Regional Development Banking and Mobilization of Funds

Sapto Jumono

1

and Chajar Matari Fath Mala

1

,Slamet Seno Adji

1

, Leroy S. Uguy

1

1

Esa Unggul University, Economic Faculty and Business

Keywords: Loan to Deposits Ratio, Regional Economy, Market Structure, Panel Data, Regression Panel

Abstract: This study aims to find out the mobilization of funds by Indonesian RDB (Regional Development Bank)

and the factors influencing it. The interaction between external changes and the internal condition of the

bank may inhibit or even accelerate the fundsmobilization. The mobilization of funds is the main role of

banking as an intermediary institution between surplus units and deficit units. The data research is quarterly

data from 2010 to 2017. There are 26 RDBs as the sample. This research uses the regression data panel as

the research method. The result of this research explainsthat regional external economic variables such as

GDP, Exchange Rate and Inflation, market concentration, and banking characteristics affect

thefundsmobilizationof Indonesian RDBs. This means the pricing strategy must pay attention to external

and internal variables. In the future, Indonesian RDBs need to develop the products that are specific to

aintain and increase the mobilization of funds that have been achieved.

1 INTRODUCTION

The mobilization of funds in order to improve the

efficiency of intermediary performance is not an

easy matter. In reality, the central role of banking is

full of challenges and risks both from internal and

external sources. The mobilization of funds is

heavily influenced by factors such as trust,

expectation, security, timeliness, flexible service,

and prudent fund management. Also, fund

mobilization also poses risks such as liquidity risk,

interest rate risk, credit risk, and capital risk. These

risks are a consequence of the reaction of the

banking management behaviour in its reaction to

changes in external conditions as well as the internal

development of the bank itself.

The bank that has a high non-performing loan

will have an impact on the crisis (Abid et al., 2014),

it has potential to disrupt the financial system and

may result in the financial crisis (Mankiw, 2014).

Therefore, the risk mitigation is a priority for every

banker to maintain bank stability in order to make

banking to remain stable in the fierce competition

era especially in financial markets.

In a healthy economy, financial institutions

should be able tobeintermediary institutions that

efficiently mobilize funds from surplus units to

deficit units (Mishkin and Eakins, 2012). Therefore,

in the economic system, the primary role of banks

and financial institutions is to implement the task of

mobilizing public funds by operating their

intermediary functions to make efficient relations

between SU (supplement units) and DU (deficit

units). Banks as the largest element in the financial

system in mobilizing funds are given special

permission to raise public funds and redistribute in

the form of loans or credit to real business sectors.

Thus, the main task system of the financial or

banking sector is to play an agent role in order to

accelerate development and encourage economic

growth to improve economic welfare.

The role of banking in mobilizing public funds is

a not easy because of the dynamics of uncertain

economic conditions, rapid regulatory changes,

intense banking competition, and other

circumstances that force bankers to be very careful

about the collection and distribution of their funds.

A credit disbursement is not only oriented to profit

but should further think and lead to efforts to

improve the economic welfare.In accelerating the

fund mobilization, bankers are required to act

optimally. They should make the funds that can be

purchased at relatively low cost. This is a challenge

because there area tight regulation and competition

between banks. The development of deposits and

loan can represent the acceleration level of funds

mobilization. If the loan to deposit ratio (LDR)

increases, it means the speed of mobilization of

Jumono, S., Matari Fath Mala, C., Seno Adji, S. and S. Uguy, L.

Regional Development Banking and Mobilization of Funds.

DOI: 10.5220/0009949804790490

In Proceedings of the 1st International Conference on Recent Innovations (ICRI 2018), pages 479-490

ISBN: 978-989-758-458-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

479

funds also increases. LDRreflects the ability of

banks to extend credit and collect public funds. The

higher LDR means the bank optimally do the

intermediation function. LDR reflects the bank's

ability to provide credits and raise public funds.

Table 1:Assets Market Share of Indonesian BankingDuring 2013-2017

Group 2013 2014 2015 2016 2017 Average

State-owned Banks

35.50%

36.98%

37.72%

39.62%

40.43%

38.05%

Foreign Exchange

Banks

39.61%

39.18%

38.54%

39.71%

40.13%

39.43%

Non-Foreign

Exchange Banks

3.28%

3.33%

3.15%

1.09%

1.19%

2.41%

Regional

Development Banks

7.87%

7.85%

7.76%

7.87%

8.19%

7.91%

Joint Venture Banks 5.86% 4.96% 5.11% 4.74% 4.49% 5.03%

Foreign Banks 7.88% 7.70% 7.72% 6.96% 5.57% 7.17%

Total 100% 100% 100% 100% 100% 100%

Total (Million, IDR) 4.954.467 5.615.419 6.132.583 6.729.798 7.387.633

Assets Growth 11.77% 8.43% 8.87% 8.91%

Source: Indonesian Banking Statistic

According to Table 1, during 2013-2017, the assets

of Indonesian banking continued to increase with the

average growth of 9.5%. The proportion of majority

asset is controlled by state-owned banks (38.05%)

and foreign exchange banks (39.43%). Meanwhile,

regional development banks owned at 7.91%, non-

foreign exchange banks owned at 2.41%, foreign

banks owned at 7.17%, and joint-venture banks

owned at 5.03%. The data shows an imbalance in the

banking asset market. The structure of the banking

market is concentrated in state-owned banks and

foreign exchange banks meanwhile the other banks

are only market followers.

The indicator of funds mobilization which is

represented by LDR. Based on Table 2, the average

percentage of LDR is at 90%. This shows that

distributed funds are smaller than the collected funds.

Joint-venture banks and foreign banks show that

their LDRs exceeds 100%, this means the credit

given to the public exceeds the funds collected. This

is interesting to be investigated the factors that

influence it. Therefore, it can be detected for further

consideration of decision-making to manage an

efficient banking industry.

Although the asset of banking regional

development bank (RDB) only amounted to 7.91%

of the national banking assets, however, the

development of RDP assets is still very possible

regarding demographic factors. RDB is the host of

every province in Indonesia. Therefore the majority

ownership shares are owned by the local, provincial

government. RDB is more potential

mobilizingpublic funds, primarily to support the

financing of infrastructure development and SMEs.

Based on Table 3, the financial health indicator

of RDB group also shows that RDBs are in healthy

condition. The capital adequacy ratio (CAR) exceeds

the healthy criteria, which is more than 8%.

Meanwhile, return on assets (ROA) of RDBs are all

above 1.5%. Even though ROA is decreased,

whomever the number is still quite high. The cost

efficiency which is represented by the cost to

income ratio (CIR) shows that RDBs are efficient,

the percentage is under 79%.

There are some previous studies about the

mobilization of funds that have been researched.

Tomak (2013) discussed the determinants of

commercial credit loans of private banks and state

banks in Turkey. The result shows that the bank size,

total liabilities, non-performing loans, and inflation

have a significant effect on commercial credit

business. Meanwhile, GDP and interest rate have no

significant effect on credit business. Buchory (2014)

studied the implementation of the intermediation

role of RDB. The intermediation role is represented

by loan to deposit ratio (LDR). The result shows

CAR and ROA are significant to LDR.

ICRI 2018 - International Conference Recent Innovation

480

Table 2: Loan to Deposits Ratio of Indonesian Banking During 2013-2017

Group 2013 2014 2015 2016 2017

Commercial Banks 89.700% 89.420% 92.110% 90.700% 90.040%

State-owned Banks 86.700% 83.730% 88.580% 88.690% 88.670%

Foreign Exchange Banks 83.770% 85.660% 87.550% 84.830% 86.060%

Non-foreign Exchange

Banks 85.100% 87.810% 81.120% 88.370% 92.490%

Regional Development

Banks

92.340% 89.730% 92.190% 93.650% 87.620%

Joint Venture Banks 122.200% 123.610% 132.770% 129.010% 129.020%

Foreign Banks 130.050% 140.040% 131.490% 122.380% 122.330%

Source: Indonesian Banking Statistic

Table 3: Performance Indicator of Regional Development Banks During 2013-2017

Tahun

Performance Indicator

CAR ROA CIR NIM

2013

17.58% 3.18%

73.49%

7.04%

2014

17.79% 2.68% 78.08% 6.65%

2015

20.61% 2.40% 79.57% 6.66%

2016

21.69% 2.58% 78.08% 7.07%

2017

21.65% 2.40% 78.65% 6.42%

Source: Indonesian Banking Statistic

The general condition of banking, the factual

phenomenon of RDBs, and the gaps of findings from

previous relevant researchmotivate this study to find

out what factors influenced the development of fund

mobilization conducted by Indonesian RDBs.

Therefore, this study aims to determine the factors

that affect the LDR regarding external factors and

internal factors. The external factors are the regional

economic conditions, which are GDP-regional, CPI-

regional and Exchange Rate-regional, and the

structure of national banking market. Meanwhile,

the internal factors are NPL, OC/TA ratio, TE/TA

ratio, ROA, and NII/TA ratio.

2 LITERATURE REVIEW

Theoretically, the linkage of mobilization

of public funds with internal and external factors can

be seen if banking is seen as a system. The banking

system that is part of the financial system works in

the economic system in society. The Bank as the

largest element of the financial system seeks to

optimize its performance by following the dynamics

of changing basic economic conditions and market

structure (external factors), then the bank exploits

these changes by adjusting to its internal conditions

to achieve equilibrium.

The interaction between the internal

banking condition and external factors can be both

directional and causality. According to the theory of

SCP (structure conduct performance) the

relationship between BC (Basic condition, S (market

structure), C (conduct) and P (performance) bank

direction.This means bank performance is a function

of external conditions and behaviour Structure affect

behaviour and behaviour also affects performance, it

makes the market inefficient, indicative of collusion,

while ESH theory actually states that the relationship

between S, C and P, is not the only direction but

causality: It can mean that in an efficient market it is

performance that becomes a function of behaviour

and market structure.The theory of financial

intermediation was first proposed by Schumpeter in

1939, stating that financial intermediation is based

on minimizing the cost of production of information

to solve incentive problems. The costs incurred by

the bank (intermediary) receive the delegation from

Regional Development Banking and Mobilization of Funds

481

the owner of the funds to monitor the funds lent to

the debtor. This has advantages regarding cost in

collecting information because this alternative is the

activity of each bank,so it is more profitable when

compared to the owner of the funds to monitor

directly. As an intermediary institution, the

intermediary function is measured by a comparison

between the number of third-party funds that can be

collected by the amount of credit or financing

disbursed or otherwise known as LDR (Ascarya and

Yumanita, 2010). To describe the relationship

between the performance of mobilization of public

funds by, here are the results of literary studies from

previous studies.

2.1 The Relationship between ROA

(Return on Asset) and LDR (Loan

to Deposit Ratio)

The bank that has a high operating profit will make

management increase the mobility of funds, which

means the bank will increase the credit obtained

from the fundscollectedfrom the public. Profitability

is represented by return on assets (ROA), which is a

profitability ratio that describes the company's

ability to generate profits from every asset used. A

high ROA indicates the banks have operating profit

more than assets

2.2 The Relationship between NPL and

LDR

The banks which have a low non-performing loan

(NPL) indicates they also have a low credit risk

decreases. This condition encourages banks to

increase the volume of loans obtained from public

funds. The high bad credit management will

decrease the bank liquidity. Non-performing loans

cause a loss of income opportunity from the credit;it

reduces profits and the ability of banks to provide

credit, particularlyto pay bank liabilities to

depositors. The high level of NPL will make the

bank more selective in distributing credits because

non-performing loans reduce the value of LDR

(Fitria and Sari, 2012).

2.3 The Relationship between OC/TA

with LDR

The ratio of OC/TA ratio describes the amount of

overhead cost compared to the total assets of the

bank. The concept of overhead cost still hasdifferent

between banking practitioners. Ideally, all costs

(excluding interest costs) which is incurred by the

bank in performing its activities are supposed to be

calculated as an overhead cost. Moreover, there is a

concept states that all costs of funds beyond the cost

used in collecting funds and the costs incurred in the

management of credit disbursement should be

calculated as an overhead cost. Therefore, earning

asset is assumed to bear the cost.If overhead cost

increases, this means all the banking activities

including fund mobilization activities will increase.

For example, technology will raise the overhead

cost,but the bank is expected to be more efficient.

2.4 The Relationship between TE/TA

and LDR

The high capital will make the bank's solvency

increases. This also will raise the banking trust and

encourage people to make a deposit. In the end, the

banking credit distribution will also be high. The

effect of CAR on LDR has also been reviewed

previously investigated by Nasiruddin (2005).

Nasiruddin (2005) found out that CAR has a positive

and significant effect on LDR.

2.5 The Relationship between NII / TA

and LDR

The high net interest income will make banking

management more enthusiastic to increase the

mobility of funds. The bank will encourage people

to save more so that the ability of banks to extend

credit also increase. The ratio of NII/TA is used to

measure the bank's management capability in

managing its earning assets to generate net interest

income. The volume of loans provided greatly

affects the bank's profit through interest income. If

interest income is high, the bank's profit isalso

predicted to increase so it can affect bank liquidity.

The amount of interest income depends on the

amount of credit volume provided. The results of

Rosadaria (2012) and Buchory (2014) found outthat

NIM has a positive and significant effect on bank

liquidity.

2.6 The Relationship between Market

Concentration and LDR

Market concentration can be interpreted as a

percentage of market share dominated by relatively

large companies to the total market share.

Accidental factors do not cause concentration but it

caused by the permanent forces that lie behind the

concentrations that usually do not change much over

time. Concentration also indicates the level of

ICRI 2018 - International Conference Recent Innovation

482

production of a market or industry that focuses only

on one or a few (2-10) largest companies.

Concentration is the number of market shares of

reputable companies or oligopolists, whereby

companies are aware of the interdependence of each

other.

If market conditions become more concentrated,

the market is increasingly monopolized, and the

competition is decreasing.Normally, the more

concentrated market share of the company's market

is narrowed so that the ability of banks in the

mobilization of public funds decreases. The ability

of mobilization of funds by the follower decreases,

this may not be true if the follower bank has certain

capabilities/advantages in expanding the market,

they penetrate the newmarket to increase the

mobility of public fund, the bank will increase

financial inclusion so that society save more and

bankability to distribute credit also increased.

2.7 The Relationship between

Exchange Rate and LDR

If the domestic currency exchange rate is

depreciated, then the value of bank asset in the form

of the domestic currency will decrease. This can

make interest rates rise and the acceleration of

mobilization of public funds to go down. The

opposite may happen if the interest rate set by the

bank already includes exchange rate risk, therefore if

the exchange rate of domestic currency depreciates

the bank does not need to raise the interest rate so

that the mobilization of public funds will increase.

2.8 The Relationship between Inflation

and LDR

If inflation occurs, the value of the bank's assets in

the form of the domestic currency will decrease.

Thiscould makebank interest rates rise,andthe

achievements of banks in the mobilization of public

funds are going down. The opposite may happen if

the interest rate set by the bank already includes the

risk of inflation, so if the inflation occurs then the

bank does not need to raise interest rates so that the

mobilization of public funds still running and still

rising.

The previous research on inflation has been

studiedby Hasanudin and Prihatiningsih (2010).

Theyused Rural Bank in Central Java as the sample;

the result shows inflation has a positive effect on

credit growth of Rural Bank.

2.9 The Relationship between GDP and

LDR

The relationship between GDP and LDR is by the

theory of money demand. If GDP rises, it means

income society rises, therefore demand for money

for transactions and keep watch also rises. On the

other hand, the ability of people to save also

increases. When the income of society is high, then

bank deposits will also increase which make the

increment of the ability of banks in distributing

credits.

3 RESEARCH METHOD

3.1 Data and Research Variables

This study is applied research because the purpose

of this study is to apply the previous research

method and then it will be developed theoretically.

This research is also explanatory research because

this study also aims to explain the causal

relationship between variables through hypothesis

testing.

The object of this research is the banking market

industry in Indonesia. While the subject of research

is RDBs (regional development bank). This research

observes the development of the regional economy,

market structure, banking characteristics, and the

research focus is banking liquidity. The data used

are secondary data from published financial

statements of the Bank Indonesia, World Bank, BPS,

and Indonesian Banking Statistics (SPI) in the period

of 2010-2017, quarterly data.

The population is all regional development banks

which operate in Indonesia from 2010 until 2017.

The sample is saturation sample which consists of

27 Indonesian regional development banks.

3.2 Model Specification

To create patterns of influence of regional economic

conditions, market structure and banking

characteristic on funds mobilization, the

econometric model as follows:

itititit

ititittit

eROAOCTATETANIITANPL

GDPRCPIRERRCRLDR

98765

43210

(1)

Symbol i indicates individual bank or individual

province while t is period ofthe quarter in a certain

year; LDR = loan to deposit ratio. The LDR is an

Regional Development Banking and Mobilization of Funds

483

indicator to measure the fund mobilization of banks.

A higher LDR implies a lower intermediation

banking; CR = Concentration ratio; ERR = regional

exchange rate; CPIR = regional consumer price

index; GDPR = regional gross domestic product;

NPL = non performing loan = credit risk; ROA =

return on total assets / banking profitability; TE / TA

= equity to assets Ratio; NII / TA = NII proportion

in total assets and OC / TA = proportion of overhead

of total assets

3.3 Research Variables

According to Table 4, the variables of internal

factors and external factorsrefer to previous theories

and research. The internal factors are banking

specific characteristics (Athanasoglou et al., 2008).

Banking specific characteristics are factors derived

from the internal condition of the bank, which can

be seen from the financial ratios in the balance sheet

and earnings report bank loss.

Table 4: Operational Definition Variables and Their Measurements

Variable Measurement/

Formula

Notation Impact

Dependent

Variable

Fund

Mobilization

Loan to

Deposit Ratio

(Loan/Deposit) X 100%

LDR

DETERMNAN(Independent Variable)

Internal

banking

Profitability, Assets

Capital, Cost & Revenue

Management

Return o

Assets

Non-

Performing

Loan

Net Interest

Income

Overheadcost

Ratio

Capital

(NOI/TA) X 100%

(NPL /

Total Loan ) X 100%

(NII/Total Assets) x

100%

(Overheadcost/Total

Assets) X 100%

(Equity/Total Assets)

x 100%

ROA

NPL

NIM

OC/TA

TE/TA

+

-

+

_

+

Banking Market

Structure

Market Share &

Competition

Market

Concentration

of Assets

Total market share assest

4 bank terbesar pada

pasar assets perbankan

(%)

CR4A

-

Macro

Economy

Exchange Rate

Inflation

Economy Activity

Exchange Rate-

regional

Inflation -

regional

GDP-regional

Rupiah/USD

(CPIt-CPIt-1)/CPIt-1

*100

GDR-riil (Constant

Price)

ER-r

Inf-r

GDP-r

-

-

+

ICRI 2018 - International Conference Recent Innovation

484

4 RESULTS AND DISCUSSION

To make inferential analysis, firstly in this research

is done by making three models of panel data

regression,i.e OLS (Ordinary Least Square) model,

FE (Fixed Effect), and RE (Random Effect). After

that, selected the best among the three models by

using Chow test to choose between OLS model with

FE model; Hausman's test to choose between FE

model and RE model, and LM (Lagrange Multiplier)

to choose between OLS or RE models.

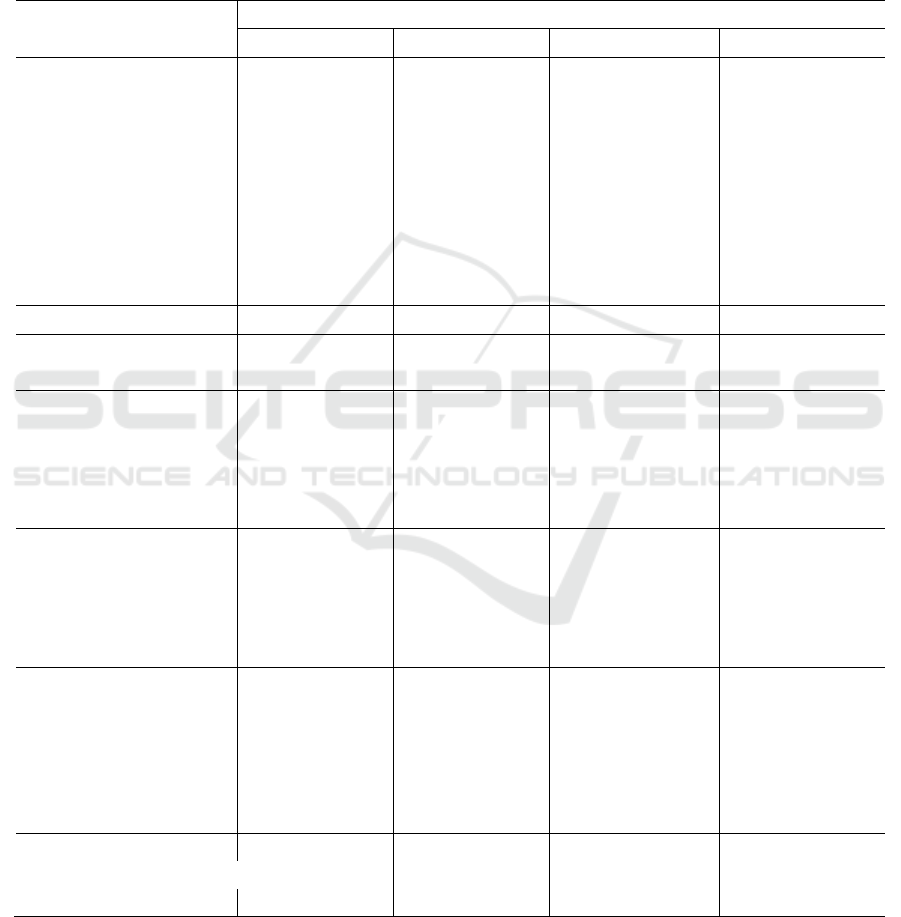

Table 5: The Factors Affecting Loan to Deposits Ratio in Regional Banking

Independent

Variables

Model

FE RE OLS GLS

NPL -1.2158385*** -1.2158385*** -1.2158385*** -1.2158385***

NII/TA 5.4877495*** 5.4877495*** 5.4877495*** 5.4877495***

OC/TA 0.60485704 0.60485704 0.60485704 0.60485704

ROA -3.5475949*** -3.5475949*** -3.5475949*** -3.5475949***

TE/TA 1.1549594*** 1.1549594*** 1.1549594*** 1.1549594***

CR4A 84.5836790** 84.5836790** 84.583679** 84.583679**

ER-R 0.00123691*** 0.00123691*** 0.0012369*** 0.0012369***

CPI-R 0.0402731300* 0.040273130* 0.040273130* 0.040273130*

GDP-R 1.501e-08** 1.501e-08** 1.501e-08** 1.501e-08**

_cons -20.656519 -20.656519 -20.656519 -20.656519

F( 9,791)/ Wald chi

2

(9) 50.380

449.08

41.650

379.57

Prob > F / Prob > chi

2

0.00000

0.00000

0.00000

0.0000

R-sq: within 0.3718 0.3711

between 0.0886 0.1384

overall 0.2845 0.3034

R-squared 0.3215

Adj R-squared 0.3138

Number of obs 801 801 801 801

Number of groups 26 26 26 26

Obs per group: min 30 30 30 30

avg 30.8 30.8 30.8 30.8

max 31 31 31 31

OLS/RE : chi

2

(1) 514.34

Prob > chi

2

0.0000

OLS/FE : F(25, 766) 10.830

Prob > F 0.00000

FE/RE : chi

2

(8) 14.920

Prob>chi

2

0.0606

Multicol test /Mean VIF 32.65

Autocorr test / F( 1,25) 18.513

Prob > F 0.0002

Source: Secondary Data, Processed

Regional Development Banking and Mobilization of Funds

485

Then, after chosen the best model is tested BLUE

(best linear unbiased estimation). If the escape is

interpreted the model, but if not pass will be made an

alternative model of GLS (Generalized Least

Square).

Chow test results show that prob-F = 0.0000 <0.05,

it means that the model selected is the FE model.

Hausman test shows prob-F value = 0.06> 0.05, it

means the model chosen is RE model. The LM test

shows the prob-F value = 0.0000 <0.05 which means

the model chosen is the RE model. Therefore, from

the model selection test it is evident that the suitable

or appropriate model is the RE model. The RE

model as the best model needs to be tested BLUE

via post-estimation test.

To find out whether the selected RE model meets

the BLUE criteria or not, a multicollinearity and

autocorrelation test is required. The multicollinearity

test results show a VIF (Variance Inflating Factor) of

32.65> 10; means there are indications of

multicollinearity. While the Autocorrelation test

shows prob-F = 0.0002 <0.05, there is an indication

of autocorrelation. So, RE does not meet the

qualification of BLUE test. Therefore, we need to

look for the alternative models. In this research, the

alternative chosen model is GLS (Generalized Least

Square).

Based on Table 5, the GLS model shows that the

mobilization of public funds by RDBs which is

represented by LDR is influenced by

macroeconomic factors, market structure, and

banking characteristics. This means the systemic

development of mobilization of public funds by

Indonesian RDBs is related to regional

macroeconomic conditions such as GDP-R, CPI-R

and ER-R; the structure of the national banking asset

market (CR4A) and the bank's internal conditions

such as NPL, NIM, ROA and TE/TA.

4.1 The Effect of NPL on LDR

The non-performing loan has a significant and

negative effect on LDR. This is a good condition

because a low NPL indicates smaller credit risk

which makes bank increase the allocation of credit.

This result is in accordance to research from Saryadi

(2013) which stated the higher NPL wouldresult in

the greater credit risk. Fitria dan Sari (2012)

statedthat a high NPL would make the bankmore

selective in distributing credit.

4.2 The Effect of NIM on LDR

The ratio of NII/TA variable has a significant

positive effect on LDR which means the greater net

interest margin will also make the greater LDR. This

indicates bank has managed to optimize the

difference between interest income and interest

expenses from total assets operated by the bank. The

optimal net interest margin drives to increase LDR.

The result isin accordance with the findings of

Rosadaria (2012) and Buchory (2014) which found

out that NIM had a significant positive effect on

bank liquidity.

4.3 The Effect of ROA on LDR

Return on assets has a significant negative effect on

LDR which means alow ROA will make a high

LDR. This does not mean if a low ROA will make

operating profit goes down. Mathematically, a lower

ROA occurs because the growth ofoperating profit is

smaller than the growth of asset. Asset growth

affects increasing market access which makes the

bank's ability to attract and distribute fund is getting

stronger. This study supports Myers's (1984) who

stated that a high level of profitability would make

firms use retained earnings as a source of funds

compared to outside sources of funds from debt (in

this case, third-party funds) and it results in a decline

of the intermediary function of banks especially in

lending.

4.4 The Effect of TETA on LDR

A high capital adequacy ratio can provide a large

space internally and externally for banks because the

adequacy of banks capital is a requirement of safety

regulations. The higher capital adequacy will

makean optimal an intermediary function of banks in

this case the credit distribution.

In this research, the ratio of TE/TA has a

significant and positive effect on LDR which means

the high capital will increase LDR. Increasing the

capital of banks to make the solvency of banks

increases, this berimpak on trust society sehinggan

ability of banks to collect public funds and

channelled back to the community in the form of

credit becomes increasingly rising.The study

supports the findings of Saryadi (2013) which states

that if CAR increases, it will increase LDR.

ICRI 2018 - International Conference Recent Innovation

486

4.5 The Effect of Concentration on

LDR

CRA4 variable is the level of assets market power of

the four largest banks. The result shows that

concentration has a significant and positive effect on

LDR which means that the direction of the national

banking assets market structure is in line with the

development of funds mobilization by RDBs. This is

reasonable because RDBs are one of the parts of the

national banking system. It only has a small market

share,so it becomes a market follower. Therefore,

funds mobilization of RDBs is affected by the

dynamics of the national banking market structure.

4.6 The Effect of Exchange Rate on

LDR

The trend of Rp/USD currency of regional-province

has a positive effect on LDR. Thismeansthe

dynamics of forex market provincehas a role in the

rise of the turmoil of the RDBs’ capability in

mobilizing funds. The more Rp/USD currency rises

nominally; it will help RDBs in mobilizing funds.

Banking management succeeded in utilizing the

depreciation of rupiah to keep increasing LDR. This

result supports the research from Mongid (2008)

which suggests thatthe exchange rate has a

significant positive effect on the provision of credit.

4.7 The Influence of Inflation on LDR

The regional inflation which represents the

development of provincial market output prices has

a significant and positive influence on LDR. This

means that price development in the regional

goods/services market plays a significant role in

RDBs’ capability in mobilizing funds. A high CPI

will support RDBs in mobilizing funds. This is

because banking management managed to anticipate

the impact of inflation in pricing strategy to keep

increasing LDR

4.8 Influence of GDP on LDR

The GDP-R variable or regional gross domestic

product development progress a significant and

positive influence on LDR. This means the regional

output market condition contributes to the rise of the

turmoil on the mobilization capability of RDBs’

funds. The greater the regional economic activity

means better people's income,so this encourages

people to be able to save, on the other hand, the

demand for public money also rises, especially the

demand for money for transactions. Therefore, the

access to BPD in collecting and channelling funds is

increasing.

5 CONCLUSIONS

5.1 Finding

The fundsmobilization of RDBs in all provinces in

Indonesia is influenced by the external factor of

internal banking. The external factors consist of

regional GDP, regional exchange rate, regional

inflation and national banking concentration. They

have the significant and positive effect of the loan to

deposit ratio. Meanwhile, the internal banking

factors that have a significant positive effect are

NIM (net interest margin) and TE / TA (equity/asset

ratio). The variable which has a negative significant

effect is non-performing loan and return on assets.

This indicates that bank operations in Indonesian

RDBs are systematically working to optimize the

rotation of funds, the fundsmobilization is affected

by changes in regional economic conditions and the

structure of the national banking market. Therefore,

the RDBs need to mitigate the risk. Moreover, the

utilization and anticipation of the opportunities and

threats sourced from these external factors need to

be oriented in long-term perspective without neglect

on short-term interests especially in managing the

health aspects of profitability, capital, interest rate

spread, earning assets and cost-revenue

management.

5.2 Implications

The implementation of intermediation role of RDBs

by increasing the effectiveness of funds mobilization

can be enhanced to prioritize management pricing.

Net interest income can be increased by increasing

the volume of third-party fund and loan by making

loan growth bigger than third party fund growth. It

also can be increased by arising financial inclusive

to penetrate and explore new potential market,but it

still should consider the prudential aspect of

reducing risk.

The effectiveness of fund mobilization can also

be done by developing specific banking products.

Therefore the customers will be still loyal. The

product development is not only focused on credit

and deposit market, but it is also important to

develop fee-basedincome-based products. This is

important because the future of the market will be

more competitive so that the NIM must be thinning.

Regional Development Banking and Mobilization of Funds

487

The development of fee-based income products is an

alternative to maintain the stability of bank revenue.

It is important to prioritize and upgrade EWS

(early warning system) to anticipate changes in

regional macroeconomic conditions and market

structure changes, as these external variables are

significant to the accelerated mobilization of funds.

These external factor changes need to be included in

every decision making especially in the pricing

strategy which greatly affects the rapid mobilization

of public funds by banks.

REFERENCES

Abid, L., Ouertani, M. N., and Zouari-Ghorbel, S. (2014).

Macroeconomic and bank-specific determinants of

household's non-performing loans in Tunisia: A

dynamic panel data. Procedia Economics and Finance,

13: 58-68.

Ascarya, A., & Yumanita, D. (2010). Determinants of

bank’s net interest margin in Indonesia. In

International Conference on Eurasian Economies.

Athanasoglou, P. P., Brissimis, S. N., and Delis, M. D.

(2008). Bank-specific, industry-specific and

macroeconomic determinants of bank profitability.

Journal of international financial Markets, Institutions

and Money, 18(2): 121-136.

Buchory, H. A. (2014). Analysis of the effect capital,

credit risk and profitability in the implementation of

banking intermediation function: study on regional

development bank all over Indonesia in 2012. In

Proceeding Kuala Lumpur International Business,

Economics and Law Conference, 4: 311-327.

Fitria, N., and Sari, R. L. (2012). Analisis Kebijakan

Pemberian Kredit Dan Pengaruh Non Performing

Loan Terhadap Loan to Deposit Ratio Pada PT. Bank

Rakyat Indonesia (Persero), Tbk Cabang Rantau, Aceh

Tamiang.(Periode 2007-2011). Jurnal Ekonomi dan

Keuangan, 1(1).

Hasanudin, M., and Prihatiningsih. (2010). Analisis

Pengaruh Dana Pihak Ketiga, Tingkat Suku Bunga

Kredit, Non Performance Loan (NPL) dan Tingkat

Inflasi Terhadap Penyaluran Kredit Bank Perkreditan

Rakyat (BPR) di Jawa Tengah. Jurnal Teknis, 5(1).

Mankiw, N. G. (2014). Principles of Macroeconomics.

Seventh Edition. Stamford: Cengage Learning.

Mishkin, F. S, and Eakins, S. (2012). Financial Market

and Institutions Seventh Edition. United State of

America: Prentice Hall.

Mongid, A. (2008). The Impact of Monetary Policy on

Bank Credit during Economic Crisis: Indonesia's

Experience. Jurnal Keuangan dan Perbankan, 12(1):

100-110.

Myers, S. C. (1984). The capital structure puzzle. Journal

of Finance, 39 (3): 575-592.

Nasiruddin, N. (2005). Faktor-Faktor Yang

Mempengaruhi Loan to Deposit Ratio (LDR) Di BPR

Wilayah Kerja Kantor Bank Indonesia Semarang.

(Doctoral dissertation, Program Pascasarjana

UNIVERSITAS DIPONEGORO).

Rosadaria, G. (2012). Analisis Faktor-Faktor Yang

Mempengaruhi Loan to Deposit Ratio Sebagai

Likuiditas Perbankan. Thesis. Economics Faculty.

University of Indonesia.

Saryadi, S. (2013). Faktor-faktor Yang Berpengaruh

Terhadap Penyaluran Kredit Perbankan (Studi Pada

Bank Umum Swasta Nasional Devisa). Jurnal

Administrasi Bisnis, 2(1).

Tomak, S. (2013). Determinants of commercial banks’

lending behavior: Evidence from Turkey. Asian

Journal of Empirical Research, 3(8): 933-943.

ICRI 2018 - International Conference Recent Innovation

488

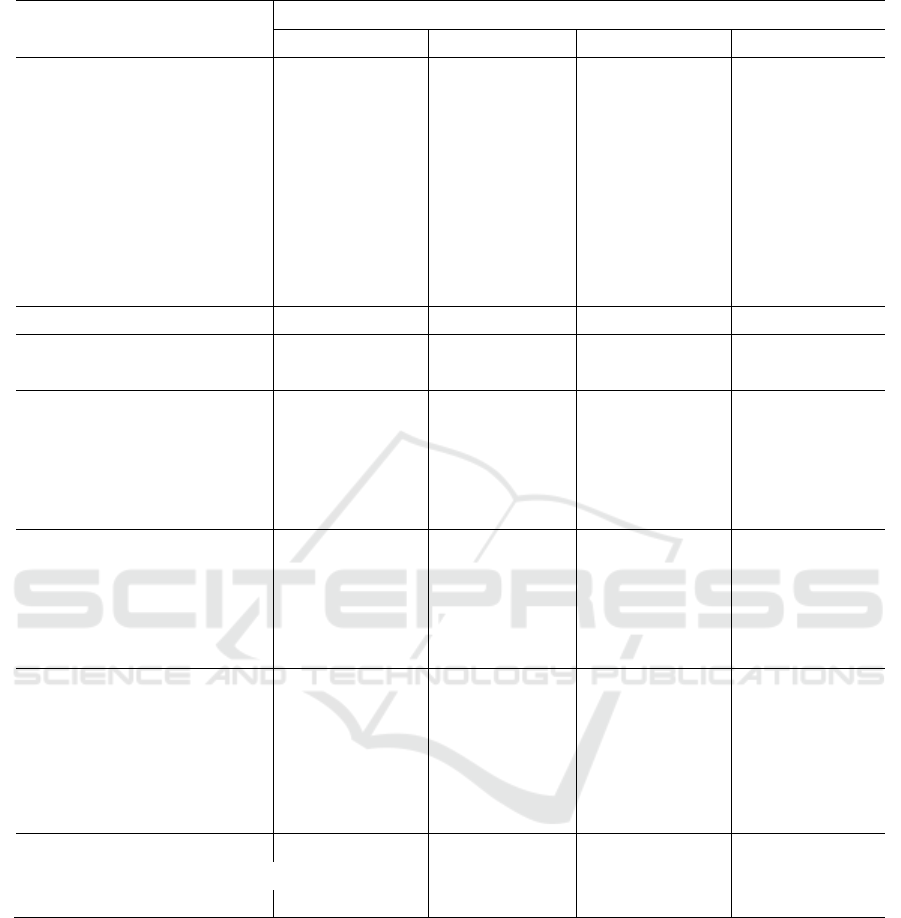

Tabel 3: The Factors Influence Loan to Deposits Ratio in Indonesian RDBs

Independent

Variable

Model

FE RE OLS GLS

NPL (Non performing loan) -1.2158385*** -1.2158385*** -1.2158385*** -1.2158385***

SPREAD (Spread rate) 5.4877495*** 5.4877495*** 5.4877495*** 5.4877495***

OC/TA (overhead cost) 0.60485704 0.60485704 0.60485704 0.60485704

BEP (Basic Earning Power) -3.5475949*** -3.5475949*** -3.5475949*** -3.5475949***

TE/TA (total equity/total asset) 1.1549594*** 1.1549594*** 1.1549594*** 1.1549594***

CRA4 (concentration of assets) 84.5836790** 84.5836790** 84.583679** 84.583679**

ER-R (Exchange rate-Region) 0.00123691*** 0.00123691*** 0.0012369*** 0.0012369***

CPI-R (Inflation-Regional) 0.0402731300* 0.040273130* 0.040273130* 0.040273130*

GDP-R (GDP-Regional) 1.501e-08** 1.501e-08** 1.501e-08** 1.501e-08**

_cons -20.656519 -20.656519 -20.656519 -20.656519

F( 9,791) / Wald chi

2

(9) 50.380

449.08

41.650

379.57

Prob > F / Prob > chi

2

0.00000

0.00000

0.00000

0.0000

R-sq: within 0.3718 0.3711

between 0.0886 0.1384

overall 0.2845 0.3034

R-squared 0.3215

Adj R-squared 0.3138

Number of obs 801 801 801 801

Number of groups 26 26 26 26

Obs per group: min 30 30 30 30

Avg 30.8 30.8 30.8 30.8

Max 31 31 31 31

OLS/RE : chi

2

(1) 514.34

Prob > chi

2

0.0000

OLS/FE : F(25, 766) 10.830

Prob > F 0.00000

FE/RE : chi

2

(8) 14.920

Prob>chi

2

0.0606

Multicol test / Mean VIF 32.65

Autocorr test / F( 1,25) 18.513

Prob > F 0.0002

Regional Development Banking and Mobilization of Funds

489

Table 4: The Factors Which Influence Loan to Deposits Ratio in Indonesian RDBs

Independent

Variable

model

fe re ols gls

Nplgipt -1.2158385*** -1.2158385*** -1.2158385*** -1.2158385***

Spreadsipt 5.4877495*** 5.4877495*** 5.4877495*** 5.4877495***

Octaipt 0.60485704 0.60485704 0.60485704 0.60485704

Bepipt -3.5475949*** -3.5475949*** -3.5475949*** -3.5475949***

Tetaipt 1.1549594*** 1.1549594*** 1.1549594*** 1.1549594***

cra4t 84.5836790** 84.5836790** 84.583679** 84.583679**

kurspt 0.00123691*** 0.00123691*** 0.0012369*** 0.0012369***

ihkpt 0.0402731300* 0.040273130* 0.040273130* 0.040273130*

pdrbcppt 1.501e-08** 1.501e-08** 1.501e-08** 1.501e-08**

_cons -20.656519 -20.656519 -20.656519 -20.656519

F( 9, 791) 50.380 41.650

Prob > F 0.00000 0.00000

Wald chi

2

(9) 449.08 379.57

Prob > chi

2

0.00000 0.0000

R-sq: within 0.3718 0.3711

between 0.0886 0.1384

overall 0.2845 0.3034

R-squared 0.3215

Adj R-squared 0.3138

Number of obs 801 801 801 801

Number of groups 26 26 26 26

Obs per group: min 30 30 30 30

avg 30.8 30.8 30.8 30.8

max 31 31 31 31

OLS/RE : chi2(1) 514.34

Prob > chi

2

0.0000

OLS/FE : F(25, 766) 10.830

Prob > F 0.00000

FE/RE : chi2(8) 14.920

Prob>chi

2

0.0606

Multicol test /Mean VIF 32.65

Autocorr test / F( 1,25) 18.513

Prob > F 0.0002

ICRI 2018 - International Conference Recent Innovation

490