Review Multi Factors Authentication for Financial Technology using

Biometric Features

Imelda and Tjahjanto

Universitas Budi Luhur

Keywords: biometrics, multi factors authentication, financial technology.

Abstract: Financial Technology is increasingly needed in industry 4.0 towards the era of society 5.0. This need was

triggered by the many brokers that made marketing a product very expensive. The existence of Financial

Technology can eliminate brokers, cut the product marketing chain. The effect is that consumers can get

products at affordable prices and good quality because of direct selling. The contribution of this research is to

review multi factors authentication for Financial Technology that uses biometric features. The results of this

study obtained recommendations for biometric features that are in accordance with user needs that can be

used for Financial Technology.

1 INTRODUCTION

Financial Technology is increasingly needed in

industry 4.0 towards the era of society 5.0. This need

was triggered by the many brokers that made

marketing a product very expensive. The existence of

Financial Technology can eliminate brokers, cut the

product marketing chain. The effect is that consumers

can get products at affordable prices and good quality

because of direct selling (Wu, 2017). The Industrial

Revolution was marked by the emergence of the big

data system, cloud computing, supercomputers, smart

robots, unmanned vehicles, genetic engineering, and

neurotechnology development that enabled humans

to optimize brain function further. In this 4.0

industrial revolution manufacturing activities were

integrated through massive wireless and big data

technology. Figure 1 shows the conventional versus

online models of 4.0 industrial revolution in

Indonesia.

Figure 1: Conventional versus online models of 4.0

industrial revolution in Indonesia.

Society 5.0 is a human-centered society that

balances economic and technological progress by

solving problems through systems that integrate

cyberspace and physical space. Innovation in society

5.0 will reach a forward-looking society that breaks

the sense of stagnation that exists. Communities

whose members respect each other, and society where

everyone can lead an active and pleasant life. Figure

2 shows that the application of society 5.0 will help

the community to handle needs in an automated

manner and as a place where people can enjoy their

lives.

Figure 2: Achieving Society 5.0.

Financial technology (Fintech) is a Blockchain

technology for transferring money that opens the

126

Imelda, . and Tjahjanto, .

Review Multi Factors Authentication for Financial Technology using Biometric Features.

DOI: 10.5220/0008930501260128

In Proceedings of the 1st International Conference on IT, Communication and Technology for Better Life (ICT4BL 2019), pages 126-128

ISBN: 978-989-758-429-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Application Programming Interface (API) between

companies and Fintech banks and promotes payments

without cash. Figure 3 shows a few of conventional

versus online models Fintech in Indonesia.

Figure 3: A few of conventional versus online models

Fintech in Indonesia.

Blockchain is a cheaper way to create a reliable

security system in cyberspace (Lynn et al., 2019). In

Society 5.0, cybersecurity will be a key factor. This

technology will be very useful to ensure

cybersecurity. One of the securities of cybersecurity

is from the side of authentication.

The contribution of this research is to review multi

factors authentication for Financial Technology that

uses biometric features. The results of this study

obtained recommendations for biometric features that

are in accordance with user needs that can be used for

Financial Technology.

2 LITERATURE REVIEW

Ometov et al., (2018) have conducted a survey of the

evolution of authentication systems towards Multi-

Factor Authentication (MFA), sensors used and

vision of future trends in a connected world including

online payments to authenticate users with the system

directly or by involving the cloud. MFA is

specifically expected to be used for human-to-

everything interaction by enabling authentication that

is fast, user-friendly, and reliable when accessing a

service.

Qaddour, (2018) investigated the problems and

challenges related to the security of cloud computing

authentication. This means that someone can save his

work around the world, retrieve, update, delete, and

use data/information stored in the cloud from

anywhere in the world at any time. The popularity of

cloud in the business world has resulted in data

centers that are growing rapidly and extensively, but

there are risks in the utilization of resource sharing,

which leads to privacy and security issues. The new

solution provided by Qaddour, (2018) was proposed

to improve user authentication on Cloud Computing

using biometrics with multifactor authentication

techniques. Other researchers, Hussein and Scholar,

(2018) have conducted a comprehensive survey of

user authentication techniques using biometrics for

cloud computing.

(Yang et al., 2019) Finance is the most mature

biometric market outside the domain of law

enforcement because the logic is that protecting

money is a top priority for most people. Financial

companies have become early adopters of biometrics.

For example, cash machines with fingerprint readers

are currently used at increased speeds. In addition, the

new MasterCard, which includes an embedded

fingerprint reader, seeks to introduce a biometric

authentication layer for card payments, so as to

increase customer comfort in terms of security and

convenience. Compared to other biometric properties

(eg, faces, irises, and sounds), fingerprint-based

recognition systems are studied most widely and are

used most widely. For fingerprints, valley patterns

and ridges are determined after birth, and different

fingerprint patterns are owned by even identical

twins.

3 FUTURE WORK

Martani, (2019) stated in Figure 4 that there are 5

things to respond to the future: (a) investing in

developing digital skills, (b) implementing a

prototype of new technology, learn by doing, (c)

education based on international certification and

digital skills, (d) responsive to industry, business and

technological development, (e) curriculum and

human-digital skills-based learning.

Figure 4: Respond to the future.

Review Multi Factors Authentication for Financial Technology using Biometric Features

127

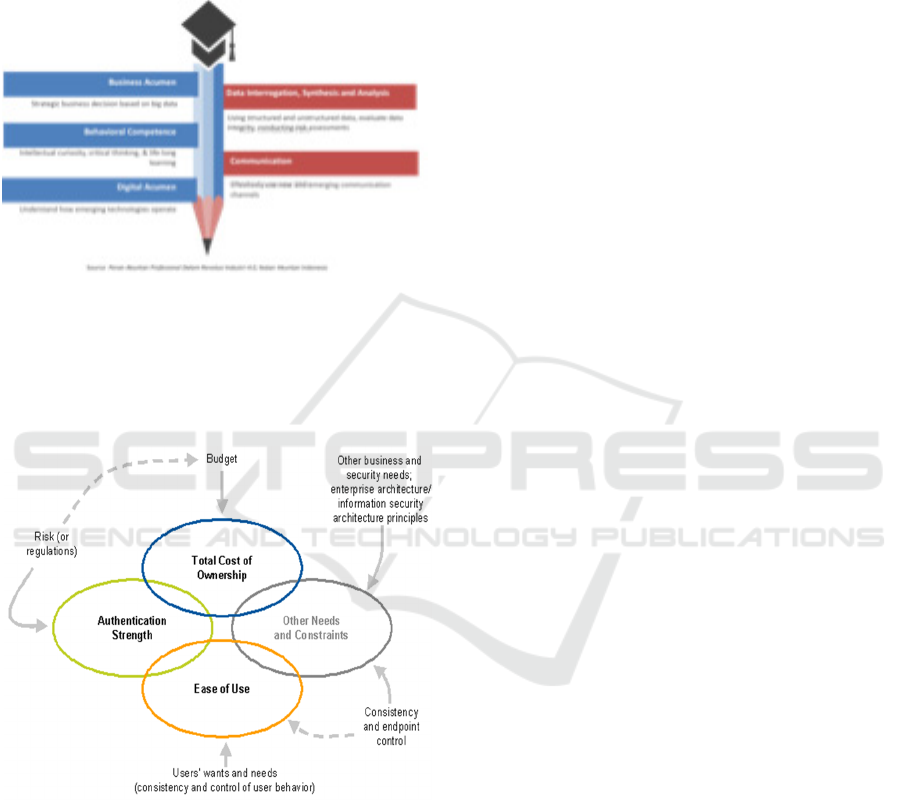

Figure 5 shows there are five mastery elements

that help the process of identifying and gathering

accounting information in the Industrial Revolution

era 4.0: (i) Business Acumen, (ii) Behavioral

Competence, (iii) Digital Acumen, (iv) Data

Interrogation, Synthesis, and Analysis, (v)

Communication.

Figure 5: Mastery 5 elements of ICT.

Ometov et al., (2018) says in Figure 5 that there

are five categories of authentication methods who you

are, what you know, what you have, what you

typically do and the context.

Figure 5: Determine the "Best" Authentication Method.

REFERENCES

Hussein, A.M., Abbas, H.M. and Mostafa, M.-S.M., 2018.

Biometric-based Authentication Techniques for

Securing Cloud Computing Data - A Survey.

International Journal of Computer Applications,

179(23), pp.44–52.

Lynn, T., Mooney, J.G., Rosati, P. and Cummins, M., 2019.

Disrupting Finance: FinTech and Strategy in 21st

Century Palgrave S., Palgrave Macmillan, Cham.

Available at: http://hdl.handle.net/10419/191566.

Martani, D., 2019. AKUNTAN DALAM ERA REVOLUSI

INDUSTRI 4 . 0 DAN TANTANGAN ERA SOCIETY

5 . 0, Available at:

https://staff.blog.ui.ac.id/martani/files/2019/04/Aku

ntansi-di-ERA-Revolusi-4.0-dan-Society-5.0-

04052019.pdf.

Ometov, A., Bezzateev, S., Mäkitalo, N., Andreev, S.,

Mikkonen, T. and Koucheryavy, Y., 2018. Multi-

Factor Authentication : A Survey †. Cryptography,

2(1), pp.1–31. Available at:

www.mdpi.com/journal/cryptography.

Qaddour, J., 2018. Multifactor Biometric Authentication

for Cloud Computing. In ICN 2018: The Seventeenth

International Conference on Networks. pp. 45–51.

Wu, P., 2017. Fintech Trends Relationships Research : A

Bibliometric Citation Meta-Analysis. In ICEB 2017

Proceedigs. 16. pp. 99–105. Available at:

http://aisel.aisnet.org/iceb2017/16.

Yang, W., Wang, S., Hu, J., Zheng, G. and Valli, C., 2019.

Security and Accuracy of Fingerprint-Based

Biometrics: A Review. Symmetry. Available at:

www.mdpi.com/journal/symmetry.

ICT4BL 2019 - International Conference on IT, Communication and Technology for Better Life

128