The Effect of Productive Zakah on Increasing Mustahiq

Revenue and Profit

Purnama Putra

1

, Mas Deden Tirtajaya

1

and Wahyu Hidayat C. Pratama

2

1

Department of Islamic Banking, Universitas Islam 45, Bekasi, West Java

2

Department of Accounting, Universitas Islam 45, Bekasi, West Java

Keywords: Productive Zakah, Revenue, Profit, Mustahiq.

Abstract: Alms (zakah) which are enshrined in the Al-Quran and Al-Hadith if viewed from an economic perspective

can be functioned as financial instruments in Islam. The shift in the distribution of zakah from consumptive

to productive is expected to provide a trickle-down effect for the economy of the mustahiq. Mustahiq

transformation becomes muzakki as the main target of distributing productive zakah. This study seeks to

determine the effect of productive zakah utilization on mustahiq revenues and profits. The mixed method

chosen is the concurrent embedded strategy model. The sample was chosen through a purposive method of

LAZNAS DPU who are mustahiq Daarut Tauhiid who had a profession as traders and were fostered in the

Misykat program and the writer had also confirmed them to the branch leader and the person in charge of

the program. The results of this study show that productive zakah positively influences the revenues and

profits of the mustahiq who are involved in developing the DPU DT Misykat program.

1 INTRODUCTION

Zakah is defined as a part of property with certain

requirements that are required for the owner to be

handed over to those who have the right to receive it

(mustahiq), with certain conditions (Putra, 2016).

Zakah can foster a work ethic. By paying zakah,

someone will work well, so that the conscious

movement of zakah is basically a movement to

create a good work ethic by providing equitable

welfare and prosperity for all (Huda, Rini, Mardoni,

& Putra, 2012).

The wisdom and benefits of zakah which include

two dimensions, both vertical and horizontal, make

zakah a very potential mechanism when it is

developed. Economic development in its

implementation requires an instrument that can

prioritize people's economy(Winoto & Pujiyono,

2011) The golden age of the governance of Umar

bin Abdul Aziz was clean and honest and zakah was

handled well, until at that time a country that was

almost a third of the world wide has no Mustahiq to

receive zakah because all Muslims had become

muzakki, that was the first time zakah was

transferred to another country because it is no longer

worthy of being blessed ((Hasbiyah & Putra, 2017a;

Huda et al., 2012; Putra, 2016)

Nowadays, the existence of zakah management

institutions is a solution in the method of channeling

zakah for poverty alleviation purposes. Zakah

management institutions in Indonesia are divided

into two, namely the Amil Zakah Agency (Badan

Amil Zakah) and the Amil Zakah Institution

(Lembaga Amil Zakah). The general functions are:

(1) as a financial intermediary; (2) empowerment.

National Zakah Agency (BAZNAS), Regional

Zakah Agency (BAZDA), and the National Zakah

Institution (LAZNAS) are independent zakah

institutions established by the government and the

community (Huda et al., 2012; Rini, Huda, Mardoni,

& Putra, 2017; Roziq, Yulinartati, & Ekaningsih,

2013)

The distribution of Zakah Infaq Shadaqa (ZIS)

funds, especially zakah, has now developed, from

the beginning it was only oriented towards the

fulfillment of needs (consumptive) now has reached

zakah as a source of productive funds that can boost

the economy (Winoto & Pujiyono, 2011). Zakah

also has the ultimate goal of turning a mustahiq into

muzakki. Zakah given to mustahiq as a support for

the utilization of productive zakah, this development

in the form of business capital (Hasbiyah & Putra,

2017b; Rini et al., 2017; Wulansari & Setiawan,

2014). Therefore zakah as a wealth that grows and

2120

Putra, P., Tirtajaya, M. and C. Pratama, W.

The Effect of Productive Zakah on Increasing Mustahiq Revenue and Profit.

DOI: 10.5220/0009939921202133

In Proceedings of the 1st International Conference on Recent Innovations (ICRI 2018), pages 2120-2133

ISBN: 978-989-758-458-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

develops must be implemented in a real policy in the

field not only limited to definition. (Hasbiyah &

Putra, 2017a) Productive zakah is directed by the

distribution of zakah which makes recipients

produce something continuously with the assets they

receive in economic activities to develop economic

productivity. (Hasbiyah & Putra, 2017b; Putra,

2016; Winoto & Pujiyono, 2011) The utilization of

productive zakat is in the form of business capital.

The influence of zakat in the form of Bussines

capital increasing the development of capital,

turnover and profit (Wulansari & Setiawan, 2014).

The productive zakah itself is present as a solution to

transform mustahiq into muzakki by giving zakah

funds in the form of business capital and techniques

for developing business skills for the mustahiq to

increase income and business profits for the

mustahiq so that in the future, mustahiq will become

muzakki.

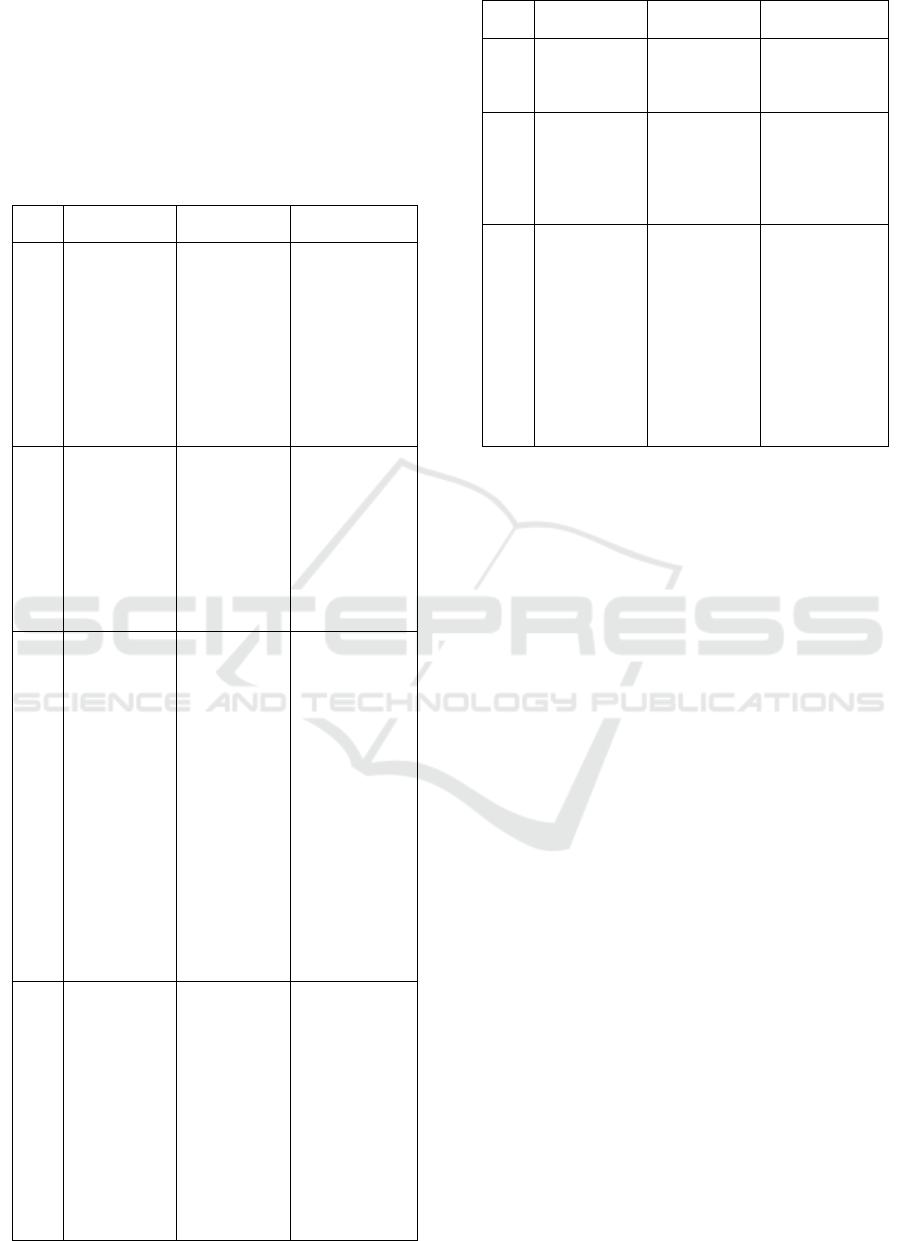

A summary of the recognition of revenues and

profits in sharia transactions according to the

Indonesian Accountants Association (2014),

Nurhayati & Wasilah (2015), as well as Harahap,

Wiroso, & Yusuf (2010), Hasbiyah & Putra (2017a)

are listed in table 1. This study directs that

mustahiq's business profits through the capital

provided in the productive zakah utilization program

provided by LAZNAS can be classified in the form

of mudharabah and musyarakah agreements which

in the form of later profit sharing from mustahiq to

LAZNAS that provides funds can be in the form of

zakah, infaq, or alms so that the aim of empowering

mustahiq through the utilization of productive zakah

can be achieved by transforming mustahiq to

become muzakki.

2 METHODS

In this study the author tries to determine the effect

of productive zakah on Mustahiq income and

Mustahiq profits. Creswell (2016), Sugiyono (2016),

and Sarwono (2011) say in a concurrent embedded

strategy model research model that combines the use

of quantitative and qualitative research methods

simultaneously / together (or vice versa), but the

weight of the method is different. The primary

method is used to obtain the main data, and the

secondary method is used to obtain data to support

data obtained from the primary method.

2.1 Data Collection

This study, the author uses a population in the form

of allMustahiq who receive zakat from LAZNAS

Dompet Peduli Umat Daarut Tauhiid (DPU-DT).

Samples are selected using a purposive method with

consideration thatMustahiq receives productive

zakat funds from LAZNAS DPU-DT in the form of

business capital forMustahiq who works as a trader

or in the form of business coaching that will be

carried out by DPU-DT.

Questionnaires given to respondents are closed

questions, namely questions prepared by a number

of specific answers as choices that will be

distributed to respondents which areMustahiq who

receive productive zakat itself. In addition to using

questionnaires distributed to respondents, the

researcher conducted interviews by giving several

questions to informans who served as DPU-DT

branch heads or other staff related to programs

carried out to distribute productive zakat to the

Table 1: Revenues and Profit Recognitions.

Sharia

Transacti

ons

Revenues Profits

Murabah

ah

The selling price is

the acquisition

price plus the

profit

Comparison

between margin

and acquisition cost

of murabahah

assets

Salam

When the seller

sends the buyer's

order and the

payment is made

on the agreed day

Difference between

the amount paid by

the buyer and the

cost of the ordered

goods

Istishna

Recognized when

the process of

making orders is

complete and

submitted to the

buyer

The difference

between the cost of

acquisition and

cash value

Mudhara

bah

Proportional

distribution in

accordance with

the agreement

The profit-sharing

principle, namely

net income, is gross

profit less expenses

related to capital

management

Musyarak

ah

Revenue equals

the distribution of

partners in

accordance with

the agreement

The portion of the

profit-sharing

amount is

determined based

on the ratio of

income

Ijarah

Recognized when

the benefits of

assets are handed

over to

tenants/lessor

At the time of the

difference between

the selling price

and the carrying

amount of the

ijarah object

The Effect of Productive Zakah on Increasing Mustahiq Revenue and Profit

2121

community, in addition to the interviews, the authors

also obtained supporting data related to the programs

carried out in empowering Mustahiq through

productive zakat. We use likert modification from

numbers 1 - 4 by eliminating the choice of hesitation

or neutral. The reason is because the doubt category

has a double meaning, which can be interpreted as

not being able to give an answer, neutral, or hesitant.

2.2 Data Analysis

Qualitative data analysis is carried out at the

time of data collection, and after completion of data

collection for a certain period. At the time of the

interview, researchers have conducted an analysis of

the answers interviewed. If the answers interviewed

after being analyzed have not been satisfactory, the

researcher will continue the question again to a

certain extent to the resource person. While

quantitative analysis based on questionnaires to

mustahiq researchers do calculations to answer the

problem formulation by using classical assumption

test with normality test and linearity test, and

perform calculations to test hypotheses that have

been proposed using F test, t-test, R test, test simple

linear regression, and the determination coefficient

test related to the utilization of productive zakat

funds on Mustahiq income and Mustahiq business

profits.

The hypothesis raised for the quantitative aspects in

this study are:

H1 = The utilization of productive zakat funds has a

significant positive effect on Mustahiq income.

H2 = The utilization of productive zakat funds has a

significant positive effect on Mustahiq business

profits.

The use of mixed methods is expected to be able to

answer hypotheses and provide confidence in the

data obtained from the participants of the Misykat

program participants and the efforts that have been

made by the organizer (DPU-DT) of the program.

3 RESULT AND DISCUSSION

3.1 Mechanism of Productive Zakah

Management in Community-based

Sharia Microfinance Programs

(MiSykat)

Zakah management is an activity of planning,

implementing and coordinating in the framework of

collecting, distributing and utilizing zakah (IKAPI,

2012) from this definition the writer refers to the

mechanism of zakah management is related to the

process of an structured activity, according to zakah

where the process is starting from the management

of zakah, collecting zakah, distributing zakah,

utilizing zakah funds and supervising the activities

of each program in the amil zakah agency or

institution.

The MiSykat program is a program dedicated to

mothers, in its activities the MiSykat program

always accompanies the assemblies formed by the

Bekasi branch of DPU-DT, its assistance is to

provide religious material in the hope that the

assembly members remain firm in their Islamic

faith, finance, and given skills by providing training

(Ekaningrum, 2016).

In its implementation, the MiSykat program has a

vision and mission that is used as a reference in

carrying out its program, as for the vision and

mission of the MiSykat program held by the Bekasi

branch DPU-DT which the authors get from

interviews with leaders of the Bekasi DPU branch,

among others are:

Vision: Delivering mustahiq to be muzakki.

Mision:

Increasing household economic income.

Optimizing the potential of members towards

independence.

Increasing productivity, changing mindset,

and member performance.

Cultivate saving and saving lifestyle.

Increasing network access, skills, and

business members.

DPU-DT Bekasi branch in the management of

productive zakah funds through the Misykat

program has 41 people registered as beneficiaries in

the city of Bekasi since the beginning of the

establishment of the Misykat program

ICRI 2018 - International Conference Recent Innovation

2122

3.1.1 Distribution of Funds for Zakah

Misykat Programs at DPU-DT Bekasi

Branch

Zakah funds that are distributed can be empowered

and utilized, then the distribution must also be

selective for consumer needs or for productive

needs(Fakhrudin, 2008; Hasbiyah & Putra, 2017b).

In the MiSykat Program in the DPU-DT is a

Creative Productive Zakah category, namely zakah

which manifests itself with the provision of

revolving capital.

MiSykat Program is carried out in groups with

weekly assistance directly from Yogyakarta branch

DPU-DT(DPU-DT, 2016), before conducting

distribution, there are several criteria that must be

met by prospective MiSykat member groups

namely:

Muslim.

Women.

Citizens of the Republic of Indonesia.

Already have a business or members have the

motivation to want to own a business.

Permanent residence.

Mustadhafiin (weakened person).

Already Married and still in productive age.

Having income but not yet reaching Nisab

Khoul Zakah in accordance with Sharia.

Categorized as faqir and poor.

There are several paths implemented by DPU-DT

Bekasi in the empowerment process through this

misykat program with the aim that the program is

targeted in providing aid funds for its efforts so that

the distribution of funds is more controlled.

3.1.2 Utilization of Productive Zakah Funds

for the Misykat Program at the Bekasi

Branch of DPU-DT

Decree of the Minister of Religion of the Republic

of Indonesia. No. 581/1999 Chapter V Article 28

states that the utilization of productive business can

be carried out if the eight ashnafs have been fulfilled

and there are advantages, with assistance used for

real business by obtaining income or profits

Utilization carried out for the MiSykat Program

is to conduct guidance every once a week for

assemblies that have not been established and the

activities carried out are the provision of material by

assistance from the Bekasi branch of DPU-DT based

on the mentoring stage.

3.1.3 Mustahiq's Revenue and Business

Profits in the Misykat Program at the

DPU-DT Bekasi Branch

Depend on this research said that mustahiq

income is not able to meet all needs because it is not

due to unemployment or does not find a suitable job,

but he works and earns a fixed income, but income

and income are not balanced with his expenses,

while according to accounting referred to as business

profit is the difference between realized revenue

arising from transactions in a certain period is faced

with costs incurred in that period (Harahap, 2015)

In this study, the revenue and business profits

mustahiq the author got after observing and also

distributing questionnaires to 32 beneficiaries of the

members of the community, this number was

reduced from a total of 41 beneficiaries due to their

own members who resigned, there was a busyness

outside of the findings so never present at pekan

meetings, assembly members are lazy to take part in

mentoring or peer meetings, from the assembly there

are several members who are elderly so that they are

no longer productive and resign.

3.2 Descriptive Analysis

Researcher obtaining data directly from Pulo Asem

village, this study also used questionnaires by

distributing questionnaires to 32 mothers from

members of several assemblies from a total of 41

initial participants of the Misykat program.

The descriptive analysis that was examined from

respondents based on gender, age, business, income

before coaching, profit before coaching, income

after coaching, and benefits after coaching were

processed using eviews.

3.2.1

Age and Business

Based on the results of observations and also

filling out the questionnaire to 32 respondents the

beneficiaries obtained the average age was 42 years

old with the highest age was 56 years and the lowest

age was 27 years. Whereas for the business obtained

data as much as 81% of respondents have a trading

business, 16% of respondents have a service

business, and only 3% of respondents have a

livestock business.

The Effect of Productive Zakah on Increasing Mustahiq Revenue and Profit

2123

3.2.2 Revenues and Profit before

Accompaniment-coaching Program

Mustahiq's revenues before participating in coaching

was 53% with an income level of IDR 500,000 -

IDR 1,400,000, 35% of respondents with an income

level of IDR 1,500,000 - IDR 2,400,000, 6% of

respondents with revenue levels of IDR 2,500,000 -

IDR 3,400 .000, and 6% of respondents who have a

revenue level below IDR. 500,000.

The mustahiq operating profit before

participating in coaching was 59% with a profit level

of IDR. 500,000 - IDR. 1,400,000, 38% of

respondents with a profit level of less than IDR.

500,000, and 3% of respondents with a profit rate of

IDR. 1,500,000 - IDR. 2,400,000.

3.2.3 Revenues and Profit after

Accompaniment-coaching Program

Based on these results obtained mustahiq income

before following coaching there are 31% with an

income level of IDR 500,000 - IDR 1,400,000, 31%

of respondents with an income level of IDR

1,500,000 - IDR 2,400,000, 28% of respondents

with an income level of IDR 2,500. 000 - IDR.

3,400,000, and 10% of respondents who have

income levels above IDR. 3,400,000.

Mustahiq's operating profit before participating

in the coaching there were 47% with a profit level of

IDR. 500,000 - IDR. 1,400,000, 25% of respondents

with a profit rate of IDR. 1,500,000 - IDR.

2,400,000, 22% of respondents with a profit rate of

less than IDR. 500,000, and 6% of respondents who

have a profit rate of IDR. 2,500,000 - IDR.

3,400,000.0.

3.3 Qualitative Data Analysis

Haryuda (2018) states that community-based Islamic

sharia or microfinance is one of the superior

programs owned by the Bekasi branch of DPU-DT,

which is a program devoted to mothers, in which the

program always provides assistance to assemblies

formed by DPU-DT Bekasi, its assistance is in the

form of providing religious material in the hope that

the assembly members will remain firm in their

Islamic faith, finance and also be given skills by

providing training.

The community program has an important role in

helping family finances obtained from beneficiaries

namely mothers and can also help from the income

that is owned by her husband, and also according to

Zurma (2018) as the group leader from the mothers

of the beneficiary program beneficiaries, with the

holding of assistance programs such as those

provided by the Bekasi branch of DPU-DT, it can be

helpful for citizens who have financial problems

with loan sharks, because it cannot be denied that

there are still many citizens who are involved in loan

sharks in his residence, with the presence of the

program, the mothers feel very helped because there

is no compulsion in it and neither is there a usury

system like that of moneylenders in the

neighborhood.

In this research to examining the validity of the

data and also for the purpose of gathering

information, the author interviewed the leader of the

branch of Dompet Peduli Ummat Daarut Tauhiid

Bekasi branch named Muhammad Ihsan, researchers

also sought information by interviewing the program

responsible, Haryuda, and the authors were also

assisted by several related parties who has control

over the financial register in Bekasi DPU-DT and

who is in control of the overall misykat program

namely Reni, Imam Mustaqim, and the author is

assisted by several other DPU-DT Bekasi staff..

According to the head of the DPU-DT Bekasi

branch, in an effort to maximize productive zakah

funds, DPU-DT Bekasi developed a program called

Misykat, namely in the form of capital provisioning

programs and also business assistance to mustahiq,

procurement of healthy barakah carts, procurement

and assistance of farmers, and livestock so develop

self-sufficiency in mustahiq. In this program, DPU-

DT Bekasi has the aim of establishing mustahiq by

improving the quality of life of the community with

productive programs (Ihsan, 2018).

The matter conveyed by the head of the Bekasi

DPU-DT branch in accordance with what was said

by the program responsible that the Community

Based Sharia Microfinance program (Misykat) is a

productive economic empowerment program that is

managed systematically, intensively and

continuously, by making financial services

(revolving funds) as empowerment entry point. The

pattern of financial services carried out by Misykat

adopted a number of banks grameen patterns with

adjustments based on the sharia system(Haryuda,

2018).

Before this program was implemented, there was

a long process carried out by the Bekasi branch of

the DPU-DT which coordinated with the central

DPU-DT through a feasibility test, in the form of

theoretical studies and field studies conducted by

other DPU-DT branches and also from the amil

institution other zakah(Ihsan, 2018).

ICRI 2018 - International Conference Recent Innovation

2124

The purpose of this program is to increase access

and affordability of financial services by developing

special service schemes for the target business

productive actors who have not been able to reach

bank financial services (DPU-DT, 2016), according

to Ihsan (2018) this program is to make mustahiq,

which is to improve the quality of life of the people

with productive programs, this is also harmonized

with the targets to be achieved by DPU-DT Bekasi,

namely to establish mustahiq finance and also can

change mustahiq into muzakki, while according to

Haryuda (2018) said that the aim and target of this

program was to change mustahiq into muzakki,

reduce poverty in Indonesia by giving capital

without interest, and creative hall training.

There are several processes in terms of

submitting recipients of productive zakah such as

can by personal means, in which prospective

beneficiaries come directly to the office to propose

zakah funds by collecting ID cards, then there is a

home survey conducted by the DPU, and there is the

next way through assemblies that are fostered by

DPU, then collected and given business capital,

coaching, and also directives on each

month(Haryuda, 2018).

In the interview process that the author did, Ihsan

(2018) as the branch leader said there were several

channels that were used to determine the new

assembly with the aim that the misykat program was

on target in helping funds for its efforts so that the

distribution of funds was more controlled, the stages

were:

Regional survey, aims to make this MiSykat

program truly on target, especially for the

poor or those affected by the disaster.

Permit and socialize the MiSykat program to

the local government, to provide clarity on the

purpose of the MiSykat program.

Survey of locations, the purpose of the

location survey is to see the exact data of the

population classified as poor people in the

area.

Socializing the MiSykat program to

prospective new members, this stage is

carried out many times with the aim to

provide a general overview of new members

related to the program provided.

Registration of prospective new members,

distributing registration forms to prospective

members of the MiSykat program.

Interview with new members, interviews are

conducted at the time of gathering all the data

for new prospective members, the purpose of

this interview is to re-check the data that has

been collected.

Committee meetings, aiming for the

determination of candidates with the

applicable provisions on the criteria for

acceptance of prospective new members.

Announcement of acceptance of new

members in the MiSykat program.

Ratification of the formation of a new

assembly namely the MiSykat assembly.

In the selection process for prospective

beneficiaries who have submitted themselves or who

have already been observed by the DPU-DT Bekasi,

there are several criteria that become a priority and

also become a selection conducted by DPU-DT

Bekasi which was said by Ihsan (2018) that the

recipient This productive zakah can be categorized

in mustahiq zakah which is included in 8 asnaf

(Haryuda, 2018).

Before being revealed to train mustahiq in terms

of coaching, the person in charge of the program is

given training and direction in advance by DPU-DT

regarding what operations he must give to the

beneficiaries, in this case DPU-DT brings in special

speakers from the center (Ihsan, 2018), the same

thing was also conveyed by Haryuda (2018) as the

person in charge of the program who said there were

preparations held by the office in this case the

Bekasi DPU in the form of material and non-

material given to him and also to all staff and

employees in all aspects related to zakah.

In its implementation, the program uses the

techniques of guidance and training that is

accompanied by supervision carried out by the staff

of the DPU, according to the person in charge of the

program in implementing zakah through this

mission, likening people who are fishing, where

people are fishing to get fish, he must have a hook

and lure, as well as DPU does not give the results

but as a facilitator in the form of training and

coaching so that mustahiq has its own creativity in

running its business so that it can achieve what it

wants (Haryuda, 2018).

In the process of mentoring, Haryuda (2018).

explained that the Bekasi DPU-DT carried out

various stages that have their respective roles in

carrying out the misykat program, so that the

mustahiq could be fostered properly, while the

stages in the utilization of the MiSykat program

included: In the mentoring process, Haryuda (2018).

explains that the Bekasi DPU-DT carries out various

stages that have their respective roles in carrying out

the misykat program, so that the mustahiq can be

The Effect of Productive Zakah on Increasing Mustahiq Revenue and Profit

2125

built properly, while the stages in the utilization of

the MiSykat program include:

Special Assistance

Special assistance is seen in terms of the

provision of material, namely the communication

between mentoring and assembly members related

to assistance material that will be provided each

week, with things like this the assembly members

will know about what they question and create

interaction between the material providers and the

assembly members.

Comprehensive Assistance

Assistance instructed to be interpreted as one of

the uses for which material is given such as faith,

entrepreneurship, economic management and good

cooperation between members and fellow members

of the assembly in the Yogyakarta branch of DPU-

DT.

Saving and Financing

Savings and Financing activities are a benefit of

the MiSykat where members of the community can

easily borrow funds to increase their business

capital, so some people will be interested in

participating in MiSykat activities and increase their

knowledge.

In addition to providing assistance, the Bekasi

branch of DPU-DT helps in conducting training to

open new businesses, assisting in the posting of

MiSykat member products, some products have been

included in the mini market and some have been

running to entrust their business processes to stalls

(Haryuda, 2018), this mentoring teaches its members

to save, invest and in its assistance activities there is

cash, the cash is used for funds that are rotated when

members borrow the funds for their efforts in adding

their business capital.

In carrying out the misykat program, the training

provided by the Bekasi DPU-DT to the

beneficiaries, Ihsan (2018) said that as a support for

productive zakah-based economic empowerment

programs training programs for beneficiaries such as

hard skills (cooking, sewing, making cakes,

handicrafts, etc.), and also holding soft skills

training, Haryuda (2018) also said that there was

business training in the form of misykat to mothers

with capital provision, independent creativity, as

well as some hard skills and soft skills given by

DPU-DT

In the implementation, in addition to coaching

and also training conducted by DPU-DT Bekasi to

the beneficiaries, there is a control mechanism that is

carried out every once a week at each meeting, then

memorization, installments, business, and the

packaging is controlled and we become facilitators

in the resulting product (Haryuda, 2018).

Based on some of the information that the author

has collected, it can be seen that since the

establishment of the ummah empowerment program

through productive zakah funds provided by holding

community-based Islamic microfinance, the Bekasi

branch of DPU-DT has 41 people registered as

beneficiaries in the city of Bekasi. In its

development several members also experienced a

decrease in the number of assemblies that had been

established and those that had not been established,

so the authors conducted this research based on 32

people who actively participated in the program,

Zurma (2018) said there were several causes of the

reduction of the members of the assembly, among

them were due to members MiSykat himself

resigned, there was a busy life outside of the

findings so that he was never present at the pekan

meetings, the assembly members were lazy to attend

mentoring or pekan meetings, from the assembly

there were several members who were elderly so

that they were no longer productive and resigned.

In order to answer the research question, the

mustahiq income level in this study is the change

produced by Mustahiq before and after receiving

productive zakah and the effort to realize the peace

of life mustahiq be guaranteed so that it can live

independently and skillfully with economic changes

and also the profitability level of mustahiq in this

study is the change produced by mustahiq before

and after receiving productive zakah and the effort

to realize the peace of life mustahiq be guaranteed so

that it can live independently and skillfully with

economic changes.

Based on data from interviews with informants,

relating to income and also the business benefits

ofMustahiq, Ihsan (2018) said that by holding the

productive zakah-based empowerment program,

successfully increasing business income and profits

for beneficiaries, this was also conveyed by Haryuda

(2018) who said that mustahiq could be said to be

independent if it had produced a minimum of fifty

thousand per day as an indicator, and until now it

was proven by the program, the beneficiaries

experienced an increase in terms of income and

business profits. In addition to the DPU-DT Bekasi,

the author also conducted interviews with the

beneficiaries and also the group leader of the

mothers who benefited from the program, Hasanah

(2018), Suwarni (2018), and Zurma (2018) said that

with the program being held, can increase income

and business profits in each month because with the

ICRI 2018 - International Conference Recent Innovation

2126

addition of capital can increase innovation in its

business.

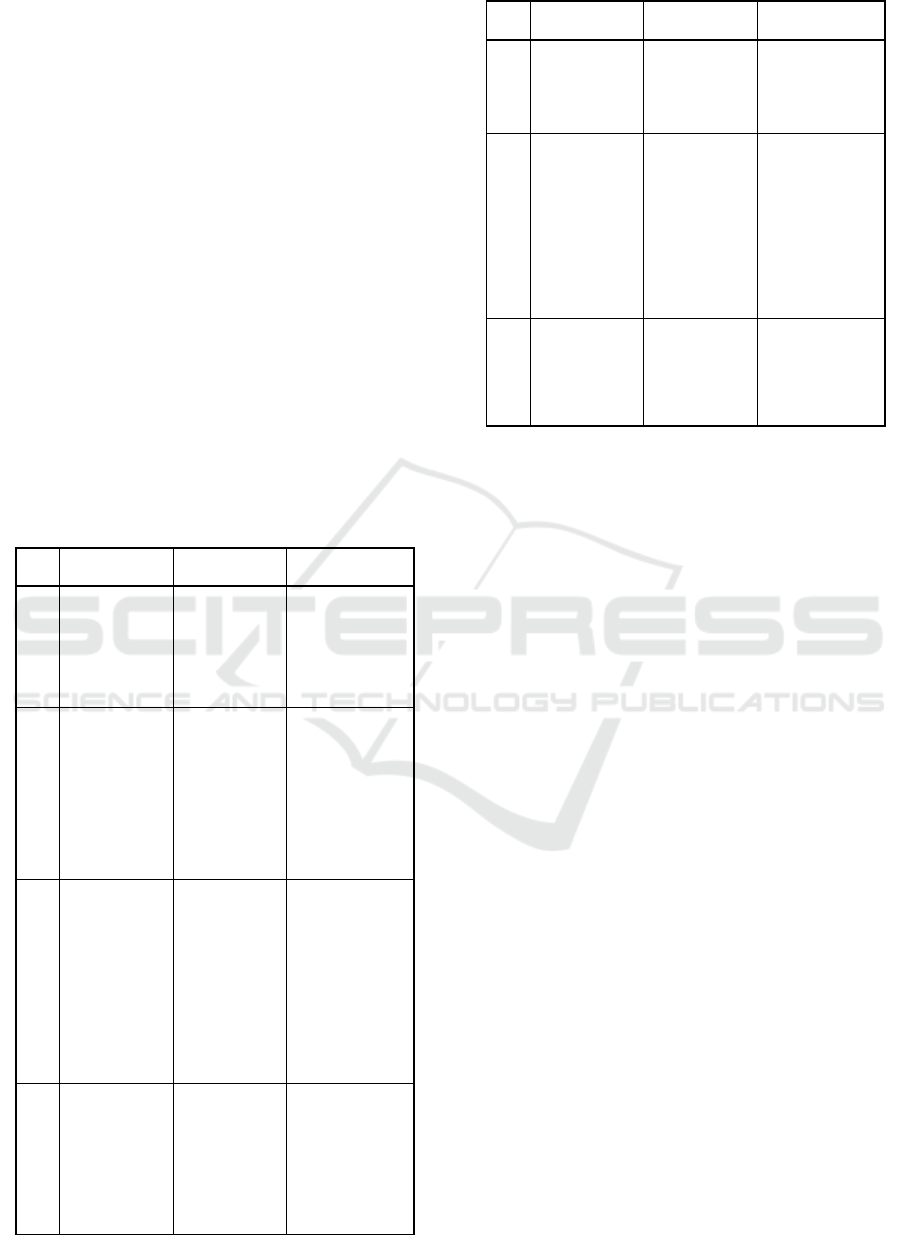

In table 2 the following is an interview about the

implementation and program, for example from the

head of the Bekasi branch of DPU-DT and also from

the person in charge of the program:

Table 2: Interviews of Branch Managers and Program

Personel.

No Information

Branch

Manager

Program

Personnel

1.

Misykat

Target

There are two

main targets,

namely

independence

and

transforming

mustahiq to

become

muzakki

Changing

mustahiq into

muzakki,

reducing

poverty in

Bekasi by

providing

interest-free

capital and

creative hall

training.

2.

Criteria for

Distribution

of Zakah

Funds

Recipients of

productive

zakah are

categorized in

mustahiq

zakah namely

fakir, poor,

gharimin,

converts, and

fiisabilillah.

Described in the

Quran 8 asnaf

and DPU look

for people

include the 8

asnaf categories

3.

Business

Training for

Mustahiq

As a

supporting

productive

zakah-based

economic

empowerment

program

training

programs for

beneficiaries

such as hard

skill skills

(cooking,

sewing,

making

handicraft

cakes, etc.),

as well as soft

skills training.

There is

business

training in the

form of misykat

to mothers with

capital

provision,

independent

creativity

training, and

also weekly

installments

4.

Increasing

Revenue and

Profits

With the

holding of the

productive

zakah-based

empowerment

program,

Alhamdulilla

h succeeded

in increasing

the income

and profits of

the

beneficiary

businesses.

There is an

increase in

terms of income

and also

business profits,

while mustahiq

can be said to

be independent

if it has

produced a

minimum of 50

thousand as an

indicator, can

apply again and

No Information

Branch

Manager

Program

Personnel

the payment

must be in

accordance with

the agreement.

5.

Training in

Making

Financial

Reports for

Mustahiq

There is

currently no

training in

preparing

financial

reports.

There is no

training in

making

financial reports

to mustahiq.

6.

Training to

Program

Personnel

Provided By

DPU

There is

training

provided by

the DPU to

program

managers

who are

invited by

presenters

from the

center each

month.

DPU prepares

material and

non-material

materials to the

person in charge

of the program

and also

employees in all

matters related

to zakah.

The productive zakah fund utilization program

included in the community-based sharia

microfinance program held by DPU-DT Bekasi has

at least been running in 2015 until now, based on the

results of the interviews that the authors received

from Hasanah (2018) and Suwarni (2018), they just

followed the program for two years from mid-2015.

Based on Zurma's explanation (2018) as the

group leader of the beneficiaries, the beginning of

the existence of a mass program was motivated by

the large number of people owed to loan sharks, so

that the lives of the surrounding communities

became very burdened because they were unable to

pay their debts, with the presence of community

service as a solution for the community there is an

additional capital but there are no elements of

ribawi, and with the existence of this misykat there

are many people who have been released from loan

sharks. Besides being motivated by the large number

of moneylenders, this program can also help support

the family's economy, especially housewives by

joining this program to help her husband's finances.

Suwarni (2018) as the beneficiary explained

about the situation in running a business that has

various kinds of constraints, according to him he has

not mastered the techniques in trading well so that it

can attract consumers to buy their wares and there

are still many who do not know their wares so there

are very few knowing it.

The Islamic microfinance program is present in

the midst of the anxiety of the mustahiq to present

special training desired by them, in this case

Suwarni (2018) said the training provided by DPU-

DT Bekasi is in the form of quality improvement,

The Effect of Productive Zakah on Increasing Mustahiq Revenue and Profit

2127

sales, and also savings and knowledge improvement

religion, Hasanah (2018) said that DPU-DT Bekasi

was present by providing training in the form of

brooch making, sewing techniques, making cakes,

and so on.

In the Misykat program implementation,

Hasanah (2018) and Suwarni (2018) said that the

training schedule was held once a week, which was

held every Wednesday.

After the training done, Suwarni (2018)

acknowledged that he experienced a fairly good

business development, because with the additional

costs, the production level would also increase,

while Hasanah (2018) said that the businesses

owned by him had developments with additional

capital and also the training provided by DPU-DT

Bekasi can open its insights not only in terms of

business but in the religious aspect for the better.

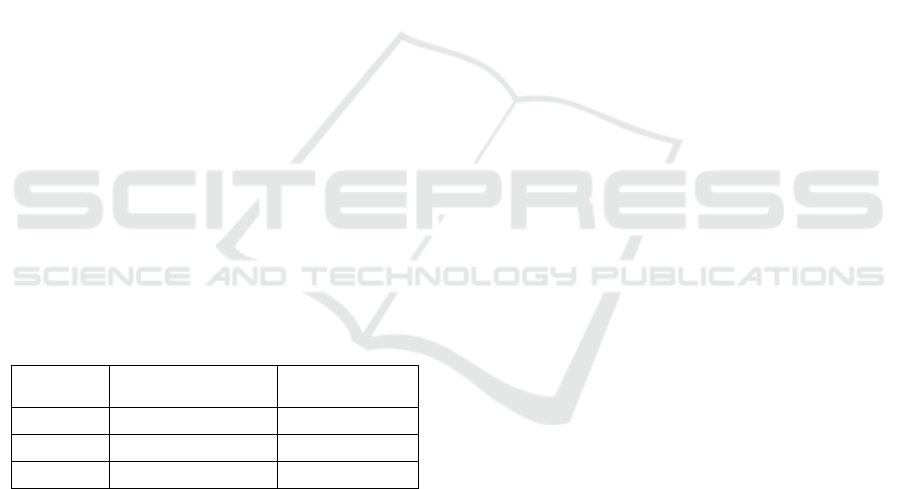

Table 3 presents responses from beneficiaries of

the misykat program according to Hasanah (2018)

and Suwarni (2018) from DPU-DT Bekasi:

Table 3: Interviews with Mustahiq.

N

o

Informati

on

Mustahiq

1

Mustahiq 2

1

.

The

period of time

receiving

productive

zakah

It's have

been 2 years

It's have

been 2 years

2

.

Increasin

g Revenues

and Profit

after coaching

program

Have an

increase in

income and

business

profits every

month

Has an

increase in each

month, due to

the additional

business capital

provided

3

.

Business

Process

Constrain

Having

constraints in

terms of

sales, namely

not too

mastered

about sales,

so there are

still few

people who

know about it

There are

no perceived

obstacles.

4

.

Training

Provided by

DPU DT

The

training

provided by

DPU-DT is in

the form of

quality

improvement,

sales, and

DPU-DT

provides

training in the

form of brooch

making, sewing

techniques, cake

making, etc.

N

o

Informati

on

Mustahiq

1

Mustahiq 2

also savings

and

enhancements

related to

religiosity

5

.

Business

Development

after

receiving

coaching

program

Experien

ced well

enough,

because of the

additional

funds, the

level of

production is

also

increasing

Owned

businesses have

developments

with additional

capital and

training

provided by

DPU-DT.

6

.

Training

Schedule

Once a

training

schedule per

week

The

training

schedule is held

on Wednesday

every week.

3.3 Quantitative Data Analysis

Researchers used questionnaire data to be able to

calculate and analyze the effect of utilizing

productive zakah funds on mustahiq income and

mustahiq business profits, as for the steps taken by

the authors in the form of validity, reliability, and

classical assumption tests.

3.3.1 Validity Test

Siregar (2013) says that validity is a measure that

shows the level of validity or the validity of an

instrument. Test the validity of item statements with

the Corrected Item Total Correlation technique,

which correlates between item scores and total

items, then corrects the correlation coefficient.

While in some researches revealed the validity test

was used to measure the validity or validity of a

questionnaire. A questionnaire is said to be valid if

the question in the questionnaire is able to reveal

something that will be measured by the

questionnaire (Pernanu & Putra, 2016; Putra &

Silviana, 2017).

Based on the results of the validity test with the

utilization variable productive zakah funds (X)

shows that there are 13 valid statement items,

namely items 3, 4, 6, 7, 8, 9, 11, 12, 13, 16, 17, 18,

and 19, this item can be declared valid because r

count ≥ r table, with r table value 0.349. Based on

these results it can be concluded that there are 13

valid statements from a total of 20 statements in the

independent variable.

The results of the validity test of mustahiq (Y1)

revenue variable indicate that there are 12 valid

ICRI 2018 - International Conference Recent Innovation

2128

statement items, namely point 1, 2, 2, 3, 6, 7, 9, 10,

11, 13,14,16,17, these items can be declared valid

because r count ≥ r table, with r table value 0.349.

Based on these results it can be concluded that there

are 12 valid statements from a total of 17 statements

in the dependent variable.

While the results of the validity test of mustahiq

(Y2) business profit variable indicate that there are

14 valid statement items, namely items 1, 2, 3, 5, 7,

9, 10, 11, 12, 13, 16, 17, 18, and 19, items it can be

declared valid because r counts ≥ r table, with r table

value 0.349. Based on these results it can be

concluded that there are 14 valid statements from a

total of 20 statements in the dependent variable.

3.3.2 Reliability Test

Sugiyono (2016), a reliable instrument is an

instrument that when used several times to measure

the same object, will produce the same data, while

Pernanu and Putra (2016) in their research said, in

addition to being valid, the instrument must also

meet reliability standards.

Reliability testing is used to test the consistency

of the measuring instrument, where there are

similarities of results if the measurements are

repeated. The method in its measurement uses α

cronbach with a limit of 0.349 which is to determine

whether the variable is reliable or unreliable. If the α

cronbach value is greater than 0.349 then it is

reliable and if it is smaller it is not reliable. Based on

the reliability test, the following data are obtained:

Table 4: Reliability Statistic.

Varia

bles

Cronbach’s

Alpha

N of Items

X 0,725 13

Y

1

0,686 12

Y

2

0,820 14

Based on the reliability test for the variable

utilization of productive zakah (X) on the 13 valid

statements that have been tested produce Cronbachs

Alpha value of 0.725, while the mustahiq (Y1)

income variable for the number of 12 valid questions

worth 0.686 and mustahiq (Y2) operating profit

variable of 0.820 all three has a value of> 0.349 so

that it can be said that the questionnaire is reliable.

3.3.3 Classic Assumption Test

Normality test is used to test the data of independent

variables (X) and variable data (Y) in the regression

equation produced, which is normally distributed or

not normally distributed. Regression equation is said

to be good, if it has data independent variables and

the dependent variable is distributed close to normal

or very normal (Siregar, 2013)

Based on the Normality Test using Eviews it is

known that the value of the probability variable of

productive zakah funds to the income mustahiq

worth 0.674142 and 0.209610 for the value of the

utilization variable productive zakah funds to the

business profits mustahiq both worth> 0.05, it can be

concluded that the data is distributed normal.

The linearity test is used to determine whether

each variable used as a predictor has a linear

relationship or not with the dependent variable.

Linear line linearity test is a proof of whether the

linear line model applied is really in accordance with

the situation or not.

The results of the linearity test of the productive

zakah efficiency variable, mustahiq income and

mustahiq business profit value of the significance of

deviation from linearity is 0.672, the utilization

variable of productive zakah funds to mustahiq

business profits worth 0.462 are both> 0.05, it can

be concluded that there is a linear relationship.

3.3.4 Hypothesis Testing

Goodness of fit model analysis is known by

simultaneous test or model test or Anova Test,

which is a test to see how the influence of all the

independent variables together on the dependent

variable. Or to test whether the regression model we

make is good / significant or not good / non

significant. To see the F table in testing hypotheses

on the regression model, it is necessary to determine

the degree of freedom or degree of freedom (df)

(Putra, 2015)

Siregar (2013) said that the F Test was aimed to

determine the feasibility of multiple regression

models, whether the effect was significant or not,

then the significance level used was 0.05. If the

probability F is smaller than 0.05, the regression

model can be used to predict the independent

variable or in other words the dependent variable

simultaneously affects the dependent variable.

Conversely, if the probability value F is greater than

0.05, the regression model cannot be used to predict

the dependent variable or in other words the

independent variables simultaneously do not affect

the dependent variable.

The variable PDZM (Fund Distribution of Zakah

Mustahiq) against Mustahiq Revenue (PM) of

6.994106 with a probability of 0.012885. The sig

The Effect of Productive Zakah on Increasing Mustahiq Revenue and Profit

2129

value = 0.012885 <0.05, so that alternative H is

accepted, which means that the utilization variable

of productive zakah funds on mustahiq income has a

significant effect because the sig value <0.05.

The F value calculated the variable PDZM

(Distribution of Funds of Zakah Mustahiq) against

the Profit of Mustahiq (KM) of 4.310422 with a

probability of 0.046545. The sig value = 0.046545

<0.05, so that alternative H is accepted, which

means that the utilization variable of productive

zakah funds to the profit of mustahiq has a

significant effect because the sig value <0.05.

The t test (partial test) aims to test the hypothesis

and find out whether the independent variable

partially has a significant effect on the dependent

variable. If t count (significant probability) is below

0.05, the independent variables individually have a

significant effect on the dependent variable,

otherwise if t counts above 0.05, the independent

variables individually do not have a significant

effect on the dependent variable (Sugiyono, 2015).

The significance value of independent variables

individually on dependent research. The result of t

count is 2.644637, t table is 1.694. This result can be

concluded that t arithmetic (2.644637)> t table

(1.694) so that H1 is accepted, which means that the

Productive Zakah Fund Utilization variable (PDZP)

has a significant positive effect on Mustahiq

Revenue (PM).

The significance value of the independent

variables individually for the dependent results of t

count are 2.076155, t table is 1.694. This result can

be concluded that t count (2, 076155)> t table

(1,694) so that H1 is accepted, which means that the

Productive Zakah Fund Utilization variable (PDZP)

has a significant positive effect on Business Profit

Mustahiq (KM).

Regression Linear Test. Simple linear regression

analysis used in this study aims to examine the effect

of independent variables on the dependent variable.

The independent variable in this study is the

Productive Zakah Fund Utilization (PDZP) while the

dependent variable is Mustahiq (PM) Income and

Business Profit Mustahiq (KM). A simple linear

regression equation is obtained as follows:

PM = 24.08989α + 0.370167PDZP (1)

The results of the simple linear regression

analysis equation can be explained by the following

statement:

The constant is 24,089, meaning that if the

utilization of productive zakah funds

(PDZP) has a zero value, then mustahiq

(PM) revenue remains.

The value of the coefficient of utilization of

productive zakah funds (PDZP) is 0.370.

These results indicate that there is a

positive relationship between the

productive zakah utilization variable

(PDZP) and mustahiq (PM) revenue, the

greater the productive zakah funds issued

by the amil zakah institution, the greater the

revenue achieved by mustahiq in the

management of the given capital. A simple

linear regression equation is obtained as

follows:

KM = 25.61798α + 0.466159PDZP (2)

The results of the simple linear regression

analysis equation can be explained by the following

statement:

A constant of 25.617, meaning that if the

utilization of productive zakah funds

(PDZP) has a zero value, then the business

profit of mustahiq (PM) remains.

The value of the coefficient of utilization of

productive zakah funds (PDZP) is 0.466.

These results indicate that there is a

positive relationship between the

productive zakah utilization variable

(PDZP) and the business benefits of

mustahiq (PM), the greater the productive

zakah funds issued by the amil zakah

institution, the greater the business profits

achieved by mustahiq in capital

management which are given by DPU DT.

The coefficient of determination (R Square)

shows how much the independent variable explains

the dependent variable. The value of R Square is

zero to one. On the contrary, R Square is equal to 1,

so the percentage of the contribution of influence

given by the independent variable to the dependent

variable is perfect, or the variation of the

independent variables used in the model explains

100% variation of the independent variables (Putra

& Silviana, 2017; Siregar, 2013)

The coefficient of determination (R2) = 0, means

that there is no relationship between the independent

variable and the dependent variable, on the contrary

for the coefficient of determination (R2) = 1 there is

a perfect relationship. Adjusted R Square value =

0.162029 from the table above shows that 16.2% of

PM variance can be explained by changes in the

productive zakah fund utilization variable (PDZP),

while the remaining 83.8% is influenced or

ICRI 2018 - International Conference Recent Innovation

2130

explained by other variables that are not included in

this research model.

The Adjusted R Square value = 0.096484. 9.64%

of the PM variance can be explained by changes in

the productive zakah fund utilization variable

(PDZP), while the remaining 90.83% is influenced

or explained by other variables that are not included

in this research model.

A different t-test is used to determine whether

two samples that are used are not related have

different average values. The different test t-test is

done by comparing the difference between two

average values with the standard error of the

difference between the averages of two samples. The

different purpose of the t-test is to compare the

average of two grubs that are not related to each

other, what is the value of the two groups it has the

same or not the same average value (Ghozali, 2013).

The Difference Test using eviews, it is known

that mustahiq income variable between before

participating in coaching and after participating in

coaching has a sig (2 tailed) of 0,000 meaning <0.05

so that it can be concluded that there is a difference

in income. The same thing happens in the Mustahiq

business profit variable between before participating

in coaching and after participating in coaching.

3.4 The Effect of Productive Zakah

Funds Utilization on Mustahiq

Revenues

The result of t count in table 5 is 2.644637, t

table is 1.694. These results can be concluded that t

count (2.644637)> t table (1.694) so that H1 is

accepted, which means that the Productive Zakah

Fund Utilization variable (PDZP) has a significant

positive effect on Mustahiq Revenue (PM). The

utilization of productive zakah funds can determine

business profitsMustahiq if the greater the

productive zakah funds provided by the Amil Zakah

institution in the form of business capital, the greater

the business profits to be received byMustahiq from

the capital proceeds. This research supports the

Sharia Enterprise Theory theory proposed by

Triyuwono (2007) that this diversification of

economic power in the concept of sharia is highly

recommended, considering that sharia prohibits the

circulation of wealth only in certain circles(Mansur,

2012).

Sharia Enterprise Theory (SET) does not only

concern individual interests, but also other parties.

Therefore, SET has a great concern for broad

stakeholders. According to SET, stakeholders

include God, humans, and nature (Mansur, 2012).

In the theory of productive zakah mentioned by

Azizy in Nafiah(2015), it is argued that zakah should

not be just consumptive, so ideally zakah should be

used as a source of people's funds. The use of zakah

for consumptive is only for emergency matters. That

is, when there is a mustahiq that is impossible to be

guided to have an independent business or indeed

for urgent purposes, then consumptive use can be

made.

In this study, productive zakah is a means for the

national amil zakah institution DPU-DT to account

for zakah funds that have been collected from

muzakki and then given to mustahiq, the zakah

funds given are intended to prevent the occurrence

of wealth circulating only among certain mustahiq

can also feel the zakah funds through a productive

zakah program in the form of business capital, so

that mustahiq can utilize the zakah funds to be used

as a business and in the future it will become

muzakki.

3.5 The Effect of Productive Zakah

Fund on Mustahiq Business Profits

The results of t count for the variable utilization

of productive zakah funds is greater than t table with

a significance value smaller than 0.05, indicated by a

significance value of 0.046 <0.05. These results can

be concluded that the second hypothesis can be

accepted with the variable variable utilization of

productive zakah funds having a positive and

significant effect on the profitability of mustahiq.

Utilization of productive zakah funds can determine

mustahiq's business profits if the greater productive

zakah funds provided by the amil zakah institution

in the form of business capital, the greater the

business profits that will be received by mustahiq

from the proceeds of the given capital.

Nafiah (2015) has proven in her research that

there is a positive influence between the utilization

of productive zakah on the program of rolling cattle

at the Regency of Gresik on welfare of mustahiq,

which through the rolling cattle program can

increase the profitability of mustahiq, while in other

research results, Winoto and Pujiyono (2011) argued

that there must be an increase in mustahiq business

profits after obtaining business capital assistance

provided by Semarang City BAZ.

The results of this study support the Sharia

Enterprise Theory proposed by Triyuwono (2007) in

that the diversification of economic power in the

concept of sharia is highly recommended,

considering that sharia prohibits the circulation of

wealth only in certain circles, thus that through

The Effect of Productive Zakah on Increasing Mustahiq Revenue and Profit

2131

productive zakah funds, can prove that the wealth

owned by a person can be useful and disseminated

with the help of the national amil zakah institution as

the manager and distributor of the zakah funds

(Mansur, 2012).

In the theory of productive zakah mentioned by

Azizy in Nafiah(2015), it is argued that zakah should

not be just consumptive, so ideally zakah should be

used as a source of people's funds. The use of zakah

for consumptive is only for emergency matters. That

is, when there is a mustahiq that is impossible to be

guided to have an independent business or indeed

for urgent purposes, then consumptive use can be

made.

In this study, productive zakah is a means for the

national amil zakah institution DPU-DT to account

for zakah funds that have been collected from

muzakki and then given to mustahiq, the zakah

funds given are intended to prevent the occurrence

of wealth circulating only among certain mustahiq

can also feel the zakah funds through the productive

zakah program in the form of business capital, so

that mustahiq can utilize the zakah funds to be used

as a business and in the future they will become

Muzakki.

Based on the results of this research if the zakat

management organization around Bekasi in the form

of LAZ and BAZ by empowering and assisting

mustahiq is expected to be able to improve the

economy by increasing their revenues and profits as

awhile produce economic growth that support

government programs in poverty alleviation.

4 CONCLUSION

This study aims to examine the effect of

productive zakah funds. In this study, the author

uses a mix method which is a combination of

qualitative-based research and quantitative research.

Based on the analysis and research results by

testing the hypothesis using simple regression

analysis, it can be concluded as follows: (1.) the

utilization of productive zakah funds, the results of

testing hypotheses in t test shows that the productive

zakah variable has a significant positive effect

onMustahiq income. Because the greater the

productive zakah funds provided as business capital,

the moreMustahiq income level is generated. (2.)

Utilization of productive zakah funds, the results of

testing hypotheses in the t test shows that the

variable utilization of productive zakah funds has a

significant effect on the profit of Mustahiq business.

Because the benefits of Mustahiq business will be

increasingly obtained if there is business capital

assistance provided through productive zakah funds

so that they can meet the desires of consumers.

REFERENCES

Creswell, J. W. (2016). Research Design Pendekatan

Metode Kualitatif, kuantitatif, dan campuran.

Yogyakarta: Pustaka Pelajar.

DPU-DT. (2016). Microfinance Syariah Berbasis

Masyarakat Pemberdayaan Ekonomi Produktif

Masyarakat Pra-Sejahtera. Bandung: Dompet Peduli

Umat Daarut Tauhiid.

Ekaningrum, A. E. (2016). Efektivitas Pengelolaan Zakat

Produktif Program Mirofinacne Syariah Berbasis

Masyarakat Di Dompet Peduli Ummat Daarut Tauhiid

Cabang Yigyakarta Terhadap Pemberdayaan Ekonomi

Masyarakat. Universitas Islam Indonesia. Retrieved

from https://dspace.uii.ac.id/handle/123456789/2145

Fakhrudin. (2008). Fiqh dan Manajemen Zakat di

Indonesia. Malang: UIN Malang Press.

Ghozali, I. (2013). Aplikasi Analisis Multivariete Dengan

Program IBM SPSS 23. Semarang: Badan Penerbit

Universitas Diponegoro.

Harahap, S. S. (2015). Teori Akuntansi. Depok: PT Raja

Grafindo Persada.

Harahap, S. S., Wiroso, & Yusuf, M. (2010). Akuntansi

Perbankan Syariah. Jakarta: LPFE Usakti.

Haryuda. (2018). Program Personel Report. Bekasi.

Hasanah. (2018). Interview with Mustahiq. Bekasi.

Hasbiyah, W., & Putra, P. (2017a). Ekonomi Syariah (1st

ed.). Jakarta: Akademika Pressindo.

Hasbiyah, W., & Putra, P. (2017b). Peran Zakat Produktif

dengan Pemberian Modal Usaha dalam Meningkatkan

Ekonomi Umat. Maslahah, 8(1), 93–110.

Huda, N., Rini, N., Mardoni, Y., & Putra, P. (2012). The

Analysis of Attitudes , Subjective Norms , and

Behavioral Control on Muzakki ’ s Intention to Pay

Zakah. International Journal of Business and Social

Science, 3(22), 271–279.

Ihsan, M. (2018). Interview with Branch Manager. Bekasi.

IKAPI. (2012). Undang-Undang Pengelolaan Zakat dan

Wakaf. Bandung: Fokus Media.

Ikatan Akuntan Indonesia. (2014). Pernyataan Standar

Akuntansi Keuangan. Jakarta, Indonesia.

Mansur, S. (2012). PELAPORAN CORPORATE

SOCIAL RESPONSIBILITY PERBANKAN

SYARIAH DALAM PERSPEKTIF SYARIAH

ENTERPRISE THEORY (Studi Kasus pada Laporan

Tahunan PT Bank Syariah Mandiri). Economic: Jurnal

Ekonomi Dan Hukum Islam, 2(2), 107–133.

Nafiah, L. (2015). Pengaruh Pendayagunaan Zakat

Produktif Terhadap Kesejahteraan Mustahiq Pada

Program Ternak Bergulir BAZNAS Kabupaten Gresik.

El-Qist, 2(1).

Nurhayati, S., & Wasilah. (2015). Akuntansi Syariah Di

Indonesia (4th ed.). Jakarta: Salemba Empat.

Pernanu, I. G., & Putra, P. (2016). Pengaruh Motivasi dan

ICRI 2018 - International Conference Recent Innovation

2132

Kepuasan Kerja terhadap Kualitas Pelayanan : Survey

pada Karyawan BTN Kantor Cabang Syariah Kota

Bekasi. Maslahah, 7(2), 15–32.

Putra, P. (2015). Analisis Tingkat Pemahaman Mahasiswa

Terhadap Pernyataan Standar Akuntansi Keuangan

Syariah (PSAK-S). JRAK, 6(1), 38–50.

Putra, P. (2016). Analisis Faktor-Faktor yang

Mempengaruhi Intensi Muzaki Membayar Zakat :

Sebuah Survey pada Masyarakat Kota Bekasi.

Maslahah, 7(1), 99–109.

Putra, P., & Silviana. (2017). MODEL AIDA SEBAGAI

STRATEGI PEMASARAN BAGI NASABAH

MENGAMBANG PERBANKAN SYARIAH (

SURVEI MASYARAKAT DI KOTA. Jurnal

Organisasi Dan Manajemen, 13(1), 10–21.

Rini, N., Huda, N., Mardoni, Y., & Putra, P. (2017). Peran

Dana Zakat Dalam Mengurangi Ketimpangan

Pendapatan Dan Kemiskinan. EKUITAS (Jurnal

Ekonomi Dan Keuangan), 17(1), 108.

http://doi.org/10.24034/j25485024.y2013.v17.i1.2230

Roziq, A., Yulinartati, & Ekaningsih, L. A. F. (2013).

Three Circles Model Revitalisasi Lembaga Pengelola

Zakat. Inferensi, 7(2), 387–408.

Sarwono, J. (2011). Mixed Methods Cara Menggabung

Riset Kuantitatif dan Riset Kualitatif Secara Benar.

Jakarta: PT. Elex Media Komputindo.

Siregar, S. (2013). Metode Penelitian Kuantitatif

menggunakan SPSS. Jakarta: Kencana.

Sugiyono. (2016). Metode Penelitian Kombinasi (Mix

Methods). Bandung: Alfabeta.

Suwarni. (2018). Mustahiq Interview Results. Bekasi.

Triyuwono, I. (2007). Mengangkat “Sing Liyan” Untuk

Formulasi Nilai Tambah Syariah. In Simposium

Nasional Akuntansi X Unhas (pp. 1–21). Makasar:

Universitas Hasanudin.

Winoto, G. N., & Pujiyono, A. (2011). Pengaruh Dana

Zakat Produktif terhadap Keuntungan Usaha

Mustahik Penerima Zakat (Studi Kasus BAZ Kota

Semarang). Universitas Dipoinegoro.

Wulansari, S. D., & Setiawan, A. H. (2014). Analisis

Peranan Dana Zakat Produktif terhadap Perkembangan

Usaha Mikro Mustahik (Penerima Zakat) (Studi Kasus

Rumah Zakat Kota Semarang). Diponegoro Journal of

Economics, 3(1), 1–15. Retrieved from http://ejournal-

s1.undip.ac.id/index.php/jme

Zurma, N. (2018). Group Chair Interview Results. Bekasi.

The Effect of Productive Zakah on Increasing Mustahiq Revenue and Profit

2133