Financial and Marketing Behaviour to Improve MSMEs

Performance

Beby Kendida Hasibuan

1

, Prihatin Lumbanraja

1

, Arlina Nurbaity Lubis

1

, and Fekri Ali Shawtari

2

1

Faculty of Economic and Business, Universitas Sumatera Utara, Medan, Indonesia

2

Community College of Qatar, Doha, Qatar

Keywords: Financial Behaviour, Marketing Behaviour, Smes, Performance, Finance

Abstract: Micro, small and medium enterprises have become the main development wheels of a country. Unfortunately

many of these businesses do not last long with relatively low performance. Low performance makes the

business's attractiveness decrease. The main problems that often occur are problems in the scope of marketing

and financial behavior. This study aims to evaluate the influence of financial and marketing behavior in

driving the performance of MSMEs. A total of 300 SMEs participated in this study. Data were collected using

a research questionnaire. Data were evaluated using multiple linear regression analysis. This research shows

that currently the performance of MSMEs is only influenced by marketing activities. Financial behavior

cannot yet reflect improvements in MSME performance.

1 INTRODUCTION

Indonesia is a developing country that is promoting

the growth of Micro, Small and Medium Enterprises

(MSMEs). At present, the UMKM sector is 60.34

percent of Indonesia's GDP. As we know, MSME is

one of the important sectors that can encourage a

country's economy and reduce poverty. The existence

of MSMEs is believed to be able to contribute to

poverty alleviation efforts through job creation

(Adomoko, Danso, and Damoah, 2016).

In general, performance can be used as a

benchmark for the health of an MSME activity and is

the key to success of an MSME. To be able to realize

the strategic improvement of its performance,

MSMEs are asked to be able to prepare target

markets, adapt to the environment, have certain

managerial factors, create product innovation, have

creativity and productivity, be sensitive to changes in

technology and networks. In addition, performance

can include a variety of meanings including company

growth, survival, success and competitiveness.

Performance can also be described as a company's

ability to create acceptable results and actions (Eniola

& Etenbang, 2015a)

In fact, it is often found that MSMEs have

difficulty in developing their businesses due to low

HR problems, business ownership, access to finance,

marketing problems, and business management

issues. The main problems faced by SMEs in

improving their business performance are problems

in managing human resources and problems in terms

of product marketing (Puwaningsih and kesuma,

2015)

At present there are still many MSME activities

where management is still very simple. And not

supported by reliable human resources. This is due to

the MSME actors view that the activities of MSMEs

as side activities only. Where the mindset of

Indonesian people is still limited to a decent career is

working in an office. Up until now, business people

are still dominated by housewives and young people

who fill their spare time. Even though HR aspects

play an important role in business progress.

Besides the HR aspect, another problem faced by

the UMKM is the problem of marketing their

products. As is well known marketing of MSME

products is still limited to traditional marketing by

relying on the power of promotion from the users of

these products. In addition, the SMEs do not take

advantage of the use of digital promotional media in

marketing their products.

One of the problems most often faced by SMEs is

the problem of the difficulty of getting access to

funding to develop a business. This is as a result of

the lack of financial literacy that is owned by SMEs

so they are difficult to get access to bank financing

Hasibuan, B., Lumbanraja, P., Lubis, A. and Shawtari, F.

Financial and Marketing Behavior to Improve MSMEs Performance.

DOI: 10.5220/0009202202530259

In Proceedings of the 2nd Economics and Business International Conference (EBIC 2019) - Economics and Business in Industrial Revolution 4.0, pages 253-259

ISBN: 978-989-758-498-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

253

and it is difficult to manage their personal finances. A

national survey conducted by OJK in 2016 showed

that the level of MSME financial literacy was very

low. Where micro entrepreneurs have the lowest

literacy rate of 23.8%.

UMKM is one of the important sectors in running

the economy of a country. To be able to support the

development of MSMEs, it is very necessary to

support all parties to get MSME performance. This

study aims to evaluate the relationship between

aspects of financial and marketing behavior that are

rarely applied by business actors. In an effort to

achieve these objectives a model of MSME

performance improvement is needed in order to find

out what components are needed to be able to

improve the performance of MSMEs.

2 LITERATURE REVIEW

2.1 Measuring MSMEs Performance

At present the company must be able to provide added

value to the products produced. However, this is

difficult for MSMEs to do, due to lack of ability and

limited working capital management. This has an

impact on MSME performance that is not optimal. Ali

in Aribawa (2016) suggested MSME performance

was analyzed using an approach based on the

following three assumptions, namely:

(1) Measuring MSME performance is often

difficult to do quantitatively, due to limited

resources (financial and labor understanding).

(2) Performance measurement generally looks at

complex financial indicators, so this does not

fully show the actual conditions that occur in the

business.

(3) Performance measurements that are often used

are relatively only appropriate when used for

large companies that are structured in company

management.

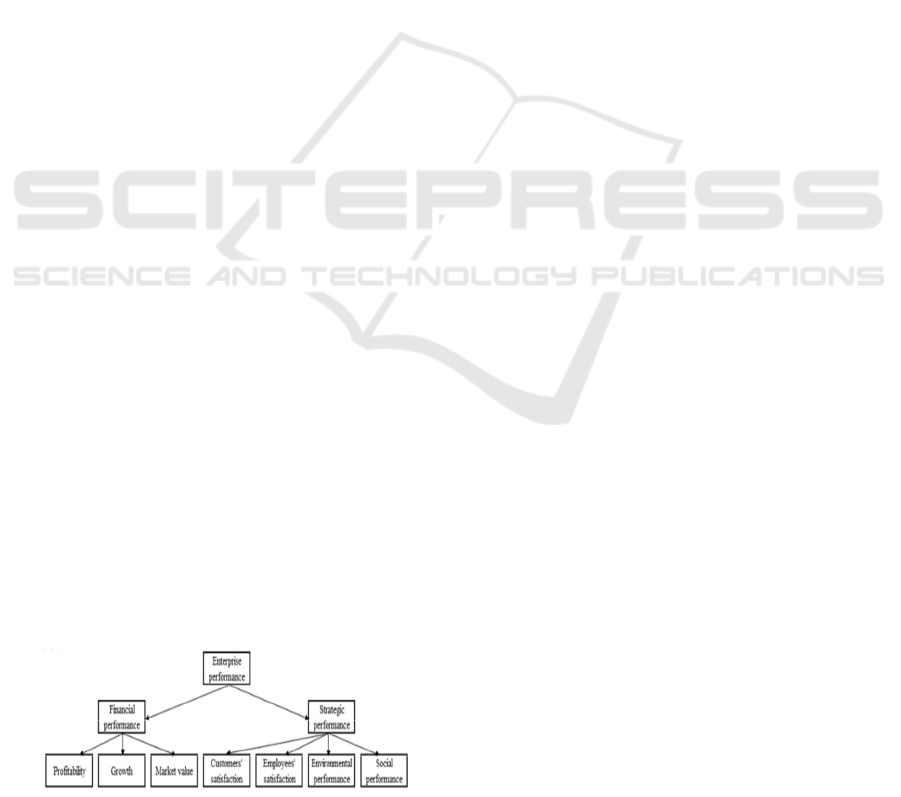

Simply put, Liang, You and Liu (2010) and

Santos and Brito (2012) identify performance into

two types namely financial performance and strategy

performance which can be described as follows:

Figure 1. Measuring MSMEs Performance

2.2 Marketing Behaviour

Marketing behaviour related to how the owner of

MSMEs applied the concept of marketing mix in firm

operational at daily basis. The marketing mix consist

of 4P; Price, Product, Promotion, and Place.

The first mix were product. This aspect is related

to the development of products to be marketed. The

product is a very important aspect in the marketing

mix that can influence the steps in the other marketing

mix. Product development needs to be done to

maintain market demand for the products offered.

Innovation in this case plays an important role in

influencing the market.

The second one related to price. Price in the

narrow sense is the amount of money paid for goods

or services, in the broader sense the price is the sum

of all values that consumers exchange in order to

benefit from owning or using goods or services

(Kotler and Keller, 2012). In the research of Peres-

Cabanero et al. (2011) concluded that price fixing can

have a positive impact on sales and profits in micro,

small and medium businesses, this is because small,

micro and medium entrepreneurs can see

opportunities to gain profits and prices that can set

effective prices that can be accepted by the market

The third one related to promotion. According to

Kotller and Keller (2012) promotion is an effort by

marketers to influence other parties to participate in

the exchange of goods or services. Promotion is also

an attempt to communicate useful information about

a business or product and service to influence

potential buyers. Promotion not only discusses the

product, the price of the product and the distribution

of the product but also communicates the product to

the consumer so that the product is famous and the

edges are bought

The last one related to places or distribution

channel. Kotler and Keller (2012) state that

distribution channels or market channels aim to move

goods from producers to consumers. So it can be said

that the distribution channel helps facilitate the

transfer of property rights of goods or services so that

consumers can buy. Distribution channels overcome

the time, place and ownership gap that separates

goods and services from those who need them. To

distribute goods through several alternative channels

that can be selected by the producer, depending on

which channel contributes to the effectiveness and

cost efficiency

EBIC 2019 - Economics and Business International Conference 2019

254

2.3 Financial Behaviour

Financial literacy is one of the main driving factors of

business success that requires major attention. As is

known, the business environment changes very

quickly, so financial literacy is needed to oversee

business financial resources during the business life

cycle and connect effectively to financial products

and services (Eniola and Etenbang, 2015). Financial

literacy for MSME owners can be defined as someone

who knows about financial financing and financial

management for businesses for business

development, knows how to obtain the right products

and services for their business, and interacts with

potential buyers of the products and services they

offer (Mabula 2016).

Hilgert et al (2003) in Ida and Dwinta (2010)

found that consumers who have financial knowledge

are more likely to behave in financially responsible

ways (financial management behavior). Personal

financial knowledge is an element of personal

financial health within a conceptual framework

consisting of financial satisfaction, financial

behavior, and financial attitude and objective

measurement (Joo 2008).

3 RESEARCH METHOD

3.1 Research Time and Characteristics

This research was conducted by conducting a study

of SMEs in the city of Medan. The research location

is focused on several locations in the city of Medan

such as around campuses in the city of Medan, in the

business area (downtown) and other strategic

locations.

3.2 Participant

The unit of analysis in this study is the SMEs in

Medan. This is done to find out how the performance

of the MSME actors. It is planned that the research

will involve 300 MSME actors. Because there is no

real record of the number of MSMEs in the city of

Medan, this study uses the assumption that 50% of the

community are business operators. With an error rate

of 5% and a degree of confidence of 95%, the

minimum number of samples based on the Lemesow

formula for an unknown population is at least 100

business operators. To avoid errors in data collection

and better estimation, a number of 300 MSMEs

owners were participated in this study. The

participants were taken with non-probablity

sampling. Their consent were taken to participate in

this study.

3.3 Data Collection Method

Self-administered questionnaires were employed

during our research. The questionnaire in this study

was prepared based on a theoretical study and

adjusted to the MSME's condition that was the object

of research. Therefore, the research questionnaire

requires a validity and reliability test before it is

applied as an instrument for research data collection.

The validity and reliability testing of this instrument

was carried out on 30 MSMEs owners outside the

research sample later. Evaluation of the validity of the

questionnaire is done by face validity by adjusting the

list of questions raised with existing theories, as well

as the Pearson correlation which shows the

correlation value of the total score on each variable.

The instrument reliability test was conducted by

evaluating the Cronbach's alpha value on each

variable proposed in this study

3.4 Data Analysis Method

We employed multiple linear regression to evaluate

the impact of each behaviour on its dependent

variable, MSMEs Performance.

4 RESULT AND DISCUSSION

4.1 Participants’ Characteristics

Characteristics of respondents by sex were carried out

to obtain the distribution of characteristics of business

operators in Medan City based on gender. In general,

Indonesia adheres to segregation where generally

men make a living and women take care of the

household. The results of tabulation of respondents

by sex are summarized in Table 1.

Table 1. Responden Based on Gender

Gende

r

N

of Sample %

Male 140 46,67

Female 160 53,33

Total 300 100,00

Table 1 provide information that the involvement

of women in the business environment (MSME) is

greater than the involvement of men as entrepreneurs.

This labor force participation indicates that the role of

Financial and Marketing Behavior to Improve MSMEs Performance

255

women in the work environment has increased.

Women prefer entrepreneurship where they can

balance their time between household duties and

duties as an entrepreneur.

Majority of business owners in Medan City are in

the age range of 20 to 29 years (39%) followed by

ages 30 to 39 years (30.33%). This indicates that the

spirit of young entrepreneurs in the city of Medan has

begun to grow and increase the participation of young

people in the business environment. Some start this

business by continuing the family business, but many

also start a business from scratch.

Majority of business operators are married

(55.67%). Changing the phase of a person's life from

being single to being married can be one of the

motivating motivations for one's entrepreneurship.

Previously it was informed that in terms of age range,

the majority of business operators were already at the

age of marriage so that many of the business actors

were married. Even so, as many as 40.67% are still

not married. Other statuses in this characteristic

include divorce and death from business actors.

Majority of business owners have the last

education level achieved is high school, followed by

the level of Bachelor education (S1). This shows that

one of the factors that drives business actors is the

problem of education where the last education they

have is generally difficult to find work that can meet

family needs. At present it is very rare for companies

to accept employees with a high school education or

below. Nevertheless, participation of bachelor

graduates (S1) in the business environment itself has

improved.

Majority of business owners run businesses based

on the status of private ownership. Even so, there are

still many business actors who choose to run their

business as a joint venture where there are various

limitations when choosing to run their own business,

especially with regard to capital.

4.2 Regression Model Evaluation

This research model uses two independent variables

and one dependent variable. The independent

variables used in this study are financial behavior and

marketing behavior of MSMEs in Medan City. The

dependent variable of this study is the business

performance of the MSMEs. A total of 300 businesses

participated in this study.

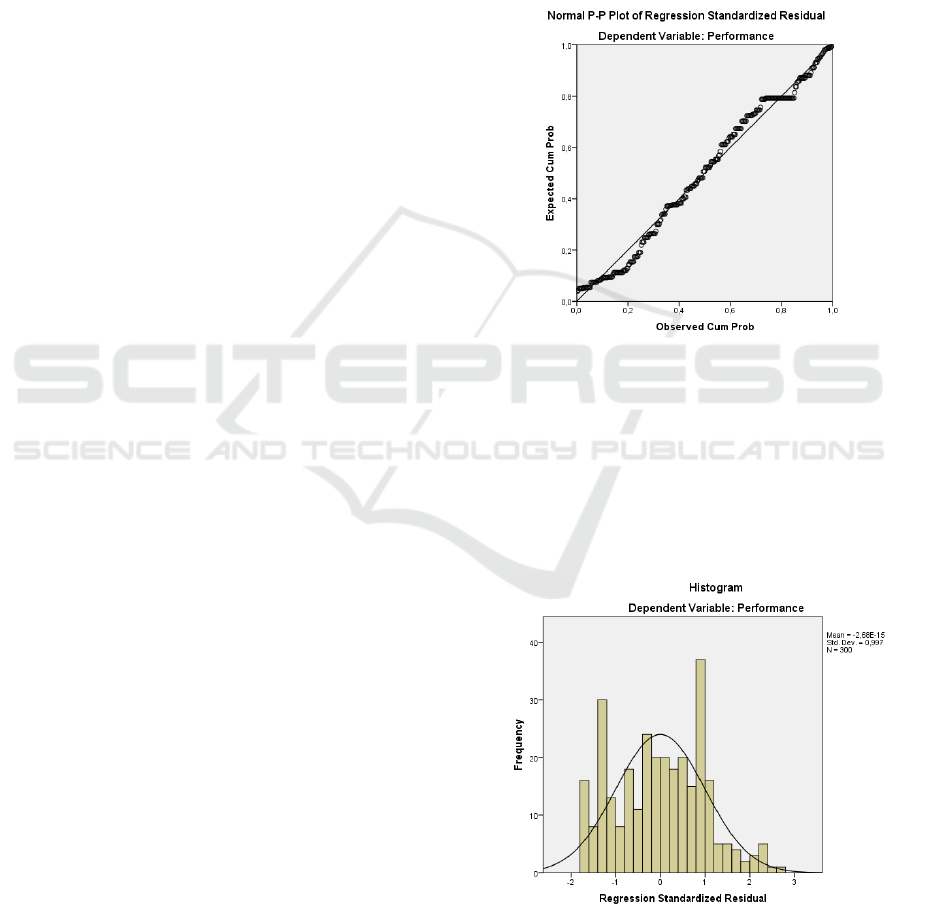

4.2.1 Residual Normality Test

The normality test aims to find out whether the

intruder or residual variable regression model has a

normal distribution. Good data is data that has a

pattern like the shape of a bell on the histogram

diagram. The data normality test used in this study is

the Kolmogorov-Smirnov test. Criteria for testing one

sample using a one-sided test that is by comparing the

probability with a certain level of significance that is

if a significant value or probability <0.05, then the

distribution of data is not normal and if a significant

value or probability> 0.05, then the data is normally

distributed. Evaluation using graphs is used to

support statistical evaluation results.

Figure 2. PP Plot Evaluation

Figure 2 shows that data residuals are spread

evenly along diagonal lines. Nevertheless there are

some points that move away from the diagonal lines

that lead to abnormal distribution. The data histogram

in Figure 3 shows the blanks on the left side of the

residual data distribution that indicate the data are not

normally distributed. Statistical evaluations were

carried out to confirm this.

Figure 3. Residual Histogram

EBIC 2019 - Economics and Business International Conference 2019

256

Kolmogorov Smirnov Test were used to evaluate

the normality based on statistics. The test result were

summarized in Table 2 as follow:

Table 2. Normality Test

Tests of Normality

Kolmogorov-Smirnov

a

Statistic Df Sig.

Unstandardized

Residual

,037 300 ,200

a. Lilliefors Significance Correction

Table 2 provides information that statistically, the

Kolmogorov-Smirnov test, gives a significance

value> 0.05 which indicates that the residual data is

normally distributed. Thus, the assumption of

normality in residual data has been fulfilled.

4.2.2 Multicollinearity Test

Symptoms of multicollinearity can be seen from the

value of tolerance and VIF (Varⅰance Inflate Factor).

Both measures indicate the variables which are

strongly affecting other dependent variables.

Tolerance is to measure the variable variables of the

dependent variables which are not explained in terms

of the other variables. The value that is used for

Tolerance> 0.1 and VIF <5, then there is no

multicolon.

Table 3. Collinearity Analysis

Model Collinearity

Statistics

Tolerance VIF

1

(Constant)

Financial_Behaviou

r

,731 1,368

Marketing_Behaviou

r

,731 1,368

a. Dependent Variable: Performance

Table 3 showed evidence that there is no problem

of multicollinearity of data on the independent

variables of the study. Each element of marketing

communication technology is independent so that the

variables proposed in this model do not affect each

other.

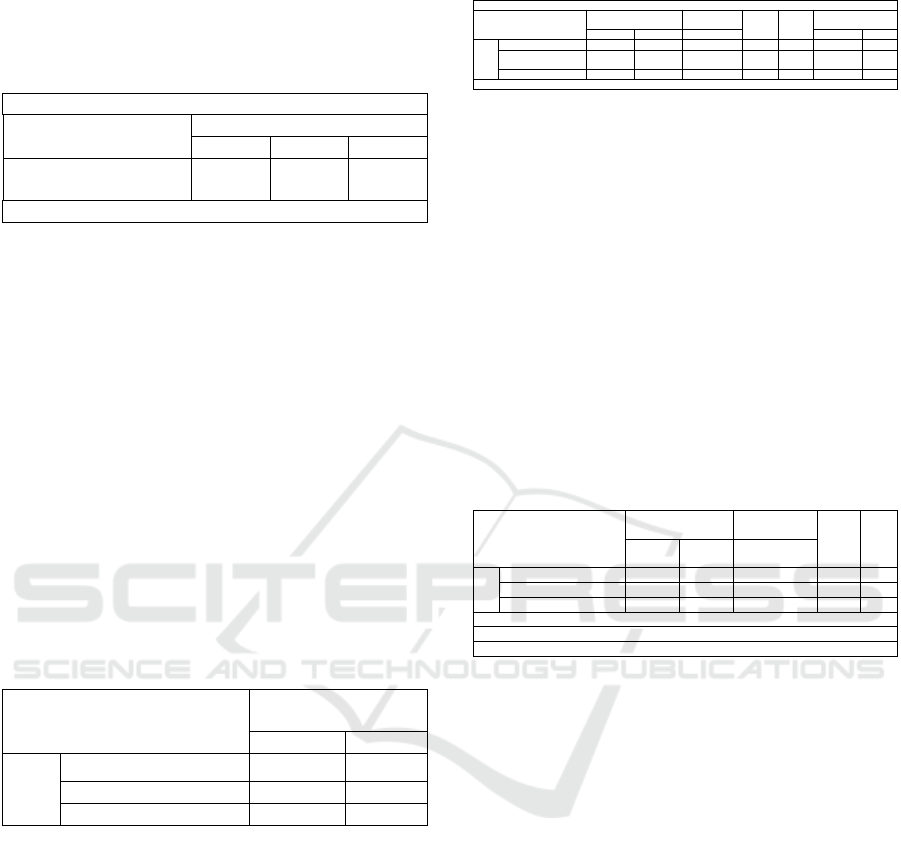

4.2.3 Heterokedasticity Test

Heterokedastity test data in this study were evaluated

using Glesjer-test statistical method. The result is

summarized as follow:

Table 4. Glesjer Test Analysis

Coefficient

Model Unstandardized

Coefficients

Standardized

Coefficients

t Sig. Collinearity

Statistics

B Std. Erro

r

Beta Tolerance VIF

1

(

Constant

)

,697 ,187 3,732 ,000

Financial_Behaviour -,082 ,045 -,124

-

1,836

,067 ,731 1,368

Marketin

g

_Behaviou

r

,030 ,051 ,040 ,587 ,558 ,731 1,368

a. Dependent Variable: ABSRES

Table 4 indicates that there are no statistically

significant independent variables on the value of the

residual data abslout. Thus statistically there is no

problem of heterocedasticity of data

4.2.4 Multiple Linear Regression Analysis

The research model has been evaluated qualitatively

based on classical assumptions. The model has

fulfilled the classical assumption criteria so that the

prediction results from this research model are best

linear unbiased estimators and can be used to evaluate

the conditions that occur in the research sample. The

results of the regression conducted in this study are

summarized as follows:

Table 5. Regression Result

Model Unstandardized

Coefficients

Standardized

Coefficients

t Sig.

B Std.

Erro

r

Beta

1

(

Constant

)

,941 ,342

2,748 ,006

Financial_Behaviou

r

-,030 ,082 -,023 -,373 ,709

Marketin

g

_Behaviou

r

,679 ,094 ,443 7,239 ,000

a. Dependent Variable: Performance

F-Statistics = 34,033

(

Si

g

< 0,05

)

Ad

j

usted R-Square = 0,181

Table 5 provides information that financial

behavior and marketing behavior explain 18.1% of

the conditions of MSME performance. Thus, there are

81.9% influences from outside the model currently

proposed. The significance level of the F-test on the

proposed model <0.05 (Table 5) which indicates that

together, financial and marketing behaviors play a

role in influencing the performance of MSMEs in

Medan City.

Regression models that can be formulated based

on the results of this study are:

Y = 0,941 – 0,03 Financial Behaviour + 0,679

Marketing Behaviour + e

Financial behavior has very little influence on the

performance of MSMEs (B = -0.03) with a

significance level of> 0.05. Thus, there is not enough

evidence to state that financial behavior influences

the performance of MSMEs. Financial behavior

includes attitudes that are accompanied by actions

against debt, financial records, bookkeeping, and

options for investing from operating results. These

Financial and Marketing Behavior to Improve MSMEs Performance

257

behaviors statistically have no effect on the

performance of MSMEs in Medan at present. One of

the main reasons is the low awareness of business

actors to implement the financial behavior itself.

However, based on research that has been carried out

this behavior, for now, is not significant to the

achievement of their performance.

Marketing behavior in this study had a positive

influence (B = 0.679) and significant (sig <0.05) on

the performance of MSMEs. In the proposed model

this influence is the dominant influence on the

achievement of MSME performance. Thus, there is

enough evidence to state that marketing behavior has

a positive and significant effect on the achievement

of MSME performance in Medan. Every one unit

increase that occurs from marketing behavior, MSME

performance will increase by 0.679 units. This

marketing behavior includes activities in product

development, evaluation and pricing, evaluation and

determination of distribution channels, as well as

promotional activities to increase demand for

products. Thus, the better this marketing behavior is

applied by business actors, the better performance it

will achieve.

5 CONCLUSIONS AND

SUGGESTIONS

This study shows that the current situation of business

actors shows that current financial behavior does not

affect the performance of MSMEs. The application of

financial behavior is currently not effective, therefore

it needs attention and development in financial

behavior in order to create performance

improvements based on the financial behavior of

business actors. On the other hand, marketing plays a

very important role in influencing this performance.

Marketing in this case is closely related to the

achievement of performance. Good marketing will

bring customers and create performance, especially

from a financial perspective.

ACKNOWLEDGMENTS

The authors gratefully acknowledge that the present

research is supported by Universitas Sumatera Utara.

The support is under the research grant TALENTA -

Penelitian Dasar for year 2019

REFERENCES

Adomoko, S., Danso, A., dan Damoah, J.O. 2016.

Themoderating influence of financial literacy on the

relationship between access to finance andfirm growth

in Ghana.Venture Capital. 18(1).43-61.

Ardiana, I.D.K.R., Brahmayanti., I.A., Subaedi., (2010).

Kompetensi SDM UKM dan Pengaruhnya Terhadap

Kinerja UKM di Surabaya. Jurnal Manajemen Dan

Kewirausahaan, Vol.12, No. 1, Maret 2010: 42-55

Aribawa, Dwitya (2016). Pengaruh Literasi Keuangan

Terhadap Kinerja dan Keberlangsungan UMKM di

Jawa Tengah. Jurnal Siasat Bisnis Vo. 20. No 1, Januari

2016, Hal 1-13.

Eniola, A. A., & Entebang, H. (2014). SME firms

performance in Nigeria: Competitive advantage and its

impact. International Journal of Research Studies in

Management, 3(2), 75-86.

http://dx.doi.org/10.5861/ijrsm.2014.854

Eniola, A. A., & Entebang, H. (2015a). Government policy

and performance of small and medium business

management. International Journal of Academic

Research in Business and Social Sciences, 5(2), 237-

248. http://dx.doi.org/10.6007/IJARBSS/v5-i2/1481

Eniola, A. A., & Entebang, H. (2015b). SME firm

performance-financial innovation and challenges.

Procedia - Social and Behavioral Sciences, 195, 334-

342. http://dx.doi.org/10.1016/j.sbspro.2015.06.361

Eniola, A. A., Entebang, H., & Sakariyau, O. B. (2015).

Small and medium scale business performance in

Nigeria: Challenges faced from an intellectual capital

perspective. International Journal of Research Studies

in Management, 4(1), 57-71.

http://dx.doi.org/10.5861/ijrsm.2015.964

Hasibuan, B, K., Lubis, Y,M., dan Ritonga, W,A, HR. 2017

Financial Literacy and Financial Behavior as a Measure

of Financial Satisfaction. Atlantis Press.

https://www.atlantis-press.com/proceedings/ebic-

17/25891530

https://www.liputan6.com/bisnis/read/3581067/umkm-

sumbang-60-persen-ke-pertumbuhan-ekonomi-

nasional

Ida dan Cinthia Yohana Dwinta. (2010). Pengaruh Locus of

Control, Financial Knowledge, Income terhadap

Financial Management Behavior. Universitas Kristen

Maranatha: Jurnal Bisnis dan Akuntansi Vol. 12, No. 3.

Kotler, Philip dan Kevin Lane Keller. 2012. Marketing

Management, 14th Edition. New Jersey: Prentice Hall.

Liang, T. P., You, J. J., & Liu, C.C. (2010). A resource-

based perspective on information technology and firm

performance: a meta analysis. Industrial Management

& Data Systems, 110(8), 1138–1158.

http://dx.doi.org/10.1108/02635571011077807

Mabula, Juma Buhimila. (2016). Reviewing Financial

Literacy for SMEs and Entrepreneurs in Developing

Economies, International Journal of Science and

Research (IJSR). Volume 5 Issue 6, June 2016 .ISSN

(Online): 2319-7064. Pp.882-886.

http://dx.doi.org/10.21275/v5i6.NOV164309

EBIC 2019 - Economics and Business International Conference 2019

258

Peres-carbanero, Carmen, Tomas Gonzales-cruz dan Sonia

Cruz-Ros. 2011. Do Family SME Managers Value

Marketing Capabilities’ Contribution to Firm’s

Performance, Journal of Marketing and Intelligence

Planning 30:116-142

Purwaningsih, Ratna., dan Kusuma, Panjar Damar ( 2015).

Analisis Faktor-Faktor Yang Mempengaruhikinerja

Usaha Kecil Dan Menengah (UKM) Dengan Metode

Structural Equation Modeling(Studi Kasus UKM

Berbasis Industri Kreatif Kota Semarang). Prosiding

SNSTke – 6 Fakultas Teknik Universitas Wahid

Hasyim Semarang. Pp 7-12

https://media.neliti.com/media/publications/176529-

ID-analisis-faktor-faktor-yang-mempengaruhi.pdf

Santos, J. B. & Brito, L. A. L. (2012). Toward a subjective

measurement model for firm performance. Brazilian

Administration Review (BAR), 9(6), 95–117.

http://dx.doi.org/10.1590/S1807-76922012000500007

Soetiono, Kusumaningtuti S., dan Setiawan, Cecep. 2018

Literasi dan Inklusi KeuanganIndonesia. Rajawali

Press

Financial and Marketing Behavior to Improve MSMEs Performance

259