Financial Inclusion and Bank Efficiency

Muhamad Faeqi Hadi Saputra

1

and Mariani Abdul-Majid

1

1

Fakulti Ekonomi dan Pengurusan, Universiti Kebangsaan Malaysia, Bangi, Malaysia

Keywords: Efficiency, Financial Inclusion, SFA, Bank Performance

Abstract: This paper uses stochastic frontier analysis to examine whether the impact of financial inclusion on bank

efficiency. Using an international sample of 2,207 banks in 70 countries over period 2008-2016. We found

that increasing financial inclusion using technology more effective in terms of cost for banks comparable to

conventional methods. More specifically, we find that financial inclusion on access dimension proxied by

ATM per 1,000 km

2

have a negative relationship with cost inefficiency, while branch per 100,000 adults

has a positive relationship with cost inefficiency. Moreover, we find evidence that financial inlusion on

used dimension proxied by deposit accounts per 1,000 adults show that positive effect on cost efficiency.

These findings show that financial products and services are innovation based on technology must be

improved. Technological innovation is key implication for policy makers, bank regulators, and industry

players to create more financial inclusiveness for people.

1 INTRODUCTION

Expanding formal financial access to low-income

has become an important concern for many countries

worldwide, World Bank state on Demirguc-Kunt et

al., (2015), more than two-thirds of regulatory and

supervisory institutions have been tasked with

encouraging financial inclusion in more than 50

countries. It makes sense because many studies state

that the financial sector has a positive impact on the

economic growth and stability of developing

countries (Paşali, 2013) Other studies found that by

removing barriers to access to formal finance would

increase funding. (Allen, 2012). This can be a source

of financing for people who have not accessed to

finance for consumption activities or business

purposes, which will increase the economy due to

the creation of employment (Guiso, Sapienza and

Zingales, 2004; Allen et al., 2012; Banerjee et al.,

2015). Hence, reduce income inequality and

indirectly decrease poverty (Burgess and Pande,

2005; Beck, Demirgüç-Kunt and Levine, 2007;

Bruhn and Love, 2014)

In the other perspective, banks as financial

institutions also required maintaining sustainability

and efficiency in order to cover the costs has been

incurred, especially increasing competition and

technological developments encourage banks to

change their behavior and to expand their services

and activities. Furthermore, the question that arises

is how to affect financial inclusion on bank

efficiency.

We use Stochastic Frontier Analysis to analyses

impact financial inclusion on bank efficiency in 70

countries period 2008-2016. For measure financial

inclusion, we used two dimensions: the first

concerns the outreach or access to financial services

while the second relates to the use of financial

services The findings show that ATM density and

deposit bank accounts have a positive impact on cost

efficiency while Branches have negative relations

with cost efficiency. This suggests that increasing

financial inclusion using technology more effective

in terms of cost for banks comparable to

conventional methods.

This study contributes to both the existing

literature by providing new evidence on the impact

of financial inclusion on bank cost efficiency using

an international sample. Many studies have been

done on the effect of financial inclusion on

economic growth(Paşalı, 2013), poverty (Bruhn and

Love, 2014), unemployment (Beck, Demirguc-Kunt

and Martinez Peria, 2007). A Very limited study has

been done on the relationship between financial

inclusion and bank performance. We suggest

improving financial inclusion using technology will

1294

Saputra, M. and Abdul-Majid, M.

Financial Inclusion and Bank Efficiency.

DOI: 10.5220/0009510712941300

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 1294-1300

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

improve bank efficiency. This study examine impact

financial inclusion on banks’ efficiency, thus adding

a new perspective and enrich upon earlier works on

relative efficiencies determinant and financial

inclusion literature. We highlight the impact of

financial inclusion on the relative bank cost. This

paper structured as follows, Section 2 provides a

brief overview of financial inclusion, Section 3

presents the data and methodology, Section 4

provides Result and last section 5 Conclusion.

2 THEORICAL FRAMEWORK

2.1 Financial Inclusion

There are several concepts offers in defining

financial inclusion, for example, Amidžić, Massara

and Mialou (2014), state financial inclusion is an

economic environment where individuals and firms

are not denied access to basic financial services.

Sarma (2016) defines the process that ensures the

ease of access, availability and usage of the formal

financial system for all members of an economy.

Many studies suggest that financial inclusion have

positive impact on economic development and

poverty reduction. For instance Beck, Demirguc-

Kunt and Martinez Peria (2007), find that Increasing

degree of financial inclusion have social and

economic benefit.Supported by Bruhn and Love,

(2014) showing that greater financial inclusion

reduces poverty, income inequality and

unemployment. This confirmed by Allen et al.,

(2012), found that increased bank penetration of

commercial banks has a positive and significant

impact on household’s use of bank accounts and

bank credit particularly those with low income, no

salaried job, and less education in Kenya

For measurement studies, financial inclusion

can be understood through two broad dimensions:

The first concerns the outreach or access to financial

services while the second relates to the use of

financial services (Beck, Demirguc-Kunt and

Martinez Peria, 2007; Amidžić, Massara and

Mialou, 2014). Focusing on outreach dimension

refers to ability customer to easily reach access to

bank physical outlet. Data from the World Bank’s

Global Financial Inclusion Index (Findex) survey

reveal that of the 2.5 billion individuals excluded

from financial systems globally, about 20 percent

cite the long distances to reach access financial

service as the prime reason for not having an

account with a formal financial institution (Allen et

al., 2012). The literature suggests some proxies that

commonly to capture outreach or access dimension

are Automated Teller Machines (ATM) per million

people and a number of bank Branches per million

people. other indicators of banking sector outreach

have been used geographic Automated Teller

Machines (ATMs) per 1,000km2 and number of

bank Branches per 1,000km2 (Beck, Demirgüç-Kunt

and Levine, 2007; Ahamed et al., 2017; Sarma,

2016; Gopalan and Rajan, 2018). Higher branch and

ATM intensity in demographic and geographic

indicate that greater access to financial services by

households and enterprises (Gopalan and Rajan,

2018). Viewed from the perspective cost, ATMs are

much more cost-effective and require the least

amount of investment commitment relative to

establishing bank branches or allowing deposit-

taking functions (Damar, 2006).

We use ATM per 1,000km

2

and bank branch

100,000 adult to capture outreach dimension (Beck,

Demirgüç-Kunt and Levine, 2007; Allen et al.,

2016; Sarma, 2016; Gopalan and Rajan, 2018). For

usage dimension of financial inclusion we employs a

number of deposit accounts per capita defined as the

number of deposit account per 1,000 people.

2.2 Bank Efficiency and Financial Inclusion

The existing literature on the performance analysis

of banks classified into several types: financial

ratio(Ou et al., 2009) , SFA approach ((Fries and

Taci, 2005; Abdul-Majid, Saal and Battisti, 2011;

Alexakis et al., 2018), DEA approach (Berger,

Hasan and Zhou, 2010; Mobarek and Kalonov,

2014; Giordani and Floros, 2015). We use SFA

measure efficiency. This model allows us to control

for environmental factors by simultaneously

estimating the parameters of the stochastic frontier

and the inefficiency model, based on the assumption

that efficiency differences between banking

industries are determined by financial inclusion,

macro indicator and bank-specific characteristics

variables. We found that there was lack literature

that discussed financial inclusion and efficiency,

even though the literature that discussed directly

analyzing costs efficiency and financial inclusion

did not yet exist, but there were several studies that

had examined them separately. (Ou et al., 2009)

investigating impact of ATM intensity on cost

efficiency in Taiwan show that ATM intensity

shows that ATM intensity positively impacts banks’

cost efficiency. But different result also evidence by

(Damar, 2006) Using a Data Envelopment Analysis

(DEA) approach The find that participation in shared

ATM networks has failed to increase efficiency of

small and medium-size banks in turkey. However,

these studies do not include for any financial

inclusion with many dimension directly in the

estimated costs function or as directly influencing

inefficiency. Our model below will improve on this

earlier study by including for such usage and service

Financial Inclusion and Bank Efficiency

1295

or outreach dimension of financial inclusion and

considering their impact on cost efficiency.

3 RESEARCH METHOD

The study uses unbalanced panel data included 70

countries from 2008-2016, which consist of 14091

observations, obtained from 2606 CBs and 55 IBs.

All data on the bank’s financial statements collected

from Bureau van Dijk and Fitch Ratings (Abdul-

majid, Saal and Battisti, 2010; Ahamed et al.,

2017).The macro data compiled from the World

Development Indicators (WDI) World Bank. The

variables used to measure financial inclusion

compiled from the IMF FAS database (Sarma,

2016; Kim, Yu and Hassan, 2017).

In our analysis, we estimate cost efficiency

and measure impact financial inclusion on cost

efficiency. For cost efficiency, the frontier is

defined by the potential minimum cost, and the

actual cost lies above the minimum frontier owing to

inefficiency, inefficiencies are measured in

comparison with an efficient cost frontier. Most

studies on cost efficiency use data envelopment

analysis (DEA) or stochastic frontier analysis (SFA)

to calculate this frontier. As a significant number of

previous bank studies have adopted a cost function

approach (Ferrier and Lovell, 1990; Fries and Taci,

2005; Abdul-Majid, Saal and Battisti, 2011). A

single equation stochastic cost function model

described as:

ln𝐶

ln𝐶 𝑌

, 𝑊

,𝛿

;𝐵 𝑢

𝑣

,𝑖

,….,𝑁,t ,…,time

Where 𝐶 is the observed cost of bank𝑖 time 𝑡 ,

𝑌

is a vector of output, 𝑊

is a vector of input

prices 𝑖, 𝐵 is a vector of parameters to be estimated

and 𝛿

is a vector of control variables that include

bank-specific variables which are added to the

model as they may explain part of the efficiency

differences between banks. Next, 𝑣

is a two-sided

error term representing the statistical noise, while 𝑢

represents non-negative variables that account for

inefficiency, for both assumed to be independently

and identically distributed.

Maximum-likelihood estimates are obtained by

estimating a multiproduct translog cost function. The

specified cost function including environmental

variables can be written as:

ln𝑇𝐶

𝛼

𝛼

𝑙𝑛 𝑦

𝛽

𝑙𝑛𝑤

1

2

𝛼

𝑙𝑛 𝑦

𝑙𝑛 𝑦

1

2

𝛽

𝑙𝑛𝑤

𝑙𝑛𝑤

𝑙𝑛 𝜒

𝑙𝑛𝑦

𝑙𝑛𝑤

𝜃

𝑡

1

2

𝜃

𝑡

𝜑

𝑙𝑛 𝑦

𝑡

𝜌

𝑙𝑛𝑤

𝑡𝜁

𝑍

𝜀

𝑢

𝑣

Where,

𝑤

and 𝑇𝐶

Where ln𝑇𝐶

is is the observed total cost of

firm i, 𝑦

is the m-th output, ln 𝑤

is n-th input

price, 𝑍

represent other explanatory variable that

effect the total cost, T is a time trend that capture for

technological change and 𝛼,𝛽,𝜒,𝜃,𝜑,𝜌 and 𝜁 is

parameter to be estimated . The components of

composite error term 𝜀

𝑢

𝑣

𝑢

capture cost

inefficiency and 𝑣

is a random error. The cost

function is assumed to be non-decreasing, linearly

homogenous and concave in input prices, which is

satisfied if each of the β

n

is non negative they

combine to satisfy the homogeneity constraints,

∑

𝛽

1

We simplify by imposing symmetry

constraints, 𝛼

= 𝛼

and 𝛽

𝛽

.

Measurement of cost efficiency requires

data on total costs, outputs and input prices. The

dependent variable is total cost (TC), which includes

both interest and operating costs, bank outputs as

loans for conventional banks or financing for Islamic

banks (𝑌

) and other earning assets (𝑌

) . While input

included price of funds (𝑤

) equals total interest

expenses on deposit and non-deposit funds divided

by total deposit, price of labour (𝑤

) equals total

expenditure on employee, such as salaries and

allowances over total asset. Price of capital (𝑤

)

equal other operating expenses over fixed asset.

Furthermore, we included bank specific

variable, used profitability measured by the Return

on Average Equity (ROAE) (ζ

1

), loan quality (ζ

2

)

measured by the ratio of non-performing financing

or loans to total financing for Islamic bank and total

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1296

loan for conventional bank (Abdul-majid, Saal and

Battisti, 2010). Furthermore, we use Islamic bank

dummy (ζ

3

) to capture differences in bank

characteristics and operating environment that may

influence costs.(Abdul-Majid, Saal and Battisti,

2011; Alqahtani, Mayes and Brown, 2016)

To investigate the factors that are correlated

to bank inefficiencies𝑢

, we use the single step

estimation of the cost function and inefficiency

function. The inefficiency component 𝑢

is

assumed to be a function of set of explanatory

variables 𝛿

and a vector of coefficients (𝜆) to be

estimated. In other words:

𝑢

𝜆𝛿

𝜔

There are several variables included in our

model that variables grouped into two categories.

The first category is the macroeconomic condition

and consists measured by GDP growth(𝛿

and

individual using internet per % of Population (𝛿

.

This variable explains the macro conditions under

which the bank operates. We suggest that it will help

facilitate financial inclusion, in general play a

critical role in improving efficiency.(Thompson and

Garbacz, 2007; Gopalan and Rajan, 2018). We

expect to help to reduce cost inefficiency.

The second category is financial inclusion,

included two dimensions: the first concerns the

outreach or access to financial services measured by

automated teller machines (ATMs) per

1,000km

2

𝛿

and a number of bank branches

100,000 adult (𝛿

(Beck, Demirgüç-Kunt and

Levine, 2007; Amidžić, Massara and Mialou, 2014)

We suggest that ATM density have negative impact

on bank inefficiency

Next, several studies have identified branch

expansion as a negative factor for bank efficiency as

it can lead to cost increases, particularly with respect

to employees and fixed assets ( Bernini and Brighi,

2017). Further, geographical distance between

branches and head office is also identified in the

literature as a negative factor for the efficiency of

banks due to higher informational and agency costs

(Bikker and Bos, 2008).We expect branch density

have positive impact on cost inefficiency.

While the second relates to the use of

financial services proxied by deposit account per

1,000 adult ( 𝛿

(Sarma, 2016; Gopalan and Rajan,

2018) . Bank collects deposits and makes it a source

of funding to loans and investment. Han and

Melecky (2014) found that financial inclusion will

provide banks new sources of funds more cheaper

and more insensitive to risk.Poghosyan and Čihak

(2011) also confirm that banks depending

extensively on wholesale funding are more exposed

to distress than those banks that are mostly

depending on retail deposits.

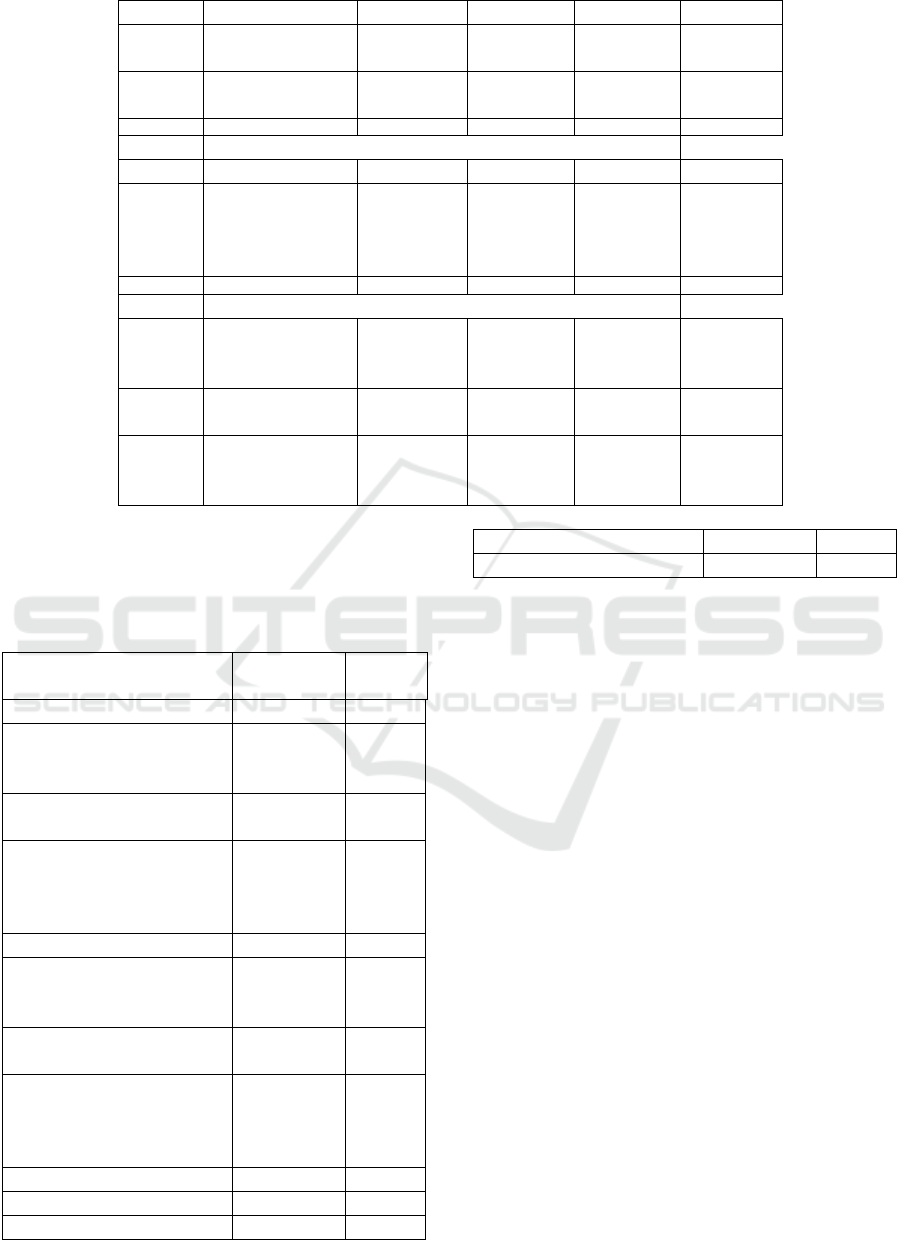

Table 1: Descriptive statistics for sample Bank, Macro and Financial Inclusion Indicator, 2008–2016

S

y

mbol Variable Mean SD Min Max

TC

Total Cost (US

$ ,million)

2503.484 11064.68 0.09 169702

Bank Output

Y

1

Loans (US$,

million )

38448.9 190276 0.84 2700000

Y

2

Other earning

Asset (US$,

million )

21077.5 94348.9 0.45 1600000

Cost of bank

inputs

W

1

Price of deposit

(US$, million )

0.062 0.0977 0.000091 0.985

W

2

Price of labor

(US$, million )

0.0207 0.029 2.30E-06 0.802

W

3

Price of

physical capital

(US$, million )

0.064 0.0923 0.0054 1.26

Bank-Specific Variable

ζ

1

ROAE (US$, 0.063 0.375 -26.34 6.49

Financial Inclusion and Bank Efficiency

1297

million )

ζ

2

Islamic Bank

dumm

y

0.132 0.114 0 1

ζ

3

Loan quality

(US $, million)

0.074 0.102 0 1

Macro Indicator

δ

1

GDP

g

rowth 2.74 3.556 -12.71 25.56

δ

2

Individual

Using Internet

per % of

Population

51.56 24.74 1.26 97.3

Financial Inclusion Indicator

δ

3

Bank branches

per 100,000

adults

68.6 42.236 2 168

δ

5

ATM per 1,000

km

2

24.45 28.6 0 112

δ

7

Deposit

accounts per

1,000 adults

55.79 36.17 5 187

Source : data bank scope and Fitch rating

4 FINDING

Table 2: Maximum Likelihood Estimates : 2008-

2016

Coefficient

Estimated

Value SE

GDP growth -0.083*** 0.010

Ln Individual Using

Internet per % of

Population -0.495*** 0.079

Bank branches per

100,000 adults 0.006*** 0.002

Country with Islamic

Bank (Dummy) * Bank

branches per 100,000

adults

0.031*** 0.011

ATM per 1,000 km

2

-0.092*** 0.007

Country with Islamic

Bank (Dummy) * ATM

per 1,000km

2

-0.123** 0.052

Deposit accounts per

1,000 adults -0.840*** 0.093

Country with Islamic

Bank (Dummy) *

Deposit accounts per

1,000 adults

-0.045*** 0.009

Constant 2.585*** 0.365

Log likelihood -6861.07

Number of observation 14,091

LR test 737.1***

Table 2 shows the maximum likelihood in

analyzing the effect of financial inclusion on bank

efficiency, for GDP growth 𝛿

, has a negative and

significant impact on banks’ inefficiency. Our

results are in line with previous studies (Fries and

Taci, 2005) who has a negative relation on banks’

cost inefficiency. Higher GDP growth stimulates

investment which increase the volumes of banking

business in terms of traditional loan-deposit services

and non-interest generating activities reduces bank

costs and leads to an improvement in bank

efficiency. Internet 𝛿

has negative sign, this result

indicate technology shift reduce cost and make

operational activities more efficient.

Bank branches per 100,000 adult 𝛿

, has

positive with bank cost inefficiency its means the

growth in the number of branches in the banking

network will significantly increase costs. In line with

(Ou et al., 2009; Bernini and Brighi, 2017).Indicate

establishing a full-service branch requires more

costs for work and operating activities, besides that a

branch has a limited time for operations

The coefficient of ATM per 1,000 km

2

𝛿

is

negative significant to bank inefficiency. A higher

ATM per 1,000 km

2

indicates greater substitution

effect onto the labor force. Strengthen by previous

finding𝛿

ATMs may overcome the restrictions of

traditional branch offices such as limited hours,

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1298

finite banking sites, lower productivity, and slow

processing speed. Thus, banks with a considerable

human capital are facing pressures to improve

operating efficiency and reduce cost. Support by

Berger, Hasan and Zhou (2010), examines the

economic effects on technological progress of the

US banking industry. He argues that advances in IT

appear to have increased productivity and economies

of scale in processing electronic payments and

reduce cost significantly.

Deposit account per 1,000 adults 𝛿

, have

negative correlation with bank inefficiency because

an inclusive financial sector banks will have greater

access to a large pool of customer deposits, leading

to less volatile customer deposit funding for banks.

More stable customer deposit funding should have a

positive effect on bank operating efficiency.

Supported by (Han and Melecky, 2014), inclusive

finance will provide banks with the opportunity to

get cheaper funding from previously untouched

sources of funds, in addition to retail funding

cheaper and more insensitive to risk. The lower

coefficient Deposit account per 1,000 adults in

Islamic banks-countries 𝛿

𝛿

indicate an increase

in deposit accounts expanding with Branch is

relatively more costly than other banks. This

happens because Islamic banks are new in the

market and have limited equity to make expansion

beside that Islamic bank are limited in term

investment and expertized make costly. Similar with

Alqahtani, Mayes and Brown (2016), who

empirically reviewed the operational activities of the

Islamic Finance. The IF institutions operate cost

efficiently, whereas conventional banking is more

cost efficient in dual banking countries where there

is no significant difference between business

orientation and stability

5 CONCLUSIONS

This study uses Stochastic Frontier Analysis to

investigate the impact of financial inclusion on bank

cost efficiency using an international sample of

2,207 banks in 70 countries for the period 2008-

2016. The results show that the dimensions of

services proxied by ATMs per 1,000 km2 have a

negative relationship with the efficiency of bank

costs, while branches of 100,000 adults have a

positive relationship with the inefficiency of bank

costs. this is because for establishing a full-service

branch requires more costs for employee and

operations. furthermore, a Negative relationship

between ATMs and inefficiencies shows a greater

substitution of the effect of labor use. For the

dimensions of use proxied by deposit accounts per

1,000 adults shows a negative relationship with this

inefficiency indicates the higher use of financial

services can reduce bank costs due to increased bank

funding sources

Greater financial inclusive environment give

more opportunities banks have access to funding that

is cheaper and more stable from customer deposits

that were previously untouched. This gives an

advantage to banks to run efficient operational

activities, besides the use of technology such as

ATM is helpful in increasing productivity so that

further technological innovation is needed to further

optimize the bank's performance.

Considering the evidence that impacts financial

inclusion on cost efficiency. there are two important

goals for the governments and financial institutions.

First, policymakers should introduce more

competition in the banking system, raising financial

infrastructure and enhancing the efficiency of the

legal system to promote better financial inclusion

considering the numerous benefits that can be

obtained. Second, financial products and services are

innovations based on technology must be improved

which improves productivity and cost efficiency.

These steps will have a positive impact on financial

inclusion, which in turn can promote economic

development. For future research, we recommended

using a multidimensional index of financial

inclusion to measurement financial inclusion and

using more dimension to view on another

perspective to continue this research.

REFERENCES

Abdul-majid, M., Saal, D. S. and Battisti, G. (2010)

‘Efficiency in Islamic and conventional banking: An

international comparison’, Journal of Productivity

Analysis, 34(1), pp. 25–43.

Abdul-Majid, M., Saal, D. S. and Battisti, G. (2011) ‘The

impact of Islamic banking on the cost efficiency and

productivity change of Malaysian commercial banks’,

Applied Economics, 43(16), pp. 2033–2054.

Ahamed, M. M. et al. (2017) ‘Inclusive Banking,

Financial Regulation and Bank Performance: Cross-

Country Evidence’, (October), pp. 1–51. Available at:

http://www.busman.qmul.ac.uk/media/sbm/research/p

apers/files/4A-Inclusive-Banking-Financial-

Regulation-and-Bank-Performance.pdf.

Alexakis, C. et al. (2018) ‘Performance and productivity

in Islamic and conventional banks: Evidence from the

global financial crisis’, Economic Modelling. Elsevier

B.V.

Financial Inclusion and Bank Efficiency

1299

Allen, F. et al. (2012) Resolving the African Financial

Development Gap: Cross-country Comparisons and a

Within-country Study of Kenya. No.6592.

Allen, F. et al. (2016) ‘The foundations of financial

inclusion: Understanding ownership and use of formal

accounts’, Journal of Financial Intermediation.

Elsevier Inc., 27(2016), pp. 1–30.

Alqahtani, F., Mayes, D. G. and Brown, K. (2016)

‘Economic turmoil and Islamic banking: Evidence

from the Gulf Cooperation Council’, Pacific Basin

Finance Journal. Elsevier B.V., 39, pp. 44–56. doi:

Amidžić, G., Massara, A. and Mialou, A. (2014)

Assessing Countries’ Financial Inclusion Standing-A

New Composite Index IMF Working Paper Statistics

Department Assessing Countries’ Financial Inclusion

Standing-A new Composite Index. Washington, DC.

Available at: https://www.imf.org/external/

pubs/ft/wp/2014/wp1436.pdf.

Banerjee, A. et al. (2015) ‘The Miracle of Microfinance?

Evidence from a Randomized Evaluation’, American

Economic Journal: Applied Economics, 7(1), pp. 22–

53.

Beck, T., Demirgüç-Kunt, A. and Levine, R. (2007)

‘Finance, inequality and the poor’, Journal of

Economic Growth, 12(1), pp. 27–49.

Beck, T., Demirguc-Kunt, A. and Martinez Peria, M. S.

(2007) ‘Reaching out: Access to and use of banking

services across countries’, Journal of Financial

Economics, 85(1), pp. 234–266.

Berger, A. N., Hasan, I. and Zhou, M. (2010) ‘The effects

of focus versus diversification on bank performance:

Evidence from Chinese banks’, Journal of Banking

and Finance. Elsevier B.V., 34(7), pp. 1417–1435.

Bernini, C. and Brighi, P. (2017) ‘Bank branches

expansion , efficiency and local economic growth’,

Regional Studies. Taylor & Francis, 0(0), pp. 1–13.

Bikker, J. and Bos, J. W. B. (2008) Bank performance: A

theoretical and empirical framework for the analysis of

profitability, competition and efficiency, Bank

Performance: A Theoretical and Empirical Framework

for the Analysis of Profitability, Competition and

Efficiency. Routledge.

Bruhn, M. and Love, I. (2014) ‘The real impact of

improved access to finance: Evidence from mexico’,

Journal of Finance, 69(3), pp. 1347–1376.

Burgess, R. and Pande, R. (2005) ‘Do Rural Banks

Matter? Evidence from the Indian Social Banking

Experiment’, American Economic Review, 95(3), pp.

780–795.

Damar, H. E. (2006) ‘The effects of shared ATM networks

on the efficiency of Turkish banks’, Applied

Economics, 38(6), pp. 683–697. Demirguc-Kunt, A. et

al. (2015) The Global Findex Database 2014:

Measuring Financial Inclusion around the World.

Ferrier, G. D. and Lovell, C. A. K. (1990) ‘Measuring

cost efficiency in banking’, Journal of Econometrics,

46(1–2), pp. 229–245.

Fries, S. and Taci, A. (2005) ‘Cost efficiency of banks in

transition: Evidence from 289 banks in 15 post-

communist countries’, Journal of Banking and

Finance, 29(1 SPEC. ISS.), pp. 55–81.

Giordani, G. and Floros, C. (2015) ‘Number of ATMs, IT

investments, bank profitability and efficiency in

Greece’, Global Business and Economics Review,

17(2), pp. 217–235.

Gopalan, S. and Rajan, R. S. (2018) ‘Foreign Banks and

Financial Inclusion in Emerging and Developing

Economies: An Empirical Investigation’, Journal of

International Development, 30(4), pp. 559–583.

Guiso, L., Sapienza, P. and Zingales, L. (2004) ‘The Role

of Social Capital in Financial Development’,

American Economic Review, 94(3), pp. 526–556.

Han, R. and Melecky, M. (2014) Financial Inclusion for

Financial Stability Access to Bank Deposits and the

Growth of Deposits in the Global Financial Crisis,

Policy Research Working Paper.

Kim, D. W., Yu, J. S. and Hassan, M. K. (2017) ‘Financial

inclusion and economic growth in OIC countries’,

Research in International Business and Finance.

Elsevier B.V.

Mobarek, A. and Kalonov, A. (2014) ‘Comparative

performance analysis between conventional and

Islamic banks : empirical evidence from OIC countries

Comparative performance analysis between

conventional and Islamic banks : empirical evidence

from OIC countries’, Applied Economics. Routledge,

46(3), pp. 253–270.

Ou, C. S. et al. (2009) ‘Impact of ATM intensity on cost

efficiency: An empirical evaluation in Taiwan’,

Information and Management, 46(8), pp. 442–447.

Paşalı, S. S. (2013) Where Is The Cheese? Synthesizing a

Giant Literature on Causes and Consequences of

Financial Sector Development. Washington, DC.

Available at: http://www-

wds.worldbank.org/external/default/WDSContentServ

er/IW3P/IB/2013/10/16/000158349_20131016083448

/Rendered/PDF/WPS6655.pdf.

Poghosyan, T. and Čihak, M. (2011) ‘Determinants of

Bank Distress in Europe: Evidence from a New Data

Set’, Journal of Financial Services Research, 40(3),

pp. 163–184.

Thompson, H. G. and Garbacz, C. (2007) ‘Mobile, fixed

line and Internet service effects on global productive

efficiency’, Information Economics and Policy, 19(2),

pp. 189–214.

Sarma, M. La (2016) Financial Inclusion in Asia. Edited

by S. Gopalan and T. Kikuchi. London: Palgrave

Macmillan UK. doi: 10.1057/978-1-137-58337-6.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1300