Macroeconomics and Jakarta Composite Index

Restu Hayati, Poppy Camenia Jamil and Azmansyah

Department of Management, Universitas Islam Riau, Pekanbaru, Indonesia

Keywords:

Jakarta Composite Index (JCI), Macroeconomics, Dow Jones Index, BI 7 Days Rate, The Fed Rate, Exchange

Rate, World Oil Prices

Abstract:

This study was conducted to determine the effect of macroeconomic variables on the Jakarta Composite Index

(JCI). By using time series data from 2016-2018, multiple regression analysis with the least square model

is used to prove the influence of dow jones index (DJIA), BI 7 days rate, fed rate, exchange rate, inflation

and world oil prices against the Jakarta Composite Index. After going through the data stationary test and

classic assumption test, the results of the study prove that there is no significant effect both simultaneously

and partially between macroeconomic variables on the Jakarta Composite Index (JCI) on the Indonesia Stock

Exchange (IDX).

1 INTRODUCTION

As a developing country, Indonesia has enormous

potential in the growth of investment, especially

in financial assets. This potential is evidenced by

the growth of the Jakarta Composite Index (JCI)

in the last 10 years which reached 200%. JCI

is the weighted average price of all shares of

companies listed on the Indonesia Stock Exchange.

The increase in JCI will be an indicator of the

improving investment climate of Indonesia’s financial

securities. The JCI price increase also followed by

the growth of market capitalization originating from

foreign investment and domestic investment. At

the end of 2018, market capitalization in Indonesia

reached almost 7,000 trillion rupiah, an increase of

7 times compared to the previous 10 years. Even

though in 2019, domestic market capitalization in

Indonesia has reached 50% compared to foreign

market capitalization, but the composition of foreign

investment in the country continues to increase,

thereby reducing the composition of domestic

investment. The investment growth is an opportunity

that foreign and domestic investors can use in

investing in the indonesian capital market.

An increase in market capitalization will certainly

increase demand and supply of shares in Indonesia.

Although fundamental financial performance factors

play an important role in the investor’s consideration

of investment policies, macroeconomic factors and

competition in developing countries’ stock exchanges

can also influence the flow of funds and thus affect

JCI price levels. It cannot be denied that investors

are eagerly always trying to find information related

to macroeconomics which will be a consideration

of investment policies. (Barakat et al., 2016)

(Barakat, Elgazzar and Hanafy, 2016) explain that

macroeconomic variables can explain and have an

important role in market fluctuations. News about

the increase in the domestic interest rate (BI 7

days rate), the foreign interest rate (the fed rate),

the development of the Dow Jones index price, the

rupiah exchange rate against the USD, inflation, and

even the development of world oil prices has always

been highlights in financial media. And this is also

supported by the opinions of several experts from

securities companies (Paramitra Alfa Sekuritas, 2018)

(Artha Sekuritas, 2019) (OSO Securities, 2019) (Bina

Artha Sekuritas, 2019), and also by the Indonesian

Stock Exchange representatives (Wintoro, 2014).

Some studies that support the influence of the macro

economy on the stock index that are (Samadi et al.,

2012) (Vejzagic and Zarafat, 2013), (Sudarsana and

Candraningrat, 2014), and (Barakat et al., 2016).

Whereas some studies have found that

macroeconomics factors do not contribute to stock

index price. (Wijayaningsih et al., 2016) found that

the fed rate had no significant effect on JCI. (Salameh

and Alzubi, 2018). found that the Stock Exchange

in the United Arab Emirates was influenced by the

Stock Exchange in the UK, but not by the stock

exchange in the USA. (Ullah et al., 2014) found

Hayati, R., Jamil, P. and Azmansyah, .

Macroeconomics and Jakarta Composite Index.

DOI: 10.5220/0009060401170122

In Proceedings of the Second Inter national Conference on Social, Economy, Education and Humanity (ICoSEEH 2019) - Sustainable Development in Developing Country for Facing Industrial

Revolution 4.0, pages 117-122

ISBN: 978-989-758-464-0

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

117

that in the long run the exchange rate and interest

rate have a significant effect while inflation has no

effect on the stock market. Likewise with research

(Asmara and Asmara, 2018) which found that there

was no relationship between inflation and JCI. (Sir,

2012) found that there is a causality relationship

between macroeconomic variables on stock returns.

This study will prove whether these macroeconomics

number really affect investor behavior that will

significantly change JCI prices.

2 RESEARCH PROBLEM

The problem in this study is the value of JCI which

continues to increase with a significant increase over

the past 10 years reaching 200%. By ignoring

the fundamental factors, this study focuses more on

macroeconomic variables that have been trusted and

have been proven by various studies to affect stock

indexes.

In Indonesia in the last 2 years (2016-2018), the

pattern of JCI change is very much in accordance with

the changing pattern of macroeconomic variables.

JCI in the last two years has increased by 30%

where there has been a decline in interest rates by

17%, a decrease in inflation by 24%, a decline in

the exchange rate by 4.5%, an increase in DJIA by

42%, an increase in world oil prices by 81%, and an

increase The Fed’s interest is 995%.

So, the research problem that we want to prove

in this research is “Are there significant influences

between macroeconomic factors on the Jakarta

Composite Index (JCI)?”

3 LITERATURE REVIEW

3.1 Macroeconomic Variables

Research that links macroeconomic variables to stock

returns begins to be enlivened by (Fama and Schwert,

1977) and (Fama, 1981). By using inflation as the

main macroeconomic variable that is most influential

so that it causes a stock anomalous return. After that,

more and more studies using other macroeconomic

variables are used in predicting stock prices, stock

returns, and also stock index prices.

Macroeconomic variables used in this study are:

• Dow Jones Industrial Average (DJIA) The DJIA

is the index used to determine the weighted

average of the 30 largest companies in the United

States which was founded by The Wall Street

Journal. This index is used as a measure of the

performance of the largest companies in America

that will determine the condition of the USA

economy.

• BI & Days Rate The 7 days BI rate is the reference

interest rate of banks in Indonesia, which has been

determined by Bank Indonesia as the central bank.

7 days showing a period of 7 days used Bank

Indonesia s to evaluate monetary policy in setting

the benchmark interest rate.

• The Federal Reserve Rate (The Fed Rate)

The Fed Rate is the interest rate at which

depository institutions (banks and credit unions)

lend reserve balances to other depository

institutions overnight, on an uncollateralized

basis (wikipedia).

• The exchange rate of the rupiah against the dollar

An exchange rate is an agreement known as a

currency exchange rate for payments now or later,

between two currencies of each country or region

(wikipedia).

• Inflation Inflation is an increase in the prices of

goods in general and continously. Inflation data

in Indonesia is obtained from the publication of

Bank Indonesia as the central bank in Indonesia.

• Oil Prices oil price is the price of petroleum that

uses the West Texas Intermediate (WTI) standard.

WTI is a world standard of petroleum produced

from North America which is in great demand,

especially in the USA and China.

3.2 Jakarta Composite Index

The Jakarta Composite Index is the average daily

stock of all shares listed on the Indonesia Stock

Exchange. JCI is seen as the most commonly used

general index in Indonesia as a measurement of the

average performance of all shares.

4 METHODOLOGY

4.1 Population and Sample

The population and sample in this research are Jakarta

Composite Index (JCI) in Indonesia Stock Exchange.

Secondary data used is from 2016 - 2018 so the

overall data is 36 (n = 36).

4.2 Data Analysis

Data were analyzed using multiple regression

analysis using software EViews. The multiple

ICoSEEH 2019 - The Second International Conference on Social, Economy, Education, and Humanity

118

regression equation from the study is as follows:

Y = a + b

1

X

1

+ b

2

X

2

+ b

3

X

3

+ b

4

X

4

+ b

5

X

5

+b

6

X

6

+ e

(1)

Where,

• Y = Jakarta Composite Index

• X

1

= Dow Jones Index (DJIA)

• X

2

= BI 7 Days Rate

• X

3

= The Federal Reserve Rate

• X

4

= Exchange Rate (IDR to USD)

• X

5

= Inflation

• X

6

= Oil Price

• a = constanta

• b

1

, b

2

, b

3

, b

4

, b

5

, b

6

= The Federal Reserve Rate

• e = error

Before the multiple regression testing is carried

out, each variable is subjected to data stationarity

testing to determine whether or not there is a trend

pattern on time series data. This is done to avoid

spurious regression in research.

After that, classical assumptions were tested on

the data, namely multicollinearity and normality

so that best linear unbiased estimator (BLUE)

requirements were fulfilled in the regression with the

least squares model.

Furthermore, the F test is used to determine

the simultaneous effect between all macroeconomic

variables on JCI. Likewise, with the t test, it is used to

determine the partial effect of each macroeconomic

variable on JCI. The hypothesis is accepted if the

significance value < 0.05.

5 RESULTS

5.1 Data Stationarity

Data stationarity is tested using a unit root test

at various levels until it reaches stationary. The

probability of the unit root test can be seen in the table

below:

At level 0, all time series data on each variable

forms a trend pattern with a probability value > 0.05.

Therefore, stationary testing is carried out at level 1st

difference. Based on the table above the data at the 1st

difference is stationary with all probability values in

each variable ¡ 0.05. Furthermore, multiple regression

analysis is done using the 1st difference data.

Table 1: Unit Root Test

Variable Level 1

st

difference

Jakarta Composite

Index (JCI)

0.4476 0.0004

Dow Jones

Index (DJIA)

0.4490 0.0004

BI 7 Days Rate 0.0609 0.0008

The Fed Rate 0.9997 0.0002

Exchange Rate 0.7247 0.0000

Inflation 0.1724 0.0000

Oil Price 0.2295 0.0023

5.2 Classical Assumption Test

Classical assumption test is done so that the multiple

regression equation model satisfies the best linear

unbiased estimator (BLUE).

5.2.1 Multicollinearity

Multicollinearity is used to determine the correlation

between independent variables.

Table 2: Multicollinearity Test

Variable

Centered Variance

Inflation Factor (VIF)

Dow Jones

Index (DJIA)

1.310733

BI 7 Days Rate 1.250585

The Fed Rate 1.133625

Exchange Rate 1.308130

Inflation 1.180933

Oil Price 1.457788

Based on the table above, there is no correlation

between the independent variables with the centered

VIF value <10. This means that each independent

variable in the study has no resemblance so that it is

suitable to be used as an economic macro variable that

can affect Jakarta Composite Index (JCI).

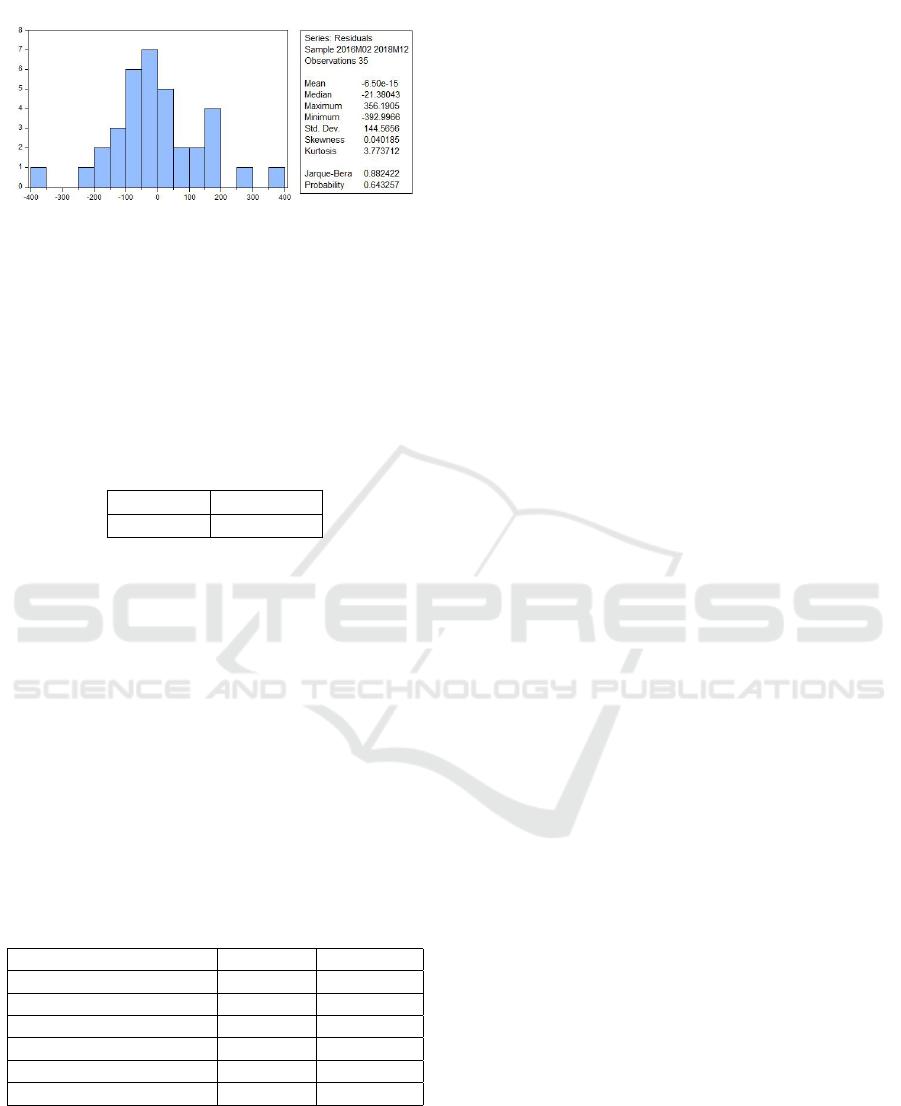

5.2.2 Normality

The normality test aims to test whether in the

regression model, the residual confounding variable

has a normal distribution.

The data in this study are normal with a Jarque

Beta> 0.05 probability value, which is 0.643257.

Macroeconomics and Jakarta Composite Index

119

Figure 1: Jarque Beta Normality Test

5.3 Hypothesis Test

5.3.1 Simultaneous Effect

The value of F and its probability that determines the

influence all macroeconomic variable on the Jakarta

Composite Index can be seen in the table below:

Table 3: Simultaneous Effect

F-statistic Probability

0.79 0.585318

The calculated H

456

F value is 0.79, smaller than

the F table value of 2.42. In addition, the probability

F value > 0.05, which is 0.58. Based on the statistical

analysis, the decision was that there was no significant

simultaneous effect between the DJIA, the BI 7 days

rate, the Fed rate, the rupiah exchange rate, inflation

and world oil prices against the Jakarta Composite

Index (JCI).

5.3.2 Partial Effect

The value of t and its probability that determines

the influence of each macroeconomic variable on the

Jakarta Composite Index can be seen in the table

below:

Table 4: Partial Effect.

t-statistic Probability

Dow Jones Index (DJIA) 1.122180 0.2713

BI 7 Days Rate -0.882821 0.3848

The Fed Rate 1.648327 0.1105

Exchange Rate 0.508940 0.6148

Inflation 0.426376 0.6731

Oil Price -0.898726 0.3765

The t value of statistics for each variable does

not exceed t table, which is 2.03. Likewise, the

probability value of each variable is more than

0.05. This means that none of the macroeconomics

variables have a partial effect on JCI.

5.3.3 Contribution of Macroeconomic Variables

to JCI

The contribution of Dow Jones Index (DJIA), BI 7

days rate, fed rate, exchange rate, inflation and world

oil prices against the JCI are 0.1447 or 14.47%. With

no significant influence between all macroeconomic

variables on JCI it is reasonable that macroeconomic

contributions are 14.47%. The rest, 85.53% is

influenced by other variables outside of this study.

Following are the multiple regression equations

that explain the effect of macroeconomics on JCI:

JCI = 4.64 + 0.07DJIA − 94.53BI7DaysRate+

495.03T heFedRate + 0.06ExchangeRate+

41.54In f lation − 6.9OilPrice

(2)

Based on the regression equation above it is

known that the variable domestic interest rate (BI 7

Days Rate) and oil prices, have a negative relationship

while other macroeconomic variables have a positive

relationship. If the Indonesian government increases

the benchmark interest rate, JCI will decline even

though the decline is not significant. Likewise, with

world oil prices. The increase in world oil will add to

the average operational burden of public companies

in Indonesia, especially manufacturing companies so

that it will reduce the company’s stock price even

though the decline is not significant.

6 DISCUSSION

The results prove that suprisingly macroeconomic

factors do not have a significant influence on

JCI. During this time, every financial media and

even investment managers from securities companies

always make a fuss if macroeconomic changes occur

that could affect investors’ decisions. This research

proves the opposite.

The Down Jones Index is often seen as a

baromater of world market performance consisting

of 30 companies. When market experts say the

market is going up or down, it illustrates that DJIA

is experiencing fluctuations. The stock price of

the 30 best companies in America is a reference

to the state of the world economy. The rising

price of Dow Jones provides information that the

world economy is improving which should affect the

economies of other countries including Indonesia.

The rising price of DJIA has often been responded

positively by domestic investors related to the

hope of future economic conditions. If economic

conditions improve, stock prices will also experience

ICoSEEH 2019 - The Second International Conference on Social, Economy, Education, and Humanity

120

an increase. But, in fact, DJIA did not significantly

influence JCI. This might be due to the lack of

direct connection between these 30 companies and

companies in Indonesia. Dow Jones has also been

criticized as no longer a reflection of market prices

in the world economy.

BI 7-days rate does not contribute to JCI because

the offered interest rate is not too competitive so

investors tend not to mind the fluctuation in the BI

7 Day Rate. The 7 days BI rate in Indonesia, which

were around 4-6% in the past two years, did not

provide an incentive for investors to moved their

funds to financial institutions that provide less risk.

The Federal Reserve Rate has no effect on the

JCI, this can be caused by the average company

incorporated in the Indonesia Stock Exchange which

is represented through the JCI is a company that

operates almost entirely in Indonesian territory and

is not directly related to The Federal Reserve Rate.

From the investor side, it might be preferable to

invest in Indonesia despite the opportunity to increase

profits with promising interest rates in America.

Exchange rate risk will be an additional consideration

for investors in transferring funds from Indonesia.

Changes in the exchange rate of the rupiah against

the dollar also did not contribute to fluctuations in

the value of the JCI. Investors who invest in the

Indonesia Stock Exchange usually have their own

preferences on the choice of industrial sectors that

are of interest so that even if there are significant

changes to the exchange rate it will not affect

investor interest in investing. In addition, in terms of

companies in general, they have carried out exchange

rate risk management so that it does not affect the

company’s financial performance. Likewise, inflation

is not the main focus of investors in investing which

is supported by research (Ullah et al., 2014) and

(Asmara and Asmara, 2018) and (Geetha et al., 2011).

Oil Price should be a consideration because it can

affect production costs but not the entire company is

in the manufacturing production sector. Of the 600

companies listed on Indonesia Stock Exchange, only

about 23% are manufacturing companies. JCI is a

combination of all sectors in the Exchange, because

on the average there is no effect of oil price on the

value of the JCI.

Based on the results it is known that overall macro

factors do not affect the JCI, assuming that the round

of funds that occur in the capital market already has

its own investment preferences by each investor.

7 RESEARCH DEFICIENCY

Due to limitations in data collection, this study uses

short-term time frames, from 2016 to 2018. Future

research is expected to use a span of 10 years so that it

can see changes in macroeconomic strength towards

JCI from year to year.and add a comparison of the

influence of fundamental and macroeconomic factors

on JCI.

8 CONCLUSIONS

The results of this study prove that although the

JCI change pattern follows the changing pattern

of macroeconomic variables, but after it has been

proven by a series of statistical tests, none of the

macroeconomic variables affect JCI in the short run.

This might be caused by investors in Indonesia pay

more attention to the fundamental factors which are

the company’s financial performance. In addition,

stock indices in a country do have a tendency to

increase due to developments in a country’s Stock

Exchange.

REFERENCES

Asmara, W. P. and Asmara, I. P. W. P. (2018). Pengaruh

variabel makro ekonomi terhadap indeks harga saham

gabungan. None, 7(3).

Barakat, M. R., Elgazzar, S. H., and Hanafy, K. M. (2016).

Impact of macroeconomic variables on stock markets:

Evidence from emerging markets. International

journal of economics and finance, 8(1):195–207.

Fama, E. F. (1981). Stock returns, real activity,

inflation, and money. The American economic review,

71(4):545–565.

Fama, E. F. and Schwert, G. W. (1977). Asset returns

and inflation. Journal of financial economics,

5(2):115–146.

Geetha, C., Mohidin, R., Chandran, V. V., and Chong,

V. (2011). The relationship between inflation and

stock market: Evidence from malaysia, united states

and china. International journal of economics and

management sciences, 1(2):1–16.

Salameh, H. M. and Alzubi, B. (2018). An investigation of

stock market volatility: evidence from dubai financial

market. Journal of Economic and Administrative

Sciences, 34(1):21–35.

Samadi, S., Bayani, O., and Ghalandari, M. (2012).

The relationship between macroeconomic variables

and stock returns in the tehran stock exchange.

International Journal of Academic Research in

Business and Social Sciences, 2(6):559.

Macroeconomics and Jakarta Composite Index

121

Sir, M. M. (2012). Impact of the macroeconomic variables

on the stock market returns: The case of germany and

the united kingdom. Global Journal of Management

and Business Research, 12(16).

Sudarsana, N. M. A. D. and Candraningrat, I. R. (2014).

Pengaruh suku bunga sbi, nilai tukar, inflasi dan

indeks dow jones terhadap indeks harga saham

gabungan di bei. Jurnal Fakultas Ekonomi dan Bisnis

Universitas Udayana (Unud), Bali, Indonesia, hlm.

3291, 3308.

Ullah, F., Hussain, I., Rauf, A., et al. (2014). Impacts

of macroeconomy on stock market: Evidence from

pakistan. International journal of management and

sustainability, 3(3):140–146.

Vejzagic, M. and Zarafat, H. (2013). Relationship between

macroeconomic variables and stock market index:

Cointegration evidence from ftse bursa malaysia

hijrah shariah index. Asian journal of management

sciences & education, 2(4).

Wijayaningsih, R., Rahayu, S. M., and Saifi, M. (2016).

Pengaruh bi rate, fed rate, dan kurs rupiah terhadap

indeks harga saham gabungan (ihsg)(studi pada

bursa efek indonesia periode 2008-2015). Jurnal

Administrasi Bisnis, 33(2):69–75.

Wintoro, D. (2014). Structural model of the idx credibility.

Indonesian Capital Market Review.

ICoSEEH 2019 - The Second International Conference on Social, Economy, Education, and Humanity

122