Bank as a Value Added Tax (VAT) Collector: A Real-time Solution

for Improving VAT Collection in Digital Economy - A Case Study in

Indonesia

Hadining Kusumastuti

Tax Administration Laboratory, Vocational Education Program, Universitas Indonesia

Keywords: VAT Collector, Digital Economy, Ease of Administration

Abstract: The raising of digital economic transactions poses its challenges for the Government of Indonesia (GoI) in

taxing digital transactions, especially in the Value Added Tax (VAT) collection mechanism. The

sustainability of VAT as a valid source of income is very dependent on the ability of GoI to enforce the

rules and collect VAT effectively on the transaction concerned or has the potential to be subject to VAT.

Several studies have been conducted by involving Financial Institutions as third parties appointed as VAT

Collectors by utilizing the development of technology platforms. This paper focuses on the study of the

possibility of involving the bank as a Financial Institution acting as a VAT Collector in Indonesia involving

digital transactions in terms of the ease of administration principle. The research methodology uses

descriptive analysis, data collection obtained from documentation studies and literature reviews. The results

of the discussion indicate that technology platform readiness is needed to facilitate the appointment of the

Bank as VAT collector and the potential imposition of VAT collection fees on the bank’s customers.

1 INTRODUCTION

The digital economy has revolutionized many

aspects of our lives, and it is increasingly becoming

the economy itself. One of the critical components

of the digital economy is the electronic commerce

(E-commerce) which is defined as “the sale or

purchase of goods and services conducted over

computer networks by methods specifically to

receive or place of orders”. The spread of the

internet and digital payments, the number of digital

buyers is progressively growing; e-commerce

enables companies to establish their presence on the

market at a national level and also to extend their

business across borders. (Testa, 2016)

The development of the digital economy has

raised numerous issues from a tax perspective. In

particular, the increased businesses and consumers

mobility, the development of new business models,

the reliance of data, which are some of the

characteristics of the digital economy, are

challenging traditional tax systems. Action 1 of the

base erosion and profit shifting (BEPS) project

launched by the Organization for Economic

Cooperation and Development (OECD) is aimed at

addressing these challenges. According to the

OECD, the growth of online B2C cross-border trade

of goods and services is challenging the traditional

VAT systems. (Testa, 2016)

Sourcing at least some e-commerce sales on

a destination basis are problematic, and strong rule-

based administrative efforts could generate new

distortions. (David R. Agrawal, 2016) For example,

defining the places of sale and use for digitized

products can be difficult and e-commerce often

shifts tax compliance from the vendor to the buyer,

facilitating tax revenue leakages. The destination

could be determined by the billing address of a

credit card, but this is easily evaded with electronic

cash and other mechanisms. Issues of cross-border

shopping and mail-order catalogues have long

challenged administration of indirect taxes on a

destination basis. (Agrawal & Fox, 2016)

Based on this background, this paper focuses on

the possibilities of involving Bank as VAT

Collector, as intermediaries between supplier and

consumer, for e-commerce transactions which are

part of the growing digital transactions nowadays in

terms of ease of administration principle. Study case

in Indonesia by referring to current banking and tax

regulations.

Kusumastuti, H.

Bank as a Value Added Tax (VAT) Collector: A Real-time Solution for Improving VAT Collection in Digital Economy - A Case Study in Indonesia.

DOI: 10.5220/0010026400002967

In Proceedings of the 4th International Conference of Vocational Higher Education (ICVHE 2019) - Empowering Human Capital Towards Sustainable 4.0 Industry, pages 9-13

ISBN: 978-989-758-530-2; ISSN: 2184-9870

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

9

2 RESEARCH QUESTIONS

The research questions of this paper are:

a. What is the background problem about the

possibility appointed bank as VAT Collector?

b. How is the possibility involving bank as VAT

Collector based on Indonesia’s regulation?

c. What are the challenges Appointed Bank as

VAT Collector in terms of Ease of

Administration Principle?

3 RESEARCH URGENCY

This research has an urgency for some parties,

namely:

a. Government

For the government, this study is expected to

provide input about the possibilities to raise the

GoI’s revenue in VAT sector from digital

economy transactions through a bank as one of

the financial institutions.

b. Taxpayers

From this research is expected to provide

knowledge tax arising in a digital economy

transaction, especially VAT in e-commerce

transactions.

4 LITERATURE

4.1 Digital Market

The defining characteristics of digital markets

according to the OECD Model (OECD, 2015):

a. Direct network effects: In digital markets,

utility from the consumption of a specific good

or service is often dependent on the number of

other end-users consuming the same good or

service.

b. Indirect network effects: indirect network

effects arise in the context of multi-sided

markets. They occur when a specific group of

end-users (e.g., users of a social network)

benefit from interacting with another group of

end-users (e.g., advertisers on a social

network), for instance, via an online platform,

for example, accommodation rental,

transportation or peer-to-peer e-commerce.

c. Economies of scale: In many cases, the

production of digital goods and services entails

relatively higher fixed costs and lower variable

costs. Software development, for instance,

requires considerable investments in

infrastructure and human labour; however,

once the final program has been developed, it

can be maintained, sold, or distributed at

meagre marginal costs.

d. Switching costs and lock-in effects: Digital

transactions can be carried out on different

electronic devices; however, end-user devices

often rely on different operating systems. As a

result, customers may be locked-in to a

particular operating system once they have

acquired a specific device. This effect is due to

psychological as well as monetary switching

costs which end-users must incur to switch

from one system to another.

e. Complementarity: Many of the goods and

services traded in digital markets are

complements; that is to say, customers derive

more utility from consuming two (or more)

complementary goods together.

4.2 Ease of Administration Principle

There are three basic principles in an ideal taxation

system: Revenue Productivity, this principle is

related to the interests of the government, which

makes tax as a source of state revenue. Equity /

Equality, this principle states that there must be

fairness in every tax collection carried out by the

government, it can be interpreted that the tax

collected in accordance with the economic

capabilities possessed by each taxpayer. Ease of

Administration is an especially important principle

in the tax collection system. This principle affects

the level of public awareness in carrying out every

tax obligation. There are several indicators in the

principle of ease of administration: Certainty, stating

that there must be certainty from taxpayers and tax

authorities regarding tax subjects, tax objects, the

basis of taxation, tariffs and how the taxation

procedures are. Efficiency, in terms of Fiscus: The

cost of conducting supervision and administration of

taxpayers is relatively low. In terms of taxpayers:

The cost of carrying out tax obligations is relatively

low. The convenience of payment, taxes are

collected at the right time (Pay As You Earn).

Determination of the due date of tax payment.

Payment procedure: Simplicity, easy to carry out

and not complicated. These principles can be

described simply as an equilateral triangle. (Arianty,

2017)

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

10

Figure 1: Principle in an ideal tax system (Rosdiana, 2012)

5 METHODOLOGY

The research method used is descriptive. The

collection of data in the form of secondary data. The

secondary data obtained through the search of

various literature and documents.

6 RESULT AND DISCUSSION

The results of this research are discussed in the

below paragraph:

6.1 The Background Problem about

the Possibility Appointed Bank as

VAT Collector

VAT is a general tax on consumption which means

that in principle all supplies of goods or services

made by taxable persons for consideration are

subject to it. The tax must be charged at each stage

in the production and distribution chain and

generally the vendor is responsible for the correct

calculation, collection, and remission of the VAT on

his supplies (Vendor collection model). In contrary

with e-commerce transaction, there are

intermediaries between supplier and consumer, that

is a marketplace (like Amazon, Alibaba, Asos,

Bukalapak, Shoppee and Tokopedia).

Some of the VAT issues that international e-

commerce raises include tax administration

problems posed by e-commerce. A tax invoice is a

primary instrument of a transaction that is liable to

VAT. According to Rosenberg (2008), e-commerce

brings with it a paperless environment, hence, many

traders may not be issuing paper invoices and

transactions may not be easily traceable. (Patel,

2014)

Existing VAT collection mechanisms are in dire

need of modernization, in that they are inefficient

and increasingly burdensome on revenue authorities

and suppliers. Some observers have proposed the

use of financial institutions as VAT collectors and

technology to facilitate their task. The OECD

conclusion that VAT collection by financial

institutions is not a viable option is based on

resistance and objections raised by financial

institutions coupled with the general international

perception of the banker-customer relationship as

regards customer privacy when the proposal was

considered. Doernberg and Hinnekens argue that

withholding taxes by financial institutions should be

a method of last resort if the registration of non-

resident vendors turns out to be ineffective VAT

accountability and collection too. Recent

technological advances, and a shift in VAT

collection trends at the local level, warrant further

research into the viability of VAT collection by

financial institutions in the case of cross-border

digital trade. (Zyl & Schulze, 2014)

What was clear since the beginning was that

online transactions, like those marketplaces, had to

be subject to VAT in the same way as conventional

supplies. This situation is ideal by the nature of VAT

as a general tax on consumption, which means that

all supplies of goods or services made by taxable

persons for consideration should be subject to it.

(Testa, 2016) However, taxing VAT to online

transactions is hard to do. It is because online

transactions are way different from conventional.

Those marketplaces as intermediaries are coming

from not only from Indonesia like Bukalapak,

Shopee, and Tokopedia, but also coming from

outside Indonesia like Amazon from the United

States and Asos from the United Kingdom, so it is

impossible for this marketplace appointed as VAT

Collector because they are not Indonesian Tax

Payer.

6.2 The Possibility Involving Bank as

VAT Collector based on

Indonesia’s Regulation

The basis of this model is to collect VAT on each

transaction through an electronic payment system at

the point at which it is traded - for example, a credit

card system - based on the location of the customer

and the VAT rules applicable in that jurisdiction. In

other words, the customer is immediately assessed

when the transaction is entered, and the VAT

payable is transferred to the relevant revenue

authority without delay. This transaction is typically

achieved when the supplier submits the customer’s

credit card or other payment details to the

customer’s bank or credit card company. The bank

Bank as a Value Added Tax (VAT) Collector: A Real-time Solution for Improving VAT Collection in Digital Economy - A Case Study in

Indonesia

11

or company then identifies and locates the

customer’s place of residence or establishment.

Details of the transaction - the purchase price and

type of supply - are transmitted to the financial

institution to enable it correctly to assess the

transaction based on the VAT rules applicable in the

jurisdiction where the customer resides, is

established, or has a permanent address. The amount

payable by the customer is the final amount

inclusive of VAT. A split-payment system separates

the payment in two: the purchase price is transferred

into the supplier’ s bank account while VAT is

transferred to the relevant revenue authority. (Zyl &

Schulze, 2014)

Based on Indonesia’s Banking Regulation Law

No. 10 in 1997 about Banking, due to tax purpose,

stated in article 41 verse 1. For tax purpose, the

leadership of Bank Indonesia at the request of the

Minister Finance has the authority to issue a written

order to the bank to give a statement and show

written evidence and letters concerning the financial

condition of specific Depositing Customers to tax

officials.”. This law reinforced by the issuance of

Government Regulation on the successor to Law

no.1 of 2017 about Access to Financial Information

for Tax Purpose. Bank for tax purpose can request to

state the financial condition of individual customers

to tax officials, so there is a possibility to have

engaged between DGT and Bank Institution to

collect VAT Revenue from e-commerce transaction.

6.3 The Raising Challenges by

Appointed Bank as VAT Collector

in Terms of Ease of Administration

Principle

Simplified VAT collection where the destination

principle applies, financial institutions tasked with

VAT collection, are only required to account for

VAT in the jurisdiction where they are established.

VAT collection is consequently simplified to the

extent that the financial institution applies a single

set of VAT rules. This rule should be contrasted

against the registration method where suppliers, as

VAT collectors, are required to register in multiple

jurisdictions and are further required to apply

multiple VAT rules. It should, however, be noted

that a customer can hold a bank account with a

financial institution not established in the

jurisdiction in which he resides. In these cases, the

financial institution would be required to apply a set

of VAT rules that applies in the foreign country

where the customer resides. This condition could

place an additional administrative burden on the

financial institution, which must then cooperate with

various tax authorities. As VAT payments are

automatically transferred to revenue authorities,

financial institutions are not burdened with

completing complicated VAT returns and manual

payment systems. The automated payment system

under the RT-VAT system simplifies the collection

and remittance process, creating a VAT collection

mechanism that places the least administrative

burden on the financial institution. (Zyl & Schulze,

2014)

Under a credit system, financial institutions

would not be required to verify the taxpayer’s status.

All transactions are taxed in real-time when payment

is facilitated, irrespective of the customer’s tax

status. Where, because of the customer’s tax status,

the transaction qualifies for an exemption or zero

ratings, the customer can claim VAT levied and paid

in real-time as input credits. Under a credit system,

VAT collection by financial institutions can be

simplified, VAT fraud issues eliminated, and the

taxpayer’s privacy can be ensured. (Zyl & Schulze,

2014)

Under the registration and reverse-charge

models, the taxable entity (the entity tasked to

collect VAT) generally carries the administrative

cost of collecting VAT on behalf of revenue

authorities. Where the taxable entity develops

systems to simplify the VAT collection and

remittance burden, the taxable entity bears the cost

of development and implementation of these

systems. Some observers have proposed that this

general practice cannot be applied in the case of

VAT collection by financial institutions. It is

suggested that the cost of developing and

implementing were integrated with the real-time

collection system. Revenue authorities should bear

this integration as it is the focus that will ultimately

benefit from the implementation.

7 FUTURE WORK

The Government of Indonesia needs to consider this

possibility appointed Bank as VAT Collector due to

the rapidly growing e-commerce transactions. Why

this possibility to appointed Bank as VAT Collector

to need to be concerned by the Government of

Indonesia, especially Directorate General of Tax

(DGT), as per data Tax Revenue 2018, the revenue

from VAT generate around 43% from total revenue,

with detail as follow:

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

12

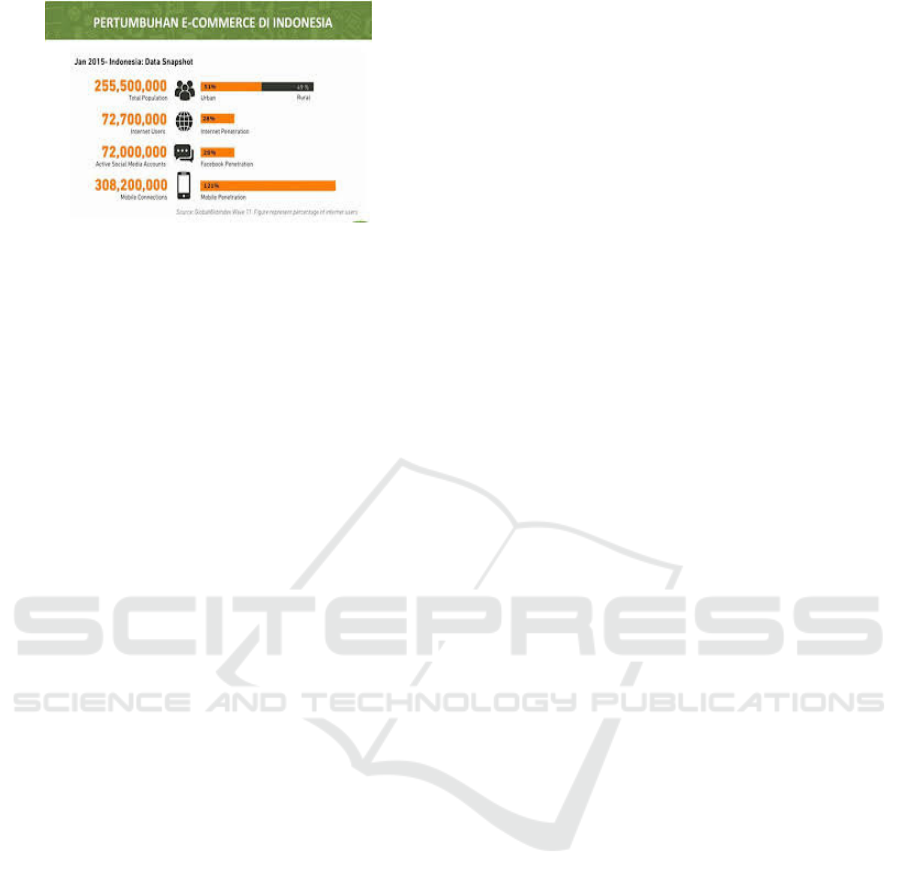

Figure 2: e-commerce growth

a. The rapid growth of e-commerce transactions in

Indonesia.

b. Due to the contribution of VAT revenue, Tax

Revenue reached more than 40% of total tax

revenue in 2018.

c. Need to simplify the credit method of VAT

system to raise the tax revenue from VAT sector

in e-commerce.

So based on these reasons, the future work that

the GoI, especially DGT, need to be concerned are:

a. The research about the possibility appointed

Bank as VAT Collector comparing to other

countries.

b. Discuss with the Bank as Financial Institution to

bridging the possibility to appointed Bank as

VAT Collector due to general international

perception of the banker-customer relationship

as regard customer privacy.

8 CONCLUSIONS

The Conclusion of this paper detail as follows:

1. The background problem about the possibility

to appoint the bank as VAT Collector is the

raising e-commerce transaction. In the tax

perspective, online transactions had to be

subject to VAT in the same way as

conventional supplies.

2. There is a possibility to involving Bank as

VAT Collector as per Law No. 10 of 1998

about Banking and Government Regulation of

the successor Law No. 01 of 2017 about

Access to Financial Information for Tax

Purpose.

3. The challenges Appointed Bank as VAT

Collector in terms of Ease of Administration

Principle:

a. The resistance and objections raised by the

bank, coupled with the general

international perception of the banker-

customer relationship as regards customer

privacy.

b. The financial institution would be required

to apply a set of VAT rules that applies in

the foreign country where the customer

resides.

c. This condition could place an additional

administrative burden on the financial

institution which must then cooperate with

multiple tax authorities

ACKNOWLEDGEMENTS

We would like to express our gratitude to those

involved in carrying out this research.

REFERENCES

Agrawal, D. R., & Fox, W. F. (2016, September 1). Taxes

in an e-commerce generation. International Tax Public

Finance, 803-926. doi:10.1007/s10797-016-9422-3

Arianty, F. (2017). Tinjauan Atas Asas Keadilan dan

Kemudahan Administrasi Pajak dalam Pengenaan

Pajak Penghasilan Final 1% Terhadap Wajib Pajak

UMKM. Jurnal Vokasi Indonesia, 22-32.

David R. Agrawal, W. F. (2016). Taxes in an e-Commerce

Generation. Springer Science and Business Media,

907.

OECD. (2015). OECD (2015), Addressing the Tax

Challenges of the Digital Economy, Action 1 - 2015

Final Report, OECD/G20 Base Erosion and Profit

Shifting Project, OECD Publishing, Paris,. Paris:

OECD Publishing.

Patel, S. H. (2014). Challenges of Value Added Tax on

International E-Commerce in Electronic Goods and

Services in Kenya. Research Journal of Finance and

Accounting, Vol.5, No.7, 139-143.

Testa, M. G. (2016). VAT treatment of E-commerce

intermediaries. Lund: Lund University.

Theron, N. (2012). A Comparitave Study Of Value Added

Tax Collection Methods In The Context Of E-

Commerce And Virtual Worlds From A South African

Perspective. Pretoria: University of Pretoria.

Zyl, S. v., & Schulze, W. (2014, November). The

collection of value added tax on cross-border digital

trade - part 2: VAT collection by banks. The

Comparative and International Law Journal of

Southern Africa, Vol. 47, No. 3, 316-349.

Bank as a Value Added Tax (VAT) Collector: A Real-time Solution for Improving VAT Collection in Digital Economy - A Case Study in

Indonesia

13