Comparing Three Models to Evaluate Financial Soundness of Life

Insurance Companies in Indonesia

Tia Anna Widati and Eka Pria Anas

Universitas Indonesia, Jakarta, Indonesia

Keywords: CARAMELS, Financial Soundness, Financial Strength Rating, Life Insurance Companies, Risk-Based

Capital.

Abstract: This research aims to compare three models to evaluate the financial soundness of life insurance companies

in Indonesia. The three models are RBC (risk-based capital) as regulatory assessment from Indonesia

Financial Services Authority (Otoritas Jasa Keuangan); CARAMELS (capital adequacy, asset quality,

reinsurance and actuarial issues, management soundness, earnings and profitability, liquidity, sensitivity to

market risk) from The International Monetary Fund; and FSR (Financial Strength Rating) from Standard and

Poor’s. The theory used in this research is financial performance theory as elaborated by Bertoneche & Knight

(2001); Steffan (2008); Needles, Frigo & Powers (2004); Beaver (1966); and Outreville (1998). This case

study research uses mixed-method and secondary data. The result concludes that life insurers have healthy

financial condition using three models. Although an insurer has the best result on RBC, it doesn’t necessarily

show the best results on CARAMELS and FSR model. Therefore, the synthesis of three models is needed to

measure financial soundness comprehensively using both quantitative and qualitative indicators.

1 INTRODUCTION

The insurance industry is growing as it has a gross

premium increase every year. In 2016, gross premium

recorded IDR 362 trillion, then in 2017 it became IDR

408 trillion, or there is a 12.7% increase (Indonesia

Financial Services Authority, 2018a). Moreover,

Indonesia Financial Services Authority (2018a) also

stated that the increase is particularly reached by life

insurance which has the biggest portion of gross

premium (47.7%), then followed by agencies

administering of social insurance (32%), non-life and

reinsurance (17.3%), and companies administering of

mandatory insurance (3%).

On the other hand, the insurance industry

generally encounters risks, for instance underwriting,

investment, management, business, and legal risk

(Smajla, 2014). In Indonesia, this industry

particularly has to overcome liquidity and solvency

risk. As being stated by Dewi (2018), there were few

cases that the insurance companies’ business licenses

were terminated due to liquidity and solvency

problems, as indicated on this table below.

Tabel 1: Termination Case of Business License of

Indonesian Insurance Companies.

Insurance Companies Name

Termination

Year

PT Asuransi Jiwa Bumi Asih Jaya

2013

PT Asuransi Jiwa Nusantara

2013

PT Asuransi Karyamas Sentralindo

2013

PT MAA General Assurance

2015

PT Asuransi Jiwa Bakrie

2016

PT Asuransi Raya

2017

Source: Indonesia Financial Services Authority, 2018b.

Regarding this issue, Indonesia Financial Services

Authority has regulated risk-based capital (RBC) in

minimum level 120% as stipulated on Regulation No.

71/POJK.05/2016. The RBC purpose is to determine

insurance companies’ capital needs based on risk

level they need to settle (Simandjuntak, 2004). In

other words, as long as they meet the requirements,

they are considered in a good state.

Moreover, Handayani (2015) stated that the

higher RBC ratio they achieve, the better financial

health they have. Nevertheless, PT Asuransi

Jiwasraya is still able to face liquidity problem

although it reached RBC 123% in 2017.

568

Widati, T. and Anas, E.

Comparing Three Models to Evaluate Financial Soundness of Life Insurance Companies in Indonesia.

DOI: 10.5220/0008433805680576

In Proceedings of the 2nd International Conference on Inclusive Business in the Changing World (ICIB 2019), pages 568-576

ISBN: 978-989-758-408-4

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Researchers have attempted to evaluate the

financial health of insurance companies, mostly using

the RBC model. Even so, there is one research,

written by Kartono (2003), indicated that the

evaluation of financial health should consider both

RBC ratio as quantitative aspect and others

qualitative aspects as well. Besides, international

research by Holzmüller (2009), comparing RBC in

the United States, Solvency II in Europe, and Swiss

Solvency Test in Switzerland, showed that RBC has

some flaws, as ever stated by Cummins, Harrington

& Niehaus (1995), so reformation of RBC is needed.

Beside RBC, researchers also evaluate financial

health using other models. Ansari & Fola (2014)

evaluate the financial health of life insurance in India

using CARAMELS model (capital adequacy, asset

quality, reinsurance and actuarial issues, management

soundness, earnings and profitability, liquidity,

sensitivity to market risk). The result showed that this

model could comprehensively capture quantitative

aspects. On the other hand, evaluation of rating can

also be used to gain complete evaluation of financial

soundness, as pointed out by Ambrose & Seward,

1988; Ambrose & Carroll, 1994; and Yakob et al.,

2012.

In Indonesia, mostly the researches are conducted

about RBC, and it is rare to find other models to

assess insurers’ financial soundness. Based on this

research gap, this study aims to compare three models

to assess the financial soundness of life insurance in

Indonesia. Those three models are risk-based capital

(RBC) by Indonesia Financial Services Authority;

capital adequacy, asset quality, reinsurance and

actuarial Issues, management soundness, earnings

and profitability, liquidity, sensitivity to market risk

(CARAMELS) by The International Monetary Fund;

and Financial Strength Rating (FSR) by Standard and

Poor’s.

This research hopefully can be input for a

regulator to evaluate regulations and model to assess

insurers’ financial health. Besides, it can be used as

precautious indicators by insurers to detect if there are

problems in their financial conditions.

2 LITERATURE REVIEW

2.1 Financial Performance of Insurers

Financial performance of a company can be reflected

from its financial statements that show how great a

company manage and run its business (Neddles, Frigo

& Powers, 2004). Moreover, a company can also

analyze business valuation through financial

statements (Bartoneche & Knight, 2001). This

financial assessment can also be used as a decision-

making basis (Nurfadila, Hidayat & Sulasmiyati,

2015).

Ratios have been used since a long time ago as a

simple device to analyze financial statements, and at

present state, it becomes useful to compare financial

statements among firms and over time periods

(Horrigan, 1968). As stated by Bartoneche & Knight

(2001) that financial ratios become tools to do

business valuations and assess financial soundness. In

addition, ratios can also be used as a predictive tool

to measure solvency and determine the credit-

worthiness of financial institutions' borrowers

(Beaver, 1966).

Some of the ratios that can be computed are

profitability, efficiency, financial, and liquidity ratios

(Bartoneche & Knight, 2001). Moreover, to use these

ratios, a company must consider consistent data and

methodology in order to compare ratios over periods

(Steffan, 2008).

In particular, insurance companies also conduct

ratio analyzes derive from financial statements to

assess their financial health. There are a few

important ratios that can be used, such as loss,

expense, and combined ratio (Outreville, 1998).

Besides, Record of Society of Actuaries (1986) stated

that the evaluation of financial health considers both

quantitative and qualitative areas as used by rating

agency A.M. Best.

Quantitative areas consist of profitability,

leverage, and liquidity. Meanwhile, qualitative areas

include reinsurance ability, reserves adequacy, and

management performance (Record of Society of

Actuaries, 1986).

2.2 Three Models to Evaluate Insurers’

Financial Soundness

In spite of financial ratios explained above, there are

few models applied globally to evaluate financial

soundness.

2.2.1 Risk-Based Capital (RBC)

Deborah & Deborah (2015) stated that risk-based

capital (RBC) is a tool to measure minimum capital

required by insurers to support their business

operations. The bigger risk an insurer has, the larger

amount of capital needed to settle the risk (Deborah

& Deborah, 2015). The RBC equation is stated

below:

Comparing Three Models to Evaluate Financial Soundness of Life Insurance Companies in Indonesia

569

Equation 1: Risk-Based Capital.

solvency level

minimum capital based on risks

Based on Circular Letter Indonesia Financial Services

Authority No. 24/SEOJK.05/2017, solvency level is

admitted to assets minus liabilities. Then, admitted

assets consist of deposits, stocks, bonds, medium

term notes, real estate investments, repurchase

agreements, land and buildings, gold, and policy

loans. Finally, minimum capital based on risks

consider credit, liquidity, market, insurance, and

operational risks.

2.2.2 Capital Adequacy, Asset Quality,

Reinsurance and Actuarial Issues,

Management Soundness, Earnings and

Profitability, Liquidity, and Sensitivity

to Market Risk (CARAMELS)

Das, Davies & Podpiera (2003) explained

CARAMELS as a model to assess the financial

soundness of insurers. The International Monetary

Fund then developed this model to assess the

insurance industry aggregately across the globe. The

indicators used in this model are shown below (Das,

Davies & Podpiera, 2003).

First, capital adequacy is a ratio to indicate

insurers' ability to accept the loss. It also considers

capital as the main indicator to measures financial

health (Das, Davies & Podpiera, 2003).

Second, asset quality is needed to evaluate the

degree of exposure of capital risk (Das, Davies &

Podpiera, 2003).

Third, reinsurance and actuarial issues can be

measured through risk retention ratio. It is a

management policy to transfer a certain portion of

risk to reinsurance companies (Das, Davies &

Podpiera, 2003).

Fourth, management soundness is an indicator of

an efficient management system. Otherwise,

management run inefficiently can be an indicator

there is a potential problem in an insurance company.

Fifth, earnings and profitability show how much

profit an insurer earned (Das, Davies & Podpiera,

2003).

Sixth, liquidity is a ratio to identify the loss

probability of selling non liquid assets quickly (Das,

Davies & Podpiera, 2003).

Seventh, sensitivity to market risk is a ratio to

assess the risk of investment assets to overcome

claims in the future and gain returns to shareholders

(Das, Davies & Podpiera, 2003).

Ratios in CARAMELS model is useful both for

life insurance and non-life insurance companies and

each ratio will be properly used for each segment.

2.2.3 Financial Strength Rating (FSR)

Standard and Poor's (S&P) as an international rating

agency has developed a Financial Strength Rating

model for insurance companies that comes from

insurance rating framework. This model uses both

quantitative and qualitative criterions.

There are several steps on the insurance rating

framework (Standard and Poor's, 2013). First, S&P

evaluate business risk profile and financial risk

profile of insurance companies. For business risk

profile, S&P (2013) analyzes detail of industry and

country risks and competitive position. Meanwhile

for financial risk profile, S&P (2013) measures

capital and earnings, risk position, and financial

flexibility.

Second, S&P analyzes enterprise risk

management, as well as management and

governance.

Third, S&P (2013) concerns about the company’s

liquidity. Step one until three can give a credit-

worthiness picture for insurance companies.

Finally, S&P (2013) also considers government

support to the insurance industry then give ratings to

the companies.

2.3 Prior Studies

There are a lot of researches about RBC. One of them

is research written by Nurfadila, Hidayat and

Sulasmiyati (2015) in PT Asei Reasuransi Indonesia

from 2011-2013. This research used descriptive

quantitative. The result showed that the RBC ratio is

great on that company. Besides, there is also another

research about RBC by Kirmizi and Agus (2009) that

uses a quantitative approach. The result showed that

RBC didn't specifically increase premium and

profitability.

Moreover, Holzmüller (2009) conducted

research comparing United States RBC, Europe

Solvency Test and Swiss Solvency Test. The result

showed that Solvency II and the Swiss Solvency

Test had better scores than RBC.

In addition, Smajla (2014) had research about

CARAMELS for insurance industry using

secondary data in a year. The result indicated that

the regulator has to give extra attention to capital

adequacy, liquidity, and management soundness,

as they give the biggest contribution to financial

soundness.

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

570

Besides, researchers commonly use agency

rating methodology to assess the solvency of

insurance companies. This is conducted by

Ambrose & Carroll (1994) using A.M. Best's

Rating. The descriptive statistics in this research

indicated that a company with rating A or A+

didn’t necessarily have a high probability of

insolvency, so the rating could provide insufficient

warning of financial distress (Ambrose & Carroll,

1994).

Pottier (1998) also pointed out that using a

combination of rating, rating changes and total

assets is more efficient than using financial ratios

alone. This study also concluded that rating

changes combined with financial ratios could be

significant insolvency prediction models.

3 RESEARCH METHODOLOGY

Yin (2003) stated that case study investigates the

phenomenon in real life context, and Woodside

(2010) added that it focuses on acquiring data from

describing, understanding, predicting, or empirical

inquiry on the individual. Moreover, Dul & Hak

(2008) explained that a case study could be a single

or small number of cases and analyzed in a qualitative

manner.

The aim of case study research is to investigate

and answer specific research questions, and find

evidence to explain the phenomenon (Gillham, 2000).

In addition, Dul & Hak (2008) distinguished case

study types: a single case study which only acquires

evidence from one instance, and comparative case

study which needs data from more than one instances

to achieve the research objective.

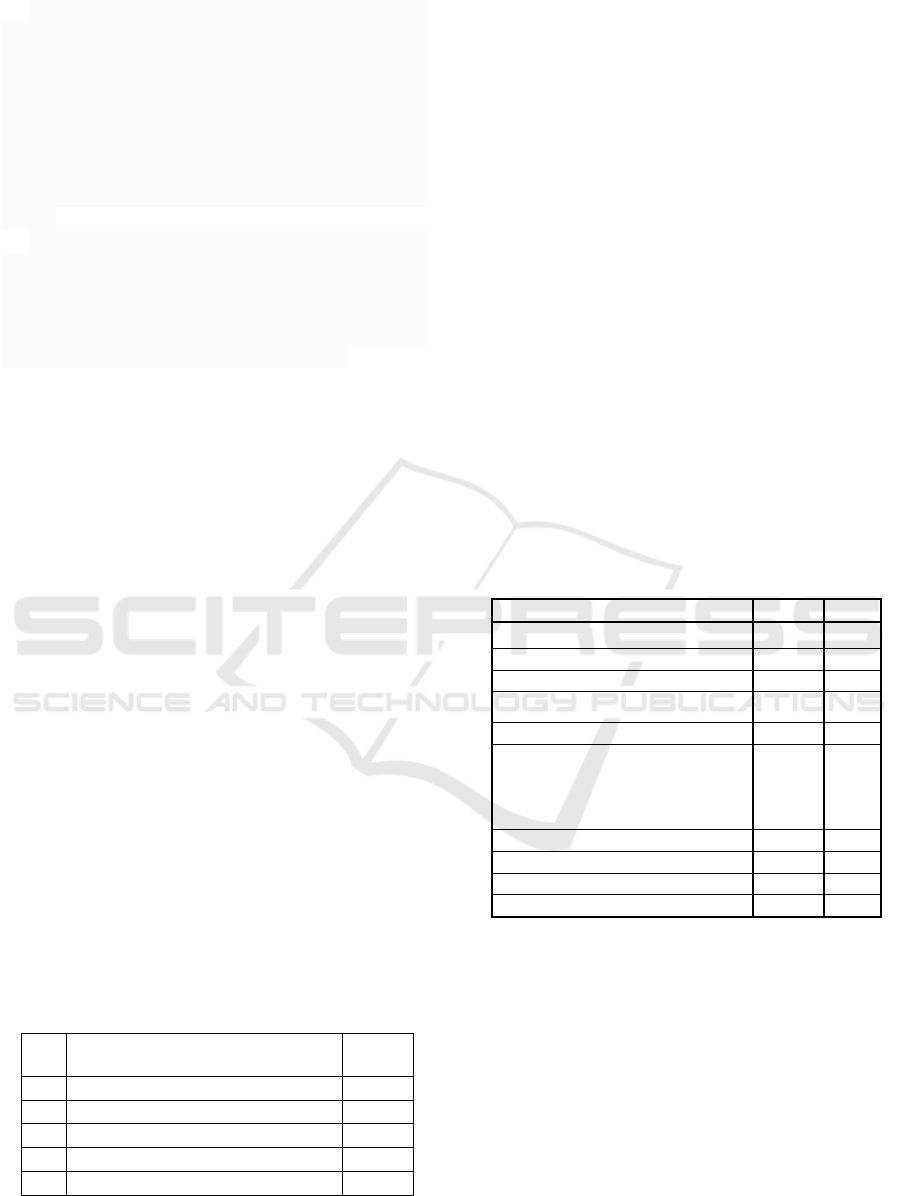

This research uses a single case study to give a

better explanation of the phenomena of liquidity and

solvency problem faced by insurers, although they

have sufficient RBC ratios. The inquiry process of

evidence is conducted in multiple unit analysis in five

life insurance companies as stated below.

Tabel 2: Unit Analysis for Research.

No.

Insurance Companies

RBC

2017

1.

PT Prudential Life Assurance

677%

2.

PT Asuransi Jiwa Generali Indonesia

317%

3.

PT Asuransi Tugu Mandiri

170%

4.

PT Equity Life Indonesia

237%

5.

PT Indolife Pensiontama

233%

The criterions to choose those companies is

because they have RBC more than 300% as stated by

Riadi (2014) that the best RBC is at 300%. In

addition, they are conventional life insurance

companies that published financial statements year

ended 2017 publicly.

This research uses secondary data. Data is

collected through their corporate websites, content

analysis, and other forms of documentations. Then

data is analyzed using content analysis, both for

quantitative and qualitative data. Quantitative data

analysis is done by computed ratios resulted in the

numerical description, whereas qualitative data

analysis is conducted descriptively (Neuman, 2011).

4 RESULT AND DISCUSSION

4.1 Financial Ratios

Financial ratios are measured to determine the

financial performance of life insurance companies in

Indonesia. The ratios used are shown below.

Table 3: Financial Performance Based on Measured Ratios.

Ratios

Good

Bad

Operational:

- Operational expense

Low

High

- General expense/ reserves

Low

High

- ROA

High

Low

- investment results / reserves

High

Low

- premium & investment result

adequacy/

High

Low

claims payment & general

expense

- Insurance session

Low

High

Capital

High

Low

Liquidity

High

Low

Competitive position

High

Low

To make the assessment easier, the companies

acquire the best ratio will get ‘1’, the worst will get ‘-

1’, and neither good or bad will get ‘0’. Based on the

that, PT Prudential Life Assurance gained total score

5, PT Asuransi Jiwa Generali Indonesia -6, PT

Asuransi Jiwa Tugu Mandiri 0, PT Equity Life

Indonesia -8, and PT Indolife Pensiontama 9. So, PT

Indolife Pensiontama acquired the best result,

whereas PT Equity Life Indonesia reached the lowest

results. Overall, this shows that higher RBC doesn’t

reflect better financial performance measured by

financial ratios.

Comparing Three Models to Evaluate Financial Soundness of Life Insurance Companies in Indonesia

571

4.2 Analyzing Three Models

Despite using ratios, financial soundness in this

research is also measured based on these three

models.

4.2.1 Risk-based Capital (RBC)

Based on financial statements published in each

corporate websites, the result of RBC is shown as

follow.

Tabel 4: Risk-Based Capital 2017.

Companies

2017

(in million IDR)

Solvency

Level

Minimum

Capital

Based on

Risks

(MMBR)

RBC

(%)

PT Prudential

Life Assurance

2,654,994

392,060

677

PT Asuransi

Jiwa Generali

Indonesia

522,125

164,690

317

PT Asuransi

Jiwa Tugu

Mandiri

167,564

98,581

170

PT Equity Life

Indonesia

395,758

167,090

237

PT Indolife

Pensiontama

5,326,241

2,284,021

233

Source: Financial Statements 2017 Each Company

Information in Table 4 indicates that PT

Prudential Life Assurance achieved the highest RBC.

On the other hand, the lowest RBC is given to PT

Asuransi Jiwa Tugu Mandiri.

Moreover, although PT Prudential Life Assurance

has the highest RBC, PT Indolife Pensiontama gained

the highest both on solvency level and minimum

capital based on risks. The higher solvency level

showed that PT Indolife Pensiontama has bigger

admitted assets than the liabilities among other

companies. Meanwhile minimum capital based on

risks showed that the company had its money to

anticipate some risks. Particularly in this case is

market risk, as the company has many assets that can

be affected by market condition. For instance, stocks,

bonds, mutual funds, and government securities.

PT Prudential Life Assurance has only IDR

392,060 million as minimum capital on risks. It

means the company an only spare small amount of

money to anticipate risks, despite the fact that this

company invests mostly on stocks and mutual funds.

Meanwhile PT Asuransi Jiwa Tugu Mandiri has the

smallest amount of solvency level and minimum

capital based on risks. The biggest portion of

minimum capital risks is for market risk, since the

company invests mostly on mutual funds and stocks.

4.2.2 Capital Adequacy, Asset Quality,

Reinsurance and Actuarial Issues,

Management Soundness, Earnings and

Profitability, Liquidity, and Sensitivity

to Market Risk (CARAMELS)

To assess financial soundness through CARAMELS

model, there are some ratios used as elaborated

below.

Capital Adequacy

Equation 2: Capital to Total Assets Ratio.

capital x100

total assets

This ratio is used to assess capital portion to total

assets owned by a company. In 2017, each company

had the capital to total assets ratio of less than 20%.

PT Equity Life Indonesia earned the biggest ratio:

17.7% capital is from total assets. Meanwhile, the

lowest ratio is acquired by PT Indolife Pensiontama:

3.4% of capital is from total assets. The bigger ratio

the company has, then the bigger portion of liabilities

it has. For instance, PT Equity Life has the capital to

total asset ratio of 17.7%, then its liabilities is 82.93%

(100%-17.7%).

Asset Quality

Equation 3: Asset Quality Ratio.

receivables

(gross premium + reinsurance recoveries)

The use of this ratio is to know management control

in giving loan to debtors. The biggest ratio earned by

PT Equity Life Indonesia (0.54%). On the other hand,

there are two companies, PT Asuransi Jiwa Generali

Indonesia and PT Asuransi Jiwa Tugu Mandiri, that

don’t have receivables, so this ratio can’t be

computed.

Reinsurance and Actuarial Issues

Equation 4: Risk Retention Ratio.

net premium x 100

gross premium

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

572

This ratio becomes an indicator to know a company's

policy in facing risks. Based on the assessment,

almost all of the gross premiums earned by

researched companies are from net premium. The

ratio is ranging from 91.64% (owned by PT Equity

Life Indonesia) to 99.99% (owned by PT Indolife

Pensiontama). This means that those companies have

good risk retention.

Management Soundness

Equation 5: Management Soundness Ratio.

operating expenses x 100

gross premium

This ratio shows the efficiency of management

in reducing expenses to earned gross premium.

Through the assessment, the most efficient

company is PT Indolife Pensiontama which has

the lowest ratio (only 3%). On the other hand, PT

Equity Life Indonesia acquired the highest ratio

(29.86%).

Earnings and Profitability

Equation 6: Return on Equity (ROE) Ratio.

profit after interest, tax and dividend x 100

share capital

This ratio is useful to assess the company's

profitability based on returns earned from

shareholders equity. The highest ROE is earned by PT

Prudential Life Assurance (5.75%), whereas the

lowest ROE is acquired by PT Equity Life Indonesia

(5.75%).

Liquidity

Equation 7: Liquid Ratio.

liquid assets x 100

total assets

The ratio above is useful to assess the company's

liquidity or its ability to fulfill its obligations. Among

five companies, PT Prudential Life Assurance gained

the highest ratio (94.17%), meanwhile PT Indolife

Pensiontama acquired the lowest ratio (75.32%).

Sensitivity to Market Risk

From financial statements of five companies, the

investment assets on those companies are mostly

stocks, bonds, real estate, land and buildings, and

gold. These assets can easily get affected by market

condition. Based on the portion of investment assets,

PT Prudential Life Assurance has the biggest portion

of assets that can get affected by market condition

(83.72% of total assets). On the other hand, PT

Asuransi Jiwa Generali Indonesia has the lowest

portion of assets (64.57%) that can get affected by

market condition.

4.2.3 Financial Strength Rating (FSR)

Standard and Poor’s assesses financial soundness

through insurance rating framework to give ratings

for insurance companies. The indicators then are

implemented in this research.

Business Risk Profile (BRP)

This indicator is used to assess the inherent risk of

insurance companies. The ratio used to assess

business risk profile is reinsurance utilization ratio.

Equation 8: Reinsurance Utilization Ratio.

reinsurance

gross premium

Based on the assessment, five companies have

reinsurance utilization ratios of less than 20%. It

means those companies are scored ‘1' (extremely

strong).

Even so, business risk profile also considers the

insurance industry and country risk assessment

(IICRA) and competitive position. IICRA shows

inherent risk faced by a company to run its business

(both for insurance and non-insurance companies).

The competitive position shows operational

performance, brand reputation, market position,

distribution channel control, and diversification.

The BRP indicates that five insurance companies

have ‘neutral' assessment. The insurance industry

overall is regulated strictly by the Indonesia Financial

Services Authority (Otoritas Jasa Keuangan/OJK).

But, the regulations are not significantly increase

insurance market penetration in Indonesia.

Financial Risk Profile (FRP)

The financial risk profile is to assess insurance

companies in particular through some indicators:

capital and earnings, risk position and financial

flexibility.

Capital and earnings can be measured through

capital adequacy. In Indonesia, insurance companies

must have capital at 120%. Besides, the government

has a significant intervention on insurance industry

through business permits, so financial risk profile is

considered at ‘significant risk'.

Comparing Three Models to Evaluate Financial Soundness of Life Insurance Companies in Indonesia

573

Risk position is assessed through diversification

of investment portfolio. Insurance companies mostly

have stocks (23%), government securities (23%),

mutual funds (22.8%), deposits (13.8%), bonds

(13.5%), investment property (1.4%), and other

investments. Based on this, ‘positive' assessment can

be given as investment portfolio is diversified.

Financial flexibility is to assess the accessibility

of external capital. Based on the information traced to

five companies researched, it is most likely that the

companies get capital from their shareholders since

they are not publicly listed companies. Besides, it is

also possible to get capital from other sources, for

instance Banks. Since there is no solid evidence, so

the assessment is considered as ‘neutral'.

Enterprise Risk Management

Enterprise risk management evaluates some factors:

risk management culture, risk control, and emerging

risk management.

Risk management culture assesses risk mitigation

conducted by companies. Then, risk control is about

risk management policy done by companies. Finally,

emerging risk management is needed to understand

threats that possibly happen in the future, for example

the existence of insurtech (insurance technology).

Overall the enterprise risk management of five

insurance companies is ‘neutral’ as they conduct risk

management, even though the details are publicly

limited.

Liquidity

One indicator to assess the company's liquidity is

through liquidity ratio assessment. As stated from the

previous part, the liquidity ratio shows that PT

Prudential Life Assurance earned the highest result.

This means PT Prudential Life Assurance is very

liquid and able to fulfill its obligations.

4.3 Comparing Three Models

Analysis of the three models above shows that those

life insurance companies have the healthy financial

condition. Every company has an RBC level more

than the required level by the regulator. The indicator

of CARAMELS also shows that those companies

have good financial performances. Besides,

indicators in FSR also indicate that the companies

have the quite good financial condition.

Although PT Prudential Life Assurance has the

highest RBC (677%), it does not necessarily mean

that the company also has the best results on other

indicators in CARAMELS and FSR. Based on

CARAMELS indicator, this company is at its best on

earnings and profitability (ROE), and liquidity

indicators. On FSR, this company has the best

assessment on competitive position indicator.

On the other hand, PT Indolife Pensiontama

indicates the best assessment for almost all indicators

in CARAMELS. Those indicators are reinsurance and

actuarial issues, management soundness, earnings

and profitability, and sensitivity to market risk. In

addition, FSR indicators show that this company has

a ‘neutral' assessment. This good assessment happens

even though the company has RBC less than 300%

(233%).

4.4 Synthesis of Three Models

Based on the elaboration above, the synthesis of three

models can be used to gain a better assessment of

insurance companies' financial soundness. There are

some other ratios as quantitative aspects that can be

implemented as follow.

a. The expense ratio, to assess a company's

efficiency to earn a premium.

b. Capital to technical reserves, to identify the

portion of capital to reserves.

c. Receivables to gross premium plus reinsurance

recoveries, to indicate receivables portion to

gross premium and reinsurance that a company

has.

d. Risk retention ratio, to show company’ retention

to overcome risks without reinsurance.

e. Liquidity ratio, to indicate a company's ability to

pay short-term obligations.

f. ROE, to assess the profitability of equity owned

by a company.

g. ROA, to assess investment returns gained by a

company.

On the other hand, there are some qualitative

aspects that can be assessed as follow.

a. Management and governance, to understand that

the company conducts corporate governance,

discloses information transparently and

accountably through its corporate website.

b. Risk management, to analyze the company's

effort to mitigate risks.

c. Competitive position, to assess the company's

strategy in facing competition.

5 CONCLUSION

This research indicates that five insurance companies

have the healthy financial condition by assessing

through RBC, CARAMELS, or FSR. Comparison of

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

574

three models shows that CARAMELS and FSR

assess financial health more comprehensively than

RBC. Therefore, the synthesis of three models can be

used to gain a better assessment of insurance financial

soundness.

However, this research is only conducted on five

life insurance companies in Indonesia. Besides, this

research only used financial statements year-ended

2017. Hopefully in the future there is research

conducted aggregately for insurance industry using

data over periods.

REFERENCES

Ambrose, J. M., Carroll, A. M., 1994. Using Best’s Ratings

in Life Insurer Insolvency Prediction. Journal of Risk

and Insurance, 61(2), pp. 317-327.

Ambrose, J. M., Seward, J. A., 1988. Best’s Ratings,

Financial Ratios and Prior Probabilities in Insolvency

Prediction. Journal of Risk and Insurance, 55(2), pp.

229-244.

Ansari, V. A., Fola, W., 2014. Financial Soundness and

Performance of Life Insurance Companies in India.

International Journal of Research, 1(8), pp. 224-253.

Bartoneche, M. K., 2001. Financial Performance. Oxford:

Reed Educational and Professional Publishing Ltd.

Beaver, W. H., 1966. Financial Ratios As Predictors of

Failure. Journal of Accounting Research, Vol. 4, pp.

71-111.

Cummins, J. D., Harrington, S., Niehaus, G., 1995. An

Economic 4 of Risk-Based Capital Requirements for

the Property Liability Insurance Industry. Journal of

Insurance Regulations, Vol. 11, pp. 427-447.

Das, U. S., Davies, N., Podpiera, R., 2003. Insurance and

Issues in Financial Soundness. The International

Monetary Fund Working Paper.s

Dewi, F. S., 2018. Jangan Gandakan Kerugian Nasabah.

Published in Bisnis Indonesia newspaper, March 13,

2018.

Dul, J., Hak, T., 2008. Case Study Methodology in Business

Research. Oxford: Butterworth-Heinemann.

Gillham, B., 2000. Case Study Research Methods. New

York: Continuum.

Handayani, K., 2015. Analisis Kinerja Keuangan

Perusahaan BUMN Asuransi yang Go Publik

(Menggunakan Analisis Rasio dan Risk-Based

Capital). Jurnal Studi Manajemen dan Bisnis, 2(2), pp.

188-201.

Holzmüller, I., 2009. The United States RBC Standards,

Solvency II and Swiss Solvency Test: A

Comparative Assessment. The Geneva Papers on

Risk and Insurance, 34(1), pp. 56-77.

Horrigan, J. O., 1968. A Short History of Financial Ratio

Analysis. The Accounting Review, 43(2), pp. 284-294.

Kartono, P. S., 2003. Perbandingan Model Risk-Based

Capital dan Ruin Probability sebagai Pengukuran

Risiko pada Perusahan Asuransi Jiwa. Depok:

Universitas Indonesia. Published as Graduate Thesis.

Kirmizi, Agus, S. S., 2011. Pengaruh Pertumbuhan Modal

dan Aset terhadap Rasio Risk-Based Capital,

Pertumbuhan Premi Neto, dan Profitabilitas Perusahaan

Asuransi Umum di Indonesia. Pekbis Jurnal, 3(1), pp.

391-405.

Neuman, W. L., 2011. Social Research Methods:

Qualitative and Quantitative Approaches, 7

th

Edition.

Boston: Ally & Bacon.

Needles, B. E., Frigo M. L., dan Powers, M., 2004. Strategy

and Integrated Financial Ratio Performance Measures:

Empirical Evidence of the Financial Performance

Scorecard and High Performance Companies. Editor:

Epstein, M.J., Manzoni, F. Studies in Managerial and

Financial Accounting, Vol. 14.

Nurfadila, S., Hidayat, R., Sulasmiyati, S., 2015. Analisis

Rasio Keuangan dan Risk-Based Capital untuk Kinerja

Keuangan Perusahaan Asuransi: Studi pada PT Asei

Reasuransi Indonesia (Persero) Periode 2011-2013.

Jurnal Administrasi Bisnis, 22(1), pp. 1-9.

Otoritas Jasa Keuangan (OJK), 2016. Peraturan OJK No.

71/POJK.05/2016 tentang Kesehatan Keuangan

Perusahaan Asuransi dan Reasuransi.

Otoritas Jasa Keuangan (OJK), 2017. Surat Edaran OJK

No. 24/SEOJK.05/2017 tentang Pedoman Perhitungan

Jumlah Modal Minimum Berbasis Risiko bagi

Perusahaan Asuransi dan Perusahaan Reasuransi.

Otoritas Jasa Keuangan (OJK), 2018a. Statistik

Perasuransian (Insurance Statistics) 2017. Available

at: https://www.ojk.go.id/id/kanal/iknb/data-dan-

statistik/asuransi/Pages/Statistik-Perasuransian-

Indonesia---2017.aspx [Accessed December 22, 2018].

Otoritas Jasa Keuangan (OJK), 2018b. Pengumuman.

Available at: https://www.ojk.go.id/id/berita-dan-

kegiatan/pengumuman/Default.aspx

[Accessed December 22, 2018]

Outreville, J. F., 1998. Theory and Practice of Insurance.

London: Kluwer Academic Publishers.

Pottier, S. W., 1998. Life Insurer Financial Distress, Best’s

Ratings and Financial Ratios. Journal of Risk and

Insurance, 65(2), pp. 275-288.

Riadi, S. A., 2014. Analisis dan Cara

Mengindentifikasi Potensi Risiko Usaha

Asuransi Kerugian melalui Financial Due

Diligence (Uji Tuntas Keuangan) Berbasis

Risiko: Studi Kasus Pelaksanaan Financial

Due Diligence di Asuransi ABC. Jakarta:

Universitas Indonesia. As graduate thesis and

not publicly published.

Record of Society of Actuaris, 1986. Financial Ratio

Analysis Systems, Vol. 12 No. 3. Moderator:

Montgomery, J. O. Panelist: Montgomery, J. O., dan

Townsend Jr, F. S. Recorder: Tang, L. M.

Simandjuntak, H. B., 2004. The Power of Values in

Uncertain Business World: Refleksi Seorang CEO.

Jakarta: Gramedia Pustaka Utama.

Smajla, N., 2014. Measuring Financial Soundness of

Insurance Companies by Using CARAMELS Model –

Comparing Three Models to Evaluate Financial Soundness of Life Insurance Companies in Indonesia

575

Case of Croatia. Interdiciplinary Management

Research, Vol. 10, pp. 600-609.

Standard and Poor’s, 2013. Rating Direct – Insurers:

Rating Methodology. Standard and Poor’s Rating

Services.

Steffan, B., 2008. Essential Management Accounting: How

to Maximise Profit and Boost Financial Performance.

England: Kogan Page Limited.

Woodside, A. G., 2010. Case Study Research: Theory,

Methods, Practice. United Kingdom: Emerald Group

Publishing Limited.

Yakob, R., Yusop, Z., Radam, A., Ismail, N., 2012.

CAMEL Rating Approach to Assess the Insurance

Operators Financial Strength. Jurnal Ekonomi

Malaysia, 46(2), pp. 3-15.

Yin, R. K., 2003. Case Study Research Design and

Methods: Third Edition. California: Sage Publications,

Inc.

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

576