Analysis the Interdependence of Foreign Debt and Economic Growth

in Indonesia

Mayani Pratiwi Pasaribu

1

, Muhammad Fitri Rahmadana

2

and Fitrawaty

2

1

Graduate Faculty State University Of Medan, Medan – Indonesia

2

Faculty of Economic, State University Of Medan, Medan - Indonesia

Keywords: Foreign Debt, Economic Growth

Abstract: This research is aimed to analyze interdependence of foreign debt on economic growth in Indonesia.

Methods used in this research with Vector Autoregression (VAR), by using time series yearly data from

1991 to 2016. Model analysis tools obtained is estimation results obtained, the relationship between the two

variables, namely external debt and economic growth have a 2-way relationship or feedback, meaning that

both variables affect each other. And based on the results of the unit root test (Unit Roots Test), the

relationship between the two variables external debt and economic growth have a relationship stationary at

first differences which means that there is a long-term relationship between external debt and economic

growth in Indonesia.

1 INTRODUCTION

Sustainable development is needed to improve the

economy of a country. Indonesia, as the country is

developing, it has obstacles in realizing development

programs for national prosperity. The government

faces the problem of limited capital to finance

development. This is due to the gap in income and

expenditure or the existence of a development

budget deficit. The Indonesian government carries

out various policies including implementing foreign

debt policies.

According to the Big Indonesian Dictionary, debt

is money that borrowed from other people. While

etymologically, debt or debt (English) comes from

the French term dette or Latin term debit which

means "the one who owes”. The term debtor is said

to have been first used in English in the early 13th

century.

The Big Indonesian Dictionary also defines loans

as debts borrowed from other parties with the

obligation to repay. Whereas Foreign Loans are a

number of funds obtained from other countries

(bilateral) or (multilateral) which are reflected in the

balance of payments for investment activities, close

the saving-investment gap and foreign exchange gap

that is carried out by both the government and the

private sector.

According SKB Menteri Keuangan and Kepala

Bappenas (No. 185/KMK.03/1995 dan Nomor

KEP.031/ KET/5/1995) Foreign Loans are state

revenues in the form of foreign exchange, or foreign

exchange that is ratified or in the form of goods and

services obtained from the provision of foreign loans

that must be repaid with certain conditions.

People, companies and countries institutionally

are never separated from the practice of debts. Not

only for business purposes, but also for meeting

consumer needs. In business, debt is considered a

common thing to increase business capital.

Something similar happened in the governance of a

country. Almost all countries, have even continued

to owe to add funds or national development capital.

Indonesia, as a developing country, has a long

history of debt or loans to external parties, both

bilaterally and multilaterally through international

and regional financial institutions.

Lincolin Arsyad (2010) said foreign debt is a

source of funding for government budgets and

economic development. External debt is used to

finance state expenditure so that it can support

economic activities, especially productive activities

so that in turn it will encourage economic growth.

Debt is usually used to finance budget deficits.

Foreign debt can be a variable that can drive the

economy while hampering economic growth.

Encourage the economy to mean, if the debts are

used to open employment and investment in the

Pasaribu, M., Rahmadana, M. and Fitrawaty, .

Analysis the Interdependence of Foreign Debt and Economic Growth in Indonesia.

DOI: 10.5220/0009510406430649

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 643-649

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

643

0

2E+11

4E+11

6E+11

8E+11

1E+12

1.2E+12

1991

1994

1997

2000

2003

2006

2009

2012

2015

stokULNtotal

(miliardollarAS)

GDP(constant

2010US$)

development sector which can ultimately drive an

economy, while inhibiting growth if the debts are

not used optimally because there is still a lack of

oversight function of the person in charge of the

debts themselves.

Source: worldbank.go.id

Figure 1: Graph of the development of foreign debt

and economic growth in Indonesia from 1991-2016

Based on the graph above that shows the total

external debt and GDP both fluctuate. But from

2007 to 2016 the total external debt and GDP

experienced an increase every year. Foreign debt

continues to increase because the government cannot

meet the needs of the economy. And GDP that

continues to increase is supported by growth in

public consumption, government and private

investment, and other things are not discussed in this

study.

Normatively, every foreign debt is used by

Indonesia is for development expenditure. The hope

is to participate in financing various development

projects and creating economic growth as indicated

by rising GDP values and creating jobs, which in

turn can contribute to reducing poverty.

In practice, not all foreign debt is spent on

development spending. Some of the debt is actually

used to cover the principal and interest installments.

Hernatasa's research (2004) found the existence of

Fisher Paradox, a situation where more and more

foreign debt repayments were made, the greater the

accumulation of foreign debt. A similar condition

was stated by other researchers that installments plus

interest on foreign debt were substantially financed

by new debts resulting in a net transfer of financial

resources from Indonesia to foreign creditors

(Swasono dan Arief, 1999).

This condition is certainly not profitable. This is

because most of the funds from the State Budget

(APBN) are expected to drive the economy, turned

out to be sucked in by routine expenditures, most of

them which were realized in principal installments

and debt interest. The payment of principal and

interest on foreign debt has an effect on the economy

because in certain conditions the installment

payments can have a negative impact on the

economy there by eliminating the positive

contribution of foreign debt.

Foreign debt is needed to have a positive

influence on economic growth such as by increasing

production (GDP), expand employment

opportunities and improve balance of payments.

However, if the debt is used improperly then the

possibility of being able to have a negative impact

on economic growth even threatens the country's

macroeconomic stability.

Rachmadi (2013:13) said that Indonesia's

Foreign Debt is able to encourage Indonesia's

Economic Growth. Economic sectors that absorb

foreign debt are quite high, proven to show

increasing GDP growth.

Atmadja (2000) said that in the short term,

foreign debt is very helpful for the Indonesian

government in its efforts to cover the budget deficit

of state revenues and expenditures, due to the

financing of routine expenses and considerable

development expenditures. But in the long run, it

turns out that the government's foreign debt can

cause various economic problems in Indonesia, one

of which can cause the rupiah exchange rate to fall.

Foreign debt is like development capital. Foreign

debt can increase investment activities so that

domestic needs can be met. In the economy of a

country there is an indicator that is used to assess

whether the economy is going well or badly.

Indicators in assessing the economy are reflected in

GDP growth.

With all the reviews above, in this study, the

author will discuss how the reciprocal relationship

between foreign debt and economic growth in

Indonesia.

2 THEORICAL FRAMEWORK

Foreign debt

Foreign debt is part of the total state debt obtained

from creditors outside the country. Recipients of

foreign debt can be in the form of governments,

companies or individuals. The form of debt can be in

the form of money obtained from private banks,

governments of other countries or international

financial institutions.

Indonesia is one of the third world countries.

Before the monetary crisis in the Southeast Asia

region, Indonesia had a fairly high economic growth

rate. This is in line with the economic development

strategy reserved by the government at that time,

which placed high economic growth as a priority

target of national economic development.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

644

Indonesia's economic growth since the end of the

1970 has always been positive, and the level of

income per capita is relatively low, causing the

relatively high target of economic growth to be

insufficiently financed with own capital, but it must

be supported by using foreign capital assistance. The

government which initially became the main motor

of development continues to increase its foreign debt

so that it can be used to finance national economic

development in order to achieve the target of such a

high level of economic growth, without being

accompanied by an increase in the ability to

mobilize capital in the country. This indicates a

positive correlation between the success of

economic development at the macro level and an

increase in the amount of government foreign debt

(growth with indebtedness) (Atmadja, 2000).

EVIEWS application for the VAR:

Stationarity test, optimum lag selection,

Cointegration Test, Vector error correction model

(VECM), Instrument vector Autoregression.

ܲܧ

௧

ൌ ܽ

ܷܮܰ

௧

െ݅ ܾ

ܲܧ

௧ି

ߜݐ

ୀଵ

ୀଵ

ܷܮܰ

௧

ൌ ܿ

ܷܮܰ

௧

െ݅ ݆

ܲܧ

௧ି

ߣݐ

ୀଵ

ୀଵ

It is assumed that δt and λt are not

correlated.

PE = Economic Growth

PEt-j = Economic Growth Lag

ULN = foreign debt

ܷܮܰ

ݐ

െ݅ = foreign debt Lag

Economic growth

In general, economic growth is defined as an

increase in the ability of an economy to produce

goods and services. Economic growth is one of the

most important indicators in carrying out an analysis

of economic development that occurs in a country.

Economic growth shows the extent to which

economic activity will generate additional

community income in a given period. Because

basically economic activity is a process of using

production factors to produce output, then this

process in turn will result in a return of service to the

factors of production owned by the community.

With the economic growth, it is expected that

people's income as the owner of production factors

will also increase (Sukirno, 2006: 423).

Factors that influence economic growth

according to Sukirno (2010: 429) include: land and

other natural wealth; the number and quality of the

population and labor; capital goods and technology

level; social system and attitudes of the community;

market area as a source of growth.

3 RESEARCH METHOD

This study will examine the analysis of foreign debt

and economic growth in Indonesia (Cointegration

Method) during the period 1991-2016. Problems in

this study will be analyzed using vector

autoregression. Simply put, VAR describes a

relationship that "causes each other" (causality)

between variables in the system, by adding an

intercept. Outcome data were analyzed using the

EVIEWS application for the VAR: Stationarity test,

optimum lag selection, Cointegration Test, Vector

error correction model (VECM), Instrument vector

Autoregression.

4 RESULT AND DISCUSSION

1. Stationary Data Test

Stationary data testing can be done with the graph

method and unit root method. Unit root test is used

augmented Dickey-fuller test (ADF) if the value of

absolute statistics t is smaller than the critical value

in the MacKinnon table at various levels of

confidence (1%, 5% and 10%). Then indicates data

is not stationary. Besides that it can also be seen in a

prob value greater than 0.05 which also indicates

that the data is not stationary. Conversely, if the

ADF value is greater than the critical value of

various levels of confidence (1%, 5% and 10%),

then there is no unit root or stationary data.

Table 1: ADF Test

Variable

Unit

Roo

t

Include in test

equation

ADF Test

Statistic

Critical

Value 5%

Probability Information

Foreign

Debt

Level Intercept -0,383176 -2.991878 0.8972

Stasioner

b

ut

not

significan

t

First Diff Intercep

t

-3.021560 -2.991878 0.0471 Stasione

r

Economic

Growth

Level Intercep

t

-4.771149 -2.991878 0.0008 Stasione

r

First Diff Intercep

t

-7.082076 -2.991878 0.0000 Stasione

r

Analysis the Interdependence of Foreign Debt and Economic Growth in Indonesia

645

Table 1, it can be explained that the ADF test value

for foreign debt rates is smaller than the critical

value of 5%, means that it is stationary both at the

level but not significant, so first data is taken which

is stationary & significant. And the Economic

Growth variable is stationary at level, first different

but to equalize the data then first different is taken.

For second different in this study it was not tested

again.

2. Optimal Lag Length Test

The VAR approach is very sensitive to the amount

of data lag used, therefore it is necessary to set the

optimal lag length. Determination of the length of

the lag is used to determine the length of the period

of influence on an endogenous variable with the past

time and other endogenous variables. Determination

of length of lag can be seen from the values of the

LikelihoodRratio (LR), Final Prediction Error (FPE),

Akaike Information Criterion (AIC) and Schwarz

information (SC). Values can be seen from table 2,

the results of the optimal lag length test below.

Table 2: Optimum Lag Length Test

VAR Lag Order Selection Criteria

Endogenous variables: DLGDP DLULN

Exogenous variables: C

Date: 11/26/18 Time: 22:15

Sample: 1991 2016

Included observations: 22

Lag LogL LR FPE AIC SC HQ

0 -26.88643 NA 0.047378 2.626039 2.725225 2.649404

1 -19.00813 13.60796* 0.033411* 2.273467* 2.571024* 2.343562*

2 -18.04356 1.490709 0.044593 2.549414 3.045343 2.666240

3 -17.10400 1.281208 0.060667 2.827637 3.521936 2.991193

Table 3: Granger Causality Test

Pairwise Granger Causality Tests

Date: 11/26/18 Time: 22:18

Sample: 1991 2016

Lags: 1

Null Hypothesis: Obs F-Statistic Prob.

DLULN does not Granger Cause

DLGDP

24 0.14953 0.7029

DLGDP does not Granger Cause 24

DLULN

0.00183 0.9662

In table 3 all variables have a reciprocal

relationship or have a significant two-way

relationship at the level of 5% (probability> 0.05) in

lag 1. It means that foreign debt affects economic

growth but not significantly.

3. Results of Analysis of causality granger

Granger causality test between research variables is

intended to find out the causality relationship

between variables (Nachrowi, 2006: 289). From the

following table the results of these tests can be

known to be reciprocal relationships.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

646

4.Cointegration Test Results

Cointegration means there is a long-term

relationship (balance). In the short term and the

possibility of imbalance (disequilibrium). Because

of this imbalance, correction is needed with an error

correction model introduced by Sarga, developed by

Hendry and popularized by Engle and Granger

(Winarno, 2006: 11.7-11.9). There are three ways to

test cointegration, namely 1) Engle Grenger

Cointegration Test 2) Cointegration regression

Durbin Watson 3) Johansen test.

This study uses the johansen test, with the

johansen test, compared the value of the trance

statistic with the critical value at the confidence

level of 5% and 1%. If the value of the trance

statistic is smaller than the critical value, it can be

concluded that the two variables are not mutually

integrated (Winarno, 2006: 11.7).

Through the Johansen cointegration test in Table

5 below, there appears a trace statistic value> critical

value at a 5% confidence level. Thus indicating both

variables mutually co-ordinate. This cointegeration

is also shown in the notes below the table that says

"Trace test indicates 2 cointegrating eqn (s) at the

0.05 level".

Table 4: Johansen's Co-integration Test

Date: 11/26/18 Time: 22:50

Sample (adjusted): 1994 2016

Included observations: 23 after adjustments

Trend assumption: Linear deterministic trend

Series: DLGDP DLULN

Lags interval (in first differences): 1 to 1

Unrestricted Cointegration Rank Test (Trace)

Hypothesized Trace 0.05

No. of CE(s) Eigenvalue Statistic Critical Value Prob.**

None * 0.510925 20.95249 15.49471 0.0068

At most 1 * 0.177774 4.502011 3.841466 0.0338

Trace test indicates 2 cointegrating eqn(s) at the 0.05 level

* denotes rejection of the hypothesis at the 0.05 level

**MacKinnon-Haug-Michelis (1999) p-values

Unrestricted Cointegration Rank Test (Maximum Eigenvalue)

Hypothesized Max-Eigen 0.05

No. of CE(s) Eigenvalue Statistic Critical Value Prob.**

None * 0.510925 16.45048 14.26460 0.0222

At most 1 * 0.177774 4.502011 3.841466 0.0338

Max-eigenvalue test indicates 2 cointegrating eqn(s) at the 0.05 level

* denotes rejection of the hypothesis at the 0.05 level

**MacKinnon-Haug-Michelis (1999) p-values

Unrestricted Cointegrating Coefficients (normalized by b'*S11*b=I):

DLGDP DLULN

-0.716983 -0.925173

-0.096663 -18.03208

Unrestricted Adjustment Coefficients (alpha):

D(DLGDP) 2.789485 -0.158747

D(DLULN) -0.007701 0.027157

1 Cointegrating Equation(s): Log likelihood -24.91166

Analysis the Interdependence of Foreign Debt and Economic Growth in Indonesia

647

Normalized cointegrating coefficients (standard error in parentheses)

DLGDP DLULN

1.000000 1.290370

(5.55576)

Adjustment coefficients (standard error in parentheses)

D(DLGDP) -2.000014

(0.45317)

D(DLULN) 0.005522

(0.01067)

The next indicator based on the results of the co-

operation test, there is no sign of co-integration with

the symbol (*) at most 1. If there are marked (**) or

(*) at least one, then the equation must be solved by

the VECM method (Vector Error Correction Model)

Based on Johansen's co-integration test of the two

variables in the equation system, we can find out the

number of possible relationships.

Seen in the table above that there are:

• The trace test identifies 1 cointegration equation

at the level of 5%.

• At the Max Eigenvalue test identify there is a

cointegration equation at the level of 5%.

Thus, between the variables of Foreign Debt and

Economic Growth in Indonesia there is a

relationship between long-term balance stability and

movement in the long run, while in the short term all

variables are mutually adjusted to achieve long-term

balance.

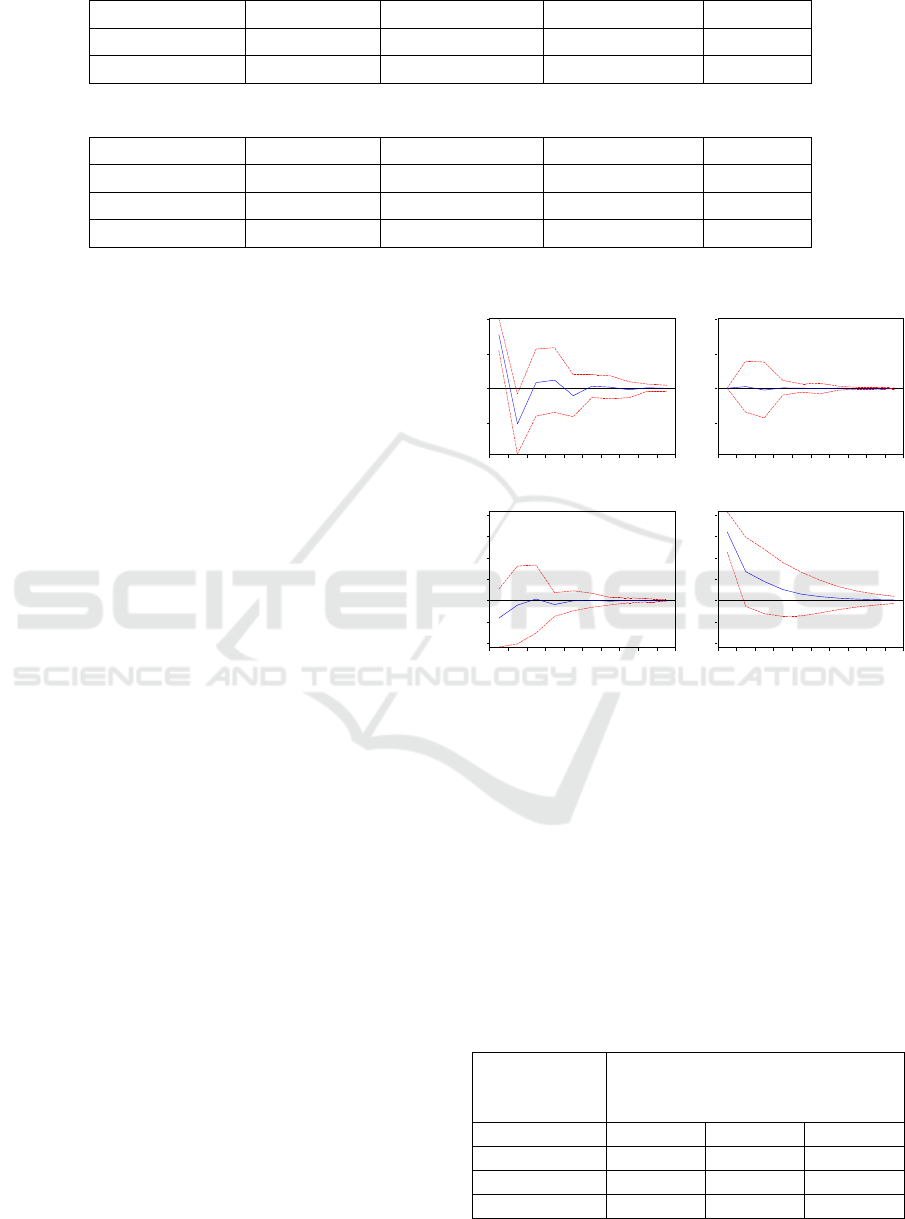

5. Impulse Response Analysis and Variance

Decomposition

• Impulse Response Analysis

Figure 2 shows the Impulse of Foreign Debt

Response to Economic Growth, and the Response of

economic growth to foreign debt.

-2

0

2

4

1 2 3 4 5 6 7 8 9 10

Response of DLGDP to DLGDP

-2

0

2

4

1 2 3 4 5 6 7 8 9 10

Response of DLGDP to DLULN

-.04

-.02

.00

.02

.04

.06

.08

1 2 3 4 5 6 7 8 9 10

Response of DLULN to DLGDP

-.04

-.02

.00

.02

.04

.06

.08

1 2 3 4 5 6 7 8 9 10

Response of DLULN to DLULN

Response to Cholesky One S.D. (d.f. adjusted) Innovations ± 2 S.E.

Figure 2: Foreign Debt Response to Different

Economic Growth

• Analysis of Variance Decomposition

After analyzing the dynamic behavior of the model

through impulse response functions, then the

characteristics of the model will be seen through

Variance Decomposition. The results of variance

decomposition can be seen in table 5 where

fluctuations in Differences in Economic Growth are

influenced by Foreign Debt. In the second period the

highest economic growth of 99.93% continued to

decline until the tenth period to 99.86%. Conversely

the effect of profit sharing experienced an opposite

increase starting from 0.0687% in the second period

to 0.1479% in the 10th period.

Tabel 5: Variance Decompotion Test

Variance

Decomposition

of DLGDP:

Period S.E. DLGDP DLULN

1 3.109088 100.0000 0.000000

2 3.728966 99.93126 0.068741

3 3.744707 99.85681 0.143188

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

648

4 3.774806 99.85350 0.146503

5 3.798797 99.85477 0.145235

6 3.800908 99.85241 0.147589

7 3.801390 99.85205 0.147947

8 3.802274 99.85212 0.147879

9 3.802433 99.85206 0.147944

10 3.802436 99.85203 0.147966

Variance

Decomposition

of DLULN:

Period S.E. DLGDP DLULN

1 0.066567 6.253329 93.74667

2 0.071958 5.724630 94.27537

3 0.074124 5.423298 94.57670

4 0.074926 5.578608 94.42139

5 0.075154 5.548120 94.45188

6 0.075237 5.536035 94.46397

7 0.075269 5.542479 94.45752

8 0.075278 5.541134 94.45887

9 0.075281 5.540655 94.45934

10 0.075283 5.540893 94.45911

Cholesky Ordering: DLGDP DLULN

5 CONCLUSIONS

After analyzing the research above, the author

concludes as follows:

1. Foreign Debt and Economic Growth are closely

related and influence each other. Increasing

Economic Growth has a positive effect on

Foreign Debt. In the long run, the relationship

between Foreign Debt and economic growth

tends to be stable but the short term tends to

decrease.

2. Johansen's cointegration test appears trace

statistic value > critical value at 5% confidence

level. Thus identifying both mutually integrated

variables.

SUGGESTION: It is necessary to do further studies

by using variables outside that used in this study..

REFERENCES

Arends, R. I. (2008) LEARNING TO TEACH (Belajar

Atmadja, A. S. (2000). Utang Luar Negeri Pemerintah

Indonesia: Perkembangan dan Dampaknya. Jurnal

Akuntansi dan Keuangan, 02 (01), 83-94.

Arsyad, Lincolin. (2010). Ekonomi pembangunan.

Yogyakarta: UPP STIM YKPN.

Hernatasa. (2004). Analisis utang luar negeri Indonesia

terhadap pertumbuhan ekonomi. Bogor: Tesis SPS-

IPB).

Rachmadi, A. L. (2013). "Analisis Pengaruh Utang Luar

Negeri Terhadap Pertumbuhan Ekonomi Indonesia

(Studi Kasus Tahun 2001-2011)".Jurnal Ilmiah

Sukirno, S. (2010). Makroekonomi Teori Pengantar Edisi

ke tiga. Jakarta: PT Raja Grafindo Persada.

Sukirno, S. (2006). Makroekonomi: Teori Pengantar.

Jakarta: PT Raja Grafindo Persada.

Swasono, S.E. dan Arief S. (1999). Pembangunan tanpa

utang: utang luar negeri dan ekonomi indonesia.

Republika, 15 Desember 1999.

Analysis the Interdependence of Foreign Debt and Economic Growth in Indonesia

649