A Reinforcement Learning Method to Select Ad Networks in Waterfall

Strategy

Reza Refaei Afshar, Yingqian Zhang, Murat Firat and Uzay Kaymak

School of Industrial Engineering, Eindhoven University of Technology, The Netherlands

Keywords:

Online AD Auction, Real Time Bidding, Ad Network, Supply Side Platform, Reinforcement Learning,

Predictive Model.

Abstract:

A high percentage of online advertising is currently performed through real time bidding. Impressions are

generated once a user visits the websites containing empty ad slots, which are subsequently sold in an online

ad exchange market. Nowadays, one of the most important sources of income for publishers who own websites

is through online advertising. From a publisher’s point of view it is critical to send its impressions to most

profitable ad networks and to fill its ad slots quickly in order to increase their revenue. In this paper we

present a method for helping publishers to decide which ad networks to use for each available impression.

Our proposed method uses reinforcement learning with initial state-action values obtained from a prediction

model to find the best ordering of ad networks in the waterfall fashion. We show that this method increases

the expected revenue of the publisher.

1 INTRODUCTION

Nowadays, online advertising plays a great role in the

income of a company who owns websites (i.e., pu-

blisher). The publisher can easily place ad slots on

its websites and increase its revenue by selling these

ad slots to advertisers. The traditional way of filling

ad slots involves publishers directly contacting adver-

tisers. However, this process is not efficient for both

stakeholders as it takes time and effort to find a proper

website or advertisement.

Real time bidding (RTB) is the process of provi-

ding advertisements for ad slots in a few milliseconds

through ad auction markets. In the ad auction sy-

stem, Supply Side Platforms (SSP) are developed to

help publishers in managing their ad slots and De-

mand Side Platforms (DSP) for assisting advertisers

in making advertisement campaigns. Ad networks are

entities between DSPs and SSPs. From the publis-

her side, whenever a user opens a website containing

an ad slot a request is sent to an ad network. The

outcome is either an advertisement filling the ad slot

successfully, i.e. impression, or a message showing

that this attempt was unsuccessful.

There are many ad networks that connect to diffe-

rent sets of advertisers through different DSPs. One

approach to choose a particular ad network given the

available ad slot is through the so called waterfall stra-

tegy (Wang et al., 2017). In the waterfall strategy, dif-

ferent ad networks in a list are tried sequentially to sell

an ad slot by sending ad requests. Ad requests conti-

nue till obtaining an advertisement unless a timeout is

encountered or the list is exhausted.

In common practice, the ordering of ad networks

is predefined and fixed based on experience of publis-

hers. However, this strategy is inefficient in terms of

time and revenue because often the first selected ad

networks cannot provide advertisements successfully.

This real time bidding process is completed in a

few milliseconds that takes a webpage to open. For

this reason, it is important not to waste time in making

unsuccessful requests to the ad networks. Besides,

publishers want to maximize their revenue obtained

through online advertising. Hence, maximizing the

revenue should be considered in selecting an ad net-

work as well. In this paper we focus on designing the

optimal ad network ordering to increase the revenue

and reduce the number of unsuccessful ad requests.

The ad network selection problem is a sequential

decision making problem. At each step, the decision

maker decides an ad network to send the ad request.

Then, a reward is received and the next state is de-

termined accordingly. Therefore, we model this pro-

blem as a reinforcement learning problem. In this mo-

del, the states are sets of ad requests and the actions

are different ad networks. We consider the sequences

256

Afshar, R., Zhang, Y., Firat, M. and Kaymak, U.

A Reinforcement Learning Method to Select Ad Networks in Waterfall Strategy.

DOI: 10.5220/0007395502560265

In Proceedings of the 11th International Conference on Agents and Artificial Intelligence (ICAART 2019), pages 256-265

ISBN: 978-989-758-350-6

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

of requests for ad slot filling as episodes and we use

the Monte Carlo algorithm to learn state-action va-

lues based on averaging sample returns (Sutton et al.,

1998). Because there are not enough data to estimate

all state-action values, we use a prediction model to

find initial state-action values and use these initial va-

lues in the averaging part of Monte Carlo algorithm,

given a real bidding dataset provided by our industrial

partner. For each ad request, the prediction model out-

puts the probability of filling the ad slot when a cer-

tain ad network is selected. We then use these values

to find state-action values. Finally, using experiments

on real bidding dataset, we show that the expected re-

venue is increased if we choose ad networks based on

the state-action values.

This paper is structured as follows. Section 2 pre-

sents a brief literature review. In section 3 the propo-

sed method is discussed. The result of applying our

method to a real time bidding dataset is presented in

Section 4. Finally, in Section 5, we make our conclu-

ding remarks and discuss future work.

2 LITERATURE REVIEW

There is a lot of research on defining a method to in-

crease the publisher’s revenue through online adver-

tising. Most of them focus on setting the floor price

dynamically. There are few approaches considering

the ad networks ordering in the waterfall strategy. In

this section we review some of these works.

The process of programmatic advertising is de-

fined as the automated serving of digital ads in real

time based on individual ad impression opportunities

(Busch, 2016). Programmatic advertising helps pu-

blishers and advertisers to reach their goals and in-

crease the efficiency of online advertising. The pro-

grammatic buying and selling of ad slots prepares new

environment for publishers and advertisers to better

communicate with each other. Publishers may easily

find suitable advertisements for their ad slots while

advertisers may target suitable users, thus increasing

potential product sales and brand visibility (Wang

et al., 2017).

An important factor in determining publisher re-

venue is the reserve price. Reserve price or floor

price is the minimum price that a publisher expects

to obtain (Zhang et al., 2014). If it is too high and

no advertiser is willing to pay it, the advertisement

slot will not be sold, whereas if this price is set too

low the publisher’s profit is affected. For this reason,

specifying that price is important and adjustments in

reserve price may lead to increase in publisher reve-

nue. The adjustment of the reserve price is not a trivial

issue and has motivated a lot of research.

Wu et al. utilize a censor regression model to

fit the censor bidding data that a DSP suffers from

these censored information especially for lost bids

(Wu et al., 2015). Because the assumption of censo-

red regression does not hold on the real time bidding

data, they proposed a mixture model namely a combi-

nation of linear regression for observed data and cen-

sored regression for censored data, so as to predict the

winning price.

Xie et al. present a method in which the calcu-

lation of reserve price is based on their prediction of

distinguished top bid and the difference between top

bid and second bid (Xie et al., 2017). They have built

several families of classifiers and fit them with his-

torical data. They convert the identification of high

value inventories to a binary decision. They also con-

vert the gap between the top and the second bid to a

binary value, by assigning 1 for significant and 0 for

not significant difference compared to a threshold. In

the next step they use the idea of cascading (Quinlan,

1986) and try to reduce the false positive rate of the

prediction algorithm by combining the series of clas-

sifiers obtained before. They inspire (Jones and Viola,

2001) who follow the same basic idea with their own

feature and classification models. After predicting

whether the top bid is high or low and the difference

between top bid and second bid is significant or not,

they change the reserve price for high top bids. In

other research, the reserve price is predicted through

optimizing the weight of features (Austin et al., 2016).

In this paper, two vectors define feature values and fe-

ature weights respectively. The inner product of these

two vectors computes the value of the reserve price.

The main process lies in learning the feature weight

vector. For this purpose, they use gradient descent.

Yuan et al. model real time bidding as a dynamic

game and adjust the reserve price by following a game

between publisher and advertiser (Yuan et al., 2014).

The game is to increase or decrease the current va-

lue of reserve price based on the auction. There are

some other works in the context of optimizing the

floor price e.g. (Cesa-Bianchi et al., 2015).

The other research area that is the main topic of

this paper, is to choose proper ad networks in the wa-

terfall strategy. Finding the best ad network for each

user impression is a research topic which has gained

less attention in recent years in comparison to reserve

price optimization. However, it is an important topic.

Sometimes there is a contract between a publisher and

an ad network. There should be a balance between

selecting this ad network and other ad networks that

may achieve higher revenue (Muthukrishnan, 2009).

According to (Ghosh et al., 2009), when the number

A Reinforcement Learning Method to Select Ad Networks in Waterfall Strategy

257

of ad networks increases, the most important factor

in selection policy is the expected revenue. However,

sometimes the better ad network may not fill the ad

slot and the publisher should try other ad networks.

This latency in filling ad slots may have bad effects

on the performance of publishers website. In other

research, (Balseiro et al., 2014) optimize the trade-

off between the short-term revenue from ad exchange

and the long-term benefits of delivering good spots

to the reservation ads. They formalize this combined

optimization problem as a multi-objective stochastic

control problem. In (Rhuggenaath et al., 2018), the

authors study a variant of the ad allocation problem

to help online publisher to decide which subset of

advertisement slots should be used in order to fulfill

guaranteed contracts and which subset should be sold

on SSPs in order to maximize the expected revenue.

They propose a two-stage stochastic programming ap-

proach to formulate and solve the display-ad alloca-

tion problem.

Reinforcement learning in real-time bidding is

also one of the hot topics during the last few years.

However, most of the research in this field is from the

advertiser’s point of view. In research done by (Ven-

gerov, 2007), a reinforcement learning algorithm is

proposed to determine the best bidding strategy. In ot-

her approaches, a reinforcement learning framework

is used for assisting advertiser bidding (Cai et al.,

2017) . In the work of (Nanduri and Das, 2007) the

focus is again on the bidder side. The focus of the

work we discuss in our paper lies rather in the publis-

her side.

3 METHODOLOGY

In this section we present our method to select the

most profitable ad network for each set of information

about an ad request. We use reinforcement learning to

find an ordering of ad networks in the waterfall stra-

tegy that fills the ad slots in the shortest time and with

the highest revenue.

We use reinforcement learning to derive the best

ordering, namely the one maximizing expected re-

venue. In reinforcement learning, an agent learns

through interaction with the environment and estima-

tes the value of each action in each state. Basically

the agent observes the current state of the environ-

ment and decides which action to take. However, the

publishers do not have access to the real time bidding

system. Due to this limitation it is not possible to ex-

plore the state-action space and evaluate our method

in the real environment. Therefore, we use histori-

cal data and consider each sequence of ad requests to

fill a certain ad slot as an episode. We estimate the

state-action values for those pairs of states and acti-

ons that are observed in our historical data. In order

to model an ad network selection problem as a rein-

forcement learning problem, we need to define sta-

tes, actions, reward function, algorithms for learning

state-action values and action selection policy (Sutton

et al., 1998).

3.1 States

Features in ad requests influence the bidding process

and an advertiser uses them and decides whether to

bid or not. Therefore, states should be related to the

ad requests. One approach to define a state is to consi-

der each unique ad request as an individual state. This

approach is not efficient because sometimes there is

no data sample for some pairs of states and actions.

If the data comes from a waterfall strategy, whereby

the ad requests are sent to the ad networks in a pre-

defined order, then there is only one observed action

for almost all the states. Hence, the problem is to find

the best ordering of one ad network which is already

solved. There is a trade-off in defining the states. On

one hand, if the states are more specific, there is not

enough ad requests in the RTB data obtained from

a predefined ordering of ad networks. On the other

hand, if each state contains large number of ad reque-

sts, the approach is similar to the predefined ordering

because the method selects the same action for large

number of ad requests.

In order to solve this problem, we select some of

the features and partition their values into intervals to

define the states. In our preliminary work, we tested

different subsets of features and different thresholds

on their values to find the states. Among them, the

combination of ad tag id, floor price and request order

make a balance between the number of states and the

number of observed ad networks for each state. Table

1 contains the definition of these features. We also

set two thresholds named t

f p

for floor price and t

ro

for request order to group ad requests based on these

thresholds. In the new states, values of floor price

are divided into two categories: below t

f p

and over

t

f p

. The same approach has been followed for request

order: below t

ro

and over t

ro

. Equation (1) defines the

states in our model.

s(x

i

) = (

Ad tag id(x

i

),

f loor price range(x

i

),

request order range(x

i

)

),

x

i

∈ D : i

th

ad request,

(1)

ICAART 2019 - 11th International Conference on Agents and Artificial Intelligence

258

f loor price range(x

i

) =

(

0 i f f loor price(x

i

) ∈ [0,t

f p

)

1 i f f loor price(x

i

) ∈ [t

f p

,m

f

]

(2)

request order range(x

i

) =

(

0 i f request order(x

i

) ∈ [0,t

ro

)

1 i f request order(x

i

) ∈ [t

ro

,m

r

]

(3)

m

r

= max

x

i

∈D

(request order(x

i

)) (4)

m

f

= max

x

i

∈D

( f loor price(x

i

)) (5)

where m

f

and m

r

indicate the maximum values for

floor price and request order in the RTB data. D con-

tains all of the ad requests that we use for our method.

3.2 Actions

The objective of our method is to decide which ad

network will be better in case of time and revenue.

Hence, in the reinforcement learning modeling of real

time bidding problem, the actions stand for selecti-

ons of ad networks. In each state, the model decides

which ad network makes the most revenue in the shor-

test time. There are N possible ad networks and each

ad request could be sent to any one of them. Usu-

ally ad networks are selected in some predefined order

depending on different situations by human decision

makers. Therefore, the number of samples for each

state-action pairs is different. In sum, the actions are

ad networks and there are at most N possible actions

in each state.

Equation (6) is the definition of the possible acti-

ons in each state. Since some combinations of states

and actions do not exist in the historical data, the acti-

ons set of each state is a subset of all actions.

a(x

i

) ∈ {a

1

,a

2

,...,a

N

} (6)

In this formulation a

1

,...,a

N

are ad networks. Ba-

sed on these definitions of states and actions, there

are more than one action for each state in historical

data. Therefore, the problem is the ordering of these

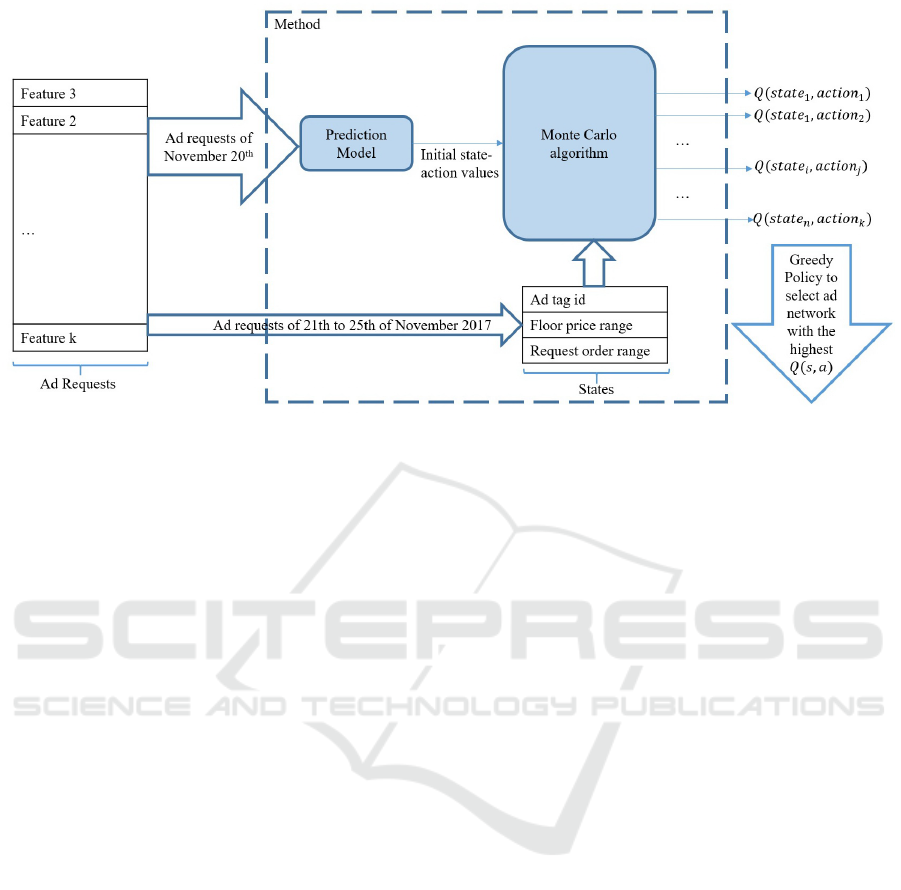

actions. Figure 1 illustrates the formation of a sample

state and actions.

Equation (7) defines the ad requests for each state-

action pair. In this equation, D(s,a) is the list of ad

requests that their corresponding state and action are

(s,a).

D(s,a) = {x

i

∈ D|(s(x

i

),a(x

i

)) = (s,a)} (7)

Figure 1: State and Actions.

3.3 Reward Function

We consider two objectives at the same time to decide

which action is better. High revenue is the first ob-

jective. The second one is providing advertisements

as soon as possible. Hence, a publisher should select

an action that has the most success probability and

highest expected revenue. As we cannot observe the

actual revenue of selling one impression

1

and the floor

price is the lower bound of revenue for an impression

(ad request with event state = 1), we assign the value

of floor price as the reward of successful ad reque-

sts. Conversely, unsuccessful attempts are penalized

by the value -1. This forces the agent (SSP) to find the

advertisement in the shortest time possible. Equation

(8) defines the reward function of our model.

Reward

x

i

(s,a) =

(

−1 i f event state(x

i

) = 0

f loor price(x

i

) i f event state(x

i

) = 1

x

i

∈ D(s,a) (8)

f loor price and event state come from the ad re-

quest x

i

.

3.4 Finding Initial Values for

Reinforcement Learning Algorithm

Because many of the SSPs select ad networks in a

predefined order, usually there are not enough data to

estimate all state-action values. For this reason we

build a prediction model to estimate an initial value

for all state-action values.

In order to find initial state-action values, we first

find the success probability of sending requests to a

certain ad network. We use supervised learning met-

hods. The feature vector contains information related

1

This is the case for online publishers who rely on SSPs

to sell their impressions.

A Reinforcement Learning Method to Select Ad Networks in Waterfall Strategy

259

Table 1: Information in each ad request.

Field name Definition Type

Event state The result of attempt: 0: fail, 1: success Numerical

Timestamp time of ad request (hour of a day) Numerical

Opportunity order shows how many times a user has entered our system Numerical

Country code A code specify country of the user visiting publishers website. Nominal

Ad tag id A unique string corresponds to an advertisement slot Nominal

Ad network id Id of each ad network (Ad exchange, AdSense, AOL, ) Nominal

Referrer URL URL of the server that shows the ad Nominal

Referrer domain Domain of the server that shows the ad Nominal

Page URL URL of the webpage containing the ad slot Nominal

Page domain Domain of publishers website Nominal

Device name Name of user device Nominal

OS name Users operating system Nominal

Browser name Users browser Nominal

Floor price The amount of floor price (reserve price) Numerical

Request order Order of current attempt in a sequence of attempts. Numerical

to the ad request and the target value is whether se-

lecting an ad network will provide an advertisement

or not.

The dataset is provided by an online publisher,

which contains ad requests that are the information

of interactions between a publisher and ad networks

to fill the ad slots. The publisher is an entertainment

company website, using ad networks such as Google

ad exchange, AOL and SpotX to sell their ad slots.

Each webpage of this website has some advertising

slots which should be filled with ads provided by the

ad networks. In the dataset there are lots of different

ad requests. The majority are unsuccessful attempts

in finding an advertisement and the rest are impressi-

ons. Table 1 illustrates the features of an ad request in

our data.

Our feature vector is a selected subset of the fe-

atures illustrated in Table 1, which has shown to

provide the best prediction after experimentation.

The most promising combination of features contains

floor price, time, ad tag id, request order, ad networks,

page domain, device name, operating system, oppor-

tunity order, browser name and URL. From the time

feature, we consider the hour of a day. In Table 1, the

Type attribute indicates the data type: numerical or

nominal. We use one-hot encoding method to convert

nominal data to numerical (Harris and Harris, 2010).

The one-hot encoder assigns a data column for each

value of each nominal data. Hence, there are many

columns for features that accept wide range of values.

For instance, there are many thousands URLs in the

dataset and if we use one-hot encoder to convert va-

lues of this feature into numerical data, the length of

feature vector will be very high. To overcome this

problem, we use a subset of values for each nominal

feature. First, we count the frequency of each nominal

value in our dataset and we sort the results by inver-

ted frequency, i.e. highest first. We then keep those

values with high frequencies and group the rest under

a single value name, e.g. low frequency.

The prediction model is applied on a subset of the

dataset. This subset contains only those samples that

are in a sequence which the event state of its last ad

request is one. In other words, each sequence of ad

requests of each ad slot contains a set of data sam-

ples that is sorted by request order and the request

order of the first sample is 1. Usually, datasets do not

contain explicit information about sequences of ad re-

quests. Hence, we need to infer them. We extract the

sequences by comparing the feature values of ad re-

quests that are sent within a very small difference in

time. If two ad requests sent within few milliseconds

differ only in floor price, ad network and request or-

der, while the rest of the values are the same, then we

consider them as different sequential attempts to fill

the same ad slot. For this purpose, we start by sor-

ting the ad requests by date and time. Then, we make

separate lists for each sequence and gradually insert

each data sample to the appropriate list. Initially all

lists are empty. We start from the first ad request of

the sorted dataset and add it to the first list. At each

stage, we compare the current add request with the

last ad request of all lists. If there is a list where the

last ad request has the same values with the current

except for a lower value in request order, then this

new ad request is added to that list. There should be

ICAART 2019 - 11th International Conference on Agents and Artificial Intelligence

260

at most one ad request with event state equal to 1 for

each sequence. Thus, a list is closed, whenever an

impression is added. Using this method we managed

to retrieve almost all ad request sequences. After this

process, there are some sequences without an impres-

sion. Since we do not have any information about

why these sequences are incomplete, we treat them as

errors and all such incomplete sequences are removed

from the dataset. The new dataset contains only those

sequences that end with an ad request with event state

equal to one.

The prediction task is to classify each ad request

into one of two classes: 0 for unsuccessful and 1 for

successful. In other words, the target is the value of

the event state and the objective of the prediction mo-

del is to predict this value.

Event state is a binary variable. The classifier re-

ceives an ad request and finds the probability of event

state equal to one for that ad request. Hence, for each

ad request containing an ad network id, we obtain a

probability which determines the likelihood of filling

the ad slot. The multiplication of this probability to

the floor price of the current ad request yields the ex-

pected lower bound for the revenue of the ad request.

Equation (9) shows this expected lower bound of re-

venue.

E[R(x

i

,a(x

i

))] =

P(event state(x

i

) = 1|x

i

,a(x

i

))

× f loor price(x

i

) (9)

In this equation x

i

is an ad request, a(x

i

) is the ad

network id of x

i

, event state(x

i

) is the event state of

x

i

and shows whether this ad request is successful or

not, P(event state(x

i

) = 1) is the success probability

acquired from the prediction model, f loor price(x

i

)

is the floor price of x

i

, and E[R] is the expected lower

bound of the revenue when ad request x

i

is successful.

Because the revenue is zero for event state = 0, it is

not written in the equation. Through this formula we

can find an initial value for state-action pairs.

These initial values are not sufficient for deciding

which action to take because there is no information

about the long term revenue in these values. In ot-

her words, these values are just useful to find the ad

network that will provide the advertisements in the

shortest time. For instance, if the success probability

of an ad network is 0.9, the floor price is 0.5 and the

request order is 1, this method does not care about the

revenue that another ad network may make when this

request fails. To consider long term revenue as well as

time, we model the problem as a reinforcement lear-

ning problem. For this reason we merely use these as

initial values in the reinforcement learning process.

Then, the reinforcement learning process takes into

consideration the long term revenue when selecting

ad networks.

The revenue obtained from (9) is used for learning

state-action values. As we said before, we need these

values because there are not enough data to compute

all state-action values.

3.5 Learning State-action Values

SSPs in each state act as agents and select one of the

ad networks to send the ad request. Based on the event

state, the reward might be -1 or the value of floor

price. The problem is episodic where, as explained

in section 3.4, each episode consists of an ad request

sequence. We use a policy Monte Carlo method to

learn state action values. In the Monte Carlo algo-

rithm, state-action values are obtained through avera-

ging over all observed values in the episodes. Since in

each episode there is at most one occurrence of a cer-

tain state-action pair, the first visit Monte Carlo can

do well (Sutton et al., 1998).

We change the Monte Carlo algorithm in order to

fit with our objectives. In our approach, the revenue

lower bound (as discussed in Section 3.4) is consi-

dered in the averaging. The number of data samples

used for prediction model is used as a weight for these

initial values. The Monte Carlo algorithm yields the

expected revenue of each state-action pair. The mo-

dified averaging part of the Monte Carlo algorithm is

defined in (10).

Q(s,a) =

(

n

1

(s,a)

∑

j=1

Reward

x

i

j

(s,a)+

E[R(x

i

,a)]× n

2

(s,a))

/(n

1

(s,a)+ n

2

(s,a)),

s.t. x

i

∈ D(s,a) (10)

Where n

1

(s,a) is the number of s(x

i

) and a(x

i

)

pair in the data samples observed so far, and n

2

(s,a)

is the number of s(x

i

) in the dataset used for initiali-

zation when its ad network id is a(x

i

). In other words,

n

1

(s,a) is the length of D(s,a). Before computing the

average and updating Q(s,a), the current ad request

should be added to D(s,a).

The final output of this method is the state-action

values. The publisher can decide which ad networks

to send the ad requests to achieve the maximum ex-

pected revenue in the shortest time. In the next

section, we discuss the results and evaluate our met-

hod by comparing the expected rewards using our

method to actual revenues obtained in the dataset. Fi-

gure 2 provides an overview of our proposed method.

A Reinforcement Learning Method to Select Ad Networks in Waterfall Strategy

261

Figure 2: Proposed method for learning the expected revenue of selecting each ad network in each state. First, some of ad

requests are used by the prediction model to find an expected lower bound of the revenue. Then, we use these expected values

and new ad requests to find state-action values through Monte Carlo algorithm. Finally, greedy action selection policy will

select the best action in each state.

4 EXPERIMENTS AND RESULTS

In this section, the results of our proposed method on

real time bidding auction data are discussed. The met-

hod requires initial state-action values and uses the ad

requests to learn final values for state-action pairs. For

the evaluation of the initial values obtained from the

prediction model, we use binary classification perfor-

mance measures. Since it is not feasible to test our

method in the real environment, we compare the ex-

pected revenue of selecting the action with the highest

value for each state with the actual revenue obtained

from the historical data. We consider the floor price

as a lower bound of revenue for impressions.

The dataset D contains the ad requests of one

week (20-26 November 2017) for users in the Net-

herlands. We use some part of this dataset for fin-

ding the initial state-action values and the rest for the

Monte Carlo algorithm. The attributes of our dataset

are shown on Table 1.

4.1 Initial Values Evaluation

In this section we discuss the result of event state pre-

diction on the dataset that does not contain any in-

complete sequences. As we will see, if we ensure that

there is not any incomplete sequence of attempts, we

can predict the ad network response to a request with

an acceptable precision.

As we mentioned earlier, we have seven datasets

that each one corresponds to a day of week in the pe-

riod of 20th to 26th of November 2017. Briefly spea-

king, the prediction model is a classifier that labels

each data sample with 0 or 1. A zero value denotes

that this attempt to get an advertisement from speci-

fied ad network will not be successful. Conversely, if

the prediction result is one, then the request to this ad

network will result in filling the advertising slot. Our

classifier is evaluated for this task using standard clas-

sification performance measures, namely precision,

recall, F1 score, kappa and ROC curve.

Through applying the data preparation explained

in section 3.4, the feature vector consists of 673 fea-

tures. We tested different classification methods such

as Bayesian classifier, support vector machine and

random forest classifier. We finally opted for the

random forest classifier as it has shown to achieve the

best performance on our data.

In each sequence of ad requests there is only one

impression which is always the last ad request of each

sequence. Therefore, the number of requests with

event state equal to 0 is far larger than the number

of impressions. In order to balance the dataset, there

are various approaches. For example, the SMOTE

NC is reported to be a good method for oversam-

pling (Chawla et al., 2002). However, this method

does not consider the dependencies between features.

For instance, if the browser of all ad requests from

a given user is Chrome but the prevalent browser of

the nearest neighbors is Firefox, then sampling using

SMOTE NC would result in an incorrect sample com-

bining this user characteristics to Firefox. Because

ICAART 2019 - 11th International Conference on Agents and Artificial Intelligence

262

Table 2: Performance measures for prediction model.

Event state = 1 Nov 20 Nov 21 Nov 22 Nov 23 Nov 24 Nov 25 Nov 26

Precision 0.7388 0.7668 0.7468 0.7382 0.7816 0.7991 0.8012

Recall 0.7165 0.7291 0.6781 0.6967 0.7486 0.7598 0.7662

F1 0.7275 0.7475 0.7108 0.7168 0.7647 0.7790 0.7833

Accuracy 0.7314 0.7549 0.7240 0.7261 0.7700 0.7844 0.7879

Kappa 0.4628 0.5098 0.4480 0.4521 0.5400 0.5689 0.5758

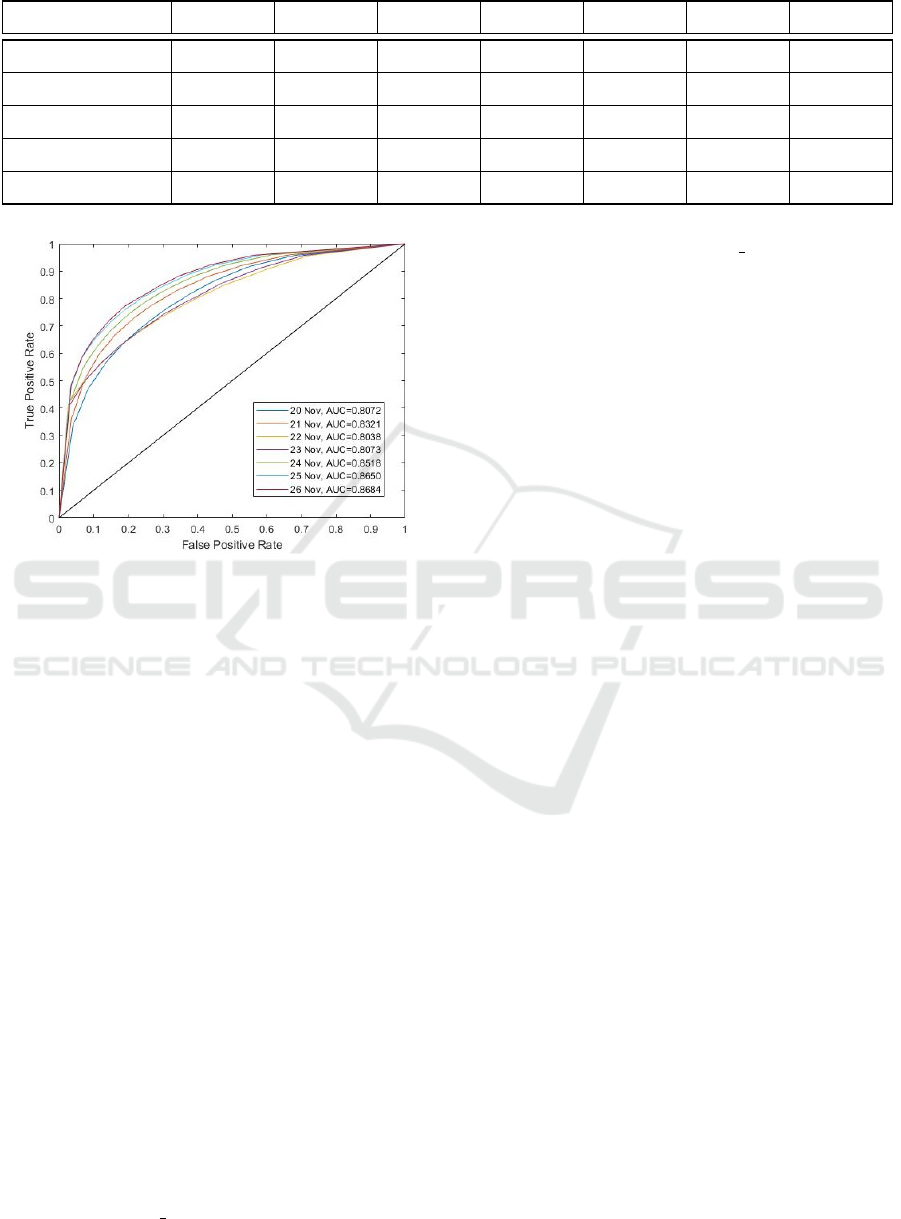

Figure 3: ROC curve for 7 datasets.

the number of samples per day are too high (about 1

million), oversampling makes the dataset very large

and loading the data for the classifier is not practical.

The samples with event state 1 are more important in

our prediction model because they provide the initial

state-action values for our method. For this reason,

we opted for the random under-sampling method for

balancing our dataset (Japkowicz et al., 2000). Using

this sampling method prevents information loss, be-

cause these values are initial state-action values and

the rest of data samples containing incomplete se-

quences will be used in the Monte Carlo algorithm.

Table 2 contains the performance measures of the

prediction model. We applied the classifier separately

on each day. For each day, we considered a holdout

cross validation with 20% of the sequences as a test

set and the remainder as the training set. As illustrated

in Table 2, if there is not any incomplete sequences we

can predict whether an ad request will provide an ad-

vertisement or not with a good F1 score (above 0.7).

Figure 3 shows the ROC curves of predicting impres-

sions (event state = 1) for seven consecutive days. The

average value of AUC for these seven dataset is 0.74.

The success probabilities for each ad network may

be obtained with a good precision when there is not

any incomplete sequences. Through multiplying the

probability of event state = 1 for each ad request and

ad network to the value of f loor price of that ad re-

quest, a lower bound of revenue is obtained.

4.2 State-action Values Evaluation

The application of reinforcement learning modeling

to our dataset, as explained in Section 3, resulted in

almost 3000 states and 5 actions. We use the initial re-

venue obtained from the prediction model as a weig-

hted value in the averaging step of the Monte Carlo

algorithm. There are about 1 million ad requests per

day. For this reason, it is not possible to load all the

data in the memory and perform the prediction pro-

cedure. However, because the reinforcement learning

step requires merely one sequence at a time, we do

not have to load all data into memory and we are thus

able to process a large number of data samples.

As mentioned before, the dataset contains the ad

requests of one week. The episodes used in the Monte

Carlo algorithm are obtained by considering the chro-

nological ordering of ad requests. We used the ad re-

quests of 20

th

of November for the initialization and

found initial state-action values. Then, we used the

data samples of the next five days in the Monte Carlo

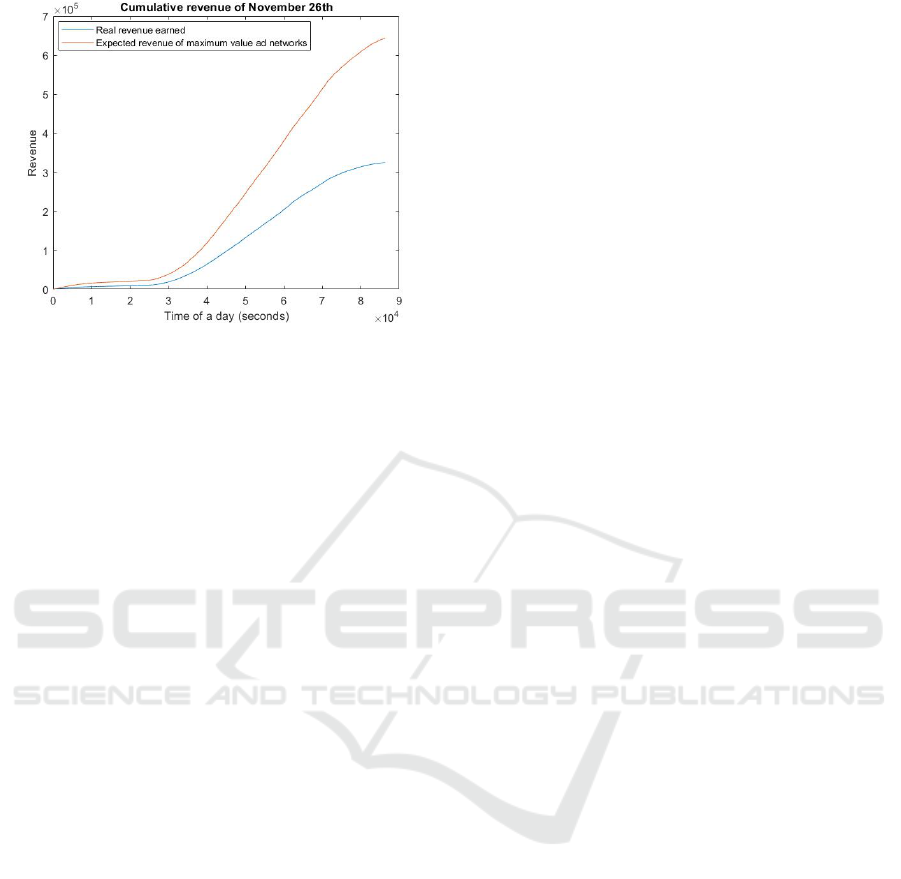

algorithm. Finally, we compared the real revenue (ba-

sed on sum of the values of floor prices for ad reque-

sts with eventstate = 1 as a lower bound for revenue)

with the expected revenue that is based on a greedy

policy with respect to the state-action values.

To determine the threshold values t

f p

and t

ro

, we

tested different values and found that 6 as floor price

threshold and 3 as request order threshold make the

best balance between the number of states and the

number of observed actions for each state. Figure 4

illustrates the cumulative revenue prediction for the

test dataset (red curve) compared to the real revenue

earned (blue curve). The ad requests of November

26 were used for testing the method. As you can see

in the figure, there is noticeable difference between

the two curves. For each episode, we considered only

the first ad request, because the state-action value of

each state-action pair is the expected revenue of a se-

quence starting from that state. Therefore, if a SSP

A Reinforcement Learning Method to Select Ad Networks in Waterfall Strategy

263

Figure 4: Expected revenue vs. real revenue.

acts greedily with respect to the state-action values

and selects the ad network with the highest value, the

resulting revenue would be far more than following

the predefined ordering approach.

Theoretically there are huge differences between

these two values which indicate the potential of our

proposed method. In the future we will test it on the

real platform and compare the theoretical results with

the observed ones.

5 CONCLUSIONS

We proposed an ad network ordering method in wa-

terfall strategy based on reinforcement learning. We

modeled ad requests as states and ad networks as acti-

ons. Then, we estimated the state-action values using

Monte Carlo algorithm. When a user visits a web

page of a publisher, the ad network that gives the hig-

hest state-action value is chosen for making the first

ad request. If this request does not get an impression,

then the next ad network is chosen among the remai-

ning ones maximizing the state-action values. This

continues till an impression is obtained.

Our experimental results using real data show that

our approach could help publishers not only to fill

their ad slots in the shortest time, but also to incre-

ase their revenue.

We use Monte Carlo algorithm to learn the state-

action values. This algorithm is useful when there

are enough episodes for each state-action pairs in the

data, which is often not the case. As future rese-

arch, we will investigate function approximation al-

gorithms for finding the state-action values which are

not observed in the data (Sutton et al., 1998), (Sze-

pesv

´

ari, 2010).

In addition, there is an interesting research que-

stion on how the developed prediction models influ-

ence the subsequent decision making, e.g., (Verwer

et al., 2017). In the future, we will experiment the sig-

nificance of each component of our method to find out

dependencies between each component and how they

effect the performance of the ad network selection

problem.

ACKNOWLEDGMENT

This work was supported by NWO (project

628.010.001) and EU EUROSTARS (Project E!

11582).

REFERENCES

Austin, D., Seljan, S., Monello, J., and Tzeng, S. (2016).

Reserve price optimization at scale. In 2016 IEEE 3rd

International Conference on Data Science and Advan-

ced Analytics (DSAA), pages 528–536. IEEE.

Balseiro, S. R., Feldman, J., Mirrokni, V., and Muthu-

krishnan, S. (2014). Yield optimization of display

advertising with ad exchange. Management Science,

60(12):2886–2907.

Busch, O. (2016). The programmatic advertising principle.

In Programmatic Advertising, pages 3–15. Springer.

Cai, H., Ren, K., Zhang, W., Malialis, K., Wang, J., Yu, Y.,

and Guo, D. (2017). Real-time bidding by reinforce-

ment learning in display advertising. In Proceedings

of the Tenth ACM International Conference on Web

Search and Data Mining, pages 661–670. ACM.

Cesa-Bianchi, N., Gentile, C., and Mansour, Y. (2015). Re-

gret minimization for reserve prices in second-price

auctions. IEEE Transactions on Information Theory,

61(1):549–564.

Chawla, N. V., Bowyer, K. W., Hall, L. O., and Kegel-

meyer, W. P. (2002). Smote: synthetic minority over-

sampling technique. Journal of artificial intelligence

research, 16:321–357.

Ghosh, A., McAfee, P., Papineni, K., and Vassilvitskii, S.

(2009). Bidding for representative allocations for dis-

play advertising. In International Workshop on Inter-

net and Network Economics, pages 208–219. Sprin-

ger.

Harris, D. and Harris, S. (2010). Digital design and compu-

ter architecture. Morgan Kaufmann.

Japkowicz, N. et al. (2000). Learning from imbalanced

data sets: a comparison of various strategies. In AAAI

workshop on learning from imbalanced data sets, vo-

lume 68, pages 10–15. Menlo Park, CA.

Jones, M. J. and Viola, P. (2001). Robust real-time object

detection. In Workshop on statistical and computatio-

nal theories of vision, volume 266, page 56.

Muthukrishnan, S. (2009). Ad exchanges: Research issues.

In International Workshop on Internet and Network

Economics, pages 1–12. Springer.

ICAART 2019 - 11th International Conference on Agents and Artificial Intelligence

264

Nanduri, V. and Das, T. K. (2007). A reinforcement le-

arning model to assess market power under auction-

based energy pricing. IEEE transactions on Power

Systems, 22(1):85–95.

Quinlan, J. R. (1986). Induction of decision trees. Machine

learning, 1(1):81–106.

Rhuggenaath, J., Zhang, Y., Akcay, A., and Kaymak, U.

(2018). Optimal display-ad allocation with guaranteed

contracts and supply side platforms. Working paper.

Sutton, R. S., Barto, A. G., et al. (1998). Reinforcement

learning: An introduction. MIT press.

Szepesv

´

ari, C. (2010). Algorithms for reinforcement lear-

ning. Synthesis lectures on artificial intelligence and

machine learning, 4(1):1–103.

Vengerov, D. (2007). A gradient-based reinforcement

learning approach to dynamic pricing in partially-

observable environments.

Verwer, S., Zhang, Y., and Ye, Q. C. (2017). Auction opti-

mization using regression trees and linear models as

integer programs. Artificial Intelligence, 244:368–

395.

Wang, J., Zhang, W., Yuan, S., et al. (2017). Display ad-

vertising with real-time bidding (rtb) and behavioural

targeting. Foundations and Trends

R

in Information

Retrieval, 11(4-5):297–435.

Wu, W. C.-H., Yeh, M.-Y., and Chen, M.-S. (2015). Pre-

dicting winning price in real time bidding with censo-

red data. In Proceedings of the 21th ACM SIGKDD In-

ternational Conference on Knowledge Discovery and

Data Mining, pages 1305–1314. ACM.

Xie, Z., Lee, K.-C., and Wang, L. (2017). Optimal reserve

price for online ads trading based on inventory iden-

tification. In Proceedings of the ADKDD’17, page 6.

ACM.

Yuan, S., Wang, J., Chen, B., Mason, P., and Seljan, S.

(2014). An empirical study of reserve price optimi-

sation in real-time bidding. In Proceedings of the

20th ACM SIGKDD international conference on Kno-

wledge discovery and data mining, pages 1897–1906.

ACM.

Zhang, W., Yuan, S., and Wang, J. (2014). Optimal real-

time bidding for display advertising. In Proceedings

of the 20th ACM SIGKDD international conference on

Knowledge discovery and data mining, pages 1077–

1086. ACM.

A Reinforcement Learning Method to Select Ad Networks in Waterfall Strategy

265