The Analysis on the Influence of Foreign Direct Investment (FDI)on

Total GDP at ASEAN

Adiguna Dwirusandi

1

and Hendri

1

1

Faculty of Economics, Universitas Negeri Medan, Medan -Indonesia

Keywords: Gross Domestic Product (GDP), Foreign Direct Investment (FDI)

Abstract: This study aims to analyze the effect of FDI on the gross domestic product (GDP) growth rate in ASEAN

countries using the panel data method during the period of 2007-2016. This study uses ordinary methods

least square (OLS). To estimate it used three models of approaches, namely common effect model (CEM),

fixed effect model (FEM) and random effect model (REM). After the Chow test and Hausman test, the best

model was obtained as a random effect model (REM). The results of the study show that the FDI (Foreign

Direct Investment) has a positive impact on the GDP (Gross Domestic Product) growth in ASEAN.

1 INTRODUCTION

Economic development for a developing country is

the main instrument for achieving its national ideals.

There are various indicators used to measure the

success of this development including economic

growth as measured by the number of Gross

Domestic Product (GDP) of each country. In each

country and international institutions such as the

World Bank, the Asian Development Bank (ADB),

and the IMF, use GDP / GDP as an indicator to

measure the level of economic development of a

country. Theoretically, it can be said that the more

advanced economic development of a country the

greater its GDP (both in total and per capita) so that

the welfare of the community increases with the

assumption of higher growth compared to

population growth..

The increase in ASEAN GDP that has occurred

so far is not supported by the inequality of

development that occurs in every country in

ASEAN. This is due to differences in social

structure, culture and the state of nature and human

resources to carry out development in each country.

Therefore, to move the regional economy of

countries in ASEAN, the Government of each

country must cooperate with each other and try to

explore domestic sources of funding and also seek

sources of foreign financing as a complement so that

development can be carried out optimally.

Harrod and Domar provide an important role in

the formation of investment in the process of

economic growth of a country. Investment is

considered an important factor because it has two

characters or two roles simultaneously in influencing

the economy, namely: First, investment plays a role

as a factor that can create income, meaning that

investment affects the demand side. Second,

investment can increase economic production

capacity by increasing capital stock, meaning that

investment will affect the supply side.

In the theory of development it is known that

investment and GDP growth rate of a country has a

positive influence. This positive relationship can

occur, because if a country's investment continues to

be encouraged it will increase the amount of capital

and encourage an increase in output so that it will

eventually increase the country's economic growth

or GDP. And in this study only discussed the

variable Foreign Direct Investment / Foreign Direct

Investment (FDI) and GDP growth. In this case

investment is a function of (GDP).

2 THEORETICAL STUDY

2.1 Foreign Direct Investment (FDI)

Foreign investment is an effort to increase the

amount of capital for economic development

1174

Dwirusandi, A. and Hendri, .

The Analysis on the Influence of Foreign Direct Investment (FDI) on Total GDP at ASEAN.

DOI: 10.5220/0009508511741178

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 1174-1178

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

sourced from abroad. Salvatore (1997) explains that

FDI consists of; 1) Portfolio investment (portfolio

investment), namely investment that involves only

financial assets, such as bonds and stocks, which are

denominated or valued in national currency. These

portfolio or financial investment activities usually

take place through financial institutions such as

banks, investment fund companies, retirement

foundations, etc .; 2) Foreign Direct Investment, is a

PMA which includes investment into assets in the

form of building factories, procuring various kinds

of capital goods, purchasing land for production

purposes, and so on. Wiranata (2004) argues that

foreign investment directly can be considered as one

of the important sources of economic development

capital. All countries that adhere to an open

economic system generally require foreign

investment, especially companies that produce

goods and services for export purposes. In

developed countries like America, foreign capital

(especially from Japan and Western Europe) is still

needed to spur domestic economic growth, avoid

market sluggishness and create job opportunities.

Especially in developing countries like Indonesia

and almost all countries in ASEAN, foreign capital

is needed especially as a result of insufficient

domestic capital. For this reason, various policies in

the field of investment need to be created in an effort

to attract foreign parties to invest in developing

countries.

In an effort to attract foreign investors to invest

specifically in developing countries, the government

continues to improve promotional activities, both

through sending envoys abroad and increasing

collaboration between national private parties and

foreign private sector.

The strategic ASEAN region is certainly the

reason for the strong flow of foreign investment into

countries in the region even though the investment is

not spread evenly due to various factors such as

differences in area size, population size and

differences in available resources.

Based on the data, that for countries in ASEAN

in general shows the condition of the amount of

fluctuating FDI from year to year. Some countries

such as Brunei even have a downward trend and the

Philippines with an increasing trend. Singapore is

the country with the highest level of foreign

investment in ASEAN. Whereas Laos and Brunei

are countries with a relatively low level of foreign

investment when compared to other countries in

ASEAN

2.2 Gross Domestic Product (GDP)

In the economy of a country there is an indicator that

is used to assess whether the economy is going well

or badly. Indicators in assessing the economy must

be used to find out the total income earned by

everyone in the economy. The right and appropriate

indicator in making measurements is the Gross

Domestic Product (GDP). In addition, GDP also

measures two things at the same time: the total

income of all people in the economy and the total

expenditure of the state to buy goods and services

resulting from the economy. The reason GDP can

measure total income and expenditure is because for

an economy as a whole, income must equal

expenditure. The definition of GDP is the market

value of all final goods and services produced in a

country in a period. However, in GDP there are

some things that are not included such as the value

of all activities that occur outside the market,

environmental quality and income distribution.

Therefore, GDP per capita which is the amount of

GDP when compared to the population in a country

is a better tool that can tell us what happens to the

average population, the standard of living of its

citizens (Mankiw, 2006).

Gross Domestic Product (GDP) is the most

concerned economic statistics because it is

considered the best single measure of people's

welfare. The underlying reason is that GDP

measures two things at the same time: the total

income of all people in the economy and the total

expenditure of the state to buy goods and services

resulting from the economy. The reason GDP can

measure total income and expenditure is because for

an economy as a whole, income must be equal to

expenditure (Mankiw, 2006: 5).

Based on the data obtained it can be seen that the

total GDP receipts of countries in the Southeast Asia

region from year to year continue to increase.

Indonesia is a country with the largest total GDP

income in ASEAN. Whereas Laos is the country

with the lowest GDP.

2.3 Literature Review

The effect of FDI on GDP growth is positive in Sri

Lanka (Balamurali and Bogahawatte, 2004), Nigeria

(Adegbite and Ayadi, 2010), Asia (Tiwari and

Mutascu, 2011), and Bangladesh (Adhikary, 2011).

FDI can also have a negative effect on primary

sector economic growth such as in OEDC countries

(Alfaro, 2003). In fact, FDI can not affect economic

growth as in Pakistan (Falki, 2009).

Based on the description above, this study tries

to answer the problem of whether there is an

influence of FDI on economic growth in ASEAN

countries which can depend on the economic,

technological, and institutional conditions of the

country where FDI is invested.

The Analysis on the Influence of Foreign Direct Investment (FDI) on Total GDP at ASEAN

1175

3 RESEARCH METHOD

This study aims to examine the effect of foreign

investment (FDI) on GDP growth in ASEAN

countries during the 2007-2016 period. The

countries that are the object of research are ASEAN

countries (Brunei Darussalam, Cambodia, Indonesia,

Laos, Malaysia, Myanmar, the Philippines,

Singapore, Thailand and Vietnam).

This study uses secondary data with the type of

panel data (a combination of time series and cross

section data) sourced from the world bank site

during the period 2007-2016.

Analysis of the effect of foreign investment

(FDI) on GDP growth in ASEAN during the 2007-

2016 period using the Generalized Least Square

(GLS) method and the model specifications are as

follows:

GDPit = α0 + α1 FDIit + µit

Where :

GDP : Gross Domestic Product

FDI : Foreign Direct Investment

α0 : Constantas

α1 : Regression Coefficient

µ : error term

i : Country

t : Year

To estimate the type of panel data it is

recommended to use the method through three

models of approaches, namely common effects

model (CEM), fixed effects model (FEM) and

random effects model (REM). Basically the use of

panel data methods has several advantages

(Wibisono, 2005), including; 1) The data panel is

able to take into account the heterogeneity of

individuals explicitly by allowing individual specific

variables; 2) The ability to control individual

heterogeneity then makes panel data can be used to

test and build more complex behavior models; 3)

The panel data are based on repeated cross-section

observations (time series), so the panel data method

is suitable for use as a study of dynamic

adjudication; 4) The high number of observations

has implications for data that are more informative,

more varied, the colinearity between variables

decreases and the degree of freedom-df increases, so

that estimation results can be obtained more

efficiently; 5) Panel data can be used to study

complex behavior models; 6) Panel data can

minimize the bias that might be caused by

aggregation of individual data.

These advantages have implications for not

having to test classic assumptions in the panel data

model (Verbeek, 2000; Gujarati, 2003; Wibisono,

2005; Aulia, 2004).

4 RESULT AND DISCUSSION

To analyze the panel data model is done through

several stages starting with determining the panel

data analysis model that is appropriate to be

interpreted.

4.1 Assumption of Data Panel Regression

The Data Panel Regression Method will give the

results of the estimation that is the Best Linear

Unbiased Estimation (BLUE) if all of the Gauss

Markov assumptions are fulfilled including non-

autorrelation.

It is this non-autocorrelation that is difficult to

fulfill when we analyze the panel data. So that

parameter estimation is no longer BLUE. If panel

data is analyzed by approaching time series models

such as transfer functions, then there is information

on the diversity of unit cross sections that are

ignored in modeling. One of the advantages of panel

data regression analysis is considering the diversity

that occurs in the unit cross section.

4.2 Determining the Panel Data Regression

Estimation Method

To choose the most appropriate model there are

several tests that can be done, including:

1) Chow Test

Chow test is a test to determine whether the

Common Effect (CE) model or Fixed Effect (FE)

is the most appropriate to be used in estimating

panel data. If Result: H0: Choose PLS (CE); H1:

Choose FE (FE)

2) Hausman Test

Hausman test is a statistical test to choose

whether the Fixed Effect or Random Effect

model is best used. If Result: H0: Select RE; H1:

Select FE

3) Test the Lagrange Multiplier

The Lagrange Multiplier (LM) test is a test to

determine whether the Random Effect model is

better than the Common Effect (PLS) method

used. If Result: H0: Choose PLS; H1: Select RE

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1176

4.3 Analysis of the Effect of FDI on Total GDP

in ASEAN

Chow test

Performed to see the estimation model that should

be used between the Common Effect Model (CEF)

and the Fixed Effect Model (FEM)

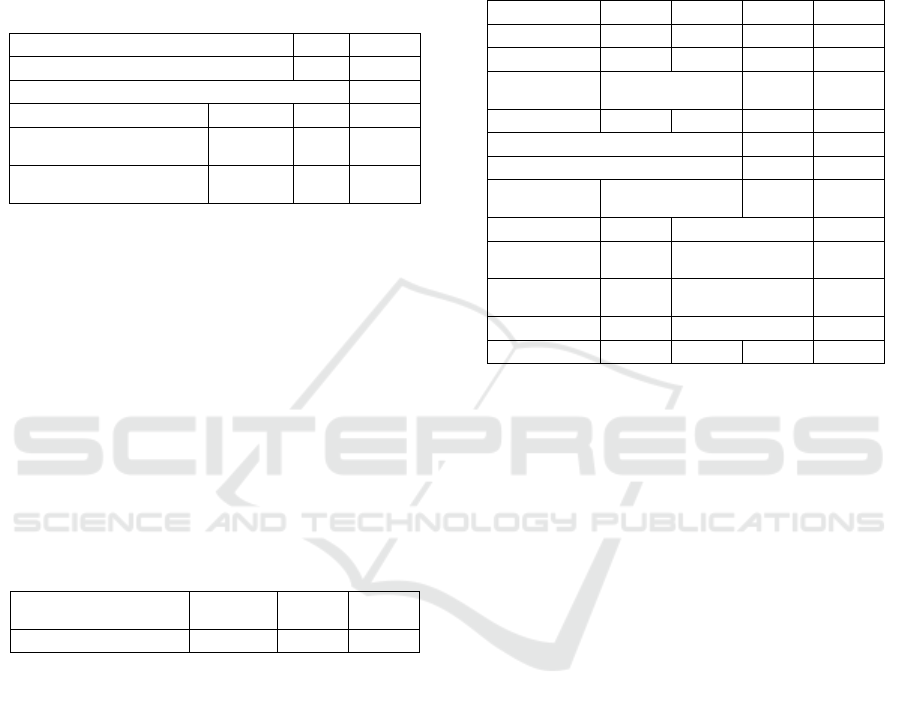

The results can be seen in table 1 below:

Table 1: Chow Test

Redundant Fixed Effects Tests

Equation: Untitled

Test cross-section fixed effects

Effects Test Statistic d.f. Prob.

Cross-section F

126.31451

2 (9,89) 0.0000

Cross-section Chi-square

262.27375

7 9 0.0000

Source : Eviews output

From the table above the value of Chi-square

Prob Cross-section 0.000 is smaller than the 95%

significant level (0.0000 <α = 0.05), then H1 is

accepted which means the fixed effect model is the

best model used for estimation.

Hausman Test

Performed to see the estimation model that should

be used between Fixed Effect Model (FEM) and

Random Effect Model (REM)

Table 2: Hausman Test

Correlated Random Effects - Hausman Test

Equation: Untitled

Test cross-section random effects

Test Summary Chi-Sq. Stat

Chi-Sq.

d.f. Prob.

Cross-section random 0.045 1 0.83

Source : Eviews output

From the table above, it can be seen that the

Prob Shi-SQ Statistic value of 0.8326 is greater than

α = 0.05 (0.8326> 0.05), meaning H1 is rejected, so

the more appropriate model to analyze the effect of

FDI on GDP is Random Effect Model (REM).

Random Effect Model (REM)

As the result of Hausman test estimation, it is found

that the best model used in this study is Random

effects model (REM), so to analyze the effect of

Foreign Investment (FDI) on total GDP in ASEAN

countries using REM (random effects model).

Table 3: Estimated REM model

Dependent Variable: GDP

Method: Panel EGLS (Cross-section random effects)

Sample: 2007 2016

Periods included: 10

Cross-sections included: 10

Total panel (balanced) observations: 100

Swamy and Arora estimator of component variances

Variable Coef Std. Erro

r

t

-Stat Prob.

FDI 4.207303 0.776787 5.416292 0.0000

C 1.67E+11 7.62E+10 2.184009 0.0313

Effects

Specification

S.D. Rho

Cross-section random 2.39E+11 0.9337

Idiosyncratic random 6.37E+10 0.0663

Weighted

Statistics

R-squared 0.232125 Mean dependent var 1.72E+10

Adjusted R-

squared

0.224290 S.D. dependent var 7.20E+10

S.E. of

regression

6.34E+10 Sum squared resid 3.94E+23

F-statistic 29.62501 Durbin-Watson stat 0.306644

Prob(F-statistic) 0.000000

Source : Eviews output

From the table of estimation results, the

regression equation in this study is made as follows:

GDP = 1.67 + 4.20FDI

Based on the model, the coefficient of determination

(R2) is 0.232125, which means that the overall

independent variable, namely Foreign Investment

(FDI) can explain the variation in the total GDP of

ASEAN countries by 23.21% and the remainder

explained by other variables outside the model.

The estimation results show that the FDI variable

has a positive and significant influence on the GDP

growth of ASEAN countries at a 90% confidence

level. The coefficient value is 4.21 which means that

every increase in FDI of 1%, Cateris Paribus, will

encourage ASEAN's total GDP to increase by 4.21

percent. These empirical results are in line with the

hypothesis which states that there is a positive

influence between investment and total GDP growth.

These empirical results reinforce the study

conducted by Balamurali and Bogahawatte in 2004

which concluded that there is a positive relationship

between FDI and the GDP growth in Sri Lanka and

research from Adhikary (2011), where FDI has a

positive effect on GDP growth in Bangladesh which

means that there are similarities in countries in Asia.

The Analysis on the Influence of Foreign Direct Investment (FDI) on Total GDP at ASEAN

1177

5 CONCLUSIONS

5.1 Conclusions

Based on the results of the analysis carried out, it

can be concluded that foreign investment has a

significant influence on GDP growth in ASEAN

with a positive influence, which means that if

foreign investment rises, it will increase the total

GDP of ASEAN countries.

5.2 Suggest

Based on the conclusions obtained, some

suggestions can be made, among others, countries in

the Southeast Asia must continue to increase

investment in their country to be able to explore the

economic potential in their country to achieve the

desired growth and of course the cooperation of each

state government is needed ASEAN countries to

achieve progress, prosperity and common prosperity

in Southeast Asian countries.

REFERENCES

Alfaro, Laura. (2003) ‘FDI and Economic Growth: The

Role of Local Financial Markets’, Journal of

International Economic, pp.89-112, doi:10.1016/

S0022-1996(03)00081-3

Balamurali, N. and C. Bogahawatte. (2004) ‘Foreign

Direct Investment and Economic Growth in Sri

Lanka’, Sri Lankan Journal of Agricultural

Economics. Vol. 6, No. 1, pp.37-50, doi:

http://dx.doi.org/10.4038/ sjae.v6i1.3469

Bishnu, Adhikary. (2011) ‘FDI, Trade Openness, Capital

Formation, and Economic Growth in Bangladesh: A

Linkage Analysis’, International Journal of Business

and Management, Vol. 6 No. 1, pp.16-28,

doi:10.5539/ijbm.v6n1p16

Dominick, Salvatore. (1997) Ekonomi Internasional, alih

bahasa oleh Haris Munandar, edisi 5 cetak 1. Jakarta:

Erlangga.

Dermawan, Wibisono. (2005) Metode Penelitian &

Analisis Data. Jakarta: Salemba Medika.

Esther O. Adegbite, Folorunso. S. Ayadi, (2011) ‘The role

of foreign direct investment in economic development:

A study of Nigeria’, World Journal of

Entrepreneurship, Management and Sustainable

Development, Vol. 6 Issue: 1/2, pp.133-147,

https://doi.org/10.1108/20425961201000011

Falki, Nuzhat. (2009) ‘Impact of Foreign Direct

Investment on Economic Growth in Pakistan’

International Review of Business Research Papers,

Vol. 5 No. 5 Pp. 110-120

Mankiw N,Gregory, dkk. (2012) Pengantar Ekonomi

Makro. Jakarta: Salemba Empat.

Wiranata, S. (2004) ‘Pengembangan Investasi di Era

Globalisasi dan Otonomi Daerah. Jurnal Ekonomi

Pembangunan’ Vol. XII No.1 2004

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1178