The Influence of Capital Structure, Profitability, and Company Size

on Firm Values in Manufacturing Companies Listed on the Indonesia

Stock Exchange

Thomas Sumarsan Goh and Melanthon Rumapea

Department of Accounting, The University of Methodist Indonesia, Jl. Hang Tuah No. 8, Medan, Indonesia

Keywords: Capital Structure, Profitability, Company Size, Firm Values

Abstract: The value of the company is achieved when an investment generates a rate of return that is greater than the

investment risk. By increasing the value of the companies, shareholders’ value will also increase, which is

indicated by the high return on investment to shareholders. Several factors that can influence firm values are

capital structure, profitability, and the size of the companies. Financial risk is a risk that affects the financial

aspects of the company. And market risk is the risk that occurs due to business competition with the emergence

of potential new competitors in the market of the same product. The population of the study was 61 and 12

companies were selected to be the samples through purposive sampling technique. The data were analyzed

by using descriptive statistics technique. From the results of the study, it can be concluded, that capital

structure has a significant effect on firm value, but has a negative coefficient direction. Even though the capital

structure of a company has decreased, but the value of the company may not necessarily decline. Profitability

has a positive and significant effect on firm value, and firm size has a positive and significant impact on firm

value. Capital structure, profitability, and company size simultaneously have a significant impact on firm

value.

1 BACKGROUND

1.1 Background of the Problem

The main goal of the company is to maximize

shareholders’ value. Thus managements find ways to

increase the value of the company. So, the company

needs to ensure that the value of the company grows

sustainably. The cost of the company is achieved

when an investment generates a rate of return that is

greater than the investment risk. At the simplest level,

all leads to the investors or shareholders. This group

of people have risk factors within the company

because they contribute their values to the company

in the hope that they can get returns.

So it is essential for companies’ need to improve

their financials to attract new investors or make

investment decisions. This is the main thing for some

companies to increase their corporate values. By

increasing the value of the companies, shareholders’

value will also increase, which is indicated by the

high return on investment to shareholders. Several

factors that can influence company values are capital

structure, profitability, and the size of the companies.

According to Agus (2010: 240), capital structure

is a comparison or balance of long-term funding of

the company as indicated by the similarity of long-

term debt to own capital. Capital structure shows the

use of debt to finance its investment, so that by

knowing the company's capital structure, investors

can find out the balance between the risk and return

on investment. The purpose of capital structure

management is to combine the sources of funds used

by the companies to finance the operations. In other

words, this goal can be seen as a combination of funds

that will minimize the cost of capital and maximize

the value of the company.

The most important thing for a company is how

the profit can maximize the wealth of the

shareholders rather than how much profit the

company makes (Santy Kusumaningrum: 2016).

According to Ferry and Jones (2001), the size of

the company is as indicated by total assets, total sales,

average of total sales, and proportion of total assets.

The size of the company has dramatically influenced

446

Goh, T. and Rumapea, M.

The Influence of Capital Structure, Profitability, and Company Size on Firm Values in Manufacturing Companies Listed on the Indonesia Stock Exchange.

DOI: 10.5220/0009216104460456

In Proceedings of the 2nd Economics and Business International Conference (EBIC 2019) - Economics and Business in Industrial Revolution 4.0, pages 446-456

ISBN: 978-989-758-498-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

the ability of the company to obtain a loan. Large

companies have significant funding needs to finance

the operation activities of the companies. Large

companies are more comfortable to get loans than

small companies. However, large companies have

more significant risks compared to smaller

companies, such as financial risk and market risk.

Financial risk is a risk that influences the financial

aspects of the company. And market risk is the risk

that occurs due to business competition with the

emergence of potential new competitors in the market

of the same product.

Firm’s size is the size of assets owned by the

company. Firm size is also an indicator that shows the

company's financial strength. So, the size of the firm

is considered to be able to influence the value of the

company, because the larger the size of the company,

the company is more comfortable to obtain funding

from both internal and external.

This research was conducted at manufacturing

companies listed at the Indonesia Stock Exchange

(IDX). A manufacturing company is a processing

industry company that processes raw materials into

semi-finished goods or finished goods which have

higher added value. In manufacturing companies,

there are three sectors, namely the essential industrial

and chemical sectors, various industrial sectors, and

the consumer goods industry sector. However, in this

article, the researcher put the limit in the research to

only study the essential industrial and chemical

sectors in manufacturing companies listed at the

Indonesia Stock Exchange.

Several studies have been conducted to analyze

the factors that can affect the value of the firm whose

results are in line or adverse. These studies include

those conducted by Nunung Nur Hanifah (2016)

showed that partially, the capital structure has

effected positively and not significantly on firm’s

value. While company growth, company size, and

profitability have impacted positively on firm’s value.

Simultaneously, capital structure, the company’s

growth, the company’s size, and profitability have

impacted positively and considerably on the firm’s

value. Based on the research of Santy

Kusumaningrum (2016) has shown that

simultaneously, all the independent variables of

capital structure and profitability have influenced

positively and significantly on firm’s value. And

based on research conducted by Ayu Sri, et al. (2013),

it showed that the capital structure has effected

negatively and significantly on firm’s value,

profitability had influenced positively and

significantly on the firm’s value, and firm size did not

affect firm’s value.

Based on the inconsistency of the above results of

several studies, therefore the researchers carried out

further research which would be able to provide more

adequate results with data that was more relevant to

current conditions.

Since the beginning of 2017, the primary and

chemical industry sectors on the Indonesia Stock

Exchange (IDX) have recorded high growth. The

primary and chemical industry sectors had recorded

growth of 17.08% year to date. This has made this

sector the second-most top growth sector after the

growth of financial industy of 29.18 year to date.

1.2 Identification of Problems

Based on the background of the above problem, the

problem identifications in this study are:

1. The value of the firms have not been stable.

2. The purpose of the company is to increase the

value of the company has not been achieved

effectively and efficiently.

1.3 Problem Formulation

Based on the description of the background and

identification of the above problem, the formulation

of the problems in this study are:

1. Does the capital structure partially influence the

value of the firm?

2. Does profitability have a partial influence on the

value of the firm?

3. Does the size of the company partially influence

the value of the firm?

4. Does the capital structure, profitability, and size

of the company influence simultaneously the

value of the firm?

1.4 Research Objectives

Based on the formulation of the problem above, the

objectives of this study are:

1. To test and analyze the effect of capital structure

on the value of the firm.

2. To test and analyze the effect of profitability on

the value of the firm.

3. To test and analyze the effect of company size on

the value of the firm.

4. To test and analyze the effect of capital structure,

profitability, and firm size on the value of the

firm.

The Influence of Capital Structure, Profitability, and Company Size on Firm Values in Manufacturing Companies Listed on the Indonesia

Stock Exchange

447

2 LITERATURE STUDY

2.1 Agency Theory

Agency theory describes the relationship between

shareholders as principals and management as agents.

Jansen and Meckling in Okky (2015:16) explain that

agency relations is agency relationship, a contract

under which one or more person (the principals)

engage another person (the agent) to perform some

service or their behalfs which involve delegating

some decision making authority to the agents.

Potential agency problems occur when the

manager's share of the company is less than one

hundred percent (Okky, 2015:17). The proportion of

ownership that only a part of the company makes

managers tend to act for personal interests and not to

maximize the company. This will cause agency costs.

The presence of managerial ownership can be

used to reduce the agency cost that has the potential

to rise, because by owning the shares of the company,

it is expected that the manager feels the benefits

directly from each decision taken.

2.2 Signal Theory

Signal theory is based on the assumption that the

information received by each party is not the same. In

other words, signal theory is related to information

asymmetry, which is what happens if one party from

a transaction has more or better information than the

other party.

If the information contains positive things, it is

expected that the market will react when the market

receives the announcement. A change in stock prices

indicates the market reaction at the time the

information is announced, and all market participants

have received the information. Whereby, external

parties will analyze the data as a good signal or a

wrong signal. If the announced information is a good

signal for external parties, then there will be an

increase in stock prices (Okky, 2015: 10). The profit

that is reported by the company can indicate the good

or bad condition of the company.

2.3 Financial Reports

2.3.1 Definition and Purpose of Financial

Statements

In simple terms, Keown (2004) defines financial

statements are reports that show the company's

financial statements at this time or in a certain period.

The purpose of the financial report that shows the

current condition of the company is the current

condition.

Financial statements describe the company's

economic posts obtained from a period. In practice,

several types of business reports are known, such as;

balance sheet, income statement, statement of

changes in equity, notes to financial statements, and

cash flow statement.

According to Kasmir (2015: 10), there are several

objectives of the preparation of financial statements,

namely:

1. Provide information about the type and amount of

assets held by the company;

2. Provide information about the type and amount of

liabilities and capital owed by the company;

3. Provide information about the type and amount of

income obtained in a given period;

4. Provide information about the amount of costs

and types of expenses incurred by the company in

a certain period;

5. Provide information about changes that occur to

assets, liabilities, and capital;

6. Provide information about the performance of the

company’s management in a period;

7. Provide information about the notes to the

financial statements; and other financial

information.

2.3.2 Analysis of Financial Statements

After the financial statements are prepared based on

relevant data and carried out the correct accounting

procedures and valuations, the actual financial

condition of the company will be seen. The financial

situation is known as how many assets, liabilities, and

capital in the balance sheet. Then it will also see the

income received and the amount of costs incurred

during specific periods. Thus, it can be understood

how are the results of the business obtained during a

certain period of income statement are prepared.

2.3.3 Value of the Firm

The value of the firm can reflect the value of assets

owned by companies such as securities. Stock is one

of the securities issued by the company. Financial

conditions influence the high and low of the stock

prices. The value of the firm is an investor's

perception of the level of success of the company that

is closely related to its stock price (Hermuningsih,

2013 : 131). High stock prices make the value of the

firm high and increase market confidence not only in

the company's current performance, but also in the

company's prospects. The stock price generally refers

EBIC 2019 - Economics and Business International Conference 2019

448

to the closing price and is the price that occurs when

the stock is traded on the market (Situmorang, 2016 :

14).

There are several methods that have been used to

measure the value of a firm, such as Price Earning

Ratio (PER), Price to Book Value (PBV), and Tobin’s

Q. Price-earnings ratio serves to measure changes in

future expected earnings ability.

Price-earnings ratio is one of the most significant

measures in fundamental stock analysis and part of

the valuation ratio for evaluating financial statements.

Price-earnings ratio is useful to see how the market

appreciates the performance of a company's stock on

company performance reflected in earnings per share.

Price-earnings ratio shows the relationship between

average stock market prices and profits per share.

Price-earnings ratio (PER) is a fundamental

analysis technique with the value of shares and

compares it with the price of shares per sheet with

profits generated from each share. According to

Brigham and Houston, the formula for calculating

PER is:

Price stock

Price-earnings ratio (PER) =

Earning per share

Companies with low growth usually have a low

PER. Besides that, it can also mean that the higher the

PER allows the market price of each share to be

better, and vice versa.

Price-earnings ratio is also a measure to determine

how the market member values a company's stock.

Firms with high growth rates usually have a high

PER, and vice versa, companies with low growth

rates, have a low PER.

2.3.4 Capital Structure

Agus (2010 : 248) states that to determine the optimal

capital structure, finance managers need to consider

several important factors such as: level of sales, asset

structure, the growth rate of the company,

profitability, profits in tax protection, company scale,

and internal corporate and macroeconomic

conditions.

The term gearing is used to describe the mix of

loan finance and equity finance in a company

(Weetman, 2011 : 348). Debt to equity ratio is the

ratio that uses debt and capital to measure the ratio.

The Debt to equity ratio is a ratio used to measure the

level of debt usage against the company's total

shareholder equity. Then the formula used is:

Total Liabilities

Debt to equity ratio (DER) = x100%

Total Capital

The debt to equity ratio can provide an overview of

the capital structure owned by the company, so that

the level of risk of uncollectible liability can be seen.

2.3.5 Profitabilities

The profitability of a company shows a comparison

between profit and assets or capital that produces the

benefit. According to Brealey, Myers, and Marcus,

the income statement measures the profitability of the

company during the year (2012 : 74). In other words,

profitability is the ability of a company to generate

profit. Company profitability concerns the ratio of

increasing company profits.

The measurement of profitability ratios can be

done with a return on assets (ROA). Return on assets

is the ratio between the balance of net income after

tax and the total assets of the company. ROA also

describes the extent of the return on all assets owned

by the company. Return on assets also to measure a

company's ability to generate profits using total assets

and after capital costs are excluded from the analysis.

Thus, the formula is:

Net profit after tax

Return on Assets (ROA) = x 100%

Total asset

ROA is a ratio used to measure the net profit obtained

from the use of assets. In other words, the higher the

rate, the better the productivity of assets in earning net

profits. This will further increase the attractiveness of

the company to investors.

2.3.6 Firm Size

The size of the company is an increase from the fact

that large companies will have a large market

capitalization, a significant book value, and high

profits. Whereas in small companies will have a small

market capitalization, little book value, and low profit

(Ayu Sri, 2013 : 6).

Block, Hirt, and Danielsen states that in

determining the appropriate capital mix, the firm

generally begins with its present capitl structure and

ascertains whether its current position is optimal

(2011 : 342)

Bauman and Kaen classify firm size as

technological, organization and institutional. Thus,

firm size is an indicator that can indicate a condition

or characteristic of a company. Firm size can be

measured by natural logarithm (Ln) on total assets,

with the formula:

Size = Ln on total assets

The Influence of Capital Structure, Profitability, and Company Size on Firm Values in Manufacturing Companies Listed on the Indonesia

Stock Exchange

449

The size of the firm is one of the variables that are

considered to influence the company's decision to

choose the form of funding. The size of the firm will

affect the company's debt policy. Companies that are

large and have a good reputation in the market will

use more debt as a source of funding. This increase in

debt can increase shareholder value.

2.4 Framework of Thinking

The thinking framework is a conceptual model of

how theory relates to various factors that have been

identified as essential problems (Sugiyono, 2012 :

91). The thinking framework in this study can be

described as follows:

Source: Drawn by the researcher

Figure 2.1: Thinking Framework

2.5 Hypothesis

According to Sugiyono (2012 : 96), the hypothesis is

a temporary answer to the research problem

formulation. The assumption in this study are:

H1: The capital structure partially has a significant

effect on the value of the firm listed on the Indonesia

Stock Exchange.

H2: Profitability partially has a significant effect on

the value of the firm listed on the Indonesia Stock

Exchange.

H3: The size of the firm partially has a significant

effect on the value of the firm listed on the Indonesia

Stock Exchange.

H4: The capital structure, profitability, and size of the

firm simultaneously have a significant effect on the

value of the firm listed on the Indonesia Stock

Exchange.

3 CONCEPTS AND THEORIES

3.1 Methods and Types of Research

The research method has used descriptive statistics

research, used to test specific theories by examining

relationships between variables. These variables are

measured so that data consisting of numbers can be

analyzed based on statistical procedures.

3.2 Research Sites

This research was conducted at the primary industrial

and chemical manufacturing companies listed on the

Indonesia Stock Exchange in 2014 - 2017 with the

site www.idx.co.id.

3.3 Research Variables

There are two types of research variables, namely:

1. Independent variable is a variable that value does

not depend on other variables.

2. The dependent variable is a variable that depends

on the value of the independent variable.

3.4 Types and Data Sources

The type of data used in this study is secondary data

which is generally in the form of evidence, records,

or historical reports of the company. The collection of

secondary data sources were obtained from the annual

report of the primary industrial and chemical

manufacturing companies listed on the Indonesia

Stock Exchange (IDX) in 2014 - 2017 by accessing

the IDX website, namely www.idx.co.id.

3.5 Population and Samples

The research population was 61 essential companies

and chemical industry companies listed on the

Indonesia Stock Exchange from eight sub-sectors.

The research sample was 12 companies in 2014 -

2017. The technique of determining the sample is

purposive sampling namely, sampling is made more

accessible by the prescribed criteria.

The criteria of researchers in sampling are:

1. The primary industrial and chemical industry

manufacturing companies on the IDX are still

active and have complete and accessible financial

data from 2014 - 2017.

2. Companies that earn net income every year from

2014 - 2017.

Capital

Structure

The Value of the

Company (Y)

Profitabilities

(X2)

Company Size

(X3)

EBIC 2019 - Economics and Business International Conference 2019

450

3. Companies that use Rupiah as the denominator in

financial statements.

3.6 Data Collection Technique

Data collection techniques are the most important

step in the research, because the main purpose of the

research is to get data (Sunyoto, 2016). Data

collection methods used in this study are; library

research and documentation techniques.

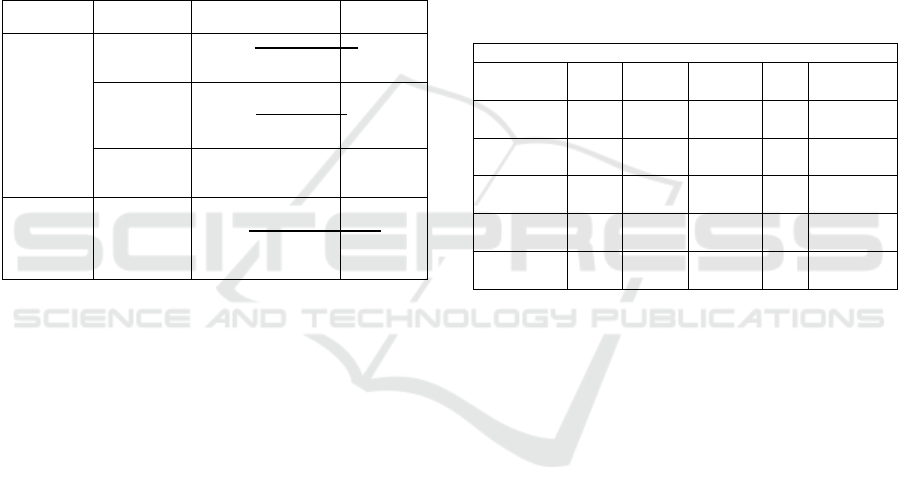

3.7 Variable Measuring Scale

The measurement scale of the variables studied are:

Table 3.1: Variable Measurement Scale

Variable

T

yp

e

Research

Variable

Parameter

Measuring

Scale

Independent

variable

Capital

Structure

(X

1

)

DER = Total

Liabilities x 100%

Total Capital

Ratio

Profitabilities

(X

2

)

ROA = Net profit

after tax x 100%

Total asset

Ratio

Company

Size (X

3)

Size = Ln on total

assets

Ratio

Dependent

variable

The value of

the company

(Y)

PER = Price

Stocks

Earning per

share

Ratio

Source: Authors' results from operational research

variables

3.8 Data Analysis Technique

The data analysis technique used in this study is

quantitative analysis. Quantitative analysis is an

analysis that uses statistical formulas that are adjusted

to the title of the research and formulation of the

problem, to calculate the numbers to analyze the data

obtained (Danang, 2016: 26).

Data analysis method is an analytical method used

to process data to obtain results and make

conclusions.

4 RESULTS AND DISCUSSION

4.1 Overview of Research Objects

In this study, the objects of the study were 61 essential

companies and chemical industry companies listed on

the Indonesia Stock Exchange from eight sub-sectors.

The technique of determining the sample in this study

was purposive sampling. Where there are 61

companies listed on essential industrial and chemical

sector companies and the remaining 12 companies

that meet the requirements. This research was

conducted for four years, from 2014 - 2017.

4.2 Research Results

4.2.1 Descriptive Statistics Test

Descriptive statistical analysis has the objective to

describe all the variables used in this study, based on

the statistics table that shows the measurement of the

mean, minimum and maximum values. The following

shows the results of testing descriptive statistics of

firm value, capital structure, profitability, and firm

size.

Table 4.1: Descriptive Statistics

Descriptive Statistics

N

Minimu

m

Maximu

m

Mea

n

Std.

Deviation

Firms’

Value

4

8

,01 ,18

,086

5

0,04987

Capital

Structure

4

8

,08 ,95

,364

4

0,2572

6

Profitabiliti

es

4

8

,01 ,21

,102

9

0,0509

5

Size of the

Firm

4

8

,12 ,18

,145

6

0,0179

7

Valid N

(listwise)

4

8

Source: Data processed with SPSS 23

From table 4.1, N shows a sample data of 48. The

minimum value of the company value is 0.01, and the

maximum amount is 0.18, and the average cost is

0.0865, and the standard deviation is 0.04987. In the

capital structure, the minimum amount is 0.08, and

the maximum amount is 0.95, and the average amount

is 0.3644, and the standard deviation is 0.25726. On

profitability, the minimum amount is 0.01, and the

maximum amount is 0.21, and the average is 0.1029,

and the standard deviation is 0.05095. At firm size,

the minimum amount is 0.12, and the maximum

amount is 0.18, and the average is 0.1456, and the

standard deviation is 0.01797.

4.2.2 Multiple Linear Regression Analysis

In this study used multiple regression analysis

models, because more than one independent variable,

which are the capital structure, profitability, and size

of the company. The results of multiple regression

analysis are as follows:

The Influence of Capital Structure, Profitability, and Company Size on Firm Values in Manufacturing Companies Listed on the Indonesia

Stock Exchange

451

Table 4.2: Multiple Linear Regression

Source: data is processed with SPSS 23

From table 4.2 it showed the multiple linear

regression analysis above, namely:

Firm value = -0.028 - 0.094 capital structure + 0.303

profitability + 0.805 firm size + e

Information:

Y = Firm Value

a = Constant

b = Regression Coefficient

X1 = Capital Structure

X2 = Profitability

X3 = Firm Size

e = Error

The explanation of the results of the regression

analysis above are:

1. The boarding value is 0.028, which means that if

the capital structure, profitability, and size of the

firm are constant, then the firm value will

decrease by 0.028.

2. The capital structure coefficient of -0.94 states

that an increase in capital structure of 1% and

other independent variables remains unchanged,

then the value of the firm will decrease by -0.94.

3. The profitability coefficient of 0.303 states that an

increase in profitability of 1% and other

independent variables remains constant, then the

value of the firm will decrease by 0.303.

4. The coefficient of company size of 0.805 states

that the increase in company size of 1% and other

variables remain constant, then the value of the

firm will increase by 0.805.

4.2.3 Classical Assumption Test

Normality Test. The normality test aims to determine

whether each variable distributes normally or not. A

normality test is needed because to test other

variables by assuming that the residual value follows

a normal distribution. The normality test is carried out

using one Kolmogorov-Smirnov sample.

Table 4.3: Normality Test Results

One-Sample Kolmogorov-Smirnov Test

Unstandardized

Residual

N

48

N

ormal

Parameters

a,

b

Mean ,0000000

Std. Deviation

,03916675

Most

Extreme

Differences

Absolute ,106

Positive ,106

N

egative -,060

Test Statistic ,106

Asymp. Sig. (2-tailed) ,200

c,d

a. Test distribution is Normal.

b

. Calculated from data.

c. Lilliefors Significance Correction.

d. This is a lower bound of the true

significance.

Source: Data is processed with SPSS 23

From the table above, shows that the data have

distributed normally by looking at the Kolmogorov-

Smirnov value of 0.106 and the value of Asymp. Sig.

(2-tailed) 0.200, which is higher (>) than 0.05. The

normality test can also be shown through histogram

images and standard P-P Plot of Regression

Standardized graphs.

Source: Data processed with SPSS 23

Figure 4.1 Histogram

Figure 4.1, shows that the shape of the curve has a

balanced slope, so it can be concluded that the

variable data is distributed normally. Normality can

be detected through residual standard p-p plot of

regression standardized graphs, as shown below.

Coefficients

a

Model

Unstandardiz

ed

Coefficients

Standar

dized

Coeffic

ients

t Sig.

Collinearity

Statistics

B

S

td.

Erro

r

B

eta

Toler

ance

VIF

Constan

t

)

-

,028

,

049

-

,562

,

577

Capital

Structur

e

-

,094

,

024

-

,484

-

3,849

,

000

,

888

1

,126

Profitab

ilities

,

303

,

126

,3

10

2

,397

,

021

,

840

1

,190

Size of

the

Fir

m

,

805

,

378

,2

90

2

,129

,

039

,

755

1

,325

a. De

p

endent Variable: Firms’ Value

EBIC 2019 - Economics and Business International Conference 2019

452

Source: Data processed with SPSS 23

Figure 4.2 Normal P-P Graph Plot of Regression

Standardized Residual

Figure 4.2, has showed that the data spreads around

the diagonal line and follows the direction of the

diagonal line. Thus, the data meet the assumptions of

normality.

Multicollinearity Test. Multicollinearity test aims to

test whether the regression model is found to correlate

with independent variables. A good regression model

should not have a correlation between independent

variables. The general limits used to indicate the

presence of multicollinearity are tolerance values >

0.1 and VIF < 10.

Table 4.4: Multicollinearity Test Results

Coefficients

a

Model

Unstandardiz

ed

Coefficients

Standar

dized

Coeffic

ients

t Sig.

Collinearity

Statistics

B

Std.

Erro

r

Beta

Toler

ance

VIF

(Consta

nt

)

-

,028

,

049

-

,562

,

577

Capital

Structur

e

-

,094

,

024

-

,484

-

3,849

,

000

,

888

1

,126

Profitab

ilities

,

303

,

126

,3

10

2

,014

,

021

,

840

1

,190

Firm

Size

,

805

,

378

,2

90

2

,009

,

039

,

755

1

,325

a. De

p

endent Variable: Firms’ value

Source: Data processed with SPSS 23

From table 4.4, it can be seen that the overall

variable has a tolerant value > 0.1 and VIF value <

10. Thus it can be concluded that the independent

variables of this study are free from multicollinearity.

Heteroscedasticity Test. Heteroscedasticity test is to

test whether in the regression model variance

inequalities occur from residuals to one observation

to another observation remains.

Source: Data processed with SPSS 23

Figure 4.3 Heteroscedasticity Test Results

A good regression model is homoscedasticity, or

heteroscedasticity does not occur. From figure 4.3, it

can be seen that the points spread randomly above and

below the number 0 on the Y-axis and do not form a

clear pattern. So it can be concluded that there is no

problem of heteroscedasticity in the regression

model.

4.2.4 Hypothesis Test

F Test (Simultaneous Test). The F test is carried out

by simultaneously testing, whether all the

independent variables used in the regression model

together can affect the dependent variable. These

testing criteria are:

1. If Fcount > Ftable, then H0 is rejected and Ha is

accepted. This means that there is a significant

influence between the independent variables (X)

together on the dependent variable (Y).

2. If Fcount < Ftable, then H0 is accepted and Ha is

rejected. This means that there is no significant

influence between the independent variables (X)

together on the dependent variable (Y).

Table 4.5: F Test Results (Simultaneous)

ANOVA

a

Model

Sum of

Squares df

Mean

Square F Sig.

Regression ,045 3 ,015 9,113 ,000

b

Residual ,072 44 ,002

Total ,117 47

a. Dependent Variable: Firm Value

b. Predictors: (Constant), Capital Structure, Profitability,

Firm Size

Source: Data processed with SPSS 23

The Influence of Capital Structure, Profitability, and Company Size on Firm Values in Manufacturing Companies Listed on the Indonesia

Stock Exchange

453

Table 4.5 showed that Fcount = 9.113 and Ftable =

2.82 (9.113 > 2.82), meaning that there is a

simultaneous significant influence between the

capital structure, profitability and size of the firm on

the value of the firm. The amount of Sig. Equal to

0,000, which means smaller than 0.05 (0,000 < 0,05),

then the whole independent variables have a

significant effect on the dependent variable.

T-test (Partial Test). The t statistical test aims to

show how far the influence of one independent

variable individually in explaining the variation of the

dependent variable. Decision criteria are:

1. If the significance value is < 0.05, it means that

the independent variable influences the dependent

variable.

2. If the significance value is ≥ 0.05, it means that

the independent variable does not influence on the

dependent variable.

3. If tcount > ttable, then the independent variable

has a significant effect on the dependent variable.

4. If tcount < ttable, then the independent variable

does not have a significant effect on the dependent

variable.

Table 4.6: T-test Results (Partial)

Model

Unstandardized

Coefficient

Standar

dized

Coeffici

ents

T Si

g

.B

Std.

Erro

r

Beta

1 (Constant) ,028 ,049 -,562 ,577

Capital

Structure

-,094 ,024 -,484 -3,849 ,000

Profitabiliti

es

,303 ,126 ,310 2,397 ,021

Firm Size ,805 ,378 ,290 2,129 ,039

Source: Data processed with SPSS 23

The explanation of table 4.6 are as follows:

a. Capital structure has influenced significantly on

the value of the firm because the tcount of -3.849

and ttable of 2.015, the significant value is 0,000

< 0,05 and the direction of the coefficient is

negative, so H1 is accepted.

b. Profitability has a significant effect on the the

value of the firm, as it is shown from the tcount of

2,397 and the table of 2,015, and the direction of

the coefficient is positive, so H2 is accepted.

c. Firm size has a significant influence on the firm

value, since tcount is 2,129 and ttable is 2.015,

and the direction of the coefficient is positive, so

H3 is accepted.

4Determination Coefficient Test. The ratio of

determination (R²) is used to measure how far the

ability of the model in explaining the variation of the

dependent variable. The ratio of determination is

between zero and one (0 ≤ R2 ≤ 1). A small R² value

or close to 0 (zero) means that the ability of

independent variables to explain variations in the

dependent variable is minimal. Values close to 1 (one)

independent variables provide almost all the

information needed to predict differences in the

dependent variable.

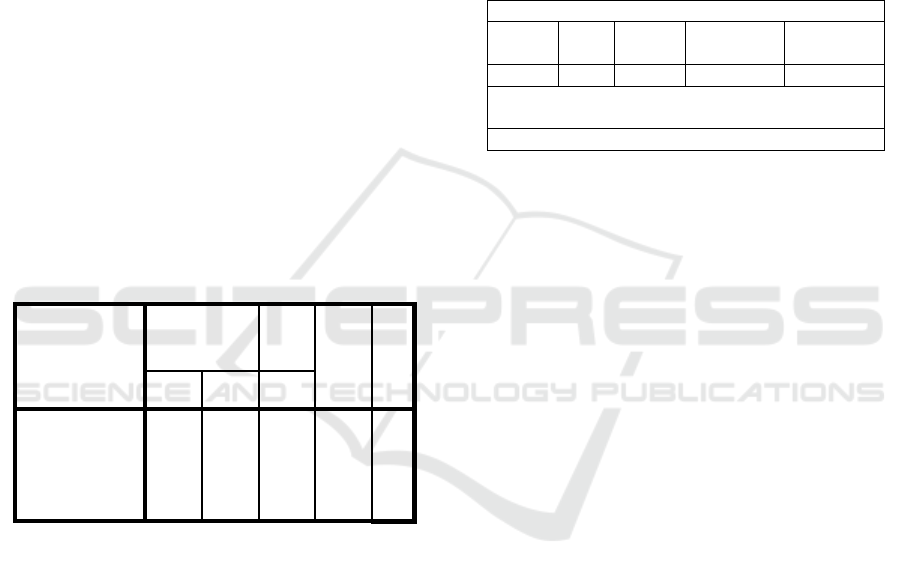

Table 4.7: Determination Coefficient Test Results

Source: Data processed with SPSS 23

Table 4.7 shows that the R2 is 0.383, which

means the value is closer to number 0, which means

that independent variables (capital structure,

profitability, and firm size) in explaining the variation

of the dependent variable (firm value) are very

limited. This also shows that company value is

influenced by 38.3% of the variable of capital

structure, profitability, and firm size. While the

remaining 61.7% is influenced by other factors that

are not examined in this study, for example, cash flow

factors, funding decisions, dividend policies,

investment decisions, and so forth.

4.3 Discussion

4.3.1 Effect of Capital Structure on Firm

Valu es

Theoretically, there is an influence of capital structure

on firm value. Where, capital structure policy is

basically a decision in selecting of funding sources

with the type of investment that must be chosen by

the company to be in line with the company's

objective, namely to maximize shareholder welfare.

From the results of the study, it showed that there

was a significant influence between capital structure

on firm value, but with a negative coefficient

direction. In other words, the capital structure has a

negative and significant effect on firm value. Even

though the capital structure of a company has

decreased, but the value of the company may not

necessarily decline. The results of this study are

Model Summar

y

b

Model R

R

Square

Adjusted R

Square

Std. Error of

the Estimate

1 ,619

a

,383 ,341 ,04048

a. Predictors: (Constant), Capital Structure,

Profitabilities, and Firm Size

b

. Dependent Variable: Firms Value

EBIC 2019 - Economics and Business International Conference 2019

454

supported by the research of Ayu Sri Wahatma Dwi

and Ary Wirajaya (2013). But the results of this study

adverse to the research conducted by Santy

Kusumaningrum (2016) and Fifin Syahadatina

(2015), which states that the capital structure partially

has a positive and significant effect on firm value.

From the results of the test, there is a negative and

significant influence between the capital structure on

firm value which indicates that capital structure is not

always a benchmark in increasing the value of the

company. So, in order to increase shareholders’

prosperity, the company does not rely on the level of

capital structure of the company.

4.3.2 Effect of Profitability on Firm Values

Profitability is income minus expenses and losses

during the reporting period. Analysis of profitability

is very important for creditors and investors. For

creditors, are to know the source of interest and

principal payments. While for investors, are to

determine the changes in the value of the firm.

From the results of study showed that profitability

partially has a positive and significant effect on firm

value. The results of hypothesis testing showed tcount

of 2,397 and ttable of 2,015 (2,397 > 2,015), a

substantial amount of 0.021 < 0.05 with a positive

coefficient direction, so H2 is accepted. The result is

supported by previous research, namely by Nunung

Nur Hanifah (2016), Ayu Sri Wahatma Dwi and Ary

Wirajaya (2013), Santy Kusumaningrum (2016) and

Benny Halomoan Situmorang (2016) have shown that

profitability partially has a positive and significant

effect on firm value. But contrary to the research

conducted by Nur Hidayah (2015) which indicates

that profitability partially does not have a substantial

impact on firm value.

From the above results which states that there is a

significant influence between profitability on firm

value which proves that company profitability is a

benchmark in increasing the value of the firm. In this

case, investors must pay attention to the level of

profitability of the company in investing because with

the increase in the profitability of the company, it will

increase stock prices. So that, this can increase the

prosperity of the investors.

4.3.3 Effect of Firm Size on Firm Values

The size of the firm is one of the variables that are

considered to influence the company's decision to

choose the form of funding. The size of the firm will

affect the company's debt policy. Companies that are

large and have a good reputation in the market will

use debt more as a source of funding. The increase in

debt can increase shareholder’s value. This states that

the size of the firm influences the increase in firm

value.

The results also indicate that the size of the firm

influences the value of the firm because it is shown

from tcount of 2,129 and ttable of 2,015 (2.129 >

2.015), with a positive coefficient direction, so that

H3 is accepted. The size of the firm has a positive and

significant effect on the value of the firm. The results

of this study are supported by previous research

conducted by Nunung Nur Hanifah (2016) and Santy

Kusumaningrum (2016). But it is contrary to the

research conducted by Ayu Sri Wahatma Dwi And

Ary Wirajaya (2013), which states that the size of the

firm does not affect the value of the firm.

You (1995), in his paper gives a survey of the

theories of the determinants of firm size and the

distribution of firm sizes, with a special emphasize of

small firms. Thus, firm size is one of the company's

benchmarks in increasing the value of firm. So,

shareholders or investors also need to consider the

size of the firm in investing.

4.3.4 Effect of Capital Structure,

Profitability and Company Size on

Firm Value

Capital structure, profitability and firm size

simultaneously influence the value of the firm

because it shows from Fcount of 9,113 and Ftable of

2,82 (9,113 > 2,82), with a significant amount of

0,000 (0,000 < 0,05). So, to increase the value of the

firm, it is necessary to consider the capital structure,

profitability, and size of the firm.

The results of this test is supported by previous

research, namely by Nunung Nur Hanifah (2016)

with the results that simultaneously capital structure,

company growth, firm size, and profitability have a

positive and significant effect on firm value. Thus,

increasing the capital structure, profitability, and size

of the firm can also increase the value of the firm.

According to Cuong’s (2014) study has shown that

there was triple threshold effect exists between debt

ratio and firm value.

5 CONCLUSION

The purpose of this study is to test and analyze the

effect of capital structure, profitability, and firm size

on firm value. From the results of the study, it can be

concluded, that:

1. Capital structure has a significant effect on firm

value, but has a negative coefficient direction.

The Influence of Capital Structure, Profitability, and Company Size on Firm Values in Manufacturing Companies Listed on the Indonesia

Stock Exchange

455

From the results of the study, it can be concluded

that the high capital structure of a company does

not necessarily increase the value of the firm.

2. Profitability has a positive and significant effect

on firm value. The results of the study showed that

the high profitability of a company can increase

the value of the firm.

3. Firm size has a positive and significant effect on

firm value. The results showed that the size of a

firm affects the increase in the value of the firm.

4. Capital structure, profitability and firm size

simultaneously have a significant effect on firm

value. The results indicated that the level of

capital structure, profitability, and the size of a

firm affect the increase in firm value.

REFERENCES

Agus, R. 2010. Manajemen Keuangan Teori dan Akuntansi.

Yogyakarta: BPFE-Yogyakarta.

Bauman, H.D., and F. R. Kaen. 2013. Firm Size, Employees

and Profitability in U.S. Manufacturing Industries.

Social Science Research Network.

Block, Stanley B., Hirt, Geoffrey A., And Danielsen,

Bartley R., 2011. Foundations of Financial

Management, Fourteenth Edition. New York: Mc

Graw Hill.

Brealey, Richard A., Stewart C. Myers, and Alan J. Marcus,

2012. Fundamentals of Corporate Finance, Eighth

Edition. New York: McGraw Hill Education.

Cuong, Nguyen Thanh, 2014. Threshold Effect of Capital

Structure on Firm Value: Evidence from Seafood

Processing Enterprises in the South Central

Regional of Vietnam. International Journal of

Finance and Banking Studies 3, No. 3.

Dahlan, Sopiyudin. 2012. Ilmu SPSS. Jakarta: Salemba

Medika.

Dewi, Ayu Sri Wahatma. 2013. Pengaruh Struktur Modal,

Profitabilitas dan Ukuran Perusahaan pada Nilai

Perusahaan. Bali: Universitas Udayana (hal. 2-15).

Ferri, Michael G., and Wesley H. Jones. 1979.

Determinants of Financial Structures: A New

Methodological Approach. The Journal of Finance,

Vol. 34, No. 3.

Ghojali, Imam. 2013. Aplikasi Analisis Multivariate SPSS

23. Semarang: BP Universitas Diponegoro.

Hanifah, Nunung Nur. 2016. Analisa Pengaruh Struktur

Modal, Pertumbuhan Perusahaan, Ukuran

Perusahaan dan Profitabilitas terhadap Nilai

Perusahaan Perbankan yang Terdaftar di Bursa

Efek Indonesia Periode 2011-2015. Surakarta:

Universitas Muhammadiyah (hal. 5-15).

Hermuningsih, Sri. 2013. Pengaruh Profitabilitas, Growth

Opportunity, Struktur Modal Terhadap Nilai

Perusahaan Pada Perusahaan Publik Di

Indonesia. Buletin Ekonomi Moneter dan

Perbankan.

Hery. 2009. Akuntansi Keuangan Menengah I. Jakarta: PT.

Bumi Aksara.

____. 2017. Akuntansi Aset, Liabilitas, dan Ekuitas.

Jakarta: PT. Grasindo.

Hidayah, Nur. 2015. Pengaruh Struktur Modal, Ukuran

Perusahaan, Pertumbuhan Perusahaan dan

Profitabilitas terhadap Nilai Perusahaan pada

Perusahaan Asuransi yang Terdaftar di BEI.

Surakarta: Universitas Muhammadiyah (hal. 5-18).

Kamaludin dan Rini. 2012. Manajemen Keuangan Konsep

Dasar dan Penerapannya. Bandung: CV. Mandar

Madu.

Kasmir. 2015. Analisis Laporan Keuangan. Jakarta: PT.

Rajagrafindo Persada.

Keown, Arthur J, et.al. 2004. Financial Management:

Principles and Applications, Tenth Edition. New

Jersey: Prentice Hall.

Kusumaningrum, Santy. 2016. Pengaruh Struktur Modal,

Profitabilitas, Growth Opportunity terhadap Nilai

Perusahaan (Studi Empiris Perusahaan Food and

Beverage yang Terdaftar di Bursa Efek Indonesia

Tahun 2012-2015).Surakarta: Universitas

Muhammadiyah (hal. 5-15).

Okky, Damayanti. 2015. Analisis Pengaruh Laba

Akuntansi dan Komponen Arus Kas Terhadap

Return Saham Perusahaan. Jakarta: Universitas

Mercubuana (hal. 9-19).

Situmorang, Benny Halomoan. 2016. Pengaruh Tingkat

Likuiditas, Solvabilitas dan Profitabilitas terhadap

Nilai Perusahaan Food and Beverage yang

Terdaftar di Bursa Efek Indonesia. Medan:

Universitas Methodist Indonesia (hal. 6-41).

Sugiyono. 2012. Metode Penelitian Pendidikan. Bandung:

Alfabeta

Sunyoto, Danang. 2016. Metodologi Penelitian Akuntansi.

Bandung: PT. Refika Aditama.

Syahadatina, Fifin. 2015. Pengaruh Size dan Struktur

Modal terhadap Nilai Perusahaan yang Dimediasi

oleh Leverage. Surabaya: Sekolah Tinggi Ilmu

Ekonomi Indonesia (hal. 1-15).

Weetman, Pauline, 2011. Financial and Management

Accounting, An Introduction, Fifth Edition.

England: Pearson Education Limited.

You., I. J., 1995. Small Firms In Economic Theory.

Cambridge Journal of Economics, Vol. 19.

EBIC 2019 - Economics and Business International Conference 2019

456