The Future and the Challenges of the Indonesian

Banking Industry in the Digital Era

Batara Maju Simatupang and Kevin Bastian Sirait

1Magister Management, Post-Graduate Program, STIE Indonesia Banking School, Jakarta, Indonesia

2Faculty of Economics, Parahyangan Catholic University, Bandung, Indonesia

Keywords: Technology, Digital Culture, Fintech, Indonesian Banking Industry.

Abstract: This article focuses on researching the IT challenges faced by the Indonesian banking industry in the digital

age. The rapid development of technology has provided benefits for the banking sector in integrating

technology to meet the demands of its customers. Although, this advantage comes with its challenges, as with

the emergence of the fintech (financial technology) industry. This study uses an action research method, which

is applied to identify challenges faced by conventional banks and provide solutions to overcome the identified

challenges. Based on the analysis, it was found that conventional banks have a gap between their digital

products and the expectations of their customers; in which majority of the respondent is engaging in the

implementation of open application programming interface (API) to facilitate the digital banking activities of

its customers via the software and the web-service product created by the Indonesian conventional banks. The

implication is that the IT gap between banking services and their customers must be overcome. For this reason,

it is recommended that conventional banks work together in order to meet customer expectations and/or banks

can use a customer-centric approach in product development.

1 INTRODUCTION

With the rapid development and the implementation

of new technologies, all the existing industries have

started to use new technologies to improve their

operational and business activities. Some of the

industries have entered the phase of digitalization,

especially in the case of the banking industry.

According to the report produced by the company of

Frost & Sullivan (2019), it is shown that due to the

rapid development and increases of implementation

of technology in the case of internet penetration and

accessibility, the market revenue of electronic

commerce (e-commerce) is estimated to reach the

value of US$ 45.2 billion in 2019 and US$ 62.3

billion in the following year; to be precise, the aspect

of business-to-business (B2B) and business-to-

consumer (B2C) are said to be increasing in the area

of digital market in Indonesia. In other words, the

Indonesian banking industry may capitalize on this

opportunity to become the facilitator for the customer

in the e-commerce market to handle their digital

transactions, both in the domestic and international

transactions.

Despite the opportunity and the benefits of the

rapid development and implementation of new

technologies, the Indonesian banking industry may

have to consider the potential obstacles and

challenges of these advantages. One of the obstacles

faced by the banks of the digital era is the rise and the

emergence of financial technologies (fintech) firm. In

which, the product that is produced by the fintech

firm has some similarities with the product created by

the conventional banks. In general terms, the product

of the fintech firm has some feature that already exists

in the tradition banking product. Furthermore,

Anagnostopoulos (2018) stated that the product

created by the fintech firm is easier to use and faster

to fulfill the demand of digital transactions of its user

compared to the conventional bank, which means that

the product of the fintech firms creates challenges to

the Indonesian banking industry to facilitate the

domestic and international transaction in the field of

digital transactions.

Furthermore, the banking sector is one of the

sectors that are prone to disruptions (Fichman, et al.,

2014). To be precise, the disruptions which are

triggered by the rapid growth and development of

technologies. These disruptions are putting the

conventional banking industry at risk of maintaining

their position as an intermediary for their customers

in conducting digital transactions, especially in the

Simatupang, B. and Sirait, K.

The Future and the Challenges of the Indonesian Banking Industry in the Digital Era.

DOI: 10.5220/0009198100250033

In Proceedings of the 2nd Economics and Business International Conference (EBIC 2019) - Economics and Business in Industrial Revolution 4.0, pages 25-33

ISBN: 978-989-758-498-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

25

case of creating an application that has a better

performance to the fintech firms. These disruptions

are enforced due to the fintech firms has the upper

hand on implementing their technological innovations

to provide better digital financial and banking

services compared to the conventional banks.

In regards to the obstacles and challenges faced

by the Indonesian banking industry, it is considered

naïve to believe that the emergence of fintech firms

solely creates these challenges. The other aspect that

needs to be considered in this matter is the changes in

the digital culture. In other words, it is about how the

banks' customers perceive the implementation and the

benefits of technology in fulfilling their needs in

banking and financial demand in a digital manner. It

is predicted that smartphone users will dominate the

banking market share by the year 2020 in regards to

digital transactions (AT Kearney, 2014; Wirdiyanti,

2018). By this prediction, the Indonesian banking

industry must understand the demands and needs of

its customers. Oshodin et al. (2017) explain that due

to the improvement of technologies enables the firm

to create an application or product in a customer-

centric manner to fulfill the needs and demands of the

customer and the changes in the customer preference

in using a digital product.

In the case of Indonesia, it is reported that the

mobile penetration rate stands at the level of 150%

with the mobile subscriptions reaching 388.04

million people by the year of 2016 alone (Frost &

Sullivan, 2018). By the level of the mobile

penetration rate alone, it is expected for the

Indonesian banking industry to facilitate a better

medium for their customers to conduct digital

transactions. And yet, the fintech firms have the

capability to produce a better digital product

compared to the conventional banks; furthermore,

there is an information and knowledge gap on

utilizing the latest technology to provide a financial

and banking product digitally between the fintech

firm and the conventional banks (Davis, et al., 2017;

Omarini, 2018). In short, the Indonesian banking

industry needs to produce an application or a digital

product that has the same or exceed the quality of the

digital product produced by fintech firms. Based on

the report and the previous research, it can be

indicated that for the Indonesian banking industry to

be able to capitalize the changes in the trend on

conducting digital transactions, then the Indonesian

banking industry must adapt to the changes and the

shifting of preference of its user on regarding the

demands of digital transactions.

In simple terms, the Indonesian banking industry

is forced to cope with the sets of challenges that arise

from the rapid development of technologies; to be

precise, the challenges faced by the Indonesian

banking industry are the emergence of fintech firms

and the changes of digital culture or preference in

their customer on conducting digital transactions. If

the Indonesian banking industry able to capitalize on

the changes and understand the needs of its customers

regarding the demand for digital transactions, then the

Indonesian banking industry will be able to become a

favorable medium for its current and potential

customers in conducting digital transactions.

Based on the introduction above, the primary

objectives of this research are to investigate the

pattern of changes in the digital culture on conducting

digital transactions and providing solutions for the

Indonesian banking industry to be able to cope with

the challenges from the emergence of fintech firms.

With the addition of finding the set of challenges or

obstacles faced by the Indonesian banking industry in

the digital era and determined the future state of the

Indonesian banking industry if those challenges are

handled correctly or not.

2 LITERATURE REVIEW

In this section, it is provided with the literature

regarding the difference between the conventional

banking industry and the fintech industry, especially

in the context of Indonesia. Furthermore, it is also

included in the literature on the matter of impact due

to the rapid development of technology in the banking

sector.

2.1 Conventional Banking Industry vs.

Fintech Industry

The primary differences between conventional

banking with the fintech industry are solely lying to

the implementation of technology in their financial

and banking products. To be precise, in regards to

fulfilling the demand for digital products to conduct

digital transactions by the current and potential

customers. With the addition of the nature of the

industry, it is known that the fintech industry has the

nature of the "highly-innovative industry";

meanwhile, the conventional banking industry has the

nature of the "highly-regulated industry." In other

words, for the conventional banking industry, all the

banks must follow the regulations that are applied by

the government or standards to conduct any banking

activities; on the other hand, the fintech industry has

greater flexibility to implement their innovation in

technology to their activity to produce a high-quality

product. In which, the fintech industry has a

competitive advantage against the conventional

banking industry in the aspect of technology

utilization and has increased the level of competition

EBIC 2019 - Economics and Business International Conference 2019

26

with conventional banks (Romānova & Kudinska,

2017).

Furthermore, the fintech industry has a diverse

product in its application on fulfilling the demand for

digital banking and financial services (Davis, et al.,

2017). The diversity in the product created by the

fintech firms increases the possibility of the

customers to acquire and use the product easily; in

which, the product can be obtained via the internet. In

the case of the conventional banking industry (also

known as the incumbents), for every digital product

created by the incumbents, it must be validated and

checked by the regulators before the public could

access it. In other words, the regulators check the

digital product produced by the banks to see if the

incumbents meet the criteria and the regulation

applied in the banking sector. Due to the strict

regulations and rules that the incumbents have to

follow, the fintech firms are able to capitalize the gap

within the expectations and the demand of the

banking customer and the fintech firms are able to

create a product that specifically designs to fulfill the

demand with superior advantage in digital product

compared to the incumbents.

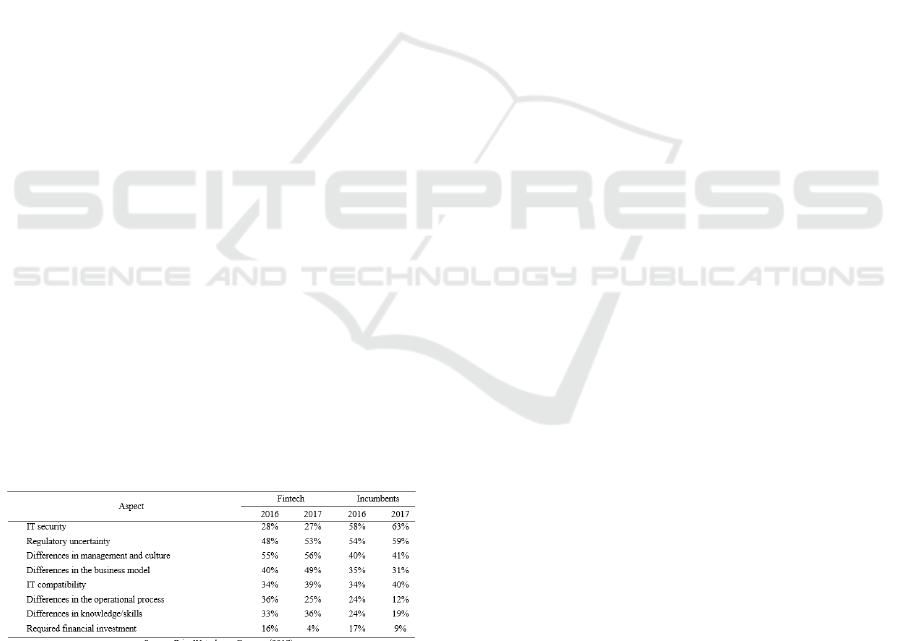

According to the report published by Price

Waterhouse Coopers (2017) which involving 1,308

respondents globally regarding the challenges faced

by the fintech industry and the incumbents, it is found

that the main challenges in the fintech industry are

focuses in the three areas, which are (1) regulatory

uncertainty, (2) differences in management and

culture and (3) the differences within the business

models; meanwhile, in the case of the incumbents, the

main challenges are focuses on (1) information and

technology (IT) security, (2) regulatory uncertainty

and (3) the differences in management and culture.

The overall percentage regarding the challenges

between the two industries is presented in Table 1.

Table 1. The Challenges Between the Fintech Industry and

Conventional Banking Industry

Source: PriceWaterhouseCoopers (2017)

Based on Table 1, it is shown that there is a high

degree of differences in challenges faced by both

industry, especially in the case of the different

management and culture. Based on the difference, the

fintech industry and the conventional banking

industry has an entirely different nature in fulfilling

the demand of digital transactions of its customer. To

be precise, the fintech industry has create six

disruptions to the conventional banking industry:

namely (1) the pace of technological innovation and

adoptions, (2) the disintermediation of financial

services, (3) industry convergence, (4) low cost and

low barriers of entry, (5) borderless platform and (6)

the democratization of investment and financial

services (Brummer & Gorfine, 2014). In simple

terms, the fintech has a different culture and

management style with the conventional banking

industry and capitalize on the benefits of the

development of technologies to gain competitive

advantages against the conventional banking

industry.

2.2 The Impact of Technology in the

Banking Sector

The impact of the rapid development of technologies

is not only focused on the emergence of the fintech

industry, but it also affects the regulators and nations

on how to handling the usage of new technology in

the banking and financial sector. Furthermore, the

impact of the advanced technology is caused by the

combination of three factors, namely (1) regulations,

(2) technological, and (3) economic factors

(Zavolokina, et al., 2016).

In regards to the regulations, due to the rapid

development of technology and its implementation in

the banking and financial sector, regulators are forced

to make regulations that can ensure every company

(fintech and conventional banks) to be prudent. In

which, these companies are forced to make necessary

changes to operate within the law, especially

regarding the code of conduct and regulations in the

matter of providing financial and banking services to

the public. In the case of Indonesia, the regulations

that are applied to the fintech industry are only

focused on the area of (1) lending and borrowing via

the internet and (2) the use of electronic money

(Iman, 2018). In which, the Indonesian regulators still

lack regulations to control any other type of fintech

activities which are operated in Indonesia, such as

cryptocurrencies and blockchain.

In terms of technological factors, the incumbents

are forced to adapt to the latest technology that can be

implemented to increases the quality of their services

in regards to fulfilling the needs and demands of

digital transactions of their current customers.

However, due to the nature of highly regulated

characteristics within the banking industry, the

incumbents must first be checked and validated by the

regulators to ensure their digital product meets the

specified standards. Meanwhile, the fintech industry

has used technological breakthroughs to provide

The Future and the Challenges of the Indonesian Banking Industry in the Digital Era

27

better services or features within the application to

fulfill the demand for digital services of its customers.

In which, there are clear relationships between the

technologies as an input for the fintech industry to

have a transformation in conducting its business

(Zavolokina, et al., 2016). Furthermore, the fintech

industry does not have the same conventional

relationship as the incumbents and its customers, in

which the fintech industry is capable of using

codifiable information to maintain the relationship

with its customers (Vives, 2017). In other words, the

fintech industry is capable of noticing the needs of its

customers in conducting digital transactions.

Finally, in terms of the economic factor; the

economic conditions forced the fintech industry and

the conventional banking industry to find the gaps or

areas of improvement to find the state of stability, in

the sense of financial and non-financial state. In the

case of fintech firms, the economic conditions

encourage the fintech firms to find the gaps in the

banking and financial services provided by the

conventional banks and compare them with the

expectations level of their customers. By taking this

step, the fintech firms can capitalize on the weakness

within the conventional banks to provide better digital

services. And, the due to the advancement of

technologies and the flexibility of those technologies,

the fintech industry is able to adopt and implement

the necessary technologies to implementing maintain

an adequate standard to meets the criteria of its

current and potential customers.

3 METHODOLOGIES

In regards to fulfilling the objectives of this research,

the determination of the future state of the Indonesian

banking industry and its challenges are analyzed

using an action research method. Action research is

defined as a scientific process in a specific problem,

in which this process is used to improve the practice

or an understanding given in the problem (McKernan,

1988; Sagor, 2000).

In other words, the action research method is used

to understand the gap between the fintech industry

and incumbents; this step was taken to provide

solutions for old players to overcome the challenges

that arise from the fintech industry. Furthermore, the

action research method is also used to analyze the

impact of changing preferences in digital culture in

connection with the rapid developments in

technology occurring in the financial and banking

sectors.

In terms of understanding the incumbent's views

in the Indonesian banking industry in the digital era,

especially in terms of the impact of technological

advances in the banking sector; The questionnaire

used in this study took a sample of the population of

Commissioners and Directors of the Bank as digital

service practitioners in Indonesia, consisting of

Commissioners, CEOs, and Directors whose main

tasks and functions are related to IT. More precisely,

this questionnaire has presented the views and

opinions of the Indonesian Banking Executives, and

they acted as a "Panel of Experts."

To find IT challenges in Indonesian banking in

the future, then as an analytical tool, the multivariate

regression approach is applied. Multivariate

regression analysis was applied to predict any

changes in the dependent variable in response to

changes in the independent variable (Hair, et al.,

2014). This approach was taken to understand how

incumbents view IT challenges in the future for

Indonesian banks, especially in prioritizing the

application of IT systems in order to meet the

demands of their customers. Furthermore, with the

answers given by the expert panel, we can uncover

the incumbent's priorities for any aspect of the

technological approach in the digital age. And this

method is also used to find the nature of the

relationship between the dependent and the

independent variables. Hence, the regression formula

used in this study is given as follows:

𝑌 = 𝛼 ± 𝛽 𝑋

Based on equation (1), the impact of IT is

presented as Y, and the priority of implementing the

IT to meet the demand of its customer is presented as

X1. The equation (1) can be determined in which

technology the incumbent uses to meet the criteria of

its customers in conducting a digital transaction using

the financial services provided by the conventional

banks. Furthermore, it could map which technologies

the incumbents prioritize in order to cope with

challenges rises from the emergence of the fintech

industry and the shifting of preference of its

customers in the digital era.

One of the research that is using an action

research approach in the banking sector is conducted

by Becker et al. (2010). Becker et al. (2010) found

that banks were dissatisfied in terms of their general-

purpose business models, especially in the case of the

documentation approach taken by banks that are still

considered traditional. Where the traditional

approach taken by banks has an indication of the

inefficiency and deficit of information in the bank,

Becker et al. (2010) stated that banks could use

business process modeling language using semantic

process building blocks to identify weaknesses in the

bank and evaluate the processes within the bank to be

improved. The results of this study indicate a variety

of actions. Specifically, the semantic modeling

EBIC 2019 - Economics and Business International Conference 2019

28

language can be used in designing a system that can

give the capability for the traditional banks in

improving its effectiveness in process-oriented

analysis in their operational activities.

Also, the action research approach is used in the

research conducted by Sudiyatno et al. (2012), it was

found that there was a negative effect on financial

leverage in terms of company performance, (2)

positive effect on financial leverage on firm value, (3)

incentive managers had a positive influence on

company performance and value, (4) capital

expenditure was found to have positive influence on

company performance even though it has a negative

influence on company value and (5) company

performance has a positive influence in terms of

company value. Based on the findings of Sudiyatno

et al. (2012), it is recommended that companies make

policies to maximize the use of debt in their capital

expenditure activities, with the addition of increased

management efforts in order to increase company

values.

Furthermore, the multivariate regression analysis

is used to enrich the analysis of the action research

approach in order to understand the nature of the

specified dependent and independent variables. Also,

the usage of multivariate regression analysis has been

performed in numerous research, such as Sufian &

Chong (2008) and Vintillă & Nenu (2016).

In the research conducted by Sufian & Chong

(2008), the multivariate regression analysis is applied

to analyze the return on asset (ROA) in response to

the internal factors and external factors of the

Philippines ' financial institutions. The variables used

by Sufian & Chong (2008) to represent internal

factors are total assets, non-interest income, total

overhead expense and the book value of stockholder;

on the other hand, the external factors are presented

with money supply growth, market capitalization,

annual inflation rate, and gross domestic product.

Sufian & Chong (2008) found that the size of the

bank, credit risk, and expense preference behavior

have negatively related to the bank's profitability;

meanwhile, the non-interest income and

capitalization are positively related to the bank's

profitability. Based on the findings of Sufian &

Chong (2008), it is suggested that the bank-specific

determinant variables are statistically significant to

the banks' profitability, even though the non-interest

income and capitalization have a positive impact on

the bank's profitability.

In terms of the research conducted by Vintillă &

Nenu (2016), multivariate regression analysis is

implemented in order to analyze the ROA and return

on equity (ROE) in response to the quick ratio,

current ratio, leverage, cash conversion, effective tax

rate, and working capital; in which the object of the

research is the companies listed on the Bucharest

Stock Exchange. Based on the findings, it is found

that the variables used in the research of Vintillă &

Nenu (2016) are statistically significant; furthermore,

it is found that there is a negative relationship

between liquidity and firms' financial performance.

Based on the findings, it is indicated that the decrease

in the aspect of liquidity can be excluded as a risk

factor for the Romanian companies.

Based on the explanations regarding the

methodologies used in this research, these

methodologies are used to fulfill the research

objectives. To be precise, these methodologies are

used to determine the challenges faced by the

incumbents, analyze the changes of preference in the

digital culture, and to provide solutions that can be

used by the incumbents to cope with such challenges.

4 FINDINGS

In this section, the methodologies that already

explained in section 3 are applied in order to fulfill

the objectives in this research. The findings of this

research and its analysis are given as follows:

4.1 Multivariate Regression Analysis

Based on the research conducted, it is found that the

IT impact in response to the implementation of IT in

order to fulfill the demand and criteria of its customer

in conducting digital transaction are moving in a

positive manner; in other words, the impact of IT is

directly related to the level of implementation of IT

by the incumbents. The regression equation from the

multivariate regression analysis is presented in

equation (2).

𝑌 = −.801 + 1.067𝑋' (2)

Based on the equation (2), the regression analysis

shows that the impact of IT is dictated by the

movement of the implementation of IT applied by the

incumbents. In other words, the degree of

implementation of IT determined the scale of IT

impact the incumbents may have in their banks,

especially in regards to fulfilling the demand and

criteria of its customers in conducting digital

transactions by using the financial services provided

by the banks.

Furthermore, the linear regression presented in

equation (2), the regression has a p-value of 0.027. In

which, the linear regression of equation (2) is

statistically significant to analyze the movement of

the IT impact in response to the IT implementation of

banks in order to the meet the criteria and

expectations of its customers. In terms of the

The Future and the Challenges of the Indonesian Banking Industry in the Digital Era

29

implementation of IT, it is found that the p-value of

the variable stands at the level of 0.027 (where the p-

value of the variable are below the 0.05 or 5%

threshold); in which, the variable of IT

implementation is statistically significant to describe

the movement of the IT impact to the incumbents.

And finally, in terms of the correlation of the IT

impact and the implementation of IT stands at the

level of 0.765 or 76.5%. The correlation value

indicates that the IT impact and the implementation

of IT has a positive relationship between one and

another. In other words, if one of the variables

increases, then the other variable has the tendency to

be increasing as well and vice versa.

4.2 Action Research Analysis

In regards to the findings using the research action

method, the steps of action research are conducted by

the process defined by Sagor (2000). The analysis of

the challenges faced by the conventional banking

sector (especially for the Indonesian banking sector)

using an action research approach is given as follows.

In accordance with the phenomenon of the emergence

of the fintech industry, the fintech industry is capable

of producing a better application for its customers in

terms of using the application for conducting digital

financial and banking services. In which, these

applications created by the fintech firms consider

better than the conventional banking sector due to the

rapid development and implementation of its product.

As Romānova & Kudinska (2017) explains, the

fintech firms is categorized into two groups, which

are (1) by become the partner for the conventional

banking sector in order to produce a digital banking

and financial for its customers or (2) by creating an

application for its customer to conduct a digital

financial and banking services which are already

provided by the conventional banks. Furthermore,

due there is a gap between the digital product

produced by the conventional banks and the

expectations of its customers in terms of digital

services, the fintech industry are able to complete the

gaps by creating a product the customers, in which the

customers did not acquire in the application created

by the conventional banks (Zavolokina, et al., 2016).

By noticing the gap between the customer's

expectation and the product created by the

incumbents, the fintech industry is capable on

capitalizing the opportunity by creating a product

with better quality and services compared to the

incumbents due to greater flexibility in implementing

its innovation to its product than the conventional

banking sector.

In terms of the changes of preferences in the

digital era, Das et al. (2016) explains that there are

four disruptions in Indonesia that already happen in

regards to the rapid development and advancement of

technology, which are (1) mobile internet, (2) cloud

technology, (3) internet of things and (4) big data and

advanced analytics. Because of these disruptions, the

customers of the banking industry are expected to

have digital services that enable them to conduct their

digital transactions as smooth and seamless as

possible. In other words, the trends that already

happened in Indonesia is that every digital transaction

can be completed just by using their smartphones or

mobile phones. Furthermore, according to the

Australian Trade and Investment Commission

(2018), the number one reasons the Indonesian

customers conducting digital transaction in 2016

(especially in their purchasing activity in the e-

commerce market) is due to the practicality factor; in

which there are 63% of the respondent engaging in

the digital transactions due to the practicality it

provides.

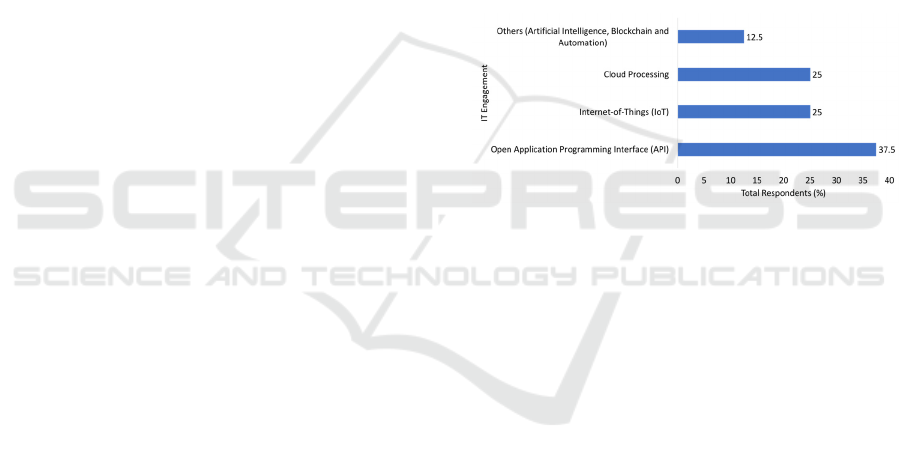

Figure 1. Indonesian Conventional Banks' IT Engagement

Based on that trend, the incumbents use different

approaches in fulfilling the demands and the needs of

their customers. Specifically, it is found that (1)

37.5% of total respondent is engaging in the

implementation of open application programming

interface (API), (2) 25% of total respondent are

engaging in the implementation of internet of things

(IoT) and (3) 25% of the total respondent are

engaging in the implementation of cloud processing.

To simplify the findings above, Figure 1 is presented

as an overview regarding the Indonesian banks’ IT

engagement in fulfilling the demands and the needs

of its customers. Furthermore, it is found that 62.5%

of the total respondent believes that it is crucial to

collaborate with the fintech firms to improve their

implementation of IT in order to meet the criteria of

its user. Meanwhile, 50% of the total respondent is

considered the implementation of big data analytics

to be important in findings the needs of its customer;

in which the conventional banks may have the

opportunity to produce an application or system to fill

the needs of its customers.

Furthermore, it is indicated that all of the

incumbents have different priorities in regard to the

implementation of IT in order to fulfill the criteria and

the demands of its customers. Also, some of the

EBIC 2019 - Economics and Business International Conference 2019

30

incumbents believe it is essential to collaborate with

the fintech firms in order to produce digital services

That meet the preference of its customer in

conducting the digital transaction; in which, some of

the incumbents working together with the fintech

firms in order to fill the gaps that exist in the digital

era. Also, it is found that not all the incumbents

prioritize the same technology in their business in

order to cope with the challenges that arise in the

digital era; to be precise, in regards to the emergence

of fintech and the changes in the preference of its

customer.

In regards to the challenges faced by the

Indonesian banking sector due to the emergence of

the fintech industry and the changes of preference in

conducting a digital transaction, the Indonesian

banking industry is faced with several problems

relating to the implementation of technology in the

digital era. Some of the problems that are identified

using the action research approach are: (1) the

incumbents are still in struggle to produce an

application or digital financial and banking services

that have the same quality (or better) with the

application with the fintech firms, (2) the incumbents

are restricted in the implementation of the new

technology and implementing its innovations due to

the nature of the industry itself (which are a “highly-

regulated industry”), (3) there are gaps between the

digital product produced by the incumbents and the

expectations of its customer (in which, these gaps are

capitalized by the fintech industry to provide digital

and financial services where the incumbents are not

able to provide to its via technology implementation)

and (4) due to the rapid development of technology,

the banks are needed to provide a better security to

protect theirs and customers data from any

cybersecurity threats that may occurs in any given

time (especially to the data that are used by the

incumbents to implements the new technology in

their digital services for its customer).

Based on the explanations on the challenges faced

by the incumbents, the challenges faced by the

incumbents are oriented on the approach to utilize

their technology to understand and fulfill the

demands, the criteria, and the preferences of its

customers in conducting digital transactions. In

simple terms, the incumbents should either learn from

its competitors (in this case, it is the fintech industry)

in regards to provide better applications for its

customer in doing digital transactions or by

examining the needs of its customers in regards to the

trends that already taken place in this digital era.

4.3 Solutions

Based on the challenges that explained in section 4.2,

several approaches or solutions can be applied by the

incumbents to cope with these challenges (in regards

to the changes of preferences of its customers and the

emergence of the fintech industry). It is identified that

conventional banking customers in need of an

application or software that can make their digital

transactions easier. On the other hand, every customer

has their own preferences or criteria in conducting

digital transactions. In which, the Indonesian

conventional banks should prioritize the necessary

technologies in order to improve the effectiveness of

their application in fulfilling the needs and the criteria

of its customers in conducting digital transactions or

banking activities.

In this regards, some of the solutions are: (1) the

incumbents could collaborate with the fintech firms

in developing their own digital financial and banking

product to fulfill the demand and the criteria of its

customers, (2) the incumbents could create or develop

their digital banking and financial services using the

customer-centric approach in order to obtain the

information of the needs of its customer and the

incumbents could prioritize which technology to be

implemented to meets the criteria, (3) the incumbents

should have an adequate security to protect the banks

and its customer data in the digital era (especially on

the data which are used to facilitate the customers

digital transactions) and (4) the implementation of

technology by the incumbents should focus on the

aspect of practicality (in which, the application has

the characteristic of seamless and easy-to-use feature)

to be able to keep up with the trend that are already

taken places.

Following the result of the regression analysis

presented in equation (2), the incumbents should

prioritize the technologies that are needed by its

customers. By prioritizing the technologies based on

the criteria and the demands of its customers, the

incumbents are able to keep up with the trends in

conducting digital transactions. Furthermore, by

prioritizing the technology to be implemented based

on the trends, the incumbents are able to develop their

digital product using the customer-centric approach

to maximize the performance and the quality of their

product to meet the criteria and the expectations of its

customers and the trend in the digital culture.

5 CONCLUSIONS

Based on the analysis using the multivariate

regression analysis, it is found that the impact of IT

in response to the implementation of IT in the

Indonesian conventional banks is statistically

significant. Furthermore, the impact of IT is dictated

by the implementation of IT to fulfill the demands of

its customers. Meanwhile, in regards to the analysis

The Future and the Challenges of the Indonesian Banking Industry in the Digital Era

31

using correlation analysis, it is found that the impact

of IT with the IT implementation in terms of meeting

the criteria and the expectation of its customers in

conducting digital banking activities is found to be

positively related. Thus, the more frequent the

conventional banks implementing new technologies,

then the impact of IT will be increasing as well and

vice versa.

In terms of findings using the action research

analysis, it is found that the incumbents are faced with

the following challenges: (1) the incumbents are in

struggle to create an application or digital services

that have the same quality with the product created by

the fintech firms, (2) the incumbents are restricted in

implementing their new technology because to the

nature of the ``highly-regulated industry" in the

conventional banking sector, (3) there are still an

existing gaps between the product created by the

incumbents and the expectations of its customer and

(4) due to the rapid development or advancement

of technologies that are taken places, the incumbents

are needed to provide protection to the cybersecurity

threats that may occur at any given time.

As for the changes in the preferences of the

conventional banks' customers, the majority of the

respondents in this research are engaging in the

development of open API within their system. In

which, this open API system is improved to facilitate

better integration between the software and the web-

services product that is created by the conventional

banks in facilitating the digital banking activities of

its customer. Also, some of the respondents are

focusing on other aspects of IT, such as artificial

intelligence, cloud processing, and IoT. Hence, these

engagements are also focusing on the improvement of

the user's experience of its customers while using the

application created by the Indonesian conventional

banks.

In regards to the solutions that can be applied by

the incumbents to cope with identified challenges

from the action research analysis, the solutions are

given as follows: (1) the incumbents should

collaborate with the fintech firms in developing or

creating their digital product to meet the criteria and

the expectations of its customers, (2) it is advisable

for the incumbents to develop their digital financial

and banking services using a customer-centric

approach to obtain the information regarding the

trend that already taken places in the digital era, (3)

the incumbents should have an adequate security on

protecting the banks and its customers data from the

cybersecurity threats due to the rapid development of

technologies and (4) it is advisable for the incumbents

to develop or create a digital product that is focused

on the aspect of practicality to enhance the experience

of its customers.

The findings, the challenges and the solutions in

this research are in line with the research conducted

by Brummer & Gorfine (2014) and Zavolokina et al.

(2016) in terms of the emergence and the impact of

the fintech industry, with the additions of the changes

in the preference of customers in the digital era. In

simple terms, the challenges created are due to the

advancement of technologies, and the fintech industry

is capable of noticing and capitalizing the gap

between the digital banking product created by the

incumbents and the expectations of its customers to

produce a better-quality application compare to the

conventional banks.

Finally, the limitation of this research is that it

only focuses on the perspectives of the Indonesian

conventional banks in the digital era. Specifically, the

perspectives in this research are only using the expert

panels of individuals that are operated in the banks

that are classified into the category of Book four

banks in terms of the impact of IT and its

implementations in Indonesia. Based on the

conclusion and the explanations above, the future

research regarding the role of IT in the Indonesian

banking industry and the fintech industry will be

including the perspectives of the incumbents and the

fintech in regards to the implementation of

technologies that can be used in creating an

application or digital product that can meet the

criteria and fulfilling the needs of the needs of its

customers in Indonesia.

REFERENCES

Anagnostopoulos, I., 2018. Fintech and regtech: Impact on

regulators and banks. Journal of Economics and

Business, Volume 100, pp. 7-25.

AT Kearney, 2014. Going Digital: The Banking

Transformation Roadmap, Chicago: AT Kearney.

Australian Trade and Investment Commission, 2018. E-

Commerce in Indonesia: A Guide For Australian

Business, Sydney: Commonwealth of Australia.

Becker, J., Weiß, B. & Winkelmann, A., 2010. Transferring

a domain-specific semantic process modeling language

- Findings from action research in the banking sector.

Pretoria, Association For Information System.

Brummer, C. & Gorfine, D., 2014. Fintech: Building a 21st-

Century Regulator's Toolkit, Santa Monica: Milken

Institute.

Das, K., Gryseels, M., Sudhir, P. & Tan, K. T., 2016.

Unlocking Indonesia's Digital Opportunity, Jakarta:

McKinsey&Company.

Davis, K., Maddock, R. & Foo, M., 2017. Catching up with

indonesia’s fintech industry. Law and Financial

Markets Review.

Fichman, R. G., Dos Santos, B. L. & Zheng, Z., 2014.

Digital Innovation as A Fundamental and Powerful

EBIC 2019 - Economics and Business International Conference 2019

32

Concept in The Information Systems Curriculum.

Management Information Systems, 38(2), pp. 329-353.

Frost & Sullivan, 2018. Digital Market Overview:

Indonesia, Santa Clara: Frost & Sullivan.

Frost & Sullivan, 2019. The Future of Indonesia,

Jakarta: Frost & Sullivan.

Hair, J. F., Black, W. C., Babin, B. J. & Anderson,

R. E., 2014. Multivariate Data Analysis. 7th ed. Harlow:

Pearson.

Iman, N., 2018. Assessing the dynamics of fintech in

Indonesia. Investment Management and Financial

Innovations, pp. 296-303.

McKernan, J., 1988. The Countenance of Curriculum

Action Research: Traditional, Collaborative, and

Emancipatory-Critical Conceptions. Journal of

Curriculum and Supervision, pp. 173-200.

Omarini, A. E., 2018. Banks and Fintechs: How to Develop

a Digital Open Banking Approach for the Bank’s

Future. International Business Research, 11(9), pp. 23-

36.

Oshodin, O., Molla, A., Karanasios, S. & Ong, C. E., 2017.

Is FinTech a disruption or a new eco- system? An

exploratory investigation of banks’ response to FinTech

in Australia. Hobart, Australasian Conference on

Information Systems, pp. 1-11.

PriceWaterhouseCoopers, 2017. Redrawing the lines:

Fintech’s growing influence on Financial Services,

London: PriceWaterhouseCoopers (PWC).

Romānova, I. & Kudinska, M., 2017. Banking and fintech:

A challenge or opportunity?. Contemporary Studies in

Economic and Financial Analysis, Volume 98, pp. 21-

35.

Sagor, R., 2000. Guiding School Improvement with Action

Research. Alexandria: Association for Supervision and

Curriculum Development.

Sudiyatno, B., Puspitasari, E. & Kartika, A., 2012. The

Company's Policy, Firm Performance, and Firm Value:

An Empirical Research on Indonesia Stock Exchange.

American International Journal of Contemporary

Research, 2(12), pp. 30-40.

Sufian, F. & Chong, R. R., 2008. Determinants of bank

profitability in a developing economy: Empirical

evidence from the Philippines. Asian Academy of

Management Journal of Accounting and Finance, 4(2),

pp. 91-112.

Vintillă, G. & Nenu, E. A., 2016. Liquidity and Profitability

Analysis on the Romanian Listed Companies. Journal

of Eastern Europe Research in Business & Economics,

pp. 1-8.

Vives, X., 2017. The Impact of Fintech on Banking. In: G.

B. Navaretti, G. Calzolari, J. M. Mansilla-Fernandez &

A. F. Pozzolo, eds. Fintech and Banking. Friends or

Foes?. Rome: Europeye srl, pp. 97-106.

Wirdiyanti, R., 2018. Digital Banking Technology

Adoption and Bank Efficiency: The Indonesian Case,

Jakarta: Otoritas Jasa Keuangan (OJK).

Zavolokina, L., Dolata, M. & Schwabe, G., 2016. The

FinTech phenomenon: antecedents of financial

innovation perceived by the popular press. Financial

Innovation, 2(1), pp. 1-16.

The Future and the Challenges of the Indonesian Banking Industry in the Digital Era

33