Loyalty towards Islamic Microfinances Industry: The Role of Religiosity,

Image, and Trust

Fertika Puspita Dewi

1

1

Post Graduate Program of Islamic Finance and Banking, Politeknik Negeri Bandung, Bandung, Indonesia

Keywords:

Islamic Microfinances, Religiosity, Image, Trust, dan Loyalty.

Abstract:

Developing and generating customer loyalty is very important to give a positive impact on business results

such as deposit amount, operating and marketing costs, rate customer retention and income. By having cus-

tomers who are loyal to the product or organization, a business organization will be able to improve its business

performance. Therefore, understanding the way to build customer loyalty is very important for every organiza-

tion. In other words, loyalty is an important key for developing sustainable competitive advantage. However,

the literature shows a lack of attention in assessing loyalty in the context of Islamic microfinance institutions

(sharia cooperatives/BMTs). This study attempts to examine customer loyalty of Islamic microfinance insti-

tutions (sharia cooperatives/BMTs) through three important determinants, religiosity, image, and trust. This

study used a field survey based on self-managed questionnaires with 300 respondents in total. The samplings

were taken from some major cities in West Java Province, Indonesia, as representatives. The sample data were

analyzed statistically through path analysis with the Partial Least Square Structural Equation Model (PLS-

SEM) to determine perceptions of religiosity, image, trust, and loyalty. The results of this study indicate that

Trust and Image have a positive effect on loyalty, but Religiosity does not. This finding shows that even though

a person’s religiosity is considered good, it does not make the customer loyal to sharia cooperatives/BMTs.

Customers will be more loyal if sharia cooperatives/BMTs can provide good image and trust, that will generate

customer’s desire to be loyal. However, Religiosity has an influence on Trust and Image, so it is still important

to increase Religiosity so that it can indirectly increase Loyalty.

1 INTRODUCTION

Islamic banking is a dynamic segment in the bank-

ing industry (Abou-Youssef et al., 2015). The mar-

ket segmen of Islamic bank from the side of deposi-

tors and debtors (clients) is dominated by private en-

trepreneurs as well as micro, small and medium en-

terprises (MSMEs) (Wahyudi et al., 2013). MSMEs

dominate 97.22% of the total businesses and absorb

90.98% of the total workforce (Keuangan, 2012).

Islamic banks in Indonesia are expected to be an

extension of the government in credit programs aimed

at MSMEs, such as small business loans (KUK), farm

business loans (KUT), and community credit busi-

nesses (KUR), so that the potential of micro, small

and medium enterprises can be spread evenly (In-

donesia, 2009). Through its policy, Bank Indonesia

decides that Islamic bank financing for MSMEs can

be carried out directly or through partners (or with re-

lated programs) with other financial institutions such

as Sharia cooperatives or Baitul Maal Wa Tamwil

(BMTs) (Indonesia, 2009).

BMT is an Islamic microfinance institution

(LKMS) that grows from the community and devel-

ops very rapidly (Sapudin et al., 2018). BMT has a

very strategic role in empowering society, especially

those from lower classes and its role in alienating

the community from usury practices (Sapudin et al.,

2018).

Every business depends on customers as its main

source of income (Khattak, 2010). Developing and

generating customer loyalty is very important because

it can give a positive impact on business results such

as the amount of deposits, operating and marketing

costs, retention of customers and income (Bakar et al.,

2017). By having customers who are loyal to the

product or organization, a business organization will

be able to improve its business performance (Suhar-

tanto and Suhaeni, 2014). Loyal customers tend not to

look for additional information from alternative prod-

ucts or services, thereby reducing the possibility of

them moving to other service providers (Gounaris and

262

Dewi, F.

Loyalty towards Islamic Microfinances Industry: The Role of Religiosity, Image, and Trust.

DOI: 10.5220/0009868202620267

In Proceedings of the International Conference on Creative Economics, Tourism and Information Management (ICCETIM 2019) - Creativity and Innovation Developments for Global

Competitiveness and Sustainability, pages 262-267

ISBN: 978-989-758-451-0

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Stathakopoulos, 2004). Due to this reason, under-

standing the way to build customer loyalty is very im-

portant. Customer loyalty is very crucial in conduct-

ing business in today’s competitive market, including

Islamic banks and sharia cooperatives/BMTs (Ehigie,

2006). In other words, loyalty is important key for

developing sustainable competitive advantage (Li and

Petrick, 2010). It can be said that the key to the suc-

cess of achieving marketing theory is identifying cus-

tomer loyalty (Hennig-Thurau et al., 2002). Religios-

ity, trust, and image are the keys to achieve it.

This study tries to examine customer loyalty

through those three important determinants: religios-

ity, trust, and image. More specifically, this study is

aimed at assessing direct effect of religiosity on cus-

tomer loyalty and evaluating the mediating effect of

trust and image on the relationship between religios-

ity and customer loyalty in Islamic microfinance insti-

tutions (sharia cooperatives/BMTs) in West Java, In-

donesia.

2 LITERATURE REVIEW

In Indonesia, the one that can carry out the role as

Islamic microfinance institution is the Islamic Finan-

cial Services Cooperative (KJKS) and Baitul Mal Wat

Tamwil (BMT) which are regulated in the 1945 Con-

stitution of the Republic of Indonesia (articles 27 and

33) and Law no. 17/2012 concerning cooperatives.

Sharia Savings and Loan Cooperatives or Islamic Fi-

nancial Services Cooperatives (KJKS) are kinds of

cooperatives whose business activities are engaged in

financing, investment, and savings according to the

profit sharing pattern (sharia). Beside being based

on KJKS which is fully operating in sharia, conven-

tional cooperatives can also open Sharia Financial

Services Units (UJKS) (KUKM, 2004). Aside from

being an institution that collects and distributes funds

in the form of investment, also as Baitul Maal (house

of wealth), which also collects and distributes funds

from zakat, infaq and shadaqah, and as Baitul Tamwil

(financing house) which basically offers financial in-

termediation by managing funding and savings, so

that it can be said as a social and business entity (Wu-

landari and Kassim, 2016).

Customer loyalty is very important in conduct-

ing business in today’s competitive market, includ-

ing in Islamic banks and sharia cooperatives/BMTs.

(Ehigie, 2006). Customer loyalty is seen in vari-

ous ways, such as their possibility in returning to the

bank for services, their committed relationships, their

recommendation to others, and their positive saying

about the bank (Choudhury, 2014). Therefore, it can

be said that the key to the success of achieving mar-

keting theory is identifying customer loyalty (Hennig-

Thurau et al., 2002).

Religiosity, trust, and image are the keys to loy-

alty. Religiosity refers to a structured order of beliefs,

symbols, and practices to enable an individual to feel

close to God and as a guide to his personal relation-

ships with others (Souiden and Rani, 2015). The con-

cept of religion has been treated by many as a con-

struction that affects individual lifestyle, and identity

(Glock, 1972). Strengthening this view, Tang and Li

(2015) claims that maintaining one’s religious iden-

tity will affect his behaviour. If customer feels that

the services of Islamic banks are in line with Sharia

or Islamic values, the attitude he gives will benefit

the Islamic banks themselves. A support for this as-

sumption is found in an empirical study which sees

the relation between religiosity and loyalty in the Chi-

nese market. The research shows that there is a pos-

itive relationship between variables in various prod-

ucts (Tang and Li, 2015).

A high level of trust is a buffer against negative ex-

periences that can arise to customers. Customers tend

to ”forgive” negative experiences and consider them

an exception if they trust the bank. However, with a

low level of trust, negative experiences can be con-

sidered ”proof” that the bank cannot be trusted (van

Esterik-Plasmeijer and van Raaij, 2017). Thus, it is a

stigma that customers who have deep trust to a bank,

tend to continue the relationship and generate loyalty

(Mosavi and Ghaedi, 2012).

The image of an Islamic microfinance institution

is a reflection of the relationship between all the be-

liefs, experiences, feelings, impressions, and knowl-

edge that someone has about Islamic microfinance in-

stitution (Amin et al., 2013). This explanation shows

that religiosity is the core of the Image (Wahyuni and

Fitriani, 2017). As a result of satisfying services, fa-

vorable image will lead to a positive assessment of

services and affect the customer’s future behavioral

intentions.

I in an academic writing and presents a framework

that is poured into the model in figure 1 below:

Figure 1: Thinking Framework

The hypotheses that can be proposed in this study

are:

Loyalty towards Islamic Microfinances Industry: The Role of Religiosity, Image, and Trust

263

1. Hypotheses 1 (H1) states that Religiosity (X1) has

an effect on Image (X3).

2. Hypotheses 2 (H2) states that Religiosity (X1) has

an effect on Trust (X2).

3. Hypotheses 3 (H3) states that Religiosity (X1) has

an effect on Loyalty (Y).

4. Hypotheses 4 (H4) states that Image (X3) has an

effect on Trust (X2).

5. Hypotheses 5 (H5) states that Image (X3) has an

effect on Loyalty (Y).

6. Hypotheses 6 (H6) states that Trust (X2) has an

effect on Loyalty (Y).

3 METHODS AND EQUIPMENT

The data used in this study were primary data ob-

tained by giving questionnaires related to the vari-

ables used in this study. The samples were chosen

by using convenience sampling technique as the easi-

est way to obtain samples (Anandya and Suprihhadi,

2005). This is due to consideration of the time since

the data were only collected within a month. This

study requires 300 respondents based on the Zikmund

formula, with a margin of error of 5% (Suhartanto,

2014). Therefore, the data were taken from 300 cus-

tomers of the Sharia cooperatives or BMTs in West

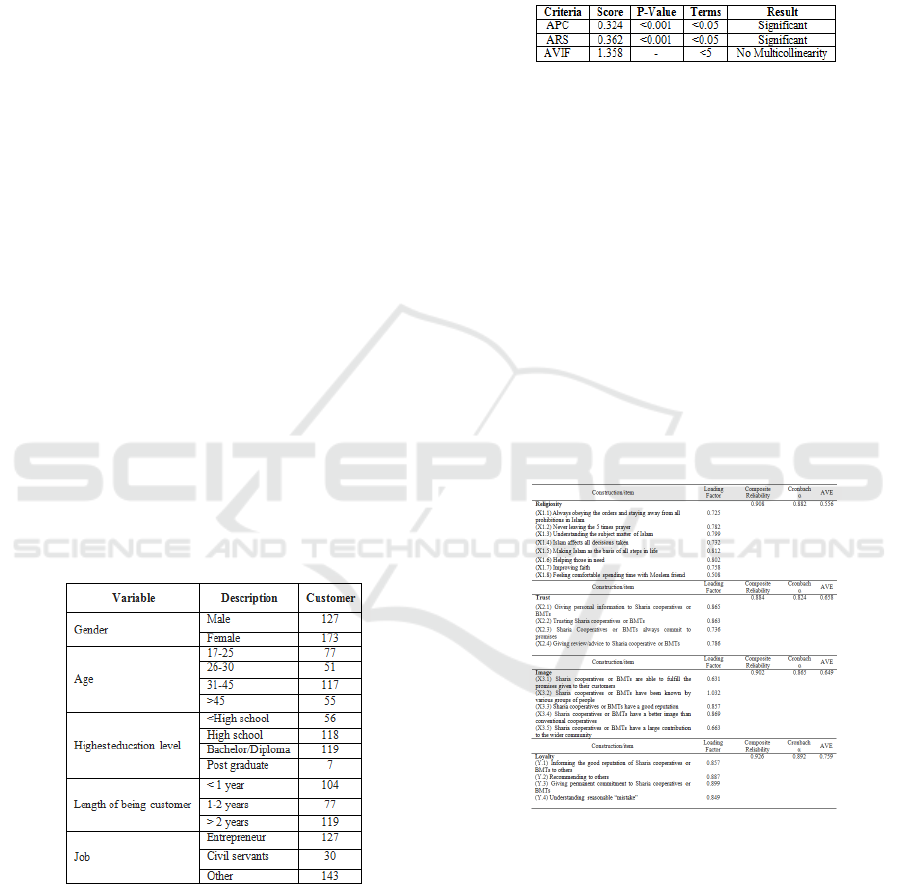

Java, Indonesia. Figure 2 below illustrates the de-

scription of the respondents” characters.

Figure 2: Respondent demographic characters.

4 RESULT

Based on the results of testing with WarpPLS 6.0,

the calculations of the fit model are as follow (the fit

model is to evaluate whether it is appropriate or sup-

ported by the following data):

Figure 3: Fit Model Analysis.

The output results show APC of 0.324, ARS of

0.362, and the criteria for goodness of fit models have

been fulfilled, which is significant (p value fulfills the

requirements <0.05). The AVIF value of 1,358 has

also fulfilled the criteria, less than 5, which indicates

that there is no multicollinearity in the model. The

standard loading factor illustrates the magnitude

of the correlation between each indicator and its

construct. The value of the loading factor is said to be

ideal if it is >0.70, but in the empirical experience of

the study, the value of the loading factor >0.50 is still

acceptable (Haryono, 2017). The other conditions to

be considered are the Cronbach’s alpha value >0.70,

the Composite Reliability value >0.70, and the AVE

value >0.50 (Widarjono, 2015).

Figure 4: Reliability and Validity Check.

Based on the results of Figure 4, it can be seen that

Religiosity, Trust, Image, and Loyalty of Sharia co-

operatives or BMTs have met the requirements. The

indicators are valid. Thus, it can be said that Sharia

cooperatives or BMTs have already had good reliabil-

ity.

The results show that the Average R-squared

(ARS) value is 0.362 with P <0.001. Average block

VIF (AVIF) value is 1.358 which means accepted be-

cause it is <5 (ideally <3.3). Furthermore, the Av-

erage full collinearity VIF (AFVIF) value is 1,861,

ICCETIM 2019 - International Conference on Creative Economics, Tourism Information Management

264

it is accepted because it is <5 (ideally <3.3). The

value of Goodness of Fit (GoF) is 0.487. It means

that the compatibility of the model is large. Like-

wise, the values of Sympson’s paradox ratio (SPR),

R-squared contribution ratio (RSCR), statistical sup-

pression ratio (SSR), and nonlinear bivariate causal-

ity direction ratio (NLBCDR) are each worth 1.000

and meet the model fit test compliance requirements.

In accordance with the indicators which must be ful-

filled in WarpPls, Religiosity and Image variables can

predict 14% (R2 = 0.14) Religiosity, Trust variable

can predict 38% (R2 = 0.38) Religiosity, Loyalty can

explain 57% (R2 = 0.57) Loyalty.

The complete results of assessment toward the hy-

potheseis can be seen in Figure 5 and Figure 6 below:

Figure 5: Result of Testing Model

Figure 6: The Resume of the Direct Effect Hypothesis Test.

The validation In accordance with Figure 6 and

Figure 5, the results of testing the hypotheses of direct

relationship between variables can be seen as follows:

1. Hypotheses 1 (H1) states that Religiosity (X1) has

an effect on Image (X3). The test result shows

path coefficients of 0.37 (p ¡0.01). It means that

H1 is accepted or in other words Religiosity (X1)

has a significant positive effect on Image (X3).

2. Hypotheses 2 (H2) states that Religiosity (X1) has

an effect on Trust (X2). The test result shows path

coefficients of 0.14 (p ¡0.01). It means that H2 is

accepted or in other words Religiosity (X1) has a

significant positive effect on Trust (X2).

3. Hypotheses 3 (H3) states that Religiosity (X1) has

an effect on Loyalty (Y). The test result shows

path coefficients of 0.07 (p =0.10). It means that

H3 is not accepted or in other words Religiosity

(X1) has no effect on Loyalty (Y).

4. Hypotheses 4 (H4) states that Image (X3) has an

effect on Trust (X2). The test result shows path

coefficients of 0.55 (p ¡0.01). It means that H4

is accepted or in other words Image (X3) has a

significant positive effect on Trust (X2).

5. Hypotheses 5 (H5) states that Image (X3) has an

effect on Loyalty (Y). The test result shows path

coefficients of 0.44 (p ¡0.01). It means that H5

is accepted or in other words Image (X3) has a

significant positive effect on Loyalty (Y).

6. Hypotheses 6 (H6) states that Trust (X2) has an

effect on Loyalty (Y). The test result shows path

coefficients of 0.37 (p ¡0.01). It means that H6 is

accepted or in other words Trust (X2) has a sig-

nificant positive effect on Loyalty (Y).

Based on the condition that must be fulfilled in

PLS-SEM analysis using the WarpPLS analysis tool,

it can be concluded:

The results show that Religiosity has a positive

and significant effect on direct Image with coeffi-

cient of 0.37 and significance of <0.01. Religiosity

has value with coefficient of 0.14 and significance of

<0.01 toward trust, which means that Religiosity has

a positive and significant effect on Trust. It shows that

Sharia cooperatives/BMTs customers feel Religiosity

can reflect good image and build trust for sharia co-

operatives/BMTs. Whereas, Loyalty has coefficient

of 0.07 with significance = 0.10 toward Religiosity,

which means that there is no significant relationship

between these two. Furthermore, the Image variables

have a positive and significant effect on the Trust with

coefficient of 0.55 and a significance ¡0.01, Image

also have a positive and significant effect on Loyalty

with the coefficient is 0.44 and a significance <0.01.

Meanwhile, Trust has a positive and significant effect

on Loyalty of 0.37 and significance <0.01. These re-

sults show that sharia cooperatives/BMTs customers

feel that a good image can create trust and loyalty, so

that good image and trust must be maintained, and

improved because they have the potential to create a

desire for customers to maintain their loyalty to the

institutions.

The literature has clearly identified that religios-

ity, image, and trust are determinants of customer loy-

alty (Amin et al., 2013)(Hoq et al., 2010).However,

there are a lack of studies that examine the direct ef-

fect of religiosity toward loyalty and its indirect effect

toward image and trust. Therefore, it can be said that

the results of this study offer a plausible explanation

on those problem if they are seen from the practice of

Islamic Microfinances.

This study also shows that religiosity is an impor-

tant determinant of trust, image, and loyalty. This

finding suggests that as customers increasingly com-

mit to their religion (in this case Islam), they tend

to have an increasingly positive image, develop trust,

Loyalty towards Islamic Microfinances Industry: The Role of Religiosity, Image, and Trust

265

and become more loyal towards the Islamic microfi-

nances. This study supports the previous studies on

the positive relation between religiosity and image as

well as trust (Amin et al., 2013)(Hoq et al., 2010) and

the effect of religiosity on loyalty (Wahyuni and Fitri-

ani, 2017) in various products and services. However,

the result of the mediation test suggests that the effect

of religiosity on loyalty is neither simple nor direct.

For Islamic microfinance customers, in addition to not

affecting directly on loyalty, religiosity affects loyalty

through strengthening trust towards the Islamic mi-

crofinance as a financial institution. Further, from the

theoretical perspective, this study extends the knowl-

edge on the relationship between religiosity and cus-

tomer loyalty in Islamic microfinances by integrating

image and trust as mediation factors.

5 CONCLUSION, LIMITATION

AND FUTURE RESEARCH

In general, the results of this study indicate that Trust

and Image increase Loyalty, but Religiosity does not.

The findings show that even-though a person’s reli-

giosity is considered good, it does not make the cus-

tomer loyal to the sharia cooperatives/BMTs. Cus-

tomers will be more loyal if the institutions can main-

tain good image and build trust. However, Religiosity

has an influence on Trust and Image, so it is impor-

tant to increase Religiosity so that it can indirectly in-

crease Loyalty. Therefore, sharia cooperatives/BMTs

must be able to improve their performance to create

good image of sharia cooperatives/BMTs and main-

tain customers’ trust. It will create a good impres-

sion and increase customer loyalty to remain perma-

nent because the main competitors of sharia cooper-

atives/BMTs are not only from the conventional side

but also from fellow Islamic banking industries.

From managerial perspective, this study gives im-

portant impact. Convincing customers that the Is-

lamic Microfinance is fully compliant with Islamic

principles (Sharia) will prevent the customers switch-

ing to another Islamic microfinance. This study im-

plies that Islamic values are the platform for manag-

ing the customers of Islamic banks. This platform

subsequently forms an operational system and proce-

dures that enable the bank to create loyalty amongst

current customers. The Islamic Microfinance can

establish a Sharia Advisory Council to observe and

guarantee that the activities and operations are in ac-

cordance with Sharia. Establishing this council is

important to enhance customer trust towards the Is-

lamic microfinance. Further, a communication strat-

egy focusing on the compatibility of Islamic Micro-

finance with Sharia values could convince the cus-

tomers on the suitability of Islamic microfinance ser-

vices to meet their banking and religious needs.

The results of the study are not enough to repre-

sent Indonesia in general because all samples were

from West Java Province, which were taken from

some representative cities, such as Bandung, West

Bandung Regency, Bandung Regency, Cimahi, Sub-

ang Regency, Bekasi, Bekasi Regency, Depok, Bogor,

and Bogor Regency. In fact, there are previous stud-

ies which also take Islamic banks as the object of the

researches that result differently. To obtain a better

and more representative result of the model, future re-

search can test the relationship between the variables

in other locations/countries. Therefore, in the future,

it is very recommended to conduct research using

quota sampling techniques to obtain adequate sam-

ples that represent customer perceptions of Islamic

cooperatives/BMTs in several regions in Indonesia to

obtain more comprehensive results.

Moreover, the focus of this research is attributed

to the role of religiosity in influencing trust, image,

and loyalty towards Islamic banks. There are many

other variables influencing customer loyalty, such as

quality, satisfaction, and value. To obtain a compre-

hensive model of loyalty, future studies can include

these variables in the model. Including these addi-

tional variables can shed further light on consumer

loyalty towards Islamic bank services. Lastly, the ex-

tended loyalty model could also be tested in other Is-

lamic products and services (e.g., Islamic insurance,

halal food etc.).

ICCETIM 2019 - International Conference on Creative Economics, Tourism Information Management

266

REFERENCES

Abou-Youssef, M. M. H., Kortam, W., Abou-Aish, E., and

El-Bassiouny, N. (2015). Effects of religiosity on con-

sumer attitudes toward islamic banking in egypt. In-

ternational Journal of Bank Marketing.

Amin, M., Isa, Z., and Fontaine, R. (2013). Islamic banks.

International Journal of Bank Marketing.

Anandya, D. and Suprihhadi, H. (2005). Riset pemasaran

prospektif & terapan.

Bakar, J. A., Clemes, M. D., and Bicknell, K. (2017). A

comprehensive hierarchical model of retail banking.

International Journal of Bank Marketing.

Choudhury, K. (2014). Service quality and word of mouth:

a study of the banking sector. International Journal of

Bank Marketing.

Ehigie, B. O. (2006). Correlates of customer loyalty to their

bank: a case study in nigeria. The International Jour-

nal of Bank Marketing, 24(7):494–508.

Glock, C. (1972). ”on the study of religious commitment”

in je faulkner (ed.) religion’s influence in contem-

porary society, readings in the sociology of religion,

ohio: Charles e.

Gounaris, S. and Stathakopoulos, V. (2004). Antecedents

and consequences of brand loyalty: An empirical

study. Journal of brand Management, 11(4):283–306.

Haryono, S. (2017). Metode sem untuk penelitian manaje-

men dengan amos lisrel pls. Luxima: Jakarta.

Hennig-Thurau, T., Gwinner, K. P., and Gremler, D. D.

(2002). Understanding relationship marketing out-

comes: an integration of relational benefits and

relationship quality. Journal of service research,

4(3):230–247.

Hoq, M. Z., Sultana, N., and Amin, M. (2010). The effect of

trust, customer satisfaction and image on customers’

loyalty in islamic banking sector. South asian journal

of management, 17(1):70.

Indonesia, B. (2009). Indonesian islamic banking outlook

2010. Bank Indonesia, Jakarta.

Keuangan, K. (2012). Kebijakan antisipasi krisis tahun

2012 melalui program kridit usaha rakyat. Kementrian

Keuangan.

Khattak, N. A. (2010). Customer satisfaction and aware-

ness of islamic banking system in pakistan. African

Journal of Business Management, 4(5):662.

Li, X. and Petrick, J. F. (2010). Revisiting the commitment-

loyalty distinction in a cruising context. Journal of

Leisure Research, 42(1):67–90.

Mosavi, S. A. and Ghaedi, M. (2012). A survey on the rela-

tionship between trust, customer loyalty, commitment

and repurchase intention. African journal of business

management, 6(36):10089.

Sapudin, A., Najib, M., and Djohar, S. (2018). Strategi

pengembangan lembaga keuangan mikro syariah

(studi kasus pada bmt tawfin jakarta). Al-Muzara’ah,

5(1):21–36.

Souiden, N. and Rani, M. (2015). Consumer attitudes and

purchase intentions toward islamic banks: the influ-

ence of religiosity. International Journal of Bank

Marketing.

Suhartanto, D. (2014). Metode riset pemasaran. Bandung:

Alfabeta.

Suhartanto, D. and Suhaeni, T. (2014). Model loyalitas

pelanggan dan loyalitas karyawan: Telaah konsepsual

dan metodologikal. In Prosiding Industrial Research

Workshop and National Seminar, volume 5, pages

254–260.

Tang, G. and Li, D. (2015). Is there a relation between

religiosity and customer loyalty in the c hinese con-

text? International Journal of Consumer Studies,

39(6):639–647.

van Esterik-Plasmeijer, P. W. and van Raaij, W. F. (2017).

Banking system trust, bank trust, and bank loyalty. In-

ternational Journal of Bank Marketing.

Wahyudi, I., Dewi, M. K., Rosmanita, F., Prasetyo, M. B.,

Putri, N. I. S., and Haidir, B. M. (2013). Risk man-

agement in islamic bank.

Wahyuni, S. and Fitriani, N. (2017). Brand religiosity aura

and brand loyalty in indonesia islamic banking. Jour-

nal of Islamic Marketing.

Widarjono, A. (2015). Analisis multivariat terapan edisi ke-

dua. Yogyakarta: UPP STIM YKPN.

Wulandari, P. and Kassim, S. (2016). Issues and challenges

in financing the poor: case of baitul maal wa tamwil in

indonesia. International Journal of Bank Marketing.

Loyalty towards Islamic Microfinances Industry: The Role of Religiosity, Image, and Trust

267