Economic Empowerment Model through Sharia’ Financing: A Case

Study on the Beneficiary of ‘Mesra Soft Loan’ in Bandung City

Muhammad Iqbal and Hendrati Dwi Mulyaningsih

Department of Business Administration, Telkom University, Bandung, Indonesia

Keywords: Economic Empowerment, Islamic Finance, Mosque, Economy, Social, Spiritual.

Abstract: The paper aims to elaborate on an Islamic finance instrument as an empowerment tool in empowering the

micro-small economic sector. Particularly, this study seeks to analyze socio-economic empowerment effect

on the beneficiaries through an Islamic finance instrument issued by the Bandung City Government, called

‘Mesra Soft Loan' or ‘Kredit Mesra'. This research was conducted in several places in Bandung City, West

Java, Indonesia, which focused on PD. BPR Kota Bandung and Masjid Baitul Ma'mur, Bandung Kidul

Districts. The community, through sharia’ cooperative group, was collected to be empowered in a mosque.

The contract of qardhul hasan instruments was applied from funds budgeted by the Government of Bandung

City that channeled through the partnership of PD. BPR Kota Bandung and sharia' cooperatives in community

mosques. This qardhul hasan instruments, through Kredit Mesra program, had given exceptional impact in

developing and empowering the micro-small economic sector in the city. This program had succeeded in

impacting the social, economic, and spiritual aspects of society as an empowerment program.

1 INTRODUCTION

Islam is the second largest religion in the world after

Christianity, with a total of 1.6 billion people or 23%

of the world's total population. Indonesia becomes a

country with the largest Muslim population in the

world, with about 209 million people or 87.2% of the

total population (Masci & Desilver, 2017).

With a Muslim population of 209 million,

Indonesia had great potential for ZISWAF funds

(Zakat, Infaq, Sadaqah, and Waqf).). Firmansyah

(2009) estimated the potential for Zakat by accepting

zakat levels of at least 2.5% of each Gross Regional

Domestic Product (GRDP) as follows: 1) Agricultural

zakat levels amount to 2.5% of the GRDP value of the

agricultural sector; 2) Mining zakat level was 2.5% of

the GRDP value of the mining sector; 3) Zakat in

other sectors was 2.5% for each sector. However, the

Center for Strategic Studies of the National Zakat

Agency (Puskas Baznas) in 2017 noted that the

potential for zakat in Indonesia reached Rp.286

trillion per year, bigger than previous research.

If the potential of Rp. 286 Trillion of Zakat fund

could be managed appropriately, and the fund could

be used as a response to alleviate poverty, which was

a current fundamental problem of Indonesia since

Zakat actually targets people who are considered

poor. As of Allah SWT in Surat At-Taubat (9): 60:

"Zakah expenditures are only for the poor and for the

needy and for those employed to collect [zakah] and

for bringing hearts together [for Islam] and for freeing

captives [or slaves] and for those in debt and for the

cause of Allah and for the [stranded] traveller – an

obligation [imposed] by Allah. And Allah is Knowing

and Wise.”

However, in the reality, the absorption of Zakat

fund has not been optimal yet. During the year of

2017, the absorption of Zakat fund that noted in

BAZNAS’s data was only Rp. 6 Trillion, very far

below the estimated amount that BAZNAS noted.

Only 2.09 percent of the Rp. 286 Trillion of zakat

fund estimation from BAZNAS could be collected.

The Zakat, in fact, had not been able to overcome

poverty in Indonesia yet. In March 2018, the Central

Bureau of Statistics had noted that the poverty rate

was at 9.82 percent. However, often missed by the

media attention was the definition of BPS's "absolute

poverty" and the blurring of the actual number of

poverty.

The national poverty line in March 2018, which

resulted in a poverty rate of 9.82 percent, was IDR

400,995. However, if the poverty limit was changed

using the middle-income poverty line standard of

World Bank with a figure of USD 3.9 or IDR 56

348

Iqbal, M. and Mulyaningsih, H.

Economic Empowerment Model through Sharia’ Financing: A Case Study on the Beneficiary of ‘Mesra Soft Loan’ in Bandung City.

DOI: 10.5220/0008431103480357

In Proceedings of the 2nd International Conference on Inclusive Business in the Changing World (ICIB 2019), pages 348-357

ISBN: 978-989-758-408-4

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

thousand per day, Indonesia's poverty rate will

increase dramatically to 30 percent in 2016. Indonesia

was even inferior to Vietnam by 11 percent.

Poverty in Indonesia was reflected by its position

in the fourth place as the country with the greatest

inequality in the world, with data from 1% of

Indonesia's richest people controlling 49.3 percent of

national wealth. This condition is only better than

Russia, India, and Thailand. When it was pulled-up to

10 percent of the richest, its control reached 75.7

percent. (Credit Suisse Global Wealth Databooks,

2017).

However, The Muslims, as the biggest religion

population in Indonesia, ironically contributed only

12 percent of the total economy of Indonesia (Dahuri,

2016). From the 50 of the Richest in Indonesia, only

8 people were Muslims (Tanjung, 2017). The data

showed that the contribution of Muslims of Indonesia

in the national economic was less contributed.

Furthermore, the data indirectly said that Muslims in

Indonesia is the biggest contributor to the national

poverty index.

Bandung, as the 4th biggest city in Indonesia and

the biggest city in West Java province, faced a

poverty problem of 117 thousands of household or

444 thousands of people living under poverty line.

This number represented 8.1% out of the total

population of Bandung City.

In 2017, the Bandung City Government had a

target in poverty alleviation efforts in the city of

Bandung. To solve this problem, the Bandung City

Government organized the "Kredit Mesra" program,

a mosque-based sharia' financing instrument, to

provide convenience in igniting and developing

micro-businesses. This program targeted efforts to

improve the welfare of the community through the

empowerment of mosque-based microfinance

institutions. By involving Bank Perkreditan Rakyat

Kota Bandung, the Kredit Mesra program was faced

with the ability to run in 4000 mosques in the city of

Bandung and be expected increasing in the future.

This Kredit Mesra program, in its application,

uses the contract of qardhul hasan as an Islamic

contract of finance. According to the research that

held by Said and Mahmuddin (2015), the attention to

the development of SMEs through the qardhul hasan

instrument is based on the fact that SMEs has a

greater power to reduce social and economy

disparities, unemployment and decreases poverty

rate.

Through Kredit Mesra program, a holistic

approach was used by the Government of Bandung

City in empowering the micro-small economic level

community, particularly they who come from

Muslims society. The mosque-based empowerment

approach is jointly integrates economy, social, and

spiritual aspect by mean to function the mosque as the

central place of worship and to reinforce the social

awareness and to shape good conduct and behavior of

the ummah. In addition, it is also meant to build the

awareness of the Muslim community on the

importance of unifying the spiritual, social and

economy aspects. (Said & Mahmuddin, 2015).

Indeed, mosques do not only act as a centre of religion

and worship of Muslims, but also as a centre for the

development and activities of ummah in the fields of

social, educational, economic, political, and defense,

as narrated in Al-Sira Al-Nabawiyya. From the

research held by Amaney Jamal (2005), the religious

aspect not only touches the soul more and builds or

constructs the awareness based on the feeling rather

than the mind, but also, as explained by Bagby

(2004), has a stronger bonding power for the

community because there are deep spiritual

dynamics, resulting in a feeling of community.

2 OBJECTIVE OF RESEARCH

Based on the reason explained, this study aims to

identify and to understand the model of economic

empowerment based on sharia’ financing scheme,

through Kredit Mesra program, that given to its

beneficiaries as an empowerment tool.

3 LITERATURE REVIEW

3.1 Community Economic

Empowerment

Ras (2013, p. 62) explained that as an effort to

alleviate poverty, the strategy considered as the most

appropriate to reduce poverty was through a

community empowerment strategy.

Empowerment referred to the delegation of some

authority and responsibility to employees and

involving them in the decision-making process, not

in mere job activities, but rather at all the levels of

management (Empowerment, n.d.).

According to Malumbot (2015), principally,

community empowerment was the concept of

actualizing the potential that had actually been owned

by individuals in society to organize themselves. The

process of community economic empowerment had a

starting point to establish the community to be able to

improving their own standard of living by using and

Economic Empowerment Model through Sharia’ Financing: A Case Study on the Beneficiary of ‘Mesra Soft Loan’ in Bandung City

349

accessing local resources as well as possible. The

approach used in community empowerment aimed to

increase public awareness and capacity to be able to

influence policy changes that were pro-society.

Community empowerment encouraged the

internalization of development for the poor and

marginalized job creation, as well as the participation

of the poor in building and establishing the social

capital and good governance.

According to Suharto (2005), the community

empowerment could be interpreted as a process and

an objective, with the following explanation:

1. As a process, empowerment was an activity series

to strengthen a weak group in society, including

the individuals who experienced poverty

problems.

2. As an objective, empowerment referred to the

circumstances that a social change wanted to

achieve, which were an empowered society,

having the power or knowledge and ability to

meet their life needs, both physical, economic and

social aspect, such as confident in conveying

aspirations, having livelihood, participating in

social activity, and independent in running their

life duties.

However, Fahrudin (2012) explained that community

empowerment was an effort to make the community

becoming capable and independent through the

following actions:

1. Enabling, was creating an atmosphere or climate

that allowed people to develop themselves. The

starting point was the recognition that every

human being and every community had potential

that could be developed. Empowerment was an

effort to build power by encouraging, motivating

and raising awareness of its potential and to make

serious efforts to develop it.

2. Empowering, was increasing the capacity

through reinforcing the potential or power that

community owned. This reinforcement included

concrete steps such as providing various inputs

and opening up access to opportunities that could

make people more empowered.

3. Protecting, was protecting interests by

developing a protection system for the people as

the subject of development. In the empowerment

process, the weak must be prevented from

becoming weaker, due to lack of power in the face

of the strong. Protecting, in this case, was seen as

an effort to prevent unbalanced competition and

exploitation of the strong to the weak.

3.1.1 The Objective of Economic

Empowerment

Mardikanto (2014) explained that there were six

objectives of community economic empowerment:

1. Better Institution, by improving

activities/actions performed, it was expected to

improve institutions, including the development

of business partnership networks.

2. Better Business, improving education

(enthusiasm for learning), improving business

access, activities and institutional changes, were

expected to improve business development.

3. Better Income, through the improvement of

business development, it was expected that it

would be able to improve the income earned,

including the income of the household and the

community.

4. Better Environment, Improvement in income

was expected to improve the environment

(physical and social) because environmental

damage was often caused by poverty or limited

income.

5. Better Living, The improvement in the level of

income and environmental conditions were

expected to improve the living conditions of

household and community.

6. Better Community, a better life, which was

supported by a better environment (physical and

social), was expected to create a better community

life.

3.1.2 Stages of Community Economic

Empowerment

As in figure 1, Wilson (as cited in Tukasno, 2013)

explained four stages of empowerment process, were:

1. Awakening, at this stage, the community was

made aware of their abilities, attitudes and skills

owned, and also plans and hopes for better and

more effective conditions.

2. Understanding, at this stage, the community

were given new understanding and perceptions

about themselves, their aspirations and other

general conditions.

3. Harnessing, after the community had been aware

and had understood about empowerment, it was

time for them to decide to use for their

community's benefit.

4. Using, Using skills and abilities as part of daily

life.

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

350

Figure 1: Wilson’s Four Stages of Empowerment Process.

(Source: Wilson (as cited in Tukasno, 2013)).

3.2 Qardhul Hasan as Sharia’ Finance

Contract

In terms of terminology, al-Qardhu al-Hasan (soft and

benevolent loan) was a loan given on the basis of

mere social obligations, in this case, the debtor was

not required to return anything except the loan.

Further, the nature of Qardhul Hasan did not provide

financial benefits (Adnan, 2006). Whereas, some

experts stated that giving assets to other people which

could be billed or asked to return or in other words

lent without expecting a reward was defined as al-

Qardh. In classical fiqh literature, qardh was

categorized in aqd tathawwui or contract of help and

not as a commercial transaction (asy-Syarbasyi,

1987) (Sabiq, 1987).

However, Abidin, Alwi, and Ariffin (2011)

believed that Qadrul Hasan could be used as an

effective means of economic development and

poverty alleviation.

The Islamic scholars allowed the transaction of

qardh based on the hadith that was narrated by Ibnu

Majjah and Ijma or consensus of Islamic scholars.

However, the God, on the Al-Quran, commanded the

humans to lend something for “God’s religion”. It

was explained on Al-Quran surah al-Hadiid:

”Who is he that will lend to Allah a goodly

loan, then (Allah) will increase it manifold to

his credit (in repaying), and he will have

(besides) a good reward” (Al-Quran surah Al-

Hadiid 57:11, Translation by Muhammad

Taqi-ud-Din al-Hilali and Muhammad Muhsin

Khan).

The basis of the argument in this verse was that

humans were called to 'lend to God', meaning to

spend wealth in the way of Allah.

Antonio (2001) explained that in alignment with

lending to God, humans were also called “to lend to

other human being”, as a part of civil society.

Another command was narrated by Ibnu Majjah

in a hadith that the Prophet (Peace be upon Him) said:

“Ibn Mas’ud narrated that the Prophet

(Peace be upon Him) said: ‘There is no

Muslim who lends something to another

Muslim twice, but it will be like giving charity

once’” (HR Sunan Ibn Majjah no. 2, kitab al-

Ahkam,; Ibn Hibban and Baihaqi)

It was narrated from Anas bin Malik that the

Messenger of Allah (

ﷺ

) said: "On the night on

which I was taken on the Night Journey (Isra),

I saw written at the gate of Paradise: 'Charity

brings a tenfold reward, and a loan brings an

eighteen fold reward.' I said: 'O Jibril! Why is

a loan better than charity?' He said: 'Because

the beggar asks when he has something, but

the one who asks for a loan does so only

because he is in need.' " (HR Ibnu Majjah no.

242, Kitab al-Ahkam, and Baihaqi).

The Islamic scholars agreed that al-qardh was

permitted to do. This consensus was based on the

nature of humans who could not live without help

from their brothers. No one owned everything that

was needed. Because of that reason, lending and

borrowing had become a part of human's life. Islam

very paid its attention to all of its followers' needs

(Antonio, 2001).

3.2.1 The Application of Al-Qardh

In the book of Bank Syariah: Dari Teori ke Praktik,

Antonio (2001) explained that the application of al-

Qardh, as a financial product, was usually applied as

followed:

a. As a complementary products to the customers

who had been proven of their loyalty and

reliability, who needed an immediate bailout for a

relatively short period of time. The customers

would return as soon as possible in a sum of

borrowed money.

b. As a facility to customers who needed fast fund

while they could not be able to withdraw their

fund because, for example, their money was saved

in the form of deposit.

c. As a product that was donated to micro-

enterprises or helping the social sector.

3.2.2 Source of Fund

Futhermore, Antonio (2001) said that the nature of al-

Qardh did not give financial benefits. Because of that

Awakenin

g

Understanding

Harnessin

g

Using

Economic Empowerment Model through Sharia’ Financing: A Case Study on the Beneficiary of ‘Mesra Soft Loan’ in Bandung City

351

reason, the al-Qardh funding could be taken

according to this following categories:

a. Al-Qardh needed to help customers' finances

quickly and short terms. The bailout could be

come from the bank’s capital fund.

b. Al-Qardh needed to help micro-enterprises and

social welfare could be sourced from funds of

zakah, infaq, and sadaqah. Besides from the

source of ummah’s funds, the practitioners of

sharia’ banking, as well as Islamic scholars, saw

the existence of other fund sources that been able

to be allocated to Qardh al-Hasan, which were

doubtful incomes, such as nostro services at

conventional correspondent bank, interest of L/C

collateral in foreign bank, etc. one of the

considerations the utilization of these funds was

akhaffu dhararain rule (took less harm or

mudharat). It considered if Muslims’ fund were

allowed in non-Muslim institution, it might be

used for something detrimental to Islam, for

example, the fund of Arab Muslims in Jewish

bank in Switzerland. Therefore, the parked funds

would be better taken and utilized for social

welfare needs.

The risks in al-Qardh were counted having high-risks

because it was considered as a fund that not been

closed with collateral (Antonio, 2001).

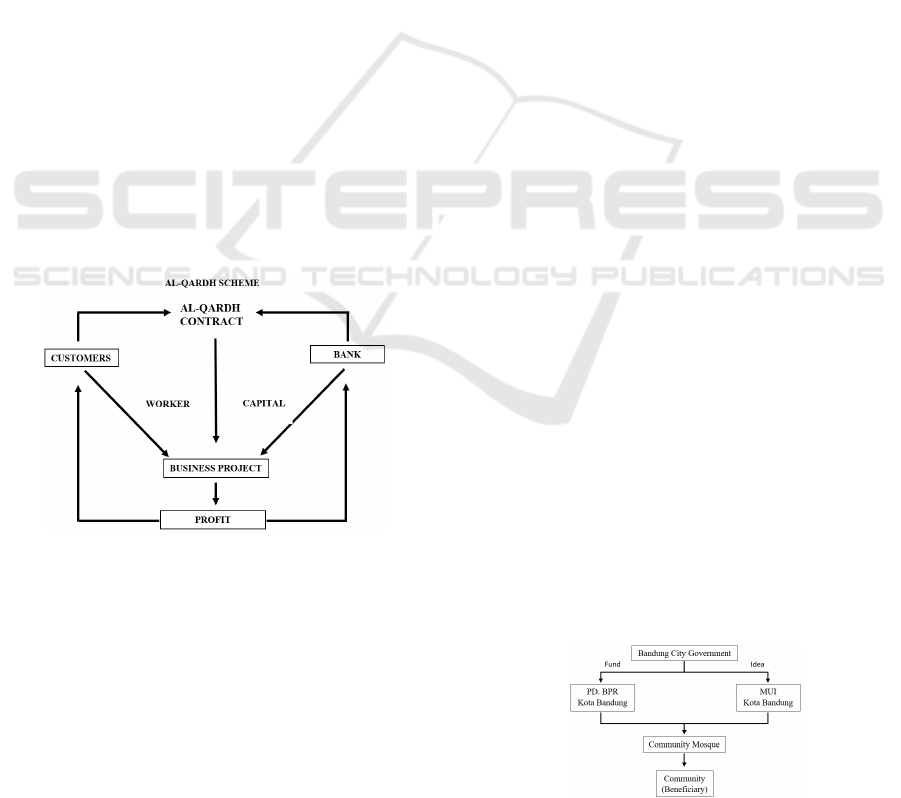

In general, al-Qardh could be visualized into

figure 2.

Figure 2: Al-Qardh Scheme. (Source: Antonio (Bank

Syariah: Dari Teori ke Praktik, 2001)).

4 RESEARCH METHODOLOGY

This study aims to identify the model of economic

empowerment based on Sharia’ financing through

Kredit Mesra program. The research used a

qualitative approach to explore the research subject.

This research location was focused on PD. BPR Kota

Bandung and neighborhood of Masjid Baitul Ma'mur,

Bandung Kidul District. The techniques of qualitative

data collection, as pointed out by Bodgan and Biklen

(1982, 27) were participant observation and in-depth

interview. In addition, documentation and online data

searching studies were used as the additional

collection method

In-depth interview was addressed to the HRD

manager of PD. BPR Kota Bandung, the Head of

Masjid Baitul Ma’mur, and three beneficiaries of

Kredit Mesra program the empowerment target.

Observation on beneficiaries was used to see the

reality of the empowerment activity in the field to

identify the result of an in-depth interview. In

addition, documentation and online data searching

were used to proof the data gotten and comparing

with the data published.

5 RESULTS AND DISCUSSION

5.1 Kredit Mesra

Kredit Mesra was a community empowerment

program from the Government of Bandung City in the

form of a soft loan with Islamic principles which was

rolled out through a community mosque that owned

sharia' cooperative. Kredit Mesra was launched in

2017 by the former Mayor of Bandung, M. Ridwan

Kamil. This loan program was devoted to Muslim

people due to the channeling system through the

community mosque that only could be reached by the

ummah of the mosque. It was expected that the Kredit

Mesra could stimulate the growth of the economy in

the mosque's neighborhood and create the mosque as

the centre of ummah’s activities, not only in the field

of ibadah but also muammalah.

Kredit Mesra, as an economic empowerment

program, was issued by the Government of Bandung

City. However, on the implementation, the Bandung

City Government appointed PD. BPR Kota Bandung

to distribute the fund and manage administration, and

MUI (Indonesian Ulema Council) to socialize the

Kredit Mesra idea to the community mosque and to

give assistance to the mosque and beneficiaries.

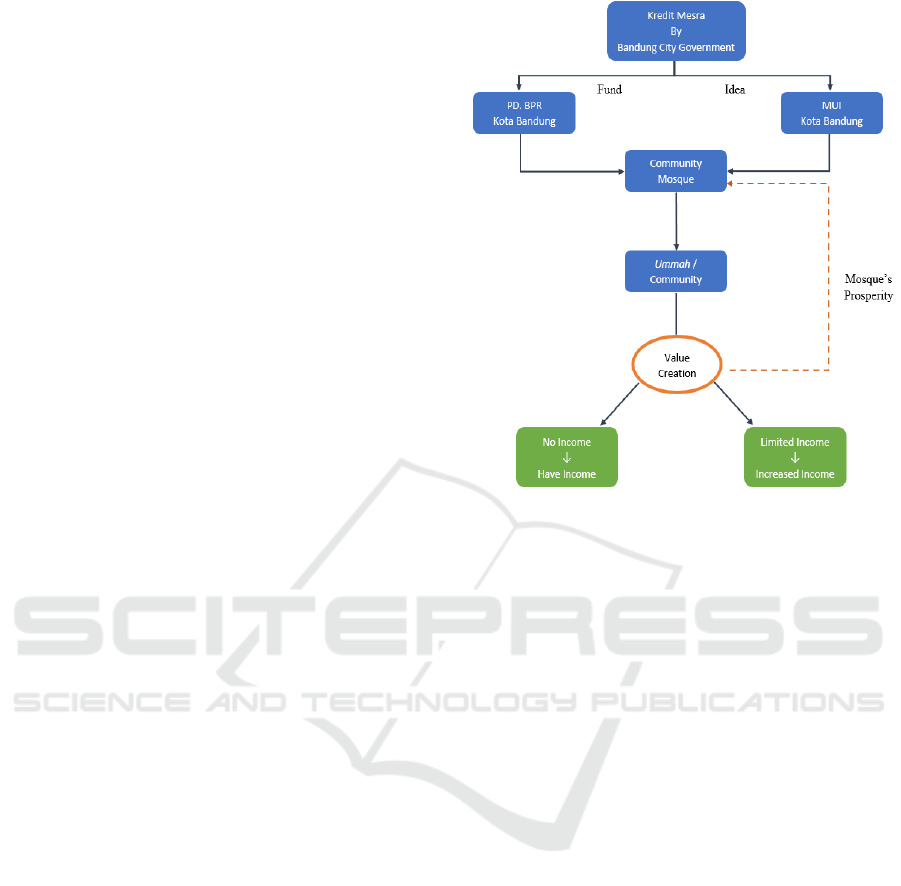

The structure could be seen as follow in figure 3.

Figure 3: The Structure of Kredit Mesra.

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

352

PD. BPR Kota Bandung as a regional-owned

company was pointed by the Government of Bandung

City to distribute the fund allocated for the program

of Kredit Mesra. The budget of funds used by BPR

Kota Bandung is the budget allocated by the City

Government of Bandung amounting to 600 Billion to

run this program. By the recommendation of Sharia

cooperative at the community mosque as the party

that administered administrative matters, the BPR

Kota Bandung transferred funds to the beneficiaries.

In its socialization, the Bandung City Government

appointed MUI of Bandung City to socialize the

Kredit Mesra program to community mosques in the

city of Bandung. Furthermore, the MUI of Bandung

City had the duty to direct mosques in the

implementation of this program and was also tasked

with providing assistance, through community

mosques, to the beneficiaries of the Kredit Mesra

program.

In its presence, the program targeted people with

small and micro economic levels who had businesses

as targets. This matter was created because the main

purpose of the Kredit Mesra program was to

empower the community, Muslim community in

particular, and it was designed to alleviate and help

the poor community which in Islam was seen as the

enemy that could harm the dignity of all the poor as

the noble creation of God.

This program had been created to be based in

mosques because the main target was the ummah who

lived around the mosque, and often came and

worshiped in the mosque. Furthermore, because this

program adhered to the value of trust in customers, it

was expected that beneficiaries who often worship in

mosques were trustworthy and able to use the loan

properly and repay it well.

Figure 4: The Application Flow of Kredit Mesra.

To be able to get this program, the beneficiary had

to be a member of sharia' cooperative at the mosque

that they wanted to apply for the program. It aimed to

show that the beneficiaries were the jama’ah of the

mosque and to fulfill the requirement because the

recommendation that explained the beneficiary was

proper to get the financing program should be issued

by the sharia' cooperative. Furthermore, the

beneficiary had to form a group to apply to this

program. It was required in purpose to make sure that

the empowerment program targeted community as

the main target, not an individual.

According to the PD BPR Kota Bandung’s

statement, the Kredit Mesra program had already

been available in over 10 out of around 4000

community mosques in Bandung City. Masjid Baitul

Ma’mur in Bandung Kidul District one of the 170

community mosques that had run this program. This

mosque served several districts in southern Bandung

area, besides the Bandung Kidul District, such as

Batununggal, Buahbatu, Regol, and Lengkong, that

had a total population of over 429,300 living in this

area since the scarcity of mosques that owned sharia'

cooperative.

5.2 Kredit Mesra as a Tool of

Economic Empowerment

The Kredit Mesra as a sharia' financing product to

empower the community, according to the

explanation of PD. BPR Kota Bandung and the Head

of DKM Masjid Baitul Ma'mur, had been

successfully empowering and stimulating the

economic between ummah. It was marked by the

growth of the individual economy, the increment of

ummah's independency, and the economy in the

mosque's neighborhood and the prosperity of the

mosque increasing. The loan rate of return was also

100%, as PD BPR explained.

The Masjid Baitul Ma'mur, as a mosque that

serves the application of Kredit Mesra program for

five districts in the southern area, had issued over 190

recommendation of applicants who were eligible to

receive the benefit of Kredit Mesra program to PD.

BPR Kota Bandung. As the intermediary that serves

Kredit Mesra application, Masjid Baitul Ma'mur

inadvertently received the benefit that came from the

existence of Kredit Mesra. First, it got a new member

of its sharia' cooperative that automatically

contributed to an increase in the amount of savings of

members of cooperatives managed by its sharia'

cooperative which some of the profits would be

channeled for the aim of the mosque prosperity.

Furthermore, from the statement given by the

Head of DKM Masjid Baitul Ma’mur, after this

Economic Empowerment Model through Sharia’ Financing: A Case Study on the Beneficiary of ‘Mesra Soft Loan’ in Bandung City

353

program had run to the beneficiaries who applied

trough this mosque, the absorption of ZISWAF

(Zakat, Infaq, Shadaqaah, and Waqaf) fund at Masjid

Baitul Ma’mur increased highly. The mosque’s

financial balance, based on interview result with

DKM Baitul Ma’mur, had already reached Rp. 50

Million in only latest six months which it did not

usually happened before the existence of this

program. Moreover, the mosque got additional

income from infaq since it was currently doing

expansion of its building and build a new Madrasah

at its area that averagely reached Rp. 12 Million per

month.

The Kredit Mesra beneficiaries came from a

homogeny background, small and micro economic

level of community. The beneficiaries were they who

had business, either business that was already running

or new business, due to the requirements that the

prospective debtors had to have a business.

Most of the beneficiary started their business as a

form of survival effort after they had gotten economic

difficulties because work termination and

extraordinary condition that forced them to survive

with starting a business. However, another reason

also became the reasons why the beneficiaries started

their business, i.e., their needs to find certain goods

that became an idea to run a business, although they

also had economic difficulties but it was not the main

reason.

The beneficiaries got to know the availability of

Kredit Mesra program, from the explanation of DKM

Baitul Ma'mur, because of the socialization from

MUI and BPR Kota Bandung at their mosque.

However, some of the beneficiaries knew it because

they got information from their relatives or even been

referenced by other mosques since the mosque in

their neighborhood had no sharia' cooperative.

Almost all of the groups of beneficiaries, based on

an interview with DKM Baitul Ma'mur and the

beneficiaries, consisted with the members who had

already known and trusted each other. It was

reasonable because the beneficiaries expected if they

knew each other closely, the problem that might be

occurred in the future could be minimizing and be

avoiding since the Kredit Mesra was based on

trustworthy.

The Sharia' principle usage of the financing

program became a special attractiveness for their

beneficiaries to apply for this program. In term of

loan given, based on the informants' experiences, it

was not burdened at all since it had no loan interest

and no sanction or penalty given, although it had an

administrative cost. The application and fund

disbursement was also easy and quick.

Furthermore, the beneficiaries felt improvement

after they had received this program. They

experienced economic improvement. For example,

they who had no income and suffered critical

economies difficulties experienced improvement

economically and became independent. They who

already had business could get additional capital to

add new goods to sell and made their income

increasing.

The Kredit Mesra affected its beneficiaries'

fulfillment of needs, either physical or nonphysical

thing. The improvement began with their fulfilment

of daily basic needs. After had received this sharia’

based empowerment financing program, the

beneficiaries became able to fill their needs more

freely and been free owing to warung in fulfilling

their daily needs, although there was no significant

change, explained the beneficiaries, since they only

bought what they really needed.

Besides the fulfillment of daily basic needs, some

of the beneficiaries had been able already to fulfill

their secondary needs though with a different

purpose, such as buying a new motorcycle to help

running their business or buying a laptop for their

child study. The fulfillment of nonphysical goods

became more achievable. The beneficiaries became

able to send their children to higher education and to

get proper health facilities.

Since the beneficiaries received the Kredit Mesra

loan, they could contribute to their family economy.

The income that they earned from their business was

felt strongly affected to their economy. In some cases,

their income even became the main source of the

family revenue. The savings and assets (gold) that

were sourced from the income gotten as the results of

this empowerment program could be created by the

beneficiaries.

Furthermore, besides economic improvement, the

beneficiaries could contribute to determining the

family decision to their family, and their partner's

willingness to give a chance for the beneficiaries

became one of some factors.

The beneficiaries got improvement in social

aspects. Through joining this program, they could

meet and know new people from other groups. The

contribution to environment economy was improved

through the ZISWAF fund that they could give after

receiving the Kredit Mesra program or even

increasing in number and frequency. This program, as

felt by the beneficiaries, extremely saved their life

from the bondage of loan shark which influential in

turning the beneficiaries business off or even

breaking their family’s economy down.

The Kredit Mesra contributed to strengthening the

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

354

ukhuwah islamiyah towards its beneficiaries. The

beneficiaries became more often to come to the

mosque for attending religious class, meeting other

jama’ah, praying congregationally or salah al

jama’ah, attending and contributing for a religious

event, and even they had understood the prohibition

of Riba and tried to avoid it as much as possible. The

Head of DKM Masjid Baitul Ma’mur said that the

Kredit Mesra program had been successfully

empowering the people and brought change to them

in muammalah and ibadah aspects. ’If the

muammalah aspects are strong, the ibadah aspects

will follow,’ the DKM Masjid baitul Ma’mur says.

5.3 The Impact of Empowerment

The community empowerment was the concept of

actualizing the potential that had actually been owned

by individuals in society to organize themselves. The

process of community economic empowerment had a

starting point to establish the community to be able to

improve their own standard of living by using and

accessing local resources as well as possible

(Malumbot, 2015). The indicators of success used to

measure the success of community empowerment

programs, according to publication of RISTEKDIKTI

(as cited in Arifin, 2014), consist of declining in

number of poverty; improvement of business and

income of the community; improvement in public

awareness of efforts to improve the welfare of poor

families in their environment; increment in group

independency which is characterized by the growing

development of member and group productive

businesses, stronger group capital, more neat group

administration systems, and increasingly the extent of

group interaction with other groups in society;

community capacity and equitable income

improvement characterized by an increase in income

of poor families who are able to meet basic needs and

basic social needs. This indicator approach was used

by the Researcher because it was able to

comprehensively explain and analyze in identifying

the effects of the economic empowerment process

that occurred on the Kredit Mesra beneficiaries.

Declining the number of poverty is an indicator

that shows the declining of poverty number as the

positive impact of the empowerment program. Based

on the Researcher's analysis, the improvement in

alleviating poverty through this program is

experienced by the beneficiaries and the environment

where they live. It is reflected by the statement from

DKM Masjid Baitul Ma’mur that stated if the Asnaf

(people who are entitled receiving zakat) from poor

community was declining, and the number of

Muzakki (people who are obligated to pay zakat fund)

was increasing, especially for the Zakat al-Fitr since

the collection of Zakat fund was centered in that

community mosque. The beneficiaries who had not

been able to pay zakat before they got the assistance

of Kredit Mesra, currently, they are able to spend this

obligation as their income has been able to fulfill their

needs. This declining in poverty number aspect

became a critical factor in community empowerment

since this program aimed for poverty alleviation.

Improvement of business and income of the

community was marked by the improvement in the

beneficiaries’ business and income. From the findings

in the field, the beneficiaries experienced some

improvement, on their business in particular. Two

beneficiaries who were observed said that using this

Kredit Mesra assistance, they could develop their

business significantly. Previously, they only made

their business as a side business that was run

irregularly. However, through the Kredit Mesra that

they got and develop for their business, they could

make their business becoming the main income for

their family and improve their business in the number

of goods sold or the condition of the shop owned. The

income of their business was also improving since it

became the current main income for their family and

their living. It was reflected by a beneficiary who

could get IDR 500 thousand per day after she got the

Kredit Mesra and run her business properly when she

had worked before, she only could earn IDR 60

thousand per day.

Improvement in public awareness of efforts to

improve the welfare of poor families in their

environment was becoming an important aspect since

the community empowerment targeted communal

and not individual. This Kredit Mesra program

required its beneficiary to apply in a group that made

this program did not target an individual but

community. The beneficiaries, after they could run

and develop their business, became aware that this

empowerment program was really helping and

important to they who want to empower themselves

and becoming independent.

It was proven by the statement of a beneficiary

who said that this program was really empowering the

small economic society. It made them becoming free

to borrow money from the loan sharks when it

actually killed the small businesses.

Some of the informants from the beneficiaries

even promoted this program to their fellow and

relatives who had small businesses and said that this

program was really soft loan and helpful for the

business.

Increment in group independency, as an empo-

Economic Empowerment Model through Sharia’ Financing: A Case Study on the Beneficiary of ‘Mesra Soft Loan’ in Bandung City

355

werment indicator, was characterized by the growing

development of productive members and groups, the

stronger the capital of the group, the more tidy the

group administration system, and the broader

interaction of groups with other groups in society.

From the Researcher analysis, this aspects had been

gotten by the beneficiaries because the solidarity in

their Kredit Mesra own group had been formed. It

was marked by the group cohesiveness in paying the

loan, more advanced business that run by every

individual in the group, involvement of group

members in giving help when one of them getting

difficulties, the frequency of interaction among the

beneficiaries, get involved in helping community

through the ZISWAF funds given by Kredit Mesra

beneficiaries, strengthen the fraternity and ukhuwah

islamiyah that experienced among the beneficiaries

and its community since they were started to come

mosque often that made them got to know each other.

Community capacity and equitable income

improvement were marked by an increase in income

of beneficiaries who were able to meet basic needs

and basic social needs. According to the witnesses of

the beneficiaries, the income that they got after had

received the Kredit Mesra improving a lot that made

them becoming able to fill their basic needs and even

secondary needs since some of them, before

accepting the Kredit Mesra, had had no income at all

in particular. Furthermore, the beneficiaries had been

already able to allocate and to increase their ZISWAF

funds expenditure. It made the Researcher able to

conclude for his analysis that this indicator had been

reached by the beneficiaries.

5.4 Economic, Social, and Spiritual

Changing

According to from the Researcher's findings in

analyzing this empowerment scheme through the

Kredit Mesra on its beneficiaries, this Kredit Mesra

program was not only acting as en empowerment tool

but also as a value creator in community and mosque.

This program had been successfully turning the

community who had no income previously to become

able earning income from a business made using this

program. It also turned they who had had income

already but limited into profit gains in their business.

Through this program, the prosperity of the mosque

was also improving since the increase of people who

came to the mosque and expended their ZISWAF

money through the mosque. It could be seen in figure

5.

Figure 5: Value Creation of Kredit Mesra.

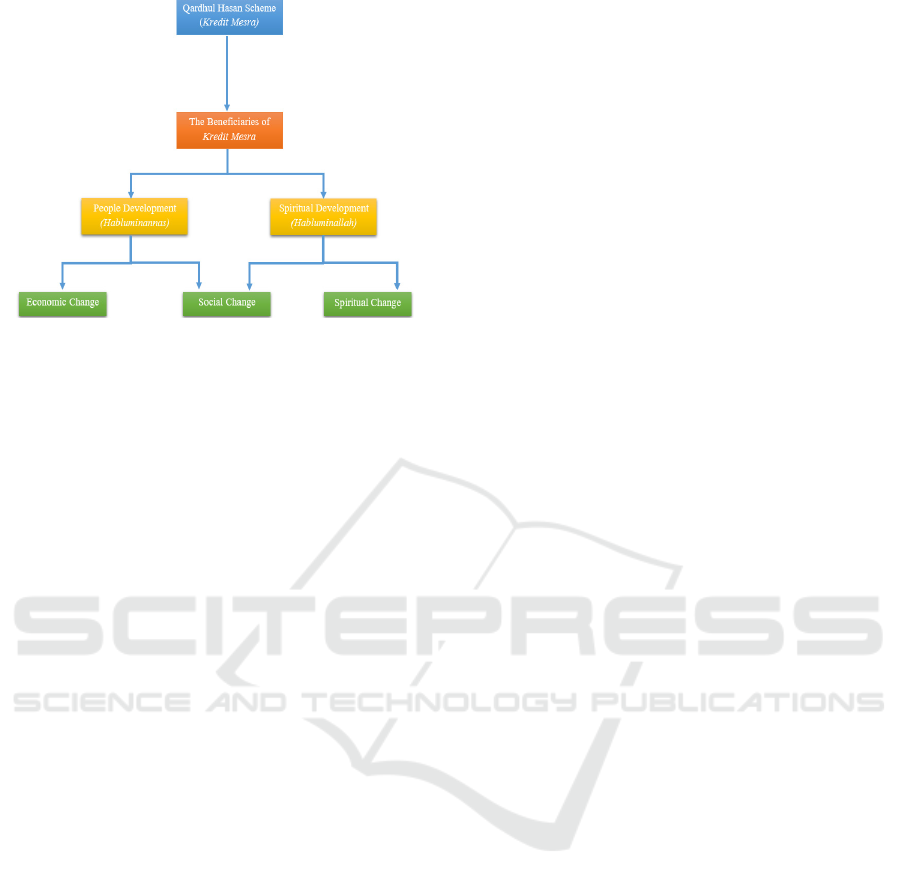

Furthermore, the generation of Kredit Mesra fund

by the mosque and its beneficiaries became an

implementation of social entrepreneurship action,

particularly in Islamic perspective. In Islamic social

entrepreneurship, as explained by Mulyaningsih and

Ramadhani (2017), Muslims entrepreneur, as the

person on duty of Allah, had an obligation to manage

their activities into two roleplays: for people

development (habluminannas) and for spiritual

development (habluminallah). The beneficiaries had

been able to run this aspect. In people development

aspects, they got a change in the economic condition

of themselves through income earning and profit

gaining. For spiritual development, the improvement

of their worship activities could be seen from their

ability to issue ZISWAF fund and often becoming to

come to the mosque to attend congregation prayer and

religious classes. They even had been able to combine

the habluminannas and habluminallah aspects in

changing their society through strengthening their

fraternity and ukhuwah Islamiyah on their society.

The visualization could be seen in figure 6.

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

356

Figure 6: Overview of Islamic Social Entrepreneurship

Application through Kredit Mesra.

6 CONCLUSION

The beneficiaries’ achievement of improvement in

the empowerment indicator that had been reached.

The beneficiaries had experienced the improvement

in all points of the indicator that measured the success

of economic empowerment, were declining in

number of poverty; improvement of business and

income of the community; improvement in public

awareness of efforts to improve the welfare of poor

families in their environment; increment in group

independency which is characterized by the growing

development of member and group productive

businesses, stronger group capital, more neat group

administration systems, and increasingly the extent of

group interaction with other groups in society;

community capacity and equitable income

improvement characterized by an increase in income

of poor families who are able to meet basic needs and

basic social needs, after had been given the Kredit

Mesra program as a mosque-based sharia’ financing

with qardhul hasan scheme.

As an empowerment's object, the beneficiaries

had experienced some positive changing both in the

economic aspect, social aspect, and even spiritual

aspect. As the example, they, who had had no income

before got the Mesra soft loan or Kredit Mesra, had

been able to earn income from the business they run

that helped by this program. Further, they could fulfill

their needs and spend their obligation as a Muslim of

ZISWAF expenditure. In the social aspect, they

became able to socialize and to build fraternity and

ukhuwah islamiyah at their environment and became

able to help other who needed through their ZISWAF

expenditure, particularly shadaqaah and infaq, given

which also reflected the spiritual aspect improvement.

REFERENCES

Adnan, M. A. (2006). Evaluasi Performing Loan (NPL)

Pinjaman Qardhul Hasan: Studi Kasus di BNI Syariah

Cabang Yogyakarta. Jurnal Perbankan, Vol. 10, No. 2,

155-177.

Antonio, M. S. (2001). Bank Syariah: Dari Teori ke

Praktik. Jakarta: Gema Insani.

Arifin, F. (2014). POLA PEMBERDAYAAN KOMUNITAS

PENYAMAK KULIT DI LINGKUNGAN INDUSTRI

KECIL (LIK) DESA RINGINAGUNG KECAMATAN

MAGETAN KABUPATEN MAGETAN. Surabaya:

DigiLib UIN Sunan Ampel.

asy-Syarbasyi, A. (1987). al-Mu'jam al-Iqtisad al-Islami.

Beirut: Dar Alamil Kutub.

Bagby, I. (2004). A Portrait of Detroit Mosques: Muslim

Views on Policy, Politics and Religion. Michigan:

Institute for Social Policy and Understanding.

Credit Suisse Global Wealth Databooks. (2017). The

World's Most Unequal Countries.

Dahuri, R. (2016, July 24). Muslim Indonesia hanya Kuasai

12 Persen Ekonomi. (Republika, Interviewer)

Empowerment. (n.d.). Retrieved from businessjargons.com:

https://businessjargons.com/empowerment.html

Fahrudin, A. (2012). Pemberdayaan, Partisipasi dan

Penguatan Kapasitas Masyarakat. Bandung:

Humaniora.

Firmansyah. (2009). Potensi dan Peran Zakat Dalam

Mengatasi Kemiskinan, Studi Kasus Jawa Barat dan

Jawa Timur. Jakarta: LIPI.

Jamal, A. (2005). Mosques, Collective Identity, and Gender

Differences among Arab American Muslims. Journal

of Middle East Women's Studies, 1(1), 53-78.

Malumbot, R. H. (2015). Program Pemberdayaan Dalam

Penanggulangan Kemiskinan Di Kota Bitung: Suatu

Studi di Kecamatan Madidir Kota Bitung. Politico:

Jurnal Ilmu Politik.

Mardikanto, T. (2014). CSR (Corporate Social

Responsibility) (Tanggung Jawab Sosial Korporasi).

Bandung: Alfabeta.

Masci, D., & Desilver, D. (2017, 01). World’s Muslim

Population More Widespread than You Might Think.

Retrieved from pewresearch.org:

http://www.pewresearch.org/fact-

tank/2017/01/31/worlds-muslim-population-more-

widespread-than-you-might-think/

Ras, A. (2013). Pemberdayaan Masyarakat Sebagai Upaya

Pengentasan Kemiskinan. SOCIUS Vol. XIV , 62.

Sabiq, S. (1987). Fiqhus Sunnah, cetakan ke-8, vol. III,

page 163. Beirut: Darul-Kitab al-Arabi.

Said, M. M., & Mahmuddin. (2015). Mosque-Based

Empowerment of the Muamalat Micro Business

Community in Indonesia. Australian Journal of Basic

and Applied Sciences, 464-476.

Suharto, E. (2005). Membangun Masyarakat,

Memberdayakan Masyarakat: Kajian Strategis

Pembangunan Kesejahteraan Sosial dan Pekerjaan

Sosial. Bandung: Refika Aditama.

Tanjung, C. (2017, April 22). CT: Dari 50 Orang Kaya RI,

Hanya 8 yang Muslim. (F. Detik.com, Interviewer).

Economic Empowerment Model through Sharia’ Financing: A Case Study on the Beneficiary of ‘Mesra Soft Loan’ in Bandung City

357