Share Valuation of Indonesian Regional Development Bank using

Free Cash Flow to Equity and Relative Valuation Methods

Riko Hendrawan, Niken Susilowati and Farida T. Kristanti

Magister Management, Telkom University, Jalan Gegerkalong Hilir, Bandung, Indonesia

Keywords: Valuation, Bank, DCF-FCFE, Relative Valuation, Indonesia Stock Exchange.

Abstract: The Indonesian Regional Development Banks established to help economic equality for all regions in

Indonesia, and most of them face limited capital. The purpose of this research is to determine the fair value

of Listed Regional Development Banks in IDX in 2018, using Discounted Cash Flow with FCFE approach

and validate the result using relative valuation methods with PER and PBV approach. The sample of this

research are BJBR, BJTM, and BEKS. Financial historical data from the last five years, since 2013 to 2017

as a basic reference for the projection from 2018 to 2022, involving pessimistic, moderate and optimistic

scenario and the value is compared with market price on January 2, 2018. Results of this research indicate

that using FCFE valuation, BJBR and BJTM has overvalued in all scenarios, while for BEKS has

undervalued in all scenarios. In relative valuation method within PER and PBV approach showed PER and

PBV of all sample this research is within the industry range means the result of the calculation is proper,

except PBV for BEKS in the moderate and optimistic scenario but not significant. The conclusion of this

research is to recommend selling shares BJBR and BJTM, and buying BEKS shares.

1 INTRODUCTION

The Regional Development Banks or Bank

Pembangunan Daerah (BPD) were established with

the aim of helping equitable development in all

regions in Indonesia. BPDs have a significant

function and role in the context of regional

economic development because BPDs are expected

to be able to provide services in areas where it is

economically impossible for private banks to

provide funds for the implementation of regional

development.

Based on the Regulation of Financial Services

Authority (OJK) No. 6/POJK.03/2016, banks can be

grouped into 4 (four) BOOK categories, namely:

BOOK 1 (main capital up to less than IDR 1

trillion), BOOK 2 (main capital IDR 1 trillion to less

than IDR 5 trillion), BOOK 3 (main capital of IDR 5

trillion to less than IDR 30 trillion), and BOOK 4

(main capital of at least IDR 30 trillion).

Most BPDs in Indonesia face limited capital.

Only 3 out of 27 BPDs are categorized as BOOK 3,

the rest are only in BUKU 1 or BUKU 2 categories.

Capital is an unavoidable need because banking

expansion is highly influenced by its main capital.

The capital market is an absolutely strategic place

for industries, including banks, to obtain

funding/long-term capital. This funding also

welcomes the BPDs. However, it was found in

September 2018 that only 3 of the 27 BPDs in

Indonesia had listed their shares on the IDX,

namely: PT Bank Pembangunan Daerah Jawa Barat

dan Banten Tbk (BJBR), PT Bank Pembangunan

Daerah Jawa Timur Tbk (BJTM) and PT Bank

Pembangunan Daerah Banten Tbk (BEKS).

A company will be able to attract and/or retain

investors by continuously creating and realizing the

value of the company. Investors expect the

investment value to increase or at least it will have

the same value as the risk compensation by

considering the time value of the invested money.

According to Damodaran (2012), valuation is a

relatively simple process to discount the company's

free cash flow projections with the rate of return

expected by the investors. Valuation of public

companies whose shares are listed on the stock

exchange is much easier than closed companies. The

value of a company listed on the stock exchange can

be reflected in its stock price movements. Therefore,

the object of this research is three BPDs listed on the

Indonesia Stock Exchange (IDX), namely: BJBR,

BJTM, and BEKS.

94

Hendrawan, R., Susilowati, N. and Kristanti, F.

Share Valuation of Indonesian Regional Development Bank using Free Cash Flow to Equity and Relative Valuation Methods.

DOI: 10.5220/0008427900940105

In Proceedings of the 2nd International Conference on Inclusive Business in the Changing World (ICIB 2019), pages 94-105

ISBN: 978-989-758-408-4

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

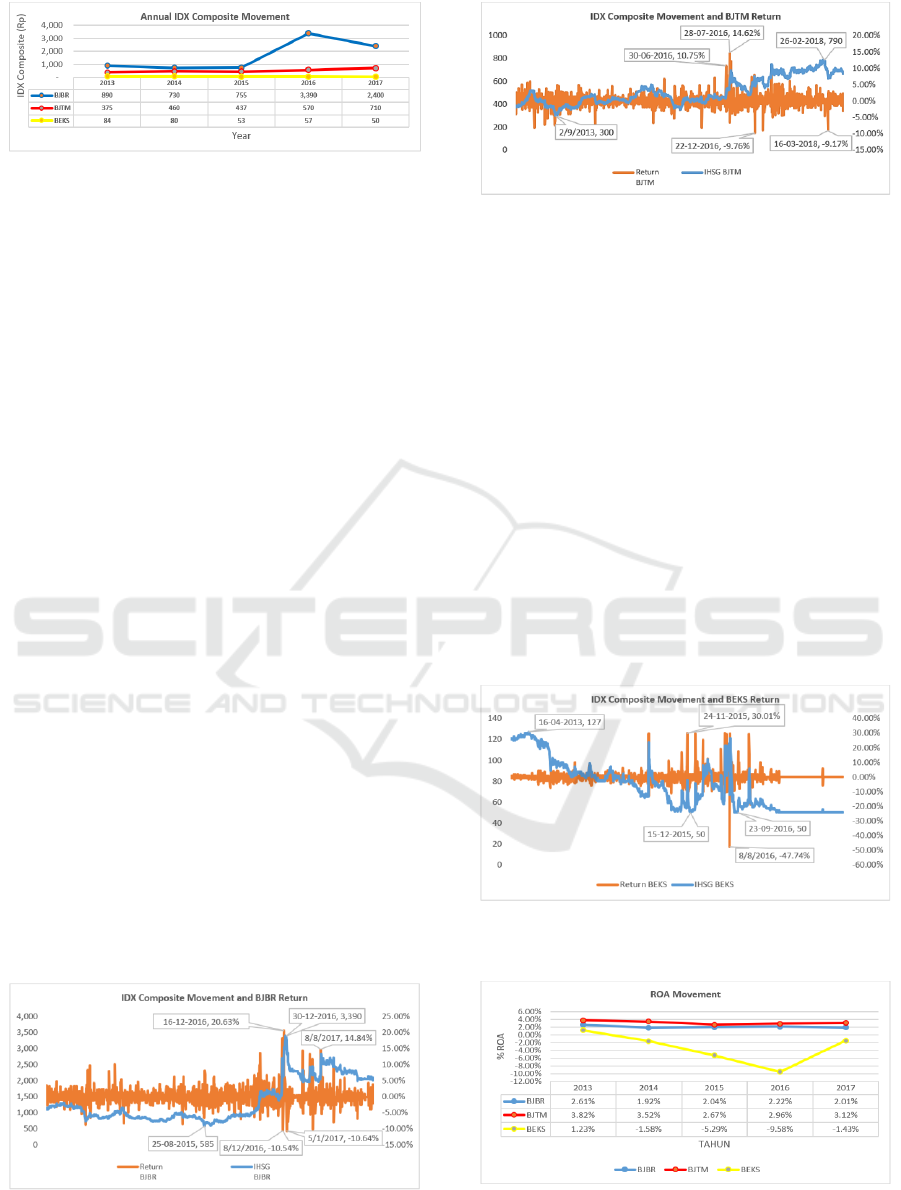

Figure 1: Annual IDX Composite Movement, period 2013

– 2017.

According to Damodaran (2012), the value of a

company or an investment instrument depends on

future cash flows that will be received or obtained

from the investment instrument. Based on data from

the IDX Composite Stock Price Index (IHSG) on

December 31, the data of three BPDs for the last five

years (2013 - 2017) are presented in Figure 1.

Based on Figure 1, throughout 2013 - 2017, the

IDX Composite for BJBR shares showed an

increasing trend with the highest point value of

3,390.00 IDR on December 31, 2016. However, on

December 31, 2017, it had a significant decline from

the previous year of 990.00 IDR (2,400 IDR-

3,390.00 IDR). Meanwhile, IDX Composite from

BJTM had an insignificant increasing trend until

December 31, 2017, which only amounted to

335.00 IDR (710.00 IDR-375.00 IDR) since the end

of 2013. On the other hand, BEKS IDX Composite

tended to have a downward trend from year to year,

with the lowest point taking place on December 31,

2017, with a value of 50.00 IDR.

Figure 2 shows the movement of BJBR shares

throughout January 2013 to June 2018, in which the

highest price of 3,390.00 IDR occurred on

December 30, 2016, and the lowest price of 585.00

IDR occurred on August 25, 2015. The highest

return 20.63% occurred on December 16, 2016, and

the lowest return of -10.64% occurred on January 5,

2017.

Figure 3 shows the movement of BJTM shares

from January 2013 to June 2018, in which the

highest price is 790.00 IDR which occurred on

Figure 2: IDX Composite Movement and BJBR Return of

BJBR, the period of January 2013 to June 2018.

Figure 3: Composite Index Movement and BJTM Return,

the period of January 2013 to June 2018.

February 26, 2018, and the lowest price is 300.00

IDR which occurred on September 2, 2013.

Meanwhile, the highest return of 14.62% occurred

on July 28, 2016, and the lowest return of -9.76%

occurred on December 22, 2016.

Figure 4 shows the movement of BEKS shares

from January 2013 to June 2018, in which the

highest price was 127.00 IDR on April 16, 2013, and

the lowest price was 50.00 IDR on December 15,

2015, and September 23, 2016. Meanwhile, the

highest return of 30.01% occurred on November 24,

2015, and the lowest return of -47.74% occurred on

August 8, 2016.

Financial ratio data in the form of Return on

Assets (ROA) and Return on Equity (ROE) listed in

the audited financial statements of the PT West Java

and Banten Regional Development Bank Tbk

Figure 4: Composite Index Movement and BEKS Return,

the period of January 2013 to June 2018.

Figure 5: Return on Assets (ROA) Movement from 2013

to 2017.

Share Valuation of Indonesian Regional Development Bank using Free Cash Flow to Equity and Relative Valuation Methods

95

(BJBR), PT East Java Regional Development Bank

Tbk (BJTM), and PT Banten Regional Development

Bank Tbk (BEKS) for the last 5 years (2013 to

2017) is presented in Figure 5 and Figure 6.

Based on Figure 5 and Figure 6, it can be seen

that from 2013 to 2017, BJBR’s ROA and ROE

tended to decrease, namely: 2.61% (ROA) in 2013

to 2.01% in 2017 and 26.76 % (ROE) in 2013 to

20.05% in 2017. A similar trend also occurred with

BJTM's ROA and ROE, namely: 3.82% (ROA) in

2013 to 3.12% in 2017, and 19.04% (ROE) in 2013

to 17.43% in 2017. Meanwhile, BEKS's ROA and

ROE showed a dramatic decline from 1.23% (ROA)

in 2013 to -9.58% in 2016, and -14.44% (ROE) in

2013 to -83, 76% in 2016. In 2017, the BEKS’s

ROA and ROE had a significant increase to -1.43%

(ROA) and -15.43% (ROE). However, the value of

BEKS’s ROA and ROE is still negative. A negative

value on ROA indicates that BEKS is in a loss

condition. While the negative value on ROE

describes that BEKS is not able to manage capital

efficiently to generate and increase revenue.

Another financial ratio used as the research

background is the variable Earning Per Share (EPS).

EPS is part of the company's profits allocated to

each outstanding share. Earnings per share or EPS

are the most widely used indicators to assess the

profitability of a company. Based on EPS data listed

in the audited financial statements of the BJBR,

BJTM and BEKS for the last 5 (five) years (2013 to

2017) are presented in Figure 7.

Based on Figure 7, it can be seen that throughout

the period 2013 to 2017, the movement of EPS

values for BJBR fluctuated and decreased in 2017 to

125.00 IDR/share when compared to 2013, which

was 141.59 IDR/share. Likewise, the value of

BEKS’s EPS decreased in 2017 to -1.19 IDR/share,

from 8.95 IDR/share in 2013. Meanwhile, in 2017,

the value of BJTM’s EPS tended to increase by

22.25 IDR/share (77.51 IDR - 55.26 IDR) when

compared to 2013 which was only 55.26 IDR/share.

Figure 6: Return on Equity (ROE) Movement in the period

from 2013 to 2017.

Figure 7: Earning Per Share (EPS) Movement from 2013

to 2017.

Research on the valuation of intrinsic stock value

was carried out by several previous researchers. The

results of previous studies indicated that intrinsic

shares in the market using several valuation methods

could provide different conditions that are

overvalued or undervalued. The research also

showed that stock prices in the market do not

necessarily reflect their fair value (intrinsic), as

stated by:

Gupta (2019) researched assessment companies

in three sectors: car, banking, and steel, use simple

linear regression, taking into account economic,

fiscal and financial policies. This research was

carried out by applying regularization machine

learning techniques. Ridge regression, ASSO, and

clean elastic techniques are used to underline these

similarities multiples of assessment. This regulator

was tested on Indian data listed companies that

cover twelve years from TA 07 to TA 2018 and four

multiples identified for research are 1) prices for

income (P/E), 2) prices for sales (P/S), 3 before the

interest tax depreciation before the firm's value of

profit and amortization price (EV/EBIDTA) and 4)

to book value (P/BV). The findings are based on

square root errors and learning curves, which

strengthens the least predictive error at P/S for the

automotive sector, EV/EBIDTA for the steel sector

and P/BV for the banking sector. The conclusion is

that specific sets of variables can be used to assess

effectively company valuation (multiple

assessments). This research contributes to market

literature that emerges by evaluating key multiples

that drive the sector to apply non-traditional

regression techniques.

Zemba and Hendrawan (2018) discuss valuations

in the healthcare sector where opportunities for

investment in the health sub-sector business in

Indonesia are still wide open, especially in the

hospital business. There are not many choices for

hospital business investment in Indonesia, and there

are only four issuers, MIKA, SAME, SILO, SRAJ.

The four will be evaluated using DCF and Relative

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

96

Evaluation, to find out the fair value. This fair value

becomes essential when investors want to execute

investment decisions, which indeed they do not want

to buy shares if the price is too high, also worrying if

buying shares whose prices have dropped. Too low

(undervalued) or too expensive (overvalued) the

price of a stock, of course, there must be a

comparison price called fair value, and this study

aims to find the fair price in question. Financial

report data is collected from the four issuers during

the five years of the 2013-2017 period as building

materials for assumptions, calculated by the ratio of

income and costs - the cost is prioritized using

geometric means, if not possible then use arithmetic.

The result is to make the next five years projection

for the period 2018-2022. The projection aims to

explore the potential of free cash flows that can be

generated by the company, that is the basis of the

valuation of the DCF method. Unfortunately, three

out of four issuers always suffer losses, let alone

having the remaining free cash flow, to finance

operations in the years that are running even though

they rely on debt. If this is the case, the DCF method

is no longer relevant because the equity value is

negative, the impact of the PER is also negative.

This makes it difficult to analyze because the stock

price is the slightest if the PER and FCFF are

negative, the valuation is overvalued. Only MIKA

whose financial performance can be processed

according to the rules of valuation theory. In the

optimistic scenario, moderate, pessimistic has been

designed, MIKA does not have a significant

difference in analysis results, all scenarios led to

overvaluation from the perspective of DCF and

undervalued when using Relative Valuation.

Aydin (2017), researched with the aim of

examining various valuation methods that can be

used as considerations in conducting mergers and

acquisitions, focusing on weaknesses and strengths.

The main focus of this study is that the DCF method

uses several scenarios, namely: pessimistic,

moderate and optimistic, to reduce estimation errors.

The researcher suggested that in carrying out

mergers and acquisitions must use many valuation

methods and give weight to each method taking into

account the conditions of the company, state, and

market.

Neaxie and Hendrawan (2017), research with the

aim of estimating the fair price valuation of

telecommunications companies listed on the Stock

Exchange using the Discounted Cash Flow (DCF)

method with the approach of Free Cash Flow to

Firm (FCFF) and Relative Value. The results of the

study indicated that by using the DCF method of the

FCFF approach on an optimistic scenario, the fair

value of TLKM was undervalued, the fair value of

ISAT was in overvalued conditions, and the EXCL

fair value was in an undervalued condition. In the

moderate scenario, TLKM's fair value was

undervalued, ISAT's fair value was overvalued, and

EXCL's fair value was overvalued. In the pessimistic

scenario, TLKM's fair value was overvalued, ISAT's

fair value was overvalued, and EXCL's fair value

was overvalued. Meanwhile, using relative valuation

with the PER approach, TLKM's fair value was

undervalued, ISAT's fair value was overvalued, and

EXCL's fair value was undervalued. Then, with the

PBV approach, TLKM's fair value was in an

overvalued condition, ISAT's fair value was in an

overvalued condition, and EXCL's fair value was in

an undervalued condition. Furthermore, with

multiple EBITDA approaches, TLKM's fair value

was in an overvalued condition, ISAT's fair value

was in an undervalued condition, and EXCL's fair

value was undervalued.

Vuuren (2016) conducted a study to assess

property companies using the DCF profit method.

This study highlights the advantages and

disadvantages of the DCF profit method as a review

of the 1-year capitalization technique and the cost

approach. In both cases, the DCF profit method is

considered superior. Three particular improvements

for DCF's profit method is: The first is that business

revenue must be estimated based on a weighted

probability approach which will reduce Alpha

requirements in the WACC calculation. The second

is to potentially adopt a combined aggregate and

valuation approach in Indonesia determining

hypothetical rent solutions which are always

debatable points in practice. By converting leasing

the market from similar properties, increasing

subject, factories, and machinery business income to

a measurement unit per square meter, it is possible

to anchor and combine hypothetical rent separation

percentage. The third is an increase in the

determination in the capitalization formula

approach. When determined, it must be done by

multiplying hypothetical rent separation from

income the level of business growth or other income

growth rates depends on the financial model

business.

Kramna (2014), conducted a study to determine

the main factors in discounted cash flow assessment,

using sensitivity analysis. This is important in

business valuation, not only because of mergers and

trends acquisition but also related to the

identification of sources of economic value creation.

The results show that growth rates remain and the

Share Valuation of Indonesian Regional Development Bank using Free Cash Flow to Equity and Relative Valuation Methods

97

weighted average cost of capital is a very important

input in company rating. While the aspect of the

exchange rate only has a small impact on the value

of the company. Noteworthy is the estimation of

lasting growth the level must be in a reasonable

range, taking into account the nominal GDP growth

rate

country.

Gottwald (2012), researched with the aim of

evaluating stocks in investment decisions using the

P/E ratio method. This ratio is used in the

framework of the fundamental analysis profit model.

In realization empirical analysis, tests selected and

index determinations used for statistical assessment

of the relationship between the P/E ratio and stock

price. Based on the results indicate that the P/E ratio

method is suitable for many investors in conducting

financial analysis, assessing the fair / intrinsic price

of shares, and investing.

Kahneman (1990), conducted a study with a

Contingency Assessment Method (CVM) to

examine the proposition that CVM results are

susceptible to embedding effects that can make most

of them arbitrary and consequently useless for

practical purposes and to advance interpretations of

what insiders do answer CVM questions. The main

result of the first study is that willingness to pay is

almost the same for narrowly defined goods

(equipment and rescue personnel) and for categories

that are far more inclusive (all disaster preparedness,

or even all environmental services).

Correspondingly, the values specified for more

specific items vary in the order of magnitude

depending on the depth of insertion in the category

that the PAPs were initially assessed. This result

seems to cancel the basic assumption of CVM: that

standard value theory applies to the steps obtained

by this method. Because the choice of inclusion

structure is arbitrary, the estimated value obtained

from the CVM survey will change.

The equation of several previous studies and this

research is that they both conduct a calculation

analysis on the intrinsic value of stock prices.

Whereas, the difference is in the object of research

and the method/approach used.

According to Damodaran (2012), in general,

there are three approaches to valuing an asset,

namely: Discounted Cash Flow (DCF) Valuation,

Relative Valuation, and Contingent Claim

Valuation. Each of the three approaches has a

variety of different valuation approaches.

Based on the phenomenon where there is a

fluctuating stock price of banking sector companies

in Indonesia from year to year, and there is a

significant return value at a certain period and from

the results of previous studies which show that stock

prices do not reflect the actual value (intrinsic

value), the researcher intends to conduct research on

the valuation of fair prices (intrinsic value) from the

shares of BJBR, BJTM and BEKS using the

Discounted Cash Flow (DCF) method with the Flow

to Equity (FCFE) approach and methods Relative

Valuation with Price to Earning Ratio (PER)

approach and Price Book Value (PBV) in an

optimistic, moderate and pessimistic scenario.

2 LITERATURE REVIEW

2.1 Valuation

According to Damodaran (2012), valuations play a

crucial role in many financial fields, both in

corporate finance, in mergers and acquisitions, and

portfolio management. The value of a company is

influenced by business conditions, both macro

conditions and micro conditions of the company.

Macro conditions, among others: the political,

economic, and social conditions of the country

where the company conducts business activities.

While micro conditions are the industrial conditions

of the company. In general, there are 3 (three)

approaches to valuing an asset, namely: Discounted

Cash Flow (DCF) Valuation, Relative Valuation,

and Contingent Claim Valuation.

2.2 Value of The Firm

Company value is an investor's perception of the

level of success of a company in managing its

current resources, linked to the company's stock

price. Demand and offers from investors influence

the formation of stock prices. High stock prices

make the value of the company high, and it can

increase market confidence not only in the

company's current performance but also in the

company's prospects in the future. Nevertheless, the

stock price in the market does not necessarily reflect

the real price of the company.

2.3 Method of Discounted Cash Flow

Evaluation

Discounted Cash Flow (DCF) method is a stock

valuation method using the time value of money

concept (Damodaran, 2012). The theory used as the

basis of this method is the fair value of shares

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

98

(present value) which is all money flowing in the

company in the future (future value) when

discounted

The DCF valuation method has 3 (three)

variations in the calculation approach that can be

used to analyze stock prices according to the needs

of each analysis. The three variations are (1)

Dividend Discounted Model; (2) Free Cash Flow to

Equity; and (3) Free Cash Flow to Firm (Neaxie and

Hendrawan, 2011).

Free Cash Flow to Equity (FCFE) is an

operational net cash flow available after the

company fulfills all debt obligations, capital

expenditures, and working capital, which is

distributed to equity holders. According to

Damodaran (2012), estimating a company's cash to

be returned to shareholders can be done through

several stages. The first stage, each investment

expenditure issued must be reduced first with the

company's net income so that it can represent cash

outflows, and then depreciation is added again

because accounting both of these are not spending

cash but non-cash cash. The second stage, the

increase in working capital will reduce the cash flow

available to shareholders so that only non-cash

working capital is considered. The last stage is

where the company has new debtor has been paid in

the company's cash flow. So the payment of the

principal debt represents cash out while the issuance

of new debt will represent the incoming money.

FCFE can be calculated by using the following

formula:

FCFE = Net Profit - (Capital-Depreciation Expenditures)

-(Change in Non-Cash Working Cap.) (1)

Determining the discount rate requires an in-

depth analysis of the company's financing structure

and current market conditions. Neaxie and

Hendrawan (2017) suggest that the discount rate is

the expected return by investors and creditors on

funds invested in the company. The discount rate

used in FCFE is called the Weighted Average Cost

of Capital (WACC). Company value (value of the

firm) can be calculated using the WACC formula to

discount FCFF values, with the following formula

(Damodaran, 1996: 242):

t

t

t

After determining the present value of cash flows

obtained from the period and specific scenarios

(FCFE) and also from the terminal value discounted

for the present value, then the two present values are

added together to give the firm value or equity value

(Steiger, 2008). The formula for calculating

company value is to use FCFE whose growth has

been stable at certain years, and after that, it grows

constant at the perpetual growth rate of g, which is

as follows (Damodaran, 1996: 242):

t

t

t

+

n

TV = FCFE

n+1

/ (WACC - g

n

)

Weighted Average Cost of Capital (WACC) is

the overall capital cost of a company that reflects a

combination of costs or weighting costs of all

funding sources used by the company. Minor

changes to the WACC will result in major changes

in company value. The WACC is calculated by

weighting the source of capital according to the

company's financial structure and then multiplying it

by cost. The WACC formula is as follows:

WACC = (Comp. of Equity*rate of equity) +

((Comp. of Debt*rate of debt)*(1-tax))

The factors contained in the WACC are

explained as follows:

2.3.1 Cost of Equity

Cost of Equity is the rate of return expected by the

shareholders (equity) of their investment in the

company. Equity costs are calculated by using the

approach from the Capital Asset Pricing Model

(CAPM). According to this method, the return

expected by investors is determined by an analysis

of the risk-free rate, risk premium, and beta for

assets. Beta measures changes in stock prices

concerning the overall stock market. This reflects

market risk.

2.3.2 Cost of Debt

Cost of Debt is the interest rate that must be paid by

the company for its debt or external capital. The

most influencing factor for Cod is the company's

credit rating. The difference between the risk-free

interest rate and the interest rate that companies pay

to borrow money is called credit spread. Credit

spread does not only depend on the creditworthiness

of the company (rating) but also depends on market

conditions.

2.4 Relative Valuation Method

Relative valuation, or often called the market

(2)

(5)

(4)

(3)

Share Valuation of Indonesian Regional Development Bank using Free Cash Flow to Equity and Relative Valuation Methods

99

valuation method, is often used as a reference to

assess capital market players because the calculation

method is quite simple with not many input

variables. The Relative Valuation method also in

real terms reflects the view of the market.

According to Damodaran (2012), the advantages

of the Relative Valuation model are also its

weaknesses. First, ease in Relative Valuation can be

put together, attracting several similar groups of

companies, can also produce estimates of

inconsistent values where key variables such as risk,

growth, or potential cash flows are ignored. Second,

the fact that multiples reflect the market atmosphere,

which also illustrates that using the Relative

Valuation method to assess an asset can produce a

too high value when the market overestimates

similar companies, or vice versa when the market

underestimates similar companies. Third, there is

room for bias in all valuation methods, the lack of

transparency regarding the underlying assumptions

in the Relative Valuation method makes it

vulnerable to manipulation. The Relative Valuation

method used in this study is the Price Earning Ratio

(PER) approach, and Price Book Value (PBV).

2.4.1 Price Earning Ratio (PER) Approach

Another alternative in conducting valuations to

calculate the intrinsic value of a stock or

fundamental value is to use the profit value of the

company (earnings) (Jogiyanto, 2010). Estimates of

the intrinsic value of shares in a company's analysis

can be determined using 2 (two) components of

relevant information from the company, namely:

Earning Per Share (EPS) and earnings multiplier.

Thus, the expected function of EPS and the amount

of PER of the company's shares are the intrinsic

value of a stock. The formula for determining the

intrinsic value of shares through PER is as follows:

Po = EPS estimation x PER

If the intrinsic value of the stock has been

obtained by the formula above, the next step is to

compare the intrinsic value of the stock with the

market price.

2.4.2 Price to Book Value (PBV) Approach

One alternative approach to determine the value of a

stock with the Relative Valuation method is to use

the relationship between stock market prices and

book value per share (Damodaran, 2012).

Theoretically, the market value of stock must

describe the value of the book. The formula for Price

Book Value (PBV) is as follows:

PBV =

3 METHODOLOGY

The research conducted is verification research

because it aims to test a theory or the results of

previous research. Based on the purpose, this is

descriptive research. Descriptive research is used to

ascertain and explain the characteristics of variables

in a situation. Descriptive methods offer researchers

a profile that aims to describe aspects related to

interesting phenomena, such as individuals,

organizations, industry-oriented, or other

perspectives (Sekaran and Bougie, 2013). Based on

the involvement of researchers, this is a study in

which the researcher does not manipulate or

intervene. This is because researchers only take

secondary data that already exists without making

changes to it. Based on the unit of analysis, this

research is included in group research because it

only examines 1 (one) group, namely shares in the

category of Regional Development Bank (BPD)

companies listed on the Indonesia Stock Exchange

in 2018. Whereas, based on the time of

implementation, this is a cross-sectional study, in

which the data is collected only once, perhaps over a

period of months or years, to answer research

questions (Sekaran and Bougie, 2013).

This research uses samples with the purposive

sampling method. Purposive Sampling is a method

of selecting samples with specific focus, criteria, and

objectives so that samples can be used to solve

problems well (Sekaran and Bougie, 2013). The

sampling criteria in this study are Regional

Development Banks (BPD) listed on the Indonesia

Stock Exchange and BPD with audited financial

statements for at least the last 5 (five) years.

The type of data used by the data provider is

obtained from the official sample company website

or the Indonesian Stock Exchange website, data

regarding the company's stock price that published.

The data analysis method that the author uses in

this study is quantitative analysis, with raw data in

the form of audited financial statements for the past

5 (five) years, the 2013 period. 2017. The financial

statements used include Financial Position Report/

Balance Sheet, Profit, and Loss Statement, and Cash

Flow Statement.

(6)

(7)

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

100

The initial steps taken on financial report data,

with the help of Microsoft Excel software, are to

conduct a historical analysis of company

performance which includes: revenue growth,

Earning After Tax (EAT) margin, working capital

margin, and depreciation and amortization margin,

then revenue projection and The EAT projection is

calculated. The next step is to calculate the cash

flow using the DCF method (FCFE), calculate the

capital/WACC cost, calculate the Terminal Value

and discount the FCFE value and Terminal Value as

the basis for calculating Enterprise Value, Equity

Value and intrinsic value / fair price of the

company's shares.

The fair price or intrinsic value obtained from the

calculation using the FCFE method is then compared

with the results of calculations using the Relative

Valuation (PER and PBV) method in the

scenario/condition: optimistic, moderate and

pessimistic. The fair value of shares is used as a

basis for decision making by investors.

4 ANALYSIS AND DISCUSSION

Based on calculations and analyzes that have been

done using the Discounted Cash Flow method Free

Cash Flow to Equity (FCFE) and Relative Valuation

methods with the Price to Earning Ratio (PER) and

Price Book Value (PBV) approach with 3 (three)

scenarios, namely: Pessimistic scenarios, moderate

scenarios, and optimistic scenarios, the intrinsic

value of each company is obtained. The calculation

results from Relative Valuation with the PER and

PBV approaches will validate the results of the

calculation of intrinsic values with the FCFE

approach. It is valid if the results of the Relative

Valuation calculation are in the range of PER and

industrial PBV.

Based on Table 1, it can be seen that in the

pessimistic scenario, the intrinsic value of BJBR and

BJTM shares using the DCF method using the FCFE

approach is overvalued because the stock price on

January 2, 2018, is higher than the calculation of its

intrinsic value. Meanwhile, the intrinsic value of

BEKS shares has been undervalued because the

stock price on January 2, 2018, is lower.

The result of the calculation of the intrinsic value

of BJBR in the pessimistic scenario is 1,215.52 IDR

while the price on January 2, 2018, is 2,360.00 IDR,

a difference that is quite far between the intrinsic

value of BJBR and the stock price in the market is

probably due to the estimated lower BJBR revenue

growth in the next 5 (five) years projection of

7.14%. Whereas, BJTM has an intrinsic value of

126.80 IDR, which on January 2, 2018, BJTM share

price is 720.00 IDR, the difference between the

intrinsic value in the pessimistic scenario and the

stock price in the market is probably caused by the

estimated revenue growth average BJTM is low in

the next 5 (five) years projection, which is 9.96%.

Also, BEKS has an intrinsic value of 55.67 IDR,

which on January 2, 2018, the share price of BEKS

is 50.00 IDR. BEKS's intrinsic value is slightly

above the share price.

Table 1: Results of the Calculation of Intrinsic Values.

Company

Scenario

Intrinsic

Value

Stock

Price

2

nd

Jan

2018

Result

BJBR

Pessimistic

1,215.52

2,360

Overvalued

Moderate

1,387.73

Overvalued

Optimistic

1,967.67

Overvalued

BJTM

Pessimistic

126.08

720

Overvalued

Moderate

126.32

Overvalued

Optimistic

126.44

Overvalued

BEKS

Pessimistic

55.67

50

Undervalued

Moderate

68.03

Undervalued

Optimistic

73.25

Undervalued

Table 2: Results of Calculation of Relative Valuation.

Company

Scenario

PER

PER

IDX

PBV

PBV

IDX

BJBR

Pessimistic

7.40

-322.14

1.17

0.32

Moderate

8.37

24.59

1.33

1.71

Optimistic

11.67

141.62

1.89

4.8

BJTM

Pessimistic

1.58

-322.14

0.24

0.32

Moderate

1.58

24.59

0.24

1.71

Optimistic

1.57

141.62

0.24

4.8

BEKS

Pessimistic

22.11

-322.14

4.64

0.32

Moderate

26.35

24.59

5.67

1.71

Optimistic

27.80

141.62

6.10

4.8

Based on the results of the calculation of the

intrinsic value in the pessimistic scenario, the BJBR

and BJTM stock prices are overvalued. Thus,

investors are recommended to make a sale or not

make a purchase of these shares. In contrast to

BEKS shares which are in undervalued conditions,

investors are recommended to buy BEKS shares.

The results of the PER calculation in the BJBR

pessimistic scenario are 7.40 times, BJTM is 1.58

times, and BEKS is 22.11 times. While quarterly

IDX data (Q1 2018) shows that the average PER

value of banking companies is 24.59 times, with the

lowest PER value for BJTM of 1.58 times and the

highest PER value for BEKS of 22.11 times. This

shows that the results of the research calculations are

in the range of the existing PER in the market.

Furthermore, the PBV calculation results with a

pessimistic scenario show that the PBV value for

Share Valuation of Indonesian Regional Development Bank using Free Cash Flow to Equity and Relative Valuation Methods

101

BJBR is 1.17 times, the PBV value for BJTM is 0.24

times, and the PBV value for BEKS is 4.64 times.

Meanwhile, quarterly IDX data (Q1 2018) shows

that the average PBV value of banking companies is

1.71 times, with the lowest PBV value for BJBR of

1.17 times and the highest PBV value for BEKS of

4.64 times. This shows that the results of research

calculations are in the PBV range in the market.

Based on the results of valuation calculations in

the pessimistic scenario using the Relative Valuation

PER approach, the BJTM PER value is the lowest

when compared to BJBR and BEKS, with a PER

value of 1.58 times, which means that if we invest

BJTM shares then the return time on capital or the

Break Event Point (BEP) is around 1 year 6 months,

faster than BJBR and BEKS. So, investors are

advised to choose BJTM shares rather than BJBR

and BEKS shares. Meanwhile, companies

recommended increasing their earnings per share if

they want a low PER value.

Meanwhile, through the PBV approach, it was

found that the BJTM stock price was lower than

BJBR and BEKS, which was equal to 0.24 times.

This means that the BJTM stock price is valued at

0.24 times compared to its intrinsic value.

Meanwhile, BJBR share price is valued at 1.17 times

compared to its intrinsic value, and BEKS share

price is valued at 4.64 times compared to its intrinsic

value.

In the moderate scenario, the intrinsic value of

BJBR shares is IDR 1,387.73, while on January 2,

2018, the price of BJBR shares is IDR 2,360, so that

it can be said that BJBR stock price is overvalued

compared to its intrinsic value. The considerable

difference between the intrinsic value and the stock

price in the market in the moderate scenario is

probably due to the low average estimate of BJBR

revenue development in the next 5 (five) years

projection of 8.08%. The intrinsic value of BJTM is

126.32 IDR, whereas on January 2, 2018, the share

price of BJTM is 720.00 IDR, so the BJTM stock

price is overvalued when compared to its intrinsic

value. The intrinsic value of BEKS is 68.03 IDR,

while on January 2, 2018, the price of BEKS shares

is 50.00 IDR, so it can be said that BEKS stock price

is undervalued when compared to its intrinsic value.

Based on the results of the intrinsic value

calculation in the moderate scenario, the result is

that the BJBR and BJTM stock prices are

overvalued, so investors can sell or not buy BJBR

and BJTM shares. Meanwhile, BEKS is

undervalued, which means investors are

recommended to buy BEKS shares.

In the moderate scenario, the results of the PER

PER BJBR are 8.37 times, the PER value of BJTM

is 1.58 times, and the BEKS is 26.35 times.

Meanwhile, quarterly IDX data (Q1 2018) shows

that the average PER value of banking companies is

24.59 times, with the lowest PER value for BJTM of

1.58 times and the highest PER value of BEKS is

26.35 times. This shows that the results of the

calculation of the study are in accordance with the

range PER in the market.

Furthermore, the results of the study with a

moderate scenario show that the BJBR PBV value is

1.33 times, the BJBR PBV value is 0.24 times and

the BEKS PBV value is 5.67 times. Meanwhile,

quarterly IDX data (Q1 2018) shows that the

average PBV value of banking companies is 1.71

times, with the lowest PBV value for BJTM of 0.24

times and the highest PBV value of BEKS of 5.67

times. This shows that the results of research

calculations are partly in PBV market range and

some are outside the market range, in this case, the

value of the BEKS PBV is a little (not significant)

above the maximum range.

Based on the results of the valuation calculation

in the moderate scenario using the Relative

Valuation PER approach, it was found that the

BJTM stock price was lower than BJBR and BEKS,

with a PER value of 1.58 times. This means that if

we invest BJTM shares, the return time on capital

(BEP) required is 1 year and 6 months, faster than

BJBR and BEKS. So, investors should choose

BJTM shares rather than BJBR and BEKS shares.

While the advice for companies if they want a low

PER value is to increase their earnings per share

from their shares.

With the PBV approach, the BJTM stock price is

also lower compared to BJBR and BEKS, namely

BJTM PBV of 0.24 times, this means that the BJTM

stock price is valued at 0.24 times compared to its

intrinsic value. Meanwhile, BJBR stock price is

valued at 1.33 times compared to its intrinsic value,

and BEKS share price is valued at 5.67 times

compared to its intrinsic value, so investors should

choose BJTM shares instead of BJBR and BEKS

shares. As for companies, it is recommended that

they should increase the book value of the company

by increasing the amount of equity so that the value

of the PBV drops.

In the optimistic scenario, the intrinsic value of

BJBR shares is 1,215.52 IDR, while on January 2,

2018, the BJBR stock price is 2,360.00 IDR, so it

can be said that BJBR stock price is overvalued

compared to its intrinsic value. The significant

difference between intrinsic value and stock price in

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

102

the optimistic scenario in the market is due to the

low estimate of the average BJBR revenue growth in

the next 5 (five) year projections of only 9.96%. The

intrinsic value of BJTM is 126.44 IDR, while the

stock price on January 2, 2018, is 720.00 IDR, so it

can be said that BJTM stock price is undervalued

when compared to its intrinsic value. The difference

between the intrinsic value in the optimistic scenario

and the stock price in the market is because the

average estimate of revenue growth is positive at

5.15% in the next 5 (five) year projections. The

intrinsic value of BEKS is 73.25 IDR, whereas on

January 2, 2018, the price of BEKS shares was

50.00 IDR, so it can be said that BEKS 'share price

was undervalued when compared to its intrinsic

value. The difference between intrinsic value and

stock price in an optimistic scenario on the market is

due to the good performance of the company with

Revenue Projection of 9.96%.

In this optimistic scenario, it is recommended

that investors sell shares or not buy BJBR and BJTM

shares because the stock price in the market is

overvalued while BEKS shares are recommended

that investors buy shares or retain existing shares

because the stock price in the market is consistently

undervalued. Furthermore, companies are advised to

maintain stock prices in the market so that they are

not too far from their intrinsic value, so companies

need to improve their performance by increasing

revenue and growing revenue and by making

efficiency on all types of company expenses and

costs both OPEX and CAPEX.

In the optimistic scenario, the results of the study

show that BJBR PER value is 11.67 times, BJTM

PER value is 1.57 times, and BEKS is 27.80 times.

While quarterly IDX data (Q1 2018) shows that the

average PER value of banking companies is 24.59

times, with the lowest PER value for BJTM of 1.57

times and the highest PER value of belongs to BEKS

of 27.8 times. This shows that the results of the

research calculations are in the PER range of the

market.

Overall, BEKS has a PER value that is quite

large or above average for several scenarios, namely

in the pessimistic scenario of 22.11 times, in the

moderate scenario 26.35 times and in the optimistic

scenario 27.8. Meanwhile, the industry average PER

is 24.59 which is still within the industry range.

Furthermore, the results of an optimistic scenario

show that the BJBR PBV value is 1.89 times, the

BJTM PBV value is 0.24 times, and the BEKS PBV

value is 6.10 times. Meanwhile, quarterly IDX data

(Q1 2018) shows that the average PBV value of

banking companies is 1.71 times, with the lowest

PBV value for BJTM companies by 0.24 times and

the highest PBV value for BEKS companies at 6.10

times. This shows that the results of the calculation

in the scenario are optimistic, some PBV is in the

market range (BJBR and BJTM), and some are

outside the market range (BEKS).

Based on the results of the valuation calculation

in the optimistic scenario using the Relative

Valuation PER approach, it was found that the

BJTM stock price was lower than BJBR and BEKS,

where the PER value of BJTM which was smaller

than BJBR and BEKS had a PER value of 1.58

times. This means that if we invest in BJTM shares,

the return time needed (BEP) is one year six months,

faster than BJBR and BEKS. So, investors should

choose BJTM shares rather than BJBR and BEKS

shares. While the advice for companies if they want

a low PER value is to increase their earnings per

share from their shares.

Meanwhile, if using the PBV approach, the

BJTM stock price obtained is also lower compared

to BJBR and BEKS, where the value of BJTM PBV

which is smaller than BJBR and BEKS is 0.24 times.

This means that the BJTM stock price is valued at

0.24 times compared to its intrinsic value.

Meanwhile, BJBR share price is valued at 1.89 times

compared to its intrinsic value, and BEKS share

price is valued at 6.10 times compared to its intrinsic

value. So it is recommended for investors to choose

BJTM shares instead of BJBR and BEKS shares.

Meanwhile, companies are advised to increase their

book value by increasing the amount of equity, so

that the value of their PBV falls.

5 CONCLUSIONS

5.1 Optimistic Scenario

Using the FCFE method, the intrinsic value / fair

price of BJBR and BJTM shares is overvalued when

compared to the market price. While the intrinsic

value / fair price of BEKS shares is in an

undervalued position. The calculation results are

validated by the Relative Valuation method

approach with the PER (Price Earning Ratio) and

Price Book to Value (PBV) approaches. The results

are generally included in the industry range in

accordance with data in IDX Q1 2018. Although the

value of PBV of BEKS shares is slightly above the

industry range, it is not significant. Thus, investors

should sell or not buy BJBR and BJTM shares and

are advised to buy BEKS shares.

Share Valuation of Indonesian Regional Development Bank using Free Cash Flow to Equity and Relative Valuation Methods

103

5.2 Moderate Scenario

Using the FCFE method, the intrinsic values / fair

prices of BJBR and BJTM shares are overvalued

when compared to the market price. Meanwhile, the

intrinsic value / fair price of BEKS shares is in an

undervalued position. The results of the calculation

are validated by the Relative Valuation method

approach with the PER (Price Earning Ratio) and

Price Book to Value (PBV) approaches. The results

are still in the industry range according to the data in

IDX Q1 2018. Although the value of the BEKS

stock PBV is slightly above the industry range, it is

not significant. The result is a suggestion for

investors to sell or not buy BJBR and BJTM shares,

and better buy BEKS shares.

5.3 Pessimistic Scenario

Using the FCFE method, the intrinsic value / fair

price of BJBR and BJTM shares are overvalued

when compared to the market price. While the

intrinsic value / fair price of BEKS shares is in an

undervalued position. The calculation results are

validated by the Relative Valuation method

approach with the PER (Price Earning Ratio) and

Price Book to Value (PBV) approaches. The results

are still in the industry range according to the data in

IDX Q1 2018. With these results, investors should

sell or not buy BJBR and BJTM shares, and better

buy BEKS shares.

The result of this research shows that the relative

valuation method can be used as a way to validate

the intrinsic value of stock.

6 RECOMMENDATIONS

6.1 For Further Research

1. To carry out further research using historical data

for 10 (ten) years, so that the growth projections

used are more representative.

2. To carry out intrinsic analysis of the stock prices

of the three companies (BJBR, BJTM, and

BEKS) in 2019 and then to validate some of the

estimates/ assumptions that have been made in

this study.

3. To conduct research by adding primary data in

the form of direct information (interviews) with

company management, related to company plans

and strategies going forward in increasing

company growth, in order to maximize the

assumptions of researchers in conducting

forecasting.

4. To calculate the intrinsic value or fair price of

the company with different valuation methods,

such as the Dividend Discount Model, so that the

results can be used as a comparison and

additional information for investors.

6.2 For Investors

The results of this study can be a reference and

investment consideration for investors. Based on the

results of this study, the authors suggest that

investors BJBR, BJTM, and BEKS, at the time this

research was conducted, are the right conditions to

sell their shares because based on the comparison of

the intrinsic value of the stock with market prices is

in an overvalued position. Likewise, the results of

validation with the PER and PBV values, the

majority support the decision to sell shares.

6.3 For the Companies

This research is carried out by the author objectively

for academic and practical purposes. The results of

this study are expected to provide constructive input

for sample companies and especially Regional

Development Banks (BPD) in Indonesia to improve

company performance by building stronger

fundamentals, for example increasing revenue

through escalating the number of productive credit

distribution that has gone through sufficient risk

assessment to avoid increasing Non Performing

Loans (NPL). In addition, it is necessary to improve

corporate governance to provide a sense of security

for investors who entrust their investments, as well

as being a trigger for other BPDs to participate in

registering their shares on the Indonesia Stock

Exchange. The good corporate performance will

attract the (prospective) investors to invest their

capital in the BPD.

REFERENCES

Aydin, N., 2017. Mergers and Acquisition: A Review of

Valuation Methods. International Journal of Business

and Social Science.

Damodaran, A., 2012. Investment Valuation, John Wiley

& Sons Inc. United States of America, 3

rd

edition.

Gottwald, R., 2012. The Use of the P/E Ratio to Stock

Valuation. GRANT Journal.

Gupta, F.,2019. Evaluating the Accuracy of Valuation

Multiples on Indian Firms Using Regularization

Techniques of Penalized Regression. Theoretical

Economics Letters.

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

104

Kahneman, D., Knetsch, J.L., 1990. Valuing Public

Goods: The Purchase of Moral Satisfaction. Journal of

Environmental Economics and Management 22.

Kramna, E., 2014. Key Input Factors for Discounted Cash

Flow Valuations. Wseas Transactions on Business and

Economics.

Neaxie, L.V., Hendrawan, R., 2017. Stock Valuations in

Telecommunication Firms: Evidence from Indonesia

Stock Exchange. Journal of Economic and

Management Perspectives.

Sekaran, U., Bougie, R., 2013. Research Methods for

Business: A Skill-Building Approach, Wiley. New

York, 6

th

edition.

Vuuren, D.J., 2016. Valuing Specialized Property Using

the DCF Profits Method. Journal of Property

Investment and Finance.

Zemba, S., Hendrawan, R., 2018. Does Rapidly Growing

Revenues Always Produce An Excellent Company’s

Values?. DCF & PE Valuation Assessment on

Hospital Industry. ISCLO.

Share Valuation of Indonesian Regional Development Bank using Free Cash Flow to Equity and Relative Valuation Methods

105