Oil and Gas Companies and Their Fair Value: Evidence from

Indonesia Stock Exchange

Nur Hakim Fibrianto

and Riko Hendrawan

Magister Management, Telkom University, Gegerkalong Hilir Street, Bandung, Indonesia

Keywords: Fair Value, Oil and Gas companies, Valuation.

Abstract: State revenues in crude petroleum and natural gas production sub-sector are still high, so the public still

wants to invest its shares. There needs to be a valuation analysis in estimating the fair price of shares based

on fundamental data. The purpose of this study was to analyze the valuation of shares in oil and gas

companies MEDC, ENRG, and ELSA, using the DCF-FCFF method and control it using the RV PER-PBV

method. In this study, there are three scenarios: pessimistic, moderate and optimistic using historical data

from 2013-2017 as the basis for projections for 2018-2022. Comparing the results of the market share fair

value on January 2, 2019, the DCF-FCFF method concluded that the condition was pessimistic: MEDC-

ENRG (overvalued), ELSA (undervalued); moderate: MEDC-ENRG-ELSA (undervalued); optimistic:

MEDC-ENRG-ELSA (undervalued). The RV PER-PBV method shows that the value of MEDC-ENRG-

ELSA is still within the IDX market range Q1-2018. Recommendations for investors are to buy stocks in

undervalued conditions and sell them in overvalued conditions, while for further researchers research can be

done in other sectors besides the oil and gas sector and more assumption data are used for the validity of

data analysis.

1 INTRODUCTION

Industrial companies that are engaged in the crude

petroleum and natural gas production sector or

which we are often familiar with in the oil and gas

sector are still one of the biggest contributors to state

revenues. State revenues in the oil and gas sub-

sector in 2018 to the first semester were US $ 3.5

billion higher when compared to the same period

last year, which was recorded at US $ 17.3 billion or

greater than the same period last year which was US

$ 13, 8 billion, as reported by

www.industri.business.com online media, so that

public interest is still high to invest its shares in the

oil and gas sector. Oil and gas exploration and

production have been enlivened by foreign and local

companies, but the increase in world oil prices does

not necessarily increase stock prices in the capital

market. Based on the purposive sampling criteria of

the closing stock price summary data of oil and gas

companies listed on the Indonesia Stock Exchange

(IDX) until the end of Quarter-2 2018, there were

three companies with large revenue values but

experienced a significant and fluctuating decline in

stock prices, namely PT. Medco Energi International

(MEDC) Tbk, PT. Energi Mega Persada (ENRG)

Tbk and PT. Elnusa (ELSA) Tbk.

Stocks are one component of financial

instruments that have high-risk high return

characteristics. Stock prices can always fluctuate at

any time due to various factors and information

circulating on the exchange. The movement of the

price of a stock in the short term cannot be

ascertained precisely, Neaxie and Hendrawan

(2017). Based on JCI data (Jakarta Composite

Index) on the IDX (Indonesia Stock Exchange) from

January 2013 to June 2018, presented as follows:

Figure 1.1: Trend of Close Price vs Return, Jakarta

Composite Index (JCI). Source: Processed.

106

Fibrianto, N. and Hendrawan, R.

Oil and Gas Companies and Their Fair Value: Evidence from Indonesia Stock Exchange.

DOI: 10.5220/0008428001060116

In Proceedings of the 2nd International Conference on Inclusive Business in the Changing World (ICIB 2019), pages 106-116

ISBN: 978-989-758-408-4

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Based on the graph in Figure 1.1, it shows that

the JCI has seen an increasing trend in the period of

January 2013 to June 2018, although in the middle

period, some points have fluctuated and the closing

price trend tends to strengthen. Then if we look

deeper based on the return value of the period, there

are several high yield points, with the highest value

of 4.54% on September 19, 2013 and the lowest

yield, which is -5.75 % occurred on August 19,

2013, this shows the risks and returns of an

investment instrument.

The following is a review of the movement of

the stock vs return closing price in the three oil and

gas sub-sector companies with the largest revenue

value, namely PT. Medco Energi Internasional, PT.

Energi Mega Persada and PT. Elnusa

Figure 1.2: Close Price vs. Return Trend, PT. Medco

Energi Internasional. Source: Processed.

From the graph in Figure 1.2, shows that the

trend of closing prices of MEDC shares in the past

five years (2013-2018) experienced a fairly volatile

movement, where there was a close price increase in

early 2013 - late 2014 and in Q1 and Quarter -2 of

2017. The rest throughout the years 2015-2016 and

the end of 2017 to Quarter 2 of 2018 MEDC's share

price have decreased significantly. Likewise, the

movement of the return value experienced a very

volatile trend where the highest return value of

22.05% occurred on July 1, 2016, while the lowest

yield value occurred on December 8, 2017, with a

value of -16.25%.

While in Figure 1.3, it can be seen that the

closing trend of the closing price of ENRG shares is

quite volatile and has decreased from the 3rd

Quarter and 4th Quarter of 2013 and continues to

slow down at the end of semester 1 of 2015. Then

tends to be stable until Q2 2017 but the stock price is

far below the level of the previous period's price.

The closing price of the stock had experienced an

increase in the spike in July 2017 and an increase in

the period around Q1 2018. Related to the return

value of ENRG shares for the past five years also

experienced volatile movements, as well as stable

trends from the 4th quarter of 2015 to the end The

2nd Quarter of 2017. The yield trend experienced

the highest point that occurred on October 23, 2017,

with a value of 29.42% and the lowest return value

of -28.47% on July 28, 2017.

Figure 1.3: Close Price vs. Return Trend, PT. Energi Mega

Persada. Source: Processed.

In Figure Graph 1.4 shows the movement trend

of closing prices of ELSA shares over the last five

years experiencing several periods of incline and

decline, where there was an increase around the

initial period of 2013 to Q2 2014 and Quarter-1 &

Quarter-2 Year 2016, as well as the Quarter-3 period

2017 to Quarter-1 of 2018, the remaining decrease

occurs in the period in several current periods,

namely around the 3rd Quarter of 2014 to the 4th

Quarter of 2015 and the 3rd Quarter of 2016 to the

3rd Quarter In 2017. The movement of ELSA stock

value also looks very volatile with the highest value

of 21.96% on September 13, 2017, and the lowest

value occurred on August 24, 2015, with a value of -

12.85%.

Figure 1.4: Close Price vs. Return Trend, PT. Elnusa.

Source: Processed.

Based on some graphs, it can be concluded that

the growth of shares of oil and gas companies in

Indonesia in the past five years (2013-2018)

Oil and Gas Companies and Their Fair Value: Evidence from Indonesia Stock Exchange

107

experienced a fairly volatile movement. But this is

still below the average growth rate of the Jakarta

Composite Index (JCI) which tends to increase. In

assessing a company, valuation is needed. Future

cash flow or future cash flows that will be received

greatly affect the value of an investment instrument

from the company. In the world of investment, the

valuation of an asset is very important because

errors in the valuation of assets will affect the return

generated.

Every stock price always fluctuates due to

several factors circulating in the stock exchange,

Damodaran (2016) suggests that company value

(Value of the Firm) is an investor's perception of the

success rate of a company which is often associated

with the company's stock price, even though the

stock price what is on the market does not

necessarily reflect the true price of the company, so

fundamental analysis of the value of the company is

needed.

Based on the background described earlier, the

research questions in this study are as follows:

a. What is the intrinsic value of shares in MEDC,

ENRG and ELSA companies in the Indonesia

Stock Exchange using the Discounted Cash

Flow method with the Flow to Firm Free Cash

(FCFF) approach, and Relative Valuation

through the Price to Earning Ratio (PER) and

Price Book Value approaches (PBV) in a

pessimistic condition for 2018?

b. What is the intrinsic value of shares in MEDC,

ENRG and ELSA companies in the Indonesia

Stock Exchange using the Discounted Cash

Flow method with the Flow to Firm Free Cash

(FCFF) approach, and Relative Valuation

through the Price to Earning Ratio (PER)

approach and Price Book Value (PBV) in

moderate conditions for 2018?

c. What is the intrinsic value of shares in MEDC,

ENRG and ELSA companies in the Indonesia

Stock Exchange using the Discounted Cash

Flow method with the Flow to Firm Free Cash

(FCFF) approach, and Relative Valuation

through the Price to Earning Ratio (PER) and

Price Book Value approaches (PBV) in

optimistic conditions for 2018?

d. How to recommend investors to the intrinsic

value of shares in MEDC, ENRG and ELSA

companies as a basis for making decisions to

sell, buy or hold these shares in investing in

2018?

In writing this research, it is expected to have

benefits or uses for those who need it, including

theoretically this research is expected to be used as

input regarding the implementation and use of

valuation theory, especially the valuation of intrinsic

stock value and the projected value of shares more

clearly. Become a reference and description for

future research. Then there are two practical

benefits, namely for the company itself, this research

is expected to provide input for oil and gas sub-

sector companies in increasing the value of the

company through increasing performance so that the

value of shares in the market can reflect its fair

value, while for Investors, this research is expected

to provide appropriate information for investors

regarding the fair price of shares and the intrinsic

value of shares that can be used to support

investment decisions.

From the exposure of the phenomena that have

been explained above, the purpose of this research is

to look for the fair prices (intrinsic value) of the

current oil and gas sub-sector companies listed on

the Indonesia Stock Exchange (2013-2018) using the

Discounted Cash Flow (DCF) method with the Flow

to Firm (FCFF) Free Cash approach and the Relative

Valuation method with Price to Earning Ratio (PER)

and Price Book Value (PBV) approaches.

2 LITERATURE REVIEW

The values and conditions of a company are strongly

influenced by macro conditions, among others: the

political, economic, social conditions of the country

where the company carries out business activities

and the industrial conditions of the company.

Knowing the value of an asset that will be the object

of investment and what gives value to an asset is a

prerequisite for making the right decision in

choosing an investment for a portfolio. Rising

shareholders in most developed or developing

countries have caused more managers to focus on

value creation as the most important company

performance metric. This is evidence to show that

the focus of shareholder value is not only good for

shareholders but also good for the economy and

other stakeholders (McKinsey, Copeland, Koller and

Murrin, 2000).

According to Damodaran (2006), there are three

categories of approaches in conducting business

valuations of an asset, namely Discounted Cash

Flow Valuation, Relative Valuation, Contingent

Claim Valuation. The Discounted Cash Flow

approach connects the value of a stock by looking

for the present value and expected cash flow either

only from dividends (Dividend Discount Models) or

by looking for net cash flows in the future (Free

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

108

Cash Flow). Relative Valuation is an approach in

estimating the value of shares by comparing the

price of a stock that has almost the same business

characteristics as paying attention to income, book

value or sales, while the Contingent Claim approach

was specifically developed for the valuation of

options and other derivative products.

Valcic, Stumpf, and Katunar (2013) states that

for business research in the oil and gas industry can

be presented with a modern neuro-fuzzy approach.

In this case, the author examines the shortcomings of

existing methods assessment in industrial

complexity and suggest contemporary models based

on computer intelligence algorithms. Identification

and evaluation of important factors that create and

determine the value of the company in the oil and

gas industry in complex calculations involving many

variables.

Zhang (2015) examined the role of income and

book value (BV) in equity valuation, by applying a

model explanatory power method to analyze the role

of accounting data and empirically test hypotheses

with samples of companies registered in China

between 2004 and 2010, where the results were

more stable in equity valuation. In addition, these

results provide references to improve the existing

valuation model and establish accounting standards

and provide some empirical evidence for the

practical application of BV in equity valuation.

Tiwari and Singla (2015) suggested that being a

developing country with a large opportunity for

growth prospects, the valuation model assessment is

important to have a more realistic estimate of value,

where the purpose of this study is to empirically test

comparative accuracy and performance explanations

of discounted cash flows (DCF) and residual income

model (RIM) valuation models for the Indian

chemical industry and produce composite valuation

models. The results of this study indicate that the

Residual Income model and Composite Assessment

model are superior to the discounted cash flow

model and most likely the same. But because the

composite value estimate considers all the bona fide

information from each model, the Composite

Assessment model estimation becomes more

reliable.

Russel (2016) explains that the paper is to value

the patents of pharmaceutical companies using

discounted cash flows, and compare the value-

relevance of these assets against alternative

intangible asset measures such as reported intangible

assets and R&D capital, which the study values

pharmaceutical intangibles using three methods: an

income method; the sum of unamortized R&D

expenditures; the firm’s reported intangible assets.

Value-relevance tests use ordinary least squares

regression and Vuong and Clarke tests. The results

of this study are, first, the study finds that the

discounted cash-flow valuation of pharmaceutical

patents is value-relevant. Second, the value of

pharmaceutical patents explains market value better

than reported intangible assets but not R&D capital.

However, the valuation of pharmaceutical patents is

more consistent with the risks of R&D than the

valuation of R&D capital which assumes recovery of

R&D expenditure.

Sim and Wright (2017) explain that historical

stock prices have long been used to evaluate the

future of stock returns and the risks associated with

these returns. Similarly, the history of dividends has

been used to evaluate the intrinsic value of a stock

using, among other methods, the dividend discount

model. In this chapter, the authors propose an

alternative use of the dividend discount model to

allow investors to assess the risks associated with

certain stocks based on their dividend history. In this

study using a bootstrap approach to generate future

cash dividend flows, and using the Monte Carlo

simulation approach to run several experiments

model. This probability distribution allows an

investor to compare expected returns for a group of

stocks and evaluate the associated risks. With this

information, investors can make investment

decisions that are more appropriate when comparing

several dividend-producing shares. Effective use of

the dividend discount model to calculate internal

returns requires the future generation of random

dividends.

Neaxie and Hendrawan (2017), conducted

research with the aim of estimating the fair value of

shares of telecommunications companies listed on

the Indonesia Stock Exchange (IDX) using the

Discounted Cash Flow (DCF) method with a Flow

to Firm Free Cash (FCFF) approach and Relative

Assessment. The results of this study indicate that

the DCF method with the FCFF approach in an

optimistic scenario TLKM fair value is undervalued,

the fair value of ISAT is overvalued and the EXCL

fair value is undervalued. Then in the moderate

scenario, the fair value of TLKM is undervalued, the

fair value of ISAT is overvalued and the EXCL fair

value is overvalued. Furthermore, in a pessimistic

scenario, TLKM's fair value is overvalued, ISAT's

fair value is overvalued and EXCL's fair value is

overvalued. As for using the relative valuation with

the PER approach, TLKM's fair value is

undervalued, ISAT's fair value is overvalued and

EXCL's fair value is considered undervalued. Then

Oil and Gas Companies and Their Fair Value: Evidence from Indonesia Stock Exchange

109

with the PBV approach, TLKM's fair value is

overvalued, ISAT's fair value is overvalued and

EXCL's fair value is undervalued. Furthermore, with

multiple EBITDA approaches, TLKM fair value is

overvalued, ISAT fair value is considered

undervalued and EXCL fair value is considered

undervalued.

Augustyniak, Laszek, Olszewski, and Waszczuk,

(2018) explain that the study aims to describe the

method of valuation of property applied in Poland.

The valuation method is explained and assessed

critically, indicated by potential problems. Loan risk

analysis is analyzed on data about non-performing

loans (NPL). The Polish valuation method is in line

with international methods, but there are several

risks, such as a small number of transactions, the

subjective behavior of the assessor. A low NPL ratio

indicates that the assessment works correctly.

Zemba and Hendrawan (2018) stated that in his

research explained that the business investment

opportunity of the health sub-sector in Indonesia is

still wide open, because the capacity of all hospitals

in Indonesia is only able to serve 3.25% of the total

potential patients, there is still a 96.75% potential

market that equivalent to 9,501,350 customers.

Some companies that invest in the health care

business in Indonesia, there are MIKA, SAMA,

SILO, and SRAJ, all of which will be evaluated

using DCF and Relative Assessment. This research

is intended to search the fair value of the company.

This assessment reveals how well each company

makes more money in the future. Valid for all

companies, especially those in services such as

hospitals, good ratings are very sensitive, once

customers are exposed to a large scale to an event

that decreases the company's rating then to restore

fair prices takes a long time. Can be seen in a

hospital whose value is undervalued.

2.1 Discounted Cash Flow with the

FCFF approach

Discounted Cash Flow Valuation is to find the value

of an asset based on the cash flow that will be

generated in the future, where with the FCFF

approach, cash is available to the capital provider or

company funds, namely shareholders and bonds

after the company conducts operations and

investment activities. According to Damodaran

(2006) said that Free Cash Flow to Firm (FCFF) is

all the sum of all cash flow for all company owners.

The following formulas from FCFF are as

follows:

(2.1)

Determining the discount rate requires an in-

depth analysis of the company's financing structure

and current market conditions. Neaxie and

Hendrawan, (2017) suggest that the discount rate is

the expected return by investors and creditors on

funds invested in the company. The discount rate

used for FCFF discounts is called the weighted

average cost of capital (WACC). The company

value will be obtained with the following formula :

t

t

t

(2.2)

Where :

FCFF = Free Cash Flow to Firm

WACC = Weighted average cost

After determining the present value of the cash

flows obtained from the time period and certain

scenarios and also from the terminal value

discounted for the present value. Then the two

present values are then added together to give the

company value or equity value. The formula used to

calculate the value of a company using the Flow to

Firm Free Cash, whose growth has stabilized in a

given year, and after that it grows constant at the

perpetual growth rate of “g”, which is as follows:

t

t

t

+

n

(2.3)

TV = FCFF

n+1

/ (WACC - g) (2.4)

Where :

FCFF = Free Cash Flow to Firm

WACC = Weighted average cost

TV = Terminal Value

Terminal Value (TV) is the present value of all

future cash flows obtained after a period of time

determined by scenario analysis which is easier to

predict by assuming a constant growth rate for a

period of time, where the perpetual growth rate is

symbolized by g. The cost of capital or the overall

capital cost of a company reflects the cost

combination of all funding sources used by the

company. Furthermore, the overall capital cost is

called the Weighted Average Cost of Capital

(WACC). According to Damodaran ( 2006)

explained that Cost of Capital is generally calculated

based on a weighted average, or in financial

terminology often referred to as a balanced average

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

110

capital cost, WACC is the average after-tax cost of

each source of capital used by a company to finance

a project. WACC is one of the important factors in

the calculation using the Discounted Cash Flow

(DCF) model. Minor changes to the WACC will

result in major changes in company value. The

WACC is calculated by weighting the source of

capital according to the company's financial

structure and then multiplying them at their expense.

WACC = (Composition of Equity*rate of equity) +

((Composition of Debt*rate of debt)*(1-tax)) (2.5)

2.2 Relative valuation with PER and

PBV approaches

Relative Valuation is one of the most commonly

used valuation methods by comparing companies

that are similar or with the industry in which the

company is located. Market prices are obtained by

relative valuation, as a result of using real data

during the analysis. The tool used to do Relative

Valuation is multiples. One form of multiples is

price multiples, where the main component of price

multiple is the market price. Some examples of price

multiples include Price Earning Ratio (PER), Price

Book Value (PBV), Multiple EBITDA.

According to Damodaran (2006), the advantages

of the Relative Valuation model are also

weaknesses. First, ease in Relative Valuation can be

put together, pulling together some similar groups of

companies, can also produce inconsistent estimates

of value where key variables such as risk, growth, or

potential cash flows are ignored. Second, the fact

that multiples reflect the market atmosphere also

illustrates that using the Relative Valuation method

to value an asset can produce a value that is too high

when the market overestimates similar companies or

vice versa is too low when the market

underestimates similar companies. Third, there is

room for bias in all valuation methods, the lack of

transparency regarding the underlying assumptions

in the relative valuation method makes it vulnerable

the manipulation.

2.2.1 Approach to Price Earning Ratio

(PER)

Another alternative in valuation to calculate the

intrinsic value of a stock or fundamental value is to

use the profit value of the company (earnings).

Estimates of the intrinsic value of shares in company

analysis can be done using two important

information components of the company, namely

earnings per share and earnings multiplier or in other

words the expected function of EPS and the amount

of PER of the company's shares are the intrinsic

value of a stock. The formula for determining the

intrinsic value of stock through Price Earning Ratio

is as follows (Copeland, 2000):

Po = Estimation EPS x PER (2.6)

Where :

Po = Intrinsic Value of Shares

EPS = Earning Per Share

PER = Price Earning Ratio

2.2.2 Approach to Price to Book Value

(PBV)

One alternative approach to determine the value of a

stock with the Relative Valuation method is to use

the relationship between stock market prices and

book value per share. Theoretically, the market

value of stock must describe the value of the book.

The formula for Price Book Value (PBV), namely:

PBV = Po/BV (2.7)

Where :

Po = Stock Price (Equity Value)

BV = Book Value of Equity

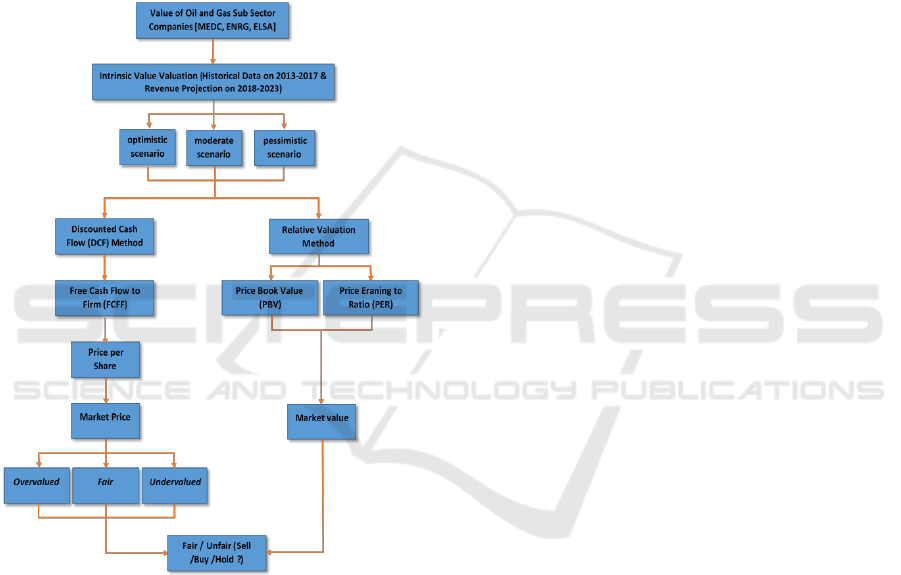

2.3 Framework of Thinking

The best solution to anticipate uncertainty about

changes in stock prices is to conduct a fundamental

analysis of valuing the intrinsic value of the stock. In

analyzing this valuation based on the assumptions

and projections of the company's conditions in the

future. This research is limited by using company

historical data from 2013 to 2017 as a basis for

projections. Next, the projection is done to

determine the future cash flow and its present value.

According to Neaxie and Hendrawan (2017), the

analysis of stock valuation calculations using the

Discounted Cash Flow (DCF) method requires

assumptions and projections to determine the

condition of the company to generate free cash flows

in the future and then calculate the present value.

Determination of assumptions and projections needs

to be adjusted to certain scenarios because of

uncertainty about the condition of the company in

the future. So on this basis, this study uses three

scenario conditions, namely optimistic conditions,

moderate conditions, and pessimistic conditions. An

optimistic condition is a condition that is considered

as the highest growth condition of the company and

Oil and Gas Companies and Their Fair Value: Evidence from Indonesia Stock Exchange

111

seen from the difference in industry growth and the

target of company management (above the industry

growth average). Moderate conditions are conditions

where the most likely to occur is seen from the

fundamental conditions of the company (the most

likely conditions). Whereas the pessimistic condition

is the condition where the condition of the company

is the worst. The final process of valuation with the

Discounted Cash Flow (DCF) method is to obtain

equity value or as an intrinsic value of the company

which then gets intrinsic value per share in each

condition scenario. The research framework is

presented in Figure 2.1 below:

Figure 2.1: Framework of Thinking.

3 RESEARCH METHODOLOGY

The type of research used is verification research

with quantitative methods that aim to explain the

existing phenomena by using numbers, namely

valuation to obtain the intrinsic value of shares of

companies engaged in the oil and gas sub-sector

business in Indonesia which is listed on the

Indonesia Stock Exchange with research variables

used in this study is the intrinsic value of shares

based on the fundamental value of the company.

Then the variables will be calculated using the

Discounted Cash Flow method FCFF approach and

Relative Valuation with the PER and PBV technique

approaches.

The population taken is all shares of the oil and

gas sub-sector company on the IDX, while the data

sample uses a purposive sampling technique which

is the three major oil and gas sub-sector companies

that have the largest market value listed on the JCI

index and still have active transactions until 2018,

namely Medco Energi Internasional, Tbk (MEDC);

PT. Energi Mega Persada, Tbk (ENRG); and PT.

Elnusa, Tbk (ELSA). The data source in this study

uses secondary data, namely five-year historical data

in the form of annual reports and financial reports

which are object research sourced from IDX.com,

the investment world, and the object's official

website research.

Research procedures are steps or sequences that

must be passed or worked on in a study. This needs

to be done in order to be able to answer the research

questions and research objectives achieved. The

research procedures that need to be carried out are as

follows:

a. Defining and formulating problems (related to

phenomena and defining variables in the

formulation of the problem)

b. Conduct library studies (theories that support

research and also refer to references from

previous studies)

c. Determine the research model and design (what

models and methodologies will be used in the

study)

d. Collecting the company's secondary data (in the

form of historical data on financial statements

and company annual reports)

e. Processing and presenting information

(historical processing data as a projection basis,

which is processed by mathematical

formulation)

f. Analyze and interpret data (analyze results data

that has been processed based on literature)

g. Conclusions and suggestions (conclusions from

the results of data analysis research that has

been done, and provide recommendations on

recommendations based on the conclusions)

The research method is an attempt to find,

develop and test the truth of a knowledge, which

business is carried out using scientific methods. The

data analysis method is the most important thing in

the study. Without data analysis, the validity of a

study is still in doubt. Because with data analysis,

the research will produce accurate research results.

Determining the method of analyzing data in a study

is a mandatory thing, and its determination is based

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

112

on the type of research conducted. The results of the

study are strongly influenced by an analytical

method. If the method used is in accordance with the

object of research, the results will be acceptable.

Whereas if it is not appropriate, then the research is

considered to be a failure. Therefore, when

conducting a study, you must consider the object of

research and determine the method to be used in data

analysis. Data analysis can be said as an ongoing

process in research, with initial analysis informing

data that is then collected. In this study, the author

will use the Discounted Cash Flow method with the

Flow to the Firm Free Cash (FCFF) approach and

the Relative Valuation method with the Price

Earning to Ratio (PER) and Price Book Value

(PBV) approaches.

4 RESEARCH AND DISCUSSION

4.1 Intrinsic Value using Discounted

Cash Flow - FCFF

Historical data used in this study is from the

company's financial statements for 2013-2017 which

will serve as the basis for calculating the free cash

flow. The projection for obtaining free cash flow to

the firm is based on the calculation of the historical

averages of 2013 - 2017 which are locked as the

basis for projections for 2018-2022. where the

spread growth results for MEDC companies are

5.55%, ENRG has 1.92%, and ELSA is 5.26% with

historical industry growth of 1.12%. In the

calculation of the spread of the company's historical

growth, the difference between the average historical

growth of the company and the historical average

growth of the industry, where spread growth results

for MEDC companies are 5.55%, ENRG has 1.92%

and ELSA worth 5.26% with historical growth

amounting to 1.12%.

In the Sales Projection analysis, the value of

industrial growth will be projected first for 2018-

2022, as the basis for other projected components

such as EBIT and FCFF projection. The type of

projection used is the type of single moving

averages, which is a projection method carried out

by taking a group of values of observations, looking

for the average value as a forecast for the period to

come, and using the following formula:

M

t

F

t+1

=

t

+Y

t-1

+Y

t-2

+…+Y

t-n+1

(4. 1)

Where :

Mt = period moving average t

Ft + 1 = year period forecast t + 1

Yt = Actual value for year period t

n = number of moving average limits

From the results of the forecasting analysis, the

industry average growth value of 5.38% is obtained,

which will then be used as the reference basis for

calculating each company's projected growth

(MEDC, ENRG, ELSA) according to the calculation

scheme in optimistic, moderate or pessimistic

scenarios.

In the optimistic scenario, the calculation of the

company's growth projection is the sum of the value

of industry growth projection coupled with the

historical growth spread and subsequently added

another half of the historical growth spread. As for

MEDC companies, the value of the calculation

results for growth projections in the optimistic

scenario is 13.71%, ENRG is 8.26%, and ELSA has

13.26%.

For the moderate scenario, the calculation of the

company's growth projection obtained from the sum

of the growth value of industry projections is added

by the historical growth industry spread only, so that

MEDC companies value the moderate scenario

growth projection of 10.93%, ENRG has 7.30% and

ELSA worth 10.64 %.

Whereas in the pessimistic scenario, the

calculation of the company's growth projection is

assumed to be the same as the value of the growth

industry projection, so that for the three MEDC,

ENRG companies, ELSA growth projection in the

pessimistic scenario is 5.38%.

Furthermore, the value of the growth projection

will be the basis for determining other projected

values for EBIT, Depreciation, and Amortization,

Capex and Networking Capital parameters which

will then produce FCFF values, Value Terminals,

Enterprise Value, Equity Value, Fair Value and EAT

value (net income). Through the results of

processing and analyzing the overall data of stock

valuations using the Discounted Cash Flow method,

the fair value of shares for each company is

obtained, as presented in Table 4.1 as follows:

Oil and Gas Companies and Their Fair Value: Evidence from Indonesia Stock Exchange

113

Table 4.1: Value of Fair Price Calculation Results

Company Shares DCF-FCFF method.

Firm

Scenario

Fair

value

Price

per 2-

Jan-

2019

Condition

MEDC

Pessimistic

344

720

overvalued

Moderate

740

720

undervalued

Optimistic

962

720

undervalued

ENRG

Pessimistic

16

50

overvalued

Moderate

59

50

undervalued

Optimistic

81

50

undervalued

ELSA

Pessimistic

368

336

undervalued

Moderate

434

336

undervalued

Optimistic

470

336

undervalued

Based on Table 4.1, it is known that MEDC's

stock price on January 2, 2019, is IDR 720, which

means that MEDC's price condition compared to its

fair price (intrinsic value) uses the Discounted Cash

Flow method on pessimistic growth (5.38%) is

overvalued, moderate (10, 93%) are undervalued,

and optimistic (13.71%) are undervalued. This

means that MEDC is in a good performance and

fundamental performance and can show significant

growth, so MEDC still has the potential to rise and

reach its fair value because most MEDC valuation

results show undervalued. As an investment

decision, MEDC shares with fundamental conditions

and good growth can be purchased by prospective

investors in accordance with the calculated intrinsic

value

Then in the ENRG company, the market share

price per January 2, 2019, is IDR 50, which means

that ENRG's share price compared to its intrinsic

value using the Discounted Cash Flow method on

pessimistic growth (5.38%) is overvalued, moderate

(7.30%) at undervalued, and optimistic (8.26%) is

undervalued. This indicates that ENRG in

performance and fun performance is quite good and

shows significant growth, and ENRG shares still

have the potential to rise and reach its fair value. As

an investment decision, ENRG shares can be

purchased by prospective investors in accordance

with the target value of the fair price that has been

calculated.

Furthermore, for ELSA’s company, the market

share price per January 2, 2019, is IDR 336, then

this means that ELSA stock prices, when compared

to the fair price using the Discounted Cash Flow

method on pessimistic growth (5.38%) are

undervalued, moderate (10.64%) under conditions

that are undervalued, and optimistic (13.26%) which

means undervalued. This shows that ELSA is in a

good performance and fundamental performance, as

well as showing good growth as well, so ELSA

shares still have the potential to rise and reach its

fair value. As an investment decision, ELSA shares

can be purchased by prospective investors in

accordance with the calculated fair price value.

4.2 Intrinsic Value using Relative

Valuation – PER and PBV

In addition to using the Discounted Cash Flow

method with the Free Cash Flow to Firm (FCFF)

approach, the valuation calculation is also done by

the Relative Valuation method with the PER and

PBV approaches. Based on the results of calculation,

processing, and analysis of overall stock valuation

data using the Relative Valuation PER and PBV

approach, intrinsic value is obtained for the three oil

and gas companies MEDC, ENRG, and ELSA using

a pessimistic, moderate and optimistic scenario,

which are presented in Table 4.2 and range values

the PER-PBV ratio in IDX Q1-2018 market is

presented in Table 4.3 below:

Table 4.2: Value of Intrinsic Calculation Results Company

with RV-PER and PBV method.

Firm

Scenario

Intrinsic

value

PER

Intrinsic

value

PBV

MEDC

Pessimistic

2.42

4.35

Moderate

5.22

9.36

Optimistic

6.78

12.15

ENRG

Pessimistic

0.13

1.76

Moderate

0.46

6.41

Optimistic

0.63

8.83

ELSA

Pessimistic

6.59

0.88

Moderate

7.78

1.04

Optimistic

8.43

1.12

Table 4.3: Value of the oil and gas sector PER-PBV

Range Ratio in Market IDX Q1-2018.

The range of PER-PBV Ratio for the Migas Sector

at IDX Q1-2018

Category

PER

PBV

Average

Firm

22.07

Firm

2.08

The lowest

PKPK

-11.84

ARTI

0.22

The highest

ESSA

127.93

APEX

8.62

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

114

The results showed that the three oil and gas

companies, namely MEDC, ENRG, and ELSA with

overall scenarios both pessimistic, moderate and

optimistic, possessed PER and PBV values which

were still in the market ratio range PER and PBV

values according to market data contained in IDX

data in the Quarter-1 2018, where the lowest PER

value in the company PT. Perdana Karya Perkasa

Tbk. (PKPK) of -11.84 times and the highest PER

value in PT. Surya Eka Perkasa Tbk. (ESSA) of

127.93 times, while for the lowest PBV value at PT.

Ratu Prabu Energi Tbk. (ARTI) of 0.22 times and

the highest PBV value in PT. Apexindo Pratama

Tbk. (APEX) of 8.62 times.

Besides that, it shows that with the calculation

results using the RV PER-PBV method which is still

in line with the range market, the assumption that is

built on the valuation processing analysis based on

the first method, Discounted Cash Flow with the

FCFF approach is fulfilled, because in the PER

calculation and This PBV, one of the most important

components, is the value of earnings data from one

of the final results of the DCF method calculation,

namely in the form of net income value or EAT

(Earning After Tax).

Based on the explanation of the three scenarios,

it is recommended for investors to buy ENRG shares

if they use the PER approach because they are

cheaper than MEDC and ELSA, and can also buy

ELSA shares if they use the PBV approach because

the price is cheaper than MEDC and ENRG.

5 CONCLUSION AND

RECOMMENDATION

5.1 Conclusion

The results of this study indicate that the fair value

of shares using the Discounted Cash Flow method in

the pessimistic scenario, namely MEDC for IDR 344

under overvalued conditions, ENRG worth IDR 16

under overvalued conditions, and ELSA at IDR 368

under undervalued conditions. Then in the moderate

scenario for MEDC, IDR 740 was in an undervalued

condition, ENRG was IDR 59 under undervalued

conditions, and ELSA was IDR 434 under

undervalued conditions. Furthermore, on the

optimistic scenario of IDR 962 valued at

undervalued conditions, the IDR 81 ENRG was

undervalued, and the IDR 470 ELSA was

undervalued.

The Relative Valuation method with the PER

and PBV approaches shows that with all calculation

scenarios both pessimistic, moderate and optimistic,

the three oil and gas companies MEDC, ENRG and

ELSA have PER and PBV values that are still in the

market ratio PER and PBV according to the data

IDX in Quarter-1 2018, where the lowest PER value

was -11.84 times in PKPK companies, and the

highest PER was valued at 127.93 times for ESSA

companies, while for the lowest PBV value was 0.22

times for the highest ARTI and PBV companies

worth 8.62 times in the APEX company.

As an investment decision, it is theoretically

recommended to buy shares under the intrinsic

value, investors can buy shares if they are in an

undervalued condition, where in this case for the

DCF-FCFF method it is advisable to choose a

moderate scenario because of the most likely

conditions of the company's growth, the market

condition value is close to its fair value, so the

shares for MEDC, ENRG, and ELSA companies are

worth buying in this condition. Then on the RV

PER-PBV method with the three pessimistic,

moderate and optimistic scenarios, then for the PER

approach, the ENRG share price is cheaper than

MEDC and ELSA, whereas in the PBV approach,

ELSA stock prices are cheaper than MEDC and

ENRG.

5.2 Recommendation

Based on these conclusions, the researcher makes

suggestions that can be used as a reference basis for

further writing, where in writing this study is

expected to be able to provide benefits or can

contribute to those in need, among others,

theoretically, this research is expected to be an input

regarding implementation and use of valuation

theory, especially the assessment of the intrinsic

value of shares and the clearer value of stock

projections, and is expected to be a reference and

illustration for future research. While practically, for

the company itself, this research is expected to

provide input for oil and gas sub-sector companies

in increasing the value of the company through

improved performance so that the value of shares in

the market can reflect its fair value and investors,

this research is expected to provide information to

investors that stock prices are reasonable and

intrinsic value of shares that can be used to support

investment decisions.

In evaluating a valuation, it depends on the data

and assumptions used. Appropriate data cleaning

needs to be done as in other income data, interest

Oil and Gas Companies and Their Fair Value: Evidence from Indonesia Stock Exchange

115

containing debt that does not occur overvalued,

while in making projected assumptions here, the

author uses the type of assumption from one single

moving average projection, so the researchers can

then use the projection assumption others are more

complete, and it is expected that the data will be

more accurate. In addition, you can also add other

valuation methods such as contingent claims,

discounted dividend model methods, etc.

Stock prices are always fluctuating, and the

amount of sentiment information circulating in the

market becomes something that is uncertain and

very risky for investors. Therefore investors should

pay attention to the target price, and they must also

pay attention to the fundamental conditions and

company performance as comparative information in

making decisions. As an investment decision, it is

theoretically recommended to buy shares under the

intrinsic price, in this case, investors can buy shares

if they are undervalued and sell them in overvalued

conditions.

To maintain and increase stock prices in the

market, companies must not only improve the

performance of companies with income, companies

must also consider the costs and expenses of

companies both OPEX and CAPEX in this case the

company must do a program of costs & expenses

that burden the company.

REFERENCES

Augustyniak, H., Laszek, J., Olszewski, K., Waszczuk, J.,

2018. Property Valuation for Mortgage Purposes in

Poland. Property Management, Vol. 36 Issue: 2,

pp.234-247.

Damodaran, A., 2006. Damodaran on Valuation second

edition, United States of America: John Wiley & Sons

Inc.

Copeland, T., Koller, T., Murrin, J., 2000. Valuation

Measuring and Managing The Value of Companies on

Third Edition, United States of America: John Wiley

and Sons Inc.

Neaxie, L.V., Hendrawan, R., 2017. Stock Valuations in

Telecommunication Firms: Evidence from Indonesia

Stock Exchange. Journal of Economic and

Management Perspectives, Volume 11, Issue 3.

Russel, M., 2016. The Valuation of Pharmaceutical

Intangibles. Journal of Intellectual Capital, Vol. 17 Iss

3 pp. 484 – 506.

Sim, T., Wright, R.H., 2017. Stock Valuation Using the

Dividend Discount Model: An Internal Rate of Return

Approach. In Growing Presence of Real Options in

Global Financial Markets. Published online: 30 Nov

2017; 19-32.

Tiwari, R., Singla, H.K., 2015. Do Combining Value

Estimates Increase Valuation Accuracy? Evidence

from Indian chemical industry. Journal of Accounting

in Emerging Economies, Vol. 5 Iss 2 pp. 170 - 183

Valcic, S.B., Stumpf, B.C., Katunar, J., 2013. Business

Valuation in Oil and Gas Industry: New Challenges.

MIPRO 2013, May 20-24, 2013, Opatija, Croatia.

Zemba, S, Hendrawan, R., 2018. Does Rapidly Growing

Revenues Always Produce An Excellent Company’s

Value? DCF & P/E Valuation Assessment on Hospital

Industry. Journal e-Proceeding of Management:

Vol.5, No.2 Agustus 2018 | Page 2045.

Zhang, T.W.T., 2015. The Roles of Accounting Data in

Equity valuation: Evidence from China. China

Finance Review International, Vol. 5 Iss 1 pp.

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

116