Income Tax Rates Increase Policy of Tire Industry Imports

Siti Mahdya Wardah, Adang Hendrawan, and Milla Sepliana Setyowati

Department of Fiscal Administration Science, Faculty of Administration Science, Universitas Indonesia,

Keywords Tax Rate Policy, Tire Industry, Import

Abstract: In 2018, there was a weakening of the trade balance which also caused the current account deficit. To

overcome this problem the government then issued a number of policies to strengthen the stability of the

rupiah, such as an increase in the Income Tax (income tax) tariff on imports in PMK No. 110 / PMK.010 /

2018. One of the industrial objects affected by the tariff increase in Article 22 of the income tax on imports

is the tire industry. His study raises the issue of regulations governing tire import provisions, which before

PMK No. 110 / PMK.010 / 2018, there is a Minister of Trade Regulation No. 6 of 2018 which was allegedly

had the opposite effect of suppressing imports. The purpose of this study was to determine the analysis of

changes and policy implications of the increase in Article 22 income tax on imports. The concepts used

include the concept of tax policy, tax rate policy, income tax, withholding tax system, tax credit, international

trade, and imports. The research approach used is qualitative with descriptive research type. The results

showed that the purpose of the policy change was to consider more regular functions and be regulated based

on the criteria for the types of consumer goods. In addition, the perceived implication for the government is

an increase in the receipt of Article 22 Income Tax and the return of recommendations in the Regulation of

the Minister of Trade No. 05 of 2019. Then the implications for importers who are expected to disrupt the

company's cash flow and increase the psychological burden of taxpayers have not been so influential.

1 INTRODUCTION

The rubber industry, rubber, and plastic goods are one

type of non-oil and gas processing industry in

Indonesia which has a competitive advantage

compared to other countries. The prospect of the

rubber industry in Indonesia is very potential, so the

Ministry of Industry based on the National Industrial

Development Master Plan establishes the rubber

industry as one of the priority sectors in 2015-2019.

Indonesia, which is one of the main countries

producing natural rubber, has problems in absorbing

domestic natural rubber consumption to produce an

added value of goods. In the Master Plan for the

Acceleration and Expansion of Indonesia's Economic

Development (MP3EI, 2011), the use of natural

rubber in Indonesia is absorbed mainly by the tire

industry, which consists of 4-wheeled wheels, 2-

wheeled tires, retreaded tires, and bicycle tires. Four-

wheeled tires occupy the top position with a share of

rubber used as much as 31%. The use of natural

rubber which is dominated by the tire industry sector

is in line with the use of natural rubber in the

downstream industry that is profitable because the

Indonesian tire industry has a competitive advantage

with an adequate supply of raw materials.

The national tire industry is one of the mainstay

industries of the government with an average tire

industry growth of 7 to 8 percent per year. In addition,

in terms of exports, the tire industry is also very

reliable because of all the total production, 70 percent

is aimed at the export market, and the export value

could reach the US $ 1.5 billion in 2012. Prior to

2018, the domestic tire industry experienced an

increase in tire production used to fill the national

market as well as overseas expansion. With the

import value can be reduced to 56, this is one of the

achievements of the tire industry which is quite

encouraging supported by Regulation of the Minister

of Trade (Permendag) Number 77 / M-DAG / PER /

11/2016 Regarding the Provisions on Tire Import

which take effect on January 1, 2017. However, at the

beginning of 2018, domestic tire industry activities

also began to drop which was alleged since the

issuance of Regulation of the Minister of Trade No.

06 of 2018 concerning Amendments to the

Regulation of the Minister of Trade No. 77 / M-DAG

/ PER / 11/2016 Regarding Provisions on Tire

Wardah, S., Hendrawan, A. and Setyowati, M.

Income Tax Rates Increase Policy of Tire Industry Impor ts.

DOI: 10.5220/0009402702570267

In Proceedings of the 1st International Conference on Anti-Corruption and Integrity (ICOACI 2019), pages 257-267

ISBN: 978-989-758-461-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

257

Imports. Until the second quarter of 2018, this tire

import activity has reached US $ 350 million which

increased more than 100% compared to the same

period in the previous year, US $ 150 million.

One of the policies in the Regulation of the

Minister is that in the process of importing tires, the

checking no longer has to go through the Directorate

General of Industry, Chemical, Textile and

Miscellaneous Ministry of Industry, but only through

the Director General of Foreign Trade at the Ministry

of Trade. The policy intended for the acceleration of

exports and imports is actually considered by

employers as a form of convenience for importers

because they are given leeway in conducting checks

on imports. In addition, in response to the weakening

of the trade balance in 2018 which later became one

of the causes of the current account deficit (CAD) in

the second quarter of 2018 to become a deficit, the

government issued a policy of increasing Article 22

Income Tax rates in PMK No. 110 / PMK.010 / 2018

in September 2018. The government added several

objects that were affected by the increase in Article

22 income tax tariffs, one of which was tire as one of

the objects in PMK No. 110 / PMK.010 / 2018 which

on tire imports is subject to a 200% tariff increase,

from 2.5% to 7.5%. Tariff adjustment in the tire

industry which is intended to deal with imports as

stipulated in PMK No. 110 / PMK.010 / 2018 is

interesting to study because, in addition to the

renewal of the Minister of Trade Regulation in the

same year, it is considered to have the opposite effect

of suppressing imports, the government also responds

to these conditions by raising Article 22 income tax

(income tax) on imports. In theory, the imposition of

Article 22 Income Tax that is not final is not a burden

for taxpayers and is not charged to customers,

because Article 22 income tax that has been paid can

later be used as a deduction or tax credit for the

income tax payable.

Based on the description, in order to further study

concerning the amendment to the increase in the

income tax rate policy article 22 of the income tax law

on imports, the main problem in this study is:

1. How is the analysis of the policy change in the

increase of income tax Article 22 tariffs on

imports in the tire industry in the Minister of

Finance Regulation No. 110 / PMK.010 / 2018?

2. What are the policy implications of the increase

in the Article 22 income tax tariff on imports in

the tire industry in the Minister of Finance

Regulation No. 110 / PMK.010 / 2018?

2 THEORITICAL REVIEW

2.1 Fiscal Policy

Public policy according to Carl Friedrich in Santoso

(2012, p. 35) is a collection of actions by governments

that have goals and have a direction to achieve the

goals and objectives that have been set previously.

Among the public policies governed by the

government is the policy regarding government

expenditure and revenue. This policy is usually

referred to as fiscal policy. Fiscal policy in Rahayu

(2010, p. 1) is a policy in the form of adjustments in

the field of government expenditure and revenue in

an effort to improve economic conditions and

conditions. According to R. Mansury (1999, p. 1),

fiscal policy in the broadest sense is the policy of

influencing community production, employment

opportunities and inflation using instruments in the

form of tax collection and expenditure on the state

budget. Meanwhile, if viewed narrowly, fiscal policy

is a policy that relates in determining what can be a

tax base, who can be taxed and who is excluded, what

is the object of taxation and what is excluded, how to

regulate the amount of tax owed to how to regulate

procedure for carrying out tax payable. In Musgrave

(1989, p. 6) it is mentioned that fiscal policy is

divided into 4 (four) functions, namely the allocation

function, distribution function, stabilization function,

and regulation function.

2.2 Tax Policy

Tax according to Adriani as quoted in Brotodihardjo

(1993, p. 2) is interpreted as contributions to a state

that can be forced, which is owed to people who are

obliged to pay it according to regulations by not

getting contra (direct), which is appointed directly

and is useful for finance public expenditure related to

the task of the government or the state in carrying out

government activities. According to Marsuni (2006,

p. 37), when viewed in terms of juridical and

economic aspects in the study of public policies, tax

fulfills the elements contained in the policy because it

has 2 (two) functions, namely the budgetair function

and the regularend function. However, specifically

Sommerfield, Anderson and Brock in Rosdiana

(2012, pp. 44-45) suggest that there are five tax

functions, namely raising revenues, economical price

stability, economic growth, and full employment,

economic development, and wealth distribution.

ICOACI 2019 - International Conference on Anti-Corruption and Integrity

258

2.3 Tax Rate Policy

There are several kinds of notions of tariffs in the field

of business economics as explained in Purwito (2009,

pp. 197-198), namely Ad valorum rates, specifics,

compound rates, antidumping, retribution rates,

differential rates, and preference rates. Meanwhile, in

Marsyahrul (2005, pp. 6-7), the types of tax rates are

divided into 4 (four), namely proportional rates,

progressive rates, degressive rates, and fixed rates.

Rosdiana (2012, p. 90) in her book stated that in

determining the tax rate policy, careful consideration

must be given in determining the amount of tax,

which not only takes into account the marginal tax

rate, but also the effective tax rate. This is done so that

the determination of the tax rate does not distort

someone's choice to work and make someone choose

to relax. Therefore, increasing tariffs or setting high-

income tax rates may not necessarily increase state

revenue, but can also reduce state revenue.

2.4 Income Tax

Understanding income tax in Resmi Siti (2007, p. 74)

is a levy that is formally made aimed at people who

earn or on income received or obtained in a period or

period of tax year provided for the interests of the

state and the community in national life and having a

state as an obligation. Then Gunadi (2013, p. 296)

defines income tax as a tax that is imposed on income

in the framework of the ability to pay (ability to pay).

Mansury (1996, p. 1) mentions the definition of

income that can be taxed must have 5 elements,

namely additional economic capabilities, income

received or obtained by taxpayers (using cash basis or

accrual basis), originating from Indonesia or from

outside Indonesia , is used for consumption or is used

in giving wealth, as well as by any name and form.

The point is that the determination of income is based

on the actual economic nature and does not depend on

the juridical form used by the Taxpayer.

2.5 Witholding Tax System

According to Nurmantu (2003, pp. 106-107), a hybrid

system or commonly referred to as withholding

system is a taxation system in which a third party or

commonly referred to as a witholder is given an

obligation or is regulated in taxation laws to deduct

income tax from income paid by the taxpayer. This

withholding system has several advantages. As cited

in Rosdiana (2012, p. 109), the first advantage is that

withholding makes a significant contribution to state

revenue. There is an imposition of withholding in the

process of import trade, one of which is widely

applied by developing countries. Keen (2008, p.

1895) states that there are two main points to the

application of withholding in developing countries

that need to be emphasized. First, when the

application of taxes on imports in recent times has

become a concern due to the issue of trade

liberalization for many developing countries. In this

case, the withholding tax on imports takes the form of

a tax paid at the beginning to later be charged to

domestic sales. Then the second is there is little

evidence of the extent to which the withholding

system actually reaches informal traders or vice

versa, where in practice payments withholding are

credited or returned to compliant taxpayers.

2.6 Tax Credits

Tax credits are a concept for subtracting certain

values from taxes owed in the current year. Soemitro

(2004, p. 73) in this case explained that the tax credit

takes into account several things, namely taxes that

have been deducted or collected by third parties, taxes

that have been paid for themselves during the year

and taxes that have been owed or have been paid

abroad, with income tax payable by the taxpayer. The

tax credit is divided into two types, namely

refundable and non-refundable (Smith, Hasselback,

& Harmelink, 2016). In the refundable type, if the

nominal tax credit is greater than the tax payable, the

excess tax credit can be returned to the taxpayer. But

on the contrary, for non-refundable types, taxpayers

will not get excess if the tax credit is greater than the

tax payable.

2.7 International Trade

International trade in Purwito and Indriani (2014, p.

1) is a type of activity related to trade between one

place and another, which crosses the regional

boundaries of a country and is interdependent by

applying rules traditionally, bilaterally, regionally or

internationally agreed rules in agreements in a global

agency or organization. This trading activity is a

source of a very large and significant contributor to

the growth of Gross Domestic Product (GDP) and

growth in the economic, social to political fields of a

country (Purwito M. A., 2009, p. 4).

2.8 Import

In Purwito (2014, p. 10), the import is the activity of

importing goods into customs areas; both activities

carried out by individuals or entities carried by means

Income Tax Rates Increase Policy of Tire Industry Imports

259

of transport and crossing national borders for which

this causes the fulfillment of customs obligations such

as paying import duties and taxes in the framework of

imports. In relation to imports, there are several types

of import constraints as revealed by Anindita (2008,

pp. 33-41), namely, import tariffs and import quotas.

Barriers in the form of import tariffs are the most

recent and obvious trade barriers, but simple and

clear. An import tariff is a fixed amount per unit

(specific tariff) or a fixed percentage of the price of

imported goods.

3 RESEARCH METHODS

The research approach used in this study is a

qualitative approach. In Cresswell (2009, p. 59),

qualitative research is research based on assumptions

and the use of theoretical frameworks which then

shape or influence the study of a problem imposed by

individuals or groups on a social problem. Data

collection techniques are qualitative using literature

study and data collection through in-depth interviews

with the Fiscal Policy Agency, the Directorate

General of Customs and Excise, the Directorate

General of Taxes, the Ministry of Trade, the Ministry

of Industry, academics, the Association of the

Indonesian National Association of Importers and the

Association Indonesian Tire Company (Neuman,

2014, p. 466). The data analysis technique used is

qualitative data analysis techniques by collecting data

from data collection techniques in the form of

verbatim or interview transcripts.

4 DISCUSSION

4.1 Analysis of Policy Changes to

Increase in Article 22 of the Income

Tax Rate on Imports in the Tire

Industry

4.1.1 Analysis of Changes to Article 22 of

the Income Tax Rate on Imports

2018 returns to the year of weakening the non-oil and

gas trade surplus, specifically until the second

quarter. Compared to the same quarter in the previous

year, the decline in non-oil and gas surpluses and the

increase in oil and gas deficit was almost double. The

trade transaction deficit then results in a current

account deficit or current account deficit (CAD) in

the second quarter of 2018. The current account

deficit reaches 3% of Gross Domestic Product (GDP)

or calculated at the US $ 8 billion and is also an

achievement of the current account in 4 years lastly.

Because one of the factors of the current account

deficit is that it is important to import non-oil and gas

goods, the government then issued a fiscal policy as a

tool to improve imports. Article 22 of the importance

stated in the Regulation of the Minister of Finance

(PMK) No. 110 / PMK.010 / 2018. Previously, the

government had issued a similar policy in PMK No.

175 / PMK.011 / 2013. With a more similar

background, namely the deficit at the time of trade, an

increase in Article 22 income tax tariffs in 2018

further on attractions in kind according to the

Harmonization System (HS) Code with three fare

flights which is from 2.5% to 7.5%, 2.5% to 10% and

7.5% to 10%. Article 22 discusses due to the

development of needs and changes in people's

lifestyles on consumer goods. The previous policy

could not be done before.

The issuance of the policy response to suppress

imports in the form of an increase in Article 22 of the

Income Tax rate on imports actually becomes its own

question given how the nature of Article 22 Income

Tax is theoretically not final. Where, for this matter,

Article 22 Income Tax is not a direct burden for

taxpayers and cannot be charged to consumers. This

is because Article 22 Income Tax that has been paid

can later be used as a deduction or tax credit on

Income Tax payable at the end of the tax year. Even

the taxpayer can take back the income tax through the

restitution process if it turns out that until the end of

the year, there is more tax. However, this policy turns

out to be more targeted at the cash flow side of the

importing company, where an increase in tariffs on

Article 22 Income Tax will cause the company to bear

the initial funds to pay Article 22 income tax on

imports at the beginning of production. So, the

purpose of the government to adjust Article 22

income tax policy by increasing the tariff of some tax

objects is to carry out the regulating function or

regularend.

Meanwhile, in determining the amount of Article

22 income tax tariffs on imports to 7.5% and 10%,

there is no specific calculation because in this case,

the increase in Article 22 income tax rates aims to

regulate or put more emphasis on the regularend

function. This then becomes reasonable if it says the

tax rate can be charged higher so that the income on

the tax decreases. The decline in income from Article

22 income tax will later indicate decreased import

trade activities which means the tax function as a

regulator can be said to be successful. However, in

contrast to the regularend function, if the tax rate

ICOACI 2019 - International Conference on Anti-Corruption and Integrity

260

increase is intended to increase revenue or prioritize

the budget function, then to determine the tariff, in

this case, must consider carefully by looking at the

effective tax rate and marginal tax rate as set out in

the form of a laffer curve. Based on the theory formed

by the laffer curve, if the higher the tax rate, at some

level of the tariff at the beginning can cause income

on tax to increase. However, in this laffer curve, there

is an optimum point where precisely when the tariff

increases again above the optimum point, the income

on taxes will actually reverse. So, again as the initial

statement, if the purpose of the tariff adjustment is for

the function of the budgeter, then the selection of the

tariff rate must pay attention to its optimum point.

However, if for the regular function as in this case,

the tax rate can be raised as high as possible so that

tax revenue decreases which are directly proportional

to the decline in imports. If illustrated in the laffer

curve, the tariff determination of 7.5% and 10%

should have exceeded the optimum point, where by

passing the optimum point, the expected impact

would be to decrease income from Article 22 Income

Tax on these imports.

4.1.2 Analysis of Determination of Tires as

One of the Objects in the Income Tax

Rate Increase Article 22 Policy on

Imports

There are 1,147 types of goods which are subject to

an increase in Article 22 Income Tax. From 1,147,

types of goods are then divided into three groups of

types of tariffs, namely:

1. 1,719 types of goods that experienced an

increase from 2.5% to 7.5%.

2. 218 types of goods have increased from 2.5%

to 10%.

3. 210 types of luxury goods increased from 7.5%

to 10%.

Tires are one of the objects experiencing an

increase in Article 22 income tax tariff from 2.5% to

7.5%. In PMK No. 110 / PMK.010 / 2018, there are

26 HS Code types of tires, namely from HS

4011.10.11 to 4013.90.99, which are included as

tariff increase objects. Apart from the fact that tires

are one of the types of consumer goods, another

reason that the tires entered into the object of

increasing Article 22 of the Income Tax rate to 7.5%

is due to a surge in imports in early 2018 that reached

more than 100%. In fact, if compared to previous

years, this tire can be said to be successful in

suppressing imports by up to 50%. One of the causes

of the increase in import figures was that it was

allegedly due to the policy of eliminating import

recommendations from the Ministry of Industry as

stated in the Minister of Trade Regulation No. 6 of

2018 concerning Provisions on the Import of Tires.

The regulation of simplification issued by the

Minister of Trade actually triggers imports to rise.

However, in general, the increase in imports of tires

was not only influenced by the removal of

recommendations and shifts in the inspection. There

are several other factors which are allegedly causing

an increase in imports in early 2018 such as an

increase in imports that can also occur because in the

country there is an increase in the automotive

industry. The report of an increase in the industry

would certainly cause the need for tires as one of the

automotive components to increase.

Although it is not the only factor that can increase

imports, giving import recommendations to importers

in carrying out their activities is an important urgency

to pay attention to the government concerned.

Especially if it turns out that the policy issued by the

government can actually distort the effectiveness of

other government policies that cause dispute. The

technical ministry which deals with tire imports,

namely the Ministry of Industry, is more aware of the

condition of the tire industry, industry needs, and

domestic tire production. With the recommendation,

the technical ministry can have consideration

regarding the number of domestic tire needs that can

be imported. So, because the ministry has a mapping

of the number of needs and the number of imported

goods, the condition of more imported goods in the

country that can kill this industry should be

prevented.

With regard to this phenomenon, finally, the

policy on this recommendation was reviewed and

reviewed so that in December 2018, the government

re-issued Permendag No. 117 of 2018 concerning the

Second Amendment to the Minister of Trade

Regulation No. 77 / M-DAG / PER / 11/2016

Regarding Provisions on the Import of Tires. In

Permendag No. 117 In 2018, giving

recommendations back into force and supervision

returned to the border. Based on Agus, Secretary

General of APBI, to avoid a long quilling time, the

supervision was also moved to the Bonded Logistics

Center. However, despite that, by continuing to

simplify the administration of importers, the

government which in this case is the Ministry of

Industry and integrated with INSW and INA-Trade

(Ministry of Trade) created a system for submitting

recommendations online. Then, because of the

absence of regulations regarding the transition period

for the treatment of importers who import while

applying rules of trade ministry (Permendag) No. 6 of

Income Tax Rates Increase Policy of Tire Industry Imports

261

2018, where the recommendation was abolished until

finally it was obliged to return, then Permendag No.

117 of 2018 was amended again in the third

amendment to Permendag No. 05 of 2019.

4.2 Implications of Policy Changes to

Increase in Article 22 of the Income

Tax Rate on Imports

4.2.1 Implications of Policy Changes to

Increase in Article 22 of the Income

Tax Rate on Imports for the

Government

The government, which in this case acts as a policy

maker, stresses that the policy of increasing the tax

rate is more focused on the regularend function or

entering the tax function as an instrument of

development policy, as stated by Rosdiana. The

policy of increasing the tax rate is a tool to distort

economic activity that is not expected by the

government, especially on imports. With the tax rate

being raised, the government is trying to hamper

growth in imports due to the high trade balance deficit

in 2018 and to encourage domestic industries that are

supported by incentives and facilities to encourage

the sector.

Although the increase in tax rates will also have

an impact on increasing tax revenues, particularly

income tax article 22, the government does not focus

on these revenues. Additional revenue due to the

increase in tariff is only as excess or excess as a side

effect because the main impact expected by the

increase in tax rates is to be able to reduce imports

that will enter Indonesia, not to increase revenue from

the income charged as article 22.

Table 1 Outgrowth of Non-Oil and Gas income tax 2014-2018 (in trillion rupiah)

Description

2014 2015 2016 2017 2018

LKPP LKPP LKPP LKPP LKPP

Income Article 21 of the income tax law 105.7 114.5 109.6 117.8 150.5

Income Article 22 of the income tax law 7.3 8.5 11.4 16.2 15.6

Income Article 22 on imports of the income tax

law

39.5 40.3 38.0 43.2 52.1

Income Article 23 of the income tax law 25.5 27.9 29.1 34.0 39.7

Personal Income Article 25/29 of the income

tax law

5.6 8.3 5.3 7.8 7.3

Corporatr Income Article 25/29 of the income

tax law

148.4 183.0 169.7 206.6 230.6

Income Article 26 of the income tax law 39.4 42.2 36.1 43.7 49.2

Final and Fiscal income tax income 87.3 119.7 117.7 106.3 160.5

Other Non-Oil and Gas income tax income 0.1 0.2 104.2 12.1 0.2

TOTAL 458.7 552.6 630.1 596.5 705.8

Source: Ministry of Finance, in the 2019 RAPBN Financial Note (reprocessed, 2019)

In table 1 above it can be seen that the

development of non-oil and gas income tax from

2014 to 2018 has increased. For Income Tax Article

22 on imports themselves, since 2014 experienced an

increase in fluctuation up to 2018. Although it had

decreased by Rp 2.3 trillion in 2016, in 2017 Article

22 Income Tax on imports again increased. The

increase in Article 22 Income Tax on imports, in

addition to the increase in tariffs that occurred in 2018

also indicates an increase in imports of objects subject

to Income Tax Article 22.

There are several factors that can reduce import

figures. With regard to tires, the import figures which

tend to remain volatile despite the policy increase in

Article 22 of the Income Tax rate of 200%, ie, from

2.5% to 7.5% can be caused by one of them due to the

abolition of recommendations at the beginning of

2018. In addition, the increase in imports also occurs

because there are several types of tires that still cannot

be produced domestically. Imported goods are

generally goods that are not yet available in

Indonesia, such as tires for trucks, radial tires to tires

for imported cars that differ in specifications from

public tires. There are still many types of tires that

cannot be produced until the domestic supply is

limited, causing many imported tires to enter

Indonesia. In addition, the domestic price factor,

which is far more expensive than the price of

imported tires, also influences the number of

imported tires entering Indonesia.

From the above statements, a red thread can be

drawn that the implications of the policy change in

the increase in Article 22 of the Income Tax rate on

imports for the government until the end of 2018, in

ICOACI 2019 - International Conference on Anti-Corruption and Integrity

262

general, is a decline in the overall value of imports of

1,147 types of goods and a slowdown in the

realization of income tax article 22 on imports.

However, specifically for the tire industry, the import

figures actually fluctuate to increase so that it also has

implications for the additional income of Article 22

Income Tax, although not significant in number.

Therefore, it can be said that the increase in Article

22 income tax tariff on imports is only one of the

many tools that affect it. There are also other policies

needed to strengthen the aim of suppressing imports.

4.2.2 Implications of Policy Changes to

Increase in Article 22 of the Income

Tax Tariff for Importers

Article 22 of Income Tax Law is a type of tax that can

become a credit at the end of the tax year as Article

25/29. These taxes are taxes paid upfront during the

year for the income tax that was just outstanding at

the end of the tax year. Article 22 Income Tax is

refundable, where if at the end of the tax credit year

has a nominal greater than the amount of tax owed,

the excess of the tax credit can be returned to the

taxpayer.

However, it turns out, the government's goal in

issuing a policy to suppress imports is to influence the

company's cash outflows or cashflow due to the need

for initial funds to pay Article 22 Income Tax on

imports at the beginning of production becomes

greater. The existence of disruption in cash flow is

expected to be one way to reduce imports where there

are additional costs borne by the Taxpayer by

preparing cash in advance to pay the Article 22

Income Tax so that it becomes greater than the

previous tariff policy.

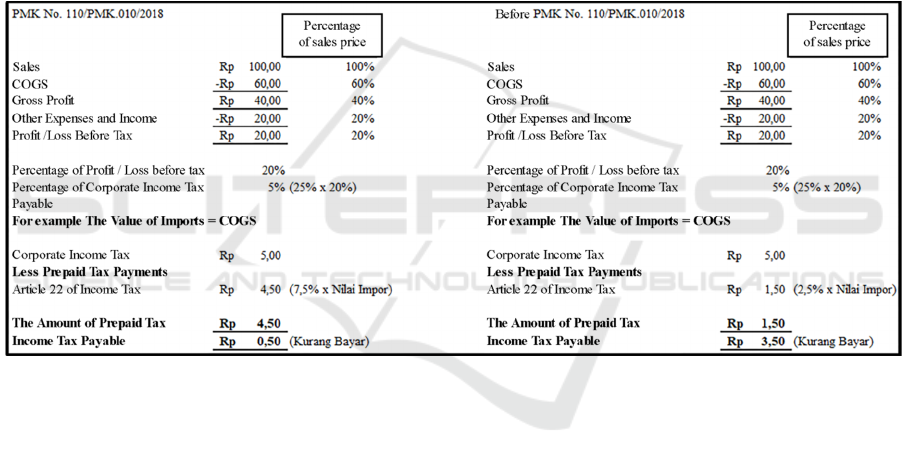

Figure 1: Illustration of Article 22 Income Tax Calculation on Imports

Source: has been reprocessed, 2019

In Figure 1, an illustration can be seen as an

example of the implications of changes in Article 22

income tax rates on imports. The same profit shows

the amount of Rp. 20 and there is a Corporate Income

Tax expense of Rp. 5, for income tax Article 22 there

is a difference if using the old tariff, which is 2.5%

and the tariff is in accordance with PMK No. 110 /

PMK.010 / 2018, which is 7.5%. Assuming the

import value is equal to the total cost of goods sold,

there is a difference in the magnitude of Article 22

income tax, which for those subject to a tariff of 7.5%,

the total income tax Article 22 for imports is Rp. 4,5

and Rp. 1.5 for 2.5% tariff. Although it can be

credited at the end of the tax year so that Article 22

Income Tax on imports that have a 7.5% tariff tends

to have a lower year-end tax liability compared to the

amount of Article 22 Income Tax on imports that

have a 2.5% tariff, where the final tax payable year

still greater amount of tax Pay Less.

In addition to hampering cash flow, this Article 22

income tax is also projected to create a psychological

burden on taxpayers. Psychological burdens in Lopes

and Martins (2013, p. 54), these burdens include

anxiety, stress, and affect emotions that occur when

taxpayers relate to tax authorities. Complex taxation

systems and the uncertainty of taxation law can

increase the psychological burden. On the other hand,

some taxpayers work around this by using the

services of consultants to reduce psychological

burdens, so that these burdens are shifted into the

financial burden of taxpayers.

Psychological burden as one of the costs in

compliance costs referred to herein is an

administrative burden, where there is a threat for

Income Tax Rates Increase Policy of Tire Industry Imports

263

taxpayers to be subject to tax audits because of the

possibility of a tax credit, in this case, one of Article

22 Income Tax on imports by 7.5%, exceeding the

margin or company profits that cause the company to

experience overpaid conditions.

Figure 2 Illustration of Calculation of Percentage of

Corporate Income Tax and Article 22 of Income Tax on

Imports

Source: has been reprocessed, 2019

If compared to Figure 2, to avoid the potential for

Overpayment conditions, it is necessary to have a

more detailed calculation of the amount of margin or

net profit obtained by the company. Can be seen in

Figure 2, there is a calculation of what the minimum

net profit percentage is compared to the total sales by

the percentage of import value. In this calculation, it

is known that if the value of imports of imported

goods, which in this case is tiring, amounts to 60% of

the company's total sales, then the company must

have at least a minimum net profit percentage of 18%

of total sales. This was circumvented so that at the end

of the tax year at least the tax owed would be zero and

not cause more pay. This calculation is based on the

current Corporate Income Tax rate, which is 25% and

Article 22 income tax tariff on imports in the tire

industry that is currently in force, which is 7.5%.

Table 2 Illustration of Calculation of Tax Percentage on Import Value and Net Income

Article 22 Income Tax rate of 7.5% Article 22 Income Tax rate of 2.5%

Import Value Net Income Difference Import Value Net Income Difference

60% 18% 70% 60% 6% 90%

50% 15% 70% 50% 5% 90%

10% 3% 70% 10% 1% 90%

Ratio 3.3 : 1 Ratio 10 :1

Source: has been reprocessed, 2019

Then in table 5.4, there is also an additional table

that shows the results of the example of each

calculation if the import value is assumed to be 60%,

50%, and 10%. Based on these import values, the

minimum net profit so that the tax at the end of the

year at least becomes zero is 18%, 15%, and 3% for

the Corporate Income Tax rate of 25% and Article 22

of Income Tax of 7.5%. When compared to the table

showing Article 22 income tax rates of 2.5%, with the

same import value and calculation as in Figure 5.4,

the minimum net income is 6%, 5%, and 1%,

respectively.

After reviewing, for Article 22 income tax rates

that are subject to 7.5%, the difference between the

percentage of net profit and import value when

compared to the percentage of import value itself is

70% or with a ratio of 3.3: 1. So, in this case if the

company wants to get around so that at the end of the

tax year does not happen Pay more taxes that can

cause psychological burdens for taxpayers with an

examination, then the value of imports, which in this

case includes cost, insurance and freight (CIF) as well

as import duties and additional duties, the

determination of the percentage of net income is at

least 70% less than the percentage of the import value

of total sales or 3 times the percentage of the import

value. In this calculation, it is assumed that the tax

paid up front is limited to Article 22 Income Tax on

imports. Meanwhile, in contrast to Article 22 Income

Tax rates which are 2.5%, the difference between the

percentage of net profit and import value reaches 90%

or with a ratio of 10: 1. However, returning to the

original goal, the calculation of the percentage or ratio

of net profit above is only as a general description of

the possibility that can occur. Percentage or ratio

calculation is only a consideration for the

psychological burden that can arise from taxpayers if

there is an overpayment in the future of tax payments.

Even though there was a complaint at the

beginning of the stipulation of the Article 22 income

tax increase on imports as stated earlier, over time

since September 2018, the general importer, in this

case quoted by Tere, said that because the policy had

not been implemented for a long time, the

implications were not yet too pronounced. General

importers, in this case, continue to carry out trading

activities as usual without directly cutting the

percentage of margins or profits and income from

these imports.

5 CONCLUSION

Changes to the increase in the income tax Article 22

tariff policy on imports as stated in PMK No. 110 /

ICOACI 2019 - International Conference on Anti-Corruption and Integrity

264

PMK.010 / 2018 to suppress imports based on the

development of needs and changes in people's

lifestyles on consumer goods. Besides this regularend

policy aims to inhibit the company's cash flow or cash

flow where the importer must provide cash at the

beginning to cover the increase in income tax rates

and cause psychological burdens for taxpayers

because of the possibility of more pay at the end of

the tax year. The tire industry, as a consumer item that

has a substitute in the country, also becomes an object

subject to tariff increases. However, the change in the

policy on the increase of Article 22 income tax tariff

on imports for the tire industry as one of the tax

objects has not been felt because of the nature of the

regulations that are still new, and there are still many

requests for tire imports.

The policy implications of the increase in the

Article 22 income tax tariff on imports as set forth in

PMK No. 110 / PMK.010 / 2018 of which are

implications for the government. The implication of

the policy change in the increase of Article 22 income

tax tariff on imports in the tire industry for the

government is that there is still fluctuation in tire

imports since September 2018 which causes the

receipt of Article 22 of income tax on imports

especially in the tire sector also fluctuates although

overall, the income of Article 22 income tax on

imports tend to slow down. In addition, because of the

dispute in Permendag No. 06 of 2018, the government

finally returned the conditions of recommendation

and inspection to the border as in Permendag No. 117

of 2018 which was revised again in Permendag No.

05 of 2019.

While the implications of the policy change in the

increase in Article 22 income tax tariffs on imports in

the tire industry for importers is not yet so influential

because general importers still carry out trading

activities without cutting margin margins and

revenues on imports, even so, to avoid Overpayment

which can cause psychological burdens for taxpayers,

the percentage of net profit must be at least 70% less

than the percentage of import value or with a ratio of

3: 1 of the percentage of import value.

LIMITATIONS

There are several limitations in this study including

the difficulty of getting information from tire

importers, which is generally due to the lack of

adequate time and the inclusion of a political year so

that it has not been able to provide a response due to

the unfavorable policy conditions. In addition,

although there is an association that houses the

combined importers of the tire industry, the

association does not have a permanent office so to

contact members of the association must be with

recommendations from other parties who know

(snowball). In addition, the policy to increase Article

22 income tax rates as stated in PMK No. 110 /

PMK.010 / 2018 only took effect on September 2018,

and until now it has not yet been able to see the real

implications because it is still in the short term. For

this reason, related to the resource person, it should

be able to ask information on tire importers from the

Ministry of Industry as the party directly related to the

importer in terms of providing recommendations on

imports and to conduct research after the policy runs

at least after 6 months so that the implications can be

seen.

REFERENCES

BOOK

Anindita, R. D. (n.d.). Bisnis dan Perdagangan

Internasional. Yogyakarta: ANDI.

Brotodihardjo, R. S. (1993). Pengantar Ilmu Hukum Pajak:

Edisi Ketiga. Bandung: PT Eresco.

Creswell, J. W. (2009). Research design: Qualitative,

Quantitative, and Mixed Methods Approaches (3rd

ed.). United States of America: Sage Publications.

Gunadi. (2013). Panduan Komprehensif Pajak Penghasilan.

Penerbit Bee Media Indonesia.

Mansury, R. (1996). Pajak Penghasilan Lanjutan. Jakarta:

Ind-Hill Co.

Mansury, R. (1999). Kebijakan Fiskal. Jakarta: Yayasan

Pengembangan dan Penyebaran Pengetahuan

Perpajakan.

Marsuni, L. (n.d.). Hukum dan Kebijakan Perpajakan di

Indonesia. Yogyakarta: UII Press.

Marsyahrul, T. (2005). Pengantar Perpajakan. Jakarta:

Grasindo.

Musgrave, R. A. (1989). Public Finance in Theory and

Practice. New York: McGraw Hill Company.

Neuman, W. L. (2014). Social Research Methods:

Qualitative and Quantitative Approaches (Seventh).

United States of America: Pearson Education Limited.

Nurmantu, S. (2003). Pengantar Perpajakan. Jakarta:

Granit.

Purwito, M. A. (2009). Kepabeanan dan Cukai (Pajak Lalu

Lintas Barang): Teori dan Aplikasi. Depok: Kajian

Hukum Fiskal FHUI.

Purwito, M. A. (2014). Ekspor, Impor, Sistem Harmonisasi,

Nilai Pabean dan Pajak dalam Kepabeanan. Jakarta:

Mitra Wacana Media.

Rahayu, A. S. (2010). Pengantar Kebijakan Fiskal. Jakarta:

Bumi Aksara.

Resmi, S. (2007). Perpajakan Teori dan Kasus. Jakarta:

Salemba Empat.

Income Tax Rates Increase Policy of Tire Industry Imports

265

Rosdiana, H. D. (2010). Pengantar Ilmu Pajak: Kebijakan

dan Implementasi di Indonesia. Jakarta: Rajawali Press.

Santoso, P. (2012). Administrasi Publik: Teori dan Aplikasi

Good Governance. Bandung: Refika Aditama.

Soemitro, R., & Sugiharti, D. K. (2004). Asas dan Dasar

Perpajakan Edisi Revisi 1. Bandung: Refika Aditama.

JOURNAL

Keen, M. (2008). VAT, Tariffs, and Withholding: Border

Taxes and Informality in Developing Countries. Journal

of Public Economics, 92, 1892–1906.

Lopes, C., & Martins, A. (2013). The Psychological Costs

of Tax Compliance: Some Evidence from Portugal.

Journal of Applied Business and Economics, 14(2), 53–

61.

Smith, E. P., Hasselback, J. R., & Harmelink, P. J. (2016).

Federal Taxation: Basic Principles (2017). Wolters

Kluwer Tax & Accounting.

Regulation

The Republic of Indonesia. Minister of Finance Regulation

(PMK) No. 110 / PMK.010 / 2018 Concerning

Amendments to the Regulation of the Minister of

Finance (PMK) Number 34 / PMK.010 / 2017

Regarding Collection of Income Tax Article 22

Regarding Payments for the Delivery of Goods and

Activities in Imports or Business Activities in Other

Fields. PMK No. 34 / PMK.010 / 2017.

The Republic of Indonesia. Minister of Trade Regulation

(Permendag) No. 6 of 2018 concerning Amendments to

the Regulation of the Minister of Trade Number 77 / M-

DAG / PER / 11/2016 concerning Provisions on the

Import of Tires.

The Republic of Indonesia. Minister of Trade Regulation

(Permendag) No. 117 of 2018 concerning the First

Amendment to the Regulation of the Minister of Trade

No. 77 / M-DAG / PER / 11/2016 concerning

Provisions on Import of Tires.

The Republic of Indonesia. Minister of Trade Regulation

(Permendag) No. 05 of 2019 concerning the Second

Amendment to the Regulation of the Minister of Trade

Number 77 / M-DAG / PER / 11/2016 concerning

Provisions on Import of Tires.

The Republic of Indonesia. Article 22 of Law Number 36

the Year 2008 concerning Income Tax.

ELEKTRONIC PUBLICATION

Andreas, Damianus. (2018) “Sebanyak 1.147 Barang Impor

Alami Kenaikan Tarif income tax Pasal 22.” Retrieved

from https://tirto.id/sebanyak-1147-barang-impor-

alami-kenaikan-tarif-income tax-pasal-22-cXeK

Andri, Yustinus. (2018). “Ini 2 Tantangan Industri Ban

Domestik Tahun Ini.” Retrieved from

http://industri.bisnis.com/read/20180703/12/812361/in

i-2-tantangan-industri-ban-domestik-tahun-ini

Anggraeni, Rina. (2018). “Sri Mulyani Bakal Mengurang

Impor Untuk Menguatkan Rupiah”. Retrieved from

https://ekbis.sindonews.com/read/1318508/33/sri-

mulyani-bakal-mengurangi-impor-untuk-menguatkan-

rupiah-1530609757

Anonim. (2013). “Peluang Industri Ban Terbuka Seiring

Pertumbuhan Kendaraan.” Retrieved from

http://id.beritasatu.com/home/peluang-industri-ban-

terbuka-seiring-pertumbuhan-kendaraan/69025

Anonim. (2016). “Romania Did This, And Now It’s Among

The Fastest Growers in Europe” Retrieved from

http://www.usfunds.com/investor-library/frank-

talk/romania-did-this-and-now-ites-among-the-fastest-

growers-in-europe/#.XBoqbVwza00

Badan Pusat Statistik. (2018) “Indikator Ekonomi Juli

2018; Buletin Statistik Bulanan”. Retrieved from

https://www.bps.go.id/

Bank Indonesia. (2018). “Laporan Neraca Pembayaran

Indonesia; Realisasi Triwulan II 2018.” Retrieved from

https://www.bi.go.id/

Bayu, Dimas Jarot. (2018) “Dianggap Berlebihan, Impor

Ban Hingga Keramik Akan Dikendalikan”. Retrieved

from

https://katadata.co.id/berita/2018/08/29/dianggap-

berlebihan-impor-ban-hingga-keramik-akan-

dikendalikan

Damhuri, Elba. (2018) “Memperkuat Rupiah, Membatasi

Impor”. Retrieved from

https://www.republika.co.id/berita/nasional/news-

analysis/18/09/05/pek7in440-memperkuat-rupiah-

membatasi-impor

Hidayat, Agung. (2018) “Tahan Ekspansi, Produsen Ban

Keluhkan Lonjakan Impor Ban.” Retrieved from

https://industri.kontan.co.id/news/tahan-ekspansi-

produsen-ban-keluhkan-lonjakan-impor-ban

Kementerian Perindustrian. (No Date). “Industri Plastik dan

Karet Hilir Prospektif di Indonesia.” Retrieved from

http://www.kemenperin.go.id/artikel/16079/Industri-

Plastik-dan-Karet-Hilir-Prospektif-di-Indonesia

Kementerian Perindustrian. (No Date). “Menperin: Industri

Ban Kian Prospektif.” Retrieved from

http://www.kemenperin.go.id/artikel/7437/Menperin:-

Industri-Ban-Kian-Prospektif

Kementerian Perindustrian. (No Date) “Industri Ban

Diandalkan.” Retrieved from

http://kemenperin.go.id/artikel/7435/Industri-Ban-

Diandalkan

Kompas. (2018, 12 10). Bedanya Ban Vulkanisir dan

Suntikan. Retrieved from

https://otomotif.kompas.com/read/2018/12/10/151743

315/bedanya-ban-vulkanisir-dan-suntikan

Kementerian PPN / Bappenas. (2011). Master Plan

Percepatan dan Perluasan Pembangunan Ekonomi

Indonesia (MP3EI) 2011-2025. Retrieved from

https://www.bappenas.go.id/id/berita-dan-siaran-

pers/kegiatan-utama/master-plan-percepatan-dan-

perluasan-pembangunan-ekonomi-indonesia-mp3ei-

2011-2025/

Kusuma, H. (2018). Neraca Dagang RI Defisit (Lagi) US$

2 Miliar. Retrieved from

https://finance.detik.com/berita-ekonomi-bisnis/d-

4167070/neraca-dagang-ri-defisit-lagi-us-2-miliar

ICOACI 2019 - International Conference on Anti-Corruption and Integrity

266

Melani, Agustina. (2018). “Ini Upaya Pemerintah dan BI

Perkuat Rupiah”. Retrieved from

https://www.liputan6.com/bisnis/read/3640748/ini-

upaya-pemerintah-dan-bi-perkuat-rupiah

Movanita, Ambaranie Nadia Kemala.(2018). “Menurut BI,

Ini Sumber Utama Penyebab Rupiah Melemah.”

Retrieved from

https://ekonomi.kompas.com/read/2018/09/11/110000

326/menurut-bi-ini-sumber-utama-penyebab-rupiah-

melemah-

Online Pajak. (t.thn.). Pajak Penghasilan Pasal 22 (income

tax Pasal 22). Retrieved from https://www.online-

pajak.com/income tax-pajak-penghasilan-pasal-22

Purnomo, Herdaru dan Prakoswa. (2018). “CAD

Membengkak Kartu Kuning untuk BI dan

Pemerintah?” Retrieved from

https://www.cnbcindonesia.com/news/2018081017484

5-4-28067/cad-membengkak-kartu-kuning-untuk-bi-

dan-pemerintah

Situmorang, Anggun. (2018). “Ini Rincian Kenaikan Pajak

Impor 1.147 Komoditas.” Retrieved from

https://www.liputan6.com/bisnis/read/3637501/ini-

rincian-kenaikan-pajak-impor-1147-

komoditasVersion:1.0

Income Tax Rates Increase Policy of Tire Industry Imports

267