Board of Director and Earnings Management in Islamic Bank

Virasty Fitri and Dodik Siswantoro

Faculty of Economics and Business, Universitas Indonesia, Jakarta - Indonesia

Keywords: Earnings Management, Islamic Banks, Board of Director.

Abstract: The purpose of this paper is to test and prove empirically the influence of the characteristics of the board of

directors on earnings management. The characteristics of the board of directors used in this study are

Islamic education background, size, number of independent directors and the financial background of

members of the board of directors. The research sample is Islamic banks in Indonesia during 2013-2017.

Data is taken from annual reports which can be accessed on the Islamic bank website. The proxy used to

measure the amount of earnings management uses Discretionary Loans Loss Provision (DLLP). The results

of this study indicate no significant results. The characteristics of the board of directors have no influence

on the practice of earnings management in Islamic banks.

1 INTRODUCTION

The phenomenon of earnings management is a

common thing in companies and banks, and even

Islamic-based banks also take part in the practice

(Quttainah et al. 2013). Viewed from an Islamic

perspective, earnings management is not in

accordance with Islamic teachings because there are

efforts to deceive the company's financial condition

to investors, which will harm investors (Obid and

Demikha, 2011). One effective way to reduce

earnings management practices is by governance

mechanisms (Jensen and Meckling, 1976). One part

of the governance mechanism is the existence of a

board of directors that acts as a link between

interests between shareholders and company

management and ensures compliance with

accounting principles (Dechow et al. 1996;

McMullen and Raghunandan, 1996), preventing

fraud in financial statements (Beasley, 1996) and

limiting earnings management practices that are

likely to occur in companies (Klein, 2002; Xie et al.,

2003). One dimension in the board of directors is a

board of directors who have an Islamic education

background considering that earnings management

practices are contrary to Islamic principles (Mersni

and Ben Othman, 2015; Quttainah et al. 2013;

Hamdi and Zarai, 2012; Ben Othman and Mersni,

2014). The size of the board of directors also plays a

role in reducing earnings management practices (Xie

et al. 2003; Quttainah et al. 2013; Mersni and Ben

Othman, 2015). Likewise the existence of

independent directors can reduce the practice of

earnings management (Liu, 2012; Taktak and

Mbarki, 2014). The board of directors with an

accounting education background are expected to

reduce earnings management practices with their

capabilities (Dechow et al., 1996; Klein, 2002;

DeFond and Jiambalvo, 1993; Naser and

Pandlebury, 1997).

The purpose of this paper is to test and prove

empirically the characteristics of the board of

directors for earnings management. Since earnings

management behavior is not in accordance with

Islamic teachings, the board of directors are

expected to play an important role in reducing

earnings management practices.

2 LITERATURE REVIEW

There are many studies on the practice of earnings

management in Islamic banks that are reviewed from

the aspect of governance. Members of the board of

directors who are members of AAOIFI play a role in

reducing the practice of earnings management

(Mersni and Ben Othman, 2015; Quttainah et al.

2013; Hamdi and Zarai, 2012). But other studies

show the opposite results (Kolsi and Grassa, 2016).

Thus, the first hypothesis is:

H1: There is a negative relationship between the

board of directors who have an Islamic religious

Fitri, V. and Siswantoro, D.

Board of Director and Earnings Management in Islamic Bank.

DOI: 10.5220/0009507511631166

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 1163-1166

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

1163

education background and earnings management

practices.

Large board size can reduce the practice of

earnings management (Quttainah et al. 2013). But

there are also studies that argue the opposite

(Beasley, 1996; Dechow et al. 1996; Loderer and

Peyer, 2002). So, the second hypothesis is:

H2: There is a negative relationship between

board size and earnings management practices in

Islamic banks.

The existence of independent directors can

reduce earnings management practices (Quttainah et

al. 2013). However, some studies have argued

otherwise (Liu, 2012; Taktak and Mbarki, 2014). So,

the third hypothesis is:

H3: There is a negative relationship between the

independent board of directors and earnings

management practices.

Members of the board of directors with a

financial background can reduce earnings

management practices using their abilities (Naser

and Pandlebury, 1997). However, other studies have

argued otherwise (Kolsi and Grassa, 2016; Xie et al.

2002). Then the fourth hypothesis is:

H4: There is a negative relationship between the

board of directors and the financial background and

practice of earnings management.

3 RESEARCH METHOD

The research method used is a quantitative empirical

study. In this study, researchers will conduct panel

regression statistical testing of the influence of the

characteristics of the board of directors on earnings

management in Islamic banks in Indonesia. The

object of this research is Islamic banks in Indonesia

in 2013-2017. The research instrument used was

documentation. Research uses quantitative data

sourced from secondary data, namely annual reports

that can be accessed on the website of Islamic banks.

In addition, information is collected that supports

research through books, online access media

(internet), and published information such as

journals, theses, and dissertations relevant to

research. The initial sample used in the study

amounted to 11 Islamic banks in Indonesia.

However, there is one Islamic bank that does not

have an annual report in 2014. Thus, the final

sample is 10 Islamic banks in Indonesia for 5 years,

namely 2013-2017.

The dependent variable in this study is earnings

management. Measurement of earnings management

To examine the relationship between the

characteristics of the board of directors and earnings

management in Islamic banks, following the

approach taken by Ben Othman and Mersni (2014)

and Mersni and Ben Othman (2015). This study uses

a two-stage approach. In the first stage, using

specific accruals to measure earnings management

in Islamic banks. More specifically, using majority

accruals in the banking sector, LLP. The proxy is

divided into two components, namely discretionary

and non-discretionary. Here's the form of the model

equation:

Non-discretionary components that are part of

LLP are the portion of accruals arising from changes

in the bank's business conditions. Because this

cannot be directly observed, it is estimated to use

variables that reflect the level of losses in the loan

portfolio. Just like Ben Othman and Mersni (2014),

the Non Discretionary LLP (NDLLP) component

was measured using a series of variables including

the initial balance of Non Performing Loans (NPL),

changes in NPL and changes in total loans. So, the

model equation is as follows:

......................................................................................1

Then, using the estimated coefficient from equation

we can calculate the non-

discretionary component of LLP, namely NDLLP:

…………………………………………………………2

Finally, the discretionary component of LLP can be

calculated through the difference between toral LLP

and NDLLP estimates. So the estimation of the

equation is as follows:

……………………………………….......3

then the equation uses the dependent variable and

independent based on the hypothesis as follows:

…………………….........4

Where:

a.

Discretionary loan loss provision

for loans, investment, murabaha,

musyarakah and mudharabah to bank I in

year t

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1164

b. Percentage of board

members who have Islamic education

background in bank i in year

c.

The size of the board of directors

in bank I in year t, expressed as the number of

board members in the bank i in year

d. Percentage of number of

external directors on the board of directors in

bank i in year t

e.

Percentage of number of board

members who have an financial background at

bank i in year t

f.

: The size of the company is proxied by

the logarithm of natural total assets in bank i in

year

g.

: ROA is obtained from net income

divided by total assets in bank i in year

h.

: CAR is determined by the formula for

capital divided by risk weighted assets bank i in

year t.

4 ANALYSIS

Descriptive Statistic

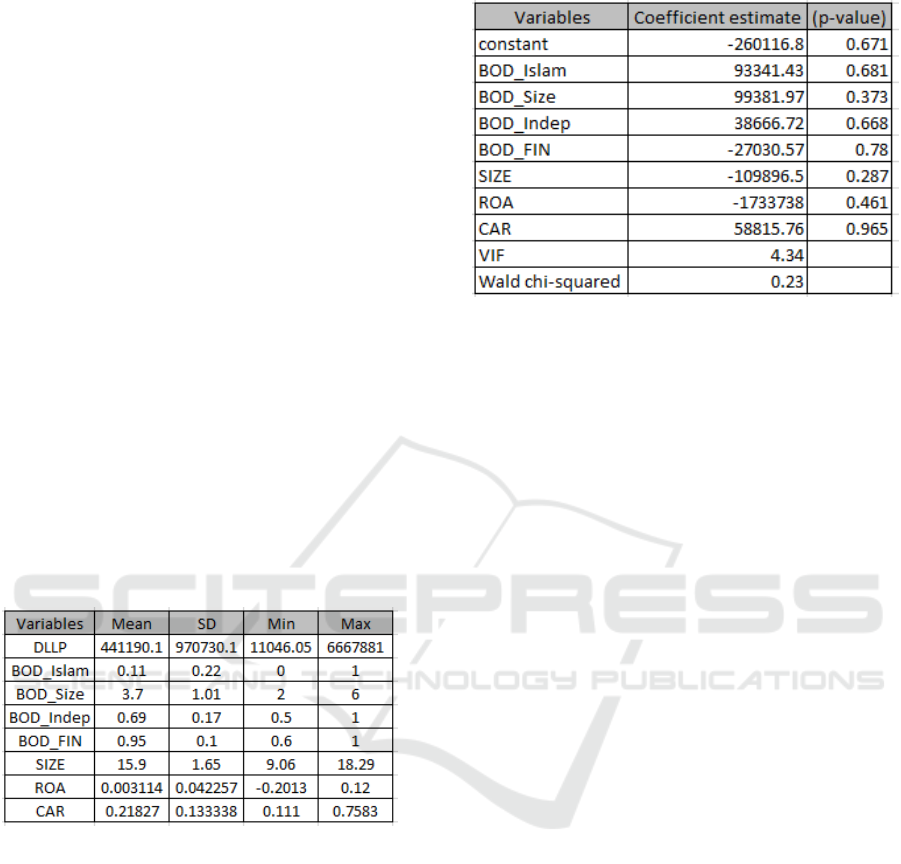

Table 1: Statistic Descriptive.

Table 1 provides the descriptive statistics for the

variables used in those estimation during the period

2013 to 2017. The mean of DLLP, measured as the

residual value from equation (1), was 441190.1 with

a minimum 11046.05 and maximum 6667881. The

average board of directors who have an Islamic

education background is 0.11 with a maximum of 1

and a minimum of 0. The average board of directors

size is 3.7 with a maximum of 6 and a minimum of

2. While the average percentage of independent

directors is 69% with a minimum of 50 % and 100%

maximum. Board of directors who have a financial

background have an average of 95% with a

minimum of 60% and a maximum of 100%.

Panel regression analysis

Table 2: Panel Regression.

Based on regression results, there are no

significant variables on earnings management.

Islamic education background has a positive but not

significant effect. this result is not in accordance

with previous research. So, this result is not in

accordance with hypothesis 1. So is the variable size

of the board of director. The regression results show

a positive but not significant relationship. This result

is in accordance with the Taktak and Mbarki (2014).

Thus, hypothesis 2 is rejected. The number of

independent directors has no significant effect on

earnings management. The regression results show a

positive but not significant relationship. This result

is in accordance with Mersni and Ben Othman's

(2015) study. Thus, hypothesis 3 is rejected. The

number of members of the board of directors with a

financial background also has no significant

influence on earnings management. Regression

results show a negative but not significant

relationship. Thus, hypothesis 4 is rejected.

This insignificant result can be caused by a small

number of samples. It is necessary to do a similar

study with more sample sizes. In addition, state

conditions also play a role in these insignificant

results. As is known, the growth of Islamic banks in

Indonesia is something new, unlike other Islamic

countries. So, the case of earnings management in

Islamic banks is still considered normal. Possible

perspectives that influence the actions of the board

of directors in dealing with earnings management

behavior. It is expected that the results of this study

can make the board of directors more aware of

earnings management behavior.

5 CONCLUSIONS

Based on the results of the study, the characteristics

of the board of directors did not play a significant

role in reducing the practice of earnings

Board of Director and Earnings Management in Islamic Bank

1165

management in Islamic banks. However, these

results cannot be generalized because the number of

samples is small and carried out in only one country.

Hopefully, further research can include more

samples with various countries.

REFERENCES

Beasley, M. S. (1996), "An Empirical Analysis of the

Relation between the Board of Director Composition

and Financial Statement Fraud", The Accounting

Review, vol. 71, no. 4, pp. 443-465

Ben Othman, H. & Mersni, H. (2014), "The use of

discretionary loan loss provisions by Islamic banks

and conventional banks in the Middle East region: A

comparative study", Studies in Economics and

Finance, vol. 31, no. 1, pp. 106-128.

DeFond, M. L., & Jiambalvo, J. (1993). Factors related to

auditor‐client disagreements over income‐increasing

accounting methods. Contemporary Accounting

Research, 9(2), 415-431.

Hamdi, F. M., & Zarai, M. A. (2012). Earnings

management to avoid earnings decreases and losses:

empirical evidence from Islamic banking industry.

Research Journal of Finance and Accounting, 3(3),

88-107.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the

firm: Managerial behavior, agency costs and

ownership structure. Journal of financial economics,

3(4), 305-360.

Klein, A. (2002). Audit committee, board of director

characteristics, and earnings management. Journal of

accounting and economics, 33(3), 375-400.

Kolsi, M. C., & Grassa, R. (2017). Did corporate

governance mechanisms affect earnings management?

Further evidence from GCC Islamic banks.

International Journal of Islamic and Middle Eastern

Finance and Management, 10(1), 2-23.

Liu, B. (2012). Sentiment analysis and opinion mining.

Synthesis lectures on human language technologies,

5(1), 1-167.

Loderer, C., & Peyer, U. (2002). Board overlap, seat

accumulation and share prices. European Financial

Management, 8(2), 165-192.

McMullen, D.A., Raghunandan, K. & Rama, D.V. (1996),

"Internal Control Reports and Financial Reporting

Problems", Accounting Horizons, vol. 10, no. 4, pp.

67.

Naser, K., & Pendlebury, M. (1997). The influence of

Islam on bank financial reporting. International

Journal of Commerce and Management, 7(2), 56-83

Xie, B., Davidson, W.N. & DaDalt, P.J. (2003), "Earnings

management and corporate governance: the role of the

board and the audit committee", Journal of Corporate

Finance, vol. 9, no. 3, pp. 295-316.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1166