Simulating a Commercial Power Aggregator at Scale

Design and Lessons Learned

Gary Howorth

1 a

and Ivana Kockar

2 b

1

Institute of Energy and Environment, University of Strathclyde, 99 George St., Glasgow, U.K.

2

Institute of Energy and Environment, University of Strathclyde, 204 George St., Glasgow, U.K.

Keywords: Agent based Modelling, Aggregation, Power, Simulation, Smart Grid.

Abstract: To evaluate aggregation models in the context of a power system, a software tool (the SmartNet simulator)

has been developed to look at the impact of managing Distributed Energy Resources (DERs) on networks’

technical operation (e.g. power flows and voltage levels) and simulates wholesale and ancillary services

market conditions. This paper focusses on the design and implementation of one of the aggregation models

that addresses the Curtailable Generator / Curtailable Load (CGCL) aggregator. The paper outlines the design

of such a software aggregator agent and discusses the lessons learned in simulating a more realistic large

power grid system. The aggregator is represented as an agent based object orientated model using a financed

based buckets system to aggregate bids from up to 300,000 devices across 10 -20,000 power nodes. The

concept/implementation can be extended to include more sophisticated bidding strategies and to use multiple

perspectives on tranches. Simulation and testing of such a large simulation system was challenging, and we

have proved that it is possible to simulate the aggregation and clustering of different types of flexibility into

a number of manageable bids in a timely manner.

1 INTRODUCTION

The objective of the EU Horizon 2020 SmartNet

project (Migliavacca et al., 2017) is to compare

different coordination approaches between actors

such as Transmission operators (TSO), Distribution

System Operators (DSO) and customers. To facilitate

interaction between, potentially, millions of

Distributed Energy Resources (DERs)

1

and manage

the TSO-DSO interaction, it is also necessary to

develop and analyse aggregation models. According

to the English Oxford Dictionary aggregation is

defined as “the formation of a number of things into

a cluster”. In a similar way, an aggregator is defined

as “a company that negotiates with producers of a

utility service such as electricity on behalf of groups

of consumers”. In this way the SmartNet aggregators

take millions of volume-cost bids from homes,

businesses and other DER’s, packages those bids into

a

https://orcid.org/0000-0002-5625-4937

b

https://orcid.org/0000-0001-9246-1303

1

Small units connected to the distribution grid with possible two-way flow of electrical power. Common examples of DERs

are Distributed Generators (solar, wind) battery storage, electric vehicles (EV) and active demand response (load that can

change its consumption to provide flexibility to the system).

larger bid units and submits those bids to a TSO, DSO

or some hybrid organization that manages flexibility

markets on behalf of TSO and DSO. The system uses

bids from a number of aggregators that represent

thousands of DERs to clear the market at thousands

of nodes. The simulator developed in the SmartNet is

based on a Dist-flow AC Optimal Power Flow

methodology to minimise system costs, i.e. minimize

cost of activation of flexibility bids, while ensuring

that network constrains are respected. The solution

provided by the simulator yields electricity nodal

prices and dispatch volumes for participating DERs

over thousands of nodes.

The focus of this paper is on the design and

implementation of one of the aggregation models, the

Curtailable Generator / Curtailable Load (CGCL)

aggregator (Marthinsen et al., 2017). This paper

outlines the design of such a software aggregator

Howorth, G. and Kockar, I.

Simulating a Commercial Power Aggregator at Scale Design and Lessons Lear ned.

DOI: 10.5220/0007854402770284

In Proceedings of the 9th International Conference on Simulation and Modeling Methodologies, Technologies and Applications (SIMULTECH 2019), pages 277-284

ISBN: 978-989-758-381-0

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

277

agent, and discusses the lessons learned from

simulating a more realistic large power grid system.

An agent based object orientated design was used

to construct the CGCL aggregator using a novel

finance based buckets or tranche system to aggregate

bids from up to 300,000 devices of four different

DER types (Solar, Hydro, Wind and Sheddable

Loads) across 10 -20,000 power nodes. A bucket is a

term typically used in business or finance to

categorize assets, but so far has not been applied in

modelling aggregators in the power industry. This

approach represents an alternative methodology to

the standard designs using optimisation techniques

and has been integrated into the aggregator agents.

The paper is organized as follows. In Section 2,

the design and operation of the CGCL aggregator is

discussed in the context of its operation in a future

power grid – a smart grid. The section focusses on the

use of financial bucketing as a methodology to

represent aggregators. Section 3 focusses on the

challenges faced and lessons learned in development

of this large-scale model, and discusses the use of

python vs other languages, as well as database issues

that occurred at scale. Section 4 expands on the

previous sections and explores potential future

designs, and reports on work that has explored these

ideas. Finally, Section 5 concludes this paper.

2 CGCL AGGREGATOR MODEL

DESIGN

The power grids in Europe and the United States are

undergoing great changes, as regulators look to

develop the so called Smart Grid and to include

participation from residential consumers and other

DERs. The objective of the EU Horizon 2020

SmartNet project is to compare different approaches

and TSO-DSO coordination schemes that will enable

better integration of DERs and their participation in

Ancillary Services (AS) provision. It will be difficult

for the traditional operators of the power grid to

interact with so many devices and individuals so a

“middle man” or a so called aggregator will be

required to manage their participation. The TSO

and/or DSOs will still need to deal with a large

number of aggregators, so to make the interactions

manageable and to facilitate market clearing, the

TSO/DSOs will need to limit the number of bids that

each aggregator can submit to participate in AS

and/or flexibility markets. In California, Demand

Side Response aggregators (DSR) are currently

limited to a maximum of 10 bids per hour per

aggregator (Kohansal and Mohsenian-Rad, 2016).

The number chosen seems somewhat arbitrary, but

fewer buckets would result in less granularity in price

bids, whilst taking significantly more bid buckets

would result in additional computational complexity

and a requisite increase in solution time.

Aggregators will eventually take many forms and

follow different types of business models. Some

aggregators will specialize on different types of

devices e.g. Electric Vehicles (EV) or CGCL. Some

will focus on multiple groups. As a first step

SmartNet developed five types of aggregators

(Storage, CHP, CGCL, thermostatically controlled

Loads [TCL] and Atomic Loads (e.g. washing

machines) (Dzamarija et al., 2018). Each aggregator

focuses on those specific devices only.

Although the focus of the simulation framework

is on coordination schemes, we present here for the

first time, a focus on a particular aggregator agent

known as the CGCL aggregator. This agent

aggregates renewable devices such as wind, solar and

hydro and also encompasses sheddable loads such as

street lamps. The simulation currently uses the

marginal bidding costs as the basis on which to

aggregate, although strategic bidding and agent

learning could be added at a later date. So far the

major focus of research has been on the aggregation

of EV’s, mainly from an algorithmic and optimization

point of view (Shafie-Khah et al., 2016, Vayá and

Andersson, 2015). There is therefore a lack of work

looking at aggregation of customers in general, as

well as the role of the CGCL aggregator.

Optimization is one method that we can use to

aggregate bids, but other alternatives could be

investigated.

In that context, we have borrowed from the

finance and risk management sector as we believe

that many future commercial aggregators would use

simpler more pragmatic solutions based on bucket

concepts which fit well with portfolio and risk

management theories. These are integrated with the

network calculations. Although we do not present the

risk and portfolio management concepts here, the

paper focusses on simulating buckets as a first step in

developing an agent that would be representative of

such a commercially focussed agent.

Buckets could be time based (Kumar, 2017), risk

based (Riskviews, 2012), default based (Krink et al.,

2008) or price /cost based. As a first step we chose to

ignore risk and concentrate on marginal costs without

risk, to investigate coordination schemes and the

feasibility of performing such an aggregation in the

SmartNet context

SIMULTECH 2019 - 9th International Conference on Simulation and Modeling Methodologies, Technologies and Applications

278

Choosing which devices go into which buckets

can be thought of as clustering exercise. At its

simplest if we ignore risk we can cluster on price/cost

but in practice a more sophisticated clustering

strategy would usually be required.

The current design of SmartNet does not address

risk in any sophisticated way, but does include a cost

adjustment or delta that can be added to the marginal

bid cost. Calculation of the delta value has not

currently been implemented.

Although simulation approaches using stochastic

optimization with constrained chance (Li, 2015)

provides a potential solution to managing risk, the

bucket approach presented below will allow us to

represent risk as in a way that is familiar to many risk

professionals in trading companies and banks. In

addition, run times for stochastic optimization

algorithms can be of the order of 30 minutes to just

over one hour (Furlonge, 2011) and may prove to be

impractical in the context of real time electricity

market clearing.

2.1 CGCL Aggregator Overview

Aggregators will be assumed commercial entities,

which are profit maximising and will have to provide

a number of functions/roles within a real market

setting. These will include but are not be limited to:

Analysis of Customers;

Analysis of the Market;

Weather forecasting;

Demand and Clearing Price forecasting;

Risk management;

Data management, Accounting and Billing;

Congestion modelling (see below);

Aggregation of Bids (Clustering) with the view to

maximise profits;

Bidding to Market and Interactions with

TSO/DSO;

Disaggregation – based on the bids submitted to

the market during the aggregation process and

results from the market clearing entity, apportion

accepted flexibility to individual devices. Note the

CGCL aggregator may be given partial

acceptance of its bids e.g. only 25% of the volume

is accepted at a certain price. The organisation

responsible for market clearing would be using

optimal power flow software to dispatch

generation and demand response bids, taking

account of constraints on power lines (voltage and

flow) as well as looking to minimise system costs.

Lower bids may be curtailed to overcome

potential congestion in the power system;

Notification of any adjustments to individual

devices from the disaggregation process.

This paper is going to focus on the modelling of

the last four listed functions. Although SmartNet also

simulates day ahead price bidding, and solving the

optimal power flow, we are going to focus on the real

time flexibility or ancillary services market portion of

the wholesale power market. In the following

subsections, we now focus on our design of a CGCL

aggregation agent written in Python using a

financially based “bucket” bidding system.

2.2 Module Descriptions

The Curtailable Generation Curtailable Load (CGCL)

aggregator/disaggregator module (henceforth called

the CGCL Aggregator) simulates the

aggregation/disaggregation of data and bids from

hundreds of thousands of devices attached to a

particular node/ or a set of nodes on a physical power

network. In this case, four different types of devices

are collated from thousands of power nodes in a

model of a real system – in this case the Italian,

Spanish and Danish Power grids:

Hydro;

Solar;

Wind;

Sheddable Loads (SEL) – e.g. Street Lamps.

For each time step, bids from these different types

of devices are combined into price “buckets” to

produce up to 20 price volume bids per time step (10

up bids and 10 down bids). Market rules determine

when aggregators will bid i.e. the time step and for

how many future intervals e.g. 12 bids of 5 minutes

for the next hour. SmartNet allows us to experiment

with these parameters.

Overall control of the bidding process, including

time steps, the number of periods bid, aggregation

and disaggregation start signals are driven by the

Market Scheduler and scenario inputs which include

details on the number of time steps , rolling time bid

window and the grid to be used in the simulation. This

data is sent to a CGCL aggregator by the scheduler.

The CGCL aggregator code initialises and creates

all the aggregators for the scenario, and collects all

the device data associated with a node to which

aggregator is connected. In effect each aggregator is

an agent (a software object), who stores the data from

all the devices connected to the aggregator’s node or

nodes, in an in-memory three dimensional matrix.

Note in the case of a transmission nodes, SmartNet

assumes that all devices associated with distribution

nodes downstream are attached to the aggregator. In

practice, aggregators may take customers from a

Simulating a Commercial Power Aggregator at Scale Design and Lessons Learned

279

variety of nodes. Different co-ordination schemes,

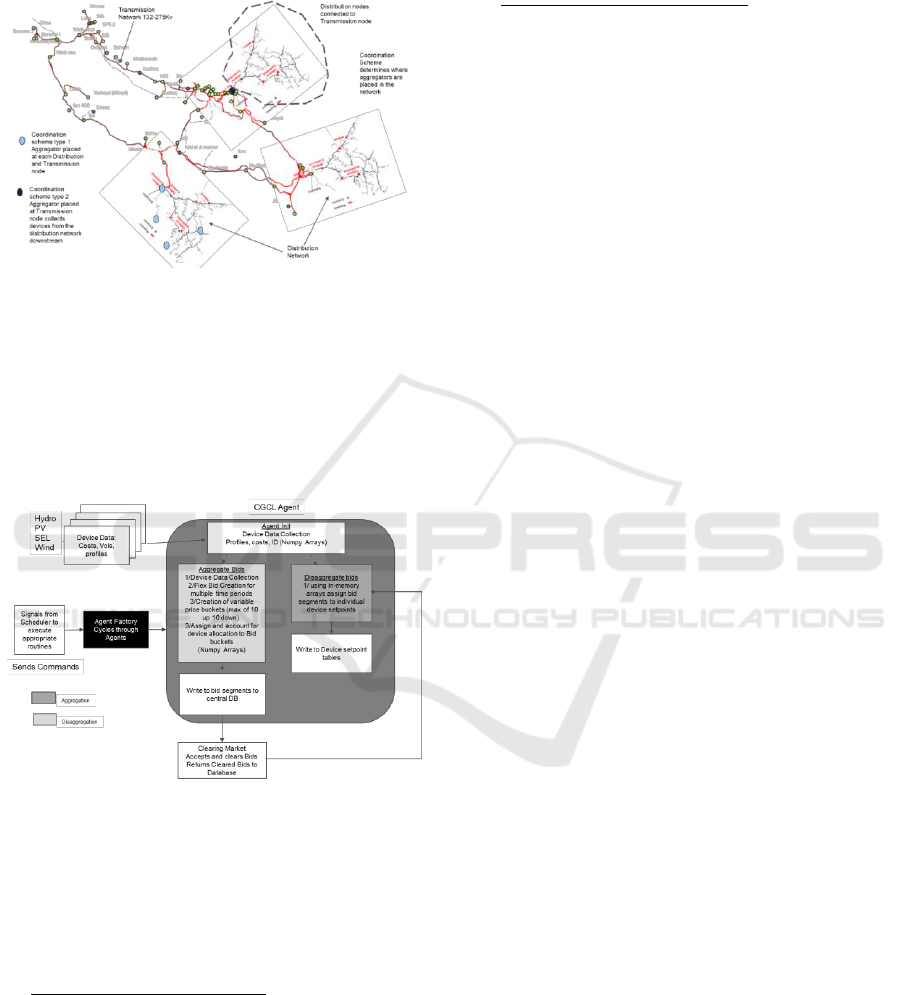

which are scenario driven, determine where the

aggregators are placed (Figure 1).

Figure 1: Aggregators assigned to transmission or

distribution nodes.

Data for each device and node locations are stored

in a Django based SQL database (Django Software

Foundation, 2017).

In the current version, buckets are clustered by

cost, but the concept can be extended to a more

general clustering algorithm using multiple variables.

Figure 2: CGCL aggregator design.

The CGCL aggregator code makes extensive use

of Pythons Numpy Array data manipulation routines

for calculation speed, which is ideally suited to n

dimensional matrix manipulation. As illustrated in

Figure 2, the CGCL aggregator code is split into two

main parts:

CGCL Aggregator Factory. This creates the

appropriate number of aggregator agent objects,

creates a list (an agent directory) of those objects,

so that we can take control of them later and

populates them with data from a relational

database. On receipt of an aggregation or

disaggregation signal from the scheduler module,

it also triggers the individual agents to perform

their calculations. Currently this is performed

sequentially, but this could be multi tasked later.

Aggregators are placed at network nodes ;

CGCL Implementation module – that contains the

logic of the individual aggregator agents.

Control of the aggregator functions is achieved

via an external scheduler.

2.2.1 CGCL Aggregator Logic

The aggregator implementation module, contains the

logic of the aggregator agents, and currently performs

four main tasks:

Initialisation of agent object - When an agent

object is created this simple function creates

internal storage of variables and sets up

parameters such as agent name and ID, max

number of bids allowed, device lists and ID’s, the

actor that “owns” the aggregator and initialises the

arrays for use in the calculations;

Initialisation of agent data - This function pulls

device specific data from the database and creates

device profiles for the devices attached to the

aggregator;

Aggregation – Creates bids for the aggregator and

sends these bids to a database, so that the market

layers can clear the market;

Disaggregation – Recovers cleared bid data

associated with the specific aggregator agent and

disaggregates cleared bids. This results in an agent

sending new set points to all of the devices on the

particular node. These setpoints are stored in an

aggregator setpoint out table.

In a large system, like the Italian power grid, we

have tens of thousands of aggregator agents. Note

SmartNet currently models aggregators at each node

but in practice, one aggregator may cover several

nodes. Each agent stores its own data such as device

profiles (both day ahead (base) and their expected or

actual profiles, performs its own calculations, and

stores the results of those calculations within its own

memory. It takes device data/flex bids from four types

of devices namely Hydro, PV (Solar) , Wind and

sheddable loads (SEL), clusters that data into price

buckets or segments and effectively bids this data to

the market by storing those bids into an agreed format

into database tables.

The aggregator sends out forward flexible bids

e.g. for the next hour we will bid 12 x 5 minute time

intervals. For each time slice, the aggregator sends

out bid buckets, which represents the aggregation of

all the devices associated with that aggregator. Each

bucket represents a price range. E.g. 10-30, 30-70

€/Mwh and so on (see Figure 3).

SIMULTECH 2019 - 9th International Conference on Simulation and Modeling Methodologies, Technologies and Applications

280

Figure 3: Bid structure overview.

Each aggregator agent performs its own

calculations and updates databases as necessary. A

minimum bid size of 1kW is used to filter bid buckets

(this is parameter driven).

Bids for the time slices are stored in a 3D array

within the agent (flex up and down versions). The

matrix represents the clusters/segments as well as the

devices in that cluster including details on its type,

volumes (real power P and reactive power Q), its bid

(price) and so on. This matrix approach allows the

logic in the module to unpick cleared bids,

disaggregate, and apportion them to individual devices

associated with aggregator. We need some way of

assigning devices to clusters and to keep a record of it

– but at speed. A database solution would have been

slow for this purpose.

2.3 Agent Aggregation

In the initial design, the aggregator calculated the

bucket price ranges so that equal number of devices

will be apportioned to each range. The price ranges

are therefore variable (see Figure 4). Our current

methodology uses a genetic algorithm optimizer to

maximise the profit of the aggregator by adjusting the

bucket sizes for both the flex up and down bids.

Devices are assigned to these buckets based on their

cost, while their ID’s are also stored in tables linked

to these buckets.

2.4 Agent Disaggregation

The market is cleared using an OPF calculation. The

clearing module then informs aggregators and their

schedulers, which trigger the aggregator

disaggregation routine. The disaggregator function

retrieves accepted bid data from appropriate database

table and uses the previously internally stored 3D

Numpy arrays (matrices) to unpick the bids to

Figure 4: Bid buckets example.

apportion them to individual devices. Where the

market clears or accepts the full volume of a

particular bucket or segment, the module logic

accepts all bids from all the devices assigned to that

particular bucket. In the case where the market

accepts a fraction of the bid segment, volumes are

apportioned on a “greedy” basis – lowest device cost

first. Cleared volumes are assigned to individual

devices appropriately bucket by bucket, by writing to

a setpoint table in the database.

2.5 Simulation Results

SmartNet stores bidding behaviour for later analysis

and provides prices at each of the nodes modelled in

the power grid. Behaviour of the CGCL agents under

different co-ordination schemes set out in the

SmartNet documentation can be very different and

imposes different costs on the system. Figure 5 shows

coordination scheme (CS) D results in much more

downward flexibility being provided by CGCL

agent’s than CS A. Prices (Figure 6) follow a similar

pattern but in the case where volumes are relatively

small, prices are set by other aggregator agent types

e.g. CHP. Price patterns will also be node dependent.

Figure 5: Volume output for 80 hours of simulation.

Simulating a Commercial Power Aggregator at Scale Design and Lessons Learned

281

Figure 6: Price output for 80 hours of simulation.

3 CHALLENGES AND LESSONS

LEARNED

Development of the full SmartNet project has taken

many man-years with the CGCL aggregator agent

model part taking around 6 man months of effort.

Simulation and testing of such a large simulation

system is challenging, and we have shown that it is

possible to simulate the aggregation and clustering of

different types of flexibility into a number of

manageable bids. Simulation for 96-time steps on a

representation of the Italian grid with 5 types of

aggregators using this framework is currently taking

around 5-6 hours per scenario using one machine

(Alienware 15 R3 7700 HQ 2.8 GHz 4 cores 8 logical

32GB DDR4). Most of the time is spent writing to a

single database, which is required to store data on

bids and other data for later analysis.

3.1 Database Speed

Simulation write speeds at each tick are shown in

Figure 7. The initial design resulted in a single time

step write time of around 4 hours at the 40th tick.

Optimisation of code using “SQL BulkCreate”

commands resulted in a significant drop to around 4-

5 minutes. Long write times are a natural

consequence of writing around 5 million records per

time step.

Figure 7: Database speed during each tick.

Experiments with database writes indicate that

having a database index causes the slowdown in

insert speed as table size. Removal of the index before

writing can improve this performance (Figure 7).

Note that indexing does help in improving read speed.

A deindexing, write and re-index approach may be

worth investigating.

Use of an in-memory database (Anikin, 2016)

could also be an option with a “write at leisure”

approach to a main database which would be stored

on a Hard Disk Drive (HDD). This would be about

200 times faster than the HDD. Our agent design

already uses this approach extensively but requires

large amounts of memory. Finally, use of a Solid-

State Drive (SDD) would bring a speed improvement

of around two times over an HDD. We are currently

using HDD for storage.

3.1.1 Database Shards

Writing to smaller focussed databases would also

help to improve database write performance.

SmartNet currently uses one database to store

everything. Writing bids to a database for one time

period only, “a current time bid database”, could

potentially improve performance. Joining of these

current bids to a historical collection of bid data could

be performed at a later time. We may wish to consider

horizontal partitioning of the database or “sharding”

(Kerstiens, 2018), although this technique can prove

to be slow when querying multiple databases.

3.2 Python vs Java Vs C++

The software simulation framework uses python as its

base. Extensive use of Numpy arrays in the CGCL

aggregator calculations helps to speed up calculations

of the order of 100-1000 times, depending on

operation, over iterating through a list.

We have considered a port of the code to Java, as

it is known that Java code could be up to 50 times

faster than python (Gouy, 2018). Benchmarks can

range from no speed up for simple algorithms to 50

times or more where computations are complex.

Unfortunately, this would involve a large conversion

effort and the Python development environment is

more productive potentially by a factor of five. A C++

formulation would also provide significant speed

improvements over Java and Python but as we have

discussed in section 3.1, database operations impose

a significant speed restriction on this implementation,

which far exceeds any benefit from a swap of

language.

SIMULTECH 2019 - 9th International Conference on Simulation and Modeling Methodologies, Technologies and Applications

282

Installation of Intel’s ® Python Interpreter using

uses its Data Analytics Acceleration and Claim Math

Kernel Library could also improve calculation times

(Intel, 2018).

3.3 Multi-threading/HPC/CUDA

Multi-threading or the use of a High Performance

Computing (HPC) environment could bring

significant benefits to simulation times. In a practical

sense, each aggregator company in the real world

would be aggregating on a separate computer

system/server remotely from the TSO/DSO clearing

entity. However, HPC data transfer latency could

reduce the benefits if machines are located on distant

clusters or are at different company premises.

Multithreading allows for improvements in

calculation times of the order of 7x (with 8 logical

cores) i.e. of the order of 87% x the number of cores.

HPC using 65 cores would therefore drastically

reduce calculation times to 1-2% of the one machine

calculation time if we ignore latency effects. An

aggregator with 300,000 devices is taking around 15

secs to perform its calculations on one machine using

single threading so a HPC setup could reduce this to

around 0.3 secs. An aggregator with a single device is

taking around <0.05 secs on a single thread.

Use of a Graphics Processing unit (GPU) with

CUDA (Couturier, 2013) would be an ideal method

to use on an aggregator module that makes extensive

use of the Numpy arrays and associated calculations.

We have estimated that speed improvements of

around 30X could be made for our design based on

the calculations alone when using an Nvidia Geforce

GTX 1070 GPU. Database access issues would

remain. Speedup will depend on array size, so in the

case of very large arrays, we may expect

improvement of 100-200, but some of aggregator

arrays only contain 1 device, so the overhead of

transferring data to the associated GPU may actually

degrade performance. This of course will depend on

the number of cores available in the GPU.

3.4 Congestion

Unintended aggregator actions caused DSO agent

intervention in the market to relieve network

congestion (power flows, voltages). Forecasting

errors (day ahead vs real time) also play a part in this

process especially when devices promised to deliver

more they actually could.

DSO Congestion management has implications

for both the overall system costs and aggregator profit

margins, and presents additional risks to the

aggregator. If the additional risk is high, aggregators

may want to anticipate congestion separately from the

DSO, and incorporate congestion risk value into their

bids.

4 FUTURE WORK

Realistic aspects of aggregation such as risk

management, strategic bidding, agent learning,

congestion and portfolio management are missing

from the current approach. A more realistic

representation of a power aggregator will require that

we include these various elements. Early work

indicates that the price of particular bids could rise by

as much as 30% under certain scenarios if we include

some of these effects. Finally, the current SmartNet

framework does not consider aggregator-to-

aggregator interactions nor does it consider

aggregators with multiple device types e.g. CGCL +

CHP or competition between them. Future versions

of our modelling will include this and will implement

the mechanisms discussed in section 3.

5 CONCLUSIONS

This paper introduced the concept of financial

buckets as a method to aggregate bids to maximise

profits to a power aggregator. Simulation and testing

of such a large simulation system is challenging, and

we have shown that it is possible to simulate the

aggregation and clustering of different types of

flexibility into a number of manageable bids in a

timely manner but this will require parallelization and

a more efficient use of database technology.

ACKNOWLEDGEMENTS

This research is funded by the UK Engineering and

Physical Science Research Council (EPSRC) and the

International Strategic Partner (ISP) Research

Studentship and the EU Hor2020 SmartNet project.

REFERENCES

Anikin, D. 2016-10-12 2016. What an in-memory database

is and how it persists data efficiently. Available from:

https://medium.com/@denisanikin/what-an-in-

memory-database-is-and-how-it-persists-data-

efficiently-f43868cff4c1.

Simulating a Commercial Power Aggregator at Scale Design and Lessons Learned

283

Couturier, R. 2013. Introduction to CUDA. Designing

Scientific Applications on GPUs, 13.

Django Software Foundation 2017. Django

Documentation.

Dzamarija, M., Plecas, M., Jimeno, J. & Marthinsen, H.

2018. Aggregation models.

Furlonge, H. I. 2011. A stochastic optimisation framework

for analysing economic returns and risk distribution in

the LNG business. International Journal of Energy

Sector Management, 5, 471-493.

Gouy, I. 2018. Python 3 vs Java - Which programs are

faster? | Available: https://benchmarksgame-

team.pages.debian.net/benchmarksgame/faster/python.

html [Accessed].

Intel 2018. Intel® Distribution for Python* Accelerate

Python* Performance.

Kerstiens, C. 2018. Database sharding explained in plain

English. Available: https://www.citusdata.com/blog/

2018/01/10/sharding-in-plain-english/.

Kohansal, M. & Mohsenian-Rad, H. 2016. A closer look at

demand bids in california iso energy market. IEEE

Transactions on Power Systems, 31, 3330-3331.

Krink, T., Paterlini, S. & Resti, A. 2008. The optimal

structure of PD buckets. Journal of Banking & Finance,

32, 2275-2286.

Kumar, D. 2017. The four bucket system. Available:

http://vro.in/s33527.

Li, C. 2015. Chance-constraint method - optimization

[Online]. Available: https://optimization.mccormick.

northwestern.edu/index.php/Chance-

constraint_method [Accessed].

Marthinsen, H., Plecas, M., Morch, A. Z., Kockar, I. &

Džamarija, M. 2017. Aggregation model for curtailable

generation and sheddable loads.

Migliavacca, G., Rossi, M., Six, D., Džamarija, M.,

Horsmanheimo, S., Madina, C., Kockar, I. & Morales,

J. M. 2017. SmartNet: H2020 project analysing TSO–

DSO interaction to enable ancillary services provision

from distribution networks. CIRED-Open Access

Proceedings Journal, 2017, 1998-2002.

Riskviews. 2012. Five Buckets of Risk. Available:

https://riskviews.wordpress.com/2012/01/17/five-

buckets-of-risk/ [Accessed 2012-01-17].

Shafie-Khah, M., Heydarian-Forushani, E., Golshan, M.,

Siano, P., Moghaddam, M., Sheikh-El-Eslami, M. &

Catalão, J. 2016. Optimal trading of plug-in electric

vehicle aggregation agents in a market environment for

sustainability. Applied Energy, 162, 601-612.

Vayá, M. G. & Andersson, G. 2015. Optimal bidding

strategy of a plug-in electric vehicle aggregator in day-

ahead electricity markets under uncertainty. IEEE

Transactions on Power Systems, 30, 2375-2385.

SIMULTECH 2019 - 9th International Conference on Simulation and Modeling Methodologies, Technologies and Applications

284