,- fixed cost which is same with

prior calculation and Rp. 16.374.374.400,- as shows

at Table 4.

Table 4: Variable Cost during Products Life-Cycle,

after increasing the total unit sold

N

o Description Total

1 IaaS Ren

t

12.692.534.400

2 Sales Prospects 918.720.000

3 Service Se

t

-Up 2.067.120.000

4 Customers visi

t

696.000.000

Total 16.374.374.400

The total of variable cost will increase because

unit sales target is increased. The Sales Prospects

Cost and Service Set-Up Cost have to be highlighted

since is influenced by the quality of the product.

Good quality product is easier to sell than bad

quality product and tend to make loyal customer.

Loyal customer will decrease the need of Sales

Prospect Activity and Service Set-Up Activity for

achieving the target profit. Bad quality product

tends having difficulty in penetrating the market, so,

it will growth slowly (Progress Selling). Good

quality product will be easier to penetrating the

market (One time selling)

Example, SaaS HRIS Total Life-Cycle Sales is

Rp. 10.909.090.909 for 2400 unit sold (See Table 1).

2400 unit is target during product Life-Cycle (4

years). It can be achieved by progress selling as

shows in table 5, or one time selling as shows in

table 6. Progress selling indicate that the product

need time to penetrate the market.

Table 5: Progress Selling

Description

Yea

r

Total

1 2 3 4

Customer per

year

4 32 88 76 200

monthly unit

rented per year

48 384 1.056 912 2.400

Customer

Growth

4 28 56 88

Table 6: One time selling

Description

Yea

r

Total

1 2 3 4

Customer per

year

50 50 50 50 200

monthly unit

rented per year

600 600 600 600 2.400

Customer

Growth

50 - - 50

Table 5 and Table 6 shows the difference of

customer growth. Table 5, PT XYZ has to sell to 88

customers to achieve 2400 unit monthly rented while

Table 6 only need to sell to 50 customers. So, the

total cost of sales prospect and Service Set-Up is

different between two table, as shows in Table 7.

Table 7: The difference between progress selling and

one time selling

Description Total

Progress Selling

Sales Prospects (Rp. 6.000.000,- x 88) 528.000.000

Service Set-Up (Rp. 13.500.000,- x 88) 1.188.000.000

Total

1.716.000.000

One Time Selling

Sales Prospects (Rp. 6.000.000,- x 50)

300.000.000

Service Set-Up (Rp. 13.500.000,- x 50)

675.000.000

Total

975.000.000

The Making of Software as a Service (SaaS) Pricing Policy: A Case Study in PT XYZ

1033

The table 7 shows that PT XYZ will save Rp.

741.000.000,- when locking the cost by producing

good quality since products development phase.

5 CONCLUSION

This research giving the pricing scheme for PT XYZ

SaaS Product. The price for SaaS-HRIS is Rp.

4.545.455,- monthly rent per unit, SaaS-Asset

Management is Rp. 13.636.364.,- monthly rent per

unit, and SaaS-Helpdesk is Rp 16.590.909,- monthly

rent per unit.

PT XYZ has to increasing the unit target sold

throughout product life-cycle to achieve monthly

target profit Rp. 150.000.000,-. The unit target sells

will be 2.400 x116% = 2.784 unit monthly rent for

SaaS-HRIS, 600 x 116% = 696 unit monthly rent for

SaaS-asset Management, 600 x 116% = 696 unit

monthly rent for SaaS-Helpdesk.

The Cost that related to activities during Product

Life-Cycle has to be considered as product cost. The

product life-cycle cost, such as: Software

Development Cost Rp. 773.306.500, IT

Infrastructure cost for developing the software’s Rp.

1.792.445.540, Internet Cost Rp. 88.000.000,

Customer Service Cost Rp. 847.740.000, Software

Update Cost Rp. 2.409.732.000, Marketing

Operation Cost (Salary) Rp. 3.480.888.000, IaaS

Rent Cost Rp. 12.692.534.400, Sales Prospects Cost

Rp. 918.720.000, Service Set-Up Cost Rp.

2.067.120.000, Customers visit Cost Rp.

696.000.000

PT XYZ has to review the cost and price

throughout product life-cycle, because future cost is

influenced by learning curve, inflation, and market

condition. Improving the quality of the product also

important, since it can reduce Service Set-Up Cost

and Sales Prospect Cost.

This combination of Target Pricing Method and

Life-Cycle Costing (LCC) method can be used in

making pricing decision for next SaaS product.

Many cost has to be locked since development

phase. Poor product quality only would result higher

marketing cost, maintenance cost, and some other

future cost.

REFERENCES

Armbrust, M., Fox, A., Griffith, R., Joseph, D. A., Katz, R.,

Konwinski, A., Zaharia, M. (2010). A View of CLoud

Computing. Communications of the ACM, pp. 50-58.

Boussabaine, A., & Kirkham, R. (2004). Whole Life-Cycle

Costing : Risk and Risk Responses. Oxford: Blackwell

Publishing Ltd.

Fabrycky, W. J., & Blanchard, B. S. (1991). Life-Cycle

Cost and Economic Analysis. London: Prentice Hall.

Fichman, R. G., & Kemerer, C. F. (2002). Activity Based

Costing for Component-Based Software Development.

Information Technology and Management, pg 137.

Hansen, D. R., & Mowen, M. M. (2015). Cornerstone of

Cost Management. South-Western: CENGAGE

Learning.

Hongmin, L., Yimin, W., Rui, Y., Kull, T. J., & Choi, T. Y.

(2012). Target pricing: Demand-side versus supply-side

approaches. International Journal Production

Economics, 172-184.

Horngren, C. T., Datar, S. M., & Rajan, M. V. (2012). Cost

Accounting A Managerial Emphasis (Vol. Fourteenth

Edition). New Jersey: Prentice Hall.

ISO/IEC/IEEE. (2015, 05 15). INTERNATIONAL

STANDARD: Systems and software engineering -

Content of life-cycle information items: Second edition.

Switzerland.

Jalao, E. R., Shunk, D. L., & Teresa, W. (2012). Life Cycle

Costs and the Analytic Network Process for Software-

as-a-Service Migration. IAENG International Journal of

Computer Science, 269-274.

Jianhui, H. (2013). Pricing Strategy for Cloud Computing

Services. Singapore: Singapore Management

University.

Kadarova, J., Kobulnicky, J., & Teplika, K. (2015). Product

Life Cycle Costing. Trans Tech Publications, 547-554.

Khrisnan, M. R. (1996). Cost and Quality Considerations in

Software Product Management. Ann Arbor: AMI.

Krishnan, M., Kriebel, C., Kekre, S., & Mukhopadhyay, T.

(2000). An Empirical Analysis of Productivity and

Quality in Software Products. Management Science,

745-759.

Lindholm, A., & Suomala, P. (2007). Learning by costing,

Sharpening cost image through life cycle costing.

International Journal of Productivity and Performance

Management, 651-672.

Lipovetsky, S., Magnan, S., & Polzi, A. Z. (2011). Pricing

Models in Marketing Research. Intelligent Information

Management, 167-174.

Shoemaker, S. (2005). Pricing and the cunsomer. Journal of

Revenue and Pricing Management, 4-5.

Sneed, H. M. (2004). A Cost Model for Software

Maintenance & Evolution. IEEE International

Conference on Software Maintenance. Vienna:

Computer Society.

Wei, L. C. (2008). A value-based pricing system for

strategic co-branding goods. emeraldinsight Kybernetes

Vol. 37 No.7, pp. 978-996.

Whitten, J. L., & Bentley, L. D. (2007). Systems Analysis &

Design Methods (Vol. Seventh Edition). New York:

McGraw-Hill/Irwin.

XYZ, P. (2017). Notulen Kick Off Meeting 2018. Jakarta:

PT XYZ.

Yin, R. K. (2009). Case Study Research. California: Sage

Publication Inc.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1034