Firm Value in a Situation of Free Cash Flow and Investment

Sensitivity, External Finance Constraint and Information Asymmetry

Rina Br. Bukit

1*

, Sri Mulyani

1

, Fahmi N. Nasution

1

,

Phou Sambath

2

1

Department of Accounting, Universitas Sumatera Utara, Jl. Prof. T.M Hanafiah, SH, Kampus USU, Medan, Indonesia

2

Faculty of Social Science and Humanities, Royal University of Phnom Penh, Phnom Penh, Cambodia

Keywords: Firm Value, Free Cash Flow and Investment Sensitivity, External Finance Constraint, Information

Asymmetry

Abstract: Good company value is an important goal of the company. But companies that have many stakeholders and

face various problems such as conflict of incentives and information asymmetry, often have difficulty in

maximizing the value of their companies. A fall in the value of a company can harm all parties including

investors. The supervisory system for company management decisions is very necessary to reduce losses and

adverse effects from the decline in company value. However, in-depth research on the company's value model

in situations where there is sensitivity to cash flows and investment, information asymmetry and restrictions

on external funding are still rarely carried out. The research objective is to test the company's value model in

situations there is free cash flow, investment, information asymmetry, and external funding restrictions. The

study population is a non-banking company listed on the Indonesia Stock Exchange in 2014-2016. This study

uses secondary data. The dependent variable of this study is the value of the company and the independent

variable is the sensitivity of cash and investment flows, information asymmetry, and external funding

restrictions. The data analysis method used in this study is a multiple regression analysis model. This study

finds that free cash flow, investment and external funding restrictions influence firm value.

1 INTRODUCTION

A company is established with the aim of increasing

the value of the company so that it can provide

prosperity for the owner or shareholders. The value of

a company is important because it relates to the

welfare of

its shareholders. The value of the

company can be described from the level of the stock

price that shows the future prospects of the company.

Some researchers have previously described the value

of the company by Tobin Q, which is the ratio of the

company's market value to the book value of the

company's equity. In other words, the firm's value is

the current financial market estimate of the return

value of each additional investment rupiah or is an

illustration of the effectiveness of company

management utilizing economic resources in its

strength. The company's goal to maximize company

value can be achieved through better performance

(Bukit, Haryanto, &Ginting, 2016;

Moeljadi&Supriyati, 2014). The reality is not easy for

all companies to maximize the value of their

company. Among the important factors that influence

the value of the company are the level of free cash

flow and investment, information asymmetry and

funding restrictions.

The findings of previous studies on the level of

sensitivity of free cash flow and investment indicate

a gap in theory and practice. Efficient financial

market theory explains that the flow of internal funds

should not be related to the level of investment.

However, in practice there is a positive relationship

between internal funds flow and investment level.

Previous research noted several reasons for the

discovery of this positive relationship, including 1)

agency issues arise in the case of managers are

involved in using internal cash flows in non-

prospective investment activities (for example,

Jensen 1986). 2) Relating to imperfect capital markets

so that expensive external funding sources may cause

managers to use internal funds to finance projects /

investments (Agrawal&Zong 2005).

Past studies show that investment companies that

are limited financially are more sensitive to internal

funds than companies that have access to outside

Bukit, R., Mulyani, S., Nasution, F. and Sambath, P.

Firm Value in a Situation of Free Cash Flow and Investment Sensitivity, External Finance Constraint and Information Asymmetry.

DOI: 10.5220/0009328306250631

In Proceedings of the 2nd Economics and Business International Conference (EBIC 2019) - Economics and Business in Industrial Revolution 4.0, pages 625-631

ISBN: 978-989-758-498-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

625

funding. For example, Agrawal&Zong (2005) used

the company data in the four largest industrialized

countries (such as US, UK, Japan and Germany) and

found that investment rates were significantly related

by internal cash levels. More specifically, this shows

that companies face limitations in accessing external

finance.

Research on the value of the company is still

interesting because information about the value of the

company is very important for stakeholders. Previous

research shows that several factors influence firm

value such as company performance, company size,

and debt monitoring (Bukit, Haryanto, &Ginting,

2016). First, company performance is often described

as company efficiency, financial stability or financial

health. Information on company performance is

important for shareholders, which is related to their

interests and welfare. Second, the literature finds that

company size is one of the determinants of firm value.

The size of the company is a reflection of the total

assets of the organization. Managers of companies

with greater assets are more flexible in using existing

company assets. Large companies have easy access to

capital markets to get funds. Higher company size is

captured by investors as a positive signal and good

prospects so that the size of the company can

positively influence the company's value. Third, the

level of debt monitoring is measured by the ratio of

total debt to total assets. A company that borrows

funds from a bank must sign a debt agreement

contract. Company managers must run the company

efficiently and effectively to avoid breach of debt

agreement contracts. Companies with high debt ratios

receive additional supervision from banks. Thus, debt

monitoring tends to have a positive impact on

company value.

However, previous studies noted that the

influence of other factors such as the level of

sensitivity of cash flow and investment, the

constraints of funding and information asymmetry of

firm value are still rarely examined and the results are

still inconsistent. The purpose of this study was to

examine the effect of the level of free cash flow and

investment, information asymmetry and funding

constraints on firm value.

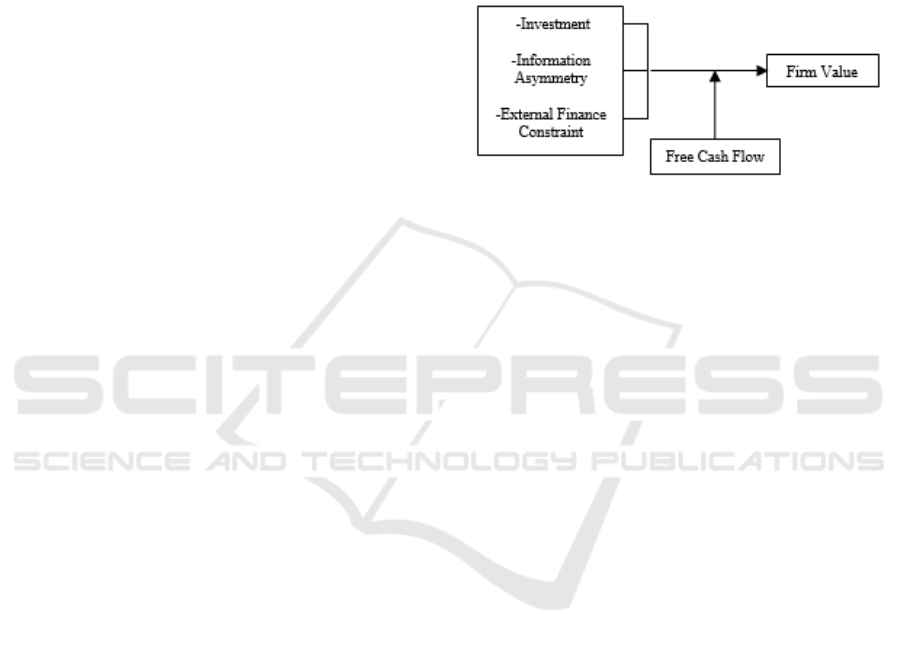

2 CONCEPTUAL FRAMEWORK

Agency theory shows that excess cash can lead to

conflict of incentives because managers tend to use

corporate money for activities that do not benefit

shareholders to achieve their personal interests

(Jensen 1986; Jensen &Meckling 1976; Chung et al.

2005). Free cash flow theory predicts companies that

have free cash flow tend to be involved with activities

that do not increase firm value (Ang et al. 2000;

Jensen 1986). Yoon and Miller (2002) say that

managers tend to manipulate earnings to avoid

companies reporting decreased income. Research

needs to be done to examine the effect of conflict of

free cash flow incentives, information asymmetry and

monitoring system on firm value. The research

framework is shown as follows:

Figure 2.1: Firm Value Model

Excess cash is an incentive problem if in its use it

creates a conflict of interest. The excess cash

reinvested in projects that do not benefit the company

is better distributed as dividends. In situations where

companies are not easy to obtain investment capital

from outside the company, free cash flow becomes an

alternative to internal funding. Cash spending that are

used efficiently to improve company performance

will maximize the value of the company. Some

research also proves that cash flow in the company

gets a positive reaction from shareholders who can

read important prospects of the use of cash (Perfect,

Peterson, & Peterson, 1995). But on the other hand,

the free cash flow hypothesis predicts that cash excess

is often used opportunistically to finance investment

projects with negative net present value (NPV) value

(Jensen, 1986; Richardson, 2005). The use of cash

excesses that do not improve shareholders' welfare

results in incentive conflicts (Jensen, 1976) so that

distributing excess cash in the form of dividends will

reduce incentive conflicts.

In addition to cash flow, conflict incentives arise

in situations of information asymmetry. Management

as a company manager has more information about

the company, while investors and creditors only have

limited information. In this study, information

asymmetry is measured in two ways: First,

information asymmetry because there are

inconsistencies between financial information (such

as information on increasing the amount of income)

and non-financial information (such as information

on increasing the number of employees) (Brazel et al.

2009). Second, information asymmetry is due to

EBIC 2019 - Economics and Business International Conference 2019

626

accounting fraud where managers change and

manipulate profits with the aim of deceiving and

misleading the views of readers of financial

statements about the actual performance of the

company (Healy &Wahlen 1999;Bukit &Iskandar,

2009). Information asymmetry causes shareholders to

not get quality information in making decisions so

that conflict of incentives occurs and the level of

welfare of shareholders decreases. Given the impact

of the losses caused by the fall of the value of the

company, the precautionary measures through the

monitoring system are very important.

Monitoring systems through external funding are

expected to increase transparency, relevance,

reliability and financial reporting timelines, reduce

capital costs, and facilitate access to international

capital markets (Choi & Meek, 2012). Increased

accounting information quality can reduce conflict

over cash incentives and information asymmetry to

increase firm value.

The presence of a monitoring system is needed

especially for companies that face incentive conflicts

to increase company value. Among the monitoring

systems that are expected to be able to oversee the

company and reduce the conflict of incentives is

external funding. Thus, the external funding

constraint may have impact in reducing firm

monitoring and firm value. Furthermore, based on the

explanation above, this study develops several

hypotheses as follow

H1. Free cash flow, Investment,Information

asymmetry, and External finance constraintare

related with firm value

H2. The influence of investment,information

asymmetry, and external finance constraint on

firm value are moderated by free cash flow

3 RESEARCH METHOD

3.1 Population and Sample

The research population is a non-banking company

listed on the Indonesia Stock Exchange in 2014-2016.

The research sample was taken randomly following

the applicable research method.

3.2 Type and Method of Data

Collecting

This study uses secondary data which is collected

from annual reports and published financial reports,

books, and scientific journals related to this research.

Data is obtained from the internet by downloading the

required data by accessing it from the Indonesia Stock

Exchange website (www.idx.com), www.ssrn.com,

www.search.proquest.com, and the website of each

company.

3.3 Variable Definition and

Operationalization

Operational definitions and variable measurements

are shown in Table 4.1 (please see Appendix 1)

3.4 Method of Data Analysis

Data analysis method is a multiple regression analysis

model. Before data analysis is performed, the

classical assumption test is carried out which includes

normality test, multicollinearity test,

heteroscedasticity test and autocorrelation test.

4 RESEARCH MODEL

The first hypothesis will be tested with the regression

equation 1 as follows:

Y= b

0

+ b

1

X

1

+ b

2

X

2

+ b

3

X

3

+ b

4

X

4

+ b

5

X

5

+

b

6

X

c1

b

7

X

c2

+ b

8

X

c3

+ε ......……… Equation 1

Where:

Y = Firm value

X

1

= Free cash flow

X

2

= Investment

X

3

= Information asymmetry

1

X

4

= Information asymmetry

2

X

5

= Constraint of financing

X

c1-c3

= Control variables

b

1

– b

5

= beta of each variable

ε = Error Term

The second hypothesis testing model

The second hypothesis will be tested by the

interaction test method with equation 2 as follows:

Y= b

0

+ b

1

X

1

+ b

2

X

2

+ b

3

X

3

+ b

4

X

4

+ b

5

X

5

+

b

6

X

1

X

2

+ b

7

X

1

X

3

+ b

8

X

1

X

4

+ b

9

X

1

X

5

+ b

10

X

c1

+

b

11

X

c2

+ b

12

X

c3

+ε ......……… Equation 2

Where:

X

1

X

2

; X

1

X

3

;X

1

X

4

; X

1

X

5

: the interaction

variables

Firm Value in a Situation of Free Cash Flow and Investment Sensitivity, External Finance Constraint and Information Asymmetry

627

5 RESULTS

5.1 Descriptive Statistics

Descriptive statistics provide a general description of

the object of research sampled. Explanation of data

through descriptive statistics is expected to provide an

initial description of the problem under study (see

Table 5.1, in Appendix).

5.2 Classical Assumption Test

Classical assumption testing is done to find out

whether there is a violation of the classic assumption

test which forms the basis of multiple linear

regression models. This research shows that this

research data has passed the classical assumption test,

so there are no problems with normality,

multicollinearity, heteroscedasticity, and

autocorrelation.

This study also conducted the correlation test

between independent variables.Table 5.2 (see in

Appendix) shows the highest correlation coefficient

is between the variable earnings management (EM)

and company growth (Gr) which is 0.180 where the

correlationcoefficient number is still below 0.8

(Gujarati, 2003). Thus it can be concluded that in this

research model there is no problem of

multicollinearity.

5.3 Research Regression Results

This research develops the previous research by

examining the effect free cash flow, investment,

asymmetry information and constraint of external

financing on the value of the company. This study

also test the moderating effect of free cash flow on the

relationship between investment, asymmetry

information and constraint of external financing on

firm value. As expected, this study shows that

investment and external finance constraint (ie debt

ratio) affect the value of the company. The results

also show that the interaction of free cash flow and

investment contributes to increasing the value of the

company. However, this study found no effect of free

cash flow and information asymmetry on firm

value.This study also showed that the effect of

information asymmetry and external finance

constraint on firm value cannot be moderated by free

cash flow (Please see Table 5.3 in the Appendix).

6 CONCLUSION

This study connects the concept of the level of free

cash flow and investment, monitoring mechanisms,

signal theory and firm value. Some managers have

personal information to signal their best performance

and the company's future prospects. Transparency of

corporate information through low information

asymmetry can reduce information gaps between

company managers and shareholders. In addition, in

order to protect the interests of shareholders, some

companies implement effective oversight

mechanisms, including monitoring by external

auditors, control by creditors or banking and

supervision by public shareholders. Generally,

companies by suppressing agency issues widely and

effective oversight mechanisms give better attention

to the interests and welfare of shareholders and have

a higher corporate value.

The findings of this research contribute to

understanding the signalling issues by the company.

Information transparency through low agency issues

and effective monitoring can improve the alignment

of interests between managers and shareholders and

reduce agency conflicts. Consistent with signal

theory, this study shows that broad investment shows

that corporate managers run companies for the benefit

of shareholders. The company's signal will show that

the company achieves what is shown in the

company's value.

The results of this research have significant

implications for policy makers and practitioners. The

findings show that good company value will be

achieved when the company is in a state of low

agency problems and effective monitoring by an

external auditor. This finding informs that certain

monitoring mechanisms will help the board of

directors to explain the application of certain

investment strategies, and understand the behaviour

of the company's investment strategy. The practical

implication of this research is that managers will have

incentives to strengthen the monitoring mechanism to

signal company performance and company value.

This research contributes to signal theory.

REFERENCES

Agrawal, R. &Zong, S. 2006. The cash flow–investment

relationship: International evidence of limited access to

external finance. Journal of Multinational Financial

Management 6(1): 89-104.

EBIC 2019 - Economics and Business International Conference 2019

628

Brazel, J.F., Jones, K.L. &Zimbelman, M.F. (2009).Using

nonfinancial measures to assess fraud risk. Journal of

Accounting Research, 47 (5), 1135-1166.

Choi, F.D.S & Meek, G.K.

2012.AkuntansiInternasional.Ed. Ke-6. Jakarta,

SalembaEmpat.

Chu, Yongqiang; Liu, Peng. 2016. A Direct Test of the Free

Cash Flow Hypothesis: Evidence from Real Estate

Transactions. Journal of Real Estate Finance and

Economics; Norwell Vol. 52, Iss. 4

Chung, R., Firth, M. & Kim, J.B. 2005.Earnings

management, surplus free cash flow, and external

monitoring, Journal of Business Research 58: 766-776.

Gujarati, D. N. 2003. Basic Econometrics.Ed.ke-4. New

York, USA: McGraw Hill.

Healy, P.M. &Wahlen, J.M. 1999.A review of the earnings

management literature and its implications for standard

setting.Accounting Horizons 13: 365–383.

Jensen, M. &Meckling, W. 1976. Theory of the firm:

Managerial behavior, agency costs, and capital

structure. Journal of Financial Economics3: 305–360.

Jensen, M.C. 1986. Agency costs of free cash flow,

corporate finance and takeovers. American Economic

Review 76: 323-329.

Moeljadi&Supriyati, Triningsih Sri. 2014. Factors

Affecting Firm Value : Theoretical Study on Public

Manufacturing Firms in Indonesia. South Asia Journal

of Contemporary Business, Economics and Law, 5:6-

15.

Odabashian, K. 2005. The effect of large increases on

opportunistic behavior and earnings

management.TesisPh.D.University of Connecticut.

Perfect, S.B., Peterson, D.R. & Peterson, P.P. 1995. Self-

tender offers: The effects of free cash flow, cash flow

signaling, and the measurement of Tobin's q. Journal of

Banking & Finance 19(6): 1005-1023.

Richardson, S. 2005. Over-investment of free cash

flow.Working Paper.University of Pennsylvania.

Rina Bukit &Fahmi N. Nasution. 2015. Employee Diff,

Free Cash Flow, Corporate Governance and Earnings

Management. Procedia Social and Behavioral Sciences

211: 585-594.

Rina Bukit &TakiahMohdIskandar. 2009. Surplus free cash

flow, earnings management and audit committee.

International Journal of Economics and Management 3

(1), 204-223

Rina Bukit, Bode Haryanto, &P Ginting. 2016.

Environmental performance, profitability, asset

utilization, debt monitoring and firm value, IOP

Conference Series: Earth and Environmental Science

TakiahMohdIskandar, Rina Bukit&ZuraidahMohdSanusi.

2012. The Moderating effect of ownership structure on

the relationship between free cash flow and asset

utilisation. Asian Academy of Management Journal of

Accounting and Finance 8(1): 69-89.

APPENDIX

Table. 4.1 Variable definition and operationalization

Variable Definisi O

p

erasionalisasi

Dependent Variable

FV Firm Value Tobin Q

Control Variable

SIZE Firm Size Ln of total asset (Koh 2003).

DEBT Debt Ratio of total debt and total asset (Ang& Ding

2006).

AUD Audit quality Auditor size, Big 4=1; Non Big 4 = 0 (Becker et al.

1998).

GROWTH Firm growth Ratio of market value and book value (Chung et al.

2005).

Inde

p

endent Variable

FCF Free cash flow Operating profit before interest rates, taxes,

depreciation and amortization / total assets at the

b

eginning of the year (Chi 2005)

Investment Purchasing assets that are

expected to provide welfare in the

future

Ratio of asset increase

Information

asymmetry

The difference of financial

data and non financialdata

∆ financial data– ∆ non financial data

(

Brezel et al. 2009

)

Financial data manipulation Discretionary accrual based on the performance

match sam

p

le

(

Chen et al. 2008; Kothari et al. 2005

)

.

ModeratingVariable

External

Financing Fun

d

Ratio of total debt and total

asset

Debt to Equity Ratio

Firm Value in a Situation of Free Cash Flow and Investment Sensitivity, External Finance Constraint and Information Asymmetry

629

Table 5.1 A. Descriptive statistics

N

Minimu

m

Maximu

m

Mean

Std.

Deviation

FIRM_SZ 382 12,229 33,648 27,460 3,184

GROWTH 377 -58,450 192,250 18,767 39,936

FCF 377 -1,150 0,329 -0,008 0,158

INV 377 -1,000 3,209 0,138 0,525

EM 374 -0,545 1,076 0,036 0,165

E_DIFF 372 -0,504 4,601 0,132 0,389

DER 377 0,032 5,056 0,584 0,625

FIRM_VALUE 382 0,079 23,181 1,813 2,927

Valid N (listwise) 369

Table 5.1.B Data Frequency and Percentage of Auditor Types

Frequency Percent

Valid

Percent

Cumulative

Percent

Valid 0 232 60,7 60,7 60,7

1 150 39,3 39,3 100,0

Total 382 100,0 100,0

Table 5.2 Multicollinearity test results

FIRM_SZ AUDIT_QLT GROWTH FCF INV EM E_DIFF DER

FIRM_SZ

1

AUDIT_QLT

0,061 1

GROWTH

0,173** 0,047 1

FCF

-0,013 0,084 0,002 1

INV

0,021 0,035 -0,070 -0,164** 1

EM

-0,020 -0,036 0,180** -0,089 0,012 1

E_DIFF

0,028 -0,108* -0,101 0,031 0,082 0,062 1

DER

-0,126* -0,102* -0,302** -0,055 -0,157** -0,135** 0,067 1

EBIC 2019 - Economics and Business International Conference 2019

630

Table 5.3 Regression Results

Model 1

DV :

Firm Value

Model 2

DV :

Firm Value

Model 3

DV :

Firm Value

Model 4

DV :

Firm Value

Model 5

DV :

Firm Value

Constant

Independent

Variable

Free Cash

Flow

Investment

DA

Ediff

DER

Moderating

Variable

FCF*INV

FCF*DA

FCF*EDIFF

FCF*DEBT

Control

Variable

Firm Size

Audit Quality

Growth

-1,701

(-4,495)

***

0,414

(1,492)

0,218

(2,625) ***

0,180

(0,683)

0,059

(0,534)

0,351

(4,811)***

0,039

(2,917)***

0,158

(1,794)*

0,083

(4,520)***

-1,799

(-4,783)***

0,059

(0,197)

0,297

(3,425)***

0,210

(0,805)

0,054

(0,491)

0,352

(4,879)***

0,965

(2,873)***

0,043

(3,228)***

0,153

(1,753)*

0,082

(4,470)***

-1,665

(-4,380)***

0,572

(1,766)*

0,216

(2,601)**

0,239

(0,882)

0,055

(0,498)

0,351

(4,809)***

-1,433

(-0,947)

0,038

(2,806)***

0,166

(1,879)*

0,082

(4,428)***

-1,701

(-4,489)***

0,402

(1,429)

0,219

(2,629)***

0,182

(0,690)

0,056

(0,508)

0,351

(4,810)***

0,131

(0,248)

0,039

(2,914)***

0,158

(1,790)*

0,083

(4,506)***

-1,728

(-4,568)***

0,032

(0,081)

0,216

(2,597)**

0,202

(0,763)

0,060

(0,542)

0,375

(5,005)***

0,603

(1,370)

0,040

(2,946)***

0,162

(1,845)*

0,084

(4,579)***

R

2

Adj R

2

F

Prob F

0,125

0,106

6,458

0,000

0,145

0,124

6,773

0,000

0,128

0,106

5, 838

0,000

0,126

0,104

5,732

0,000

0,130

0,108

5,963

0,000

Firm Value in a Situation of Free Cash Flow and Investment Sensitivity, External Finance Constraint and Information Asymmetry

631