Fast and Streaming Analytics in ATM Cash Management

Terpsichori-Helen Velivassaki

a

and Panagiotis Athanasoulis

SingularLogic, Achaias 3 & Trizinias st., Kifisia, Attica, Greece

Keywords: Cash Management, Fast Analytics, Stream Analytics, Operational Database.

Abstract: Cash management across a network of ATMs can be greatly improved, exploiting a multitude of information

sources, which however generate huge datasets, not possible to be analysed via traditional methods. Business

Intelligence in the Banking, Financial Services and Insurance (BFSI) sector can be even more challenging

when exploitation of real-time information streams is desired. This paper presents the uCash ATM cash

management system, running on top of CloudDBAppliance, supporting fast analytics over historical data, as

well as streaming analytics functionalities over real-time data, served by its Operational Database. The paper

discussed integration points with the platform and provides integration hints, thus constituting a real use case

example of the CloudDBAppliance platform, allowing for its further exploitation in various application

domains.

1 INTRODUCTION

Even in the digital age, cash remains an essential

component of the payment system, being the largest

retail payment category by number of transaction for

transactions under $10 (Reserve Bank of Australia,

2017). During the last few years, in their attempt to

achieve mobility to better serve their customers,

banks across the globe are investing on next-

generation ATMs, featuring advanced capabilities

and offering customers the ability to perform more

types of financial transactions than the ones are

currently handled by customer service

representatives. This will create a whole new

perspective of the user ATM experience, also

increasing the spatiotemporal heterogeneity of the

cash demand and the data produced by the ATMs,

derived from the new business value propositions of

these new ATMs (ATM Industry Association, 2018).

Additionally, as user mobility increases, so does the

complexity of predicting the expected user

withdrawal and deposit transactions volumes.

Banks and financial institutes nowadays face

significant challenges in managing effectively ATM

replenishment, based primarily on static prediction

algorithms. This results in high cash-out rates in

certain ATMs, while having excess leftover cash in

other ATMs, returned to banks. Accordingly,

a

https://orcid.org/0000-0002-0362-4607

ineffective cash management in ATMs leads to

considerable customer dissatisfaction due to delays

until reloading empty ATMs, as well as complex and

expensive cash logistics to reload the network.

Ideally, smart cash management should be able to

catch cash demand, affected by external factors and

not easily predictable, as e.g. the monthly

salaries/pensions. For example, an ATM, located on

the same level of a large shopping Mall as a store with

special discounts for a single day only, could have

increased cash flow. Also, cash demand in ATMs

close to social events is expected to be higher than

usual. Moreover, ATM traffic could be affected by

combined factors, such as weather and location.

Indicatively, ATMs close to beaches/seaside might

realize increased demand during warm and sunny

days or cash demand could decreased for any ATM

during cold days. Another dependence can be found

at seasonality, e.g. ATM cash demand is expected to

grow during the days before bank holidays.

In this context, appropriate cash management is

bound to ultra-fast analytics over huge datasets,

produced by large interconnected ATM channel

networks. Business objectives mandate for the

capability of processing complex queries over

thousands of columns of operational data, created by

thousands of ATMs in the order of seconds.

On the other hand, strong data privacy and

454

Velivassaki, T. and Athanasoulis, P.

Fast and Streaming Analytics in ATM Cash Management.

DOI: 10.5220/0008318504540458

In Proceedings of the 8th International Conference on Data Science, Technology and Applications (DATA 2019), pages 454-458

ISBN: 978-989-758-377-3

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reser ved

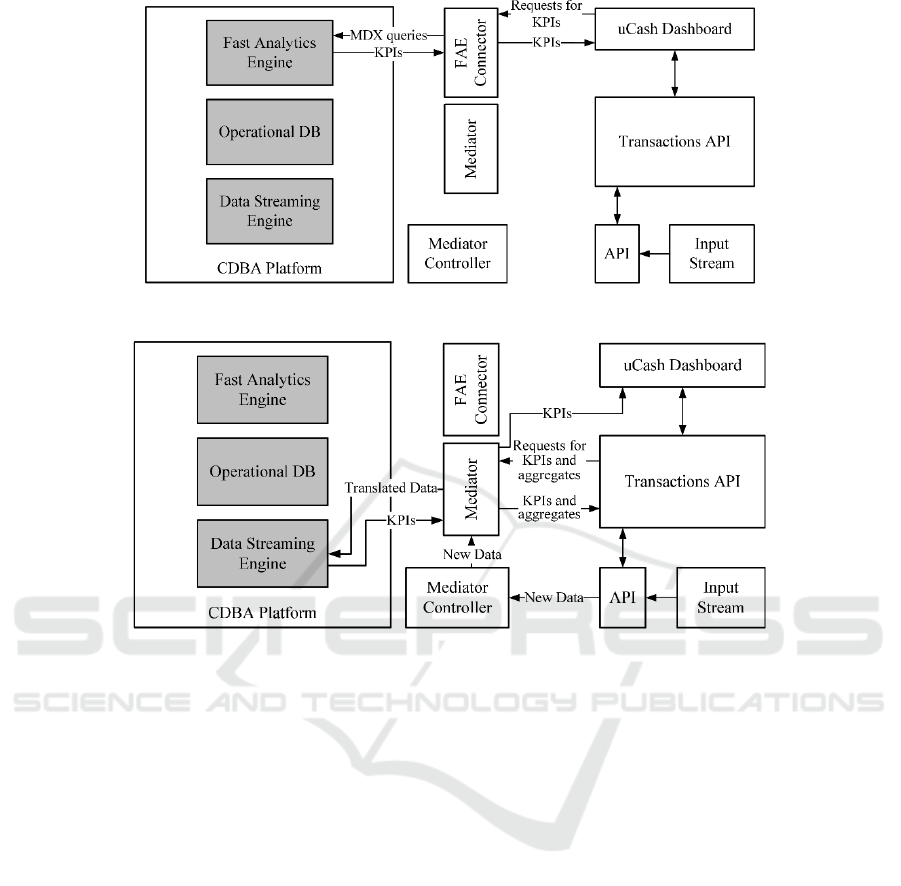

Figure 1: General architecture of the Cash Management application.

security requirements renders ATM cash

management too critical to rely on existing clouds.

In this paper, ultra-fast ATM Cash Management

system (uCash) is presented as a critical application,

running on top of the CloudDBAppliance platform

(CloudDBAppliance, 2019), incorporating a scalable

Operational Database (DB), a Fast Analytics Engine

(FAE) and a Data Streaming Engine (DSE), while

ensuring high availability. The proposed system is

able to identify both expected and unexpected

changes in external factors affecting cash withdrawal

from ATMs. To this, the proposed system relies on

streaming information received from ATM channels,

the social media, cooperating retailers, social trending

sites, the weather, financial services or other sources

are properly exploited (Velivassaki, et al., 2019).

Also, uCash should be smart enough to identify short-

or long-term changes, affecting cash demand from

ATMs, in order to feed accordingly the cash logistics.

The rest of the paper is organized as follows.

Section 2 presents the architecture of the uCash

system. Section 3 highlights the exploitation and

integration of the CloudDBAppliance platform and

Section 4 concludes the paper.

2 UCASH ARCHITECTURE

The uCash system development is led by the general

architecture presented in Figure 1. It delivers a high-

level overview of the final uCash architecture,

skipping the details of CloudDBAppliance platform

integration, which will be step-wise detailed in the

next paragraphs.

Overall, the uCash architectural components

could be spilt in greater sets of components as

follows:

1. Input Streams which include simulation

components and external data provider

components. Simulation components comprise

a set of microservices simulating events nearby

ATMs as well as offers by commercial places

nearby ATMs. External data provider

components interact with public services to get

information related to weather and currency

rates. In particular, the relevant data include

weather forecasts for arbitrary time periods

concerning the places where ATMs are located

(each simulated data item finally streamed into

the uCash system contains a detailed 48-hours

forecast) as well as the currency rates. To avoid

excess activity from these components, caching

strategies have been applied at the providers

side, only invoking the external data providers

when really needed.

2. The uCash application package including the

uCash Dashboard and the Transactions API.

The former is a front-end component

interacting with the Transactions API and

implicitly with the CloudDBAppliance

platform and is used by the various actors of the

system.

3. A set of mediation services enabling the

seamless and technology-agnostic interaction

of the uCash application package with the

CloudDBAppliance platform. The components

incorporated in this set of services are the Fast

Analytics Engine (FAE) Connector, the

Mediator (enabling integration with the

Operational Database and the DSE) and the

Mediator Controller that interacts with the

Transactions Simulator to get the simulated

data and, then, forward them to the Mediator.

Fast and Streaming Analytics in ATM Cash Management

455

Figure 2: uCash integration with the Operational Database.

3 EXPLOITATION OF THE

CLOUDDBAPPLIANCE

PLATFORM

The integration of uCash with the

CloudDBAppliance platform and its core technical

components provide a set of benefits towards

response times of simple or complex queries over the

huge dataset used by uCash, which are summarized

below.

1. Quick retrieval and aggregation of historical data

(catalysed by the Operational DB);

2. Quick retrieval of aggregated KPIs based on real-

time and historical data (catalysed by the Fast

Data Analytics framework);

3. Real-time retrieval of KPIs and aggregates based

on streaming data (catalysed by the DSE);

4. Real-time indications of correlation among the

streamed data parameters (catalysed by the DSE

ML algorithms.

The above summarise not only the integration context

of uCash with the CloudDBAppliance platform, but

also highlight the merits of the latter under a big-data

perspective, a domain where traditional IT and data

management architectures simply cannot satisfy.

3.1 Integration with the Operational

Database

The integration with the Operational DB is of

paramount importance, since it not only acts as an

in-memory database offering hot storage services

at mass scale, but also as a single-entry point of

data that can be exploited by the rest of the

1

As also documented for the case of the DSE, the Mediator

actually comprises two mediator services, the one enabling

CloudDBAppliance platform core components. In

order to integrate with the Operational DB, uCash

makes use of a Java-based Mediator component

which exposes the JDBC connection by means of a

RESTful API

1

. By means of this Mediation API,

the uCash application package are able to:

a) Create and maintain a connection pool for the

incoming requests;

b) Register transactions information to the

Operational DB;

c) Retrieve transactions information (aggregated

or not) from the Operational DB.

Figure 2 depicts the information flow of the

relevant uCash integration activities.

In detail, every time a transaction is generated,

it gets communicated to the Mediator Controller

which, in turn, interacts with the Mediator by

transforming the incoming JSON data format to a

JDBC-compliant statement, to be stored into the

Operational DB.

Next, when an actor using the uCash Dashboard

accesses the dashboard and requests a certain set of

Key Performance Indicators (KPIs) to showcase,

the following steps take place:

1. The request gets forwarded to the Transactions

API, which transforms the request into a JDBC

compatible-one and communicates it to the

Mediator.

2. The Mediator performs the query against the

Operational DB and gets the results.

The results are communicated to the uCash

Dashboard via the Transactions API.

the interaction with the Operational DB and the other being

responsible for interacting with the DSE component.

ADITCA 2019 - Special Session on Appliances for Data-Intensive and Time Critical Applications

456

Figure 3: uCash integration with the Fast Analytics Engine.

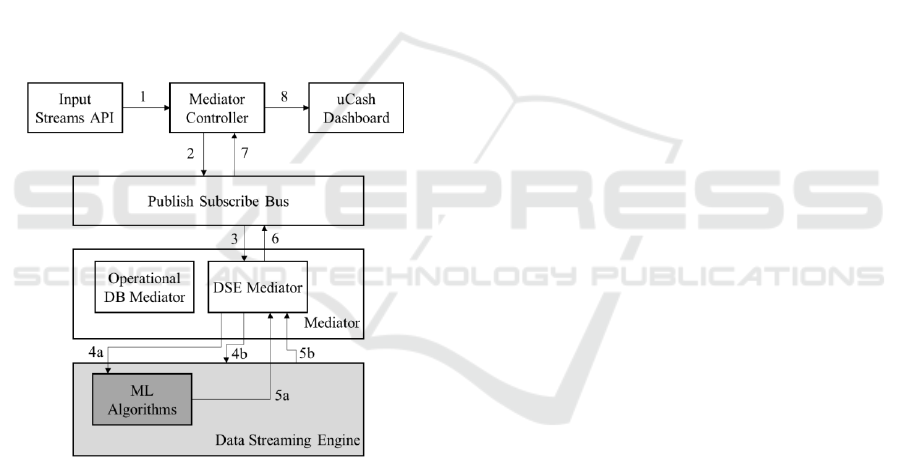

Figure 4: uCash integration with the Data Streaming Engine.

3.2 Integration of Fast Data Analytics

Engine

The scope of this integration is the quick retrieval

of KPIs and aggregates over historical data. Figure

3 presents the overall integration of the uCash

application package with The Fast Analytics

Engine. The integration flow comprises four steps

as follows:

1. The user of the uCash Dashboard asks for the

visualization of a set of KPIs.

2. The request of the KPIs is redirected to the FAE

connector which, in turn, based on the input

received, builds an accompanying

Multidimensional Expressions (MDX) query.

3. The built MDX query gets communicated to the

fast analytics engine in order to get the

requested KPI/aggregated values;

4. The answer from the fast data analytics engine

is, then, forwarded back to the AP connector

which tunnels the question back to the uCash

Dashboard.

It is worth mentioning that the fast data analytics

engine will be pre-configured to understand which

data should be retrieved from the Operational DB

so that KPI requests towards the fast data analytics

engine are rendered possible.

3.3 Integration with the Data Streaming

Engine

As already hinted and as happens with the case of the

Operational DB, the integration with the DSE is

catalyzed by the Mediator Controller and the

Mediator service.

Indicatively, whenever a new transaction is

generated and passes through the Mediator

Controller, it gets pushed to a publish/subscribe

bus for which the Mediator acts (at this point of the

data flow) as a subscriber. The received input is

then communicated to the DSE Mediator part of the

Mediator which, in turn, translates the incoming

data into tuples, able to be consumed by the DSE.

As an example, for communicating the data to the

query operated in the context of the integrated

Machine Learning (ML) algorithms the

transformations that take place are:

Fast and Streaming Analytics in ATM Cash Management

457

a) Formulate the weather (current and forecast)

data into ranked groups of weather types (e.g.

Rain, Cloudy, Rain, Snow etc) so that they are

better contextualized;

b) Flatten the incoming JSON-formatted

information into comma-delimited triplets of

type:

<timestamp>,atm_<atm_id>_<variable>,<valu

e> where the timestamp indicator is of type

YYYYmmDDHHMM.

Next, the input is forwarded to the DSE, activating

the enabled streaming queries (e.g. for calculating

aggregate cash demand for one or more ATMs) and

the ML algorithms calculating the correlation

indices among the provided variables. When the

online processing is over, the results are received

by the Mediator which, in turn, publishes them

back to the Publish Subscribe bus, feeding the

Mediator Controller. The latter informs in real time

the uCash Dashboard. Figure 5, below, depicts the

above process.

Figure 5: Detailed steps of integration with the DSE.

4 CONCLUSIONS

This paper presented the uCash Cash Management

system as a use case of the CloudDBAppliance

platform. Implementation details have been provided,

including the high-level architecture of the system,

which highlights use case specific components and

interaction points with the CloudDBAppliance

platform. The uCash system has been developed on

top of the CloudDBAppliance platform, exploiting

appropriately the platform merits in the Bank sector.

It has to be noted that the integration and exploitation

hints presented in this paper can be enablers for the

platform exploitation in other application areas and

under various scenarios, as well. As a next step, the

end to end functionalities of the uCash system, will

be validated under the final CloudDBAppliance

platform, coupling ultra-fast software with high-end

hardware components.

ACKNOWLEDGEMENTS

This work has been partially conducted within the

CloudDBAppliance project Grant number 732051,

co-funded by the European Commission as part of the

H2020 Framework Programme.

REFERENCES

ATM Industry Association, 2018. Business Value

Propositions for Next Generation ATMs. [Online]

Available at: https://www.atmia.com/files/committees/

consortium-for-next-gen-atms/bvps-for-next-

generation-atms-published.pdf

CloudDBAppliance, 2017. D7.1: Use Cases Requirements

Analysis, s.l.: H2020-732051 CDBA Deliverable

Report.

CloudDBAppliance, 2017. D7.2: Use Cases Design, s.l.:

H2020-732051 CDBA Deliverable Report.

CloudDBAppliance, 2018. D7.3: Use Cases

Implementation Version 1. s.l.:H2020-732051 CDBA

Deliverable Report.

CloudDBAppliance, 2019. CloudDBAppliance - European

Database Appliance. [Online] Available at: http://

clouddb.eu/

Reserve Bank of Australia, 2017. Reserve Bank Bulletin,

Sydney: s.n.

Velivassaki, T.-H., Athanasoulis, P. & Trakadas, P., 2019.

uCash: ATM Cash Management as a Critical and Data-

intensive Application. Heraklion, s.n.

ADITCA 2019 - Special Session on Appliances for Data-Intensive and Time Critical Applications

458