Financial Feasibility Study of Home Care Business

Erwin Suhadi

1

, Lia Amalia

1

, Sudarwan

1

and Arief Kusuma Among Praja

1

1

F

aculty of Economics and Business, University of Esa Unggul, Jakarta, Indonesia

Keywords: Business Feasibility Study, Home Care, NPV, IRR, Pay Back Period.

Abstract: The main purpose of this business plan is to assess the feasibility of the health care business in the patient's

home. Developments in health services opened many opportunities to do business in the field of health

care,and one of them is Home Care services. There are many opportunities for Home Care business that

provide an opportunity for investors to develop this business. The opportunities that exist are many people

with degenerative diseases that need long-term care, the number of Home Care in Indonesia is still a little,

the existing Home Care is difficult to reach by consumers due to the lack of online services, and limitations

of health care providers to accommodate all patients who need Home Care services. The purpose of this

study is to know the feasibility of the establishment of a business plan of Home Care in Tangerang City.

This study uses quantitative and qualitative methods. For the quantitative method, we used 3 (three)

investment criteria, which are Net Present Value (NPV), Internal Rate of Return (IRR), Pay Back Period

(PBP), and qualitative methods, we used non-financial approach, which are the operational aspects,

marketing aspects, human resources aspects and business environtment aspects. Based on the analysis of

financial feasibility, NPV of this project is IDR16,350,215 IRR is 132%, and Payback Period is 1 year 3

months. Based on the analysis of quantitative and qualitative, it can be concluded that the establishment

plan of Home Care is feasible.

1 INTRODUCTION

Every company needs good planning, related to

the business strategy or financial strategy. Financial

planning is very important to do before starting the

business due to the preparation of financial planning

function to implement the steps to measure the

achievement of business strategy, as well as provide

an overview to investors regarding the feasibility of

the company's business. Through the information

presented in financial planning, investors can

identify business risks that may occur in the future

and could be useful for investment decision making.

Investors need to analyse the financial aspects in

order to know the projection of the company's

financial statements as a whole and the changes that

occur in the financial statements during a certain

period so that based on the analysis that has been

done, investors can find out whether the business is

feasible or not.

Financial planning is one of the important

elements of business planning in order to take

investment decision making based on analysis of

several aspects. This framework consists of 5 (five)

elements of financial planning which consist of

sales, expenses, investment, capital requirements,

and financing. These 5 (five) elements generate 3

(three) components which consist of the planning of

income statement, balance sheet, and cash flow

statement.

Financial planning is a systematic process and

uses quantitative forecasting of all cash inflows and

outflows that are in line with the company's

activities in order to find out the business

opportunities in the future. Financial planning from

this perspective is used as a mechanism to view and

handle uncertainty in business. The analysis of this

financial strategy consists of an income statement,

balance sheet, and cash flow statement. Financial

planning and budgeting is a series of processes by

the company in order to execute its operational

activities. The company needs operational funds to

perform its operational activities.

Financial planning for the establishment of a new

company will use the financial projections for the

next 5 (five) years. The preparation for the

establishment of the company will begin in 2017,

and the estimated operational activities will begin in

2728

Suhadi, E., Amalia, L., Sudarwan, . and Kusuma Among Praja, A.

Financial Feasibility Study of Home Care Business.

DOI: 10.5220/0009951627282733

In Proceedings of the 1st International Conference on Recent Innovations (ICRI 2018), pages 2728-2733

ISBN: 978-989-758-458-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

early 2018. The company will begin selecting the

location of the business, renovation, purchase of

fixed assets and recruitment of human resources.

Purchases of medical support equipment will

commence in early 2018, in accordance with the

commencement of the company's operational

activities.

2 LITERATURE REVIEW

A feasibility study is an evaluation and research

of a project designed to uncover the strengths and

weaknesses of the project and determine whether the

project is feasible or not. In other words, a feasibility

study is a preliminary study undertaken to assess

whether a planned project is likely to be practical

and successful to estimate its cost. We use a

feasibility study to make decisions about a project or

business ideas. By doing a feasibility study, people

will have strong recommendations if a business idea

is worthy of being achieved. We use 3 (three) tools

for financial feasibility analysis, which are Net

Present Value, Internal Rate of Return and Payback

Period.

The definition of Net Present Value (NPV) by

Ross, Westerfield and Jordan (2008) is that an

investment is worth undertaking if it creates value

for the owner. Net Present Value is the difference

between an investment’s market value and its cost.

To determine the Net Present Value, we can simply

find the present value of after-tax cash flow of the

project. The net present value decision tool is a more

common and more effective process of evaluating a

project. Present value calculation essentially requires

calculating the difference between the project cost

(cash outflows) and cash flows generated by that

project (cash inflows).

The NPV tool is effective because it uses

discounted cash flow analysis, where future cash

flows are discounted at a discount rate to

compensate for the uncertainty of those future cash

flows. The term "present value" in NPV refers to the

fact that cash flows earned in the future are not

worth as much as cash flows today. Discounting

those future cash flows back to the present creates an

apple to apples comparison between the cash flows.

The difference provides the net present value. The

general rule of the NPV method is that independent

projects are accepted when NPV is positive and

rejected when NPV is negative. In the case of

mutually exclusive projects, we accept the project

with the highest NPV.

The definition of Internal Rate of Return (IRR)

by Lawrence L. Gitman (2009), is the discount rate

that equates the NPV of an investment opportunity

with $ 0 (because the present value of cash inflows

equals the initial investment). The IRR is closely

related to NPV. In this project, IRR of the project is

equal to a discounted rate which the net present

value (NPV) of the project is zero, which means that

the project revenue is equal to project costs. The

internal rate of return is commonly used to evaluate

the desirability of investments or projects. The

higher IRR of the project, the more desirable it is to

implement the project, and also the lower IRR of the

project, the less desirable it is to implement the

project. Based on the IRR rule, an investment is

acceptable if the IRR exceeds the required return.

The payback period (PBP) is the length of time

required to recover the cost of an investment. The

payback period of a given investment or project is an

important determinant to undertake the position or

project, as longer payback periods are typically not

desirable for investment positions. The shorter PBP

means, the more feasible investment, payback period

ignores the time value of money, unlike other

methods of capital budgeting, such as net present

value, internal rate of return or discounted cash flow.

Payback period is the most basic and straightforward

decision tool. With this method, we can determine

how long it will take to pay back the initial

investment to undergo a project. In order to calculate

this, we will take the total cost of the project and

divide it by how much cash inflow that we expect to

receive each year, this will give the total number of

years or the payback period.

Sensitivity analysis is a technique used to

determine how different values of an independent

variable impact a particular dependent variable

under a given set of assumptions. This technique is

used within specific boundaries that depend on one

or more input variables. Sensitivity analysis, also

referred to as what-if or simulation analysis is a way

to predict the outcome of a decision given a certain

range of variables. By creating a given set of

variables, the analyst can determine how changes in

one variable impact the outcome.

The sensitivity analysis is based on the variables

impacting valuation, which a financial model can

depict using some variables. The sensitivity analysis

isolates these variables and then records the range of

possible outcomes. A scenario analysis, on the other

hand, is based on a scenario. The analyst determines

a certain scenario such as a market crash or change

in industry regulation, then changes the variables

within the model to align with that scenario. The

Financial Feasibility Study of Home Care Business

2729

analyst has a comprehensive picture, by knowing the

full range of outcomes, given all extremes, and has

an understanding for what the outcomes would be

given a specific set of variables defined by real-life

scenarios.

3 METHODOLOGY

There are 5 (five) major steps in doing this

research, which are Problem Identification,

Literature study, Data Collection, Data Processing

and Analysing, and Conclusion and

Recommendation. These steps need to be taken in

order to complete the project. First, it needs to make

problem identification from the research so that it

will see the problem more clearly. This step is about

defining the problem and determining the research

objectives. The objective of this project is to

determine the feasibility of the project whether this

project is feasible or not, based on the NPV, IRR,

and PBP calculation.

Literature reviews in this project are intended to

help the reader to get the information needed to

understand this project. It provides a literature study

to help the reader to get the information needed. The

literature reviews about this project are taken from

several sources and media, which are printed books,

brochures, an article from the internet, government

regulation, interview with people involved in the

health industry, interview with prospective clients,

and printed reports from related feasibility projects.

There are 2 (two) kinds of data which will be

used in this project, revenue calculation data and

cost calculation data. The data which is going to be

used for calculating the revenue is the data that we

have from the company projected sales for 5 (five)

years, and there are 3 (three) types of costs going to

be calculated in this project, investment cost, fixed

cost and variable cost. The data will be processed

and analyze by concluding the problem-solving

model based on the method of making a good

feasibility study; this model is a common type of

model of concluding feasibility study.

We take the calculation of the overall project’s

costs, revenues, NPV, IRR, and PBP to get the

conclusion of this research. The recommendation

will also be taken from the overall project’s costs,

revenues, NPV, IRR, and PBP. We need

recommendations to improve the quality of Home

Care Business.

4 ANALYST

4.1 Capital Requirements

In order to run this business, we need working

capital IDR 650,000,000. The working capital

consists of total initial investment and the required

cash reserves. Funding at the beginning of the

establishment of the company's operations comes

from investors. Investors as a provider of funding for

the establishment of the company are given the

option to include their capital with an investment

scheme scenario of having 60%, 70% and 80% of

the paid-up capital and enter into the corporate

modal structure.

Capital requirements, both capital investment

and working capital, can be searched from various

sources of existing funds, which are own capital or

loan capital. Own capital is the capital from the

business owner while the loan capital is capital from

outside the company. In practice, the financing of a

business can be obtained by a combination of its

capital and loan capital. The choice of whether using

their capital, loan capital or a combination of both

depends on the amount of capital required and the

policy of the business owner.

Own capital is the capital obtained from the

owners of the company by issuing shares. The

advantage of using own capital to finance a business

is the absence of interest charges, but will only pay

dividends. The dividend pay-out is made when the

company gains profit, and the amount of dividend

depends on profit. The disadvantages of using its

capital is the amount is very limited and relatively

difficult to obtain.

4.2 Financial Projection

To see the company's financial development and

analyze the feasibility of the business, then we make

a projection for the next 5 (five) years. The

projection of the financial statements consists of

three scenarios, which are Optimistic Scenario,

Normal Scenario, and Pessimistic Scenario, some

assumptions used in the projection of financial

statements. We prepare pre-operation activities since

August 2017 so that at the beginning of 2018, we

can conduct business operational process.

The growth rate of market share that is used in

Normal conditions is estimated at 5%. This is due to

the company's ability in the Normal scenario is in

constant demand growth to get the patient. In

optimistic condition, it is estimated that the growth

of market share owned by Home Care business is

ICRI 2018 - International Conference Recent Innovation

2730

8%. This is due to Home Care's ability in an

optimistic scenario that can gain a large market

share increase in a short time. In a pessimistic

condition, the growth of market share owned is 3%.

This is because there is still much demand for other

Home Care services as well as the emergence of

competitors in the same industry that will take the

Home Care market share.

4.2.1 Income Statement

In a normal scenario, we assume that the average

amount of income in one year is IDR7.447.635.000,

which consists of homestay and home visit services

IDR6.640,150,000 whereas from the estimates of

action services conducted in one year by doctors and

nurses is IDR355,685,000 and income from medical

equipment rental is IDR378.000.000. Cost of goods

sold is 77% of sales, and depreciation cost is

IDR67,392,250. The dividends as a form of profit

sharing to investors are distributed on a regular basis

every year amounting to 40% maximum. The

company will make the tax payments in accordance

with the provisions of corporate income tax.

4.3 Balance Sheet

In the projection of the balance sheet with

normal scenario in 2018, the total of current assets is

IDR683,774,734 which consist of cash and bank.

Total of non-current assets consist of tangible and

intangible assets is IDR300,539,250, so the total

amount of assets is IDR984,313,984. The Company

does not have any accounts payable because the

daily operations of the company are engaged in

services, the use of operational funds is mostly used

to purchase medical supplies, that amount is

adjusted to consumer demand so it will not affect the

company's cash flow.

Loans from banks and third parties do not exist

because the company has just established, so it is

rather difficult to get a loan from a third party. Also,

the paid-up capital by investors is still positive and

sufficient to finance the company's operational

activities. The amount of paid-up capital is

IDR650,000,000 and retained earnings obtained

from the profit and loss scenario is IDR334,313,984,

so the total equity amounted to IDR984,313,984.

4.4 Equity Growth

We established this Business from independent

investment results, where the paid-up capital after

the planning of funding policy is IDR650,000,000,

and the paid-up capital result is from the investor as

a whole. The number of investors in terms of

depositing capital becomes the freedom of

shareholders to determine the portion of the joint

investment and becomes an option for business

planners due to the High Risk and High Return

factors for the investment results. We expect this

profit to provide positive value for investors in the

long term, and we also expect the value of the

company can provide good business continuity.

4.5 Cash Flow Statement

In this cash flow statement, we apply the cash

method in accordance with the application of

working capital. This is because we want to

anticipate the impact of cash flow turnover that is

not effective in its use. The cash flow statement

scenario is based on the assumptions of the values in

the projected income statement and balance sheet

year 2018 to 2022. The portion of the operating

activities, investment activities and financing

activities are described by their respective portions.

Based on the normal scenario calculation, the

company plans to provide cash flow from operating

activities IDR624,582,244, cash flow from

investment activity IDR278,026,500, and cash flow

from financing activities IDR222,875,990, so the

company will be able to generate positive net cash

flows IDR123,679,734 in the first year. The

differences in these scenarios lie in different

underlying assumption factors so that the elements

of the external factor are also accounted for cash

flow analysis of operating, investing and financing

activities.

5 CONCLUSION

5.1 Investment Feasibility Analysis

Analysis of feasibility is assessed using

Discounted Cash Flow (DCF) with Net Present

Value (NPV) parameters. This model will show the

net value of the investment to investors. Other

calculations are Internal Rate of Return (IRR),

Return on Investment (ROI) and discounted payback

period that will provide information to support the

feasibility analysis of this business. Details of

investment feasibility calculation can be seen in

table 8.1.

Financial Feasibility Study of Home Care Business

2731

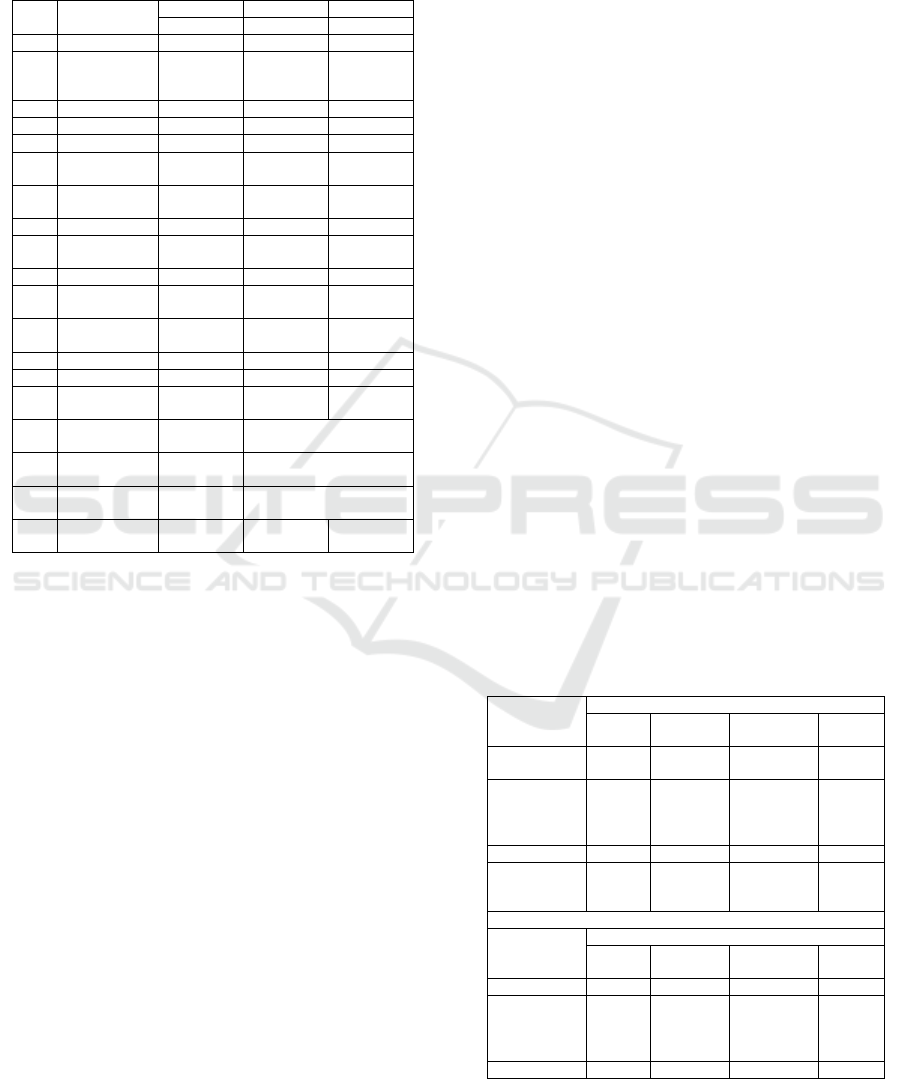

Table 8.1. Investment Feasibility Analysis

ODIS HOME CARE FINANCIAL HIGHLIGHT

2018

(in million IDR)

No.

DESCRIPTION

2018 2018 2018

Normal Optimist Pessimist

1. Revenue 7,448 10,685 4,424

2. Initial

Working

Capital Cost

650 650 650

3. EBIT 671 1,223 238

4. Gross Profit 1,724 2,399 1,106

5. Tax 114 237 30

6. Profit After

Tax

557 986 208

7. Net Profit

Margin

9% 11% 5%

8. Total Assests 984 1,242 796

9. Total

Liabilities

- - -

10. Equity 984 1,242 796

11. Return on

Equity

68% 99% 30%

12. Return on

Investment

134% 245% 48%

13. NPV 16 39 4

14. IRR 132% 185% 70%

15. Payback

Period

1 Year + 3

Months

10 Months 2 Year + 3

Months

16. Break Even

Price

295,763

17. Break Even

Unit

2,762

18. Break Even

Sales

1,756

19. WACC (Cost

of Capital)

20% 18% 22%

As explained in the Theoretical Foundations, the

Net Present Value, Internal Rate of Return and

Payback Period calculation will be the biggest aspect

which will conclude this project is feasible or not.

Based on the above calculation, it can be concluded

that the business of Home Care is feasible to be

realized. This can be seen from the positive balance

of NPV. The positive balance of NPV in business

indicates that the cash flow generates greater

revenue than the expenditures, the remaining profits

in the form of dividends will be distributed to

shareholders. NPV risk analysis can be analyzed

with WACC values of 20% in Normal scenario and

percentage of inflation growth. This business risk

can be categorized as high risk - high return.

In the Normal scenario, the rate of return is

indicated with IRR 132%, and Return on Investment

(ROI) is 134%. The IRR means that the business can

provide a rate of return and a profit greater than the

cost of capital. The duration of the Payback Period is

one year and three months for the Normal scenario

indicates the business of Home Care is a high risk -

high return.

In the calculation of Free Cash Flow for Equity

(FCFE) in the Normal scenario, the calculation of

NPV is at position IDR16 million, for the Optimistic

scenario is IDR39 million and IDR4 million for the

Pessimistic scenario. The projection in the free cash

flow has a very large proportion in the calculation of

business feasibility analysis. The result of the

company's growth rate assumption is equal to 30%,

20%, and 15% for Optimistic, Normal and

Pessimistic scenario (industrial growth and

inflation).

5.2 Sensitivity Analysis

For the sensitivity analysis, there will be some

assumptions to analyze, which are price, sales level,

inflation, change of industry regulations. The price

and sales level are internal factors which are an

important part of the cash inflow on the company

that has a revenue stream only from the home care

service. Meanwhile, the inflation, change of industry

regulations s are external factors which occurred on

the cash outflow, so we cannot control that factor,

this a fluctuation factor that can be changed at any

time due to a new government policy

Sensitivity analysis is a variation in scenario

analysis to know the risk type of forecasting whether

tested properly. We use sensitivity analysis by

selecting a key variable that affects the Net Present

Value of the data previously. We use the assumption

of a decline in sales caused by external factors.

Details of sensitivity analysis can be seen in table

8.2.

Table 8.2. Sensitivity Analysis

Description

Total Sales Per Year Period

Unit Normal Optimist Pessim

ist

Number of

Sales Target

Amount 2,415 3,863 1,449

NPV

IDR

(in

million

)

16 39 4

IRR

% 132 60 70

PBP

Year 1 Year +

3 Months

10 Months 2 Year

+ 3

Months

Description

Sales Per Service

Unit Normal Optimist Pessim

ist

Sales Down

30% 1,691 2,704 1,014

NPV

IDR

(in

million

)

29 60 19

IRR

% 45,4 138 43

ICRI 2018 - International Conference Recent Innovation

2732

In the calculation of this sensitivity analysis, we

use the assumption of 30% reduction in sales from

the previous sales scenario, which are from normal,

optimistic and pessimistic. Sales down 30% for

pessimistic scenarios will have an impact on firm

value. However, pessimistic sales targets is a

scenario when economic conditions are not good,and

we cannot achieve sales targets. In normal and

optimistic scenario still shows a positive signal and

stable economic conditions. Thus, the value of the

company can still be maintained if the scenario is

optimistic and normal in real conditions.

5.3 Feasibility Study Result

From the analysis, it concludes that the Business

Project of Home Care is FEASIBLE and can be

implemented.

REFERENCES

Brigham, Eugene F, Houston, Joel F. (2011). Principles of

Managerial Finance. Edisi 11. Jakarta: Salemba

Empat.

Cooper, Donald R, & Schindler, Pamela S. (2014).

Business Research Methods. 12

th

Edition. International

Edition. McGraw-Hill Education.

David, Fred. R. (2009). Strategic Management

Manajemen Strategi Konsep. (Dono Sunardi,

Penerjemah). Buku 1. Edisi 12. Jakarta: Salemba

Empat.

Diehl, Barbara & Dr Maria Nikolou. (11 November 2013).

From Business Models to Business Plans. Said

Business School. University of Oxford.

Gitman, L. G. (2009). Principles of Managerial Finance.

Boston: Pearson Education.

Investopedia (2017) Capital Budgeting, [online] Available

at http://www.investopedia.com/university/capital-

budgeting/decision-tools.asp.

Jiambalvo, J. (2010). Managerial Accounting. New Jersey:

Wiley.

Kotler, Philip, & Keller, Kevin Lane. (2008). Manajemen

Pemasaran. Edisi 13. Jilid 1. Jakarta: Penerbit

Erlangga.

Ross, Westerfield and Jordan. (2008). Corporate Finance

Fundamentals. New York: McGraw Hill.

Saltelli, A. (2008) Global Sensitivity Analysis. The Primer,

New Jersey: John Wiley & Sons.

Seitz, N. & Ellison, M. (2003). Capital Budgeting and

Long-Term Financial Decision. Ohio: South-Western.

Sullivan, W. G., Wicks, E. M. & Koelling, C. P. (2009).

Engineering Economy. New Jersey: Pearson

Education.

Wheelen, Thomas L, and Hunger, J. David. (2011).

Strategic Management and Business Policy Toward

Global Sustainability. 13

th

Edition. Prentice Hall.

Financial Feasibility Study of Home Care Business

2733