The Implementation of Accounting Conservatism Principle in

Indonesia

Niswah Baroroh

1

, Asrori

1

, Subowo

1

and Qurrota A’yunin

1

1

Faculty of Economics, Universitas Negeri Semarang, Indonesia

Keywords: Accounting Conservatism, Cash Flow, Independent Commissioner, Leverage, Liquidity, Profitability

Abstract: The aim of this research is to analyze the factors that influence the implementation of accounting

conservatism principle in Indonesia. The population of this research were 143 manufacturing companies

that listed on the Indonesia Stock Exchange (IDX) in 2015-2017. Technique to collect the sample was

purposive sampling, and selected 39 companies with 117 units of analysis. The technique of data collection

used documentation by collecting data published by other parties. The technique of data analysis used

multiple linear regression analysis. The test results showed that independent commissioners, leverage,

profitability, and liquidity have a significant positive effect on the implementation of accounting

conservatism, while cash flow has no effect on the implementation of accounting conservatism. Suggestions

for further research can use positive accounting theory to better explain the variables that influence the

implementation of accounting conservatism.

1 INTRODUCTION

Financial statements are information provided by the

company to stakeholders to provide an overview of

the company’s financial condition for decision

making (Collins, Hribar, & Shaolee, 2014). The

financial statements presented should be in

accordance with general accepted accounting

principles and applicable accounting standards

(SAK) in order to provide relevant information

which can be accounted for and can be compared

with each other.

One of the accounting principles that prevails in

Indonesia is the implementation of conservatism

principle. Conservatism is a precautionary principle

in which a company will recognize expenses and

liabilities as soon as possible even though there is

uncertainty about the results, but only recognize

income and assets when there is certainty that they

will be accepted. This principle is applied to provide

guarantee to stakeholders (Ball & Shivakumar,

2005) because it shows that the income and assets

listed in the published financial statement are real,

they are truly have become the rights of the

company. On the other hand, the income statement

and other comprehensive incomes will present too

low profit (understatement), because the expense is

recognized as soon as possible whereas income is

not. This is attempted to avoid any indication of

financial statement manipulation for the company’s

internal interest which can harm the external parties

of the company.

One example of financial statement

manipulations was carried out by PT Kimia Farma

in 2001 which provided overstate profit of Rp 32

billion (Bapepam). In 2015, PT Toshiba was also

proven to be inflating profit of Rp 1.2 billion over

the past seven years, which resulted in 45

shareholders seeking compensation for inappropriate

accounting practices (kompas.com). These cases

indicate that the implementation of the conservatism

principle to companies in Indonesia is still very low,

so that the financial statements produced are not

accurate enough to be used as material for decision

making for the stakeholders.

Several previous studies had tried to identify the

causal factors of the conservatism principle

application. One of them is an independent

commissioner who has no relationship with any

party. Independent commissioners can carry out

their duties by monitoring management through the

implementation of accounting conservatism.

(Foroghi, Amiri, & Fallah, 2013), (R. S. K.

1072

Baroroh, N., Asrori, ., Subowo, . and A’yunin, Q.

The Implementation of Accounting Conservatism Principle in Indonesia.

DOI: 10.5220/0009503910721078

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 1072-1078

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Pratanda, 2014) explained that independent

commissioners have a positive and significant effect

on accounting conservatism. This research result is

not in line with (Padmawati & Fachrurrozie, 2015),

(Risdiyani & Kusmuriyanto, 2015)and (Zulfikar,

May, Suhardjanto, & Agustiningsih, 2017) who

showed that independent commissioners have no

effect on accounting conservatism.

Leverage is a debt financing activity(Utama &

Khafid, 2015). The higher the leverage, the higher

the right of the creditors to oversee management

performance and demand manager to be

conservative. (R. S. Pratanda & Kusmuriyanto,

2014), showed that leverage has a significant

positive effect on accounting conservatism. This

research result is not in line with (Brilianti, 2013)

who explained that leverage does not affect the level

of accounting conservatism.

Profitability is the company’s ability to make

profits. (Saputri, 2013) presented that companies

with high profitability will tend to choose

conservative accounting to manage profits so that

they do not experience any fluctuation. (R. S.

Pratanda & Kusmuriyanto, 2014), (Syifa, Kristanti,

& Dillak, 2017) explained that profitability has a

positive effect on accounting conservatism. This

research result is not accordance with (Padmawati &

Fachrurrozie, 2015), (Jayanti, 2016) who revealed

that profitability has a negative effect on accounting

conservatism.

Liquidity is the company’s ability to pay off

short-term debt. Companies with strong conditions

will choose conservative accounting so that the

company performance is maintained. (Nasir, Ilham,

& Yusniati, 2014) stated that liquidity has a positive

and significant effect on accounting conservatism.

This research is not in line with (Susanto &

Ramadhani, 2016) who explained that liquidity has

no effect on accounting conservatism.

Cash flow is the amount of money moving into

and out which consists of company operational

activities, investment activities and funding

activities. Companies will be more conservative by

presenting small value assets and profits when cash

flow is generated high (Martani & Dini, 2010).

(Jayanti, 2016) showed that operating cash flow has

a positive effect on accounting conservatism. This

research result is not accordance with (Saputri,

2013) and (Rohminatin, 2016) who believed that

cash flow does not significantly influence

accounting conservatism.

2 THEORICAL FRAMEWORK

Institutional ownership is the number of shares by

institutional parties. Institutional parties can be an

effective monitoring tool for management in

increasing company value. The higher the

institutional ownership, then the institutional parties

have the ability to control management parties

through an effective monitoring process (Brilianti,

2013). The greater the share ownership in financial

institutions, the greater the power of voice and the

drive to oversee management performance

(Prahasita, 2016).

Independent commissioners are parties that have

no relationship with any party. The existence of

independent commissioners make the supervision

conducted by the board of commissioners becomes

strict (Siahaan, 2013), (Klein, 2002). The more

proportion of independent commissioners in a

company will show a strong board of commissioners

so the level of desired conservatism also will be

higher(Savitri, 2016). In addition, based on agency

theory, the existence of independent commissioners

can oversee management performance (El-Chaarani,

2014) so it can avoid manager’s opportunistic

attitude and demand managers to apply conservative

accounting. (Foroghi et al., 2013), (Salama, 2017),

(Ahmed & Henry, 2012) and (R. S. Pratanda &

Kusmuriyanto, 2014) explained that the proportion

of independent commissioners has a significant

positive effect on accounting conservatism.

H1: Independent commissioners have a positive

effect on accounting conservatism

Leverage is a ratio that shows a comparison of

how much debt a company has with asset or equity.

Leverage becomes an indicator to find out whether

the company finances asset or its capital is obtained

from debt. If the company has been given a loan by

creditors, then the creditors automatically have an

interest in the security of the loaned funds that are

expected to generate profit (Pambudi, 2017). The

relationship between company managers and

creditors can be seen using agency theory. The

higher the company’s debts indicate the greater the

role of creditors in overseeing managers and it will

tend to demand managers to apply accounting

conservatism. As a result, information asymmetry

between creditors and company will be decreased

because managers cannot hide financial information

that might be manipulated or overstated assets

(Susanto & Ramadhani, 2016). (Dewi & Suryanawa,

2014), (R. S. Pratanda & Kusmuriyanto, 2014)

explained that leverage has a significant and positive

effect on accounting conservatism.

The Implementation of Accounting Conservatism Principle in Indonesia

1073

H2: Leverage has a positive effect on accounting

conservatism

Profitability is the company’s ability to make

profits. The high profitability shows how the value

of a company. The higher the value of profitability,

then the company will strive to present the profit

obtained which is not too fluctuating. The

presentation of profits in order to make it look flat

and not have high fluctuation, managers can use

accounting conservatism as part of earnings

management (Padmawati & Fachrurrozie, 2015). It

is based on signal theory which reveals that manager

will provide a signal of high profitability in the form

of company growth in the future. The high

profitability makes the company has a lot of retained

profits and it indicates that accounting conservatism

is implemented (Andreas, Ardeni, & Nugroho,

2017). (Saputri, 2013) and (Syifa et al., 2017)

showed that profitability has a positive effect on

accounting conservatism.

H3: Profitability has a positive effect on accounting

conservatism

Liquidity is the company’s ability to fulfill its

short-term obligations. The higher the liquidity

indicates the better the company. The high liquidity

value will show the strength of the company’s

condition. The higher the liquidity, the more

conservative the company will be (Pramudita, 2012).

It is done in order to maintain the company’s

performance. In addition, the greater the liquidity

ratio, the company will be more careful because if

current assets increase, political costs will also

increase, so managers will tend to be conservative to

reduce profits so that political costs do not increase.

The relationship between liquidity and

conservatism can be explained by signal theory,

which can be seen from the financial information

presented by management. Companies that have

high liquidity value show the strength of the

company’s conditions (Nasir et al., 2014). It happens

because it is better when the liquidity ratio is higher

because the current assets used to pay off the current

debts are getting bigger. One way that can be done

in order to maintain the company’s performance is

applying accounting conservatism. (Nasir et al.,

2014) presented that liquidity has a significant and

positive effect on accounting conservatism.

H4: Liquidity has a positive effect on accounting

conservatism

Cash flow is the amount of money moving into

and out from activities carried out by the company.

The cash flow report consists of company

operational activity, investment, and funding. Cash

flow statement from operational activity is indicator

that determines whether the operations of a company

are able to pay off debt, pay dividend, maintain

company operation, and make new investment

(Savitri, 2016). Companies will be more

conservative when operating cash flow they produce

is high (Madsen, 2011), (Martani & Dini, 2010),

(Lightstone, Wilcox, Beaubien, & Lightstone, 2014).

The high operating cash flow can indicate the good

performance of the company (Wampler, Smolinski,

& Vines, 2009).

Cash flow and accounting conservatism can be

associated with signal theory, in which managers

provide signal in the form of cash flow information.

Cash flow information will be used by investors to

assess company performance. Managers will try to

apply accounting conservatism when the cash flow

they generate is high. (Jayanti, 2016) showed that

operating cash flow has a positive effect on

accounting conservatism.

H5: Cash flow has a positive effect on accounting

conservatism.

3 RESEARCH METHOD

This research was quantitative research using

secondary data, namely annual report data taken

from the company’s website. The population used in

this research was manufacturing companies listed on

the Indonesia Stock Exchange (IDX) in 2014 to

2016 (along with the Toshiba case revealed in 2015)

as many as 149 companies. The sampling technique

used purposive sampling and selected 39 companies

with 117 data analysis units. The sample

determination in this research was based on the

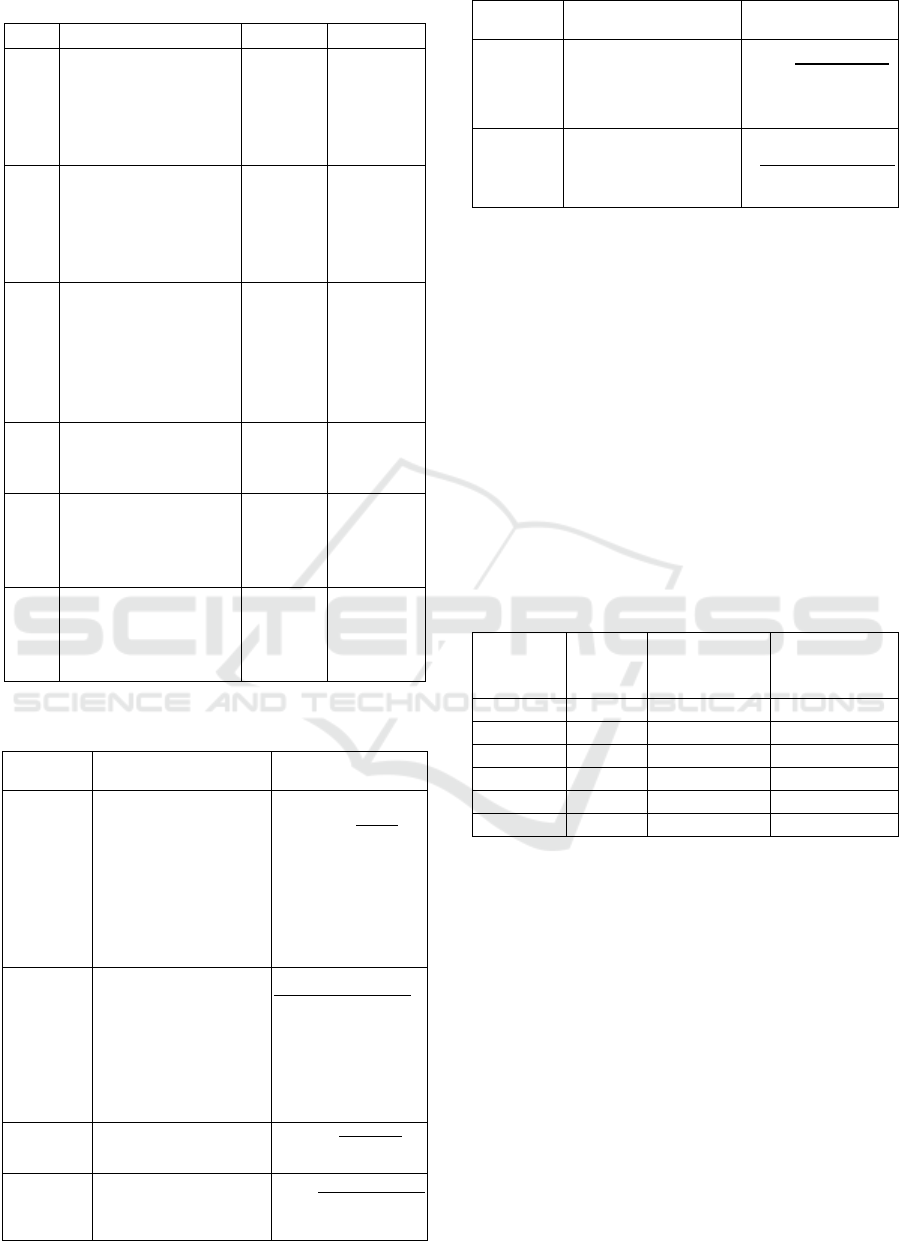

following criteria in Table 1.

This research used the implementation of the

conservatism principle as the independent variable

and independent commissioner, leverage,

profitability, liquidity and cash flow as independent

variables with the operational definition of the

variable presented in table 2.

The technique of data collection was carried out

by documenting the data related to the research

variables. The research data was in the form of the

sample company annual reports from 2014-2016.

Hypothesis testing used multiple linear regression

analysis.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1074

Table 1: Determination of Research Sample

No Criteria Beyond Number

1 Manufacturing

companies listed on

the Indonesia Stock

Exchange in 2014-

2016

149

2 Manufacturing

companies listed on

the Stock Exchange

in 2014, 2015 and

2016 respectivel

y

(14) 135

3 The company

published financial

statement

consistently from

2014, 2015 and

2016

(18) 117

4 The company

presents financial

statement in rupiah

(22) 95

5 The company has a

market to book

value of more than

1

(56) 39

6 The total number of

companies included

in the sample of the

research

39

Source: Secondary data processed, 2018

Table 2: Variable Operation Defenition

Variabel Variabel Definition Indicator

Accounting

conservatism

(MTB)

a concept that recognizes

expense and liability

immediately even though

there is uncertainty about

the results, but only

recognizes income and

asset when it is certain to

be accepted (Savitri, 2016)

𝐌𝐓𝐁

𝑷𝒓𝒊𝒄𝒆

𝑬𝑷𝑺

(Saputri, 2013)

Independent

Commission

er (IND)

parties that are not related

to any party and carry out

the main function of

independently monitoring

the company’s

management performance

(Prahasita, 2016)

Number of Independent Commissioners

Number of Commissioners

𝑥 10

(Risdiyani &

Kusmuriyanto, 2015)

Leverage

(LEV)

debt financing activities

(Utama & Khafid, 2015)

DE

R

Total Deb

t

Total Equity

(Murhadi, 2015)

Profitability

(PROF)

the company’s ability to

generate profits (Murhadi,

2015)

R

OE

Ne

t

Profi

t

after Tax

Total Equity

(Saputri, 2013)

Variabel Variabel Definition Indicator

Likuiditas

(LIK)

the company’s ability to

fulfill its short-term

obligations (Susanto &

Ramadhani, 2016)

CR

Current Asset

Current Debt

(Nasir et al., 2014)

Cash Flow

(CF)

inflow and outflow cash

or cash equivalent (PSAK

No. 2)

CFROA

Cash from Operating Activity

Total Asset

(Jayanti, 2016)

Source: Author’s summary, 2018.

4 RESULT AND DISCUSSION

The classical assumption test is a prerequisite before

hypothesis testing. This research has passed the

classical assumption test, with the normality test

result of 0.096 which is greater than 0.05. The

multicollinearity test has a tolerance value of more

than 1 and VIF less than 10. The autocorrelation test

gets a result of 0.115 which is greater than 0.05.

While the heteroscedasticity test obtains the result of

43,758 which is less than 142,138. Table 3 shows

the results of hypothesis testing related to research

variables.

Table 3: Hypothesis Test Result

Variable Partial

TestSig

Simultaneous

Test

Si

g

Determination

Coefficient

Ad

j

ustment R2

(Constant)

IND 0,045

LEV 0,000

PROF 0,000 0,000 0,884

LI

K

0,028

CF 0,472

Source: processed secondary data, 2018

Table 3 shows that the IND, LEV, PROF, LIK

variables affect the MTB variable partially with a

significance value of less than 0.05. While for the

CF variable partially does not affect the MTB

variable because the significance value is more than

0.05. The test result of the determination coefficient

obtains Adjustment R2 value of 0.884 means that

88.4% of the factors that influence accounting

conservatism can be explained by the independent

variables in this study. While the remaining 11.6% is

explained by other variables outside the research

model.

The Effect of Independent Commissioners on

Accounting Conservatism

Independent Commissioners have a significant

positive effect on accounting conservatism.

The Implementation of Accounting Conservatism Principle in Indonesia

1075

Independent commissioner variable becomes one of

the factors for companies in determining decision to

implement accounting conservatism. The more the

proportion of independent commissioners in a

company will show a strong board of commissioners

(Yanto, Hasan, Fam, & Raeni, 2017), so that the

level of conservatism desired is higher as well

(Savitri, 2016).

Agency theory explains that agency conflict can

be reduced by the existence of a board of

commissioners that demands managers to apply

accounting conservatism. (Risdiyani &

Kusmuriyanto, 2015) and (Wahyudin & Solikhah,

2017) explained that the existence of a board of

commissioners in a company is intended to reduce

the existence of an interest conflict between

shareholders and managers. Independent

commissioners will demand the managers to apply

conservative accounting to produce quality financial

information. This research result is in line with

(Foroghi et al., 2013), (R. S. Pratanda &

Kusmuriyanto, 2014) who showed that independent

commissioners have a significant positive effect on

accounting conservatism.

The Effect of Leverage on Accounting

Conservatism

Leverage has a significant positive effect on

accounting conservatism. The higher the value of

leverage will increase the company in applying

accounting conservatism. Companies that have been

given loans by creditors, the creditors automatically

have an interest in the security of the loaned funds

that are expected to generate profits (Pambudi,

2017). This result causes creditors conduct strict

supervision then managers tend to be demanded to

apply conservative accounting.

Agency theory explains the agency relationship

between managers and creditors. Creditors have an

interest in the security of the funds that have been

lent so that the funds can provide profits. In this

case, creditors have an interest in the distribution of

net assets and lower profits to managers and

shareholders so creditors tend to demand managers

to apply conservative accounting (Pramudita, 2012).

This research result is in line with (Dewi &

Suryanawa, 2014) and (Prahasita, 2016) who stated

that leverage has a significant positive effect on

accounting conservatism.

The Effect of Profitability on Accounting

Conservatism

Profitability has a significant positive effect on

accounting conservatism. The higher the value of

profitability owned by the company indicates the

better the company financial condition (Risdawaty

& Subowo, 2015), (Baroroh, 2017). Companies that

have a high amount of profitability value will try to

make the profits presented do not have high

fluctuation. If managers want to present profits to be

flat and not too fluctuating, they can use accounting

conservatism as part of earnings management

(Padmawati & Fachrurrozie, 2015).

Signalling theory explains managers give signals

to markets or investors related to the condition of the

company. Managers will provide a signal of high

profitability value in the form of the growth in the

future. The higher the value of profitability makes

the company has a lot of retained earnings and it

indicates that accounting conservatism is applied

(Andreas et al., 2017). This result is in accordance

with (R. S. K. Pratanda, 2014) and (Saputri, 2013)

who showed that profitability has a positive effect

on accounting conservatism.

The Effect of Liquidity on Accounting

Conservatism

Liquidity has a significant positive effect on

accounting conservatism. The higher the value of

liquidity will increase the company in applying

accounting conservatism. The higher the liquidity

ratio shows the better the company because the

current assets owned are able to pay off the current

debts. A large liquidity ratio shows the ability of the

company to have good performance and strong

financial conditions, so it tends to choose

conservative accounting in order to maintain the

company performance (Risdiyani & Kusmuriyanto,

2015)

Signalling theory can explain the relationship

between liquidity and accounting conservatism, in

which managers give a signal in the form of

financial information related to the condition of the

company. The condition of a company can be seen

from the value of liquidity owned by that company.

Companies that have high liquidity value show the

strength of the company’s conditions (Nasir et al.,

2014). A company will try to keep maintaining the

condition of the company itself, one of the trials is

by applying accounting conservatism. This result is

in line with (Nasir et al., 2014) who revealed that

liquidity has a significant positive effect on

accounting conservatism.

The Effect of Cash Flow on Accounting

Conservatism

Cash flow has no effect on accounting conservatism.

The higher the company’s cash flow does not affect

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1076

the choice of companies to apply accounting

conservatism. It indicates that cash flow cannot be a

determining factor for the company to make decision

to apply accounting conservatism.

Signalling theory cannot explain the relationship

between cash flow and accounting conservatism. It

happens because the cash value which is obtained by

the company cannot always finance the company

operational activity. It is proven by the research

which argues that there was a continuous decline in

cash flow during 2014-2016; therefore, applying

accounting in that condition is not the best way.

Managers will try to apply accounting procedures

that increase profits they report to hide the negative

impacts of company activities that have a decrease

in the amount of cash flow (Rohminatin, 2016). This

result is in accordance with (Saputri, 2013) and

(Rohminatin, 2016) who declare that cash flow has

no effect on accounting conservatism.

Table 4: Results of the small group trial assessment

the Learning Materials for Problem Based Learning

Strategies

No Rated aspect Average Category

1 Accurate content 3.8 Very good

2 Accuracy of coverage 3.75 Very good

3 Readability of teaching

materials

3.5 Very good

4 Logical exposure 3.5 Very good

5 Reasonable resentation 3.55 Very good

6 Examples related to

material

3.35 Good

7 Tools that make it easy 3.3 Good

8 An orderly and

consistent format

3.5 Very good

9 Changes / packaging 3.45 Good

10 Ilustration 3.3 Goo

d

4.1 Third Revision

The third revision was carried out to accommodate

suggestions from 10 students in small group trials.

Improvements include giving examples that are

appropriate to the material, the use of symbols that

are used more consistently and the use of images

that can clarify the information to be conveyed.

4.2 Results of Field Tests with 30 Students

Field trials were carried out on students in the third

semester of the Office Administration education

program totaling 30 people. In this trial students

were asked to work on problem-based student

worksheets and study the learning strategies of the

Teaching Materials for Problem Based Learning

Strategy and continued to follow the evaluation of

learning outcomes. From the results of data analysis

using SPSS for the non-Free Samples t-test are

known in table 5 below:

Tabel 5: Paired Samples Test

Paired Samples Test

Pair 1

Pretest - Postest

Paired

Differences

Mean -13.80000

Std. Deviation 5.18885

Std. Error Mean .94735

95% Confidence

Interval of the

Difference

Lower -15.73755

Upper -11.86245

t -14.567

df 29

Sig. (2-tailed) .000

The table above shows t count of -14.567 while the

hypothesis in this research is:

H0 = there is no difference in learning outcomes

before and after using the Teashing Material for

Problem Based Learning Strategy.

H1 = there are differences in learning outcomes

before and after using Teaching Materials for

Problem-Based Learning Strategy.

The results of t ¬count are -14.567 and t table -2.04

with significance 0.000 <.05, then H¬0 is rejected

and H1 is accepted meaning that there are

differences in learning outcomes before and after

using Teaching Materials for Problem Based

Learning Strategies. From the table above, it is also

known that MD -13.80 shows the average after

higher than the average before, or in other words the

negative MD value indicates that the average

learning outcomes after using Teaching Materials

for Problem Based Learning Strategies are higher

than before, it can be concluded that there is an

increase in learning outcomes after using the

Teaching Materials for Problem Based Learning

Strategies.

4.3 Fourth Revision

Questionnaire Results of Students show that the

developed textbooks are very good but it is still

recommended to improve the appearance of capers

and the contents of teaching materials with colors

that attract students' attention. This fourth revision is

carried out based on input from students by

improving the color in the caper and the appearance

of the more colorful Learning Materials for Problem

Based Learning Strategy.

The Implementation of Accounting Conservatism Principle in Indonesia

1077

4.4 Prototype / Teaching Material Model

The final result of this research is a prototype of

Teaching Material for Problem Based Learning

Strategy that will be implemented by students of the

Office Administration Education Study Program.

5 CONCLUSION

Based on the results of research and discussion, it

can be concluded that independent commissioners,

leverage, profitability, liquidity, and cash flow have

a significant effect on accounting conservatism.

Suggestions for further research can use positive

accounting theory to build hypotheses and can use

other measurement proxies for cash flow variable,

based on the result of rejected cash flow variable

testing.

REFERENCES

Ahmed, K., & Henry, D. (2012). Accounting conservatism

and voluntary corporate governance mechanisms by

Australian firms. Accounting & Finance, 52(3), 631–

662.

Andreas, H. H., Ardeni, A., & Nugroho, P. I. (2017).

Konservatisme Akuntansi di Indonesia. Jurnal Ekonomi

Dan Bisnis, 20(1), 1–22.

Ball, R., & Shivakumar, L. (2005). Earnings quality in UK

private firms: comparative loss recognition timeliness.

Journal of Accounting and Economics, 39(1), 83–128.

Baroroh, N. (2017). The Roles of Productive Assets Quality

in Mediating Effect of Risk Management

Implementation to the Firm Value in Indonesian

Banking. Jurnal Dinamika Akuntansi, 8(2), 109–116.

Brilianti, D. P. (2013). Faktor-faktor yang Mempengaruhi

Penerapan Konservatisme Akuntansi Perusahaan.

Accounting Analysis Journal, 2(3).

Collins, D. W., Hribar, P., & Shaolee, X. (2014). Author ’ s

Accepted Manuscript. Journal of Accounting and Eco-

nomics. https://doi.org/10.1016/j.jacceco.2014.08.010

Dewi, N. K. S. L., & Suryanawa, I. K. (2014). Pengaruh

Struktur Kepemilikan Manajerial, Leverage, Dan

Financial Distress Terhadap Konservatisme Akuntansi.

E-Jurnal Akuntansi, 223–234.

El-Chaarani, H. (2014). The impact of corporate governance

on the performance of Lebanese banks.

Foroghi, D., Amiri, H., & Fallah, Z. N. (2013). Corporate

Governance and Conservatism. International Journal of

Academic Research in Accounting, Finance and

Management Sciences, 3(4), 61–71.

Jayanti, A. (2016). Pengaruh positive accounting theory ,

profitabilitas dan operating cash flow Terhadap

Penerapan Konservatisme. Jurnal Ilmu Dan Riset

Manajemen, 5(10), 1–17.

Klein, A. (2002). Audit committee, board of director

characteristics, and earnings management. Journal of

Accounting and Economics, 33(3), 375–400.

Lightstone, K., Wilcox, K., Beaubien, L., & Lightstone, K.

(2014). Misclassifying cash flows from operations :

intentional or not ? https://doi.org/10.1108/IJAIM-07-

2012-0039

Madsen, P. E. (2011). How standardized is accounting? The

Accounting Review, 86(5), 1679–1708.

Martani, D., & Dini, N. (2010). The influence of operating

cash flow and investment cash flow to the accounting

conservatism measurement. Chinese Business Review,

9(6), 1.

Murhadi, W. R. (2015). Analisis Laporan Keuangan

Proyeksi dan Valuasi Saham. Jakarta: Salemba Empat.

Nasir, A., Ilham, E., & Yusniati. (2014). Pengaruh Struktur

Kepemilikan Manajerial, Risiko Litigasi, Likuiditas,

Dan Political Cost Terhadap Konservatisme Akuntansi.

Jurnal Ekonomi, 22(2), 93–109.

Padmawati, I. R., & Fachrurrozie, F. (2015). Pengaruh

Mekanisme Good Corporate Governance Dan Kualitas

Audit Terhadap Tingkat Konservatisme Akuntansi.

Accounting Analysis Journal, 4(1).

Pambudi, J. E. (2017). Pengaruh Kepemilikan Manajerial

dan Debt Covenant Terhadap Konservatisme Akuntansi.

Competitive Jurnal Akuntansi Dan Keuangan, 1(1), 87–

110.

Prahasita, H. S. (2016). Struktur Kepemilikan, tatakelola

Perusahaan, dan Konservatisma. Jurnal Akuntansi

Bisnis, XV(29), 62–76.

Pramudita, N. (2012). Pengaruh Tingkat Kesulitan

Keuangan Dan Tingkat Hutang Terhadap

Konservatisme Akuntansi Pada Perusahaan Manufaktur

Di Bei. Jurnal Ilmiah Mahasiswa Akuntansi, 1(2), 1–6.

Pratanda, R. S. K. (2014). Accounting Analysis Journal,

3(2), 255–263.

Pratanda, R. S., & Kusmuriyanto, K. (2014). Pengaruh

Mekanisme Good Corporate Governance, Likuiditas,

Profitabilitas, Dan Leverage Terhadap Konservatisme

Akuntansi. Accounting Analysis Journal, 3(2).

Risdawaty, I. M. E., & Subowo, S. (2015). Pengaruh

Struktur Modal, Ukuran Perusahaan, Asimetri

Informasi, dan Profitabilitas terhadap Kualitas Laba.

Jurnal Dinamika Akuntansi, 7(2), 109–118.

Risdiyani, F., & Kusmuriyanto. (2015). Analisis Faktor-

faktor yang Mempengaruhi Penerapan Konservatisme.

Accounting Analysis Journal, 4(3), 1–10.

Rohminatin, R. (2016). Faktor-faktor Yang Mempengaruhi

Penerapan Konservatisme Akuntansi (Studi pada

Perusahaanmanu Faktur yang Terdaftar di BEI). Jurnal

Ilmiah INFOTEK, 1(1).

Salama, F. M. K. P. (2017). Accounting conservatism ,

corporate governance and political connections. Pacific

Accounting Review, 27(1), 119–138. https://doi.org/

10.1108/ARA-04-2016-0041

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1078