The Implementation of E-Catalogue of BPJS Kesehatan:

Are Pharmaceutical Companies in Indonesia Fit Enough?

Maria Goretti Sri Puji Paramitha Susetyawati , and Dian Purnama Sari

Department of Accounting, Widya Mandala Chatolic University, Surabaya, Indonesia

Keywords: Financial distress, Ratio analysis, BPJS Kesehatan, Pharmaceutical Company.

Abstract: This research aims at making analysis by using two financial distress predictive methods, namely Altman's

and Grover's. The calculative outcomes of those two methods are then paired and compared with the

condition of the increase of decrease in profit of the company and the condition of other companies

throughout the research. The objects of research are all pharmaceutical companies registered to Bursa Efek

Indonesia (Indonesia Stock Exchange) in 2014-2017. The research use data acquired from then

pharmaceutical companies. The findings show that a number of companies are categorized within a grey

and distress zone based on Altman's method. The Grover method, however, predicts that the majority of

companies are in the category of distress during the period of research. This indicates that it is necessary for

the BPJS to review the E-Catalogue program to keep pharmaceutical companies in Indonesia to survive and

participate in the field of healthcare in the country.

1 INTRODUCTION

National Health Insurance (JKN, Jaminan Kesehatan

Nasional) is still a hot topic in Indonesia. A number

of policies by the National Social Security for

Healthcare(BPJS Kesehatan, Badan Penyelenggara

Jaminan Sosial Kesehatan) as the in-charge

institution are still inviting pros and cons. Policies

such as tiered reference (effective since September

22, 2018), Primary care physician (DLP, Dokter

Layanan Primer), additional fees (Permenkes 51,

2018), and the E-Catalogue that put medicines in

‘similar‘ price and other policies are still in question.

Some of them are not well-run, and yet the BPJS

keeps conducting them. The E-Catalogue is one of

the policies that have a big impact on the field of

healthcare in Indonesia due to the fact that patients,

besides being dependent on doctors, rely strongly on

the medicines themselves for their medication.

E-Catalogue is a program of medical supply for

the people and is a system of electronic information

related to available medicines from all

pharmaceutical factories in Indonesia, along with

their smallest price units. The medical supply is

based on the number of consumers' demands

(Nurdin, 2014). The prices offered in the E-

Catalogue are also within the lowest or smallest

units, which is intended for the government to help

patients who are in the membership of the BPJS.

This policy may sound good for the patients, and the

institution in charge of the JKN, but is it ‘fit' enough

for pharmaceutical companies in Indonesia?

In 2018 the committee of Indonesian Association

of Pharmaceutical Companies (GP-Farmasi, Komite

Gabungan Farmasi Indonesia) stated that the

national industry was facing a slowdown. As relayed

from Fauzia (2018), the Head of GP-Farmasi, it is

known that the pharmaceutical industry growth in

the last two years was even less than 5 percent. This

is thought to be the impact of the implementation of

E-Catalogue by the BPJS Kesehatan in 2013. The

medical consumption of people showed growth;

however, it was not followed by sales of

pharmaceutical products, which, on the contrary,

was decreasing. The low fixed rate of the price is

considered to be a major factor that caused the

declining sales.

Moreover, the Head of the GP-Farmasi in

Indonesia suggested that 300 out of 900 medical

supplies available in the E-Catalogue cannot be

offered to the people due to their too low prices. The

Government of Procurement Goods/Services

(LKPP) is considered to have made a mistake in

calculating the cost of medical production by

pharmaceutical companies. This statement is backed

Susetyawati, M. and Sari, D.

The Implementation of E-Catalogue of BPJS Kesehatan: Are Pharmaceutical Companies in Indonesia Fit Enough?.

DOI: 10.5220/0009399200230029

In Proceedings of the 1st International Conference on Anti-Corruption and Integrity (ICOACI 2019), pages 23-29

ISBN: 978-989-758-461-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

23

by the data coming from multiple pharmaceutical

companies in Indonesia, such as PT Kalbe Farma,

Tbk, and PT. Kimia Farma, Tbk showing that they

had experienced a slowdown of their business

growth in the year of 2015 – 2017 (Fauzia, 2018).

This is a serious issue considering that

pharmaceutical companies in Indonesia were able to

supply as many as 70 percents of domestic medical

demands in 2017 (Ministry of Industry of the

Republic of Indonesia, 2017). If the E-Catalogue is

continued with disregard of the pharmaceutical

companies' financial condition, it is possible for

these companies to face bankruptcy. It is not

difficult to imagine the bitter consequence if medical

supplies for patients in Indonesia are declining or,

for worse, disappearing. It is not impossible for the

patent medicines that are not produced as generics to

vanish from the Indonesian market. The case could

get worse if all the medical supplies are put in the E-

Catalogue with prices decided by the LKPP (The

Government of Procurement Goods/Services) that

are too cheap to the pharmaceutical companies. If

this scenario happens, the patients are put at high

risk of losing proper medical healthcare.

This research intends to analyze the financial

distress prediction of pharmaceutical companies in

Indonesia. The bankruptcy of a company in general

often begins with financial distress within the

company and an unpredictable profit rate in the

future.

The bankruptcy of a company is often marked

with financial distress in it and the uncertainty of

profit in the future. The financial distress predictive

analysis will be done by looking up through

financial reports of all pharmaceutical companies

registered to the Indonesia Stock Exchange within

the year of 2014 – 2017 by using four prediction

methods of company bankruptcy. The selection of

the year will be based on the ongoing year of the

government's E-Catalogue program.

2 THEORETICAL

FRAMEWORKS

Altman and Hotchkiss (2010) state that there are

four general terms used to describe the inability of a

company in resolving its problems, namely failure,

insolvency, default, and bankruptcy. Failure is a

condition where the return rate made by the

company from its investment is significantly and

consistently lower than the general return rate.

Insolvency is a situation where the company's

performances are declining showed by their inability

to pay their liabilities or debts – which in return

indicates the lack of liquidity within the company.

Default is a condition where the company fails to

pay the debt and the interest within the deadline that

can be caused by the contract failure between the

company and the investor. Bankruptcy occurs when

the company is facing the uncertainty of survival

caused by its ongoing financial performance decline.

The financial distress of a company begins when

they fail to execute their scheduled payment or if

there is a cash-flow prediction that the same

situation will repeat in the future (Brigham and

Ehrhardt, 2005). Two things, namely economic and

financial aspects, can cause this condition. The

economic problem includes things such as the

company's weakness and improper location, whereas

the financial problem is where the company owes

too much debt or insufficient capital. Financial

distress conditions can be seen through the

calculation and ratio analysis of the company's

financial condition, and the stakeholders can use

them to predict the probability of the company's

future bankruptcy.

3 RESEARCH METHOD

This is descriptive research, which, according to

Nazir in Bimawiratma (2016), is a research aim at

making a description, or systematic projection of the

truth, characteristics, and relationship among the

researched objects. This research employs two

methods, namely the Altman and Grover financial

distress methods, and provides a description of

bankruptcy predictive analysis of pharmaceutical

companies registered to Bursa Efek Indonesia

(Indonesia Stock Exchange) within 2014 – 2017.

These two methods are selected due to the emphasis

on a company's profit and sales that match the

condition of pharmaceutical companies after the

implementation of the E-Catalogue. Each calculation

of the analysis is provided in Table 1.

ICOACI 2019 - International Conference on Anti-Corruption and Integrity

24

Table 1: The Altman & Grover’s Analysis Formula of

Calculation

Method

of

Analysis

Altman

Z-Score

Formula

Z-Score Altman = 1,2 X1A + 1,4 X2A +

3,3 X3A + 0,6 X4A + 1,0 X5A

Information

X1A=Working Capital (Current Assets

– Current Liabilities) / Total Assets

X2A=Retained Earnings / Total Assets

X3A=Earnings before Interest and

Taxes / Total Assets

X4A=Market Capital and Preferred

Stock

X5A = Sales / Total Assets

Criteria of Calculation Result of

Categorization

a. Z-Score > 2,99 : fit company

b. 1,81 < Z-Score < 2,99 :

vulnerable situation

c. Z-Score < 1,81 : unfit company and

bankruptcy potential

Grover

Formula

Z-Score Grover = 1,650X1G +

3,404X2G + 0,016ROA + 0,057

Information

X1G = Working Capital / Total Assets

X2G = Earnings before Interest and

Taxes (EBIT) / Total Assets

ROA = Return on Assets / Total Assets

Criteria of Calculation Result of

Categorization

a. Z-Score 0,01: bankruptcy

category and unfit company

b. Z-Score -0,02: fit company and

bankruptcy potential

4 RESEARCH FINDINGS

4.1 General Description of Research

Object

The objects of the research are companies working

in the pharmaceutical field and are registered to the

Indonesia Stock Exchange during the period of 2014

– 2017 and fit in with the criteria set in sample

collection. Based on the criteria of sampling, 10

companies were finally included as the objects of the

research namely PT Darya Varia Laboratoria Tbk,

PT Indofarma (Persero) Tbk, PT Kimia Farma

(Persero) Tbk, PT Kalbe Farma Tbk, PT Merck

Indonesia Tbk, PT Pyridam Farma Tbk, PT Merck

Sharp Dohme Pharma Tbk, PT Industri Jamu &

Farmasi SidoMuncul Tbk, PT Taisho

Pharmaceutical Indonesia Tbk, and PT Tempo Scan

Pacific Tbk.

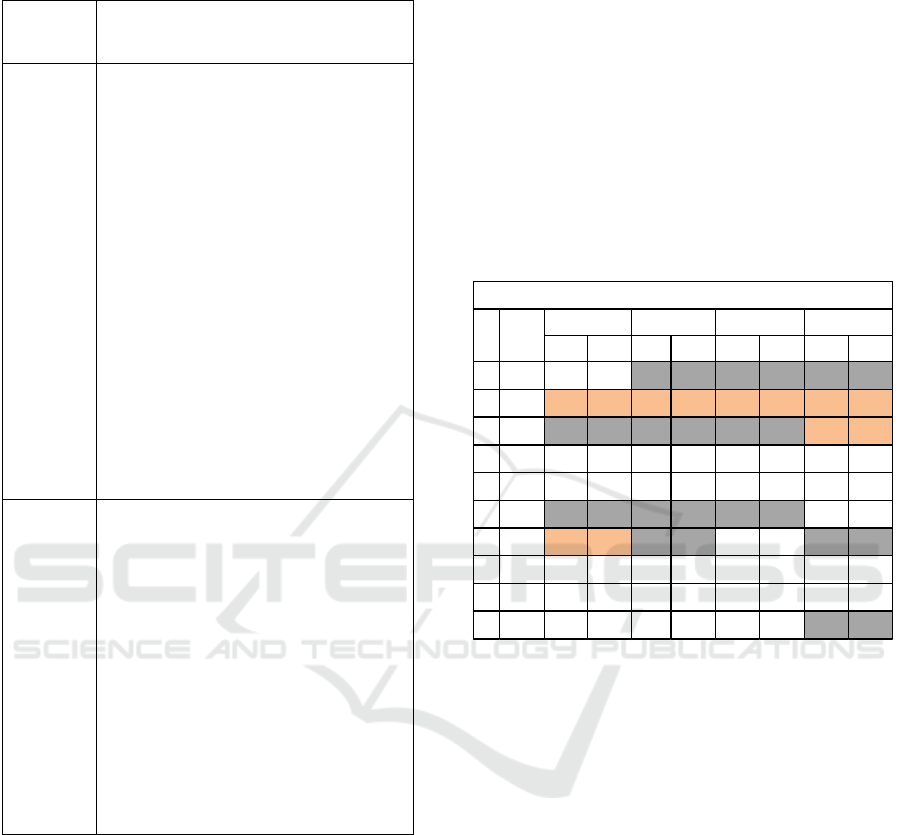

4.2 The Findings of Altman Analysis

The result of data calculation and tabulation by

using Altman's bankruptcy predictive analysis is

shown in table 2.

Table 2 The Result of Altman’s Analysis Method

Source: Tabulated Data (2018)

Information (Ket): S: Safe Zone; G: Grey Zone;

D: Distress

In the year of 2014, there are two companies that

were indicated to have financial distress and two

others that were in the grey area, and meanwhile, the

other six were falling into the category of fit and not

being indicated to have financial distress. The

indicated to be financially distressed companies

were Indofarma (Persero) Tbk with a ratio of 1,59

and Merck Sharp Dohme PharmaTbk with a ration

of 1,12 while the grey area companies are Kalbe

Farma with 2,72 ratio and Pyridam FarmaTbk with a

ratio of 2,33.

In 2015 the number of companies within the

financial distress fell into one company, and the grey

area went up to four. Indofarma (Persero) Tbk with

1,65 ratio became the only company in 2015 with

financial distress prediction, and the other grey area

four are Darya Varia Laboratoria Tbk, Kalbe Farma

Tbk, Merck Sharp Dohme Pharma Tbk, and Pyridam

Farma Tbk.

Z-Score Ke t Z-S core Ke t Z-Score Ke t Z-Score Ke t

1 DVLA 3.13 S 2.95 G 2.97 G 2.91 G

2 INAF 1.59 D 1.65 D 1.75 D 1.28 D

3 KAEF 2.72 G 2.57 G 2.07 G 1.67 D

4 KLBF 3.78 S 3.63 S 3.65 S 3.59 S

5 MERK 4.02 S 4.20 S 4.07 S 3.71 S

6 PYFA 2.33 G 2.67 G 2.69 G 3.11 S

7 SCPI 1.12 D 2.18 G 3.22 S 2.58 G

8 SIDO 6.96 S 6.89 S 6.33 S 5.71 S

9 SQBB 4.57 S 4.06 S 4.24 S 4.22 S

10 TSPC 3.22 S 3.04 S 3.14 S 2.95 G

Altman

No Kode

2017201620152014

The Implementation of E-Catalogue of BPJS Kesehatan: Are Pharmaceutical Companies in Indonesia Fit Enough?

25

In 2016 Indofarma (Persero) Tbk still became a

financial distress indicated company with 1,75

ratios, and there were three companies inside the

grey area, namely Darya Varia Laboratoria Tbk with

2,97 ratio, Kalbe Farma Tbk with 2,07, ratio and

Pyridam Farma Tbk with a ratio of 2,69.

In 2017, there were two companies within the

financial distress category. Besides Indofarma

(Persero) Tbk, Kalbe Farma was also indicated to be

financially distressed with a ratio of 1,67 and those

in the grey area were Darya Varia Laboratoria Tbk

with 2,91 ratio, Merck Sharp Dohme Pharma Tbk

with 2,58 ratio and Tempo Scan Pacific Tbk with as

many as 2,95 ratios.

4.3 The Findings of Grover Analysis

The result of data calculation and tabulation by

using Grover’s bankruptcy predictive analysis is

illustrated in table 3.

Table 3: Result of Grover’s Formula of Data

Calculation

Source: Tabulated Data (2018)

Information (Ket) : S : Safe Zone; D: Distress

In 2014, 2015, and 2016 Grover method's

analysis indicated that all companies that became the

objects of research were in financial distress

condition. All ten companies had a ratio of 0,01.

The category fit in with Grover analysis with 0,01

ratio is an unfit or bankrupt company. In 2017 there

was only one company categorized to be fit, namely

Indofarma (Persero) Tbk, with a ratio of -0,03.

4.4 Are Pharmaceutical Companies in

Indonesia Fit Enough?

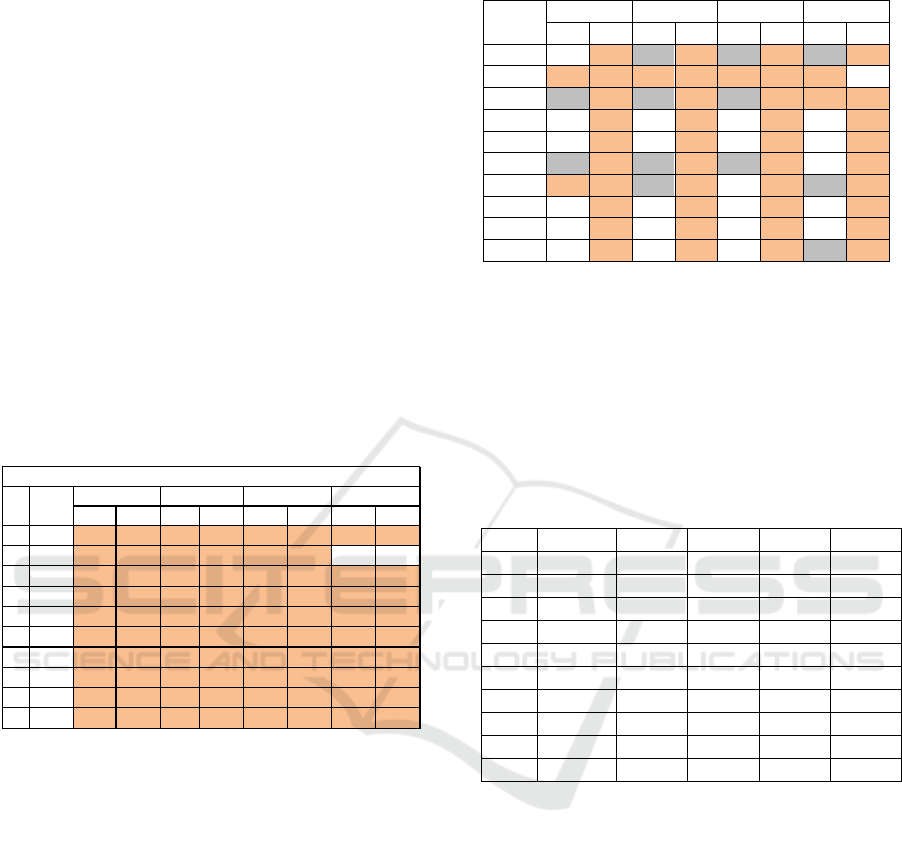

The calculation result of the four financial distress

analyses is presented in Table 4 as follows.

Table 4: The Comparison of Four Analyses Result

Source: Tabulated Data (2018)

Information: A: Altman; Gr: Grover; S: Safe

Zone; G: Grey Zone; D: Distress

In deciding the congruency of financial distress

predictive method, this research applies the

comparison of the annual profit of all sample

companies and observes their differences. The

comparison can be seen in Table 5.

Table 5 Annual Profit Comparison (in Millions of Rupiah)

Source: Tabulated Data (2018)

The gap between the increase and the decrease of

company profit within the period of 2014 – 2017 is

also summed up to determine if the increase or the

decrease of profit happened significantly or if it

happened in more than one period of the year. The

finding of the comparison can be observed in Table

6.

Z-Score Ke t Z-S co re Ke t Z-Score Ke t Z-Score Ke t

1 DVLA 1.33 D 1.31 D 1.28 D 1.27 D

2 INAF 0.32 D 0.33 D 0.19 D -0.03 S

3 KAEF 1.10 D 0.93 D 0.77 D 0.66 D

4 KLBF 1.58 D 1.50 D 1.54 D 1.50 D

5 MERK 2.13 D 1.99 D 1.90 D 1.64 D

6 PYFA 0.43 D 0.53 D 0.65 D 0.84 D

7 SCPI 0.65 D 0.80 D 1.71 D 0.82 D

8 SIDO 1.70 D 1.64 D 1.64 D 1.51 D

9 SQBB 2.71 D 2.46 D 2.61 D 2.60 D

10 TSPC 1.24 D 1.13 D 1.14 D 1.09 D

Grover

No Kode

2014 2015 2016 2017

2013 2014 2015 2016 2017

DVLA 125.796 80.929 107.894 152.083 162.249

INAF (54.222) 1.440 6.565 (17.367) (46.284)

KAEF 215.642 236.531 265.549 271.597 331.707

KLBF 1.970.452 2.121.090 2.057.694 2.350.884 2.453.251

MERK 175.444 182.147 142.545 153.842 144.677

PYFA 6.195 2.657 3.087 5.146 7.127

SCPI (12.167) (62.461) 139.321 134.727 122.515

SIDO 405.943 415.193 437.475 480.525 533.799

SQBB 149.521 164.808 150.207 165.195 17.896

TSPC 638.535 584.293 529.218 545.493 557.339

2014 2015 2016 2017

A Gr A Gr A Gr A Gr

DVLA S D G D G D G D

INAF D D D D D D D S

KAEF G D G D G D D D

KLBF S D S D S D S D

MERK S D S D S D S D

PYFA G D G D G D S D

SCPI D D G D S D G D

SIDO S D S D S D S D

SQBB S D S D S D S D

TSPC S D S D S D G D

ICOACI 2019 - International Conference on Anti-Corruption and Integrity

26

Table 6: The Annual Profit Gap (in Thousands of Rupiah)

Source: Tabulated Data (2018)

From the summary of companies', the profit gap

in Table 6 indicates that a number of companies had

significant profit declines and occurred in more than

one period of the year. Therefore, the researcher

here described each one of the pharmaceutical

companies.

4.4.1 PT Darya Varia Laboratoria Tbk

(DVLA)

PT Darya Varia Laboratoria Tbk (DVLA) was inside

a safe zone in 2014. However, it went through a

decline and was positioned under the grey zone from

2015 – 2017 according to the Altman calculation

method. This was different from the result from the

Grover method, which predicted distress on the

company from 2014 until 2017. Based on the

company profit gap, DVLA experienced a

significant increase in profit in 2015 and 2016 after

having a loss many years before. The profit increase

then declined in 2017. Moreover, the company

closed two of its subsidiaries in 2014 and 2016,

indicating an unfit (grey zone) situation that might

lead to distress.

4.4.2 PT Indofarma (Persero) Tbk (INAF)

PT Indofarma (Persero) Tbk (INAF) went through a

distress situation during the research period based on

Altman and Grover's analysis. This prediction is

backed by a significant profit downfall and the

company loss in 2016 and 2017. The company

suffered more losses up to 166,5% in 2017. The

company profit gap showed a significant decrease

indicated by the loss of profit for as much as IDR

23.933.106.631 from 2015 to 2016 and made

another one with the amount of IDR

256.216.197.879 and then another IDR

28.917.360.089 from 2016 to 2017. The 2017 loss

was even 166,5 % higher than the one in 2016. The

profit decline of the company was also backed by

the record of sale decrease of medical supplies made

by the company. In 2015, the sale plummeted to as

much as 256.216.197.879 in another IDR

105.460.436.781 in 2017. Aside from that, the

company's liability was also increasing in that year.

4.4.3 PT Kimia Farma (Persero) Tbk

(KAEF)

PT Kimia Farma (Persero) Tbk (KAEF) was in the

grey zone category based on Altman analysis from

2014 to 2016 and was in distress in 2017. On the

other hand, the Grover suggested that the company

was in distress from 2014 to 2017. Considering the

profit gap in 2016 that was far lower than before and

after that, there was a certain condition in the

company that despite making more profit, it was still

suggested to be in distress by Altman and Grover.

4.4.4 PT Kalbe Farma Tbk (KLBF)

PT Kalbe Farma Tbk (KLBF) was in a grey zone

during the research period, according to Altman

analysis from 2014 to 2016, before moving to the

safe zone in 2017. The company suffered a

significant profit decrease from 2014 to 2015 at the

time of the E-Catalogue began to take place.

4.4.5 PT Merck Indonesia Tbk (MERK)

PT Merck Indonesia Tbk (MERK) Based on the

Altman analysis calculation, the company was in the

category of the safe zone during the period of

research. Different from the three analyses, Grover

predicted that the company was in distress from

2014 to 2017. Considering the profit and other

conditions of the company, PT MERK went through

an unstable profit rate. During the period of

research, there was a closure on a company subunit

and the relocation of an employee due to a special

agreement with Merck KgaA in Germany.

4.4.6 PT Pyridam Farma Tbk (PYFA)

PT Pyridam Farma Tbk (PYFA) was classified as

the grey zone category by Altman's analysis from

2014 to 2016 before moving to the safe zone in

2017. Grover's Method suggested that the company

was in distress during the research period. From

Profit Gap

2014 2015 2016 2017

DVLA (44.866) 26.964.954 44.188 10.165.893

INAF 55.662 5.125.369 (23.933) (28.917.360)

KAEF 20.888 29.018 6.048 60.109.969

KLBF 150.638 (63.396) 293.190 102.366.477

MERK 6.702 (39.601) 11.297 (9.165.553)

PYFA (3.538) 429 2.059 1.981.085

SCPI (50.293) 201.783 (4.594) (12.212.261)

SIDO 9.250 22.282 43.050 53.274.000

SQBB 15.286 (14.600) 14.988

(147.299.368

)

TSPC (54.242) (55.074) 16.274 11.846.045

The Implementation of E-Catalogue of BPJS Kesehatan: Are Pharmaceutical Companies in Indonesia Fit Enough?

27

2014 to 2017, this company suffered quite a

significant decrease in profit and made improvement

the years after.

4.4.7 PT Merck Sharp Dohme Pharma Tbk

(SCPI)

PT Merck Sharp Dohme PharmaTbk (SCPI) was

categorized as inside distress in 2014 by Altman,

Grey zone in 2015 and 2017 and safe zone in 2016.

Grover's method also predicted that the company

was in distress during the time of the research. The

company suffered a loss in 2013 and 2014 but was

able to make a profit in the next three years.

However, the profit of the company kept down

falling from 2015 to 2017. This condition was a

subsequent impact of domestic decrease of the sale

in 2015. The company made a decline in domestic

sales for as much as 71.791.597.000 but made

improvement of export to more than 2 trillion rupiah

and therefore made a profit in 2015. Despite making

201.783.091.000 profit gain in 2015, the company

suffered a significant decline in two consecutive

years. The company was also unable to meet the

minimum requirement of free float set by the

Indonesia Stock Exchange (Bursa Efek Indonesia).

The company's request for delisting from the stock

market (BEI) also reflected its unfit condition.

4.4.8 Industri Jamu dan Farmasi Sido

Muncul Tbk (SIDO)

Industri Jamu dan Farmasi Sido Muncul Tbk (SIDO)

was in fit condition according to Altman analysis.

The finding of the calculation method is supported

by the stable and even increasing profit gain of the

company from 2014 to 2017. However, the Grover

method suggested that the company was in distress

from 2014 to 2017. It is probably due to the fact that

Altman's method still calculates stock market price

and sales, whereas Grover only calculates profit and

Return on Assets. Grover methods signal the

companies to keep themselves away from distress

possibility. The discrepancy within the company is

probably caused by the fact that many of their

products on the market are not even listed in the E-

Catalogue.

4.4.9 PT Taisho Pharmaceutical Indonesia

Tbk (SQBB)

PT Taisho Pharmaceutical Indonesia Tbk (SQBB)

was categorized to be in the safe zone by Altman's

method, while Grover's suggested the opposite by

stating that the company was in distress during the

research period. Taisho Pharmaceutical Indonesia

Tbk also suffered a profit decline in 2017 as much as

147.299.368.000. The decline in 2017 was not

equivalent to the profit gain in 2014 and 2016. The

increase in the profit was only around 14 – 15 billion

Rupiah, whereas the loss in 2017 was as much as

100 billion rupiah. Besides that, the company also

requests delisting from the Indonesia Stock

Exchange.

4.4.10 PT Tempo Scan Pacific Tbk

(TSPC)

PT Tempo Scan Pacific Tbk (TSPC) also received

the safe zone from three Altman's methods from

2014 to 2016 and became in the grey zone in 2017.

The finding of the Grover method suggested that the

company was in distress during the research period.

The profit gained by the company declined

significantly in 2014 and 2015 and increased in

2016. The profit gain in 2017 was still lower than in

2016. The efficiency and layoff were done in 2014.

5 CONCLUSIONS

The pharmaceutical companies in Indonesia went

through turbulence after the E-Catalogue took place

by the BPJS in 2013. The prediction on

pharmaceutical companies suggested that they are in

financial distress category. Grover's method

predicted that the majority of the pharmaceutical

companies in Indonesia were in distress financially.

This means that from the Return on Assets

standpoint, these companies are financially unfit.

The research focuses on the E-Catalogue policy

launched by the BPJS since 2013. The period after

the implementation of E-Catalogue (2014- 2017)

indicates that E-Catalogue affected the financial

condition of pharmaceutical companies in Indonesia.

From a profit and Return on Assets standpoint, the

conclusion is that almost all pharmaceutical

companies in Indonesia are classified to be unfit.

Studies on E-Catalogue policy need to be done in

order for the pharmaceutical companies to survive

considering that the field of healthcare strongly

depends on pharmaceutical companies in terms of

medical supplies

This research only predicts pharmaceutical

companies within the fit or unfit category.

Considering the fact that none of the companies

suffered from bankruptcy during the time of the

ICOACI 2019 - International Conference on Anti-Corruption and Integrity

28

research, this research does not compare which

methods work better in predicting the bankruptcy

and only takes the profit gain and calculation

method into the equation.

REFERENCES

Altman, E. I, Hotchkiss, E. 2010. Corporate Financial

Distress and Bankruptcy. USA: John Wiley & Sons,

Inc.

Antara. 2016. LKPP: E-katalog bisa wujudkan persaingan

sehat. https://nasional.kontan.co.id/news/lkpp-e-

katalog-bisa-wujudkan-persaingan-sehat.

Arieza, U. 2017. 2 Perusahaan Ini Mau Delisting dari BEI:

Merck Sharp dan Lamicitra. Didapat dari

https://economy.okezone.com/read/2017/07/05/278/17

29191/2-perusahaan-ini-mau-delisting-dari-bei-merck-

sharp-dan-lamicitra.

Avenhuis, J.O. 2013. Testing the Generalizability of the

Bankruptcy Prediction Models of Altman, Ohlson, and

Zmijewski for Dutch Listed and Large Non-listed

Firms. University of Twente, Enschede, the

Netherlands.

Bimawiratma, P.G. 2016. Analisis Akurasi Metode

Altman, Grover, Springate dan Zmijewski dalam

Memprediksi Perusahaan Delisting (Studi Empiris

pada Perusahaan Manufaktur di Bursa Efek Indonesia

Periode 2009 - 2013).

https://repository.usd.ac.id/6719/2/122114016_full.pdf

Brigham, E. F. and Ehrhardt, M. C. 2005. Financial

Management : Theory and Practice. China : Thompson

South-Western.

Burhanudin, Wulandari F., Widayanti R. 2017. Analisis

Prediksi Kebangkrutan Menggunakan Metode Altman

(Z-Score) pada Perusahaan Farmasi (Studi Kasus Pada

Perusahaan yang Terdaftar di Bursa Efek Indonesia

Tahun 2011 - 2015). BENEFIT Jurnal Manajemen dan

Bisnis.

Fauzan H, Sutiono F. 2017. Perbandingan Model Altman

Z-Score, Zmijewski, Springate, dan Grover Dalam

Memprediksi Kebangkrutan Perusahaan Perbankan.

Jurnal Online Insan Akuntan. 2 (1): 49 – 60.

Fauzia, M. 2018. Industri Farmasi Nasional Mengalami

Perlambatan Pertumbuhan Bisnis.

https://ekonomi.kompas.com/read/2018/04/09/214000

426/industri-farmasi-nasional-mengalami-

perlambatan-pertumbuhan-bisnis.

Kementerian Perindustrian Republik Indonesia. 2017.

Nilai Potensi Capai USD 5 M, Industri Farmasi Kuasai

70 Persen Pasar Domestik.

http://www.kemenperin.go.id/artikel/18101/Nilai-

Potensi-Capai-USD-5-M,-Industri-Farmasi-Kuasai-70-

Persen-Pasar-Domestik.

The Implementation of E-Catalogue of BPJS Kesehatan: Are Pharmaceutical Companies in Indonesia Fit Enough?

29