uCash: ATM Cash Management as a Critical and Data-intensive

Application

Terpsichori-Helen Velivassaki

1a

, Panagiotis Athanasoulis

1

and Panagiotis Trakadas

2b

1

SingularLogic, Achaias 3 & Trizinias st., Kifisia, Attica, Greece

2

National and Kapodistrian University of Athens, Panepistimiopolis, 15784 Ilissia, Attica, Greece

Keywords: Cash Management, Stream Analytics, ATM.

Abstract: Distributed cloud databases wrapped with streaming analytics modules provide nowadays quick response to

increasingly demanding real-time applications, relying on fast analytical and online processing of enormous

amounts of data or very frequently updated. However, time-critical applications, dealing with sensitive data,

typically run on mainframes, cannot fully benefit from existing solutions. Such applications can be found in

Banking, Financial Services and Insurance (BFSI) industry, one notable being the ATM cash management.

The paper presents uCash, an ATM cash management system, running on top cloud analytics appliances,

which can be hosted insite. The proposed system allows data processing and Key Performance Indicators

(KPIs) calculation and communication among diverse actors, resulting in highly efficient cash management

over large ATM networks.

1 INTRODUCTION

Even in the digital age, cash remains an essential

component of the payment system, being the largest

retail payment category by number of transaction for

transactions under $10 (Reserve Bank of Australia,

2017). During the last few years, in their attempt to

achieve mobility to better serve their customers,

banks across the globe are investing on next-

generation ATMs, featuring advanced capabilities

and offering customers the ability to perform more

types of financial transactions than the ones are

currently handled by customer service

representatives. This will create a whole new

perspective of the user ATM experience, also

increasing the spatiotemporal heterogeneity of the

cash demand and the data produced by the ATMs,

derived from the new business value propositions of

these new ATMs (ATM Industry Association, 2018).

Additionally, as user mobility increases, so does the

complexity of predicting the expected user

withdrawal and deposit transactions volumes.

Banks and financial institutes nowadays face

significant challenges in managing effectively ATM

replenishment, based primarily on static prediction

a

https://orcid.org/0000-0002-0362-4607

b

https://orcid.org/0000-0002-2884-9271

algorithms. This results in high cash-out rates in

certain ATMs, while having excess leftover cash in

other ATMs, returned to banks. Accordingly,

ineffective cash management in ATMs leads to

considerable customer dissatisfaction due to delays

until reloading empty ATMs, as well as complex and

expensive cash logistics to reload the network.

Ideally, smart cash management should be able to

catch cash demand, affected by external factors and

not easily predictable, as e.g. the monthly

salaries/pensions. For example, an ATM, located on

the same level of a large shopping Mall as a store with

special discounts for a single day only, could have

increased cash flow. Also, cash demand in ATMs

close to social events is expected to be higher than

usual. Moreover, ATM traffic could be affected by

combined factors, such as weather and location.

Indicatively, ATMs close to beaches/seaside might

realize increased demand during warm and sunny

days or cash demand could decreased for any ATM

during cold days. Another dependence can be found

at seasonality, e.g. ATM cash demand is expected to

grow during the days before bank holidays.

In this context, appropriate cash management is

bound to ultra-fast analytics over huge datasets,

642

Velivassaki, T., Athanasoulis, P. and Trakadas, P.

uCash: ATM Cash Management as a Critical and Data-intensive Application.

DOI: 10.5220/0007876606420647

In Proceedings of the 9th International Conference on Cloud Computing and Services Science (CLOSER 2019), pages 642-647

ISBN: 978-989-758-365-0

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

produced by large interconnected ATM channel

networks. Business objectives mandate for the

capability of processing complex queries over

thousands of columns of operational data, created by

thousands of ATMs in the order of seconds.

On the other hand, strong data privacy and

security requirements renders ATM cash

management too critical to rely on existing clouds.

In this paper, ultra-fast ATM Cash Management

system (uCash) is presented as a critical application,

running on top of cloud analytics appliances,

providing scalable operational databases, ultra-fast

streaming analytics and/or big data analytics, while

ensuring high availability. The proposed system is

able to identify both expected and unexpected

changes in external factors affecting cash withdrawal

from ATMs. To this, the proposed system relies on

streaming information received from ATM channels,

the social media, cooperating retailers, social trending

sites, the weather, financial services or other sources

are properly exploited. Also, uCash should be smart

enough to identify short- or long-term changes,

affecting cash demand from ATMs, in order to feed

accordingly the cash logistics.

The rest of the paper is organized as follows.

Section 2 presents a general overview of the

considered inputs. Section 3 introduces the uCash

Architecture and Section 4 concludes the paper.

2 uCash SYSTEM DESIGN

uCash is intended for optimizing cash allocation in

banks’ ATM network, in order to minimize cash out

events, excess cash left in low-demand machines,

while increasing customers’ satisfaction. So, it will

provide the tools to interested parties to make

decisions related to their responsibilities,

communicate them to interested endpoints and

visualize/share amounts to multiple parties

simultaneously, thus enhancing communication

among them, access to data and minimizing

processing/communication latency or overhead. In

brief, uCash will support cash demand prediction and

cash allocation in a bank ATM network, based on

advanced Big Data and Stream Processing analytics,

while facilitating access to both data and processed

results for eligible users.

2.1 Input and Output Streams

Figure 1 presents the input and output streams

considered for the uCash system. Specifically, input

streams include:

Figure 1: Inputs and outputs of the uCash System.

ATM Data: Information extracted by the ATMs can

provide useful insights, regarding cash demand as

well as potential temporal patterns. The ATM stream

will include the cash balance for every ATM, along

with accompanying info, such as the id of the ATM,

its location, the amount of money inserted at

replenishment, as well as the timestamp of operations.

As ATM data are useful on a real-time basis, but no

critical changes are expected within seconds, an

update rate in the order of minutes is considered

adequate.

Social Events: Social events may potentially affect

the cash demand, especially in case of ATMs located

close to the events’ area. So, information about events

taking place in short time in close locations may

provide significant insights to cash demand

predictions. In order to facilitate the prediction

process, it is assumed that less popular events or

events quite far from the ATM’s area do not affect the

ATM traffic, so they are not considered as input data.

Specifically, the social events of interest:

Collect a number of likes higher than a

predefined threshold

ℓ

;

Have number of attendees higher than a

predefined threshold

;

Take place on the same or the next day;

Are close to the ATM area.

Social Trends: Current trends can provide useful

insights on collective user behaviours, revealing

potential correlations of everyday trends with ATM

cash demand. So, uCash will consider the most

popular social trends (hashtags) for a specific location

as potential influencers of ATM cash demand.

Weather: Weather may impact on consumers’

activities. In this perspective, rainy, sunny, warm or

cold days could reveal, at some extent, people’s

willingness to socialize -and thus potentially

withdraw cash- or stay at home. Information of

uCash: ATM Cash Management as a Critical and Data-intensive Application

643

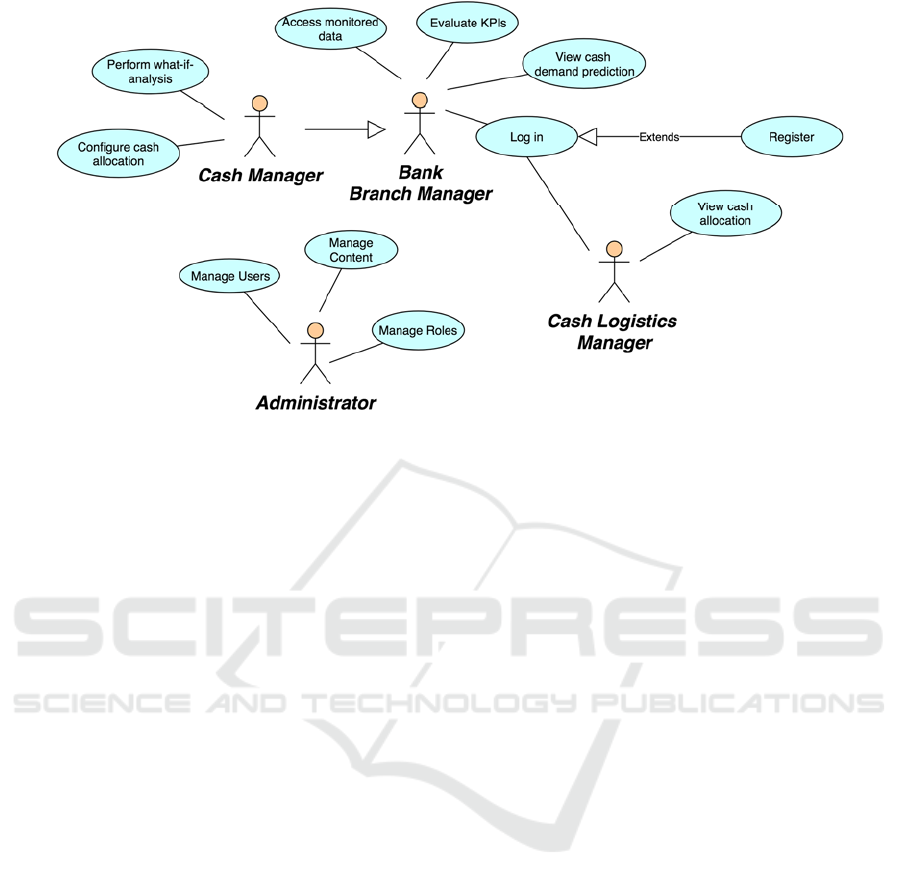

Figure 2: The uCash Use Case diagram.

interest refers to the weather forecast for the next 3

days, including the weather conditions’

characterization (such as clear, rain, partly cloudy,

snow, sunny, etc.).

Retailers’ Discounts: The ATM traffic can be

significantly affected by discounts announced by

retailers having physical stores in close proximity

with ATMs. uCash will offer an API to cooperating

retailers to submit their sales or discounts.

These individual input streams with diverse

dataset characteristics (such as frequency rates) are

subject to pre-processing, which aggregate and

synchronize diverse inputs, producing the system’s

input stream in a format favorable to Machine

Learning (ML). Thus, the final input dataset is

constructed as unstructured raw data with 1754

features with update frequency in the order of second.

The output streams include a set of KPIs and cash

demand prediction. In more detail:

Cash Demand: The cash demand is extracted by the

difference in cash balance, not including the amount

of bank replenishments over a desired period of time

for a desired ATM.

,

where

,

is the cash demand during the period

,

,

the cash balance at the ATM of interest

at time and

the amount of refills at time .

Cashout: An (operational) cashout is defined as the

event in which an ATM runs out of money or its

balance equals to 0. Its duration is defined as the

period of time since the cashout took place (balance

equal to below

), until the next replenishment.

where

for ∀ ∈

,

the cash balance at the ATM of interest at

time and

the balance threshold below which the ATM is

considered to realize a cashout.

Unavailable ATMs: The number of ATMs realizing

a cashout over desired time period.

∃ ∈

,

:

where

the number of unavailable ATMs within

the period

,

.

ATM Downtime: The total duration of cashouts at a

desired ATM over desired period of time.

where

the cash balance at the ATM of interest at

time and

the balance threshold below which the

ATM is considered to realize a cashout.

Leftover Cash: “Leftover cash” is defined as the

ATM balance at the time of replenishment. The KPI

provides the total amount of leftover money for a

desired ATM over a desired period of time.

0 ∈

,

ADITCA 2019 - Special Session on Appliances for Data-Intensive and Time Critical Applications

644

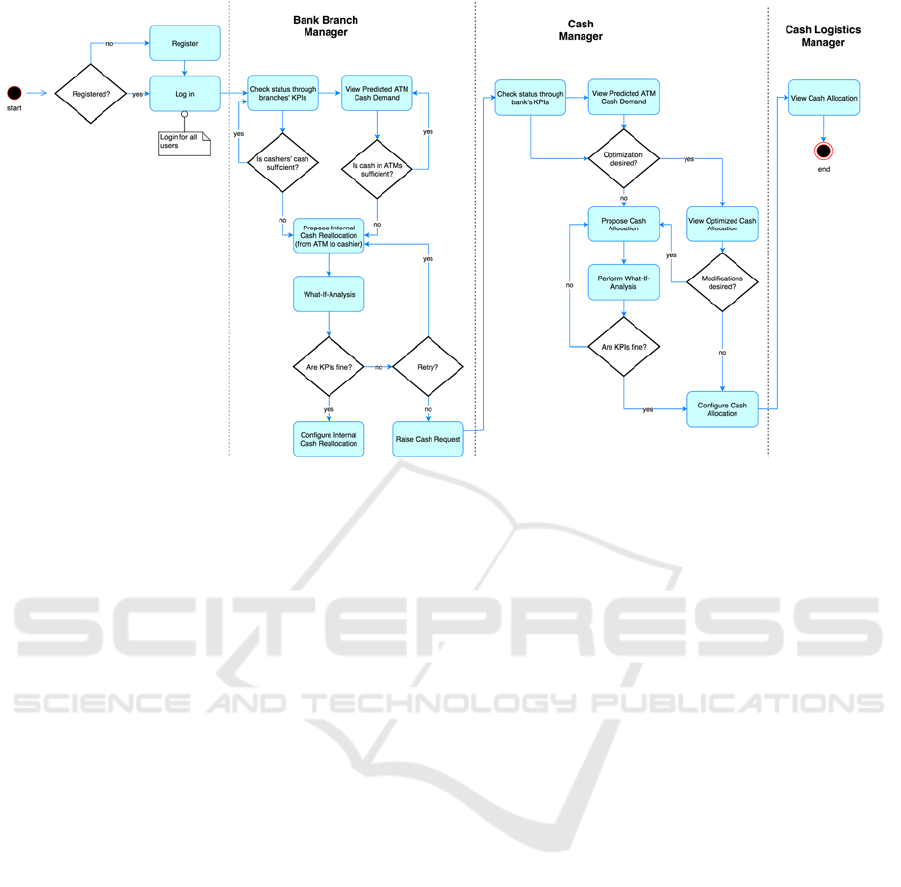

Figure 3: The uCash activity diagram.

where

the cash balance at the ATM of interest at

the time of refill.

2.2 uCash Use Case Analysis

The uCash system involves the following actors:

The Bank Branch Manager. The main

responsibilities of the Bank Branch Manager which

will be primarily enhanced via the ATM Cash

Management system are the following:

Ensuring there is adequate cash for each of the

tellers and automated teller machines.

Developing forecasts, financial objectives and

business plans.

Monitoring branch targets.

Reposting to head office

The Cash Manager. The main responsibilities of the

Cash Manager which will be primarily enhanced via

the ATM Cash Management system are the

following:

Organizing daily cash administration.

Timely matching cash application and

disbursements.

Monitoring cash transactions to ensure that bank

account balances to the report and any unusual

items are investigated.

Forecasting, monitoring and tracking cash flow on

preferred basis.

Preparing cash flow reports

Maintaining security and confidentiality of

financial records.

The Cash Logistics Manager. The main

responsibilities of the Cash Logistics Manager which

will be primarily enhanced includes the organization

of cash distribution.

(ATM Cash Management System) Administrator.

The Administrator will be able to manage access of

specific user types to the ATM Cash Management

system data.

2.2.1 Use Case Diagram

The UML use case diagram is presented in Figure 2.

The use cases considered are analyzed as follows.

Log in: The user should be able to log in the uCash

application, to access personal or their user type

related data.

Register: The user should be able to register in the

uCash application, according to their user type.

Access Monitored Data: The user should be able to

visualize both historical and real-time input datasets

input datasets in a user-friendly way, e.g. diagrams

allowing for configuration enhancing readership (e.g.

sorting, filtering, etc.). Access to datasets might be

restricted per user type (actor).

Evaluate KPIs: The user should be able to visualize

in a user-friendly format the KPIs calculated out of

input datasets, based on their field of expertise

revealed from user type (actor). Configuration of

uCash: ATM Cash Management as a Critical and Data-intensive Application

645

visualization format should be possible to facilitate

user’s perception of data.

View Cash Demand Prediction: The user should be

able to visualize in a user-friendly format predictions

of the cash demand in the ATMs of their interest,

based on actor type.

Configure Cash Allocation: The user should be able

to verify or change cash allocation proposed by the

system.

Perform What-If-Analysis: The user should be able

to perform what-if-analysis of custom cash

allocations changes, showing effects on KPIs of

interest.

View Cash Allocation: The authorized user should

be able to visualize optimized cash allocation to

ATMs on demand.

Manage Users: The authorized user should be able to

manage users’ registration, validate or disapprove

their account.

Manage Content: The Administrator should be able

to manage the content shown for each user type.

Manage Roles: The Administrator should be able to

manage the content shown for each user type.

2.2.2 Operations Analysis

The sequence of operations is presented in the activity

diagram of Figure 3. In more detail, the process is the

following:

After sign-in, the Bank Branch Manager checks

the availability of cash for both ATMs and

cashier.

If the cash is not enough, the Bank Branch

Manager may try to perform some cash

reallocation between the two channels (ATMs and

cashiers), after what-if-analysis, based on

predicted cash demand.

The Bank Branch Manager may make several

tries, checking resulting KPIs before actually

performing cash reallocation or she may raise a

cash request.

The (central) Cash Manager may automatically

optimize cash allocation or she may prefer to do

this manually, after performing what-if-analysis

of potential allocation schemas.

Even when selecting automatic cash allocation

optimization, the Cash Manager will evaluate the

result and propose any modifications, if desired,

after proper what-if-analysis.

Having decided about the cash allocation, the

Cash Manager eventually configures cash

allocation.

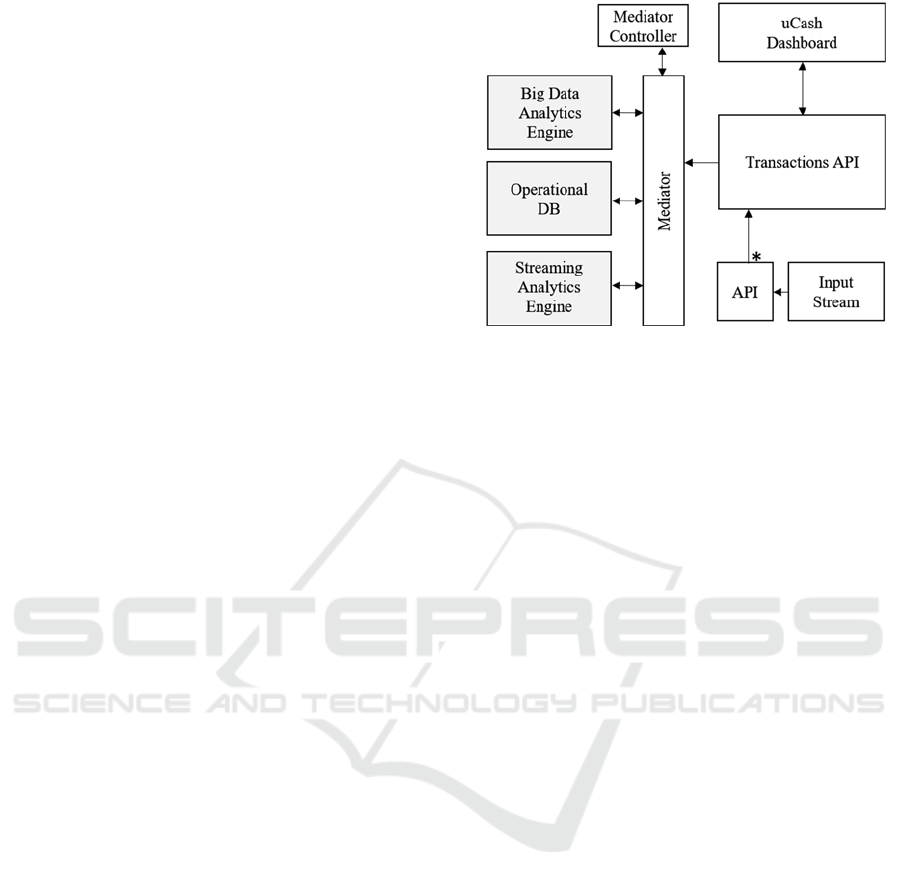

Figure 4: The uCash architecture.

Finally, the Cash Logistics Manager is able to

view the configured cash allocation, in order to

allocate cash to ATMs accordingly.

3 uCash ARCHITECTURE

uCash is aimed to exploit fast analytical and

streaming processing capabilities of third-party

frameworks, providing useful insights inferred

through a number of KPIs calculated over large

amounts of historical data or over frequently updated

streams. As uCash constitutes a critical system,

running on top of streaming and big data analytics

engines, it realizes a modular, micro-services oriented

architecture, able to easily integrate with third party

solutions. The uCash architecture is depicted in

Figure 4, in which uCash components appear in white

color, while third-party components are colored in

grey.

The main components of the uCash architecture

include APIs for every input stream, the Input

Streams Orchestrator, the Transactions’ API, the

uCash dashboard, the Mediator and the Mediator

Controller.

Input API(s): These components are responsible for

retrieving data from the input streams and providing

them to the Transactions API.

Transactions API: This component is responsible

for receiving and providing data or KPIs from/to

interacting components. It receives the input data and

forwards them to the Operational Database to be

persisted, while it asks the analytics components (Big

Data Analytics Engine and Streaming Analytics

Engine) for KPIs, as properly defined queries, and

provides them to the Dashboard.

ADITCA 2019 - Special Session on Appliances for Data-Intensive and Time Critical Applications

646

Mediator: This component acts as an adaptation API,

hiding the heterogeneity of third-party applications. It

is responsible for making queries a) over streaming

data, such as those involving moving windows, as

well as retrieving the results, and b) over historical

data, as well as retrieving the results. This component

will not provide any intelligence in query processing,

but it acts as a mediator between third-party

components and uCash, requesting KPIs and

transferring the results.

Mediator Controller: This component controls the

mediator in the sense that it triggers KPIs’ retrieval

from the corresponding components.

uCash Dashboard: This component is responsible

for authentication and authorization of users of

different types, as well as for providing role-based

access to content. Moreover, this component

incorporates the User Interface (UI) functionality of

uCash.

Following this modular architecture, uCash uses the

Mediator to easily integrate with existing analytics

systems. In the architecture of Figure 4, three external

components are considered:

An operational database, understood as a scalable

database adequately supporting ACID

(Atomicity, Consistency, Isolation, and

Durability) properties for operational and analytic

workloads and can scale in the three Vs of Big

Data (Volume, Velocity and Variety).

A scalable Big Data Analytics Engine, capable of

processing fast analytical multidimensional

queries over high-volume and variety streaming

data.

A scalable Streaming Analytics Engine, able to

process fast continuous queries over high-

frequency, volume and variety streaming data.

Indeed, uCash can work with a subset of the external

components and can easily integrate existing, new or

updated components.

4 CONCLUSIONS

uCash has been presented as a data-intensive and

critical application. The aim of the design is to derive

an ATM cash management application on top of

existing big data and streaming analytics platforms,

best exploiting their capabilities, while covering

application specific needs and adding value to the

targeted BFSI application domain. To this end, the

design methodology includes specifications related to

big data and streaming analytics (such as the input

dataset and the KPIs), as well as the specification of

the architecture.

Notably, the architecture allows the reception of

specified input dataset and its pre-processing, if

needed, while having the logic to ask the appropriate

components to apply streaming or batch analytics

over the operational or the historical data. In brief, the

specified application adequately covers analytics

over both operational and historical data, as well as

functionalities of operational databases.

ACKNOWLEDGEMENTS

This work has been partially conducted within the

CloudDBAppliance project Grant number 732051,

co-funded by the European Commission as part of the

H2020 Framework Programme.

REFERENCES

ATM Industry Association, 2018. Business Value

Propositions for Next Generation ATMs. [Online]

Available at: https://www.atmia.com/files/committees/

consortium-for-next-gen-atms/bvps-for-next-

generation-atms-published.pdf

Investopedia, 2017. Gross Profit Margin. [Online]

Available at: http://www.investopedia.com/terms/g/

gross_profit_margin.asp

Investopedia, 2017. Price Elasticity of Demand. [Online]

Available at: http://www.investopedia.com/terms/p/

priceelasticity.asp

Reserve Bank of Australia, 2017. Reserve Bank Bulletin,

Sydney: s.n.

uCash: ATM Cash Management as a Critical and Data-intensive Application

647