Analysis of Factor Affecting Profitability of State Owned Banks in

Indonesia and Notable Bank in Singapore as Basis for Bank

Management Decision Making to Its Stakeholder

Eddy Winarso

1

and Francis M. Hutabarat

2

1

Accounting Department, Economic Faculty, Widyatama University, Bandung – Indonesia

2

Accouning Department, Economic Faculty Advent Indonesia University, Bandung - Indonesia

Keywords: Capital Adequacy Ratio (CAR), Loan to Debt Ratio (LDR), Non Performing Loan (NPL), Retun on Assets

(ROA), Return on Equity (ROE), Notetable Bank

Abstract: Every firm has tendency only to seek profit whereas, the objective of a firm is not only to maximize profit

and maximize their shareholder or owner but also seek to maximize the wealth of their stakeholder. This mean

that a firm needs to benefit their stakeholder and one of the stakeholders of a firm is the community around

the company. The purpose of the study is to analyze the factor affecting return on asset of state owned banks

in Indonesia and notable bank in Singapore combined. The study is descriptive using CAR, NPL and LDR as

their independent variable and ROA and ROE as their dependent variable. The financial used in the study is

for financial data use in the study from annual report and financial statement from year 2013 – 2017. Data

analysis using statistic analysis such as descriptive statistic F test, t test and regression analysis. The result

shows that all state owned banks in Indonesia and notable bank in Singapore are healthy in terms of their

minimum capital, non performing loan and their function well in LDR ratio and in their return on assetin this

study also several ratios have been used and the results are very good, including CAR, NPL, LDR and ROA.

The mean results for CAR are 18.5% for Indonesia and 16% for Singapore banks which is above 8% standard

for minimum capital for a bank. NPL mean result is 2.5% for Indonesia and < 1% for Singapore which is

below the minimum standard of 5% which shows that BUMN bank can manage their non-performing loans.

On the other hand, BUMN bank also shows that they perform their function well in giving loans and receiving

deposits from their customer as shows in LDR ratio of 91.124% for Indonesia and 85% for Singapore which

is between 78-100% standard of Bank Indonesia. The descriptive statistic data also show that ROA has mean

of 2.972% for Indonesia and 1.02% for Singapore that is above 1.5% standard of Bank Indonesia. The result

shows that there is a significant relationship between CAR, NPL, LDR and ROA of state owned banks in

Indonesia and notable bank Singapore combined from year 2013-2017. The results however are not significant

for Return on Equity.

1 INTRODUCTION

Every firm has tendency only to seek profit whereas,

the objective of a firm is not only to maximize profit

and maximize their shareholder or owner but also

seek to maximize the wealth of their stakeholder. This

mean that a firm needs to benefit their stakeholder and

one of the stakeholders of a firm is the community

around the company.

Bank is one institution that needed by the

community in all activities such as transaction

activities and savings and loan activities is Bank.

Bank as an institution becomes a very useful

container for the community, so that even throughout

the world, banks have been trusted to be a solution for

the community regarding their finances. In the

Republic of Indonesia Law Number 10 of 1998

concerning banking industry, it is said that banks are

business entities that collect funds from the public in

the form of deposits and distribute them to the public

in the form of loans and/or other forms in order to

improve the lives of many people. (Kasmir, 2014, p.

24). In order for bank to be beneficial to its

stakeholder and the community, first bank need to

have good financial performance and in other words,

it need to be healthy and function well?

Murhadi (2015) stated that the performance of a

company can be analyzed from its financial

Winarso, E. and Hutabarat, F.

Analysis of Factor Affecting Profitability of State Owned Banks in Indonesia and Notable Bank in Singapore as Basis for Bank Management Decision Making to Its Stakeholder.

DOI: 10.5220/0009258904730479

In Proceedings of the 2nd Economics and Business International Conference (EBIC 2019) - Economics and Business in Industrial Revolution 4.0, pages 473-479

ISBN: 978-989-758-498-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

473

statements. Financial statements contain information

about financial position, financial performance, and

changes in financial position that are very useful in

making a decision. It is very important for investors

and shareholders to know the financial condition of a

company. In addition to investors and shareholders

who need these financial statements, the financial

manager also requires financial statements from the

company so that managers can use the information

contained in the financial statements so that decisions

related to Investment, financing, and company

operations can be determined. The ability of banks to

carry out their functions is to receive money from the

public in the form of savings or savings, time deposits

and checking accounts, so that this becomes a fund

collected and channeled back to the community in the

form of loans or loans can be seen from financial

statement analysis. (Kasmir, 2012)

In every business activity carried out, of course,

the first time you want is to get a profit. Various ways

that can be done by a bank to get maximum profit or

profit, one of which is a bank must have large capital.

Maximum profit can increase bank capital so that

bank operations can be carried out. And running a

business the bank must be able to achieve company

goals in general, namely to generate profits (Taswan,

2010, p. 151).

Financial ratios are part of financial statements

that show company performance. According to

Kasmir (2003:279), profitability ratio is used to

measure the level of business efficiency and

profitability achieved by the bank concerned. In other

words, profitability ratios are important financial

ratios to determine the ability of banks to earn profits

and measure the performance of a bank. One of the

banking profitability ratios is Return on Assets.

(Taswan, 2010)

Return on assets is the ratio that shows the ratio

between earnings and the total assets of the bank, this

ratio shows the level of efficiency of asset

management carried out by the bank concerned

(Pandia, 2012; Darmawi, 2014). The greater the

Return on Assets (ROA) of a bank, the greater the

bank’s profitability and the better the bank's position

in terms of asset use. In fact, what happens in

companies is that the ROA in small banks has

decreased.

A case stated in Kompas (2017) reported that PT

Bank Bukopin Tbk posted a profit that decreased by

14 percent compared to the previous period. The

report also stated that the capital adequacy ratio

(CAR) increased to 16.34 percent and in addition to

the increase in CAR, the level of liquidity is still well

maintained as loan to deposit ratio or the ratio of

credit to deposits (LDR) is 75.07 percent. On the

other hand, news by Kompas (2018), stated that PT

Bank Tabungan Pensiunan Nasional Tbk (BTPN)

achieved a net profit of Rp 1.2 trillion in 2017. This

figure fell 30 percent compared to the previous year's

achievement. While total funding increased 5 percent

to Rp. 76.5 trillion, with the composition of third

party funds (DPK) up 3 percent to Rp. 67.9 trillion.

Then the company's total assets rose 5 percent to Rp.

95.5 trillion. And it was found that the capital

adequacy ratio (CAR) reached 24.6 percent.

In other cases, Bank is known to also beneficial to

the community by bringing its responsibility in the

form of Scholarship, education endowment, and other

form of fund to the society in Indonesia. (IDN Times,

2018)

Thus from the above case it can be seen that the

condition of changes in CAR and the LDR appear to

have a change in the profit of a bank.Based on the

existing background, the researchers feel the need to

conduct research with the title

Analysis of Factor Affecting Profitability of State

Owned Banks in Indonesia and Notable Bank In

Singapore as Basis for Bank Management Decision

Making to Its Stakeholder

Significant of the Study

The uses of this study are significant for the authors,

in gaining knowledge and the practical experience in

expanding research on different countries as well as

in analyse company's financial statements and their

development. The study also significant for

researcher universities, in supporting the institution

program for their faculty. As additional information,

the study can also be used as a decision-making tool

for companies, investor and other readers.

2 LITERATURE

Financial ratios are numbers obtained from the

comparison of the extracts of one financial statement

post with another that has a relevant and significant

relationship (Harahap, 2004). Whereas according to

Ediningsih (2004) financial ratios are comparisons

between two elements of financial statements that

show an indicator of financial health at a certain time.

Financial ratios are very important for external

analysts who assess a company based on published

financial statements. This assessment includes the

problems of liquidity, solvency, profitability,

management efficiency and prospects for the

company in the future.CAR or often referred to as the

bank’s capital adequacy ratio, is a ratio to shows how

EBIC 2019 - Economics and Business International Conference 2019

474

a bank is able to finance its activities with ownership

of its capital. It is interesting to see how the adequate

capital of banks that can be seen through CAR ratios

can affect banks purpose which it maximize profit

that can be seen through profitability ratio such as

ROA.NPL is a financial ratio that is used as a proxy

against the return credit given to bank depositors in

other words the NPL is the level of bad debts at the

bank. This ratio shows that the bank's management

capabilities in managing troubled credits provided by

the bank. The smaller the Non Performing Loan

(NPL), then the small credit risk borne by the bank.

The bank has a role as the implementation of

monetary policy and the achievement of financial

system stability, so that a healthy, transparent and

accountable banking system is needed. (Indonesian

Banking Booklet 2009) The purpose of the banking

business fundamentals is to obtain optimal benefits by

providing financial services to the public. For

shareholders to invest in the bank aims to earn income

in the form of dividends or get a profit from an

increase in the price of shares owned. (Mudrajad and

Suhardjono, 2002) It is important for banks to always

maintain good performance, especially maintaining a

high level of profitability, being able to distribute

dividends well, business prospects that are always

developing, and able to fulfill prudential banking

regulation provisions well (Mudrajad and

Suhardjono, 2002). If a bank can maintain its

performance well then it can increase the value of

shares in the secondary market and increase the

amount of funds from third parties.

The increase in the value of shares and the amount

of funds from third parties is one indicator of

increasing public trust in the bank concerned. Trust

and loyalty of the owner of the fund to the bank is a

very helpful factor and makes it easier for the bank

management to develop a good business strategy.

Fund owners who lack trust in the bank concerned are

very low in loyalty. This is very unfavorable for the

bank in question, because the owners of funds can

withdraw funds at any time. It is important to evaluate

company performance, both by management,

shareholders, the government, and other parties with

an interest in and related to distributions how that

financial ratios are useful in assessing the financial

condition of a banking company. Financial ratios are

also useful in predicting company profits.

The strength of predictions of financial ratios in

predicting profits so far is indeed very useful in

assessing company performance (performance) in the

future. The strength of financial ratio predictions was

found differently by several researchers. But whether

all existing financial ratios have the ability to predict

profits, someone has already done their research.

Below discussion regarding hypothesis of the study is

comprised of results of previous studies regarding

CAR, NPL, LDR, and ROA.

Hypothesis of the Study

Based on the background description of the problem

above, the hypothesis in this study are as follows:

CAR or often referred to as the bank’s capital

adequacy ratio, is a ratio to shows how a bank is able

to finance its activities with ownership of its capital.

It is interesting to see how the adequate capital of

banks that can be seen through CAR ratios can affect

banks purpose which it maximize profit that can be

seen through profitability ratio such as ROA. (Abba,

Okwa, Soje and Aikpitanyi, 2018)

Moreover, working capital to finance operations,

as an instrument to drive the ratio, and as a tool for

business expansion. Research on the capital aspect of

a bank is more to find out how or the bank's capital is

sufficient to support its needs (Merkusiwati, 2007). In

this study, capital adequacy is studied based on the

Capital Adequacy Ratio (CAR) ratio. Capital

Adequacy Ratio (CAR) at a certain level determines

that banks have sufficient capital capacity to reduce

risk due to the increase due to an increase or increase

in wealth assets categorized as producing results and

also containing substances (Werdaningtyas, 2002).

Research conducted by Werdaningtyas (2002),

Mawardi (2005) and Suyono (2005) shows the results

that Capital Adequacy Ratio (CAR) has a positive and

significant influence on Return on Assets (ROA).

Whereas Mawardi (2005) shows that Capital

Adequacy Ratio (CAR) has a positive and not

significant effect on Return On Assets (ROA) and

Sarifudin (2005) which shows the results of a positive

and not significant Capital Adequacy Ratio (CAR)

ratio associated with Return On Asset Assets

(ROA)Whereas Mawardi (2005) shows that Capital

Adequacy Ratio (CAR) has a positive and not

significant effect on Return On Assets (ROA) and

Sarifudin (2005) which shows the results of a positive

and not significant Capital Adequacy Ratio (CAR)

ratio associated with Return On Asset Assets (ROA).

H

1

: There is a relationship between CAR and

Profitability

NPL is a financial ratio that is used as a proxy against

the return credit given to bank depositors in other

words the NPL is the level of bad debts at the bank.

This ratio shows that the bank's management

capabilities in managing troubled credits provided by

the bank. The smaller the Non Performing Loan

(NPL), then the small credit risk borne by the bank

Analysis of Factor Affecting Profitability of State Owned Banks in Indonesia and Notable Bank in Singapore as Basis for Bank Management

Decision Making to Its Stakeholder

475

hence the aspect of supervision is decreasing, so that

Non-Performing Loans (NPL) are getting bigger or

credit risk is getting bigger (Mawardi, 2005).

Research on the effect of Non Performing Loans

(NPL) shows different results. Among other things,

research conducted by Mawardi (2005) shows that

Non Performing Loans (NPL) has a negative and

significant influence on Return on Assets (ROA).

While the research conducted by, Suyono (2005)

shows the results that Non Performing Loans (NPL)

are negative and not significant to Return on Assets

(ROA).

H

2

: There is a relationship between NPL and

Profitability

According to Kuncoro and Suhardjono (2002),

financial institutions are very important in economic

development because funds are needed to implement

them.Article 3 of the Banking Law says that the main

function of bank in Indonesia banking is to collect and

channel public funds. (Fahmi, 2014). It is interesting

to see how the function of banks that can be seen

through LDR ratios can affect the its purpose which

it maximize profit that can be seen through

profitability ratio such as ROA. LDR have a positive

and significant effect on bank profits, the results of

the study of Werdaningtyas (2002) is that a Loan to

Deposit Ratio (LDR) has a negative and significant

effect on profitability (ROA). Loan to Deposit Ratio

(LDR) is also defined as how much bank funds are

released into credit (Merkusiwati, 2007). Research on

the effect of the Loan to Deposit Ratio (LDR) shows

different results. Among others, research conducted

by Suyono (2005) shows the results of the Loan to

Deposit Ratio (LDR) has a positive and significant

effect on Return on Assets (ROA). Usman (2003)

shows the results of the Loan to Deposit Ratio (LDR)

have a positive and significant effect on bank profits.

On the other hand, the result of the study of

Werdaningtyas (2002) is a Loan to Deposit Ratio

(LDR) that has a negative and significant effect on

profitability (ROA).

H

3

: There is a relationship between LDR and

Profitability

CARS, NPL, LDR are ratios that related to the

CAMEL ratio which evaluate the health of a bank

(Simanjuntak & Hutabarat, 2016). CAR or often

referred to as the bank’s capital adequacy ratio, is a

ratio to shows how a bank is able to finance its

activities with ownership of its capital. Loan to

Deposit Ratio (LDR) is defined as how much bank

funds are released into credit, while NPL is the level

of bad debts at the bank. It is interesting to see how

the adequate capital of banks that can be seen through

CAR ratios, bad debt level of bank and how much

bank funds are released into credit can affect banks

purpose which it maximize profit that can be seen

through profitability ratio such as ROA. Previous

studies stated that there is no significant relationship

between CAR and ROA (Hindarto, 2011; Catur

Wahyu Endra Yogianta, 2013; Harun, 2016). On the

other ht there is a relationship between LDR and ROA

(Catur Wahyu and, other study stated that there is a

relationship between CAR and ROA (Edwar, Yokeu,

Bernadin, 2016). Previous study stated that there is no

significant relationship between LDR and ROA

(Edwar, Yokeu, Bernadin, 2016). On the other hand,

other studies stated that Endra Yogianta, 2013;

Hindarto, 2011; Harun, 20160). Previous study stated

that there is no significant relationship between LDR

and ROA (Edwar, Yokeu, Bernadin, 2016). On the

other hand, other studies stated that there is a

relationship between LDR and ROA (Catur Wahyu

Endra Yogianta, 2013; Hindarto, 2011; Harun,

20160) and also between NPL and CAR toward ROA

(Anwar & Murwaningsari, 2017).

H

4

: There is a relationship between CAR, NPL,

LDR, and ROA

3 METHOD OF THE STUDY

To limit the breadth of the discussion in this study,

researchers limit research in terms of the scope and

limitations of research problems. This research was

conducted at state-owned banks listed on the

Indonesian Stock Exchange and notable bank in

Singapore. The study used panel data that was taken

from annual report and financial statement of four

state-owned bank Indonesia and three notable bank in

Singapore of five year data from 2013-2017 with total

sample of 35 data. The use of panel data of two

consecutive years give advantage to measurement of

the changes that take place between points in time

(Cavana et al as seen in Alzahrani Che-Ahmad,

2015). The data taken from the operational variables

used in the study comprise of independent variables

and dependent variables. The independent variables

used in this study are the Capital Adequacy Ratio

(CAR), Non Performing Loan (NPL) and the Loan to

Deposit Ratio (LDR). While the dependent variable

is Return on Assets (ROA) and Return on Equity

(ROE). The sample used in the study from four state-

owned banks that are listed at Indonesia Stock

Exchange are: Bank Mandiri (BMNI), Bank BNI

EBIC 2019 - Economics and Business International Conference 2019

476

(BBNI), Bank BRI (BBRI), and Bank BTN (BBTN),

from Banking sub sector, while the three notable bank

in Singapore are: OCBC Bank, DSB Bank and UOB

Bank.

Analysis of the variables using formula for:

1. Dependent Variable (Profitability)

a. Return on Asset as first dependent variables

with standard

ROA > 1.5%.

b. Return on Equity for the second dependent

variables with standard ROE > 12%.

2. Independent variable

a. Capital Adequacy Ratio, with CAR > 8%

standard.

b. Non Performing Loan, with NPL < 5%

standard

c. Loan to Deposit ratio, with LDR 78-100%

standard.

The statistical analysis is done using Descriptive

statistics of Mean, Standard Deviation, Minimum and

Maximum, Correlation Matrix, Regression analysis,

F-test, t-test, and Kolmogorov-Smirnov.

The economic model is used to develop a model

of a company’s profitability or its ability to gain

profit. The variable proposed for the model includes

the following functional equation:

ROA it = β0 + β1CAR + β2NPL+β3LDR + ei + uit

. . . . (1)

ROE it = β0 + β1CAR + β2NPL+ β3LDR + ei +

uit . . . . (2)

Where:

ROA it = profitability Return on Asset

ROE it = profitability Return on Equity

CAR = capital adequacy ratio

NPL = non performing loan

LDR = loan to deposit ratio

e = error term

i = indicating data for the i bank

t = time indicator

4 RESULT OF THE STUDY

4.1 Descriptive Statistic

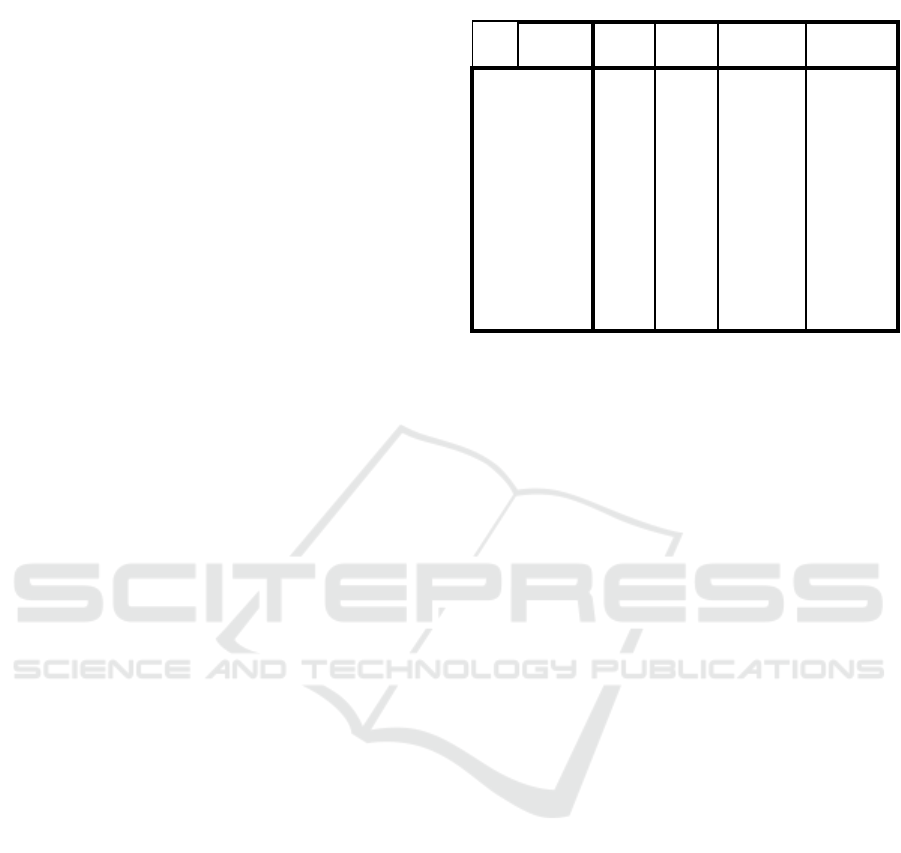

Table 1 shows the characteristic of variables of the

study based on its bank profile whether they are from

Indonesia or Singapore stock exchange origin.

Table 1. Descriptive Statistic

Grou

p

Statistics

Profile

N

Mean Std.

Deviation

Std. Erro

r

Mean

CAR

Indonesia

20 18.5065 2.59021 .57919

Sin

g

a

p

ore 15 16.4267 .85813 .22157

N

PL

Indonesia

20 2.5765 .82675 .18487

Sin

g

a

p

ore 15 .8741 .67207 .17353

LDR

Indonesia

20 91.1390 8.91516 1.99349

Sin

g

a

p

ore 15 85.1738 1.69436 .43748

ROA

Indonesia

20 2.9720 1.08742 .24316

Singapore 15 1.0240 .10398 .02685

ROE

Indonesia

20 20.7400 6.51415 1.45661

Sin

g

a

p

ore 15 11.2400 1.30701 .33747

Based on the table 1 the result shows that the

variables of the study have good mean results.

Generally, the mean results for CAR in Indonesia is

higher than in Singapore with Indonesia at 18.5065%

and Singapore 16.4267% which is both above 8%

standard for minimum capital for a bank. NPL mean

result on the other hand shows that Singapore has

lower non performing loans with .87% than its

Indonesia counterparts which is 2.5765% which is

both below the minimum standard of 5%. This shows

that State-owned bank in Indonesia and notable bank

in Singapore can manage their non-performing loans.

Moreover, State-owned bank in Indonesia shows

that they perform their function well in giving loans

and receiving deposits from their customer as shows

in LDR ratio of 91.124% which between 78-100%

standard of Bank Indonesia while Singapore notable

bank is at 85%. The descriptive statistic data also

show that ROA in Indonesia state-owned bank has a

mean of 2.972% that is above 1.5% standard of Bank

Indonesia and also above those in notable bank in

Singapore which is 1.02%. The same goes for ROE

in Indonesia 20.7% which is higher than in Singapore

at 11.2%.

Therefore, based on the result of the Descriptive

statistic, state-owned bank in Indonesia shows that

they have good financial performance in comparison

with their notable bank in Singapore.

Analysis of Factor Affecting Profitability of State Owned Banks in Indonesia and Notable Bank in Singapore as Basis for Bank Management

Decision Making to Its Stakeholder

477

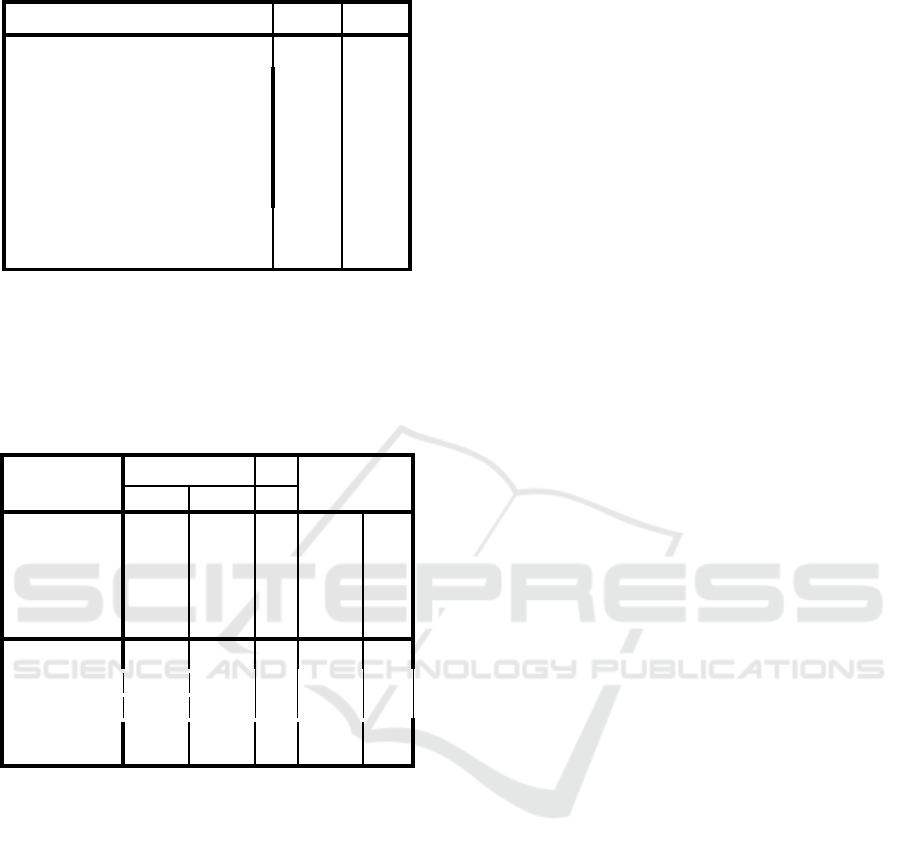

Table 2. Normality Test

ROA ROE

N

35 35

Normal

Parameters

a,b

Mean

2.1371 16.6686

Std.

Deviation

1.27354 6.86795

Most Extreme

Differences

A

bsolute

.219 .195

Positive .219 .195

Negative -.164 -.155

Kolmogorov-Smirnov Z

1.296 1.152

A

symp. Sig. (2-tailed)

.070 .140

Table 2 above show that the test distribution is

normal using kolmogrov -Smirnov normality test for

the dependent variable of the study based on Asyump.

Sig >0.05 Therefore, the data is normally distributed.

Table 3. Regression Model

Coefficients

a

Model Coefficients Coefficient

B T Sig.

1

(Constant)

5.314 1.401 .171 F 4.078

CAR .139 1.444 .159 Sig. .015

NPL .516 2.037 .050 R .532

LDR

-.074 -2.034 .051 R

Square

.283

2

(Constant)

23.114 .999 .325 F .941

CAR .434 .738 .466 Sig. .433

NPL 1.500 .972 .338 R .289

LDR

-.190 -.854 .399 R

Square

.083

Table 3 above show that the first model on

hypothesis 4 is accepted where CAR, NPL, and LDR

has a significant correlation towards profitability

based on Return on Asset with F-count 4.078 and p-

value 0.015 at α = 5%. On the other hand, the second

model is not accepted since F-count is .941 with p-

value 0.433 at α = 5%, thus there is no significant

relationship between CAR, NPL, and LDR toward

ROE.

Moreover, based on the t-test above H1is

accepted that there is a significant relationship

between CAR and ROA, however H

2

and H

3

is not

accepted that NPL and ROA is not significant and

also between LDR and ROA.

For the regression analysis, based on the table

above, the results show that the regression model for

the study is:

Y = a + b

1

X

1

+ b

2

X

2

+ b

3

X

3

ROA = 5.314 + 0.139 CAR + 0.516 NPL – 0.074

LDR

The regression model indicates that the increase

of CAR by 1 point will increase ROA by 0.139, and

the increase of NPL by 1 point will increase ROA by

0.516, and the increase of LDR by 1 will decrease

ROA by 0.074.

CAR as often referred to as the bank’s capital

adequacy ratio, based on the result shows that state-

owned bank and notable bank in Indonesia and

Singapore are able to finance its activities with

ownership of its capital. The result shows CAR ratios

can affect bank’s ability to gain profit as seen in its

ROA profitability ratio.

The result also shows that the CAR in both

country is at least twice the required standard of 8%

with mean of 18% and 16% respectively for

Indonesia state owned bank and notable bank in

Singapore which indicate they want to have sufficient

capital capacity to reduce risk (Werdaningtyas,

2002). This result is shown to be supported by

previous study such as conducted by Udom and Eze

(2018).

5 CONCLUSION

In this study the researcher found that the effect of

CAR, NPL.LDR on ROA was very good because it

found significant results between these variables. The

mean results for both Indonesian state-owned bank

and notable bank in Singapore are above 8% standard

for minimum capital for a bank. NPL also resulted

below the minimum standard of 5% which shows that

state-owned bank in Indonesia and notable bank in

Singapore can manage their non-performing loans.

On the other hand, state-owned bank in Indonesia and

notable bank in Singapore also shows that they

perform their function well in giving loans and

receiving deposits from their customer as shows in

LDR ratio between 78-100% standard of Bank

Indonesia. The descriptive statistic data also show

that ROA has mean above 1.5% standard of Bank

Indonesia. Hence, the state owned bank in Indonesia

and notable bank in Singapore has good financial

performance from year 2013-2017.

EBIC 2019 - Economics and Business International Conference 2019

478

RECOMMENDATION

The researcher saw that the relationship between

CAR, NPL, LDR and ROA was so good that

researchers recommended Indonesia and Singapore

bank investors to hold shares in state-owned

companies and notable bank listed on the Indonesian

and Singapore stock exchange. In terms of

management decision making for their stakeholder,

the banking Industry has supported the community

not only in the business sense but also in humanity

way, in terms of scholarship and also other social

responsibility action. It is best for bank state-owned

bank in Indonesia to always help the community

around and Indonesia as a whole. This is also applied

to Singapore notable bank stakeholder.

REFERENCES

Abba, G. O., Okwa, E., Soje, B., and L. N. Aikpitanyi.

(2018). Determinants of Capital Adequacy Ratio of

Deposit Money Banks in Nigeria. Journal of

Accounting & Marketing, Vol. 7 No. 2. DOI:

10.4172/2168- 9601.1000271.

Anwar, Y., and E. Murwaningsari. (2017). the Effect of

Credit Risk and Capital Adequacy Ratio upon Return

on Asset. The Accounting Journal of

BINANIAGA, Vol. 2 No. 2, December 2017. PISSN:

2527-4309, EISSN: 2580-1481.

Darmawi, H. (2014). Manajemen Perbankan. Jakarta:

PT.BumiAksara.

Ediningsih, S. I. (2004). Rasio Keuangan dan Prediksi

Pertumbuhan Laba: Studi Empiris pada Perusahaan

Manufaktur di BEJ, Wahana, Vol. 7, No. 1.

Edwar, Yokeu, Bernadin, (2016).Pengaruh CAR dan LDR

terhadap Return on Assets. Jurnal Ecodemica, Vol. 4,

No 2 (2016)

Fahmi, (2014), Bank dan Lembaga Keuangan Lainnya.

Bandung: Alfabeta.

Fahmi, (2014). Pengantar Perbankan. Bandung: Alfabeta.

Harahap, S. S. (2004.) Analisis Kritis Atas Laporan

Keuangan. Jakarta. PT Raja Grafindo Persada

Harun, U. (2016). Pengaruh Rasio – Rasio Keuangan CAR,

LDR, NIM, NPL, BOPO terhadap ROA. Jurnal Riset

Bisnis dan Manajemen, Vol. 4 No. 1

Hindarto, (2011) Analisis pengaruh CAR, NIM, LDR,

NPL, BOPO dan KAP terhadap Return on Asset. Jurnal

Bisnis Strategic, Vol. 20 No. 20

IDN Times, (2018). Jangan Ketinggalan 4 Beasiswa ini

Menantimu Di Pertengahan Semester. Available at:

https://www.idntimes.com/life/education/ambar-

riyani/jangan-ketinggalan-4-beasiswa-ini-menantimu-

di-pertengahan-semester-c1c2

Kasmir, (2003). Manajemen Perbankan. Jakarta: Grafindo

Persada.

Kasmir, (2012). Manajemen Perbankan. Jakarta: Raja

Grafindo Persada.

Kasmir, (2014). Analisis Laporan Keuangan, Edisi

Pertama, Cetakan Ketujuh. Jakarta: PT. Raja Grafindo

Persada

Kompas, (2017). Semester 1 2017 Laba Konsolidasi Bank

BukopinTurun 14 Percent. Kompas

Kuncoro and Suhardjono (2002). Manajemen Perbankan.

Yogyakarta: Salemba Empat.

Mawardi, W.(2005). Analisis Faktor - Faktor Yang

Mempengaruhi Kinerja Keuangan Bank Umum Di

Indonesia (Studi Kasus Pada Bank Umum dengan Total

Assset Kurang Dari 1 Triliun). Jurnal Bisnis Strategi,

Vol. 14, No. 1, Hal: 83-93, Juli 2005.

Merkusiwati and N. K. L. Aryani. (2007). Evaluasi

Pengaruh CAMEL terhadap Kinerja Perusahaan.

Buletin Studi Ekonomi, Volume 12 No. 1 Tahun 2007

Mudrajad, Kuncoro dan Suhardjono. (2002) Manajemen

Perbankan. Yogyakarta: BPFE

Murhadi, (2015). Analisa Laporan Keuangan. Jakarta:

Salemba Empat.

Pandia, F, (2012). Manajemen Dana dan Kesehatan Bank.

Jakarta: Rineka Cipta.

Republic of Indonesia Law Number 10 of 1998 concerning

banking industry

Simanjuntak, D., and F. M. Hutabarat, (2016). Bank

Financial Performance Using CAMEL Ratio and

Market Value Tobin’s Q of Banking Sub-Sector Listed

at Indonesian Stock Exchange. 2

nd

International

Multidisciplinary

Conference (IMC) 2016 Proceedings. Universitas

Muhammadiyah Jakarta. Available at

http://jurnal.umj.ac.id

Suyono, A, (2005). Analisis Rasio – rasio bank yang

Berpengaruh Terhadap ROA, Thesis, Program Pasca

Sarjana Magister Manajemen Universitas Diponegoro.

Taswan, (2010). Manajemen Perbankan. Yogyakarta: UPP

STIM YKPM.

Udom, I. S., and O. R. Eze, (2018). Effect of Capital

Adequacy Requirement on the Profitability of

Commercial Banks in Nigeria. International Research

Journal of Finance and Economics, Issue 165 Jannuary

2018. ISSN 1450-2887.

Werdaningtyas, H, (2002). Faktor Yang Mempengaruhi

Profitabilitas Bank Take Over Pramerger Di Indonesia.

Jurnal Manajemen Indonesia, Vol. 1, No. 2, Hal: 24-

39.

Yogianta, C. W. E., (2013). ANALISIS PENGARUH

CAR, NIM, LDR, NPL Dan Bopo Terhadap

Profitabilitas Studi Pada Bank Umum Yang Go Publik

Di Bursa Efek Indonesia Periode Tahun 2002-2010.

Jurnal Bisnis Strategi Vol. 22 No. 2 Desember 2013.

Analysis of Factor Affecting Profitability of State Owned Banks in Indonesia and Notable Bank in Singapore as Basis for Bank Management

Decision Making to Its Stakeholder

479