Assessing Free Cash Flow to Firm and Relative Valuation Method in

Agriculture Plantation Companies Listed in Indonesia Stock

Exchange in 2018

Riko Hendrawan

and Ernis Himawan

Telkom University, Jalan Gegerkalong Hilir, Bandung, Indonesia

Keywords: Agriculture Plantation companies; FCFF; Relative valuation; Bursa Efek Indonesia.

Abstract: As we know Indonesia is producer the largest CPO and the biggest Muslims in the world. Based on these

two points, the researcher tried to analyze agricultural plantation companies shares listed on the Indonesia

Stock Exchange especially sharia shares in 2018. The Stability of global CPO prices greatly influences

fluctuations stock price in the agriculture industry, why company valuation is needed. The Assessing

method employed DCF with the FCFF approach, and the Relative valuation method with PER and PBV

approaches. The 2013-2017 financial report is a basis for projections examination during period 2018-2022,

an example in research is a company that has the most substantial market value and equity in the ISSI Index

- consisting of AALI, SIMP, and LSIP applied in the pessimistic, moderate, and optimistic scenario. The

results of this study by adopting the DCF-FCFF method in all three scenarios, AALI intrinsic value, and

LSIP considered to overvalued, SIMP is undervalued. By employing Relative valuation method using the

PBV and PER approach; the AALI, SIMP and LSIP values still lie in the industry range based on IDX 1st

Quartal 2018. Referring to the calculation results, this study recommends sales for AALI and LSIP, buying

for SIMP.

1. INTRODUCTION

Indonesia is known as an agrarian country with the

largest oil palm production in the world.

Consequently, industrial growth is strongly

influenced by the value of world CPO prices. Based

on Malaysian data on palm oil, the value of palm oil

prices in the period 2017 to 2018 downward trend,

this reflected in Figure 1.1.

Figure 1.1: Palm Oil Price Graph.

The Indonesian Sharia Stock Index is a stock

index based on Islamic sharia which is included in

the List of Sharia Securities. Based on the

announcement of IDX No. Peng-

00452/BEI.OPP/06-2018 on June 7, 2018. There are

nine companies listed in the Indonesian Sharia Stock

Index which are engaged in the agriculture

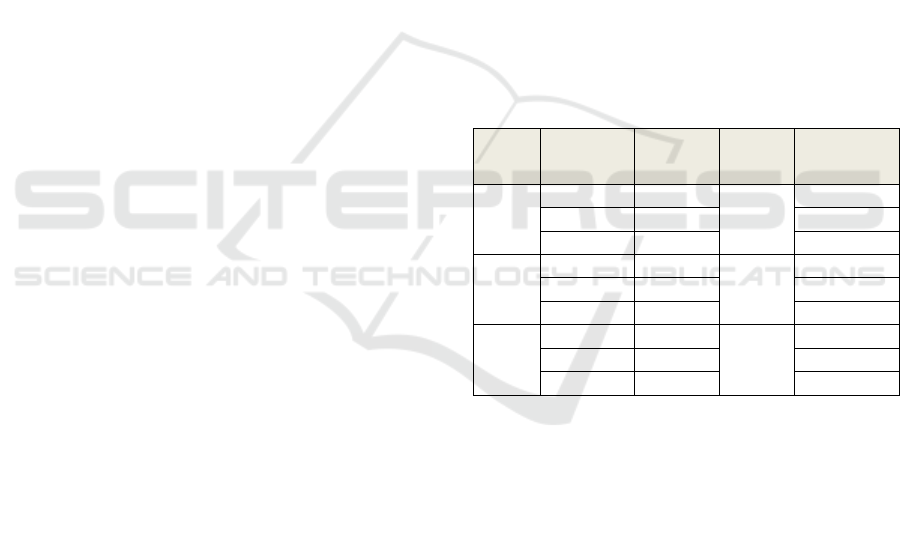

plantation industry consisting of those in Table 1.1.

Figure 1.2: Tren Stock Price ISSI.

Hendrawan, R. and Himawan, E.

Assessing Free Cash Flow to Firm and Relative Valuation Method in Agriculture Plantation Companies Listed in Indonesia Stock Exchange in 2018.

DOI: 10.5220/0008427800850093

In Proceedings of the 2nd International Conference on Inclusive Business in the Changing World (ICIB 2019), pages 85-93

ISBN: 978-989-758-408-4

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All r ights reserved

85

Table 1.1: List of Nine ISSI Shares in 2018.

Nu.

Code

Market Value

m. (IDR)

Equity

b. (IDR)

1

AALI

1,789,776

18,536

2

LSIP

1,621,795

8,122

3

SIMP

474,602

18,181

4

TBLA

177,225

4,000

5

GZCO

91,294

1,538

6

SGRO

42,501

4,005

7

ANJT

26,475

5,316

8

PALM

5,360

1,540

9

MAGP

1,264

754

The fluctuating value of the stock price shown in

designates that stock investment has a value of risk

and return that investors must bear within. This

study took three companies that possess the most

substantial market value and equity as a sample to

project the intrinsic value of the shares of the three

companies namely AALI, SIMP, and SIMP. Tren is

fluctuating stock price, risk and return present

Figure 1.3, Figure 1.4, and Figure 1.5.

Figure 1.3 shows the entire period of January

2013 to June 2018, the value of the stock price of

Astra Agro Lestari Tbk. (AALI) shows a decline,

but when seen in this period it was 13.4% on August

26, 2013, and the risk was -9.8% on February 25,

2016.

Figure 1.4 shows that during the period of January

2013 to June 2018 the value of the stock price of PT.

Salim Ivomas Pratama Tbk. (SIMP) shows a

downward trend, but further, when seen in that

period there is a return of 17.4% on March 1, 2018,

and risk of -10.7% on August 24, 2015

Figure 1.3: Tren Stock Price, Risk, and Return AALI.

Figure 1.4: Tren Stock Price, Risk and Return SIMP.

Figure 1.5: Tren Stock Price, Risk and Return LSIP.

While Figure 1.5 shows from January 2013 to

June 2018 the value of the share price of PT London

Sumatra Indonesia Tbk. (LSIP) shows a downward

trend in the value of shares, but when viewed in this

period it was 18.7% on August 22, 2013, and the

risk was -10.3% on August 19, 2013

Investment in stocks is speculative action as one

must deal with the uncertain value of stock prices in

a particular period of time.

Moreover, misprice might occur anytime.

Investment demands its player to apprehend the

fluctuation of stock prices and the company value.

Therefore, a valuation examination must be

conducted to determine the fair value of a company.

Some researchers conduct evaluations to assess the

fair price of companies.

Fundamental analysis is more relevant for stock

price valuation because it connects indicators

associated with the characteristics and financial

condition of the company, both from the cash flow

condition, risk profile, and even growth potential

due to varied investor's focus areas such as asset

quality, arrangement capital, and equity, even the

future potential of the company (Damodaran, 2006).

A valuation is a tool for analyzing and validating

a company, and an investor must conduct a valuation

in advance so that their decision will be in

accordance with the expected gain.

In conducting such an analysis, several

approaches can be utilized. The first one is used to

determine the intrinsic value of shares by

discounting the company's free cash flow and the

relative valuation method.

Based on the background as mentioned earlier,

assessing the company's intrinsic value included in

the Indonesian Syariah Stock Index is necessary,

especially in the agriculture plantation industry. This

study took three companies that possess the most

substantial market value and equity as a sample to

project the intrinsic value of the shares of the three

companies in the 2018-2022 period. The basis was

2013-2017 financial report historical data, run under

three scenarios: pessimistic, moderate, and

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

86

optimistic; using the DCF-FCFF, RV-PBV, and RV-

PER analysis method.

2. LITERATURE REVIEW

2.1 Valuation on Stock Price

Valuation stock price is a process used to determine

the intrinsic value of a stock. There are two

techniques in evaluating, namely:

a. Fundamental analysis: an analysis that

considers multiple good factors in terms of

company performance, analysis of business

competition, industry analysis, and economic

analysis both macro and micro.

b. Technical analysis: an analysis technique

based on stock price fluctuations in a

particular period.

The purpose of valuation is to find out the value

of shares in overvalued or undervalued conditions,

and in general. Damodaran (2006) stated, there are

three methods of valuation, in between:

1. Discounted cash flow valuation.

2. Relative Valuation.

3. Contingent claim valuation.

2.2 Discount Cash Flow (DCF)

This method is a model that discounts the Free Cash

Flow Firm, Free Cash Flow Equity, and dividend

discounted model (Damodaran, 2006). DCF method

focuses on cash flows generated from the company's

business and operational activities or free cash flow

starting from the assumption that all company

expense reduces company revenues.

2.2.1 Free Cash Flow to Firm

Furthermore Damodaran (2006), that assessing the

most commonly used operating assets is the present

value of the expected free cash flow in the company.

The equation is expressed as follows:

WC (1)

In determining cash flow projections, a terminal

value is used. Damodaran (2006) asserted that

terminal value reflects the current value of the

company from all future cash flows obtained from a

predetermined period time based on the analysis

scenario. The equation is expressed as follows:

(2)

After getting the cash flow value obtained from a

certain period (FCFF scenario) and the Terminal

Value discounted for the present value, the projected

value of the Company is obtained. The equation is

expressed as follows:

(3)

2.2.2 Cost of Capital

Larrabee and Voss (2013) stated that Capital costs

are the average cost of each weighted source with

the proportion of total capital represented.

Therefore, the cost of capital is also referred to as

the weighted average capital cost (WACC).

WACC is one of the most critical factors in

calculating Discounted Cash Flow. Minor changes to

the WACC will result in significant changes in

company value. Weighted Average Cost of Capital

is the composition of the capital structure between

debt and equity. The equation is expressed as

follows:

(4)

2.3 Relative Valuation

The relative valuation method is one of the most

common asset valuation methods used to compare

the value of a company's stock price in the same

industry (Damodaran, 2006). One form of multiples

is price multiples, where the main component of

price multiple is market price, some examples of

price multiples are Price Earning Ratio and Price

Book Value.

2.3.1 Price Book Value

Price to Book Value multiple is defined as market

price per share compared to book value per share,

defined as follows:

(5)

2.3.2 Price Earning Ratio

The Earning Multiple Approach is defined as a

Market price per share compared to Earning per

share, defined as follows:

Assessing Free Cash Flow to Firm and Relative Valuation Method in Agriculture Plantation Companies Listed in Indonesia Stock Exchange

in 2018

87

(6)

2.4 Previous Research

Some researchers assessed supporting this research

as follow:

Zemba and Hendrawan (2018) stated in the

research explained about the business investment

opportunity of the health sub-sector in Indonesia is

still wide open, cause capacity of hospitals in

Indonesia can be served only 3.25% from total

potential patients, there is still has potential market

about 96.75% equivalent with 9,501,350 customers.

Some companies that invest in the health care

business in Indonesia, there are MIKA, SAME,

SILO, and SRAJ, all of which will be evaluated

using DCF and Relative Assessment. This research

is intended to search the fair value of the company.

This assessment reveals how well each company

makes more money in the future. Valid for all

companies, especially those in services such as

hospitals, good ratings are very sensitive, once

customers are exposed to a large scale to an event

that decreases the company's rating then to restore

fair prices takes a long time. Can be seen in a

hospital whose value is undervalued. Perform the

research in the healthcare industry using Discounted

Cash Flow and Relative valuation method, four

companies that were sample namely SAME, SILO,

SRAJ, and MIKA, three companies SAME, SRAJ

and MIKA were overvalued during 2018, and only

SILO shares are undervalued.

Neaxie and Hendrawan (2017) perform study

projection stock price telecommunication companies

2017-2020 stock prices of three telecommunications

companies using the DCF-FCFF method, Relative

valuation PER, PBV, and enterprise multiple

approaches in three scenarios. Results Analysis of

the study using the DCF-FCFF method of the fair

value of shares in the TLKM optimistic scenario,

and EXCL undervalued, ISAT is overvalued; TLKM

moderate scenario, undervalued, ISAT and EXCL

overvalued; The pessimist scenario of TLKM, ISAT

and EXCL are overvalued. While the results using

the Relative valuation method of the TLKM PER

approach, and EXCL is undervalued, ISAT is

overvalued; the TLKM, Overvalued, ISAT, and

EXCL PBV approaches are undervalued; TLKM's

Multiple EBITDA approaches, Overvalued, ISAT,

and EXCL are undervalued.

Renu and Christie (2018) perform a comparison

of these two analysis techniques. From the results of

the study found that fundamental analysis is more

directed at how to find reasons for changes in stock

price movements. The fundamental analysis mainly

depends on the strength of estimates over a period of

time. Most long-term investors care more about the

fundamentals of corporate investment in

fundamental analysis. The disadvantage of

fundamental analysis is that the process of analysis

is complicated and takes a long time which will be

difficult for ordinary people. More importantly,

fundamental analysis cannot predict quantum

movements but only predicts bias in the direction of

stock price movements while technical analysis has

the disadvantage of using efficient market

hypotheses as technical indicators. Predictions use

past stock price trends in valuing markets by

comparing random price distributions conditioned

which serves to estimate price changes. This is very

challenging for an efficient market concept where

prices cannot be predicted in a rational.

Reddy, et al. (2011) show whether the company

adds shareholder value by generating profits

exceeding and above the cost of capital and

measuring the value generated or spent by the

company in reducing the cost of capital from the

return of capital invested using the EVA method.

Based on the results of the research method of

return, the value of the performance measure against

SVA (Shareholder Value add) is EVA 84%, ROCE

45%, RONW 37%, EPS 26%. This analysis states

that EVA is the best measure for measuring

shareholder value.

Gordon (2016) perform research was conducted

to show the discovery of the problem. Therefore this

article was used to re-examine the problem of the

many findings in mortgage financing in developing

countries. The method used is DCF to provide

detailed information about inherent asset values

where mortgage financing can be used optimally.

Based on the results of the study it was found that

using traditional approaches usually did not take into

account variations in cash flows caused by vacancies

(vacancies) or rental revisions. Based on the results

of mathematic calculation assumptions, the value of

property mortgages is ₦12 million and is based on

the cost of ₦32 million with the same

accommodation. However, if you use the DCF

method the actual value is reflected around ₦15

million for the same property.

Ved (2013) in the study it states that although

Discounted Cash is a well-received method lately,

this method may not be suitable in certain cases, for

example in Investment Companies. How can one

assume the dividends to be paid in the future by the

investment company? Moreover, how people can

assume. The assessor must be based on the fact that

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

88

the projections provided by management will

generally be growth-oriented. Therefore, it is

essential for the assessor to understand the risks

involved in achieving specific projections and hence

the discount rate and growth rate need to be chosen.

In some cases, the appraiser can recommend a set of

values and then submit to the relevant parties to

arrive at the transaction price in making a decision.

Foerster and Sapp (2006) discusses how

investors value financial assets by comparing

valuations obtained using fundamental valuation

methods and actual prices for equity during the

period of 1871 to 2005, fundamental valuation

methods require estimation of equity costs at each

time each time, whereas in dividend-based valuation

methods has performed quite well based on the

actual prices for the S & P Composite Index,

especially since 1945. Changes in the way investors

value equity over the past century, found the cost of

equity starting at 7% at the beginning of the century

to almost 11% today. Economic conditions too

explain differences and changes between estimated

costs an estimated cost of equity. The Fed Model,

but this undervaluation decreases over time, and the

Fed Model's predictive ability diminishes when one

considers other factors. We also compare the

estimated cost of equity (based on the CAPM) with

the implied steps of the actual price and dividend

series and can explain the many differences related

to economic conditions.

French (2013) complete This research uses three

valuation approaches including cost, market, and

income. In the income approach, the investment

method looks at the price of an asset that generates

income more than one period of holding an

investment. The cash flow discount (DCF) method

was developed to look at cash flows every three

months that describe the actual revenue from cash

flows. The aim is to provide general changes to the

DCF quarterly model.

The methodology used in this study is to look at the

picture of each quarter of the DCF model. That

based on research with the DCF quarterly model can

be seen to produce estimates of market value

because the use of DCF can be developed and

expanded, so it is useful to be able to do the cash

flow model appropriately.

3. THEORETICAL FRAMEWORK

The theoretical framework presented as figure 3.1.

The Indonesian Sharia Stock Index is a part of

the Indonesia Stock Exchange which is a sharia-

based stock index, the value of a fluctuating stock

price in the stock exchange is determined by the sell

(bid) and buy (demand) mechanism. Stock prices are

one of the important considerations when investing,

sentiment and information factors cause stock prices

to fluctuate, and consequently, it is difficult to

predict the value of stock prices in the future which

can cause mispriced. A valuation is a tool in

analyzing, evaluating and validating a company to

obtain intrinsic value based on

Value of the Firm

Value of the Firm

Valuation of intrinsic value

Valuation of intrinsic value

Relative Valuation Method

Relative Valuation Method

Market Price

Market Price

Sell/hold/buy

Sell/hold/buy

Undervalued

Undervalued

Fair

Fair

Overvalued

Overvalued

Discounted Cash Flow

Method

Discounted Cash Flow

Method

Free Cash Flow to Firm

Free Cash Flow to Firm

Price per Share

Price per Share

PER/PBV value

PER/PBV value

PBV

PBV

PER

PER

Optimistic

Scenario

Optimistic

Scenario

Moderat

Scenario

Moderat

Scenario

Pesimistic

Scenario

Pesimistic

Scenario

Optimistic

Scenario

Optimistic

Scenario

Moderat

Scenario

Moderat

Scenario

Pesimistic

Scenario

Pesimistic

Scenario

Average Industry

Average Industry

Under

Under

Over

Over

Sell/hold/buy

Sell/hold/buy

IDX 2018

IDX 2018

Indonesia Stock Exchange

Indonesian Syariah Stock Index

(AALI, LSIP, SIMP)

Indonesia Stock Exchange

Indonesian Syariah Stock Index

(AALI, LSIP, SIMP)

Figure 3.1: Frameworks.

the company's fundamentals. This valuation basis is

based on the assumption of the company's condition

in the future by using company historical data for

five years 2013-2017 as a basis for projecting the

period of 2018-2022.

The next process is the determination of

valuation values based on the DCF-FCFF method,

RV-PBV, and RV-PER. The projection of

determining the future cash flow is based on

assumptions using three scenarios of conditions,

namely pessimistic, moderate and optimistic. A

pessimistic scenario is a scenario that assumes that a

company's growth rate is below the growth of

industrial figures, a moderate scenario assumes that

conditions are very likely to be seen from the

company's fundamental figures and optimistic

scenario is a scenario that assumes that the

company's growth rate is above the growth of

industrial figures. The results of the analysis using

Assessing Free Cash Flow to Firm and Relative Valuation Method in Agriculture Plantation Companies Listed in Indonesia Stock Exchange

in 2018

89

the DCF-FCFF method will get intrinsic Price per

share while using RV-PBV and RV-PER will

produce a Price per share value based on equity and

earnings per share.

Based on the description of the information in the

previous article above, the researcher defines the

research as follows:

1. Identifying the intrinsic value of AALI, SIMP

and LSIP stock prices using the Discounted

Cash Flow Method Free Cash Flow to Firm

approach and comparing the Relative

Valuation method with the industry value in

the pessimistic scenario.

2. Identifying the intrinsic value of AALI, SIMP

and LSIP stock prices using the Discounted

Cash Flow Method Free Cash Flow to Firm

approach and comparing the Relative

Valuation method with the industry value in a

moderate scenario

3. Identifying the intrinsic value of AALI, SIMP

and LSIP stock prices using the Discounted

Cash Flow Method Free Cash Flow to Firm

approach and compare the Relative Valuation

method with the industry value in an

optimistic scenario.

4. Provide recommendations from results

analysis the intrinsic value of AALI, SIMP

and LSIP stock prices to investors based on

the Discounted Cash Flow Method Free Cash

Flow to Firm approach and Relative

Valuation method with the industry value in a

pessimistic, moderate and optimistic

scenario.

Based on the phenomena and conditions

described above, the purpose of this study is to find

the fair price of three agriculture-plantation

industrial companies listed on the Indonesia Stock

Exchange using the Discounted Cash Flow (DCF)

method with the Flow to Firm (FCFF) Free Cash

approach and Relative valuation method with Price

to Earning Ratio (PER) and Price Book Value

(PBV) approaches

4. METHODS

This type of research is verificative research with

quantitative methods, aimed at explaining the

existing phenomena by using numbers, namely

valuation to obtain intrinsic value of shares of

companies engaged in the Agriculture plantation

industry listed in the Sharia Stock Index Indonesia

using the Discounted Cash Flow method Free Cash

Flow to Firm approach and Relative Valuation with

the Price Book Value and Price Earning Ratio

approach.

5. DISCUSSION

This discussion reviews the results of research

obtained from each company using the Discounted

Cash Flow Method Free Cash Flow to Firm and

Relative Valuation with the Price Book Value and

Price to Earning Ratio approaches in three scenarios,

namely the pessimistic scenario, moderate scenario,

and scenario optimistic.

5.1 Results of Discount Cash Flow

Method Calculation

The results of a calculation, processing, and analysis

of overall stock valuation data based on the

Discounted Cash Flow Method Free Cash Flow to

Firm approach are shown in Table 5.1.1 below:

Table 5.1.1: DCF-FCFF Intrinsic Value.

Code

Scenario

Intrinsic

Value

Market

price 2

Jan’18

Condition

AALI

Pessimistic

6.135

13.275

Overvalued

Moderate

8.166

Overvalued

Optimistic

11.299

Overvalued

SIMP

Pessimistic

897

625

Undervalued

Moderate

1.039

Undervalued

Optimistic

1.120

Undervalued

LSIP

Pessimistic

669

2.425

Overvalued

Moderate

684

Overvalued

Optimistic

713

Overvalued

Source: calculations of researchers

The results of the study using Discounted Cash

Flow Free Cash Flow to Firm approach presented in

Table 5.1.1 obtained the intrinsic value of shares for

AALI, SIMP and LSIP companies using a

pessimistic, moderate and optimistic scenario. The

intrinsic value of the research if compared with the

market share price on January 2, 2018, the condition

of AALI and LSIP shares are overvalued. The

intrinsic value obtained from the AALI stock price

research in the pessimistic scenario was Rp. 6,135,

moderate scenario Rp. 8,166, optimistic scenario of

Rp. 11,299, the value is lower than the market share

value on January 2, 2018, which closes with the

value of AALI's shares of Rp. 13,275. Likewise, for

the intrinsic value of LSIP shares in a pessimistic

scenario as much as Rp. 669, moderate scenario Rp.

684, optimistic scenario Rp. 713, the intrinsic value

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

90

is lower than the market share value on January 2,

2018, which closes with the value of LSIP shares of

Rp. 2,425. While for SIMP shares the condition is

undervalued in the pessimistic, moderate and

optimistic scenario. The intrinsic value obtained in

the research process is higher than the market share

value on January 2, 2019, which closes with the

value of SIMP shares of Rp. 625, whereas based on

the results of the research the intrinsic value of

SIMP shares in the condition of the pessimistic

scenario is Rp. 897, moderate scenario Rp. 1,039,

optimistic scenario Rp. 1,120.

5.2 Results of Calculation of the

Relative Valuation Method

In research using the relative valuation method with

the PBV and PER approaches, based on the results

of the calculation, processing, and analysis of the

overall data, the stock valuation values obtained are

presented in Table 5.2.1.

Table 5.2.1 is the result of relative valuation with

PBV and PER approaches AALI, SIMP, and LSIP

companies with a pessimistic, moderate and

optimistic scenario.

Based on IDX 1st Quarter 2018 data, the range

of PBV is 3.33 - 0.26 times, PBV value 3.33 times at

Sumber Mas Sarana Palm Oil Company (SSMS),

PBV value 0.26 times at Gozco Plantation Tbk

(GZCO) and for the average industry PBV is 1.14

times. While the PER value range is 31.28 - 52.18

times, PER value 31.28 times at Provident Agro Tbk

(PALM), PER -52.18 times at Multi Agro Gemilang

Plantation Tbk (MAGP) and for the average industry

PER is 1.41 times

The results showed that the PBV value of these

three companies when compared with IDX 1st

Quarter 2018, designated that the value of PBV and

PER AALI, SIMP and LSIP were still included in

the Industry value range.

PBV is the company's equity value. PBV can be

defined as stock prices compared to equity values

per share. It can be calculated by dividing the stock

price by Book Value, where the Book Value is

generated from equity divided by the average

number of shares outstanding. The higher the PBV

value, the more delta between the stock price and the

actual value. In the case of PBV analysis on the

agriculture plantation company, the analysis results

that stated that the lowest PBV value of the three

companies studied was LSIP company worth 0.56

times, which means that the value of the shares is

0.56 times compared to the book value.

Table 5.2.1: RV-PBV and RV-PER Intrinsic Value.

Code

Scenario

PBV

PER

AALI

Pessimistic

0,6370

5,08

Moderate

0,8479

5,88

Optimistic

1,1732

7,97

SIMP

Pessimistic

0,7801

9,01

Moderate

0,9035

9,46

Optimistic

0,9742

10,00

LSIP

Pessimistic

0,5624

5,70

Moderate

0,5743

5,77

Optimistic

0,5991

5,91

Source: calculations of researchers

PER is the most basic benchmark in fundamental

stock analysis. Simply stated, PER is a comparison

between the stock price and the company's net profit,

where the price of an issuer's stock is compared to

the net profit generated by the issuer in a year.

Because the focus of the calculation is the net profit

generated by the company, by knowing the PER of

an issuer, investors can find out whether the price of

a stock is reasonable or not. PER is generated by

dividing the stock price by earnings per share of the

company. Based on the research data, the highest

PER is SIMP shares which is equal to 10 times,

meaning that the intrinsic price of SIMP shares is ten

times greater than the company's net profit per share.

6. CONCLUSION

The valuation results are based on technical analysis

by considering fundamental matters, using standard

formulas in valuation science, so that it is concluded:

1. In the pessimistic scenario, the intrinsic value of

the shares of an agriculture plantation company

listed on the Indonesia Stock Exchange using

Discounted Cash Flow method for AALI is

overvalued because of the market price on

January 2, 2018, Rp. 13,275 is higher when

compared to the intrinsic value obtained from the

research results of Rp. 6,135, for SIMP are in an

undervalued condition due to market prices on

January 2, 2018, Rp. 625 is lower than the

intrinsic value that has been calculated at Rp.

875, while LSIP is overvalued because of the

market price on January 2, 2018, Rp. 2,425 is

higher than the intrinsic value that has been

calculated at Rp. 669.

Based on calculations using the Relative

Valuation method of the Price Book Value

Assessing Free Cash Flow to Firm and Relative Valuation Method in Agriculture Plantation Companies Listed in Indonesia Stock Exchange

in 2018

91

approach, the value of the three companies <1.14

(average industry), namely AALI has a value of

0.64 times, SIMP 0.78 times, and LSIP 0.56

times. Whereas with the Price Earning Ratio

approach, the value of the three companies> 1.41

(average industry), namely PER AALI has a

value of 5.08 times, SIMP of 9.01 times, and

LSIP of 5.7 times. The PBV and PER values in

the range industry based on IDX 1st Quarter

2018 data.

2. In the moderate scenario, the intrinsic value of

the shares of the agriculture plantation company

listed on the Indonesia Stock Exchange using the

Discounted Cash Flow method for AALI is

overvalued because the market price on January

2, 2018 Rp 13,275 is higher than the intrinsic

value obtained from the results of research Rp

8,166, for SIMP are in an undervalued condition

due to market prices on January 2, 2018 Rp 625

is lower than the intrinsic value that has been

calculated at Rp. 1,039, while for LSIP is

overvalued because of the market price on

January 2, 2018, Rp. 2,425 is higher than the

intrinsic value calculated at Rp. 684.

Based on calculations using the Relative

Valuation method of the Price Book Value

approach, the value of the three companies <1.14

(average industry), namely AALI has a value of

0.85 times, SIMP 0.90 times, and LSIP 0.57

times. Whereas with the Price Earning Ratio

approach, the value of the three companies> 1.41

(average industry), namely PER AALI has a

value of 5.88 times, SIMP of 9.46 times and

LSIP of 5.77 times. The PBV and PER values in

the range industry based on IDX 1st Quarter

2018 data.

3. In the optimistic scenario, the intrinsic value of

the shares of an agriculture plantation company

listed on the Indonesia Stock Exchange using the

Discounted Cash Flow method, for AALI is

overvalued because of the market price on

January 2, 2018, Rp. 13,275 is higher when

compared to the intrinsic value obtained from the

research results of Rp. 11,299, for SIMP it is in

an undervalued condition due to market prices on

January 2, 2018, Rp. 625 is lower than the

intrinsic value that has been calculated at Rp.

1,120, while for LSIP it is overvalued because of

the market price on January 2, 2018, Rp. 2,425 is

higher than the intrinsic value that has been

calculated at Rp. 713.

Based on calculations using the Relative

Valuation method of the Price Book Value

approach, AALI has a value of 1.17 times> 1.14

(average industry), for SIMP 0.97 times and

LSIP 0.60 times <1.14 (average industry).

Whereas with Price Earning Ratio approach, the

value of the three companies> 1.41 (average

industry), namely PER AALI has a value of 7.97

times, SIMP of 10 times, and LSIP of 5.91 times.

The PBV and PER values in the range industry

based on IDX 1st Quarter 2018 data.

4. The recommended intrinsic value of the

calculation results is in the pessimistic, moderate

and optimistic scenario with the DCF method of

AALI and LSIP shares being "sell", and SIMP

shares "buy", while based on AALI, SIMP, LSIP

relative valuations are worth buying or

maintained if investors have owned its shares

because its value is still in the industrial range

and is included in the category of good

performance.

7. FUTURE SCOPE

This study only 5-year history data, it is expected

that for the next research to improve the accuracy

and validity of the data valuation, you should use

longer history data, such as history for 10 years and

can combine by adding contingent claim method.

For investors in investing stock price agriculture

plantation industry, in addition to using the results of

assessments as a basis for reference in decision

making, they should also look at the business,

economic and social political conditions of the

country concerned. Indonesia is the produces the

largest crude palm oil in the world, and the value

palm oil prices greatly affect the price of the

industrial stock. Related to this, in the agriculture

industry we must pay attention to the conditions and

regulations in the largest consumer countries of

CPO, other vegetable oil prices, and attention to

issue environmental sustainability, which is the

phenomena can affect the selling price of CPO.

REFERENCES

Damodaran, A., 2006. Security Analysis for Investment

and Corporate finance. Second ed. New Jersey: John

Wiley & Sons, Inc.

Foerster, S. R. & Sapp, S. G., 2006. Dividends and Stock

Valuation: A Study From the Nineteenth to the

Twenty-First Century. JEL .

French, N., 2013. The discounted cash flow model for

property valuations: quarterly cash flows. Journal of

Property Investment & Finance, 31(2), pp. 208-213.

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

92

Gordon, S., 2016. Diversifying Valuation Skills:

Discounted Cash Flow Imperatives For Sustainable

Mortgage Finance In An Emerging Market. IDC

International Journal, 3(3), pp. 1-24.

Larrabee, D. T. & Voss, J. A., 2013. Discounted Cash

Flow, Earnings Quality, Measures of Value Added,

and Real Options. VALUATION TECHNIQUES ed.

Hoboken, New Jersey.: John Wiley & Sons, Inc.

Neaxie, L. V. & Hendrawan, R., 2017. Stock Valuations in

Telecommunication Firms: Evidence from Indonesia

Stock Exchange. Journal of Economic and

Management Perspectives, 11(3).

Reddy, N. R. V. R., Rajesh, M. & Reddy, T. N., 2011.

Valuation through EVA and Traditional Measures an

Empirical Study. International Journal of Trade,

Economics and Finance, 2(1), pp. 19-23.

Renu, R. I. & Christie, P., 2018. Fundamental Analysis

Versus Technical Analysis-a Comparative Review.

International Journal of Recent Scientific Research,

9(1), pp. 23009-23013.

Ved, C. P., 2013. Valuation using Discounted Cash Flow

Method. The Chamber's Journal, Volume IX, pp. 8-

11.

Zemba, S. & Hendrawan, R., 2018. Does Rapidly

Growing Revenues Always Produce An Excellent

Company’s Value? DCF & P/E Valuation Assessment

on Hospital Industry. ISSN e-Proceeding of

Management, 5(2), pp. 2045-2060.

Assessing Free Cash Flow to Firm and Relative Valuation Method in Agriculture Plantation Companies Listed in Indonesia Stock Exchange

in 2018

93