Effect Information Sources on Frequency Trading with Personality

Type as a Moderating Variable

Andhi Wijayanto, Akhmad Nuranyanto, Kris Brantas Abiprayu

Department of Management, Universitas Negeri Semarang

Keywords: Behavioral Finance, Big Five Personality, Sources of Information, Trading Behavior.

Abstract: This study using the Big Five Personality as a measurement of personality types and surveyed 134 investor

members KSPM Forum Semarang. Researchers used the analysis of structural equation models with 3.0 Warp

PLS to evaluate the relationship between variables and moderating influence on the personality of the investor

with the resources and trading frequency. Results of the study confirmed previous findings that the source of

information that investors use as the basis for the analysis of financial have a significant effect on their

frequency trading. Financial advice significant positive effect on the trading frequency, word-of-mouth

communication significant positive effect on the frequency of trading, while the specialized press significant

negative effect on the trading frequency. Researchers also found that investor personality moderate the

relationship between resources with frequency trading.

1 INTRODUCTION

Limitations of the society in terms of knowledge of

capital markets remains one of the main constraints

delayed the step of development of capital markets

this country compared with other countries where

people are familiar with the world of capital markets

(Taslim and Wijayanto, 2016), This is also due to the

limited information that can be collected by the

investor. Investors have plenty of investment options

to increase profits on funds invested. One option that

can be done is by investing in the stock market

(Purwaningsih and Khoiruddin, 2016). Capital

market investment products that can be selected is

stock. Stock investors are owners of the issued shares

of a company, which also has ownership rights over

these companies, so investors are entitled to all

information relating to the development of the

company (Khoiruddin and Faizati, 2014). Local

investors are dominated by retail investors in

distribute their funds require information from

various sources to assess the risks involved in the

investment and also to estimate the return to be

derived from such investment (Pardosi and

Wijayanto, 2015).

Efficient market hypothesis is still being debated

in financial sector, there are pros and cons among

finance practitioners and academics about the

efficient market hypothesis. An efficient market is a

market where the price of all securities traded already

reflect all available information (Cahyaningdyah and

Witiastuti, 2010). With the information obtained, the

investor can determine when positional sell, buy or

hold the stock. Before deciding to buy or sell shares,

investors will gather information in various studies on

models of rational investment behavior shows that

more information obtained by investors will lead

them to increase their trading frequency (Grossman

and Stiglitz, 1980; Karpoof, 1986; Holthausen and

Verrecchia, 1990; Barlevy and Veronesi, 1999;

Peress, 2004; Guiso and Jappelli 2006; Abreu and

Mendes, 2012; Tauni et al., 2015, 2017, Tauni, Fang

and Iqbal, 2017, 2016). The above model explain that

the more signals investors receive information or

perceive those signals more precisely will create costs

in collecting such information. The cost of obtaining

the information will be compensated by investors to

invest in riskier assets with higher expected profits.

Investments in risky assets together with the

collection of further information cause investors will

often make adjustments to the portfolio resulting into

high frequency trading (Peress, 2004).

Financial advice from professionals has a positive

impact in trade, as it allows investors to analyze their

own capabilities and it leads to a more rational trading

decisions (Fischer and Gerhardt, 2007). Considering

the influence of financial advice on the composition

Wijayanto, A., Nuranyanto, A. and Abiprayu, K.

Effect Information Sources on Frequency Trading with Personality Type as a Moderating Variable.

DOI: 10.5220/0009199600910100

In Proceedings of the 2nd Economics and Business International Conference (EBIC 2019) - Economics and Business in Industrial Revolution 4.0, pages 91-100

ISBN: 978-989-758-498-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

91

of the portfolio, Mullainathan, Noeth and Schoar

(2012) showed that financial advice has a positive

correlation with equity exposure. These findings

reaffirmed by Claire Zhang (2014) which also

showed that investors receive financial advice has a

greater level of equity.

On the other hand, Kramer (2012) found that

retail investors to invest more in fixed income assets

and the remainder in equity when they are looking for

financial advice. Karabulut (2013) found that

individuals who are financially poor ability tend to

have a financial advisor. This finding contrasts with

Bhattacharya et al. (2012) which found that investors

have good financial capability has positive

expectations on financial advice and so they choose

to consult with a financial advisor.

Abreu and Mendes (2012) found that investors

often do trades when they get financial advice from

professionals or using specialized press highly

credible sources to obtain information and conduct a

comprehensive analysis. This was confrimed in

Tauni, Fang and Iqbal (2016) and Tauni et al. (2017)

which concluded that there is a positive relationship

between the collection of information and trading

frequency.

Tauni, Fang and Iqbal (2016) found that the

source of information used by investors as a basis of

their financial decisions, have a significant impact on

the frequency of trading. The study found that

financial advice has a significant positive impact on

the trading frequency, while the word-of-mouth

communication has a negative impact on the trading

frequency.

Tauni, Fang and Iqbal (2017) confirmed that

financial advice from a professional can increase the

frequency of trading, while the word-of-mouth

communication rarely cause more investors to adjust

their portfolios. Tauni et al. (2017) have the results

were consistent with previous studies in which

inveestor receiving financial advice will further

increase the frequency of trading. While investors

will be less likely to trade when they get the

information from mouth to mouth. They also found

that a specialized press that investors use to gather

information for its own account has a positive impact

on the intensity of trading.

In addition to the investment decision is

influenced by the source of the information obtained,

the personality of investors in investing will influence

investment decisions such as stock selection and

trading decisions. Personality factors as personal

character in financial management. Including on how

the behavior of people using the entire income. Often

allocated through spending and based on their

behavior which is reflected in the lifestyle,

environmental influences and encouragement to him

(Subiaktono, 2013). Behavioral finance theory shows

how market participants behave in actual fact, that in

accordance with the descriptive model of decision-

making used in psychology. Descriptive models show

how investors are difficult to process all the

information market, investors trade decisions may

also be influenced by psychological factors. Variables

affecting the interaction of psychology in the

collection of information has been widely discussed

in various fields of science, but in the concept of

financial decision making, variable investor

psychology is still very rarely discussed. In the

behavioral finance literature, there were some studies

also provide evidence of how the investor personality

type can affect the behavior and performance of trade

in the financial sector (Fenton-O'Creevy et al, 2004;

Hunter and Kemp, 2004; Durand, Newby and

Sanghani, 2008; Durand, Newby, Peggs, et al., 2013;

Durand, Newby, Tant, et al, 2013; Tauni et al., 2015

, 2017, Tauni, Fang and Iqbal, 2016, 2017).

2 LITERATURE REVIEW

2.1 Sources of Information and

Trading Frequency

Financial behavior was impoertant in making

investment decisions. Decision making is a process of

selecting the best alternative from a number of

alternatives available under the influence of a

complex situation. Financial advice by Abreu and

Mendes (2012) and Durand, Newby and Sanghani,

(2008) is the source of information from the

professionals. Investors get this information from

bank managers, financial advisors, and brokers.

Financial advice can affect investor frequency trading

into two opposite directions, where professional

financial advisors tend to be affected by behavioral

biases, they can restrict their clients trade (Shapira

and Venezia, 2001). On the other hand, financial

advisors have an incentive to get a high trading

commissions can encourage them to improve their

clients' trading (Haigh and List, 2005). It has been

argued that the quality of resources has a positive

impact on trade. that the resources derived from the

professional lead investors to adjust their portfolios

more often (Epstein and Schneider, 2008).

Karabulut (2013) found that individuals who are

financially less ability tend to have a financial

advisor. This finding contrasts with Bhattacharya et

al (2012) which found that investors have good

EBIC 2019 - Economics and Business International Conference 2019

92

financial capability has positive expectations on

financial advice and so they choose to consult with a

financial advisor.

H1: Financial advice positive effect on frequency

trading.

According to Tauni, Fang and Iqbal (2017) the

word-of-mouth communication is where investors

hold on social interactions to exchange information

about the capital markets. Word-of-mouth

communication is a source of information that

investors get through friends and family, peers and

colleagues as well as other social interactions.

Individual investors who have a deficiency in

evaluating investment decisions will save their time

to invest with relying the source of the information

coming from word-of-mouth communication

(Ivkovic and Weisbenner, 2007). This is in line with

research Van Rooij, Lusardi and Alessie (2011)

which also shows that ordinary investors take

referrals from public sources such as family, peers or

colleagues rather than seeking advice from a

professional.

Hong, Kubik and Stein (2004) believes that

individual investors think the stock market is more

attractive when their peers to participate in trading

activity, this suggests that social interactions may

affect the majority of participants stock market

Changwony, Campbell and Tabner (2014) establishes

that the active involvement of a person in a social

group positively effect on participation in the stock

market. Feng and Seasholes (2004) believes that

individual investors make a similar decision for the

general reaction of the public information rather than

from the effects of word-of-mouth communication.

H2: word-of-mouth communication positively effect

on frequency trading.

Specialized press are sources of information that

investors get through the financial reports, financial

newspapers, futures exchange bulletin of quotation

and other specialized media used by investors to

collect information to help analyze their portfolio

(Tauni, Fang and Iqbal, 2016, 2017; Tauni et al.,

2017),

Abreu and Mendes (2012) shows that non-

overconfident investors trade more frequently when

they get financial advice or using specialized press as

opposed to when they gather information and others

interpersonal sources. This is in contrast with the

results of research Argentesi, Lutkepohl and Motta

(2010) which showed that sales of financial

newspaper has no relationship with the quantity of

trading on the stock exchange of Italy. They argue

that the more information gathered by the investors

do not always encourage them to do more trade

because it can also dictate that trade is a bad idea.

Tauni, Fang and Iqbal (2016) found that investors

with a more open mindset rarely make trades when

they obtain information from specialized press. These

findings are not consistent with Finley and Finley

(1996) and Kasperson (1987) which shows that the

high interest in the investors are open in various

experience may lead them to consult on specialized

press, and increasingly varied and innovative

collection of information from specialized press can

give them the opportunity to seek alternative

solutions.

H3: specialized press negatively affects frequency

trading.

2.2 Personality Types in Information

Search Strategy and Trading

Frequency

In investment decision making is influenced by the

source of the information that investors obtained, the

personality of investors in investing will influence

investment decisions such as stock selection and

trading decisions. Each investor has a different

personality types in making investment decisions.

Investor personality types that we used base on

the framework of the model Big Five (Big Five

Model) that the adaptation of the NEO-five factor

theory inventorty (Costa and McCrae, 1989) namely

openness, conscientiousness, extraversion,

neuroticism, agreeableness. Where openness identify

with characteristics like personality with new,

creative and high curiosity. Conscientiousness

identify personality characteristics careful, very

cautious, and do the planning. Extraversion

personality identifies with the characteristics of a

vigorous, optimistic and brave face uncertainty.

Neuroticism emotional instability identifying

individuals who are likely to experience negative

feelings such as anxiety and nervous. Agreeableness

identify personality characteristics friendly, prioritize

the interests of others above personal interests, and

tend to avoid debate.

Using the framework of personality Big Five,

Durand, Newby and Sanghani (2008) showed that

investor personality traits affect the main source of

information to make investment decisions. They

found a positive relationship between openness and

neuroticism with financial advice. The relationship of

Effect Information Sources on Frequency Trading with Personality Type as a Moderating Variable

93

these properties to the financial advice is consistent

that neuroticism and open minded investors tend to

receive financial advice from professionals. They also

found a positive association of conscientiousness

with the use of financial publications such as the

financial report as a primary source of information.

This study may be consistent with the explanation

that investors with conscientiousness will work more

active to collect information that is relatively accurate

and is relevant (Costa and McCrae, 1992), Then,

Durand, Newby and Sanghani (2008) also found that

the preference characteristics of extraversion has a

positive association with the use of television as a

source of information, while a negative relationship

with propensity to take risks. Karabulut (2013) also

shows that investors are overconfident looking for a

little more information from financial advisors. It is

also in accordance with the Guiso and Jappelli (2006)

stated that overconfident investors tend to rely less on

information they obtain from a financial advisor.

Therefore, they collect information directly.

3 METHOD

This research used quantitative method. According to

Sugiyono (2013) quantitative research method can be

interpreted as a method of research that is based on

the philosophy of positivism, is used to examine the

population or a particular sample, and the sampling

technique is generally done at random, data collection

using research instruments with the analysis of

quantitative data in order to test the hypothesis that

has set.

The research design used in this research is the

study of design causality. Data used in this study are

primary data. Primary data is data collected for the

place of actual occurrence of the event (the source).

Methods of collecting data in this research is by using

questionnaires. Data collected online through google

docs. This method uses a questionnaire that had been

developed in a structured, where a number of written

questions submitted to the respondents to respond in

accordance with the conditions experienced by the

respondent. Questions relating to the demographic

data of respondents, the level of risk taking.

The population in this study is a member of the

Capital Markets Study Group Forum Semarang

consisting of 10 Capital Markets Study Group

(KSPM) from various universities in Semarang that

active as stock investors and investing in Indonesia

Stock Exchange.

Table 1. Capital Markets Study Group in Semarang

Source: IDX Semarang (2017)

In this study, we used a sample investors member of

the Capital Markets Study Group in Semarang and

members of the Forum KSPM Semarang with

minimum one year investment experience, as well as

at least 18 years old.

The number of samples taken in this study is

based on a formula developed by Slovin (Sevilla,

2007), The formula Slovin used in this study to

determine the size of the sample.

n =

Where n = sample size

N = the number of population

d = level of significance

The population included in this study amounted

to 10 Capital Markets Study Group incorporated in

Semarang with a total of 20 people in each KSPM, so

the total is 200 people. The significance level is set at

0.05, then the sample size in this study are:

n =

n =

,

≈ n = 133.333 rounded to 134

The number of samples in this study were 134

members belonging to capital markets study group on

Semarang.

Three independent variables in this study are

information in the capital market that is in use by

investors in financial decision making. previous

research (Durand, Newby and Sanghani, 2008; Abreu

and Mendes, 2012; Tauni, Fang and Iqbal, 2016;

Tauni et al., 2017) defines three categories of

resources in the capital market. First, the financial

advice that is the source of information that investors

get from a professional such as a bank manager,

financial advisor, broker. Second, word-of-mouth

communication is the source of information that

investors get through friends and family, peers and

colleagues as well as other private sources. Third,

specialized press are sources of information that

EBIC 2019 - Economics and Business International Conference 2019

94

investors get through the financial reports, the

financial newspapers, and other specialized press that

is used by investors to gather information. Questions

used to measure the frequency of the use of resources

adapted from research Tauni, Fang and Iqbal (2016,

2017), Tauni et al. (2017) and Durand, Newby and

Sanghani (2008) which reads "How often did you get

the information from (resources) on investments in

the stock market?". Answer is measured with a 5-

point Likert scale (1 = "never", 2 = "rarely", 3 =

"sometimes", 4 = "often", 5 = "always").

The dependent variable in this study is the trading

frequency is measured by the question "how often do

you buy and sell shares in the stock market?" The

adaptation of research (Abreu and Mendes, 2012;

Tauni, Fang and Iqbal, 2016, 2017; Tauni et al., 2017)

Answer is measured with a 5-point Likert scale (1 =

"one per month / sometimes", 2 = "2-3 times per

month", 3 = "once per week", 4 = "2-3 times per

week", 5 = "every day / often").

Big Five personality framework used to measure

the dimensions of the personality of capital market

investors. five moderating variable in this study is the

investor personality types based on the framework of

the model Big Five (Big Five Model) that the

adaptation of the Big Five, namely openness,

conscientiousness, extraversion, neuroticism,

agreeableness. based on research Barrick and Mount

(1991) scale of the Big Five is generally seen as the

most acceptable framework for applying research.

Meanwhile, according to Lippa (1991) model of the

Big Five is independent of gender, which means this

model can be applied both in men and women. And

based on research Roberts and Robins (1973)

consistently shows a model of stability and robustness

on a variety of different languages and cultures to

predict the far-reaching results. Investors personality

type was measured using the NEO-five factor

inventorty (Costa and McCrae, 1989) which is a

shortened version of NEO personality investory of the

Big Five models (Costa and McCrae, 1992), Each

personality type is measured using a Likert scale (1 =

"Strongly disagree", 2 = "Disagree", 3 = "Neutral", 4

= "Agree", 5 = "Strongly Agree").

Based on previous researchs (Holthausen and

Verrecchia, 1990; Peress, 2004; Dorn and Huberman,

2005; Abreu and Mendes, 2012; Tauni, Fang and

Iqbal, 2016, 2017; Tauni et al, 2017), The researchers

control the level of courage investors bear the risk that

may directly affect investor frequency trading. The

level of courage to risk is measured using the question

"How would you rate yourself on a scale of 1-5 with

investments in the stock market?". Answer is

measured with a 5-point Likert scale (1 = "very

willing to take risks", 2 = "willing take risks", 3 =

"Neutral", 4 = "Avoiding risks", 5 = "Very avoiding

the risks").

Control variables in this study using demographic

factor, which is a description of these factors

demographic data such as gender, age, education

level, investment experience, and investor income.

Where demographic variables measured as follows.

Gender is measured by a binary variable where male

= 0 and female = 1. Age is measured in years using

two categories (1 = "≤ 20 years", 2 "> 20 years"). The

level of education is measured by the four categories

(1 = "below high school", 2 = "high school", 3 =

"bachelor’s degree", 4 = "master’s degree or more").

Investment experience in measurement with five

categories (1 = "less than 2 years", 2 =: 2-5 years ", 3

=" 5-8 years ", 4 =" 8-10 years ", 5 =" more than 10

year"). Revenue per month is measured using the

rupiah with 4-level categories (1 = "less than 5

million rupiah", 2 = "5-10 million rupiah", 3 = "10-15

million rupiah". 4 = "more than 15 million rupiah").

4 RESULTS AND DISCUSSION

4.1 Variables Descriptive Analysis

Research

Descriptive analysis is conducted to describe the

respondents' perceptions of questions relating to the

variables used. In this study, the data processing of

the raw data that have been collected are stored and

processed using index numbers. In the descriptive

analysis researcher displays the frequency

distribution table of five personality variables,

namely openness, conscientiousness, extraversion,

Neuroticism, Agreeableness. Here is the conclusion

of the results of the descriptive analysis of the Big

Five Personality in Semarang KSPM Forum members

can be seen in Table 2 as follows

Table 2 Distribution Index Value Big Five Personality

Indicato

r

Index

Values

Criteria

Openness 75.70% Hi

g

h

Conscientiousness 75.41% Hi

g

h

Extraversion 70.52% Hi

g

h

n

euroticism 69.49%

moderate

A

g

reeableness 65.37%

moderate

Avera

g

e 71.30% Hi

g

h

Sources: Primary data is processed year (2017)

Effect Information Sources on Frequency Trading with Personality Type as a Moderating Variable

95

Based on Table 2, the Big Five Personality on

Capital markets study group in Semarang the

indicators are generally of 71.30% is high criteria. Of

the five indicators provides information that each

indicator has a different criteria with presentation

details that openness is 75.70% high criteria,

conscientiousness amounted to 75.41% High criteria,

extraversion amounted to 70.52%, high criteria,

neuroticism by 69 , 49% are moderate, agreeableness

amounted to 65.73% are moderate.

4.1.1 Structural Equation Model (SEM)

Analysis of the data used in this study using the

approach of Structural Equation Model (SEM) with

3.0 SmartPLS program. which consists of two phases:

analysis of outer models and inner models.

4.1.2 Analysis of Measurement Model

(Outer Model)

Convergent validity of the measurement model can be

seen from the correlation between the scores of

indicators with a construct score (loading factor)

criteria value of each indicator loading factor greater

than 0.70 can be said to be valid. Furthermore, for the

p-value <0.50 was considered significant. Sholihin

and Ratmono (2013) explains that in some cases,

terms of loading above 0.70 are often not met,

especially for a newly developed questionnaire.

Therefore, the loading factor between 0.40 to 0.70

should still be considered to be retained.

Subsequently explained also that the indicator by

loading <0.40 should be removed from the model.

The test results showed that the value of the loading

indicator O3 (-0.329), C3 (0.032) and N3 (-0.036) are

not acceptable. Therefore on these three indicators

were eliminated so the research model meet

convergent validity.

Discriminant validity assessed by (1) cross-

loading measurements to construct. with a view

loading latent constructs that will predict the indicator

or dimension better than other constructs. If the

correlation with the basic constructs of measurement

(for each indicator) is larger than the size of the other

constructs discriminant validity are met. (2) To

analyze the discriminant validity the criteria used are

the square roots (square roots) average variance

extracted (AVE), the diagonal column followed by a

parenthesis should be higher than the correlation

between latent variables in the same column. Based

on the test results show that the overall indicator

meets the criteria of discriminant validity. It can be

concluded that the overall indicator meets the criteria

of convergent validity.

Reliability test results seen with Composite

reliablity value of each variable used in the study

above 0.70, which means reliable. Reliablity

composite value of each variable used in the study

above 0.70, which means reliable, thus it can be said

that the variable Openness (0.716), Extraversion

(0.785), Neuroticism (.834) and Agreeableness

(0.713) were used in this study is reliable. While the

variable test hail Conscientiousness (0.639) still can

be considered as close to 0.70.

4.1.3 Evaluation of Structural Model (Inner

Model)

Structural evaluation (inner models) which includes

test model fit (model fit) path coefficient, and R².

Table 3, Fit Model P Indices and Values

Model Index p-value Criteria Information

APC 0.133 <0.001 P

<0.05

accepted

ARS 0.224 P =

0.007

P

<0.05

accepted

AVIF 1,215 Nice if ≤ 5 accepted

Source: WarpPLS output (2017)

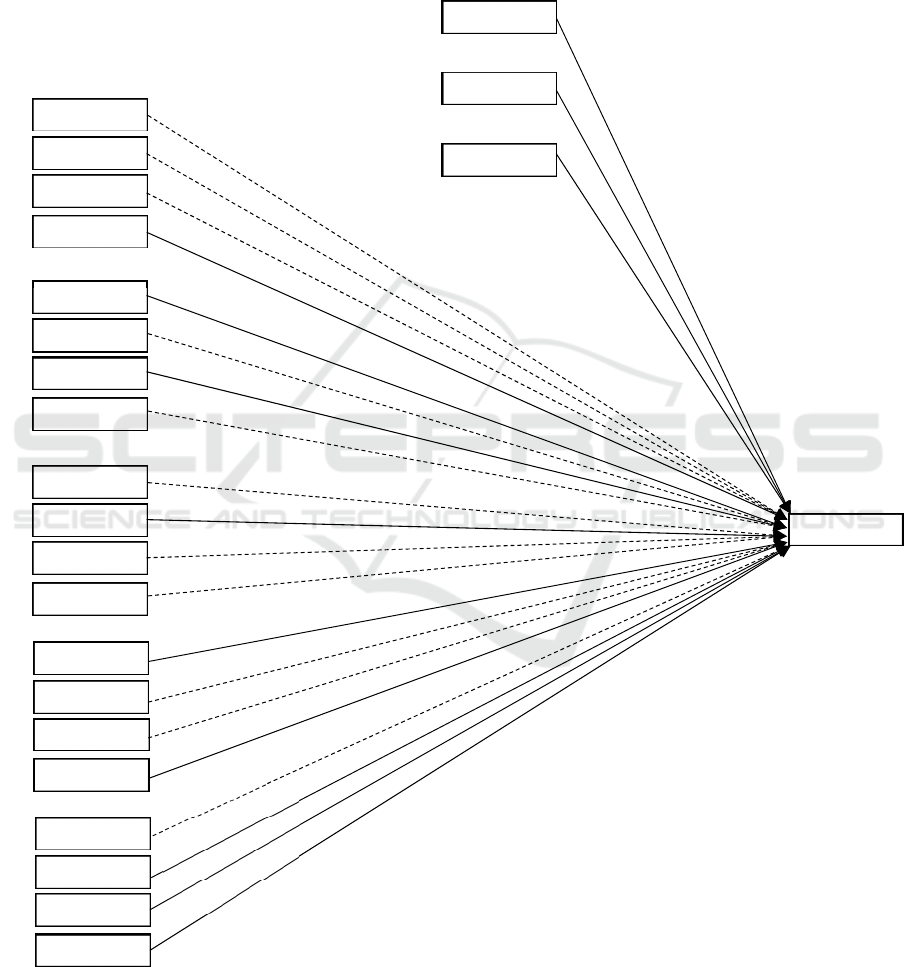

Figure 1 shows that financial advice has a positive

effect (b = 0.180; p <0.05) against frequency trading.

This finding is consistent with the argument that

investors will be trading more often when they obtain

information from a reliable source, when compared

when they obtain information from sources that lack

in trust, such as information gathered from public

sources without analyzing the stock market (Fischer

and Gerhardt, 2007; Epstein and Schneider, 2008;

Abreu and Mendes, 2012), The results of this study

are consistent with the view that financial advisors

increase the frequency of trading of individual

investors for advisory commissions are greater when

the higher frequency of their clients' trading (Shapira

and Venezia, 2001; Fischer and Gerhardt, 2007;

Karabulut, 2013).

Word-of-mouth communication has a positive

effect (b = 0.120; p <0.1) against frequency trading.

The findings about the relationship of word-of-mouth

communication with trading frequency in this study

quite compatible with the argument of Hong, Kubik

and Stein (2004) which states that social interaction

can increase participation in the capital market among

individual investors. This shows that investors with

high social interaction can increase the frequency of

individual investors trading.

Specialized press has a negative effect (b = -0.19;

p <0.05) against frequency trading. Research

EBIC 2019 - Economics and Business International Conference 2019

96

Argentesi, Lutkepohl and Motta (2010) showed that

the sale of the financial newspaper has nothing to do

with the quantity of trading in the stock market of

Italy. They argue that more financial information

collected by investors do not always lead them to

trade more frequently because it could have

information indicates that trading is a bad idea.

This finding is also in line with Abreu and

Mendes (2012), Tauni, Fang and Iqbal (2016), Tauni

et al (2017) which states that the more information

obtained by the investor comes from a specialized

press such as financial statements, financial

magazines, etc., will reduce the frequency of their

trade.

Figure 1, Structural Equation Model

Figure 1 shows that the open-minded investors

rarely adjust their portfolios when they obtain

information from specialized press. The explanation

of this finding is that open-minded people (openness)

-0.209 **

0,011

.111

0.182 *

Neur

Neur_F

A

Neur_

WOM

Neur_S

P

Agre

Agre_F

A

Agre_

WOM

Agre_S

P

-0.115

0.168 *

0.187 **

0.257 **

-0.130

0.149 *

0.043

0.147

-0.192 *

0.052

-0.200 **

0,053

Cons

Cons_F

A

Cons_

WOM

Cons_S

P

extr

Extr_F

A

Extr_

WOM

Extr_S

P

-0.109

.128

0.147

-0.203 *

Open

Open_

FA

Open_

WOM

Open_

SP

FT

0.180 **

0.120 *

-0.187 *

FA

WOM

SP

Effect Information Sources on Frequency Trading with Personality Type as a Moderating Variable

97

will be more innovative when seeking information.

They seek information from various sources outside

their habits because of the high interest in a wide

range of experience (Kasperson, 1978; Finley and

Finley, 1996), The more varied and innovative

collection of information from sources outside the

box might give them an opportunity actively seeking

new solutions to their problems (Tauni et al., 2017),

Conscientiousness reducing the positive

relationship collecting information on the trading

frequency of word-of-mouth communication. The

theoretical explanation of this finding is that

individuals with conscientious personality types are

more confident or more confident in his own ability

(Behling, 1998) they trust the information they gather

themselves rather than trusting input from others

(Wanberg and Kammeyer-Mueller, 2000), They have

a high ability to control themselves and prefer to settle

things in his own way (Flynn and Smith, 2007;

Donnelly, Iyer and Howell, 2012), Investors with a

high persistence had a strong desire to work for the

sake of their success and invest time and effort to

gather relevant information (Heinström, 2003),

Therefore we can conclude they are less trusting

information from others so that word-of-mouth

communication is a negative impact on their

frequency trading.

Extravert investors choose to trade more often

when they get the information from advisors. This

finding is consistent with the expectation that the

extravert investors tend to go out and socialize, they

prefer to consider the advice of others as a source of

information (Costa and McCrae, 1992), Moreover,

individuals with high levels of extraverts who may be

less independent in their work, they prefer to learn

and act upon suggestions or recommendations made

by professionals such as financial advisors

(Heinström, 2003), To that end, more extraversion

investors often make trades when they collect

information from financial advisors.

Neuroticism moderate positive effect on the

relationship between the use of specialized press as

an information source with a frequency trading. That

neurotic investors to trade more intensively when

they are more often obtain information from

specialized press. Individuals with high levels of

neuroticism often feel negative emotions such as

anxiety, depression, stress and fear (Costa and

McCrae, 1992),

Nervous investors may feel uncomfortable

because of their high level of sensitivity to external

stimuli related to the advice of others as well as

volatile capital market conditions in which they will

feel anxious and afraid of not knowing when they

decide to make a trade. Collecting information

through the financial statements may help them.

Where the financial reports, magazines, newspapers,

or financial news is a reliable source that can help

investors to feel comfortable and reduce feelings of

anxiety. Therefore, investors with a high level of

neuroticism has a high-frequency trading when they

gather information on specialized press.

The latter study found that agreeableness

positively moderate with all the sources of

information used by investors against their frequency

trading. This shows that investors with a high level of

agreeableness to trade more often when they gather

information from others, either from a professional or

from a friend, et al. Agreeable individuals are

individuals who cooperate and strive to maintain

harmony relationships with others

(Costa and McCrae, 1992), This attitude has the

same impact on collection of information, which they

adjust, attitude, trust others to give opinions

(Heinström, 2010), To maintain relationships with

friends, friend, or colleague, individuals with high

levels of agreeableness are rarely doubt and blame the

recommendation of those closest to them (Eisen,

Winograd and Qin, 2002), Therefore, investors will

be more frequent agreeable trade when obtaining

information from others. Additionally, agreeable

investors also increased the frequency of their trade

when they collect the information from the financial

press and match with the recommendations of

professionals and others. They also sometimes

inexperienced in evaluating investments, and hence

after gather information they follow their friends to

trade (Ivkovic and Weisbenner, 2007),

5 CONCLUSION

Based on the examination and discussion that has

been presented, it can be concluded that financial

advice has positive influence on frequency trading.

Word-of-mouth communication is a positive

influence on frequency trading. specialized press

negatively affect the frequency trading member

Capital Markets Study Forum Semarang. Researchers

also found that type of personality moderate the

relationship between resources and trading frequency

on the members of the Forum Capital Markets Study

Group Semarang. Where, increase the frequency of

trading financial advice to investors with

conscientious and agreeableness personality type.

Word-of-mouth communication to increase the

frequency of trading on the investor personality type

agreeableness, and reduce the intensity of trading on

EBIC 2019 - Economics and Business International Conference 2019

98

investor conscientiousness. While the, specialized

press increase the frequency of trading on the investor

with neuroticism and agreeableness personality types,

as well as lowering the intensity of trading on investor

openness. For researchers who will conduct further

research on the same topic with this research, can use

this study as a reference during the research process.

Suggestions for further research is to better

understand the concept big five personality type

indicator, and also further researchers can add

variables such as the return on investment in a

portfolio investor, change their investment products

such as mutual funds, bonds, etc. Subsequent research

has also suggested in order to expand the study

population.

REFERENCES

Abreu, M. and Mendes, V. (2012) "Information,

Overconfidence and Trading: Do the Sources of

Information Matter?" Journal of Economic Psychology.

Elsevier BV, 33 (4), p. 868-881. doi: 10.1016 /

j.joep.2012.04.003.

Argentesi, E., Lutkepohl, H. and Motta, M. (2010)

"Acquisition of Information and Share Srices:

Emperical An Investigation of Cognitive Dissonance,"

German Economic Review, 11 (3), p. 381-396.

Barlevy, G. and Veronesi, P. (1999) "Information

Acquisitions in Financial Markets," Review of

Economic Studies, 67 (1), p. 79-90.

Barrick, M.. and the Mount, M.. (1991) "The Big Five

Personality Dimensions and Job Performance: A Meta-

analysis," Personnel Psychology, 44 (1), p. 1-26.

Behling, O. (1998) "Employee Selection: Will Intelligence

and Conscientiousness do the Job ?," The Academy of

Management Executive (1993-2005), 88 (1), p. 77-86.

Bhattacharya, U. et al. (2012) "Is Unbiased Financial

Advice to Retail Investors Sufficient? Answers From a

Large Field Study, "Review of Financial Studies, 25

(4), p. 975-1032.

Cahyaningdyah, D. and Witiastuti, RS (2010) "Analysis of

Effect and Rogalski Effect Monday in Jakarta Stock

Exchange," Journal of Management Dynamics, 1 (2), p.

154-168.

Changwony, F.., Campbell, K. and Tabner, I.. (2014)

"Social Engagement and Stock Market Participation,"

Review of Finance, 19 (1), p. 317-366.

Claire Zhang, A. (2014) "Financial Advice and Asset

Allocation of Individual Investors," Pacific Accounting

Review, 26 (3), p. 226-247.

Costa, P.. and McCrae, R.. (1989) The NEO-PI / NEO-FFI

Manual Supplement, Psychological Assessment

Resources. Odessa: FL.

Costa, P.. and McCrae, R.. (1992) Professional Manual:

Revised NEO Personality Inventory (NEO-PI-R) and

NEO Five-factor-Inventory (NEO-FFI). Psychology.

Odessa: FL.

Donnelly, G., Iyer, R. and Howell, R.. (2012) "The Big Five

Personality Traits, Material Values, and Financial

Well-Being of Self-Described Money Managers,"

Journal of Economic Psychology, 33 (6), p. 1129-1142.

Dorn, D. and Huberman, G. (2005) "Talk and Aaction:

When Individual Investors Say and What They do,"

Review of Finance, 9 (4), p. 437-482.

Durand, R.., Newby, R., Tant, K., et al. (2013)

"Overconfidence, overreaction and Personality,"

Review of Behavioral Finance, 5 (2), p. 104-133.

Durand, R.., Newby, R., Peggs, L., et al. (2013)

"Personality," The Journal of Behavioral Finance, 14

(2), p. 116-133.

Durand, RB, Newby, R. and Sanghani, J. (2008) "An

Intimate Portrait of the Individual Investor An Intimate

Portrait of the Individual Investor," (November 2014),

p. 37-41. doi: 10.1080 / 15427560802341020.

Eisen, M.., Winograd, E. and Qin, J. (2002) Individual

Differences in Adults' Suggestibility and Memory

Performance ", in Eisen, ML, Quas, JA and Goodman,

GS (Eds), Memory and Suggestibility in the Forensic

Interview. Edited by Mahwah. NJ: Lawrence Erlbaum.

Epstein, L.. and Schneider, M. (2008) "Ambguity,

Information Quality, and Asset Pricing," The Journal of

Finance, 63 (1), p. 17-228.

Feng, L. and Seasholes, MS (2004) "Correlated Trading and

Location," The Journal of Finance, 59 (5), p. 2117-

2144.

Fenton-O'Creevy, M. et al. (2004) Traders: Risks,

Decisions and Management in Financial Markets.

Oxford: Oxford University Press.

Finley, K. and Finley, T. (1996) "The Relative Role of

Knowledge and Innovativeness in Attitudes Toward

Determining Librarians and Use of the Internet: A

Structural Equation Modeling Approach," Library

Quarterly, 66 (1), p. 59-83.

Fischer, R. and Gerhardt, R. (2007) "The Missing Link

Between Investors and Portfolios: Introducing

Financial Advice," 967 374.

Flynn, K.. and Smith, M.. (2007), "Personality and Health

Care Decision-Making Style," Journals of Gerontology

Series B: Psychological Sciences and Social Sciences,

62 (5), p. 261-267.

Grossman, S.. and Stiglitz, J.. (1980) "On the Impossibility

of Informationally Efficient Markets," The American

Economic Review, 70 (3), p. 393-408.

Guiso, L. and Jappelli, T. (2006) "Information Acquisition

and Portfolio Performance," Center for Studies in

Economics and Finance Working Paper, No. 167.

Haigh, M.. and List, J.. (2005) "Do Professional Traders

Exhibit Myopic Loss aversion? Anexperimental

Analysis, "The Journal of Finance, 60 (1), p. 523-534.

Heinström, J. (2003) "Five personality dimensions and their

influence on behavior information," Information

Research, 9 (1).

Heinström, J. (2010) From Fear to Flow: Personality and

Information Interaction. Oxford: Chandos Publishing.

Effect Information Sources on Frequency Trading with Personality Type as a Moderating Variable

99

Holthausen, R. and Verrecchia, R. (1990) "The Effect of

Informedness and Consensus on Price and Volume

Behavior," Accounting Review, 65 (1), p. 191-208.

Hong, H., Kubik, JD and Stein, JC (2004) "Social

Interaction and Stock Market Participation," The

Journal of Finance, 59 (1), p. 137-163.

Hunter, K. and Kemp, S. (2004) "The Personality of E-

commerce Investors," Journal of Economic

Psychology, 25 (4), p. 529-537.

Ivkovic, Z. and Weisbenner, S. (2007) "Information

Diffusion Effects in Individual Investors' 'Common

Stock Purchases: Covet the Neighbors' Investment

Choices," Review of Financial Studies, 20 (4), p. 1327-

1357.

Karabulut, Y. (2013) "Financial Advice: an Improvement

for Worse?"

Karpoof, JM (1986) "A Theory of Trading Volume," The

Journal of Finance, 41 (3), p. 691-694.

Kasperson, C.. (1978) "The Psychology of the Scientist:

XXXVII Scientific Creativity: a Relationship with

Information Channels," Psychological Reports, 42 (3),

p. 691-694.

Khoiruddin, M. and Faizati, ER (2014) "Market Reaction

To Dividend Announcement The Company's shares

Login List of Islamic Securities," Journal of

Management Dynamics, 5 (2), p. 209-219.

Kramer, M.. (2012) "Financial Advice and Individual

Investors Portfolio Performance," 41 (2), p. 395-428.

Lippa, R. (1991) "Some Characteristics of Gender

Diagnosticity Psychometric Measures: Reliability,

Validity, Consistency Across Domains, and

Relationship to the Big Five," Journal of Personality

and Social Psychology, 61 (6), p. 1000-1011.

Mullainathan, S., Noeth, M. and Schoar, A. (2012) "The

Market for Financial Advice: An Audit Study," The

National Bureau of Economic Research, Cambridge,

MA, NBER Working Paper Series. Available at:

www.nber.org/papers/w17929.

Pardosi, B. and Wijayanto, A. (2015) "Retrun Difference

Analysis and Optimal Portfolio Shares Risk Portfolio

With opimal not," Analysis Management Journal, 4 (1).

Peress, J. (2004) "Wealth, Information Acquisition, and

Portfolio Choices," Review of Financial Studies, 17 (3),

p. 879-914.

Purwaningsih and Khoiruddin, M. (2016) "Market Reaction

To Announcement Issuance of Sukuk Mudharabah and

Conventional Bonds," Journal of Management

Analysis, 5 (4), p. 299-313.

Van Rooij, MC, Lusardi, A. and Alessie, RJ (2011)

"Financial Literacy and Retirement Planning in the

Netherlands," Journal of Economic Psychology, 32 (4),

p. 593-608.

sevilla, CG et. al. (2007) Research Methods. QuezonCity:

Rex Printing Company.

Shapira, Z. and Venezia, I. (2001) "Patterns of Behavior of

Professionally Managed and Independent Investors,"

Journal of Banking & Finance, 25 (8), p. 1573-1587.

Sholihin, M. and Ratmono, D. (2013) Analysis of the SEM-

PLS with WarpPLS 3.0 for Nonlinear Relationships in

Social and Business Research. Yogyakarta: Andi

Yogyakarta.

Subiaktono (2013) "The Influence of Personality Traits

Against Family Financial Planning," Journal of

Management Dynamics, 4 (2), p. 150-163.

Sugiyono (2013) Educational Research Methods

(Quantitative Approach, Qualitative and R & D).

Bandung: Alfabeta.

Taslim, A. and Wijayanto, A. (2016) "Effect of Frequency

of Stock Trading, Stock Trading Volume, Market

Capitalization and Trading Day Against Total Return

Equity," Analysis Management Journal, 5 (1), p. 1-6.

Tauni, MZ et al. (2015) "The influence of Investor

Personality Traits on Information Acquisition and

Trading Behavior: Evidence from Chinese Futures

Exchange, "Personality and Individual Differences.

Elsevier Ltd, 87, p. 248-255. doi: 10.1016 /

j.paid.2015.08.026.

Tauni, MZ et al. (2017) "Does Investor Personality

Moderate the Relationship Between Information

Sources and Trading Behavior? Evidence from Chinese

stock market Purpose, "Managerial Finance, 43 (5), p.

doi: 10.1108 / MF-08-2015-0231.

Tauni, MZ, Fang, HX and Iqbal, A. (2016) "Information

Sources and Trading Behavior: Investor Personality

Does Matter?, "Qualitative Research in Financial

Markets, 8 (5), p. 94-117. doi: 10.1108 / QRFM-08-

2015-0031.

Tauni, MZ, Fang, HX and Iqbal, A. (2017) "The Role of

Financial Advice and Word-of-Mouth Communication

on the Association Between Personality and Stock

Trading Investor Behavior: Evidence from Chinese

Stock Market, "Personality and Individual Differences.

Elsevier BV, 108, p. 55-65. doi: 10.1016 /

j.paid.2016.11.048.

Wanberg, C.. and Kammeyer-Mueller, J.. (2000)

"Predictors and Outcomes of proactivity in the

Socialization Process," Journal of Applied Psychology,

85 (3), p. 373-385.

EBIC 2019 - Economics and Business International Conference 2019

100