Tax Incentive Analysis to Encourage Venture Capital Investing in

Digital Start-up Companies

Yosephine Uliarta and Milla Sepliana Setyowati

Fiscal Administrative Science, Faculty of Administrative Science, Universitas Indonesia,

Jl. Prof. Dr. Selo Soemardjan, Depok, 16424, Indonesia

Keywords: Tax Incentive, Venture Capital, Digital Start-up

Abstract: Digital start-up are generally the main drivers of the development of the digital economy. As a company that

promotes innovation, investing in startups has a very high risk. One of the startup funding comes from venture

capital investment. The purpose of this study is to analyze tax policy in Indonesia, which aims to encourage

venture capital investment in startups and illustrate tax incentives for venture capital investment implemented

in Singapore and China. This research was conducted using a qualitative approach and qualitative data

analysis techniques. The results of this study indicate that to support venture capital investing in startups, the

Indonesian government provides tax incentives in the form of tax exemptions on dividends. The tax incentives

provided are not attractive because they do not fit into the venture capital investment model. Tax incentives

for venture capital applied in Singapore are provided in the form of tax exemptions on capital gains, interest,

and dividends, while China provides tax incentives in the form of tax reductions.

1 INTRODUCTION

The government has committed to establishing a tax

incentive scheme for venture capital that funds

companies in certain categories, including startup

companies, which are listed in the 2017-2019

Electronic-Based National Trade System Roadmap

(SPNBE), and realize it by issuing PMK No. 48 /

PMK.010 / 2018 Concerning Taxation Treatment of

Equity Participation of Venture Capital Companies in

Micro, Small and Medium Enterprises (PMK

48/2018). However, this regulation does not create an

attractive tax incentive scheme for Venture Capital

Companies. The tax treatment of venture capital in

PMK 48/2018 has not changed from the previous

regulation; namely, the dividends received by venture

capital companies from investee companies are not

subject to tax on certain conditions. This regulation

only changes the maximum threshold of net sales of

investee companies that receive venture capital

funding from the provisions previously stipulated in

KMK No. 250 of 1995. The exclusion of dividends as

a tax object, as stipulated in PMK 48/2018, is

considered to be attractive for venture capital

investors. There are several alternative tax policies to

encourage investment from venture capital in the

form of incentives that can be given that have been

implemented in other countries. The forms of

incentives are tax exemption or exemption from

taxation on certain income as applied in Singapore,

and tax incentives in the form of tax reduction

implemented in China. Singapore and China were

chosen as benchmarks in this study because the

venture capital industry in both countries is fairly

advanced, and both are Indonesian competitors in

terms of venture capital investment in startups in the

Asian region. In addition, the two countries also paid

special attention to the development of the initial

stage of business and the use of technology and the

development of innovation in business. Based on this

background, the research questions raised are as

follows: (1) how tax policies to encourage venture

capital investing in digital startups (startups) that

currently apply in Indonesia and (2) how tax policies

in Singapore and China to encourage venture capital

that invests in start-up companies.

Uliarta, Y. and Setyowati, M.

Tax Incentive Analysis to Encourage Venture Capital Investing in Digital Start-up Companies.

DOI: 10.5220/0009402402290238

In Proceedings of the 1st International Conference on Anti-Corruption and Integrity (ICOACI 2019), pages 229-238

ISBN: 978-989-758-461-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

229

2 LITERATURE REVIEW

2.1 Start-up

Initially, the concept of startup refers to business

entities that have just entered the market. But over

time, the definition of a startup is associated with

specific business categories related to the

development of information and communication

technology, especially the internet as a universal,

direct, and unlimited communication media. The

startup is also associated with breakthroughs in the

economic, social, and even civilizational dimensions

related to the spread of information and

communication technology, especially the internet.

(Scale, 2019). Gaujarad (2008) explained that startup

companies have the following characteristics:

a) The company has not been long established

(usually 3 years or less).

b) The company has few employees or workers,

usually less than 20 people. This is intended to

save the cost of paying employee salaries.

Employees tend to have the ability to hold

several tasks/responsibilities at one time

(multitasking).

c) Very close to the use of technology and

applications.

d) There are operations carried out on websites. A

startup company can certainly have a site as a

corporate identity because the operations used

are in that field. Even though the services

offered are in the form of real products or

services that use applications, startup

companies will still have a website.

e) The company is still in the development stage.

2.2 Ventura Capital

Venture capital is a risk-equity investment (Gerken

and Wesley, 2014). Venture capital is a long-term

investment in the form of risk-giving capital, where

the capital provider (venture capitalist) expects

capital gains (Tony Lorenz in Rivai, 2007). Venture

capital is financial capital provided for early-stage

companies that have high potential and grow quickly

and are high risk. Venture capitalists make money by

having equity in invested companies, which usually

has new technology or business models in high-tech

industries, such as biotechnology, information

technology, software, and others (Maynard, Warren,

and Trevino, 2010). According to (Klonowski, 2010),

there are several advantages of companies that are

funded by venture capital companies. First, venture

capital financing does not expect regular interim

payments. Second, the addition of capital increases

the creditworthiness of an investee company by

increasing its capital base, thereby increasing the

value of its net assets. This is important for investee

companies when looking for additional bank

financing or leasing arrangements. Third, venture

capital financing generally increases the credibility of

investee companies with customers, material

suppliers, distributors, banks, and other financial

institutions. This credibility is based on the

assumption that venture capitalists are very selective

in their choices and only invest in companies with

strong potential for growth. Investee company

stakeholders know that venture capitalist only benefit

if the investee company continues to succeed, and this

serves to increase the credibility of the investee

company. Fourth, capital provided by venture

capitalists does not require investee companies to pay

dividends to ensure that founders can run their

business without operational constraints

2.3 Tax Incentives for Venture Capital

Investment

The provision of tax incentives for venture capital is

one of the efforts to deepen the market because this

industry has certain characteristics that are different

from other financial industries. Compared to

financing sources from banks, venture capital plays

an important role in facilitating the development of

young companies with high growth potential. In a

journal titled "Venture Capital, Entrepreneurship, and

Regional Economic Growth" Samila and Sorenson

(2011) argue that venture capital companies fill a

niche that allows capital needed to reach some of the

undeveloped and most uncertain ideas as stated

below: "venture capital firms fill a niche that allows

the necessary capital to reach some of the least

developed and most uncertain ideas. "He also

believes that traditional bank financing cannot

replace venture capital.

The high risk from startup requires banks to

charge very high-interest rates to internalize risk.

However, in general, the applicable law does not

accommodate this. In addition, when considering

lending, banks are more likely to choose safer

options, for example, companies with collateral and

credit history. Likewise, investment banks are limited

by regulatory constraints. Therefore, 'safe'

investments are made by banks, but risky businesses

are left unfunded. In this regard, venture capital helps

fill in the gaps. Players in both industries can also be

distinguished, because usually, venture capital

players are sophisticated investors, that is, investors

ICOACI 2019 - International Conference on Anti-Corruption and Integrity

230

who have deep market experience and knowledge.

Usually, they are investors who also have qualified

information about technological developments.

3 RESEARCH METHODOLOGY

This research uses a qualitative approach. Research

with a qualitative approach is research that intends to

explore and understand social problems that occur by

involving questions and procedures, with data

collected from participants and analyzed inductively,

and then the researcher makes an interpretation of the

data. The purpose of this study is to describe and

describe tax incentives as a public policy aimed at

venture capital companies that invest their capital in

Indonesian digital startups and map income tax

incentives for venture capital companies in Singapore

and China.

The formulation of public policy will have an

impact or produce good results if it is based on a

rational thought process that is supported by complete

or comprehensive data or information (Hoogerwerf in

Islamy, 2004). In designing tax incentives to

encourage venture capital investment, there are

several things that the government must consider.

This can be grouped into three main categories in the

design of tax incentive features for venture capital

investment, as formulated by the European

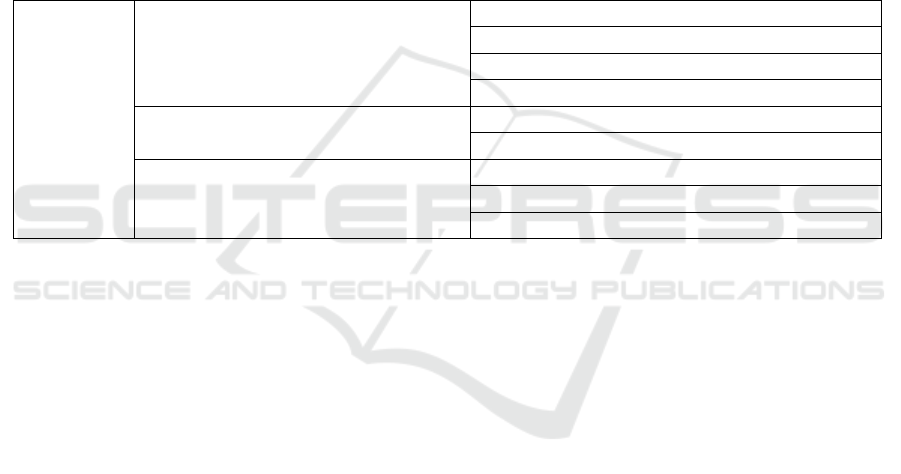

Commission (2017) in Table 1.

Table 1. Design Feature of Tax Incentive for VC Investment

Design

Feature of

Tax Incentive

for VC

Investment

Qualifying criteria for tax incentives

Business Qualification

Investor Qualification

Investment Qualification

Investment Duration

Scope of tax incentive

Form of tax incentive

The term on giving incentives at the investment stage

Ttax inccentive administration

Discretion

Monitoring fiscal costs

Monitoring the impact of providing incentives

The policy analysis set out in PMK 48/2018 in this

study will be reviewed from these three categories by

also seeing whether the provisions regarding the

scope, qualification criteria, and administration that

currently apply in PMK 48/2018 have been

formulated based on rational thought processes and

supported by comprehensive information. However,

in designing a policy, problem identification is very

basic and becomes very important for the government

to be able to take the right actions. Problems (core

problems) that are not well defined are weaknesses in

a policy (Patton and Sawicki, 1986). For this reason,

in this discussion, it is first analyzed what is

formulated by the government as a core problem in

PMK 48/2018 through the background and purpose

of its formation.

Based on the research objectives, this study is

included in descriptive research. Descriptive

research, according to Neuman (2014: 38), begins

with questions or defining issues and tries to describe

them accurately. The results of the study are detailed

descriptions of the issue or answers to research

questions. Data collection techniques used to obtain

information relevant to the problem of this study are

in-depth interviews and literature studies. In-depth

interviews were conducted with 12 informants, as

listed in Table 2.

4 DISCUSSION AND

CONCLUSION

4.1 Qualification Criteria

Esson & Zolt (2002) explained that tax incentives are

tax expenditures specifically targeted at certain types

of taxpayers or certain taxable activities. The

targeting is achieved by using qualification criteria

that explicitly limit eligibility. This is an important

part of the design of tax incentives to support the

achievement of underlying policy objectives and limit

the fiscal costs borne by the government. The design

of tax incentives for venture capital must be targeted

at companies with certain criteria. The investor

qualification criteria set out in PMK 48/2018 are

Venture Capital Companies that are registered with

OJK and invest in certain companies, including start-

up companies. This also indicates that the business

Tax Incentive Analysis to Encourage Venture Capital Investing in Digital Start-up Companies

231

Table 2. Summary of data sources

No. of

informants

Position of informants Institution Role

1

Head of Income Tax Facilities

Subdivision

Badan Kebijakan Fiskal / Fiscal

Policy Agency

Policymakers

1

The staff of Directorate of Taxation

Regulations II

Directorate General of Taxation

/ Direktorat Jenderal Pajak

The organizer of the

formulation and implementation

of policies

1

Acting Director of Informatics

Empowerment

Ministry of Communication and

Informatics

The ministry that promotes

programs to develop the digital

industry

1

The staff of Directorate of Informatics

Empowerment

Ministry of Communication and

Informatics

1

Investment Manager

VC M

Venture Capitalist

1

Head of Investment and Venture Fund

VC M Venture Capitalist

1

Investment Officer

VC K Venture Capitalist

1

Investment Officer

VC X Venture Capitalist

1 Secretary-General Amvesindo

Venture Capital Association for

Indonesian Startups

The association consists of

venture capital companies for

startups in the technology and

other creative fields

1

Tax Researcher

Danny Darussalam Tax Center

Tax Researcher

2

Lecturer

Universitas Indonesia

Academician

qualification criteria for obtaining investment are

certain companies, including startup companies.

PMK No.48 / 2018 does not specifically target groups

of venture capital companies that invest in startup

companies. This regulation uses MSME criteria as an

eligible investment recipient qualification. The

MSME criteria used are the net sales threshold. The

PMK 48/2018 changed the threshold for UMKM net

sales as a PMV business partner that was previously

Rp. 5,000,000,000.00 (5 billion) in a year to Rp.

50,000,000,000.00 (50 billion) in a year. This change

was made because the old boundaries were obsolet.

While the figure of Rp 50,000,000,000.00 is

determined by referring to Law Number 20 of 2008

concerning Micro, Small, and Medium Enterprises. In

addition, PMK 48/2018 also explained further that the

limitation of net sales for a year is intended to be the

net income for the tax year when PMV makes capital

participation to a Business Partner Company (PPU)

or an investee company. This was previously not

regulated in KMK 250/1995. This additional

explanation is intended to avoid multiple

interpretations of whether the net sales threshold is

applied annually during the investment period or only

in the year before the investment is made.

The definition of a startup company itself

theoretically has experienced a narrowing of the

meaning of being an early stage company engaged in

technology and its close relationship with innovation.

However, no specific definition was agreed upon. In

practice in Indonesia, there is no specific regulation

governing startup companies to date. In PMK

48/2018, the definition of a startup company that is

currently indirectly agreed by the regulator is an

early-stage company that in the process of developing

its business, still needs assistance or in other words, it

is not yet mature. In addition, PMK 48/2018 states

that the conditions for utilizing dividend exclusions

apply only to PMVs that invest in PPU that have not

been listed on the stock exchange. Indirectly, this

clause incorporates the characteristics of startup

companies, because companies which take the floor

on the exchange are generally considered to have

been established or mature so that they cannot be

called startup companies. The criteria for qualifying

investment recipients do not limit the business sector

and are only limited to income limits. Refinement of

the definition of startup companies - as explained in

the theoretical framework, namely companies that

rely on technology and promote innovation in their

business, are not applied to the criteria of investee

ICOACI 2019 - International Conference on Anti-Corruption and Integrity

232

companies in PMK 48/2018. Thus, the qualification

criteria in this regulation are more general but do not

negate the definition of a startup company.

Although there are several characteristics of

MSMEs that intersect with the characteristics of

startup companies, there are differences between the

two, namely, in terms of funding sources. At present,

access to MSME capital has been easier since the

availability of People's Business Credit (KUR) in

various banks. In contrast to MSMEs, startup

companies find it difficult to accept funding through

KUR because the risks are large and usually do not

have guarantees. In addition, startup companies are

usually not funded by ordinary investors, but by

investors with knowledge of innovations and

technologies related to startup funded, or also called

sophisticated investors. Thus, funding sources are

more exclusive or limited.

Qualification criteria that limit the size of

investments that meet the requirements are not

regulated in PMK 48/2018. While the qualification

criteria in the form of duration, namely, the minimum

investment period before obtaining tax incentives is

not regulated. However, PMK 48/2018 limits the

maximum duration of incentive utilization, which is

10 years. The 10 year limit is a rational decision

because theoretically, the age of venture capital

investment is around 10 years. After this period,

venture capital companies will usually divest because

they have succeeded in increasing the valuation of the

investee company. Thus, the existence of a limit on

the use of incentives for 10 years will indirectly

encourage venture capital companies to try to

increase the company's valuation within a maximum

period of 10 years.

4.2 Scope

The scope of tax incentives is a key factor or main

determinant of the function of giving incentives, and

their selection is driven by the underlying policy

objectives. As previously explained, the incentives

provided for Venture Capital Companies are provided

in the form of an exemption from income tax on

income received or obtained by PMV in the form of

profit share from the Business Partner. These

incentives — when viewed from the types of tax

incentives according to the European Commission

(2015), are tax exemptions or tax exemptions, i.e.,

incentives provided in the form of exempting certain

tax bases from the scope of certain taxes. In this case,

tax incentives are applied on a tax basis during the

holding period, which is income in the form of profit

or dividends. According to BKF, the reason why the

form of incentives provided is the exclusion of

taxation on dividends is to restore the nature of the

venture capital business that has not been reflected in

the Indonesian venture capital industry, namely

capital participation. With the exception of dividends,

it is hoped that the venture capital industry in

Indonesia will return to its business nature.

The determination of the scope of tax incentives

is driven by the underlying policy objectives

(European Commission, 2017). If the direction of

government support is to restore the venture capital

business model in accordance with its nature and to

encourage the development of the venture capital

industry, the tax exemption on dividends will become

irrelevant. The alternative chosen by the government

is not yet in line with the policy objectives due to the

lack of a comprehensive understanding of the venture

capital business model. Soemitra (2010: 308) states

that investments made by venture capital are not

carried out in order to receive short-term dividends,

but together with investee companies to develop and

increase the valuations of investee-funded

companies. In the end, the investment must be sold,

and the capital paid back to the investor.

Theoretically, the characteristics of venture capital

compared to other types of financing are venture

capital financing that is long-term (although there is a

certain time limit), so it does not expect profits by

trading its shares in the short term, but rather targeting

the gains in the form of capital gains after a certain

period . Capital gain is the profit obtained by the PMV

when divesting from a Business Partner Company

(PPU) or investee, which arises due to an increase in

valuation from PPU. The types of income received by

venture capitalists include management assistance

fees in return for management services received from

investee companies, interest in return for productive

loans, channeling fees in return for investee

companies channeling services with investors, and

capital gains. The same thing was stated by VC X, VC

K, VC M, and Asmevindo. The main income

expected from an investee company is the capital gain

obtained when selling PPU when it has succeeded in

increasing its valuations, while income in the form of

dividends has never been received, and will be very

unlikely to be received.

The perspective of policymakers on the venture

capital business model is not based on general and

theoretical concepts. Venture capital business

activities in Indonesia are unique compared to general

practice in other countries and on a theoretical level.

Both in general practice in other countries and on a

theoretical level, venture capital is a financing

business that is carried out through equity

Tax Incentive Analysis to Encourage Venture Capital Investing in Digital Start-up Companies

233

participation. However, in Indonesia, venture capital

companies registered with OJK are more dominant in

venture capital ventures in the form of financing

transactions in the form of loans, as shown in Figure

1.

Figure 1. Percentage of Types of Business Activities of

Venture Capital Companies Registered at the Financial

Services Authority (Otoritas Jasa Keuangan) as of

December 2018

Source: Otoritas Jasa Keuangan, 2018

Compared to the core of the business of venture

capital that should be - that is, equity participation,

venture capital companies in Indonesia that are

registered with OJK are more likely to resemble

financing institutions whose characteristics are debt

financing. This type of financing is actually

accommodated by regulations issued by the FSA,

namely in POJK 35 which states that venture capital

businesses consist of equity participation,

participation through the purchase of convertible

bonds (quasi-equity participation), financing through

the purchase of bonds issued by the Spouse

Businesses at the start-up stage and/or business

development; and/or productive business financing.

The POJK 35 provides a minimum inclusion

obligation as a revitalization step, but only sets a ratio

of 15% for a minimum inclusion obligation.

Policymakers must choose the best alternative -

that is, the value of the consequences that are most

suitable (rational) with the goals that have been set

when formulating a policy (Islamy, 2004). The choice

of incentive that is not in accordance with the

characteristics of venture capital business indicates

that the current policy is not an alternative that has the

most suitable consequences for the objectives to be

achieved. The current tax incentives are not attractive

because the incentives do not reduce the distortion

caused by taxes on the venture capital business.

Taxation, in general, is explained by economists as a

distortion of business. Thus, providing convenience

or relief in the form of tax incentives can be an

investment attraction aimed at attracting as many

investors as possible to invest in Indonesia. If

dividends do not cause distortion, then tax incentives

for dividends will not provide significant investment

attractiveness. Tax incentives that are more desirable

for venture capital are incentives that can reduce

distortions arising from the taxation of capital gains

when venture capital makes an exit strategy, for

example, when selling investee companies that

already have high valuations.

4.3 Administration

Tax incentives must be regularly monitored and

evaluated in the interests of transparency, efficiency,

and fiscal control. Governments must regularly

prepare tax expense reports to measure and monitor

costs, and they must be regularly reviewed to assess

their effectiveness (European Commission, 2017).

For this reason, the government must determine and

use appropriate methodologies that can accurately

measure investment trends so that the need for public

sector interventions can be demonstrated, and the

impact of these interventions can be measured. In

PMK 48/2010, administrative requirements that must

be met to be used by the government to carry out

control and evaluation are in Article 3, which states

that venture capital companies are required to book

separately income that is an Income Tax Object and

income that is not an Income Tax Object, then

reported together with the Annual Corporate Income

Tax Notification Letter. Until now, there has been no

fiscal control to measure or monitor the use of these

incentives.

4.3.1 Tax Policy to Encourage Venture

Capital Investment in Singapore

Tax incentives in Singapore are included in the

Income Tax Act Section 13H (S13H). The S13H is

awarded after fulfilling the requirements which

require direct investment into a locally based

company and develop fund management expertise in

Singapore. Tax exemption is a type of tax incentive

that can be said to be the most "generous" because it

is given by removing the entire tax base, both

permanently and temporarily. Income from certain

investments that are exempt from tax is (1) gains

arising from divestment of approved portfolio

holdings, (2) dividends from approved foreign

portfolio companies; and (3) interest arising from the

agreed convertible loan stock.

For tax purposes, in general, VC funds in

Singapore are considered tax transparent. Taxes will

ICOACI 2019 - International Conference on Anti-Corruption and Integrity

234

be imposed on the income of each investor according

to the applicable tax rate (Singapore Venture Capital

& Private Equity Association, 2019). Thus, this tax

incentive will be applied at the investor level. Tax

exemptions on profits occur when an exit strategy is

conducted, while exceptions to dividends and interest

occur in the holding period. Theoretical and empirical

literature shows that higher tax rates on capital gains

can have a negative impact on the quantity and quality

of investments (Poterba, 1989a and 1989b,

Keuschnigg, 2004 and Keuschnigg and Nielsen,

2004a, 2004b and 2004c in European Commission,

2017). This is the basis for giving tax exemption on

capital gains. Meanwhile, the tax incentives provided

in the holding period are less relevant for venture

capital investment for early-stage companies, but the

provision of tax incentives in the holding period in the

S13H scheme becomes relevant considering the

investment targets in these incentives are not only

intended for investment in early-stage companies, but

also for investments in established companies (later

stage investment), as stipulated in the qualifications

of investee companies.

4.3.2 Tax Policy to Encourage Venture

Capital Investment in China

Tax incentives for venture capital in China are

contained in Circular 55. These tax incentives allow

venture capital investors to get tax deductions equal

to 70% of the investment provided by meeting certain

conditions. The requirements for venture capital

companies that can claim these incentives are: First,

it is established in mainland China (People's Republic

of China) and is a tax resident (in the form of a

company or partnership). Venture capital in the form

of a partnership is the subject of an examination for

tax purposes (within the framework of the verification

process), and the partnership is not owned by the

founder of the invested technology startup company.

Second, submit to the National Development and

Reform Commission (NDRC) as a venture capital

company in accordance with the Provisional

Measures in the Administration of the Interim

Measures on Supervision and Administration of

Private Investment Fund, which is officially regulated

by NDRC on November 15, 2005. The venture capital

company must also comply with article 8 (Special

Provisions relating to the Venture Capital Investment

Fund) of the Temporary Act of Supervision and

Administration of the Private Investment Fund

promulgated by the China Securities Regulatory

Commission on August 21, 2014. Third, they may not

own - together with its affiliates, 50% or more equity

in a startup company that is invested two years after

the investment (International Financial Law Review,

2018).

The investment targets in Circular 55 are

companies that are in the seed stage or startup stage

engaged in technology. Qualified investee companies

are tax-resident companies that: (1) are established in

mainland China and are subject to audits for tax

purposes, (2) at the time of investment, there are no

more than 200 employees, and at least 30% of the

tertiary education), (3) total assets or annual income

does not exceed RMB30 million ($ 4.63 million or

around 56 billion Rupiah), (4) at the time of

investment, not more than five years (60 months), (5

) is not listed on the stock exchange (domestic or

foreign) at the time of investment and for two years

thereafter; and (6) has research and development

costs of not less than 20% of the total costs and

expenses in the investment tax year.

In contrast to tax incentives in Singapore, tax

incentives for venture capital in China are more

focused on developing technology and developing

investee companies. This can be seen from the

qualification criteria of investee companies that are

limited through (1) targeting business size (limiting

the number of employees, limiting total assets, and

exceptions for listed companies), (2) company age,

and indirectly (3) sector, namely the technology

sector. Meanwhile, Singapore provides broader

qualification criteria because the policy focus is to

attract funds into the country. More specifically, the

existence of criteria for the level of employee

education and minimum requirements for the use of

research and development costs in the investment tax

year indicate the direction of this policy is to

encourage the development of innovation and

technology.

4.3.3 Alternative Tax Policy to Encourage

Venture Capital Investment in

Indonesia in Digital Startup

Companies

From the analysis of tax incentives in China and

Singapore, it can be seen that the purpose of

providing tax incentives for venture capital in China

is more relevant to the goal of establishing tax

incentives for venture capital in Indonesia as

mandated by Perpres 74 on the Roadmap for

Electronic-Based National Trade Systems which was

later realized in the PMK 48/2018, which is to support

the growth of startups. Tax incentives in Singapore

allow no taxes to be collected during the investment

period in venture funds. Singapore applies a tax

Tax Incentive Analysis to Encourage Venture Capital Investing in Digital Start-up Companies

235

incentive that is fairly "generous" because the country

needs funds going into the country, given that

Singapore's economic structure relies heavily on the

non-real sector or financial sector, in contrast to

Indonesia, which focuses on the real sector. This

affects the tax incentives provided; namely,

Singapore gives more incentives to portfolio

investment, while Indonesia is more focused on

providing incentives to direct investment, for

example, foreign direct investment in pioneering

companies.

As explained earlier, tax incentives for venture

capital in China focus more on encouraging the

development of high-tech industries and knowledge-

based economies through encouraging startup

companies to increase competitiveness and promote

sustainable growth, while providing tax incentives for

venture capital in Singapore is more aimed at

encouraging inflows and anchors of local and foreign

venture capital funds to Singapore regardless of

whether the company invested is still at the startup

stage or not. These different objectives are then

reflected in the form of incentives and specified

qualification criteria. In contrast to Singapore's core

problem, the core problem that the Chinese

government is focusing on in the Circular 55 tax

incentive instrument is the need for encouragement to

develop innovation and technology through startups

and SMEs that are directed at employment. The core

problem that has been clearly defined makes the

policy in Circular 55 formulated in accordance with

the objectives to be achieved. In contrast to

Singapore, which provides tax incentives in the form

of tax exemptions on capital gains, the Chinese

government chose the form of tax incentives in the

form of an investment allowance. There are several

things that need to be considered in designing

investment allowance: (1) investment criteria that

qualify (eligible investment), (2) the amount of

allowance given, is generally given in the form of a

percentage, (3) time period (duration) and other limits

which limits the duration of incentives that can be

utilized. The investment criteria set out in Circular 55

clearly indicate the direction of the policy

(encouraging innovation, technology, and small

companies). This can be seen from the targeting of a

business size determined by limiting the number of

employees, limiting total assets, and the exception of

companies listed on the exchange), age limits of the

company, and the business sector, namely the

technology sector.

Similar to China, the background to the idea of

creating a tax incentive scheme for venture capital in

Indonesia begins with the development of startup

companies. Since Indonesian startups began to show

growth, the government began to pay attention to the

venture capital industry by revitalizing venture

capital by imposing various regulations. In addition,

Indonesia also needs encouragement in terms of

technology and innovation. Based on a report

released by Cornell University, INSEAD, and the

World Intellectual Property Organization (2018) in its

report titled "The Global Innovation Index 2018",

Indonesia is ranked 85th. Compared to neighboring

countries, this ranking is still fairly low. Singapore

ranked 5th, Malaysia ranked 35th, Thailand, and

Vietnam ranked 44th and 45th, respectively.

Meanwhile, China itself entered the list of the 20 most

innovative countries in the report, ranking 17th. The

ranking is a representation from breakthroughs made

in overall development, especially in the economic

field. The Chinese government also now prioritizes

research and sustainable development.

4.3.4 Alternative Tax Policy to Encourage

Venture Capital Investment in

Indonesia in Digital Startup

Companies

From the analysis of tax incentives in China and

Singapore, it can be seen that the purpose of

providing tax incentives for venture capital in China

is more relevant to the goal of establishing tax

incentives for venture capital in Indonesia as

mandated by Perpres 74 on the Roadmap for

Electronic-Based National Trade Systems which was

later realized in the PMK 48/2018, which is to support

the growth of startups. Tax incentives in Singapore

allow no taxes to be collected during the investment

period in venture funds. Singapore applies a tax

incentive that is fairly "generous" because the country

needs funds going into the country, given that

Singapore's economic structure relies heavily on the

non-real sector or financial sector, in contrast to

Indonesia, which focuses on the real sector. This

affects the tax incentives provided; namely,

Singapore gives more incentives to portfolio

investment, while Indonesia is more focused on

providing incentives to direct investment, for

example, foreign direct investment in pioneering

companies. Gunadi, in an in-depth interview, also

explained the same thing, that Indonesia was indeed

not focused on the financial sector because the sector

was not Indonesia's superiority. In addition,

according to him, this tax exemption will only benefit

people with high income (high net worth individuals).

As explained earlier, tax incentives for venture

capital in China focus more on encouraging the

ICOACI 2019 - International Conference on Anti-Corruption and Integrity

236

development of high-tech industries and knowledge-

based economies through encouraging startup

companies to increase competitiveness and promote

sustainable growth, while providing tax incentives for

venture capital in Singapore is more aimed at

encouraging inflows and anchors of local and foreign

venture capital funds to Singapore regardless of

whether the company invested is still at the startup

stage or not. These different objectives are then

reflected in the form of incentives and specified

qualification criteria. In contrast to Singapore's core

problem, the core problem that the Chinese

government is focusing on in the Circular 55 tax

incentive instrument is the need for encouragement to

develop innovation and technology through startups

and SMEs that are directed at employment. The core

problem that has been clearly defined makes the

policy in Circular 55 formulated in accordance with

the objectives to be achieved. In contrast to

Singapore, which provides tax incentives in the form

of tax exemptions on capital gains, the Chinese

government chose the form of tax incentives in the

form of an investment allowance. There are several

things that need to be considered in designing

investment allowance: (1) investment criteria that

qualify (eligible investment), (2) the amount of

allowance given, is generally given in the form of a

percentage, (3) time period (duration) and other limits

which limits the duration of incentives that can be

utilized. The investment criteria set out in Circular 55

clearly indicate the direction of the policy

(encouraging innovation, technology, and small

companies). This can be seen from the targeting of a

business size determined by limiting the number of

employees, limiting total assets, and the exception of

companies listed on the exchange), age limits of the

company, and the business sector, namely the

technology sector.

Similar to China, the background to the idea of

creating a tax incentive scheme for venture capital in

Indonesia begins with the development of startup

companies. Since Indonesian startups began to show

growth, the government began to pay attention to the

venture capital industry by revitalizing venture

capital by imposing various regulations. In addition,

Indonesia also needs encouragement in terms of

technology and innovation. Based on a report

released by Cornell University, INSEAD, and the

World Intellectual Property Organization (2018) in its

report titled "The Global Innovation Index 2018",

Indonesia is ranked 85th. Compared to neighboring

countries, this ranking is still fairly low. Singapore

ranked 5th, Malaysia ranked 35th, Thailand, and

Vietnam ranked 44th and 45th respectively.

Meanwhile, China itself entered the list of the 20 most

innovative countries in the report, ranking 17th. The

ranking is a representation from breakthroughs made

in overall development, especially in the economic

field. The Chinese government also now prioritizes

research and sustainable development.

REFERENCES

Abdurachman, A. (1963). Ensiklopedia Ekonomi,

Keuangan dan Perdagangan. Jakarta: Yayasan

Prapancha.

Easson, Alex dan Zolt, Eric. (2002). Tax Incentives.

Washington DC: World Bank Institute.

Gerken, Louis C., dan Wesley A. Whittaker. 2014. The

Little Book of Venture Capital Investing. New Jersey:

John Wiley & Sons, Inc.

International Financial Law Review. 2018, 4 Juli. How

China nurtures VC investments. London: Euromoney

Institutional Investor PLC

Isaksson, Anders. (2006). Studies on The Venture Capital

Process. Umeå: Umeå University

Islamy, Irfan. (2004). Prinsip-Prinsip Perumusan

Kebijaksanaan Negara. Jakarta: PT. Raja Grafindo

Persada

Klonowski, Derek. (2010). The Venture Capital Investment

Process. New York: Palgrave Macmillan.

Neuman, W. Lawrence. (2014). Social Research Methods:

Qualitative and Quantitative Approaches (7th ed).

Boston: Pearson Education Limited

Rivai, Veithzal., dan Idroes. (2007). Bank and Financial

Institution Management. Jakarta: PT Raja Grafindo

Persada

Shome, Parthasarathi. (1995). Tax Policy Handbook.

Washington D.C: International Monetary Fund.

Soemitra, Andri, 2010. Lembaga Keuangan Syariah &

Bank. Jakarta: Kencana Prenada Media Group.

Singapore Venture Capital & Private Equity Association,

2019. Setting Up PE and VC Funds in Singapore.

Diakses dari

https://www.svca.org.sg/assets/upload/toolkit/pdf/Setti

ng_Up_PE_and_VC_Funds_in_Singapore_(Ver_26-3-

2019).pdf pada 10 Mei 2019

European Comission. (2017). Effectiveness of Tax

Incentives For Venture Capital And Business Angels

To Foster The Investment of Smes And Start-Ups.

Diakses dari

https://ec.europa.eu/taxation_customs/sites/taxation/fil

es/final_report_2017_taxud_venture-capital_business-

angels.pdf pada 27 Desember 2018

Gaujard, C. (2008). An innovative organization in a context

of ruptures: a french ict start-up ideal type. Journal of

Innovation Economic, 45(1).

Holland, D. and Vann, R. J. (1998). Income Tax Incentives

for Investment. in: V Thuronyi (ed.), Tax Law Design

and Drafting. Volume 2. International Monetary Fund:

2–9.

Tax Incentive Analysis to Encourage Venture Capital Investing in Digital Start-up Companies

237

Maynard, Therese., Warren, Dana M., dan Trevino,

Shannon. (2010). Business Planning: Financing the

Start-Up Business and Venture Capital Financing. New

York: Aspen Publishers

Patton, CV., dan Sawicki, DS. (1986). Basic Methods of

Policy Analysis and Planning. Prentice Hall,

Englewood Cliffs

Skala, Agnieszka. 2019. Digital Startups in Transition

Economies: Challenges for Management,

Entrepreneurship and Education. Swiss: Springer

Nature Switzerland AG.

ICOACI 2019 - International Conference on Anti-Corruption and Integrity

238