The Role of Customer Service and Customer Trust in Enhancing

Satisfaction and Loyalty: Case in Islamic Microfinances

Fany Nelvana Arse

1

1

Post Graduate Program of Islamic Finance and Banking, Bandung State Polytechnic, Bandung, Indonesia

Keywords:

Islamic Microfinances, Service Quality, Customer Trust, Satisfaction, Loyalty.

Abstract:

The purpose of this study is to measure the relationship between variables of Service Quality, Customer Trust,

Satisfaction, and Loyalty among costumers of Islamic cooperatives/Baitul Maal Wa Tamwil (BMTs) in In-

donesia. This study uses a field survey which is based on self-administered questionnaires. The data were

taken from 300 respondents in West Java Province with several major cities as the representatives. The sample

data were analyzed statistically through path analysis by using Partial Least Square Structural Equation Model

(PLS-SEM) to determine the perception of Service Quality, Customer Trust, Satisfaction, and Customer Loy-

alty. This study found that Service Quality has a positive effect on Satisfaction (measured through Reliability,

Empathy, and Responsiveness). It, then, becomes an important determinant of Satisfaction. Satisfaction later

also has a significant positive effect on Loyalty. Therefore, from the managerial perspective, this study pro-

vides guidance for Islamic cooperatives/BMTs managers to build Customer Trust in addition to providing high

Service Quality. It must be considered because the emergence of trust in an institution can create customer sat-

isfaction and loyalty toward that institution, in this case Islamic cooperatives/BMTs. This research is expected

to have practical implication for Islamic cooperatives/BMTs policy makers to better understand the behavioral

intentions of cooperatives/BMTs customers.

1 INTRODUCTION

In order to create an industrial development that is

able to compete and has a strong structure, Indonesian

government needs to increase the distribution of pro-

cessing industry development in the country. This dis-

tribution results on a strong synergy between small,

medium and large industries that acts as a supply

chain (bps, 2018). The increase on this industrial dis-

tribution can drive the can drive the economy which

triggers the country’s growth (Hachicha and Amar,

2015).

Inherently, the financial industry has characteris-

tics that can support positively to participatory eco-

nomic growth. It will naturally direct the financial

resources to the real economic and financial sectors

that need them the most (Majid and Kassim, 2015).

When the financial sectors finally develop better, there

will be more financial resources that can be allocated

to productive use, so that more physical capital is

formed which will lead to economic growth (Tabash

and Dhankar, 2014).

Islamic line is also one of the sectors which forms

Indonesia’s economic growth (Lebdaoui and Wild,

2016), in accordance with the its obligation to imple-

ment the function of compiling and distributing pub-

lic funds (RI, 2008). The Islamic bank market seg-

ment is dominated by private entrepreneurs as well as

micro, small and medium enterprises (MSMEs) if it

seen from the side of depositors and debtors (clients)

(Wahyudi et al., 2013). MSMEs dominate 97.22% of

the total businesses and absorb 90.98% of the total

workforce (Keuangan, 2012).

prolongation of the government in credit pro-

grams aimed at MSMEs, such as small business

loans (KUK), farm business loans (KUT), and com-

munity credit businesses (KUR), so that the poten-

tial of micro, small and medium enterprises can be

spread evenly (Indonesia, 2009). Through its policy,

Bank Indonesia decides that Islamic bank financing

for MSMEs can be carried out directly or through

partners (or with relationship programs) with other

financial institutions such as Islamic cooperatives or

Baitul Maal wa Tamwil (BMTs) (Indonesia, 2009).

This becomes an opportunity for Islamic cooperatives

or BMTs to grow.

Since the time the legal entity was established, the

growth of Islamic cooperatives or BMTs fluctuated

192

Arse, F.

The Role of Customer Service and Customer Trust in Enhancing Satisfaction and Loyalty: Case in Islamic Microfinances.

DOI: 10.5220/0009867101920197

In Proceedings of the International Conference on Creative Economics, Tourism and Information Management (ICCETIM 2019) - Creativity and Innovation Developments for Global

Competitiveness and Sustainability, pages 192-197

ISBN: 978-989-758-451-0

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

every year. It can be seen from the significant increase

occurred in 1997 as 71 units, in 1998 as 115 units, and

in 1999 as 162 units. However, in 2000 this number

decreased to 31 units and kept going down gradually

until 2005. The number increased again dramatically

in 2006 as 61 units, followed by 2007 as 71 units, in

2008-2009 as 72 units, and returned to decline in 2010

to 2013. Until 2018, the growth of Islamic coopera-

tives or BMTs based on legal entity years was not as

good as in previous years which were only 11 units

(dep, 2019).

The above data raises question of the reasons be-

hind this decreasing. In addition to financial man-

agement, a financial industry, including Islamic co-

operatives or BMTs, must also consider the sources

of funding from other parties called as customers for

the sake of their growth. As the main source of,

each business depend on customers income (Khattak,

2010). Service quality and customer trust are the keys

to customer satisfaction in choosing Islamic coopera-

tives or BMTs. Customer satisfaction itself is one of

the important strategic elements in any organization

(Khamis and AbRashid, 2018).

Satisfied customers are the ones who are commit-

ted and are ready to contribute. It means that if cus-

tomers feel dissatisfied, they will look for other in-

dustries that can fulfil their satisfaction (Mosavi and

Ghaedi, 2012).

Service quality and customer trust are also able

to increase customer loyalty, so the better the quality

of service obtained, the better the level of satisfac-

tion. Customer loyalty is very important in conduct-

ing business in competitive market, including Islamic

banks and Islamic cooperatives or BMTs (Ehigie,

2006). Thus, the main factor of achieving market-

ing theory is identifying customer loyalty (Hennig-

Thurau et al., 2002).

1.1 Service Quality and Customer

Satisfaction

To increase profitability, a financial industry, includ-

ing Islamic cooperatives and BMTs, needs to pay at-

tention to the quality to the customers related the ser-

vice besides maintaining the financial traffic. Service

quality is the result of comparisons between the prod-

uct or service expected and service performance re-

ceived by the customers (Parasuraman et al., 1988).

Modern marketing believes that the continuity of any

business depends on its ability to meet customer needs

and satisfaction (Khamis and AbRashid, 2018). Cus-

tomers feel satisfied because of the good quality of

service. Based on this understanding, Service Qual-

ity uses five dimensions (Assurance, Reliability, Tan-

gible, Empathy, and Responsiveness) in accordance

with the opinion of Parasuraman (Parasuraman et al.,

1988) and one dimension of Compliance (Fauzi and

Suryani, 2019).

Customer satisfaction is generally defined as the

customer’s feelings or ratings of a product or service

after they use it. If the customer is satisfied with

the service, then the customer’s feelings towards the

industry will increase, and this feelings will result

in customer satisfaction toward the industry. Based

on this understanding, this study uses four dimen-

sions (Service, Price, Image, and Overall satisfaction)

(Hennig-Thurau et al., 2002).

The relation between service qualities is im-

portant and can be examined specifically through

SERVQUAL model of customer satisfaction (Ali and

Raza, 2017). This is supported by the previous re-

search which claims that service quality has a signifi-

cant positive impact on customer satisfaction (Ali and

Raza, 2017) (Fauzi and Suryani, 2019) (Pereira et al.,

2016) (Suhartanto et al., 2018). Based on this, the

hypothesis that can be proposed in this study is:

H1: Service quality has a significant with positive

value relationship to customer satisfaction

1.2 Customer Trust and Customer

Satisfaction

Trust is a fundamentally accepted variable for each

individual transaction. It is a psychological condition

that can only occur in certain relationship. Trust is

important in the relationship between customers and

industry in general. With a high level of trust, cus-

tomers feel confident that their needs are well served

by the industry. Service providers can also intro-

duce other actions that lead to trust, such as clear

communication, safeguarding and fulfilling promises

given to the customers.. Based on this understand-

ing, Customer Trust uses two dimensions (Trusty and

Keep promises) (Butt and Aftab, 2013) (Mosavi and

Ghaedi, 2012).

Customer trust has a positive and significant re-

lationship to customer satisfaction (Suhartanto et al.,

2011). When referring to the relationship between

customer satisfaction, trust, and loyalty, it shows that

loyalty will increase significantly if the bank can in-

crease trust. Based on this, the hypothesis that can be

proposed in this study is:

H2: Customer trust has significant with positive

value relationship to customer satisfaction.

The Role of Customer Service and Customer Trust in Enhancing Satisfaction and Loyalty: Case in Islamic Microfinances

193

1.3 Service Quality and Loyalty

When a customer trusts a service provider, he be-

lieves in the quality of service and product offered

by the provider. In this case, the customer tends

to be loyal to the industry (Garbarino and Johnson,

1999). From this understanding, loyalty uses two di-

mensions (Word of mouth communication and Strong

relationship) (Hennig-Thurau et al., 2002) (Juga et al.,

2018)(Pereira et al., 2016).

In addition to affecting customer satisfaction, ser-

vice quality also has a direct and/or indirect influence

on loyalty (Ehigie, 2006)(Pereira et al., 2016). Other

study reveals that customer satisfaction is more im-

portant than the perception of service quality in gain-

ing loyalty (Fisher, 2001). Therefore, service quality

has a positive and significant relationship to customer

loyalty (Ehigie, 2006). Based on this, the hypothe-

sis that can be proposed in this study is: H3: Service

quality has a significant with positive value relation-

ship to customer loyalty.

1.4 Customer Trust and Loyalty

A high level of trust can be very important in each

industry. If the level of trust is high, customers tend

to forgive and rule out industry mistakes because they

consider it normal. However, if the level of trust is

low, the independent errors experienced can be seen

as evidence that the industry cannot be trusted (van

Esterik-Plasmeijer and van Raaij, 2017). Trust can

lead to long-term loyalty and strengthen relations be-

tween the two parties (Singh and Sirdeshmukh, 2000).

It rises the sigma that customers who have deep trust

tend to continue the relationship so that they generate

loyal attitudes (Mosavi and Ghaedi, 2012).

Some studies show a positive and significant re-

lationship between customer trust and loyalty (Fauzi

and Suryani, 2019) (Mosavi and Ghaedi, 2012)

(Suhartanto, 2014). Based on this, the hypothesis that

can be proposed in this study is:

H4: Customer trust has a significant with positive

value relationship to customer loyalty.

1.5 Satisfaction and Loyalty

Satisfaction is the main factor in determining loy-

alty (Hennig-Thurau et al., 2002). Customer satis-

faction is the biggest contributor to customer loyalty

(Ehigie, 2006). The more satisfied customers with

bank services are, the more likely them to be loyal.

It also makes them possible to recommend the in-

stitution to others. Customer satisfaction has a pos-

itive and significant relationship to customer loyalty

(Fauzi and Suryani, 2019) (Suhartanto, 2014). How-

ever, some other studies also claim that customer sat-

isfaction has a positively insignificant relationship to

customer loyalty (Famiyeh et al., 2018)(Pereira et al.,

2016). Based on this, the hypothesis that can be pro-

posed in this study is:

H5: Customer satisfaction has a significant with

positive value relationship to customer loyalty.

2 METHODS AND EQUIPMENT

This study aims to determine the relationship between

service quality and customer trust variables on cus-

tomer satisfaction, service quality and customer trust

on loyalty, and customer satisfaction on loyalty to Is-

lamic Cooperatives or BMTs in Indonesia, West Java

Province. The data used in this study is primary data

which were obtained by giving questionnaires related

to the variables used in this study. The data were col-

lected within a month. The samples were 300 respon-

dents who were able to represent participants (Suhar-

tanto, 2014). This study obtained by using conve-

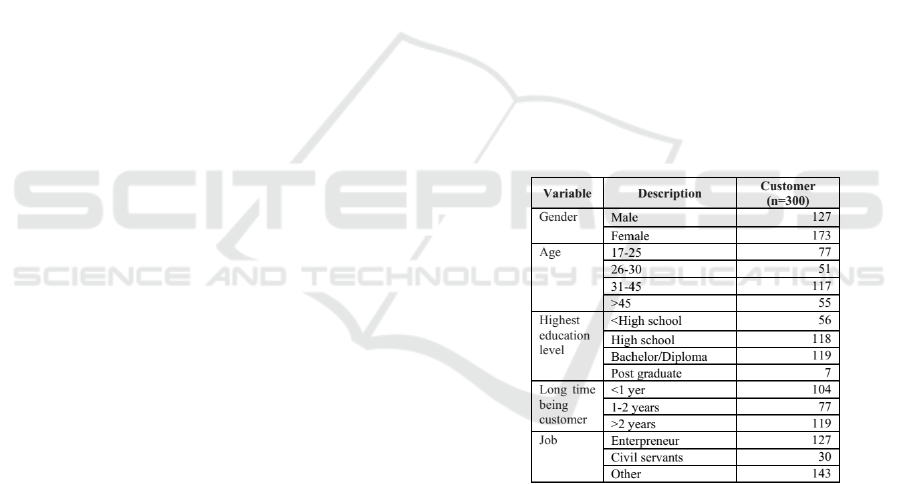

nience sampling techniques . Figure 1 below illus-

trates the description of the respondent’s character.

Figure 1: Respondent demographic characters.

To test the hypothesis, this study uses Path Anal-

ysis using PLS-SEM (Partial Least Square-Structural

Equation Modeling) because it cannot be solved using

multiple linear regression. This study uses WarpPLS

6.0 in processing the collected data.

ICCETIM 2019 - International Conference on Creative Economics, Tourism Information Management

194

3 RESULT

The standard loading factor illustrates the magnitude

of the correlation between each indicator and its con-

struct. The value of the loading factor is said to be

ideal if it is >0.70, but in the empirical experience of

the study, the value of the loading factor >0.50 is still

acceptable (Haryono, 2017). The other fulfillment of

the condition to be considered next is the Cronbach’s

alpha value >0.70, the Composite Reliability value

must be >0.70, and the AVE value >0.50 (Widarjono,

2015).

Figure 2: Respondent demographic characters.

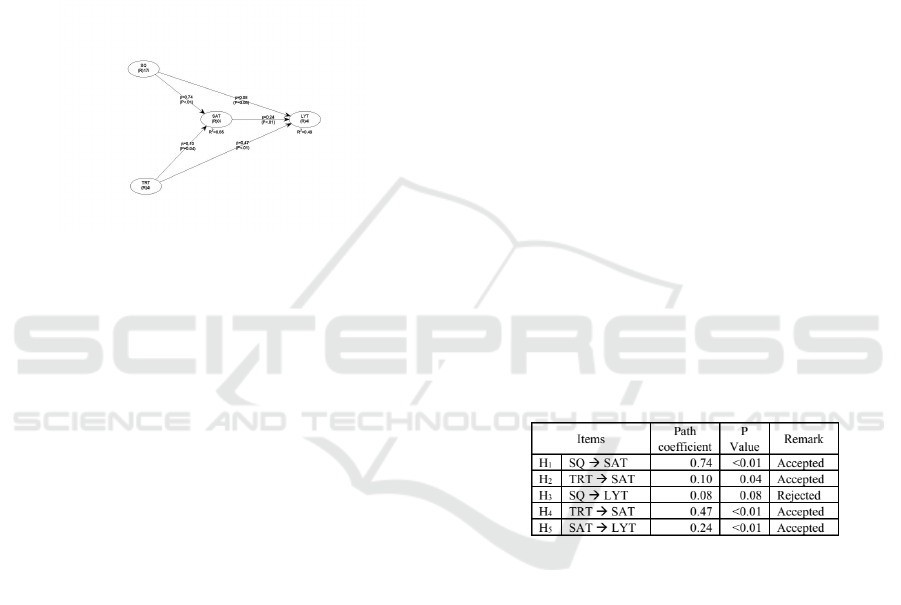

Based on the results of Figure 3, it can be seen that

Service Quality, Customer Trust, Satisfaction,

and Loyalty have met the requirements and it can

be said that the indicators are valid and have good re-

liability.

Figure 3: Reliability and Validity Check.

4 DISCUSSION AND

CONCLUSION

The validity and reliability tests above were carried

out to meet the assessment of structural models and

prove the results of this research hypotheses. The re-

sults show that the Average R-squared (ARS) value is

0.567 with P <0.001. Average block VIF (AVIF) has

a value of 2.158 which means accepted because it has

a value <5 (ideally <3.3). Next, the value of Aver-

age full collinearity VIF (AFVIF) is 2.455, accepted

if <5 (ideally <3.3). The value of Goodness of Fit

(GoF) is 0.616 which means that the compatibility of

the model is large. Likewise, the Sympson’s para-

dox ratio (SPR) value, R-squared contribution ratio

The Role of Customer Service and Customer Trust in Enhancing Satisfaction and Loyalty: Case in Islamic Microfinances

195

(RSCR), statistical suppression ratio (SSR), and non-

linear bivariate causality direction ratio (NLBCDR)

are 1.000 each and meet the model fit test compli-

ance requirement. In accordance with the indicators

which must be fulfilled in WarpPls, Service Quality

and Trust variables can predict 65% (R2=0.65) of Sat-

isfaction variable while Satisfaction can explain 49%

(R2=0.49) of Loyalty.

Based on the condition that must be met in PLS-

SEM analysis using the WarpPLS analysis tool, it can

be concluded:

Figure 4: Result of Testing Model

As the hypotheses, based on the results that Ser-

vice Quality has a significant with positive value in-

fluence on direct Satisfaction with a coefficient of

0.74 with significance <0.01. From several indicators

on Service Quality, there are three most influential in-

dicators to increase Satisfaction and Loyalty, which

are Reliability, Empathy, and Responsiveness. The

indicators are stated to be the most influential based

on the value of the Loading Factor >0.80.

The results of this study are in line with previous

research result on Islamic banks (Ali and Raza, 2017)

(Ehigie, 2006) (Fauzi and Suryani, 2019) (Khamis

and AbRashid, 2018) (Pereira et al., 2016).

This study shows that Islamic cooperatives/BMTs

customers are satisfied if the employees can show a

reliable, empathetic, and responsive attitude toward

customers’ needs. Meanwhile, for Service Qual-

ity on Loyalty, the coefficient is 0.08 with signifi-

cance=0.08, which means that it has no significant ef-

fect. Furthermore, the Trust variable has a significant

with positive value effect on Satisfaction of 0.10 with

a significant=0.04 and Loyalty of 0.47 with a signifi-

cance=0.01. It means thats customer trust will lead to

satisfaction and loyalty so that trust from customers

must be maintained and improved. Moreover, Sat-

isfaction to Loyalty has a coefficient of 0.24 with a

significant value ¡0.01. It means that customers are

already satisfied and they will certainly be loyal to

Islamic cooperatives/BMTs. It is potential to create

a desire for customers to remain as Islamic coopera-

tives/BMTs customers.

In general, the results of this study indicate that

Trust and Satisfaction increase Loyalty, but Service

Quality does not affect Loyalty. These findings show

that even though the services provided by employees

are considered good, it does not guarantee the cus-

tomers to be loyal to the Islamic cooperatives/BMTs.

Customers will be more loyal if the employees of Is-

lamic cooperatives/BMTs can provide a good sense

of trust to generate customers satisfaction. However,

Service Quality influences Satisfaction, so it is also

important to improve Service Quality in order to make

customers satisfied and indirectly increase their Loy-

alty. Therefore, Islamic cooperatives/BMTs must be

able to improve their quality, especially in terms of

Reliability, Empathy, and Responsiveness. Employ-

ees must also be able to increase customers trust to-

ward the industry. It will create a good impression

and increase customer confidence to remain a cus-

tomer because the main competitors of Islamic co-

operatives/BMTs are not only from the conventional

side but also from fellow Islamic banking industries.

The result of indirect relationships, Service Qual-

ity affects Loyalty through Customer Satisfaction.

This is indicated by the indirect effects value =0.174

and the p value of indirect effect for path with 2 seg-

ments ¡0.001. Whereas the Customer Trust does not

affect Loyalty through Customer Satisfaction with in-

direct effects =0.024 and p value of indirect effect for

path with 2 segments <0.275.

Figure 5: Hypotheses Testing Results.

5 LIMITATION AND FUTURE

RESEARCH

The results of the study are not enough to repre-

sent Indonesia in general because all samples were

from West Java Province, which were taken from

some representative cities, such as Bandung, West

Bandung Regency, Bandung Regency, Cimahi, Sub-

ang Regency, Bekasi, Bekasi Regency, Depok, Bo-

gor, and Bogor Regency. In fact, there are previous

studies which also take Islamic banks as the object

of the researches that result differently. Therefore,

in the future, it is very recommended to conduct re-

search using quota sampling techniques to obtain ade-

quate samples that represent customer perceptions of

ICCETIM 2019 - International Conference on Creative Economics, Tourism Information Management

196

Islamic cooperatives/BMTs in several regions in In-

donesia to obtain more comprehensive results.

ACKNOWLEDGEMENTS

The author would like to thank the family, Bandung

State Polytechnic lecturers, classmates of MTKPS

2017 and Muhammad Aziz Al-Hakim for their contri-

butions and support for this research. More gratitude

is also sent to previous researchers who have provided

good input for further research.

REFERENCES

(2018). Profil industri mikro dan kecil 2017.

(2019). Data jumlah koperasi indonesia7.

Ali, M. and Raza, S. A. (2017). Service quality perception

and customer satisfaction in islamic banks of pakistan:

the modified servqual model. Total Quality Manage-

ment & Business Excellence, 28(5-6):559–577.

Butt, M. M. and Aftab, M. (2013). Incorporating attitude

towards halal banking in an integrated service quality,

satisfaction, trust and loyalty model in online islamic

banking context. International Journal of Bank Mar-

keting.

Ehigie, B. O. (2006). Correlates of customer loyalty to their

bank: a case study in nigeria. The International Jour-

nal of Bank Marketing, 24(7):494–508.

Famiyeh, S., Asante-Darko, D., and Kwarteng, A. (2018).

Service quality, customer satisfaction, and loyalty in

the banking sector. International Journal of Quality

& Reliability Management.

Fauzi, A. A. and Suryani, T. (2019). Measuring the effects

of service quality by using carter model towards cus-

tomer satisfaction, trust and loyalty in indonesian is-

lamic banking. Journal of Islamic Marketing.

Fisher, A. (2001). Winning the battle for customers. Journal

of Financial Services Marketing, 6(1):77–83.

Garbarino, E. and Johnson, M. S. (1999). The different roles

of satisfaction, trust, and commitment in customer re-

lationships. Journal of marketing, 63(2):70–87.

Hachicha, N. and Amar, A. B. (2015). Does islamic

bank financing contribute to economic growth? the

malaysian case. International Journal of Islamic and

Middle Eastern Finance and Management.

Haryono, S. (2017). Metode sem untuk penelitian manaje-

men dengan amos lisrel pls. Luxima: Jakarta.

Hennig-Thurau, T., Gwinner, K. P., and Gremler, D. D.

(2002). Understanding relationship marketing out-

comes: an integration of relational benefits and

relationship quality. Journal of service research,

4(3):230–247.

Indonesia, B. (2009). Indonesian islamic banking outlook

2010. Bank Indonesia, Jakarta.

Juga, J., Juntunen, J., and Paananen, M. (2018). Impact

of value-adding services on quality, loyalty and brand

equity in the brewing industry. International Journal

of Quality and Service Sciences, 10(1):61–71.

Keuangan, K. (2012). Kebijakan antisipasi krisis tahun

2012 melalui program kridit usaha rakyat. Kementrian

Keuangan.

Khamis, F. M. and AbRashid, R. (2018). Service qual-

ity and customer’s satisfaction in tanzania’s islamic

banks: A case study at people’s bank of zanzibar

(pbz). Journal of Islamic Marketing, 9(4):884–900.

Khattak, N. A. (2010). Customer satisfaction and aware-

ness of islamic banking system in pakistan. African

Journal of Business Management, 4(5):662.

Lebdaoui, H. and Wild, J. (2016). Islamic banking presence

and economic growth in southeast asia. International

Journal of Islamic and Middle Eastern Finance and

Management.

Majid, M. S. A. and Kassim, S. H. (2015). Assessing the

contribution of islamic finance to economic growth.

Journal of Islamic Accounting and Business Research.

Mosavi, S. A. and Ghaedi, M. (2012). A survey on the rela-

tionship between trust, customer loyalty, commitment

and repurchase intention. African journal of business

management, 6(36):10089.

Parasuraman, A., Zeithaml, V. A., and Berry, L. L. (1988).

Servqual: A multiple-item scale for measuring con-

sumer perc. Journal of retailing, 64(1):12.

Pereira, D., Giantari, I. G. K., and Sukaatmadja, I. P. G.

(2016). Pengaruh service quality terhadap satisfac-

tion dan customer loyalty koperasi dadirah di dili

timor-leste. E-Jurnal Ekonomi dan Bisnis Universi-

tas Udayana.

RI, P. (2008). Uu ri, no. 21 tahun 2008 tentang perbankan

syariah c.f.r.

Singh, J. and Sirdeshmukh, D. (2000). Agency and

trust mechanisms in consumer satisfaction and loyalty

judgments. Journal of the Academy of marketing Sci-

ence, 28(1):150–167.

Suhartanto, D. (2014). Metode riset pemasaran. Bandung:

Alfabeta.

Suhartanto, D., Triyuni, N., Leo, G., et al. (2018). Online

shopping loyalty: the role of quality, trust, value, and

satisfaction. Advanced Science Letters, 24(1):735–

738.

Tabash, M. I. and Dhankar, R. S. (2014). Islamic finance

and economic growth: an empirical evidence from

united arab emirates (uae). Journal of Emerging Is-

sues in Economics, Finance and Banking, 3(2):1069–

1085.

van Esterik-Plasmeijer, P. W. and van Raaij, W. F. (2017).

Banking system trust, bank trust, and bank loyalty. In-

ternational Journal of Bank Marketing.

Wahyudi, I., Dewi, M. K., Rosmanita, F., Prasetyo, M. B.,

Putri, N. I. S., and Haidir, B. M. (2013). Risk man-

agement in islamic bank.

Widarjono, A. (2015). Analisis multivariat terapan. Yo-

gyakarta: UPP STIM YKPN.

The Role of Customer Service and Customer Trust in Enhancing Satisfaction and Loyalty: Case in Islamic Microfinances

197