The Effect of Working Capital and Retained Earnings on the

Profitability of Food and Beverages Companies Listed in Indonesia

Stock Exchange Period 2012-2017

Ramon Arthur Ferry Tumiwa

Economics Faculty, Universitas Negeri Manado, Manado, Indonesia

Keywords: Working capital, retained earnings, profitability, food and beverages companies.

Abstract: This study aims to examine and analyse whether profitability is affected by working capital and retained

earnings of companies. This research is a quantitative study using an associative method. This research was

conducted at Food and Beverage Companies listed on the Indonesia Stock Exchange for the period 2012 -

2017. The companies analysed amounted to 6 companies determined based on sampling criteria. The

analysis method used is panel data analysis by using Eviews 10 computer programming. The results of this

study found that working capital did not significantly influence profitability, while significantly retained

earning affected the profitability of food and beverage companies listed on the Indonesia Stock Exchange

(IDX) for the 2012-2017 period.

1 INTRODUCTION

Competition in the business world has increased

recently, so companies are required to be able to

adjust to changes that occur and must be able to

compete with other companies in order to maintain

business continuity. Competition in the business

world makes every company must improve its

performance so that company goals can be achieved.

One of the main goals of a company is to make a

profit. Therefore the company will carry out various

activities or activities within the company to achieve

its objectives.

Companies must always try to maximise profits

so that they can achieve results and optimal profit

levels and can support all activities in the company.

The sustainability of a company's business is

influenced by various things, one of which is the

company's profitability. Profitability is one of the

factors that can assess the good or bad performance

of a company or the company's ability to make a

profit. Profitability is a ratio that can reflect the

success and ability of a company to earn profits or

profits. The ability of a company to generate profits

for a certain period is called profitability (Munawir,

2004).

Factors that influence the high or low amount of

profitability are working capital. For companies to

obtain the maximum possible profit, can be done by

increasing the amount of production that can be sold

to make a profit or profit. One of the essential

factors of production is the working capital used by

the company to finance all activities or activities of

the company's operations to ensure the survival of a

company. Working capital is an essential factor in a

company. A company needs to pay its obligations

due to its necessity in their daily operations. The

funds are expected to re-enter the company through

the production sale.

Working capital management is related to the

management of current assets and current liabilities

of the company. If the company is not able to

maintain working capital in sufficient amounts, then

the possibility of the company will be in a state that

is unable to pay obligations that are due and

threatened with bankruptcy (Syamsudin, 2011).

With an effective and efficient working capital

management, the company can increase the amount

of profitability in the company. There have been

many studies on working capital, including those

conducted by Tumiwa and Mamuaya (2019) which

state that working capital has no significant effect on

profitability. However, different from the results of

research conducted by Felany and Worokinasih

(2018) that working capital has a significant effect

on profitability.

552

Arthur Ferry Tumiwa, R.

The Effect of Working Capital and Retained Earnings on the Profitability of Food and Beverages Companies Listed in Indonesia Stock Exchange Period 2012-2017.

DOI: 10.5220/0010704700002967

In Proceedings of the 4th International Conference of Vocational Higher Education (ICVHE 2019) - Empowering Human Capital Towards Sustainable 4.0 Industry, pages 552-558

ISBN: 978-989-758-530-2; ISSN: 2184-9870

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

One of the decisions that can be taken by the

company in achieving its objectives to be able to

maximise its profits is the funding decision. Funding

decisions in the company must be able to choose

sources of funds that are good and profitable for the

company and can allocate these funds efficiently.

Sources of funds can be obtained by the company

through the company (internal) or from outside the

company (extern). Retained earnings are profits

from net income that are not distributed to

shareholders which will later be reused or invested

into the company to increase working capital so that

it can be used to finance all operational needs in the

company because less working capital will adversely

affect the company itself. Retained earnings are the

portion of profits reinvested in the company. Not all

profits obtained by the company are distributed to

the owners (shareholders) as dividends but, will be

retained and reinvested in the company for various

purposes (Jumingan, 2009).

The increasing amount of internal funding from

retained earnings will strengthen the company's

financial position in dealing with various financial

difficulties faced by the company in the future. As

can be used as a reserve to deal with activities that

will arise in the future, can be used to pay off

corporate debts, can be used to increase working

capital or to finance company expansion in the

future. Thus, the increasing amount of retained

earnings within the company, it is also expected to

increase revenue in the company through the

activities carried out, so that it will affect the

increase in the amount of profit earned by the

company. Research on retained earnings conducted

by Sari (2013), has the result that retained earnings

have a positive and significant effect on EPS

earnings per share. Similarly, research conducted by

Anshory (2016) also states that retained earnings

have a positive and significant effect on earnings per

share (EPS).

Manufacturing industry companies are industrial

companies that dominate companies listed on the

Indonesia Stock Exchange. Companies in the

manufacturing industry are grouped into several

industry sub-categories, one of which is a food and

beverage sub-sector company. The food and

beverage sub-sector company are one of the

companies that have enormous opportunities to grow

and develop in the business world, with so many

companies listed on the Indonesia Stock Exchange

causing much competition in the business world so

that the company managers are required to be able to

compete with other companies and can maintain the

survival of the company in the future.

Food and beverage sub-sector companies are

essential companies for the development of the

nation's economy. However, that does not mean this

company does not have problems in the company.

The existence of very tight competition so

companies must be able to obtain the maximum

profit or profit from the capital they have and

perform various activities to be able to survive and

grow with the real competition in the business world

today. This aspect has led researchers to become

interested in making companies in the food and

beverage sub-sector as the object of research.

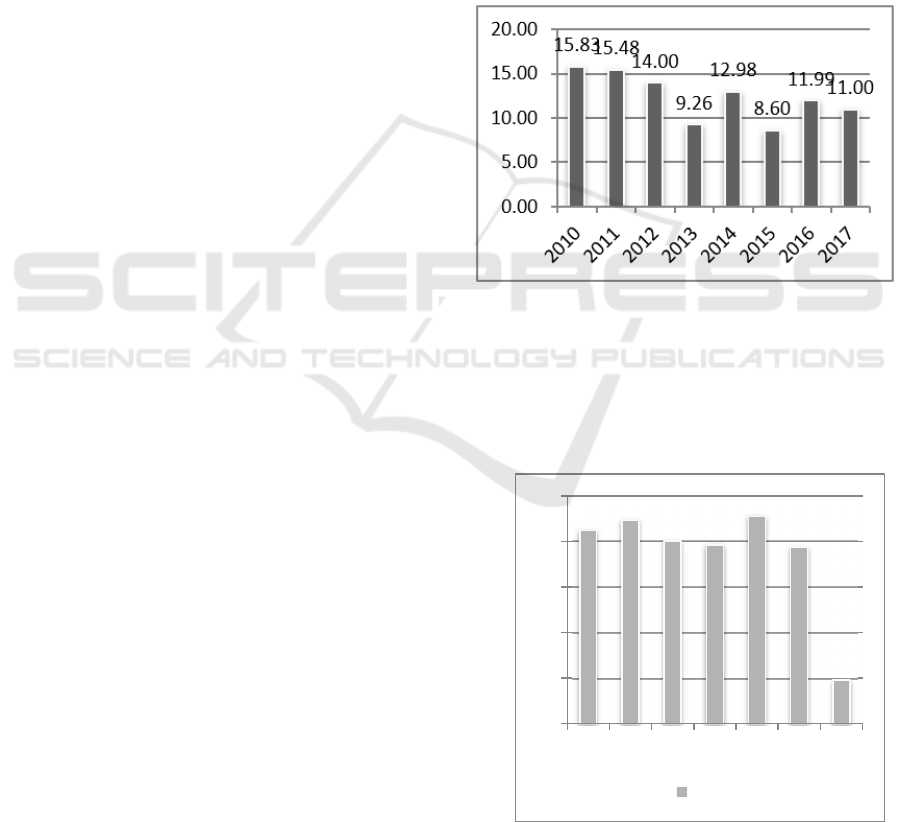

The following is the profitability of PT. Indofood

Sukses Makmur Tbk and PT. Nippon Indosari

Corpindo Tbk, namely:

Figure 1: The profitability of PT. Indofood Sukses

Makmur Tbk period 2010-2017.

Source: Data processed (2019)

Based on the data in Figure 1 above, it can be

seen that the profitability of PT. Indofood Sukses

Makmur Tbk in 2010-2017 tends to decrease and

fluctuate.

Figure 2: Profitability of PT. Nippon Indosari

Corpindo Tbk period 2011-2017. Source: Data processed

(2019)

21,21

22,37

20,07

19,64

22,76

19,39

4,80

0

5

10

15

20

25

2011201220132014201520162017

ROTI

The Effect of Working Capital and Retained Earnings on the Profitability of Food and Beverages Companies Listed in Indonesia Stock

Exchange Period 2012-2017

553

Whereas in Figure 2 shows that the level of

profitability (proxied by ROE) PT. Nippon Indosari

Corpindo Tbk tends to decrease.

The tendency of decreasing the amount of

profitability in this company can harm the

company's development going forward because if

the decline occurs continuously it will cause the

company's stock prices to fall and investors are not

interested in investing their capital in the company.

If that happens then, the company could experience

bankruptcy.

Working capital is significant in a company, so

financial managers must be able to plan well the

amount of working capital and its proper use and

following the needs of a company. If working capital

can be managed well, the profitability of the

company can increase, but on the contrary, if

working capital management is not proper, it will

reduce the level of profitability of the company itself

(Djarwanto, 2011).

A company to be able to meet the need for

working capital that will be used for its operations

requires an appropriate source of funding. It is also

profitable for the company, because if the company

uses excessively or too abundant sources of funding

from outside the company, then it will harm the

company itself because a significant interest rate that

must be paid. (Ruthiana in Rahmadhania, 2010)

states that if the company adds to the profits by a

significant amount, then the number of dividends

received by shareholders will decrease. If this is

done continuously, then shareholders who need

short-term funds will be disappointed.

Conversely, if the dividend distributed is

magnified, the retained earnings will decrease. If the

retained earnings are too small, the company will be

very dependent on foreign capital. The opportunity

to use their own capital which is relatively cheaper

becomes insufficient. In the long run, this will have

negative consequences for the company. Companies

that have much debt will be disadvantaged,

especially when the economic situation is terrible so

the company cannot work efficiently.

The purpose of this study is: (1) Knowing

whether working capital has a significant effect on

the profitability on food and beverage companies

listed on the Indonesia Stock Exchange, (2)

Knowing whether retained earnings have a

significant effect on the profitability on food and

beverage companies listed on the Indonesia Stock

Exchange.

This research is expected to provide benefits for

investors in investing their funds and for companies

as a reference and consideration and evaluation in

making funding decisions and working capital

management in order to be able to achieve the

company's goals in generating maximum profits.

2 LITERATURE REVIEW

2.1 Profitability

Profitability is the ability of a company with the

overall funds invested in assets used for the

company's operations to generate profits (Munawir,

2012). One way to measure profitability is to use

Return on Equity (ROE). ROE shows that the

company's ability to generate profits after tax using

the company's own capital (Sudana, 2011). This

ratio is significant for shareholders to know the

effectiveness and efficiency of the processing of

their own capital carried out by the company's

management. The higher this ratio, the more

efficient the use of their own capital is carried out by

the company. The formula used in this ratio is as

follows:

𝑅𝑒𝑡𝑢𝑟𝑛 𝑂𝑛 𝐸𝑞𝑢𝑖𝑡𝑦

𝑅𝑂𝐸

(1)

2.2 Working Capital

Working capital is the excess of current assets over

short-term debt. This excess is referred to as

networking capital. This excess is the number of

current assets that comes from long-term debt and

own capital (Jumingan, 2011). Meanwhile,

according to Kasmir (2016), working capital is

capital that is used to carry out company operations.

Working capital can also be interpreted as

investments that are invested in current assets or

short-term assets, such as cash, securities,

inventories and other current assets. Working capital

used in this study is the growth of working capital.

Working capital growth is the difference between

end-of-year working capital and base year working

capital. The formula for measuring networking

capital growth is as follows:

Working Capital Growth

x 100% (2)

2.3 Retained Earnings

Retained earnings are retained earnings for use in

business activities. The primary source of retained

earnings is profit from operations. Shareholders bear

the highest risk in the company's operations and

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

554

assume any loss and profit from the company's

activities. Any profits not distributed to these

shareholders will become additional equity (Kisio et

al., 2011). According to Jumingan (2011), retained

earnings are the portion of profits reinvested in the

company. Not all profits obtained by the company

are distributed to the owners (shareholders) as

dividends but will be retained and reinvested in the

company for various purposes. Retained earnings

used in this study is retained earnings growth.

Growth of retained earnings is the difference

between year-end retained earnings and essential

year retained earnings. The formula for measuring

retained earnings growth is:

Retained Earnings Growth =

Final Retained Earnings

n

Basic Retained Earnings

Basic Retained Earnings

x 100%

3

2.4 The Effect of Working Capital on

Profitability

The amount of excess working capital can be

harmful to the company in generating profits

because many funds are unemployed, and vice versa

if the amount of working capital that is less will

harm the company so that working capital must be

available in sufficient quantities. According to

Djarwanto (2011), working capital should be

available in sufficient quantities to enable the

company to operate economically and not

experience financial difficulties, for example, able to

cover losses and overcome a crisis or emergency

without jeopardising the company's financial

situation. Harahap (2010) states that working capital

affects the level of profitability because working

capital is a current asset in a company that is used

for investment, its management will significantly

affect the level of profitability of the company. The

results of research conducted by Makky et al. (2017)

and Felany & Worokinasih (2018) state that working

capital has a significant effect on profitability.

Hypothesis 1 (H

1

) = Working Capital has a

significant effect on profitability

2.5 The Effect of Retained Earning on

Profitability

Retained earnings represent retained earnings for

reuse in company activities. Any profits not

distributed to shareholders will be added to the

company's equity. If the company meets its funding

needs from internal sources, it is said that the

company is spending or financing internally. From

the results of research conducted by Sari (2013) and

Anshory (2016) states that retained earnings have a

significant effect on EPS (one of the profitability

ratios).

The amount of profit in a company will

positively affect the ability of the company to have a

substantial income as well. In this case, retained

earnings act as a source of internal funds for the

company to carry out activities within the company.

The higher the source of internal funds from retained

earnings, it can strengthen the company's financial

position in the face of financial difficulties in the

future, to pay off debt, increase the amount of

equity, and to finance the company's expansion in

the future. Thus, the increasing amount of retained

earnings in company equity, it is expected that the

higher the income earned by the company through

its activities that are increasing, so that it will affect

the increase in profits in the company. This

statement is in line with Riyanto (2010), who

explained that the reasons for companies to hold

profits are to stabilise investment and improve the

financial structure of the company.

Hypothesis 2 (H

2

) = Retained Earnings has a

significant effect on profitability

Figure 3: Framework research.

3 RESEARCH METHODS

This research is causal associative research that is

quantitative because this research relates to the

object of research, namely in companies with a

certain period in the form of the company's annual

financial statements. Moreover, information relating

to the company that is tailored to the purpose of the

study. Causal associative research is research that

aims to determine the effect between two or more

variables. This study explains the relationship of

influence and influence of the variables to be

examined.

The population in this study is the food and

beverage sub-sector industry companies (Food and

Beverages) which were listed on the Indonesia Stock

The Effect of Working Capital and Retained Earnings on the Profitability of Food and Beverages Companies Listed in Indonesia Stock

Exchange Period 2012-2017

555

Exchange during the period 2012-2017. The data

used in this study are secondary in the form of

published financial statements. The data collection

technique in this study was to use purposive

sampling, which is sampling with specific criteria.

Based on the sampling criteria where the selected

sample is six companies with a period of 6 years,

from 2012-2017 with a total of 36 data.

The data analysis technique used in this study is

to use panel data analysis which is a combination of

cross-section data and time series data using data

processing applications in the form of Eviews 10.

4 RESULTS AND DISCUSSION

4.1 Data Analysis

4.1.1 Descriptive Analysis

Table 1: Descriptive Statistics.

ROE WC Growth RE Growth

Mean 18.11066 29.67908 15.85503

Median 18.44145 12.83915 16.12175

Maximu

m

40.18710 270.0462 127.4153

Minimu

m

4.800000 -44.85350 -48.56370

Std. Dev. 8.655132 57.49393 29.40454

Observation

s 36 36 36

Cross

sections 6 6 6

Source: Data processed (2019)

Statistical descriptive test results presented in

Table 1 shows the profitability proxied by ROE

shows the lowest value of 4.800000 or 4.80%,

namely the company PT. Nippon Indosari Corpindo

Tbk (ROTI) and the highest value is 40,18710 or

40.18%, namely the company PT. Delta Djakarta

Tbk (DLTA), while the average profitability level

proxied by ROE of 18,11066 or 18.11% shows that

the amount of return on the company's profits to

investors is 18.11%. In the variable working capital

(WC), which is proxied by the growth of working

capital shows that the lowest / smallest value of -

44.85350 or -44.85%, namely the company PT.

Indofood Sukses Makmur Tbk (INDF) and the

highest / most significant value is 270.0462 or

270.04%, namely the company PT. Nippon Indosari

Corpindo Tbk (ROTI), While the average working

capital (WC) which is proxied by working capital

growth is 29.67908 or 29.67%. On the variable,

retained earnings (RE) which are proxied by the

growth of retained earnings shows that the lowest

value of -48.56370 or -48.56% is at PT. Mayora

Indah Tbk (MYOR) and the highest value is

127.4153 or 127.41% also in the same company,

namely the company PT. Mayora Indah Tbk

(MYOR), While the average retained earnings (RE)

which is proxied by the growth of retained earnings

is 15.85503 or 15.85%.

4.1.2 Panel Data Regression Analysis

Based on tests that have been conducted by

researchers using the Chow Test, Hausman Test and

Lagrange Multiplier Test, it can be seen that the

model follows the Random Effect Model. The

results of testing between Working Capital and

Retained Earnings on Profitability using the Random

Effect Model will be presented in the following

table:

Table 2: Random Effect Model (REM).

Varia

b

el

Coefficie

nt

STD.

Erro

r

t-Statistic Prob.

C

16.64

417

4.166

414

3.994

843

0

.000

3

WC?

-

0.005801

0.015

207

-

0.381443

0

.705

3

RE?

0.103

352

0.025

706

4.020

536

0

.000

3

Random Effects (Cross)

_

DLTA--C 13.27862

_

ICBP--C 0.057210

_

INDF--C -5.710229

_

MYOR--C 1.243489

_

ROTI--C 1.066996

_

SKLT--C -9.936083

Source: Data processed (2019)

The coefficient value for the Working Capital

(WC) variable, which is proxied by the growth of

working capital is -0.005801. Retained Earnings

(RE) variable is proxied by the growth of retained

earnings of 0.103352 based on the p-value of the

two independent variables. There are one significant

variable namely Retained Earnings (RE) which is

proxied by the growth of retained earnings which

has a p-value <0.05 of 0.0003 or 0.0003 <0.05,

while Working Capital (WC) which is proxied by

working capital growth is not significant because the

p-value> 0.05 is equal to 0.7053 or 0.7053> 0.05.

Based on the value of each company that has

increased profitability, there are four companies,

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

556

namely PT. Delta Djakarta tbk amounting to

13,27862, PT. Indofood CBP Sukses Makmur Tbk

at 0.057210, PT. Mayora Indah tbk amounting to

1.243489, PT. Nippon Indosari Corpindo Tbk

amounting to 1.066996. Two other companies

experienced a decrease in profitability, namely PT.

Indofood Sukses Makmur Tbk amounting to -

5.710229, PT. Sekar Laut Tbk of -9.936083. Of the

six companies that have the most substantial

influence on the research, variables are PT. Delta

Djakarta Tbk of 13,27862 and the lowest value is the

company PT. Sekar Laut Tbk of -9.936083.

From the results of the calculation of the

Random Effect Model estimates in the table, a panel

data regression equation can be formed as follows:

The constant value in the equation of 16.66417 shows

that if all the independent variables (Working Capital and

Retained Earnings) are considered to be 0, the profitability

is 16.66417. Regression coefficient value of Working

Capital (WC) of -0.0055801 which means the value of

Working Capital has a negative relationship or for every

1% change in Working Capital the profitability has

decreased by 0.0055801.

4.2 Hypothesis Test

Table 3: Partial Test Results (t-test).

Variabl

e Coefficient

Std.

Erro

r

t-

Statistic Prob.

C 16.64417

4.166

414

3.994

843

0.000

3

WC? -0.005801

0.015

207

-

0.381443

0.705

3

RE? 0.103352

0.025

706

4.020

536

0.000

3

Adjuste

d R-squared 0.301481

Source: Data processed (2019)

Based on table 3, testing the Working Capital (WC)

variable retained earnings to profitability produces a

statistical value of t of -0.381443 with a significance level

(p-value) of 0.7053 (> 0.05). Because the p-value> α (5%),

it can be concluded that Hypothesis 1 is rejected, which

means that working capital does not significantly

influence profitability. The results of this study are also

strengthened by previous studies by Tumiwa and

Mamuaya (2019), in which this study also shows that

working capital does not influence profitability.

Testing the retained earnings variable (which is

proxied by the growth of retained earnings) against

profitability (which is also proxied by ROE) produces a

statistical value of t of 4.020536 with a significance level

(p-value) of 0.0003 (<0.05). Because the p-value <α (5%),

it can be concluded that Hypothesis 2 is accepted, which

means that Retained Earnings has a significant effect on

profitability. The results of this study are also strengthened

by previous research conducted by Anshory (2016), which

shows that retained earnings have a significant effect on

profitability.

5 CONCLUSIONS

First, working capital does not significantly

influence profitability. This state is caused by the

use of working capital related to company activities

in obtaining funds and spending these funds into

various forms of company operational activities that

have been carried out effectively and efficiently so

that working capital does not affect profitability.

Second, retained earnings have a significant effect

on profitability. This situation is because retained

earnings are profits which are not distributed to

shareholders as dividends but will be retained for

reuse by the company to increase working capital so

that it can finance all operational needs within the

company.

This research can be continued by using other

variables besides those used in this study, such as

Liquidity, Leverage, Solvency, Fixed Assets, Firm

Size and others as independent variables on

profitability. Moreover, it is expected to use more

samples and also use longer observation years.

REFERENCES

Anshory, Mey Zakaria. 2016. Pengaruh Rasio Utang,

Return on Equity (ROE), dan Laba Ditahan, Terhadap

Earning Per Share (EPS) Perusahaan Makanan dan

Minuman yang Terdaftar di Bursa Efek Indonesia

Periode 2010-2012 . Prodi Akuntansi Universitas

Negeri Yogyakarta. Jurnal Profita Edisi 2 Tahun 2016

Hal. 1-16.

Djarwanto, 2011. Pokok-pokok Analisis Laporan

Keuangan. Yogyakarta; BPFE .

Fahmi, Irham. 2013. Analisis Laporan Keuangan.

Bandung; Alfabeta .

Felany, Indah Ayu dan Worokinasih, Saparila. 2018.

Pengaruh Perputaran Modal Kerja, Leverage dan

Likuiditas terhadap Profitabilitas (Studi pada

Perusahaan Sub Sektor Makanan dan Minuman yang

Terdaftar di Bursa Efek Indonesia pada Tahun 2012-

2016). Jurnal Administrasi Bisnis (JAB)|Vol. 58 No.2

Mei 2018. Hal. 119-128.

Jumingan, 2011. Analisis Laporan Keuangan. Jakarta;

Bumi Aksara .

Y

it

= α + β

1

X

1it

+ β

2

X

2it

+ … + β

n

X

nit

+ e

Profitability (ROE)= α + β

1

WC + β

2

RE

+ e

Profitability (ROE)= 16.66417– 0.0055801WC +

0.103352RE

The Effect of Working Capital and Retained Earnings on the Profitability of Food and Beverages Companies Listed in Indonesia Stock

Exchange Period 2012-2017

557

Kasmir, 2016. Analisis Laporan Keuangan. Jakarta; PT

Raja Grafindo Persada .

Kisio, Donald, E, Jerry J. Weygandt, dan Terry D.

Warfield, 2011. Akuntansi Intermediate, Jakarta;

Erlangga .

Makky, Ahmad Farhap., Salim, M. Agus dan ABS, M.

Khoirul. 2017. Pengaruh Modal Kerja Dan Likuiditas

Terhadap Profitabilitas Perusahaan (Pada Perusahaan

Manufaktur Sektor Makanan dan Minuman yang

Terdaftar Di Bursa Efek Indonesia Tahun 2012-2016).

E-Jurnal Riset Manajemen Prodi Manajemen Fakultas

Ekonomi Unisma. Hal 180-193.

Munawir, 2012. Analisis Laporan Keuangan.

Yogyakarta; Liberty .

Sartono, Agus. 2010. Manajemen Keuangan Teori dan

Aplikasi. Yogyakarta; BPFE .

Sudana, I Made. 2011. Manajemen Keuangan

Perusahaan. Erlangga, Jakarta .

Sutrisno, 2012. Manajemen Keuangan Teori, Konsep dan

Aplikasi (8th ed). Yogyakarta; Ekonisa .

Syamsudin, Lukman. 2011. Manajemen Keuangan

Perusahaan. Jakarta PT. Raja Grafindo Persada .

Tumiwa, Ramon Arthur Ferry and Nova Christian

Mamuaya. 2019. Are the Profitability of Companies

Influenced by Working Capital and Liquidity?.

International Journal of Accounting & Finance in Asia

Pasific (IJAFAP), Vol. 2 No. 1, p. 1-10

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

558