The Analysis of Exposure Economic on the Value of

Manufacturing and Mining Industry

Isma Dewi Br Panjaitan

1

, Isfenti Sadalia

1

and Khaira Amalia Fachrudin

1

1

Faculty of Economics and Business, Universitas Sumatera Utara, Medan -Indonesia

Keywords: Economic Exposure, Firm Size, Market to Book Ratio, Quick Ratio, Export Ratio, Debt to Asset Ratio,

Earning Variability, Hedging, Value of Company

Abstract: Economic exposure is a measure of change in exchange rates that effect the company’s value as measured in

the present value as measured in the present value of cash flows that aims to maximize shareholder wealth.

The purpose of this research is to find out and analyze the effect of the economic exposure of manufacturing

and mining company. The independent variables of research are firm size, market to book ratio, quick ratio,

export ratio, debt to asset ratio, earning variability and hedging against value companies with economic

exposure as intervening variable in Manufacturing and Mining Industry. This research is a statistical study

of associative. Method of data collection is done through study of documentation. The Population of this

research is the Manufacturing and Mining industries that are listed in the Indonesia Stock Exchange in

accordance with the specified criteria as much as 171 companies consisting of 132 manufacturing company

and 39 mining companies. Methods of data analysis used is using path analysis software with E-views 7.0.

The research of the first substructure is show firm size, market to book ratio, quick ratio, export ratio, debt

to asset ratio, earning variability and simultaneously hedging exposure to economics in Manufacturing and

Mining companies. The export ratio partially positive and significant effect against the economic exposure.

The second substructure result show firm size, market to book ratio, quick ratio, export ratio, debt to asset

ratio, earning variability, hedging and economic exposure simultaneously affect the company’s value in

manufacturing and mining companies. Partially only debt to asset ratio and earning variability which have

positive and significant influence to company value. Economic exposure is not an intervening variables the

influence of firm sixe, market to book ratio, quick ratio, the export ratio, debt to asset ratio, earning

variability and hedging against the value of the company.

1 INTRODUCTION

The rapid development process of the world

economy has increased the relationship of

interdependence and sharpened world business

competition. This international trade activity not

only benefits producers but as a means of meeting

unlimited consumer needs. Moreover, at this time it

will take effect and the system of the Asean

Economic Community (MEA) will take place which

supports international economic activities.

This greatly affects the income and expenditure

of companies that use foreign currencies in export or

import transactions. The fluctuation of the rupiah

exchange rate against the USD also affects stocks

(Hudiwinarti, 1998) In addition, the actions of

foreign investors who use shares as a means to take

advantage of currency speculation also influence the

value of these shares so that the value and

performance of the company is affected by foreign

exchange rates (Kuncoro, 2000). According to

(Faisal, 2001) there are three types of exposures

caused by changes in exchange rates, namely

economic translation and economic transaction.

Translation and transaction exposure are explained

in accounting calculations defined by the book value

of assets and liabilities nominated in foreign

currencies. While economic exposure is the

sensitivity of a company's value to changes in

exchange rates.

According to (Bodnar, a professor from John

Hopkins University), economic exposure is the total

impact of changes in a macroeconomic variable on

the company's market value, where changes in

exchange rates will affect the nominal value of

contracts in future contracts which will affect cash

flows company.

Researchers

who have carried out research on

Panjaitan, I., Sadalia, I. and Fachrudin, K.

The Analysis of Exposure Economic on the Value of Manufacturing and Mining Industry.

DOI: 10.5220/0009509806230627

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 623-627

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

623

economic exposures such as the (Pritamani, Shome

dan Singal, 2004) study prove that the company's

total economic exposure is negatively related to the

level of stock returns, these variables are proxied as

variables needed for hedging.

(He dan Ng, 1998) use the Quick Ratio variable

as a determinant of the level of economic exposure

faced by a company. Quick Ratio is a proxy variable

to reduce the level of hedging carried out by the

company. Other variables, namely Debt to Equity

Ratio, can be proxied as a variable needed for

hedging purposes.

(Wulandari, 2013) one of them is the mining

industry because this industry still relies on imported

raw materials. This strengthening of the exchange

rate causes local mining products to become more

expensive so that they are not competitive with

similar products from competing countries.

Based on the description of the background, the

researcher was interested in researching about

economic exposures with the title "Analysis of

Economic Exposures to Firm Values in the

Manufacturing and Mining Industry in the Indonesia

Stock Exchange". The time period examined is from

2010-2015.

2 THEORICAL FRAMEWORK

(Kanagaraj dan Sikarwar, 2011) conducting research

under the title "A Firm Level Analysis of the

Exchange Rate Exposure of Indian Firms", this

study examined the level of foreign exchange

exposure and determinants for samples of Indian

companies. For this purpose, the relationship

between exchange rates and stock returns for a

sample of 361 non-financial companies in India with

the period April 2006 - March 2011. The study

found that only 16 percent of companies were

affected by exposure where 10 percent were

significant. Furthermore, from companies that have

significant exposure 86 percent of companies have a

negative influence by Rupee appreciation which

confirms that Indian companies are exporters.

(Susilowati, 2015) conducted a research with the

title "Rupiah Exchange Rate Exposures and Stock

Returns on Companies Listed on the Kompas 100

Index". This study aims to determine the effect of

changes in the real exchange rate index on company

stock returns. Stock return is used as a proxy for

company value. The exchange rate exposure of the

company varies depending on the management

carried out by the company. Therefore this study

also aims to analyze the influence of the level of

foreign operations and explanatory variables of the

company's hedging policy on the rupiah exchange

rate exposure faced by the company. The research

sample was focused on companies listed on the

Kompas 100 Index in the period 2009 to 2013.

Based on the selection of samples by purposive

sampling, the number of samples in this study were

43 companies. This study uses multiple linear

regression analysis as a test tool. From the multiple

linear regression test in the regression model

equation 1, the beta values of each company are

obtained which indicate the level of exposure of the

company's exchange rate. The beta value was tested

in the equation 2 regression model with the ratio of

exports, firm size, long-term debt ratio, dividend

payout ratio, quick ratio, book to market value of

equity. The results showed that changes in the real

effective exchange rate index had a significant

positive effect on stock returns. Companies that have

export activities benefit when the rupiah exchange

rate depreciates against the currencies of Indonesia's

main trading partners. Exchange rate exposure will

increase along with the increase in the ratio of

exports owned by the company. This study also

found empirical evidence that two hedging

explanatory variables namely dividend payout ratio

and long-term debt ratio affect the level of exposure.

(Nur, Binti dan Ahmad, 2015) carried out

research under the title "Foreign Exchange Exposure

and Its Determinants Among Some Listed

Companies From Selected Sectors in Malaysia".

This study analyzes the exchange rate exposures of

90 Malaysian companies in various sectors such as

the agricultural sector, consumer product sector and

industrial sectors listed on Bursa Malaysia for the

period January 2008 to December 2012. The results

of this study indicate that the agricultural sector is

more affected by exposure than the sector

consumption and industrial sector. Besides that

company size, liquidity, debt, asset turnover, profit,

diversification of currencies and diversification of

foreign subsidiaries were found to be insignificant in

explaining the factors that might influence foreign

exchange exposure.

The Model Framework in this research is below:

Source: (Kurniawati Sri Lestari & Anggraeni, 2004) (Data

processed, 2016)

Figure 1: Research Design

Eksposur

Ekonomi (Z)

Firm Size (

X

1

)

Market to Book

Ratio (X

2

)

Q

uick Ratio

(X

3

)

Export Ratio (X

4

)

Debt toAsset Ratio

(X

5

)

Earning Variability

(X

6

)

Nilai

Perusahaan

(Y)

Hedging (D

1,0

)

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

624

3 RESEARCH METHOD

This study is an associative study in which research

links two or more variables (Ginting Paham &

Syafrizal Situmorang, 2008).

This research was conducted in the

Manufacturing and Mining Industry on the

Indonesia Stock Exchange. The observation period

from 2010 to 2015 was examined on the official

website www.idx.co.id. The planned time to conduct

the study was October 2015 to September 2016.

The population of 132 Manufacturing Industry

companies and 39 Mining Industry companies.

4 RESULTS

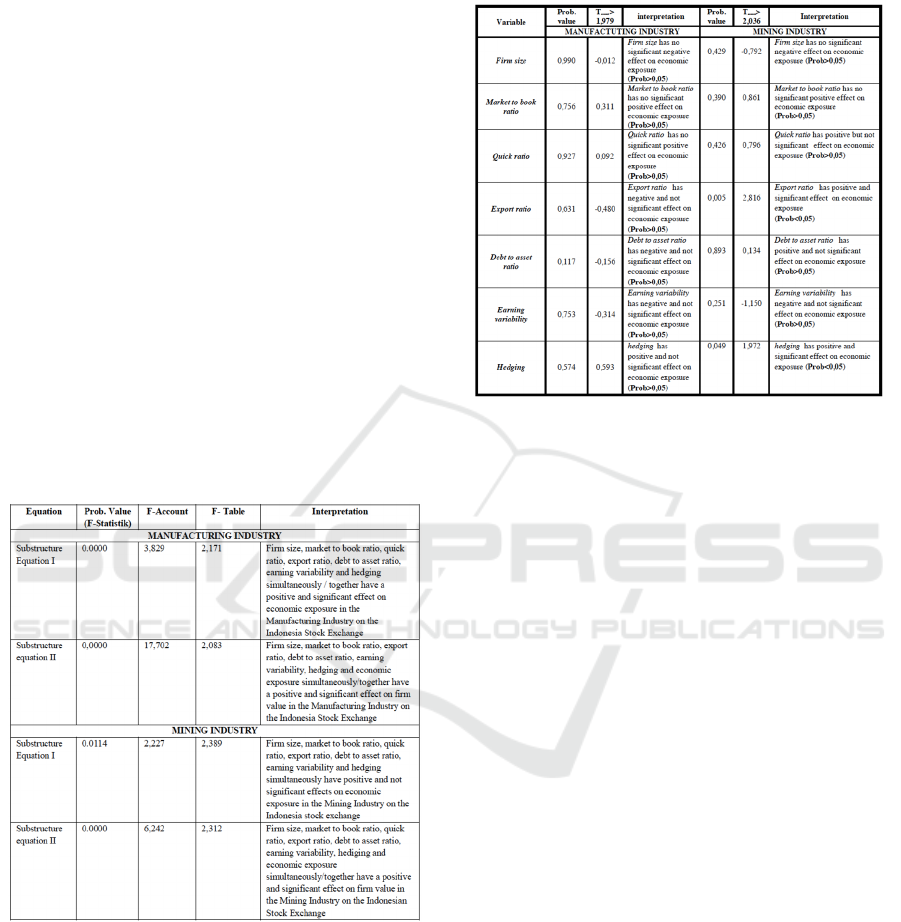

The following is a summary of the test results of the

significance of the simultaneous influence as

follows:

Table 1: Test for the Significance of Simultaneous

Influence for Equation I Structure and Substructure II for

the Manufacturing and Mining Industry.

The following is a summary of the results of the

partial effect tests as follows:

Table 2: Test the Significance of Partial Influence with

Probability Value (Sig.) For Equation I Structure in

Manufacturing and Mining Industry.

5 CONCLUSIONS

1. Based on the results of the study of economic

exposure analysis on the value of the company in

the manufacturing and mining industries on the

Indonesian stock exchange, it can be concluded

that: Firm size, market to book ratio, quick ratio,

export ratio, debt to asset ratio and earnings

variability simultaneously have a positive and

significant effect on economic exposure in the

manufacturing and mining industries in the

Indonesian stock exchange;

2. Firm Size, market to book ratio, quick ratio,

export ratio, debt to asset ratio, earnings

variability and economic exposure

simultaneously have a positive and significant

effect on firm value in the manufacturing and

mining industries in the Indonesian stock

exchange;

3. Economic exposure is not an intervening variable

(intermediary) capable of mediating the

influence of firm size, market to book ratio,

quick ratio, export ratio, debt to asset ratio,

earnings variability, and hedging of firm value in

manufacturing and mining industries on the stock

exchange Indonesia;

4. There are differences in the influence of firm

size, market to book ratio, quick ratio, export

ratio, debt to asset ratio and earnings variability

on economic exposures that do hedging and no

The Analysis of Exposure Economic on the Value of Manufacturing and Mining Industry

625

hedging in the manufacturing and mining

industries in the Indonesian stock exchange;

5. There is a difference in the influence of firm size,

market to book ratio, quick ratio, export ratio,

debt to asset ratio and earnings variability on the

value of the company through economic

exposure to hedging and non-hedging in the

manufacturing and mining industries in the

Indonesian stock exchange.

6 SUGGESTION

Based on the conclusions from the results of the

research as stated earlier, the suggestions that can be

given are as follows

1. The firm size of the manufacturing and mining

industry companies can be seen from the

research results that firm size has a positive and

significant impact on the value of the company.

There is a good idea for the company to control

its firm size if it wants to develop the company

even more in the international trade arena. the

greater the firm size of the company, the greater

the risk of being exposed to economic exposures

because the company carries out international

trade cooperation with foreign companies and the

inflow of cash and assets in foreign currencies

will increase, so the management of the company

must be able to cast a watch on the movement of

the rupiah the company does not carry out

policies in hedging, the company will be at

greater risk of being exposed to economic

exposure which will result in a decrease in the

value of the company.

2. In this study, the market to book ratio has a

positive but insignificant effect on firm value and

economic exposure for the manufacturing and

mining industries, this might occur if at the time

of the year examined some of the company's

conditions were not good because economic

movements in the country were experiencing a

crisis so that the company's ability to increase its

growth rate is very difficult. Moreover, people's

purchasing power is declining, which makes the

sale of production from the manufacturing

industry very bad, as well as companies that do

certain materials to make their products by

importing raw materials from other countries, of

course, the cost of production costs will be

impact on the sale of these products. So that

manufacturing and mining companies can take a

way by carrying out various promotional

strategies in increasing sales to cover large

operational costs so as not to have a significant

impact on the company's growth.

3. In this study more quick ratios have a negative

and insignificant impact on economic exposure

but there are also those that have a negative and

significant impact on the value of the company in

the mining industry. of course this is very

worrying for some companies because it is how

well the company fulfills its obligations, this has

a negative impact on exposure because if the

amount of assets or cash in foreign currencies is

very risky when they want to make liabilities to

other companies. This can be anticipated by

carrying out hedging policies when conducting

work agreements, so that the value of sales or

purchases of raw materials that we do are not

subject to increases or decreases in the exchange

rates of these currencies.

4. The mining industry must pay more attention to

the export ratio and continue to monitor its

progress so that it is still in good condition and

under control because the export ratio is a

variable that influences economic exposure and

also affects the value of the company. Where in

maintaining stability, companies engaged in the

mining industry must better understand and

master the techniques of using derivative

instruments such as SWAP and Hedging, where

hedging is a variable that plays an important role

in economic exposure for companies that

conduct international trade. But in this study

hedging has no significant effect on economic

exposure in the manufacturing industry only in

the mining industry hedging has a positive and

significant effect on economic exposure and on

the value of the company through economic

exposure. Mining is more significant because

Indonesia is rich in natural products in the form

of mining materials such as gold, aluminum,

coal, nickel and so on. However, some

companies have not directly processed it into

finished goods and have chosen to export raw

materials and re-import after being semi-finished

goods so that mining more often applies hedging

policies to protect the value of export sales and

import activities from their mining products.

5. This research is expected to be able to

complement previous research related to

economic exposures and can add references or

knowledge about economic exposure in a

subsequent scientific work by adding more

extensive independent variables.

6. This research is expected to be an input for

financial managers to pay more attention to any

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

626

company internal factors that influence the

occurrence of economic exposure in its

operational activities.

REFERENCES

Abdullah, M. Faisal (2005). Dasar - dasar Manajemen

Keuangan. Edisi Kedua. Cetakan Kelima. Malang :

Penerbitan Universitas Muhammadiyah.

Amirullah dan Widayat, (2002). Riset Bisnis. Edisi

Pertama. Yogyakarta : Graha Ilmu.

Anggraeni (2004).“The Foreign Exchange Exposure pada

Bank – Bank Go Public di BEJ”. Jurnal Ventura Vol.

7 No. 2.

Cheung, Y. W., M. D. Chinn & A. G. Pascual. (2005).

“Empirical Exchange Rate Models of the Nineteens:

Are Any Fit to Survive?”. Journal of International

Economics

El-Masry, A. A. (2006). “The Exchange Rate Exposure of

UK Non-Financial Companies: Industry Level

Analysis”. Managerial Finance, Vol. 32(2),115-136.

Faisal (2001) Manajemen Keuangan Internasional. Edisi

Pert. Jakarta: Salemba Empat.

Ginting, Paham & Syafrizal Situmorang (2008) Filsafat

Ilmu dan Metode Riset. Medan: USU Press.

Hudiwinarti, G. (1998) “Pengukuran Economic Exposure

Dan Faktor-Faktor Yang Mempengaruhinya Pada

Kelompok Perusahaan Barang Konsumsi Yang Go

Public Di Bursa Efek Jakarta".(Tesis). Jakarta.

Universitas Indonesia, Program Pascasarjana.

Kanagaraj, A. dan Sikarwar, E. (2011) “A Firm Level

Analysis of the Exchange Rate Exposure of Indian

Firms,” Journal of Applied Finance & Banking.

Kuncoro, M. (2000) Manajemen Keuangan Internasional:

Pengantar Ekonomi dan Bisnis Global. Edisi Kedua.

Yogyakarta: BPFE.

Kurniawati Sri Lestari & Anggraeni (2004) “Forex

Exposure Pada Berbagai Sektor Industri Yang

Terdaftar Di Bursa Efek Jakarta.” Tersedia pada:

puslit2.petra.ac.id/ejournal/index.php/nas/article/view/

17176/17124.

Nance, D. R., Clifford W. Smith, J., & Smithson, C. W.

(1993)."On The Determinant of Corporate Hedging".

The Journal of Finance, Volume 48 (1), 267-284.

Nur, W. A. N., Binti, I. dan Ahmad, W. A. N. (2015)

“Foreign Exchange Exposure And Its Determinants

Among Some Listed Companies From Selected

Sectors In Malaysia.”

Pritamani, M. D., Shome, D. K. dan Singal, V. (2004)

“Foreign Exchange Exposure Of Exporting And

Importing Firms,” Journal of Banking and Finance.

doi: 10.1016/j.jbankfin.2003.06.002.

Susilowati (2015) “Eksposur Nilai Tukar Rupiah Dan

Return Saham Pada Perusahaan Yang Terdaftar Di

Indeks Kompas 100.” Yogyakarta: Universitas Gadjah

Mada.

Wulandari, D. L. (2013) “Analisis Variabel Fundamental

yang Berpengaruh Terhadap Eksposur Ekonomi

Perusahaan Industri Komoditas Pertambangan yang

Terdaftar di Bursa Efek Indonesia Periode 2006-

2010". Fakultas Ekonomi dan Bisnis. Malang :

Univeristas Brawijaya.”

The Analysis of Exposure Economic on the Value of Manufacturing and Mining Industry

627