Influence of Financial Literacy on Performance

and Business Sustainability: Case Study on Cake Business Group

Typical Malayu Deli

Juli Meliza

1

, Dian Faqih Sumarli

2

1

Department of Management, Universitas Medan Area, Jl. SeiSerayu, Kampus UMA, Medan, Indonesia

2

Department of Accounting, Universitas Medan Area, Jl. SeiSerayu, Kampus UMA, Medan, Indonesia

Keywords: Financial Literacy, Performance, Sustainability

Abstract: This research aims to analyze the influence of financial literacy on performance and sustainability, case

studies in the business group of the Malayu pastry vendor of Deli. The structural equation model is used to

analyze data. The results confirmed the influence of financial literacy on performance and business

continuity in the Malayu pastry business group. The implication is that with proper financial literacy. The

cake Business group can make appropriate management and financial decisions, to improve business

performance and sustainability.

1 INTRODUCTION

Medan City is a city that has a diversity of culture

and the historical side of some tourist attractions.

Enjoying the culinary richness of Medan city also

must not be absent from the list of activities.

Culinary trails in the city of Medan that are not less

diverse can make everyone put heart in the town

nicknamed the Malay City of Deli. This distinctive

culinary is continued to be preserved by the

descendants of the Malay Deli in Medan, so there is

a unique business group Cake Melayu Deli. The

existence of this business group needs to continue to

be maintained, because the typical culinary of the

area becomes an attraction for tourists who visit.

Small micro-enterprise sector, can absorb the

workforce through the creation of new employment.

In general, the SME always has a common problem

that is not complet, so it is difficult to compete with

large companies. The typical Malay pastry business

group also includes SMEs who have similar issues

with SMEs in general, particularly in the field of

financial literacy.

In the year 2016, the results of OJK survey

showed that North Sumatera has an index of 31.3%

above the average value of the National Financial

Literacy Index and ranked 11 out of 33 provinces.

This data shows the low financial literacy of the city

community Medan (Segara, 2017) which will impact

the sustainability of the business.

Enriching the knowledge of SMEs to financial

expertise so that the management of business

finances can develop well (Aribawa, 2016), is one

way to maintain business sustainability.

Dahmen and Rodriguez (2014), stated that,the

necessary understanding of financial literacy rates

for business actors, especially for the preparation of

business financial statements is indispensable, in

terms of the search process of additional funds.

Anggraeni (2015) stated that, financial literacy

affects how people think of financial conditions and

influence strategic decision making in financial and

better management for business owners. However,

Eke, and Raath (2013) found that financial literacy

does not affect on SMEs growth.

Based on the descriptions, researchers are

motivated to research the level of financial literacy,

whether it affects performance and sustainability of

the business.

Meliza, J. and Sumarli, D.

Influence of Financial Literacy on Performance and Business Sustainability: Case Study on Cake Business Group Typical Malayu Deli.

DOI: 10.5220/0009202702910295

In Proceedings of the 2nd Economics and Business International Conference (EBIC 2019) - Economics and Business in Industrial Revolution 4.0, pages 291-295

ISBN: 978-989-758-498-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

291

2 LITERATURE REVIEW

2.1 Financial Literacy

Financial literacy is a lives skill that everyone needs

to be able to improve their life and survive the

current complex economy (Lusardi, 2012).

Financial literacy is a mixture of financial

knowledge and skills, and it will help business

owners make decisions and financial choices wisely

(Okello, Ntayi, Munene, andMalinga, 2017).

Based on the survey data conducted by OJK

(2013), there are four levels of financial literacy of

the Indonesian population, namely :

(1) well literate of 21.84%, namely have knowledge

and know the benefits of financial services

institutions and have Financial product usage skills;

(2) sufficient literate of 75.69%, i.e.,have expertise

and understand the benefits of financial services

institutions;

(3) lessscholarly of 2.06%, i.e., only having

knowledge of financial services institutions; and

(4) not literate of 0.41%, i.e., has no experience and

confidence in financial services institutions.

The measurement of the financial literacy

variables in SMEs uses measurement indicators

regarding the Developing Indonesian Financial

Literacy Index conducted by the Financial Services

Authority (2013). This measurement indicator is

following the research undertaken by Aribawa

(2016) namely, general knowledge banking with

four sign questions, and interest calculation of

savings and loans with a sign of 4 items.

2.2 Business Performance and

Sustainability

Mutegi et al. (2015), defining the performance of

SMEs, is the result of work achieved by the

individual, and adjusting to the role or task of the

individual in a company at a certain period, which is

associated with a value size or individualstandard

companies work.Aribawa (2016), in his research on

the measurement of varibael performance, using five

statements of analysis.

Adamoko et al. (2015), business growth is the

company's ability to increase the size of a company.

Fatoki (2014) in his research, said that business

growth and how to measure it is usually defined and

measured using absolute or relative, changes in

sales, assets, work, productivity, profits.

Business sustainability in SMEscan be seen from

the company's success in innovating, employee and

customer management, and also initial capital. This

shows that the company has an orientation to thrive

and to see the opportunity for continuous innovation

(Hudson, Smart, and Bourne, 2001).

In general, the hypotheses tested in this study

are as follows:

H

1

: financial literacy has a significant impact on

performance

H

2

: financial literacy has a significant impact on

business sustainability

Figure 1. Research Model

3 RESEARCH METHODOLOGY

3.1 Population and Samples

The type of research used in this study is

quantitative research. This research aims to

determine the influence of independent variables,

i.e., financial literacy of dependent variables,

performance, and sustainability.

The population of this research is the owner and

manager of the Malay pastry business in Medan as

many as 145 business people. The number of

samples taken in this study was as much as 100

respondents.

The characteristics of this research sample are

based on several criteria, namely: SMEs located in

Medan, have at least 1 employee, offer deli Malay

cake products.

3.2 Data Collection

This study uses primary data. Primary data was

obtained from questionnaire, which was distributed

directly to all business people, who sold a traditional

Malay cake in Medan.

The form of the statement used is a closed

statement, and the measurement scale used for the

dependent variable in this study uses sematic

defferential (a measure of the sematic defferential

scale used in the measurement of the dependent

variable is measured by giving a score of one to

five). In general, the constructs and indicators used

are presented as in Table 1.

EBIC 2019 - Economics and Business International Conference 2019

292

The sample size used is 100. The sampling

technique used is non-probability sampling with

accidental sampling, ie the sample is selected based

on the ease in obtaining the required data.

Table 1. Research Constructions and Indicators

Research Constructions Indicators

Financial Literacy 1. Opening an account

2. Minimum funds

3. Funds settle

4. Government guarantee

5. One year yield

6. Multi-year yields

7. Credit interest

Sustainability 1. Total assets

2. Turnover

3. Profit

4. Production volume

5. Sales costs

6. Number of employees

7. Business location

Performance 1. Work plan

2. Work errors

3. Sales growth

4. Decreasing fixed costs

5. Antici

p

ate

p

roduction

Source: Data processed

3.3 Technical Analysis

Collected Data is analyzed using a partial least

square based structural equation model. Smart

Software PLS 3.0 is used to help analyze the

relationship between variables.

4 RESULT AND DISCUSSION

4.1 Document of Theoretical Model

Development

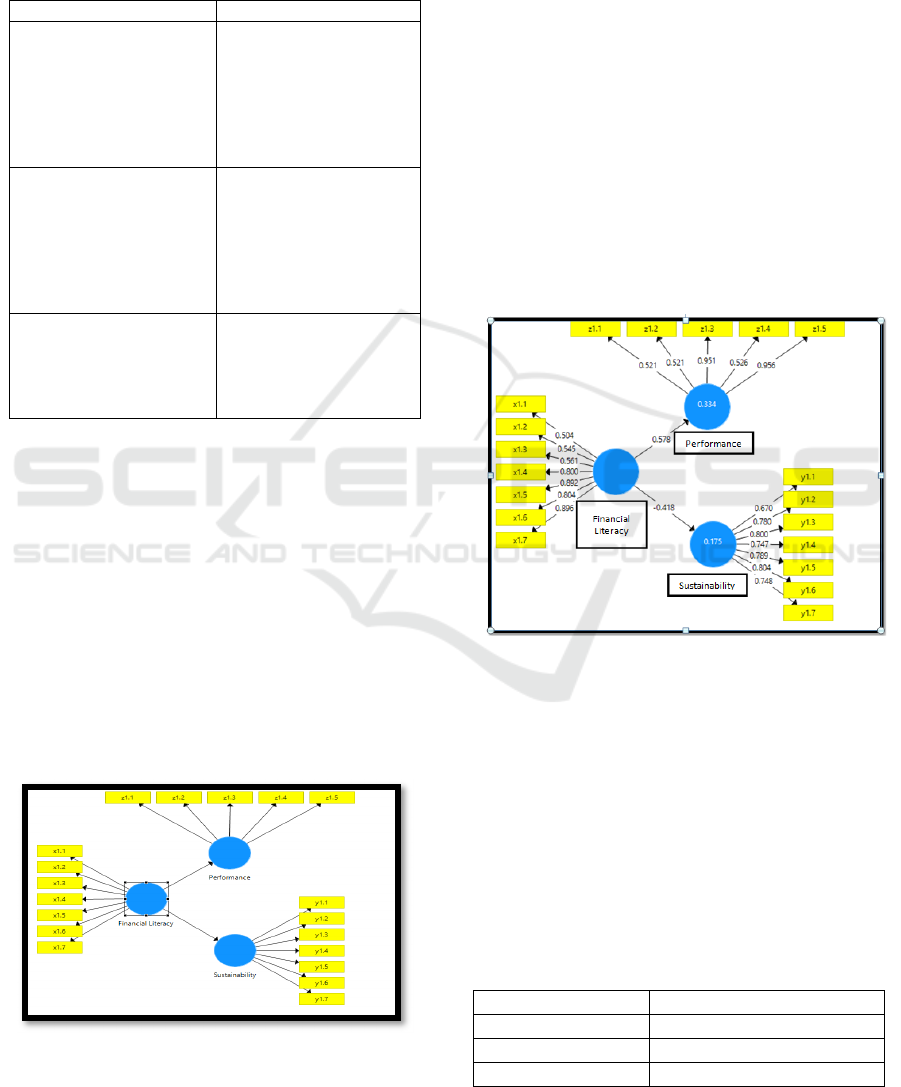

Figure 2. Theoretical Model Development Diagram

Source: PLS Output of research data (2019)

4.2 Outer Model or Measurement

Model

4.2.1 Validity and Reliability Tests

Convergent Validity

Convergent validity is seen based on the correlation

between item / indicator scores and latent variable

scores. Individual reflective measures are said to be

high if they correlate more than 0.7 with the latent

variable that is to be measured (Cahyanigrum,

Endah et al. 2015).

Convergent validity of the measurement model

with reflexive indicators can be seen from the

correlation of score items with variable scores.The

indicator is considered valid if it has a correlation

value above 0.70.But in the research stage of

developing the loading scale 0.50 to 0.60 is still

acceptable (Ghozali, 2008).

Figure 3. Output Diagram

Source: PLS Output of research data (2019)

Based on figure 3 it can be seen that the outer

loading of each item has a correlation value greater

than 0.50, so it can be said to be valid. This shows

that the indicators of each variable are declared valid

or can measure these variables appropriately

Composite reliability

Composite reliability is said to be good if the value

is above 0.60. Based on the PLS test results show

that the composite reliability value for all variables

Table 2. Value Composite Reliability

Composite Reliabilit

y

Sustainabilit

y

0,907

Performance 0,836

Financial literac

y

0,885

Source: PLS Output of research data (2019)

Influence of Financial Literacy on Performance and Business Sustainability: Case Study on Cake Business Group Typical Malayu Deli

293

Based on Table 2, Value Composite Reliability,

obtained information that the amount of Composite

Reliability on all blocks of indicators has met the

assumption Composite Reliability is more

significant than 0.6, it means that the indicator

blocks in each latent variable has a high consistency.

Discriminant Validity

Discriminant validity with reflexive indicators,the

value can be checked onthe cross-loading between

signwith its construct. Indicator correlation value to

its construction must be more significant than other

construct value. Another method of assessing

discriminant validity is to use Average Variance

Extracted (AVE) which has a construct value> 0.50

specified as a good model (Ghozali, 2008). Visible

on the AVE table the terms of construct value> 0.50

already appropriate, so it can be concluded that the

model in this study is a good model.

Table 3. Average Variance Extracted (AVE)

Avera

g

e Variance Extracte

d

Sustainabilit

y

0,583

Performance 0,528

Financial literac

y

0,536

Source: PLS Output of research data (2019)

4.3 Inner Model or Structural Model

After the estimated model meets the outer model

criteria, the next test is the structural model (inner

model). Internal model or structural model testing is

done to see the relationship between construct,

significance value, and R-square of the research

model. Evaluating structural models is by looking at

values R-square, for the t test dependent construct as

well as the significance of the structural path

parameter coefficients.

R-square

To assess the model with PLS begins by looking at

R-square for each latentdependent variable. The

following table is the result of R-square estimation.

Table 4. R-Square

R-Square Ad

j

.R-Square

Sustainabilit

y

0,175 0,166

Performance 0,334 0,328

Source: PLS Output of research data (2019)

Q-Square predictive relevance for the structural

model, measure how well the observational value

produced by the model, and also the estimated

parameter. The Q-square value> 0 indicates the

model has predictive relevance; otherwise if the Q-

square value ≤ 0 shows the model lacking predictive

connection.

Q-Square predictive relevance= 1- (1-Rsqure1)(1-Rsquare2)

= 1 – (0,825)(0,666)

= 1 – 0,54945= 0,45055

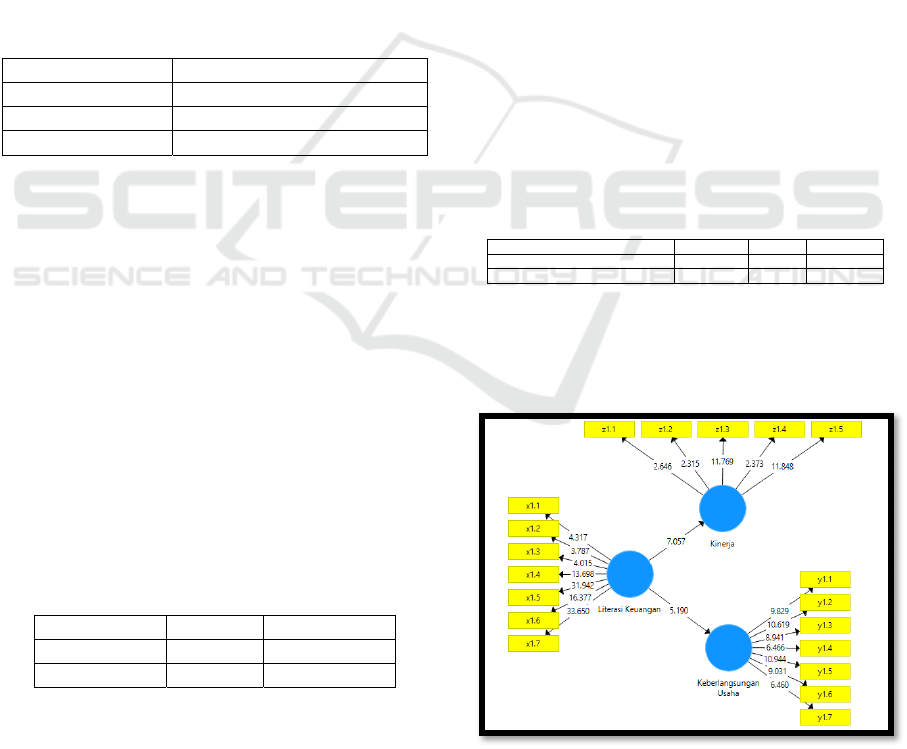

4.4 Hypothesis Testing

Hypothesis testing on the t test uses path

significance tests. Testing structural models to assess

the effect of each direction of the relationship

(causal path) and the predetermined hypothesis

testing, used bootstrapping techniques. Based on the

results of the technical analysis, all the course of the

variable relationship is significant at a significant

rate (p-value) of 5% and with the amount of t-

Statistic, respectively > 1.96. The relationship

between variables visible to the inner model

indicates all the hypotheses submitted are

acceptable.

In testing the draft model of this study proposed

test on two hypotheses as follows:

H

1

: financial literacy has a significant impact on

performance

H

2

: financial literacy has a significant influence on

the sustainability of business

Table 5. Path Coefficients

t – statistic P-value Keterangan

Financial literacy Sustainability 5,138 0,000 Significant

Financial literacy Performance 8,497 0,000 Significant

Source: PLS Output of research data (2019)

Table 5 path coefficients, shows the bootstrapping

path coefficients which illustrate the significant

positive effect between latent variables.

Path Significance Test

Figure 5. Bootstrapping Structural Model

Source: PLS Output of research data (2019)

EBIC 2019 - Economics and Business International Conference 2019

294

The coefficient value of the structural model is said

to be significant if the t-count> t-table is 1.96 (1.96

is the t-table value in the 95% confidence level). All

the indicators in Figure 5 look substantial on the

condition of t-value> 1.96.

These results mean that the relationship

between the variables seen with the model shows

that all proposed hypotheses can be accepted.

5 CONCLUSION AND

SUGGESTION

5.1 Conclusion

In general, it can be seen that there is an influence of

financial literacy on performance and sustainability

of the business in the Malay Deli Merchant business

Group in Medan.

Based on the explanation described in the

analysis and discussion chapter, it was concluded

that the most substantial direct effect occurred on the

variables of financial literacy to performance.

The research also provides insight to

stakeholders who have a role in increasing the level

of financial literacy in Indonesia.

5.2 Suggestion

In the future, researchers hope, there will be a lot of

research with a more applicative perspective for the

development of creative business in Indonesia.

Improvements to this research can be done among

others by extending the scope of the sample to a

broader extent, modifying the model to be more

involved, or could also extend the range of the

measuring indicator.

REFERENCES

Anggraeni, B. D. 2015. Pengaruh Tingkat Literasi

Keuangan Pemilik Usaha Terhadap Pengelolaan

Keuangan. Studi Kasus: UMKM Depok. Jurnal

Vokasi Indonesia, Vol.3 No.1, 22-30.

Aribawa, D. 2016. Pengaruh Literasi Keuangan Terhadap

Kinerja Dan Keberlangsungan Umkm Di Jawa

Tengah. Jurnal Siasat Bisnis, Vol. 20, 1-13.

Cahyanigrum, Endah et al. 2015.Analisa Faktor-Faktor

Yang Mempengaruhi Kinerja Perusahaan

Menggunakan Pendekatan Partial Least Square,

http://ejournal-s1.undip.ac.id/index.php/gaussian,

ISSN: 2339-2541

Eke, E., danRaath, C. 2013. SMME Owners’ Financial

Literacy and Business Growth. Journal of Social

Sciences MCSER Publishing, Rome-Italy, Vol. 4,

397-406

Hair, J.F et al. 2014. A Primer On Partial Least Squares

Structural Equation Modeling (PLS-SEM). United

States of America: SAGE.

Haryono, S. &Wardoyo, P. 2013. Structural Equation

Modeling (SEM) for Management Research. Jakarta:

PT Intermedia Personnel Utama Jakarta.

Lusardi, A., & Scheresberg, D. C. B. (2013). Financial

literacy and high-cost borrowing in the United

States.Nber, 1–42.

Okello, G. C. B., Ntayi, J. M., Munene, J. C., &Malinga,

C. A. (2017). The relationship between access to

finance and growth of SMEs in developing economies:

financial literacy as a moderator. Review of

International Business and Strategy.

Otoritas Jasa Keuangan, 2013. Developing Indonesia

Financial Literacy Index.

Otoritas Jasa Keuangan. 2013. Literasi Keuangan.

https://www.ojk.go.id/id/kanal/edukasi-

danperlindungan-konsumen/Pages/Literasi-

Keuangan.aspx.

Segara, T. 2017. Strategi Nasional Literasi Keuangan

Indonesia (Revisit 2017). Jakarta: Otoritas Jasa

Keuangan.

Influence of Financial Literacy on Performance and Business Sustainability: Case Study on Cake Business Group Typical Malayu Deli

295