International Roaming Traffic Optimization with Call Quality

Ahmet S¸ahin

1

a

, Kenan Cem Demirel

1 b

, Erinc Albey

1 c

and Gonca G¨ursun

2 d

1

Department of Industrial Engineering,

¨

Ozye˘gin University, Istanbul, 34794, Turkey

2

Department of Computer Science,

¨

Ozye˘gin University, Istanbul, 34794, Turkey

Keywords:

Telecommunications, Linear Programming, Steering International Roaming Traffic, Roaming Optimization.

Abstract:

In this study we focus on a Steering International Roaming Traffic (SIRT) problem with single service that

concerns a telecommunication’s operators’ agreements with other operators in order to enable subscribers

access services, without interruption, when they are out of operators’ coverage area. In these agreements, a

subscriber’s call from abroad is steered to partner operator. The decision for which each call will be forwarded

to the partner is based on the user’s location (country/city), price of the partner operator for that location and

the service quality of partner operator. We develop an optimization model that considers agreement constraints

and quality requirements while satisfying subscribers demand over a predetermined time interval. We test the

performance of the proposed approach using different execution policies such as running the model once and

fixing the roaming decisions over the planning interval or dynamically updating the decisions using a rolling

horizon approach. We present a rigorous trade off analysis that aims to help the decision maker in assessing

the relative importance of cost, quality and ease of implementation. Our results show that steering cost is

decreased by approximately 25% and operator mistakes are avoided with the developed optimization model

while the quality of the steered calls is kept above the base quality level.

1 INTRODUCTION

Competition in the telecommunication sector has in-

creased in the last years since the number of operators

has increased. The high number of partner operators

who can make steering for each location decreased the

price of traffic movement, yet the profit margins of

operators are also decreased. For operators wishing

to survive in this competitive environment, keeping

the international traffic steering costs to a minimum

by making the right cross connection agreements has

become more important and complex than ever.

Operators need to update their steering decisions

instantly because of instant changes on market situa-

tions in order to minimize their traffic steering costs

and increasing their profits. Currently traffic steering

decisions are made manually. These decisions cannot

converge to optimality, because, steering costs may

differ day to day and the size of data is very large.

These situations makes decision makers prone to mis-

takes.

a

https://orcid.org/0000-0002-9223-3420

b

https://orcid.org/0000-0002-5398-378X

c

https://orcid.org/0000-0001-5004-0578

d

https://orcid.org/0000-0003-3048-6403

Literature in telecommunication sector is mostly

available on specific optimization models for commu-

nication network design (Pi´oro and Medhi, 2004). Al-

though some works about designing and optimizing

telecommunication networks according to demand

are widely available in literature (Flippo et al., 2000),

(Gendreau et al., 2006), (Riis and Andersen, 2004),

an optimization model for service management is not

available except the two latest works.

In the first one (Martins et al., 2017), some mixed-

integer linear formulations are presented for the prob-

lem named Steering International Roaming Traffic

(SIRT) with different agreement methods. Their ob-

jective is to decide the quantity of voice traffic that

will be steered to optimize the wholesales margin that

occurs when steering some voice traffic to different

operators from different countries.

In the second one (Esteves et al., 2018), a mixed-

integer linear formulation is presented for the multi-

service SIRT problem which is specified as an NP-

hard problem. The designed model aims to mini-

mize the sum of the wholesale roaming costs asso-

ciated to the commercial agreements between Orange

Telecommunications Group (OTG) and its partner op-

erators in 43 countries of Europe and North America.

92

¸Sahin, A., Demirel, K., Albey, E. and Gürsun, G.

International Roaming Traffic Optimization with Call Quality.

DOI: 10.5220/0007932600920099

In Proceedings of the 8th International Conference on Data Science, Technology and Applications (DATA 2019), pages 92-99

ISBN: 978-989-758-377-3

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

The model is run for 5 simulated instances based on

the yearly forecasts of the amount of roaming traffics

of OTG subscribers in each visited country and the

problem is solved simultaneously for data and voice

traffics with different agreement types. The optimal

results are found within 5 minutes for 4 of 5 instances

and the remaining one is concluded with an optimal-

ity gap of 0.21%. The results are compared with a

scenario which assumes that the whole roaming traf-

fic is distributed equally and randomly to the partner

operatorsin the respective countries. According to the

comparison, their model provides an average of 30%

improvement in wholesale roaming costs of OTG.

However the call quality is not considered in these

proposed models. According to (Lacasa, 2011), in

a market where traffic steerings are perfectly per-

formed, no operator has market power and the com-

petitive advantage is always in the side of lower

prices. For this reason, quality is a necessity rather

than being an important criterion for operators who

are advantageous in terms of their market positions

to maintain these advantages. In this paper, we pro-

pose a new steering model for single service (only

voice steering) with call quality and apply by using

a real-life dataset of call steering transaction provide

by Turkcell which is the market leader company in

Turkish GSM sector. The optimal steering decisions

are found, steering cost is decreased by approximately

25% and operator mistakes are avoided with the de-

veloped optimization model. In addition, the quality

of the steered calls is kept above a certain threshold.

The rest of the paper is organized as follows: We

describe the problem and introduce data in Section 2.

We describe steering model with call quality in Sec-

tion 3. In Section 4, we present results and conclude

in Section 5.

2 PROBLEM DESCRIPTION

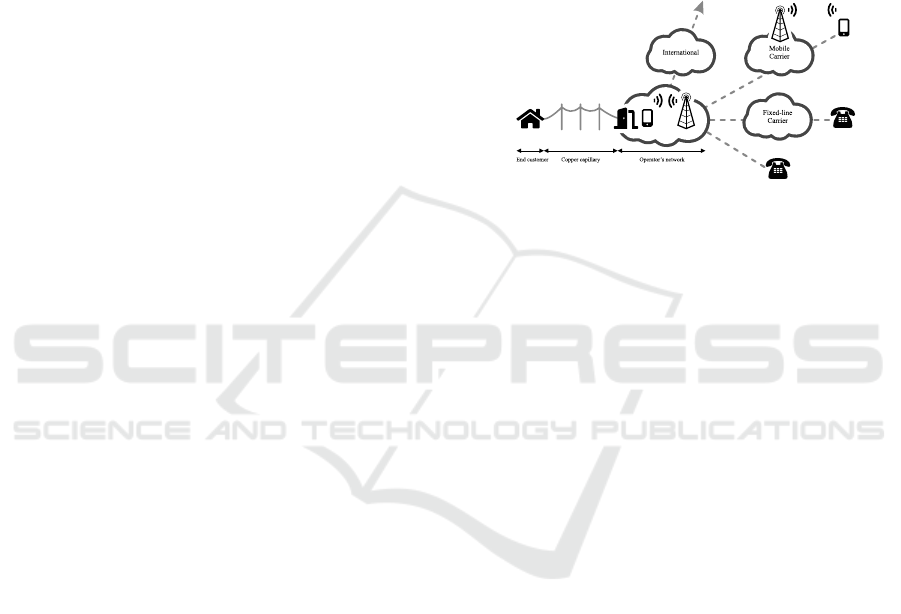

When looking at the roaming services in the telecom-

munications sector, we can categorize the roaming

services provided by operators into two different mar-

kets: retail markets where operators sell roaming ser-

vices to their own customers, and wholesale markets

where operators allow the customers of other opera-

tors (partner operators) in other countries to connect

to their network when abroad (Salsas and Koboldt,

2004). Telecommunication operators interconnect

with other operators when it is not possible to com-

plete an end–to–end call entirely on a single opera-

tor’s network (Figure 1). In such situations, traffic

is steered to partner operators to satisfy customer de-

mand. This steering operation may occur in various

scenarios. A call may originate within operator A’s

network and terminate on operator B’s network. In

a more complicated scenario, a call originates on op-

erator A’s network, transits through operator B’s net-

work, and then terminates on operator C’s network. In

that case, operator A must interconnect with operator

B and operator B must interconnect with operator C.

These new routing options force operators to estab-

lish and manage multiple interconnect agreements in

order to optimize the use of their networks, reduce

costs, and increase margins.

Figure 1: Network diagram of home operator.

The problem we solve in this paper is to steer the

international voice traffic of the home operator, Turk-

cell, with minimum cost and keep the quality on ac-

ceptable level. International call steering consists of

two part: 1) outgoing traffic steering, 2) incoming

traffic steering.

Outgoing traffic is the steered volume to partner

operators on daily basis. There are some commitment

agreements between home operator and partner oper-

ators for traffic steering. These agreements may not

lead to any profit at current period but they may in-

crease the business volume, price discounts and com-

mercial trust in the future period. In addition to these,

these agreements are important because of the qual-

ity factor of the traffic steering which has an affect on

customer satisfaction. So, besides the cost of steer-

ing, keeping the quality on an acceptable level is also

important for outgoing steering decisions.

On the other hand, incoming traffic is the steered

volume sent to home operator from partner operators

on daily basis. Incoming traffic is priced by home

operator, however it cannot interfere with the routing

processes except for the pricing; it is only obliged to

carry the demand to desired target within the scope of

the commitments made between two operators.

2.1 Dataset

In this part, data acquisition for the inputs of the

model and the properties of data are described. Ob-

jective of the model is to keep quality level on partic-

ular level while decreasing the traffic steering cost. In

order to create the model these data types are used:

International Roaming Traffic Optimization with Call Quality

93

• Unit price per minute based on location by opera-

tors (Tariff)

• Locations where operators provide service

• Outgoing demand information

• Details of agreements with other operators

• Call Detail Record (to determine quality metric)

This dataset is provided by Turkcell. Turkcell is

the market leader in Turkish GSM market with 44%

market share and the annual income of US$4.4B

in 2018 (Turkcell, 2018). In addition to the 33.8

million customers in Turkish market, Turkcell is a

global company and it serves 12.2 million customers

in Azerbaijan, Kazakhstan, Georgia, Moldova, North-

ern Cyprus and Ukraine. Turkcell has international

roaming agreements with 622 operators in 201 coun-

tries as of 2018.

The data is available for international traffic be-

tween 1.7.2017-31.10.2017 in worldwide. In the in-

coming traffic data, there are 111 operators and 555

prefixes which belong to the operators. For outgoing

traffic, there are 109 operators ant 573 prefixes in the

data. Also, the information about agreements of 7 op-

erator and 86 locations is available in the data.

2.2 Agreements

With the increasing international roaming traffic,

competition in the wholesale roaming services among

operators has gained a different dimension. In order

to provide better commercial conditions in this com-

petitive environment, the operators developed trade

agreements named International Roaming Agreement

(IRA). Under these agreements, unit prices named In-

ternational Operator Tariffs (IOT’s) are determined

unilaterally by the home operators. Lower unit prices

can be defined for higher volume traffic with bilateral

agreements. These agreements are based on mutual

commitments.

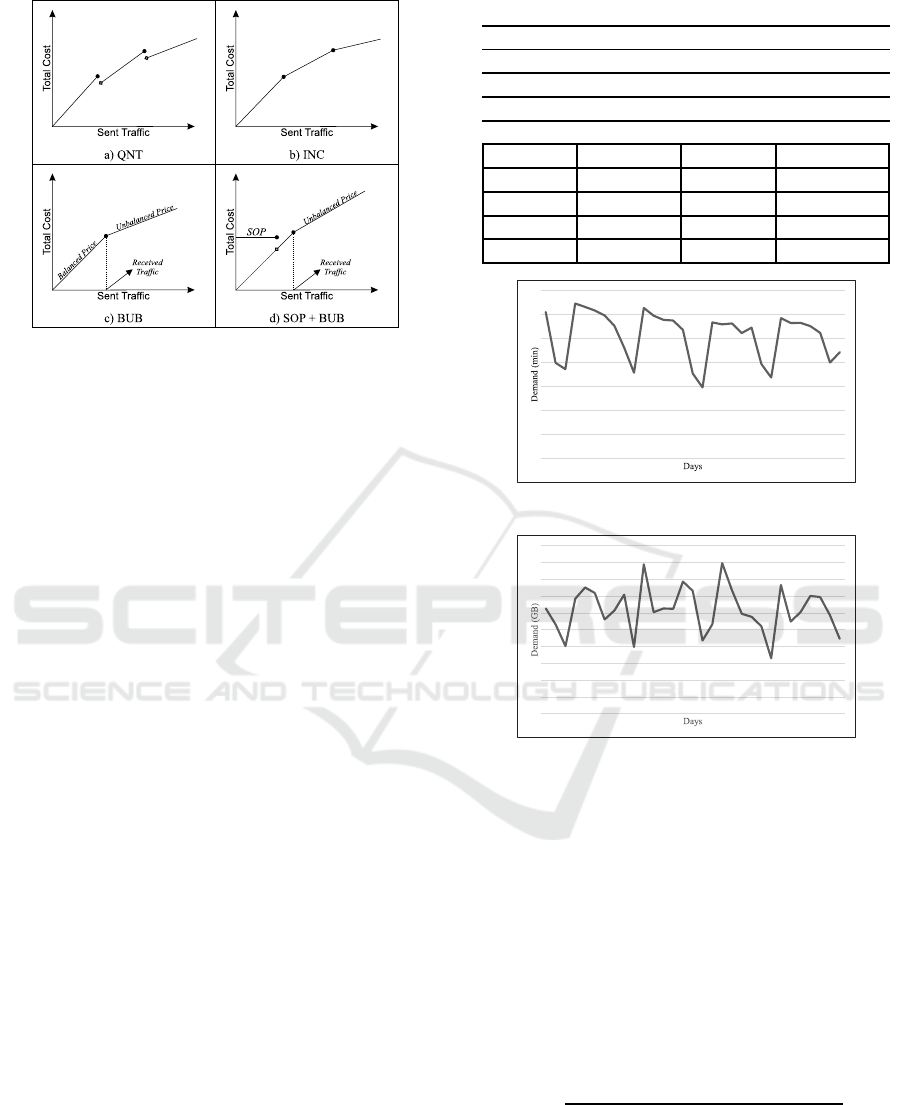

There are four basic IRA’s used in wholesale

roaming market. The first one is the pricing method

called Quantity (QNT) or Degressive / Progressive

Charging that uses a piece-wise function. Accord-

ing to this model, pricing is made within predeter-

mined proportional thresholds and it is done with X

unit price up to the limit of a certain steering volume,

and when the limit is exceeded pricing is made with

a lower Y unit price than X for all traffic from the

beginning (Figure 2a).

The second model is the pricing model called In-

cremental (INC) or Tiered Charging, where prices

are calculated in a cumulative manner with predeter-

mined volume intervals (segments) and unit prices for

these intervals (segment prices). In this model, simi-

lar to QNT, thresholds and segment prices are deter-

mined but differently when the segment of unit price

Y is exceeded, the price of the steered traffic in the

segment of unit price X is calculated over the X unit

price so the total price is incrementally calculated

based on the volume steered in respective segments

(Figure 2b).

A third model, called Balanced/Unbalanced

(BUB), is a pricing model where the amount of bi-

laterally routing is fixed, and the exceeding part of

the traffic is priced at a reduced price. For example,

if we consider that an operator A steers 1000 minutes

to the operator B and B steers 2000 minutes to the A;

operator A pays the price of 1000 minutes volume at

the unit price of B, whereas the operator B pays the

price of 1000 minutes at the unit price of A plus the

price of exceeding 1000 minutes at the reduced price

of A (Figure 2c).

The fourth model is the pricing model, named

Send-Or-Pay (SOP), where the pricing of a predeter-

mined volume is committed and paid regardless of

the amount of steering, and after the committed limit

is exceeded, pricing has to be done with one of the

other pricing models (ie. QNT, INC or BUB) for the

exceeding amount. For instance, when operator A

makes a 1000-minutes commitment and if they only

steer 800-minutes voice traffic, they pay the contract

amount which is the price of maximum 1000-minutes

steering. After 1000 minutes, one of the other agreed

pricing models comes into play (Figure 2d).

As Turkcell is one of the rule-setting operators

in its own market region, they use a unique pricing

method similar to the BUB model, but unlikely to the

BUB, commitments are made and the exceeding vol-

ume is paid by negotiating according to the fulfillment

rates of the both parties. In this method, since the

cost calculation can only be made depending on the

strategical decisions of the administrative committee,

in the cases where the commitments cannot be ful-

filled; the objective should be designated to minimize

the steering costs while setting up the mathematical

model. Thus, Turkcell takes the advantage in the ne-

gotiation phase.

There are two different partner operator types in

the problem. They are committed operators (CO)

and uncommitted operators (UO). UO are priced on

minutely based tariff and there is no guarantee on vol-

ume of service. The main reason of the agreements is

to have better price on predetermined volume of call-

ing minutes.

CO typically specify how they will exchange ter-

mination services. The party that sends more traffic

compensates the other party based on the amount of

DATA 2019 - 8th International Conference on Data Science, Technology and Applications

94

Figure 2: Payment models (Esteves et al., 2018).

traffic surplus. In this case, inter–network traffic mea-

surements are required for settlement purposes.

Agreement details with CO are:

• Agreements are between home operator and CO’s.

• All agreements are only valid for limited time.

• Agreements with CO’s may be valid at more than

one location.

• Information of valid locations and incom-

ing/outgoing call traffic volume are clearly stated

on agreement. So, agreements can include both

way of traffic (From home operator to CO and

from CO to home operators).

• Different currencies can be used on agreements.

• To reach the call traffic volume or getting closer to

limit is the main principle. In another saying there

is no penalty for not exceeding the limit. Even

if there is no penalty, it is essential to get closer

to the limit for business agreements at the end of

term. This situation creates trust issues between

operators and it leads decrements on business vol-

ume. Also, by fulfilling the agreed volume may

bring some price advantages on next agreements’

prices.

The example of agreement with a CO is shown in Ta-

ble 1.

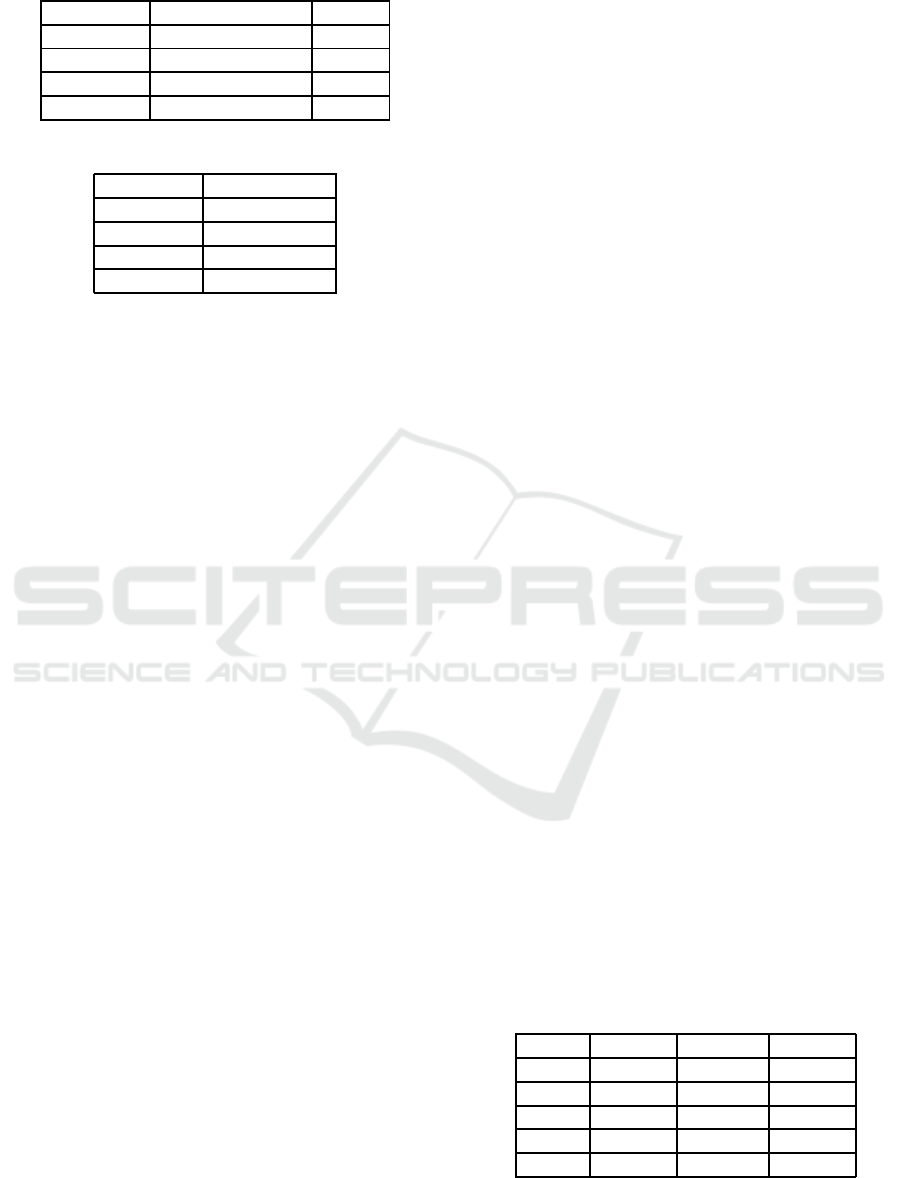

2.3 Outgoing Demand

Call Detail Record (CDR) is a detailed dataset con-

taining the time of call, length, competition status,

source phone number and destination phone number.

Outgoing demands are extracted from CDR and Fig-

ure 3 shows the demand of the calls on one-month pe-

riod. Also, Figure 4 shows the demand of data roam-

ing for the same interval. It is seen that on calls and

data roaming shows periodic behaviors on weekends.

Table 1: Example of agreements with CO.

Committed operator Currency

X EUR

Start Date End Date

1.07.2017 31.12.2017

Outgoing Traffic Incoming Traffic

Location Volume Location Volume

D1 8,500,000 D5 20,000,000

D2 1,000,000 D6 7,500,000

D3 2,250,000 D7 10,000,000

D4 1,500,000

Figure 3: Demand Voice.

Figure 4: Demand Data.

2.4 Analysis of Quality Metrics

Answer seizure ratio, network efficiency ratio, aver-

age call duration, and post dial delay are calculated by

using CDR data. These parameters are recommended

by International Telecommunication Union as perfor-

mance metrics of network (ITU-T, 2002).

• Answer Seizure Ratio (ASR) is a measure of the

network quality which is calculated by the per-

centage of the number of successfully connected

calls to the number of attempted calls (it is also

called the call completion rate).

ASR =

Seizures resulting in answer signal

Total seizures

(1)

• Network Efficiency Ratio (NER) measures capa-

bility of network to call terminal. Rather than the

ASR, NER excludes the customer and terminal

behaviors. So, it represents the pure network per-

formance better.

International Roaming Traffic Optimization with Call Quality

95

NER =

Seizures resulting in Answer

message or User Failure

Total seizures

(2)

Figure 5: ASR and NER comparison (ITU-T, 2002).

• Average Call Duration (ACD) is calculated by us-

ing call count and total call duration. In general

assumption, there is a positive linear relationship

between ACD and the call quality.

• Post Dial Delay (PDD) is the time it takes to re-

ceive feedback after a user has finished dialing

(after they pressed the dial button on their phone).

PDD is used to predict the length of the way to

destination from call source. Lower PDD means

better user experience.

Table 2 represents the correlation among quality

metrics and correlation with respect to unit prices. It

is seen that there is no direct relation between unit

price and quality metrics.

Table 2: Correlation Matrix of Quality Metrics and Unit

Prices.

ASR NER ACD PDD Price

ASR 0.72 -0.23 -0.02 0.09

NER 0.72 -0.21 0.01 0.11

ACD -0.23 -0.21 0.26 0.15

PDD -0.02 0.01 0.26 0.13

Price 0.09 0.11 0.15 0.13

ACD is not a reliable performance metric, because

customers tend to terminate the call in a short pe-

riod in long distance call due to extra costs. On the

other hand, PDD can be affected by many external

factors other than general network quality. This situ-

ation makes PDD unusable for our model. ASR and

NER are both good metrics to evaluate general per-

formance and they are correlated as seen in Figure 6.

However, ASR takes only completed seizures into ac-

count while NER also considers user failures (Figure

5). Since, NER is more comprehensive,it sets a better

threshold for measuring network quality.

Figure 6: Average ASR and NER comparison of some op-

erators.

Figure 7 represents the past quality of two part-

ner operators with the highest amount of steer-

ing(Operator

1094, Operator 23) and two partner op-

erators with the least amount of steering (Opera-

tor

796, Operator 27) according to average quality

values of the historical data.

As seen in continuous quality values in Figure

7, the variances of the quality values are in narrow

ranges, which endorses our previous assumption of

using average quality values. In our model, quality

calculation for decided steering values which has no

past data for the relevant prefixes, is done by using the

average quality of the operators’ average quality in

that location. If there is no quality information about

any prefixes in a location, then the general average

quality of the operator in all locations is used.

Figure 7: Quality comparison of some operators.

3 STEERING MODEL WITH

CALL QUALITY

After data analysis and processing, a mathematical

model for steering of international roaming is pro-

posed with cost minimization objective. The model

determines steering decisions for international roam-

ing trafficto each operator and each prefix while keep-

ing the quality on acceptable level.

The notation used in the mathematical model;

DATA 2019 - 8th International Conference on Data Science, Technology and Applications

96

sets, parameters, decision variables, and the proposed

mathematical model are provided below:

Sets:

• i = operator,

• j = prefix,

• k = location,

• P

ij

= possible operator and prefix matches,

• G

jk

= prefix and location matches,

• A

ik

= operator and location matches in agree-

ments.

Parameters:

• d

j

= Outgoing voice demand of prefix j,

• c

ij

= Unit cost of outgoing voice traffic to prefix

j over operator i,

• V

ik

= Volume of agreement for location k with op-

erator i,

• q

ij

= Network Efficiency Ratio (NER) of operator

i for prefix j,

• q

t

= Quality threshold,

• M = Big Number.

Decision Variables:

• x

ij

= amount of voice steering to prefix j over op-

erator i,

• u

+

ik

= amount of missing voice steering to location

k over operator i,

LP Model:

min

∑

i

∑

j

c

ij

x

ij

+

∑

i

∑

k

Mu

+

ik

(3)

s.t.

∑

i∈P

ij

x

ij

= d

j

∀ j (4)

∑

i∈P

ij

q

ij

x

ij

≥ q

t

∑

i∈P

ij

x

ij

∀ j (5)

∑

j∈G

jk

x

ij

+ u

+

ik

≥ V

ik

∀i,k ∈ A

ik

(6)

x

ij

≥ 0 ∀i, j (7)

u

+

ik

≥ 0 ∀i, j (8)

The Linear Programming (LP) model presented in

Equations (3) through (8) aims to minimize the to-

tal steering cost and penalizes the unsatisfied agree-

ments’ volume. In the objective function (Equation

3), Big M is a sufficiently large number that aims to

firstly minimize u

+

ik

values (set the smallest positive

values possible).

Constraint 4 ensures that the outgoing demand is

met for each prefix. Constraint 5 guarantee that if

steering occurs to prefix j over operator i, average

quality of steering have to be greater than the qual-

ity threshold. Constraint 6 ensures that satisfy the

deal volume for each operator and each location. The

rest of the constraints (Constraint 7 and 8) are non-

negativity constraints for variables.

We implement the model by using the GAMS

IDE (GAMS Development Corporation, 2013) and

CPLEX (IBM ILOG, 2010) solverfor LP. We perform

all experiments on an Intel Core i7-8550U 1.8GHz

machine with 8GB RAM.

Next section presents the scenarios we test and

discussion of the findings.

4 RESULTS

As mentioned before, the data is available for interna-

tional traffic between 1.7.2017-31.10.2017 in world-

wide. Certain assumptions are made for the problem.

Since agreements are annual, we estimate the agree-

ment volume (V

ik

) for the four month period as one

third of the real agreement volume.

We also make the following assumption to esti-

mate the quality data of the operators, which do not

have past quality data: if the average quality for a

given prefix is missing, then the location average is

used for the relevant operator. If all information about

a location is missing, then general average of the oper-

ator for all locations is assumed for the average qual-

ity of any prefix for location of interest.

The optimization model is solved for voice steer-

ing. Steering costs are calculated based on the same

exchange rate.

First, the model is solved with the zero quality

threshold. In other words, Constraint 3 is ignored in

the model (Scenario 1). The reason of this is to see

the variation in the cost and average routing quality,

where quality concern is completely ignored. How-

ever, the quality of routing is one of the crucial cri-

teria of the home operator. So in Scenario 2, quality

threshold is set as the historic average quality value

of the home operator, aiming to see the cost reduc-

tion achieved by the model, where solution quality is

matched with that of home operator’s, canceling out

the quality . In addition, we run a third scenario, Sce-

nario 3, where the average quality value of the home

operator is determined as a direct target and not as

a lower limit, by changing inequality to equality in

Constraint 3. So the model results can be comparable

with the historical results. The cost of steering for all

scenarios are presented in Table 3. The amount of un-

satisfied commitment volume is also shown in Table

4.

In Table 3 and Table 4, the ”Base” row indicates

International Roaming Traffic Optimization with Call Quality

97

Table 3: Total Costs and Average Quality Rates.

Total Cost (TRY) q

a

(%)

Base 129.2M 83.80

Scenario 1 63.8M 67.93

Scenario 2 96.9M 84.20

Scenario 3 97.4M 83.80

Table 4: Sum of Unsatisfied Commitment Minutes.

∑

ik

u

+

ik

(min)

Base 4,179,400.12

Scenario 1 1,261,630.10

Scenario 2 1,261,630.10

Scenario 3 1,261,630.10

the historic results of the home operator. When the

quality threshold is determined as zero (q

t

= 0) the

steering costs can be reduced by half. However, when

the quality threshold is equal to the historical average

quality of the home operator (q

t

= 83.8%), the cost

benefit provided by the model is around 30%. The

amount of unsatisfied commitment volume is penal-

ized with a big number, M in the model objective.

For this reason, as seen in Table 4, the unsatisfied

commitmentvolume is decreased from approximately

4.2 million minutes to 1.3 million minutes and the

whole outgoing demand have been met. The unsatis-

fied commitment volume in the second and third sce-

nario results is due to the low demand in the period.

Naturally, the determination of the quality threshold

does not cause any change.

The decision of outgoing steering in this model is

made independent of the incoming traffic steered by

contracted operator. However, in real life application

the difference between incoming and outgoing steer-

ing, so the profit amount, affects the decision.

One of the most critical points about Turkcell’s

current steering policy is its trust-oriented win-win re-

lationship with its partner operators. This relationship

makes it possible for Turkcell to make some assump-

tions due to its market size and power in the region.

One of the these assumptions of Turkcell is the as-

sumption that when a committed amount of outgoing

steering is exceeded, a same price amount of incom-

ing steering demand will be expected. Actually this

expected increase in revenue is proportional to the re-

liability and sustainability of the relationship between

partner operators and home operator. However, in this

study the correlation between incoming and outgoing

steering traffic for each partner operator is specified as

1 independentlyfrom the partner operators’ reliability

and trade relation scores.

Therefore, the mathematical model is remodeled

in such manner that it forces an increase in the volume

of outgoing steering to a contracted operator which

provides high incoming steering. In this way, we

assume that the net profit amount always increases

while the gap between incoming and outgoing traffic

is closing. The current model can be run iteratively

in this manner by also considering the demand gap

and making an update on the unit price of an opera-

tor i for prefix j by providing a discount, and deriving

an updated c

ij

value. After the update, LP model is

run again and the difference in the demand gap is ob-

served. According to the new gap, model is run again

and the process continues in the same way until the

gap value converges.

The parameter w

i

that is defined for this update

represents the weighted profit coefficient of the op-

erator i and it is obtained from dividing the gathered

revenue minus cost for each partner operator by the

total profit earned from all partner operators.

The resulting coefficient is subtracted from 1 and

multiplied with parameter c

ij

to calculate updated c

ij

value. This new coefficient will be called a

ij

.

a

ij

= (1− w

i

)c

ij

∀i, j (9)

For better understanding, let’s assume that oper-

ators ACell and BCell are committed operators and

CCell is an uncommitted operator for a home oper-

ator. The expected profit from ACell and BCell are

$60K and $40K, respectively. In this case, the values

of w

ACell

, w

BCell

and w

CCell

are:

w

ACell

= 60/100 = 0.6, (10a)

w

BCell

= 40/100 = 0.4, (10b)

w

CCell

= 0. (10c)

This shows that, commitments provide 60% dis-

count on unit price of ACell, and 40% discount on

unit price of BCell. The unit price of uncommitted

CCell remains unchanged because its expected profit

is taken as zero. In this way the ones with more

promissory commitments are prioritized and they be-

come more advantageous.

Update in the unit costs showed that the models

iteratively solved are converged after the third itera-

tion and the value of total cost does not change more.

The total costs, expected revenue and profit of the it-

erations are shown in Table 5.

Table 5: Change in Cost, Revenue and Profit in TRY.

Cost Revenue Profit

Step 0 97.4M 230.4M 133.0M

Step 1 102.5M 237.1M 134.6M

Step 2 105.2M 241.4M 136.2M

Step 3 107.3M 244.3M 137.0M

Step 4 107.3M 244.3M 137.0M

According to the results, the steering decisions is

changed with updated unit costs and the total cost is

DATA 2019 - 8th International Conference on Data Science, Technology and Applications

98

increased in the first and second iteration by about

4.4% and 5.3%, respectively. Under the main assump-

tion that the increase in the costs is going to increase

the revenue from committed operator with the same

rate, the net profit also increases as shown in Table 5.

5 CONCLUSION

A telecommunication operator makes agreements

with other operators in order to enable its own sub-

scribers access services when the subscribers are

out of the operator’s coverage area. Such opera-

tors are called the partner operators and each sub-

scriber call from abroad is steered to a partner opera-

tor. The decision for which partner the each call will

be forwarded to is based on the subscribers’s location

(country/city), the price of the partner operator for

that location and the service quality of the partner op-

erator. Finding the best forwarding for all subscribers

under the partner agreement conditions is called the

Steering International Roaming Traffic (SIRT) prob-

lem.

In this study we propose to solve the SIRT prob-

lem with a single service by developing an optimiza-

tion model that considers agreement constraints and

quality requirements while satisfying demand from

the subscribers over a predetermined time interval.

We consider two executions policies to test our ap-

proach; a) running the model once and fixing the

roaming decisions over the planning interval, b) dy-

namically updating the decisions using a rolling hori-

zon approach. Our results show that steering cost is

decreased by approximately 25% although the qual-

ity of the steered calls is kept above the base quality

level.

For future work, a decision support system can

be developed to monitor how to set commitment val-

ues of future agreements under different scenarios.

In addition, it is possible to perform stochastic de-

mand analysis and run the scenarios under uncer-

tainty. Hence, the robust performance of the model

can be measured.

REFERENCES

Esteves, J. J. A., Boulmier, G., Chardy, M., and Bechler, A.

(2018). Optimization of the steering of the interna-

tional multi-services roaming traffic. In 2018 IEEE

29th Annual International Symposium on Personal,

Indoor and Mobile Radio Communications (PIMRC),

pages 246–252. IEEE.

Flippo, O. E., Kolen, A. W., Koster, A. M., and van de

Leensel, R. L. (2000). A dynamic programming algo-

rithm for the local access telecommunication network

expansion problem. European Journal of Operational

Research, 127(1):189–202.

GAMS Development Corporation (2013). General Al-

gebraic Modeling System (GAMS) Release 24.2.1.

Washington, DC, USA.

Gendreau, M., Potvin, J.-Y., Smires, A., and Soriano, P.

(2006). Multi-period capacity expansion for a local

access telecommunications network. European Jour-

nal of Operational Research, 172(3):1051–1066.

IBM ILOG (2010). CPLEX Optimizer Release 12.9.0.

ITU-T (2002). E. 425 internal automatic observations. ITU-

T Recommendation.

Lacasa, J. D. (2011). Competition for partners: Strate-

gic games in wholesale international roaming. In

European Regional Conference of the International

Telecommunications Society, Budapest. ITS.

Martins, C. L., da Conceic¸˜ao Fonseca, M., and Pato, M. V.

(2017). Modeling the steering of international roam-

ing traffic. European Journal of Operational Re-

search, 261(2):735–754.

Pi´oro, M. and Medhi, D. (2004). Routing, flow, and capac-

ity design in communication and computer networks.

Elsevier.

Riis, M. and Andersen, K. A. (2004). Multiperiod capacity

expansion of a telecommunications connection with

uncertain demand. Computers & operations research,

31(9):1427–1436.

Salsas, R. and Koboldt, C. (2004). Roaming free?: Roam-

ing network selection and inter-operator tariffs. Infor-

mation Economics and Policy, 16(4):497–517.

Turkcell (2018). Turkcell annual report 2018.

International Roaming Traffic Optimization with Call Quality

99