The Perceived Benefit and Risk Framework of E-Wallet Adoption

among the Early Adopters in Malaysia

Roslina Hj. Mohamad Shafi, Faridah Najuna Misman

Department of Finance, Faculty of Business and Management, Universiti Teknologi MARA Cawangan Johor, Segamat

Campus, Johor, Malaysia

Keywords: E-Wallet, Benefit, Risks, Early Adopters, Fintech

Abstract: Malaysia is prime for internet and mobile phone penetration, larger population for young, tech-savvy, and

high financial literacy population. However, despite these advantages, the adoption of e-wallet remains low.

Comparing to other regional countries, Malaysia is lagging behind China, India and Singapore. Malaysians

are still sceptical on the adoption of fintech, particularly on the e-wallet usage. Accordingly, there is an urgent

need to understand why users are willing or hesitant to adopt the e-wallet. Supporting the Bank Negara

Malaysia’s on the digital banking reforms, the study aims to accelerate further on the benefit and risk of e-

wallet usage in Malaysia. A survey consists of eight components on benefits and risks on e-wallet has been

conducted among the early adopters. The results reveal that the intention to use e-wallet is high. Economic

benefit is the main factor of the e-wallet usage. However, the users responded negatively on the risks;

signifying that stronger framework on the risk management should be established further.

1 INTRODUCTION

Financial technology (fintech) should embrace the

fourth industrial revolution (IR 4.0). This is important

especially among today’s digitally savvy consumers

who used to experience the convenience and

performance of Uber, Amazon, Alibaba and Netflix.

Similarly, the consumers are expecting the same IR

from the banks and financial institutions. The Bank

Negara Malaysia (BNM) is currently accelerating

from conventional payments system to electronic

payments (e-payments) system reforms. E-wallet is

the third wave of Malaysia banking reforms in the e-

payments system. The banking reform is taken to

address the vision of Financial Sector Blueprint 2011-

2020 (FSBP). The main purpose of this banking

reform is mainly to correct price distortions, ‘rewire’

market incentives, and improve the accessibility,

quality and value proposition of e-payment services.

Many initiatives and facilities have been established

to address the objectives of the reform, with the

expectation that mobile payment plays significant

roles in facilitating the e-wallet adoption. Malaysia is

prime in realizing the e-wallet reform because of its

high penetration for internet and mobile phone usage,

larger young population, tech-savvy, and high

financial literacy population (Punwatkar & Verghese,

2018). As the usage of the mobile payment

increasing, the volume of cheque usage has declined

by 42 percent; while the volume of electronic funds

transfer (EFT) has exceeded cheque usage by 2.8

times in the year 2017. In addition, the volume of

debit card transaction had increased by more than six

times from 25.1 million in 2011 to 162.3 million in

2017 (BNM, 2018).

However, despite the declining usage of cheque

and debit card transaction, the e-wallet adoption in

Malaysia still at its infancy. According to Nielsen

Payment Landscape Report, while 67 percent of

Malaysians use some form of cashless payment (with

debit card; 63 percent, and online banking; 57

percent, being the primary method), yet a mere 8

percent of the population uses mobile wallets as a way

of payment.

The low adoption of e-wallet is however hinder

by many challenges, from both the merchants and

customers’ perspectives. For instance, lower tier

merchants facing barriers where they need to pay a

transaction fee (also known as the Merchant Discount

Rate or MDR) and to subscribe to point of sales

(POS) terminal facilities. On the other hand,

customers have different perception on the benefits of

e-wallet, where at the same time they are also

Mohamad Shafi, R. and Misman, F.

The Perceived Benefit and Risk Framework of E-Wallet Adoption among the Early Adopters in Malaysia.

DOI: 10.5220/0009326905790584

In Proceedings of the 2nd Economics and Business International Conference (EBIC 2019) - Economics and Business in Industrial Revolution 4.0, pages 579-584

ISBN: 978-989-758-498-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

579

concerns on the safety risk and financial risk of the e-

wallet adoption. The perception on the e-wallet

adoption is also depending on the customers’ age.

Kumar & Lim (2008) compared the willingness to

adopt mobile service among the baby boomers and

generation Y. They found that being a member of a

particular generation could influence willingness to

use mobile technology. This is further supported by

Goi & Ng (2011) who reveals that young customers

using mobile phones have a positive perception of

using mobile commerce applications.

Accordingly, the study intends to explore further

the main drivers that influence the adoption of the e-

wallet among the early adopters. The study also

intends to shed lights on whether the adoption of e-

wallet is in line with the theory of reasoned action

(TRA) where it explains the relationship between

attitudes and behaviors within human actions.

The remaining of the study will discuss the

literature in Section Two, follows by data and

methodology in Section Three, results and analysis in

Section Four and concludes in Section Five.

2 THE BENEFIT AND RISK

CHALLENGES ON THE

ADOPTION OF E-WALLET

AND FINTECH

Studies on the area of e-wallet adoption is still at the

early stage. Therefore, the study will adapt and adopt

similar approach and variables that is available in the

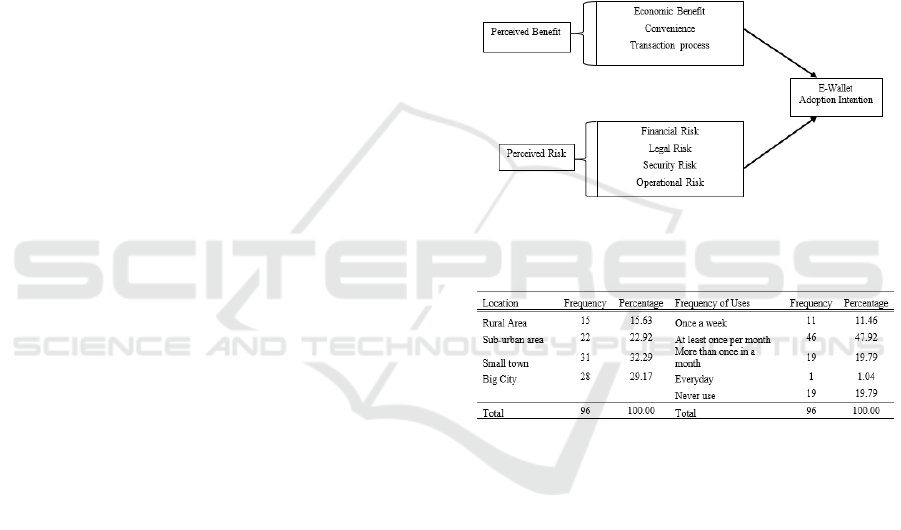

fintech literature instead. The study considers three

types of benefits namely the i) economic benefit, ii)

convenience, and iii) transaction process. On the

other hand, four categories of risks is considered

namely i) financial risk, ii) legal risk, iii) security risk,

and iv) operational risk.

Earlier studies in fintech also discussed the

benefits of fintech using similar terminologies like

‘perceived usefulness’ and ‘perceive ease of use’. For

instance, Bhattacherjee & Sanford (2006) and Kim &

Choi (2015), reveals that when a user feels

“usefulness” through various factors, this has led to a

high impact on “intention to use”. Lee & Shin (2011)

claimed that ‘ease of use’ could be affected by

technology readiness and specialized knowledge,

which in turn had an impact on “intention to use”.

Kim, Park, Choi & Yeon (2015), studied the

mobile payment services in Korea. The study

analyzed the causal relationship between CFIP

(Concern for Information Privacy) and Self-efficacy.

The result reveals that convenience and usefulness are

the most critical influential variables in adopting the

mobile payment service. Similarly, (Ryu, 2018) also

supported that convenience is also perceived as one

of the factors in using the fintech.

In addition, brand and service trusts also plays a

role in determining the acceptance of fintech among

the customers. Chuang, Liu & Kao (2016) studied the

behavioral intention among consumers in Taiwan

servicing industry. The study reveals that brand and

service trust has a significantly positive effect on

attitudes of fintech users.

The intention to adopt the fintech is also

associated with age factor. Young people have always

related their fintech experience with emotions.

Emotions, such as enjoyment and sense of fun,

influence the perceived level of satisfaction with

mobile services (Kumar & Lim, 2008). This is further

evidence by Boonsiritomachai & Pitchayadejanant

(2017) who reveals that the hedonic motivation

theory, specifically the pleasure of using mobile

banking as the most important factor of fintech

adoption among the gen Y in Thailand. Similar trend

of e-wallet adoption also can be identified in

Cambodia. The millennial of Cambodian, also has

high expectation on the benefits factors of the e-

wallet namely the performance expectancy, effort

expectancy, and facilitating condition (Cheng, Khim

& Thai, 2018).

On the other hand, the adoption of the fintech is

also depending on the perception of risks. The main

barrier to use mobile banking in Thailand, Cambodia

and India is mainly on security concerns (Tavilla,

2015; Boonsiritomachai & Pitchayadejanant, 2017;

Punwatkar & Verghese, 2018), consumer behavior

and functional barrier (Cheng, Khim & Thai, 2018).

The security becomes the most considered factor

because consumer’s experienced transparency in the

payment process that entrusted their safety.

Besides, customers are also concern on the legal

risks. Recent study by Ryu (2018), shows that there

are concern on legal risks among the early adopters

and late adopters in Korea. Trust play as an important

role in reducing the customers’ perception on the risk

of using e-wallet.

Trust is the top challenge to fintech

users in markets such as Chile, France and Japan. This

is especially true when customers are more rely on their

current banks or insurer when considering a new service,

rather than alternative fintech providers (Ernst & Young,

2019).

Synthesizing all the literatures above, the study

would hypothesize further whether the benefits and

risks are the factors of the e-wallet adoption among

the early adopters in Malaysia.

EBIC 2019 - Economics and Business International Conference 2019

580

3 DATA AND METHODOLOGY

This study aims to investigate the relationship

between the benefit and risk framework of e-wallet

among the early adopters. Early adopters are chosen

as respondents because this generation will set and

dominate the market in the next 10-15 years. Besides,

early adopters are IT-savvy and are more enthusiastic

on the digital platforms. In order to achieve the

objective, this study employed a primary data survey

by sending a questionnaire to the undergraduate

students of Universiti Teknologi MARA Cawangan

Johor, Malaysia. The questionnaires were distributed

to the students that have intention to use the e-wallet

services. A method of purposive sampling was

applied in this current study. A total of 100

respondents have participated in the survey. However

only 96 were found usable for the data analysis. The

set of questionnaires was adapted from Ryu (2018).

Few items for each category; benefits and risks were

used to measure all variables. Each of items has

assigned a corresponding Likert Scale with anchors

ranging from 1 as “Strongly Disagree” and 5 as

“Strongly Agree”.

This research focusses into two broad categories

which are benefit and risk framework of e-wallet

adoption in Malaysia. To study the perceived benefit

of e-wallet, this study examines three major areas,

namely economic benefit, convenience and

transaction process. While for the perceived risk

framework, this study focusses only into four

categories of risks, namely financial risk, legal risk,

security risk and operational risk. Figure 1 presents

the proposed research framework used in this study.

Ryu (2018) claims that consumers will normally

choose available services that offer them the best

value with a given risk states. In this study, perceived

benefit is expected to have a positive relationship

with the e-wallet adoption decision. On the other

hand, perceived risk is expected to have a negative

relationship with the e-wallet adoption. The following

hypotheses are proposed.

H

0

: β ≤ 0

H

1

: β > 0

H

1

: Perceived benefit is positively related to E-

wallet adoption decision

H

0

: β ≥ 0

H

2

: β < 0

H

2

: Perceived risk is negatively related to E-

wallet adoption decision

Data collected from the survey was analyzed

using the IBM SPSS version 25 software. A

descriptive statistic is used to explore and understand

the important information of the respondents. The

factor analyses using the principal component

analysis (PCA) approach were used to reduce the

variables that are account for. This study also runs a

correlation test and multiple regression to examine

which variables; perceived benefit and perceived risk

that will influence the decision to adopt e-wallet

services among early adopter. Below is the regression

equation used:

Adoption Intention

i

= f (Perceived benefit

i

,

Perceived risk

i

) + Ꜫ

i

Figure 1: Proposed Research Framework

Table 1. Sample Profile

4 RESULTS AND ANALYSIS

As mention in the previous section, there are seven

variables; three variables under perceived benefits

category (economic, convenience and transaction)

and four variables under perceived risk category

(financial, legal, security and operational risks).

However, after the factor analysis procedure, the test

suggested the item to be categorized into only five

groups of variables. Therefore, the items were re-

categorized according to the factor analysis results.

The five new categories are economic benefits,

convenience, financial risk, security risk and

operational risk. Table 1 reports a sample profile of

the study. As the study using a purposive sampling in

the data collection methods, all the respondents are

the students of UiTM Cawangan Johor with the age

range between 15 to 25 years old. The table shows

The Perceived Benefit and Risk Framework of E-Wallet Adoption among the Early Adopters in Malaysia

581

that majority of the respondents which is about 47.92

percent at least use an e-wallet services once a month.

The statistics also reports that about 11 and 19

percent of the respondents uses e-wallet once in a

week and more than once time in a month,

respectively. Out of 96 respondents, only 19

respondents never use the e-wallet services. These

statistics imply that e-wallet services are quite well

acceptable among the early adopters in the study.

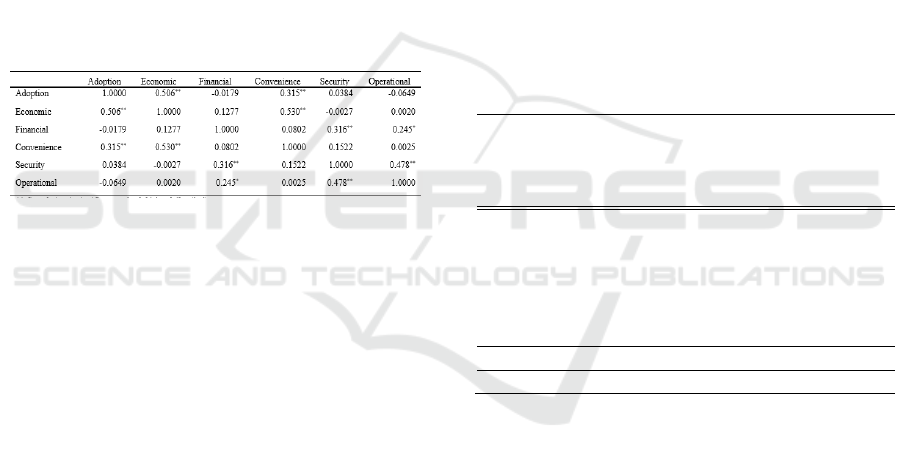

To further investigates the relationship between

the benefit and risk with the intention to use the e-

wallet services, this study conducted a Pearson

correlation test. The result of the test is reported in

Table 2. The correlation examines the relationship

between dependent and independent variables and by

conducting this test, the nature of relationship of the

variables can be known. The test identifies three

variables to have a positive relationship with the

intention to adopt e-wallet services.

Table 2. Correlation Results

**Correlation is significant at the 0.01 level (2-tailed)

*Correlation is significant at the 0.05 level (2-tailed)

The variables are economic, convenience and

security. These results imply that the higher economic

benefits, convenience and high security may

influence users to adopt e-wallet services. However

out of three positive results only two of them are

having a significant correlation with intention to

adopt the e-wallet services. The two variables are

economic benefits and convenience. The negative

correlation between financial and operational risk are

as expected. These indicates that, the higher the risk

exposure resulted from the transaction the lower the

influence on the intention to adopt the e-wallet.

Theoretically, the provider of the e-wallet services

should ensure that the financial and operational risk

are at very minimum level or they should guarantee

that all transactions are safe.

To further investigate the factors that may

influence the e-wallet adoption, this study conducts a

multiple regression analysis. The dependent variable

was regressed against the independent variables. The

analysis is conducted using a cross sectional

regression of 96 respondents. Table 3 presents the

multiple regression results. The explanatory power of

the results of the regression model is about 27.7

percent. This figure indicates that 27.7 percent from

the variation of dependent variable is explained by the

independent variables includes in the study.

Economic benefit shows a positive and significant

result at 1 percent significance level. The coefficient

value of economic benefit is 0.521. This implies that

when the economic benefit of e-wallet increases by

one unit, it will increase the intention to use it by

0.521.

This study suggests that only one variable that is

statistically significant to influence the decision to

adopt the e-wallet services among early adopters. The

other variables included in this study does not shows

any statistically significant influence on the decision

to adopt the e-wallet services. This result is partly in

line with the previous studies which linking the

benefits and adoption of various fintech services (for

instance Kim & Choi, 2015; Lee & Shin, 2011).

The results of this study also partially answering

the Theory of Reasoned Action (TRA). The pre-

existing attitude does affect the student’s intention to

adopt the e-wallet.

Table 3: Regression results

Unstandardized

Coefficients

t Si

g

.B

Std.

Erro

r

(Constant) 1.8646 0.5247 3.5535 0.0006**

Economic 0.5210 0.1127 4.6214 0.0000**

Convenience 0.0389 0.0978 0.3980 0.6916

Financial -0.0990 0.0991 -0.9996 0.3202

Security 0.0920 0.0908 1.0126 0.3140

Operational -0.0799 0.0872 -0.9160 0.3621

R-Squared 0.2770

F-Stat

6.888

(

0.000

)

**

**. Correlation is significant at the 0.01 level (1-tailed).

Yet, the overall results of this study may be

contradicting with previous findings (Ryu, 2008) due

to a few reasons. The first reason, culture and

geographical area might play an important role in the

decision of adopting the e-wallet services. Majority

of the retails customers still prefer to use a traditional

payment in their daily transactions. Second, e-wallet

services are considered new in Malaysia. E-wallet

start its journey as an e-payment in Malaysia financial

system on early of 2018. Due to this reason, there is a

possibility of not many customers truly understand

how its work. The finding of this survey suggests that

the economic benefit such as cheaper fees or amount

of discount offered is the only significant factor that

affect their decision to use the E-wallet. The finding

also suggests that the early adopters not really taking

care on the risk involved in the transaction of e-

EBIC 2019 - Economics and Business International Conference 2019

582

wallet. This might be due to the age factor as younger

generation are normally willing to take risky activities

as compared to the more matured generation.

Cauffman et al. (2010) claim that avoidance

behaviours increase linearly with the age.

5 CONCLUSION AND

RECOMMENDATION

The adoption of e-wallet services has gradually

getting attention among the consumers. The banking

sector should take this opportunity to realize the

transformation of banking sector in line with the

IR4.0. The study shed lights on the demand-side

survey among the early adopters of e-wallet. It

discloses the factors of e-wallet adoption whether it is

influence by its benefits or by its risks. The study

reveals that the early adopters in UiTM Cawangan

Johor are driven by the perceived economic benefits,

rather than fear on the risks. This is especially true in

the case of the undergraduate’s students where they

have limited financial resources and therefore

choosing services that is cheaper and lower costs.

Result on the perceived risk is statistically

insignificant, even though it is showing negative

relationships. It is still perplex as whether the early

adopters are truly risk-taker (who love thrills and do

not mind taking risky actions on the e-wallet

adoption), or whether they are actually risk-neutral

(have lack of awareness on the risk-effect of the e-

wallet services; are not really sure whether they like

or dislike risk, or they simply do not think about it

enough to worry). However, our benefit and risks

framework have certain limitations. We have not

studied psychological factors, such as social

influences; and we should also extend our scopes on

the risks side by including the privacy risks, and cyber

security risks. Hence, suggesting direction of the

forthcoming research.

The study also suggests some paradigm shift in

the implementation of the banking policy where the

banks might need to disclose more benefits of the e-

wallet adoption among the youngsters. The banks

also should reveal and make it clear on the term and

conditions, that is related to the risks. Banks should

be able to ‘learn’ a customer’s preferences to provide

tailored customer recommendations and enable rapid

responses.

REFERENCES

BNM, Bank Negara Malaysia (2018). Transforming Mobile

Phones into E-Wallets in Malaysia.

Bhattacherjee, A., & Sanford, C. (2006). Influence

Processes for Information Technology Acceptance: An

Elaboration Likelihood Model. MIS Quarterly, 30(4),

805–825. Retrieved from http://www.itandsociety.org

Boonsiritomachai, W., & Pitchayadejanant, K. (2017).

Determinants Affecting Mobile Banking Adoption by

Generation Y based on the Unified Theory of

Acceptance and Use of Technology Model modified by

the Technology Acceptance Model Concept. Kasetsart

Journal of Social Sciences, 1–10.

https://doi.org/10.1016/j.kjss.2017.10.005

Cauffman, E., Shulman, E. P., Steinberg, L., Claus, E.,

Banich, M. T., Graham, S., & Woolard, J. (2010). Age

Differences in Affective Decision Making as Indexed

by Performance on the Iowa Gambling Task.

Developmental Psychology, 46(1), 193–207.

https://doi.org/10.1037/a0016128

Cheng, F. M., Khim, C., & Thai, S. (2018). Consumer

Adoption of E-Wallets: A Study of Millennials at the

Institute of Foreign Languages, Cambodia. In

Proceedings of the 21st Asia-Pacific Conference on

Global Business, Economics, Finance & Social

Sciences (pp. 1–16). Retrieved from

www.globalbizresearch.org

Chuang, L.-M., Liu, C.-C., & Kao, H.-K. (2016). The

Adoption of Fintech Service: TAM Perspective.

International Journal of Management and

Administrative Sciences (IJMAS), 3(07), 1–15.

Retrieved from www.ijmas.orgwww.ijmas.org

Ernst & Young. (2019). Global FinTech Adoption Index

2019. Retrieved from

https://assets.ey.com/content/dam/ey-sites/ey-

com/en_gl/topics/banking-and-capital-markets/ey-

global-fintech-adoption-index.pdf

Goi, C. L., & Ng, P. Y. (2011). Perception of Young

Consumers on Mobile Phone Applications in Malaysia.

World Applied Sciences Journal, 15(1), 47–55.

Kim, Y., Choi, B., & Choi, J. (2015). A Study on the

Successful Adoption of IoT Services : Focused on

iBeacon and Nearby. Journal of Information

Technology Services, 14(1), 217–236.

https://doi.org/10.9716/kits.2015.14.1.217

Kim, Y., Park, Y.-J., Choi, J., & Yeon, J. (2015). An

Empirical Study on the Adoption of “Fintech” Service:

Focused on Mobile Payment Services. Advanced

Science and Technology Letters, 114(Business), 136–

140. https://doi.org/10.14257/astl.2015.114.26

Kumar, A., & Lim, H. (2008). Age Differences in Mobile

Service Perceptions: Comparison of Generation Y and

Baby Boomers. Journal of Services Marketing, 22(7),

568–577. https://doi.org/10.1108/08876040810909695

Lee, J.-E., & Shin, M. (2011). Factors for the Adoption of

Smartphone-based Mobile Banking: On User’s

Technology Readiness and Expertise. Journal of

Society for E-Business Studies, 16

(4), 155–172.

The Perceived Benefit and Risk Framework of E-Wallet Adoption among the Early Adopters in Malaysia

583

Punwatkar, S., & Verghese, M. (2018). Adaptation of e-

Wallet Payment: An Empirical Study on Consumers’

Adoption Behavior in Central India. International

Journal of Advanced in Managament, Technology and

Engineering Sciences, 8(3), 1147–1156. Retrieved

from http://www.ijamtes.org/gallery/154 conf-mba.pdf

Ryu, H.-S. (2018). Understanding Benefit and Risk

Framework of Fintech Adoption: Comparison of Early

Adopters and Late Adopters. In Proceedings of the 51st

Hawaii International Conference on System Sciences

(pp. 3864–3873).

https://doi.org/10.24251/hicss.2018.486

Tavilla, E. (2015). Transit Mobile Payments : Driving

Consumer Experience and Adoption.

APPENDIX

Table 4: Differences between Network Based and Card

Based E-Wallet

Network

Based E-

Wallet

Card Based E-

Wallet

Types It stores digital

money on the

cloud

It rides on

existing card

network

Examples WeChat pay,

Grab Pay,

Touch n Go

AEON wallet,

BigPay, Mpay

Walet

Issuing e-

money

Yes Yes

Pay to other

merchants

(open loops)

Yes Yes

Linked to a

card scheme

(visa,

mastercard)

No Yes

EBIC 2019 - Economics and Business International Conference 2019

584